Take action: Already sent a gift card to a scammer? Act quickly and follow these steps to try to recover your money.

Scammers favor gift cards because they’re quick to buy, easy to spend or transfer, and utterly untraceable. If a scammer can successfully trick you into sending them a gift card code, there’s very little you can do to get the value back.

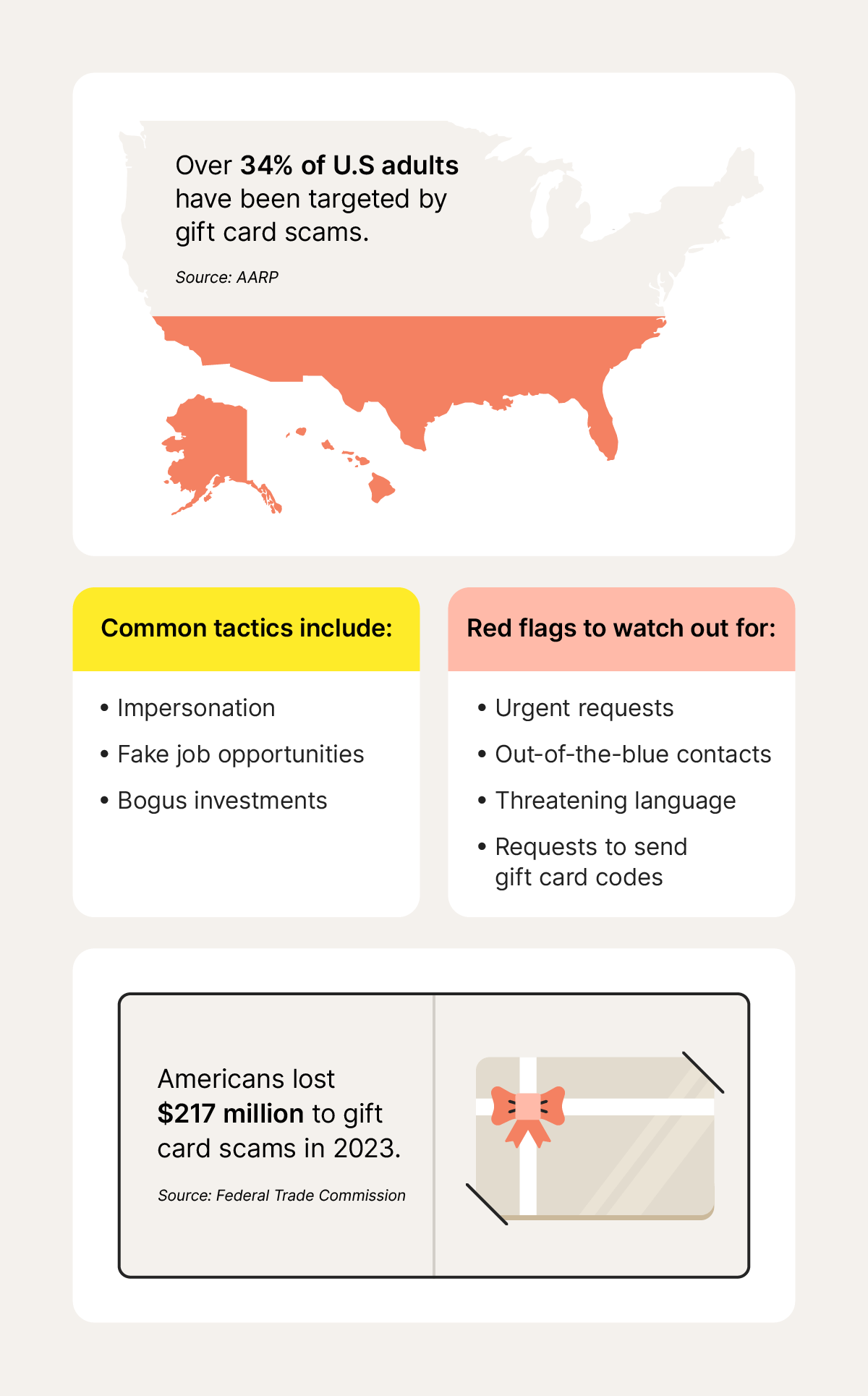

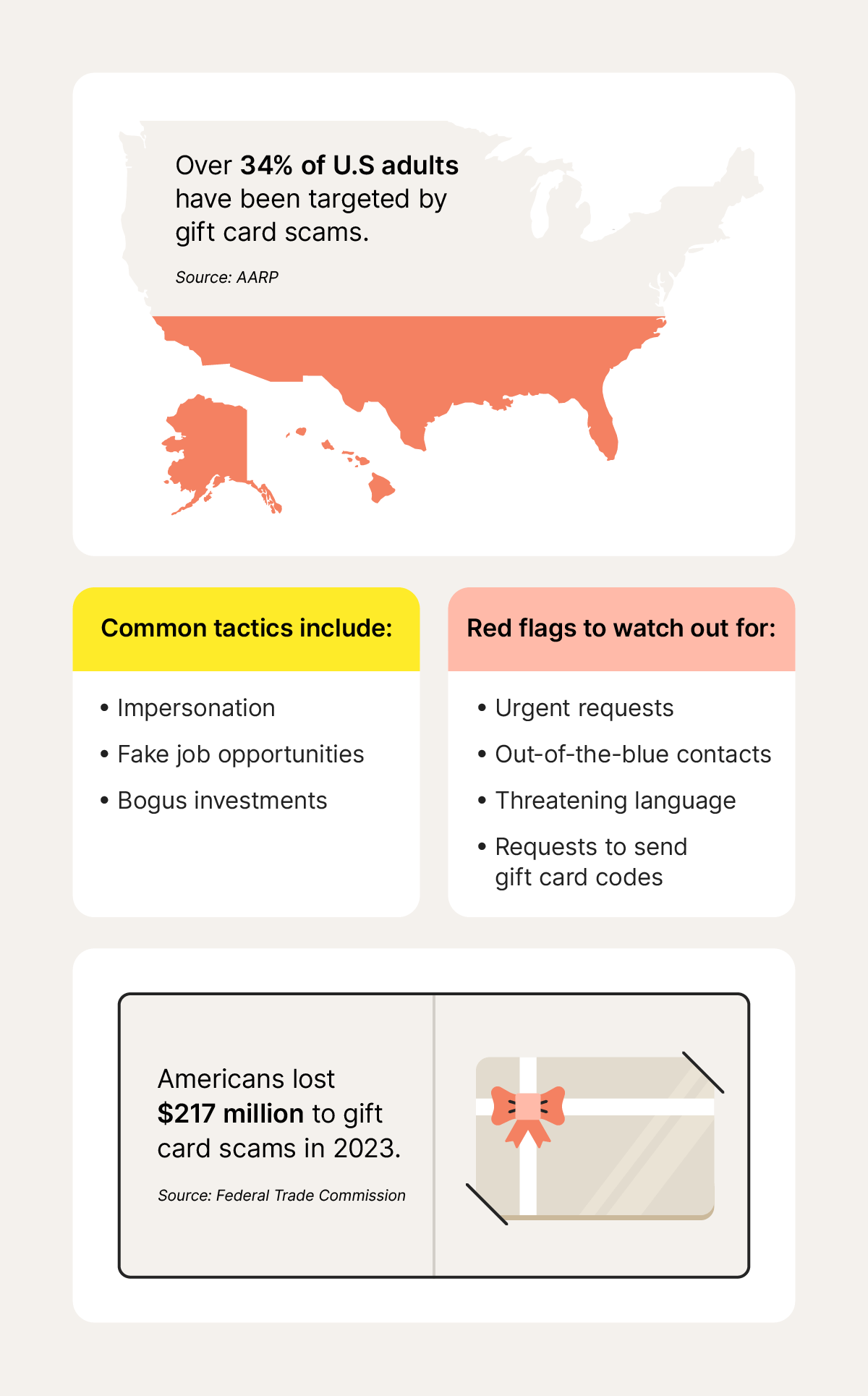

This has made them an alarmingly common feature of diverse scam types, with one study showing that 34% of U.S. adults have been targeted by a scam involving a gift card payment at some point.

Americans reported losing a whopping $212 million to gift card fraud in 2024, and total reported losses to this type of fraud don’t seem to be slowing down. It’s more important than ever to recognize the warning signs of a scam so you can avoid falling victim.

Learn more about how these scams work, why scammers use gift cards, and the red flags to watch for.

1. Fake tech support agents

Some scammers pose as tech support representatives from well-known companies like Apple, Microsoft, or Best Buy’s Geek Squad, claiming your device has a virus or there’s an error with your account. After gaining your trust, they pressure you to pay for fake services with gift cards.

In one case, a 70-year-old California woman lost $24,000 after a fake pop-up alert on her computer urged her to call what appeared to be Microsoft support. The scammer on the other end of the line convinced her to withdraw cash from her bank account, buy Lowe's gift cards, and read the card numbers over the phone.

Spot the red flag: No legitimate tech company will randomly contact you by phone, text, email, or pop-up message about a computer issue, and they certainly won’t ask you to pay them in gift cards.

2. Scammers pose as family with an “emergency”

Fraudsters may impersonate a friend or relative to gain your trust, often claiming they’re facing a crisis, like a medical issue or travel trouble, and urgently ask for help. Then, they’ll request gift cards to solve the so-called emergency.

With the rise of AI scams, fraudsters can even mimic your loved one’s voice, making their impersonation even more convincing. If you receive this kind of call, you should hang up and call the person back at their usual number to ensure the call was real. Or ask them a question only they would know the answer to, like, “What did we do the last time we saw each other?”

Spot the red flag: If a loved one claims to be in a crisis but asks for gift cards to resolve it, it's almost certainly a scam. In a real emergency, gift cards would never be the solution.

3. Scammers pose as government agencies

In other impersonation schemes, fraudsters pretend to be from legitimate government agencies like the IRS, the Social Security Administration (SSA), or your local police department. They contact you (often by phone), make up a fake story about how you owe them money, and threaten you with fines or arrest unless you pay them immediately with gift cards.

In one IRS tax scam example, the fraudster may claim they’re investigating you for tax fraud and threaten to arrest you unless you “settle the debt” by purchasing and sending gift card codes. These scare tactics are designed to pressure you into acting quickly, leaving you no time to verify the claim.

Spot the red flag: Government agencies will never contact you via phone without first informing you of the upcoming call via another medium, like direct mail. They’ll also never request gift cards as payment.

4. Employment-related gift card scams

Scammers may pose as your boss or a coworker, typically reaching out via text or email with an urgent request to buy gift cards as an important, last-minute favor for a client or a meeting.

One TikTok user described her experience with this type of employment-related fraud. When she was an intern, she received a text that appeared to be from the CEO of the company, urgently requesting $1,200 worth of gift cards to hand out after a client meeting.

The message stressed that she needed to send the codes before the meeting ended, which created a sense of urgency and made the request seem more legitimate.

Spot the red flag: Your boss is highly unlikely to ask for gift cards out of the blue. If you get a message like this, verify the request with your boss in person or over the phone before buying anything.

5. Gift card scams on online marketplaces

Gift cards are the preferred method of payment for many scammers operating on legitimate resale platforms, appearing in Facebook Marketplace scams and OfferUp scams, for example.

In one version of an online marketplace scam, a fraudster will list gift cards for sale, often at a tempting discount (like a $100 card for $50). The scammer might claim they don’t shop at that store anymore and just want to get rid of the card. But once you buy it, you’ll find out the card has a zero balance.

In another variation, scammers pose as buyers and offer to pay for your item using gift cards. After you ship the product, you’ll discover the gift card has expired or has already been drained.

Spot the red flag: If someone insists on using gift cards as payment or sells them at a too-good-to-be-true rate, it’s likely a scam.

6. Scammers threatening to shut off your utilities

In this scam, a fraudster impersonates a representative from your utility company, claiming you're behind on payments and threatening to disconnect your electricity or water. They’ll pressure you to pay immediately, often requesting unusual payment methods like gift cards.

One Reddit user shared their mother’s experience with a utility scam, noting how she was told to buy gift cards from a local drug store to settle a supposed past-due electric bill.

Spot the red flag: Legitimate utility companies don’t demand payment via gift cards or threaten to turn off your utilities without prior notice.

7. Fake charities asking for gift cards

Charity scams, often orchestrated on Instagram, Facebook, and other social media sites, prey on people’s generosity by pretending to raise funds for causes like disaster relief, medical research, or human rights.

In fact, these “fundraisers” are actually trying to get money for themselves under false pretenses and they may request donations through unusual payment methods, like gift card codes sent via direct message.

Spot the red flag: Be wary of anyone asking for gift card donations online, as legitimate charities rarely ask for contributions this way. And, if you ever want to donate to a charity, do it through their official website and not social media.

8. Romantic interests asking for gift cards

Scams involving gift cards will often exploit trust, and romance ploys are one social engineering tactic scammers use to build it. In romance scams, fraudsters create a fake dating or social media profile and pretend to be interested in a romantic relationship with you.

Once they’ve gained your trust, these fraudsters will make up an “emergency” or claim they're planning a trip to visit you, claiming they need financial support to cover the costs. They’ll ask you to send them gift cards as payment, before disappearing if you send them what they’ve asked for.

Spot the red flag: If a romantic interest — especially one you’ve never met in person — requests gift cards, they’re likely a scammer catfishing you.

9. Scammers claiming you won a contest

Scammers know how to grab your attention — for example, by telling you you've won a giveaway, sweepstakes, or contest. To appear legitimate, they’ll claim to be from a company that runs real sweepstakes, like Publishers Clearing House, perhaps even pointing you towards a fake website where your win is confirmed.

The catch? To claim your “prize,” you have to pay upfront fees using gift cards. But if you send codes to the scammer, they’ll disappear, leaving you without the winnings you were promised.

Spot the red flag: No contest will ask you to pay a fee with a gift card to receive your prize. Always confirm a “win” through official channels to make sure it’s legitimate.

10. Overpayment scams

An overpayment gift card scam happens when a scammer posing as a buyer on an online marketplace sends you too much money and then asks you to return the extra amount using gift cards. This tactic is especially common among scammers targeting small business owners.

Here’s how it typically works:

- A scammer poses as a customer and purchases an item or service from you, and then “accidentally” overpays.

- They reach out, apologize for the mistake, and ask you to send the difference back in gift cards.

- The original payment turns out to be fraudulent — often a fake check or a credit card from a lost or stolen wallet.

- When the bank reverses the fraudulent payment or it bounces due to lack of funds in the sender’s account, you’re left without the money and down the value of the gift cards you sent as a “refund.”

Spot the red flag: If someone says they’ve overpaid you and wants the difference back in gift cards, it’s almost always a scam. Don’t comply with their request. Instead, raise a support ticket on the marketplace to resolve the issue.

11. Tampered gift cards

Some scammers tamper with gift cards in-store by recording the card number and PIN before the card is even purchased. Then, when a real customer loads money onto the card, the scammer drains the balance.

Another trick involves covering the original barcode with a fake one. When the cashier scans it, the funds are added to the scammer’s account instead of onto the card. You can see this tactic demonstrated in this TikTok, where the user peels off the fake barcode to reveal the real one underneath.

To stay safe, avoid selecting cards from the front of the rack and opt for ones tucked in the back or middle, which are less likely to have been tampered with. Better yet, consider giving cash instead.

Spot the red flag: When looking for a gift card in stores, watch for ones with torn packaging, scratched-off PIN covers, or barcode stickers that look oddly placed or askew.

How do gift card scams work?

In a typical gift card scam, the scammer deceives a victim into buying a gift card and sharing the card number and PIN, giving the scammer access to the funds. Scammers use urgency, pressure tactics, and fabricated stories to trick people into handing over these gift card details. Here’s a step-by-step rundown of the process:

- The scammer contacts you through text, phone, social media direct messages, or email.

- They make up a fake scenario to cause panic and confusion, such as a loved one being in trouble or you owing them money.

- They ask you to buy gift cards to fix the issue, often giving specific instructions on which stores to purchase them from.

- They ask for the card numbers and PINs to steal the funds, even if you physically have the gift card itself.

- They cut contact and disappear with your money, potentially reselling the cards on the dark web or using them for purchases before you even realize you’ve been scammed.

Why do scammers want gift cards?

Scammers want gift cards because they’re an easy, anonymous way to steal money and are nearly impossible to track. They're quick and simple for victims to purchase and just as easy for scammers to cash in.

Here’s a more detailed look at why gift cards are a go-to payment method for fraud:

- Widely available: Gift cards can easily be bought at most stores or online, making them effortless for victims to buy without thinking the situation through.

- No personal info needed: Gift cards don’t require any personally identifiable information (PII), like a name or account number, helping the scammer remain anonymous.

- Difficult to trace: Most gift cards can’t be linked to a specific person or transaction, making it difficult for authorities to track the scammer.

- Instant access to funds: Once the victim sends the code and PIN, the scammer can drain the funds within minutes.

- Nonrefundable: Gift cards are similar to cash; once they’re redeemed, the money is gone and there’s no way to reverse the transaction.

Once the scammer receives the gift cards, they can use them to purchase goods or sell them for a profit on the dark web.

How to spot a gift card scam

Certain signs can help you spot a gift card scam, such as someone refusing other payment methods for no discernible reason. Keep an eye out for these warning signs:

- Sense of urgency: Scammers pressure you to act quickly so you don’t have time to think the situation through. This tactic isn’t unique to gift card scams, but is a core component of practically all online scams.

- Unsolicited calls or messages: Be cautious of anyone contacting you out of the blue with a request for money. You should be especially wary if they request gift cards as payment for a debt you were unaware of.

- Refusal to accept other payment methods: If someone claims they will only accept gift cards, and not other, more typical payment methods like credit cards, they’re almost certainly trying to scam you.

- Requests for gift cards from specific retailers: Scammers may direct you to a specific store to buy the gift cards. Not only can this tactic make their request seem more legitimate (simply because it’s more specific), it may also be intended to avoid stores that limit the maximum gift card value.

What to do if you’ve sent a gift card to a scammer

If you’ve already sent a gift card to a scammer, reach out to the companies and financial institutions involved as soon as possible. Here are a few steps to help you try to recover your money and protect your finances:

- Notify your bank or credit card company: If you used a debit or credit card to buy the gift card, contact your bank to report the fraud and ask if they can reverse the charge.

- Contact the gift card issuer: Reach out to the company that issued the card by phone or via an official online channel and explain the situation. If you have the receipt or gift card details, share them. While a refund isn’t guaranteed, some issuers may be able to help.

- Report the scam: File a report with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. You may also want to notify your local police department, especially if you provided the scammer with personal information they could use to commit identity theft.

- Watch out for follow-up scams: Scammers may try to contact you again, so be cautious with unknown calls, emails, or texts, especially those asking for money or personal information. Consider placing a fraud alert on your credit report or freezing your credit as a precaution to help prevent identity theft.

Can you get your money back from a gift card scam?

While it’s difficult to recover money lost to a gift card scam, it’s still worth reaching out to the card issuer. Some companies offer protections that might help you reclaim your funds.

Here’s a summary of relevant contact information to report gift card fraud to popular retailers often favored by scammers, such as Amazon and Walmart. If you still have the gift card or the receipt, be sure to have it on hand when you contact the retailer.

Amazon |

Call 888-280-4331 or email reportascam@amazon.com. |

|---|---|

Apple |

Call 800-275-2273 and say “gift cards” when prompted, or contact Apple Support online. |

Best Buy |

Call 888-237-8289. |

eBay |

Chat with eBay Customer Service. |

Google Play |

Fill out this form. |

Sephora |

Call 877-737-4672. |

Steam |

Contact Steam Support. |

Target |

Call 800-544-2943 or email abuse@target.com. |

Visa |

Call 800-847-2911 or fill out this form. |

Walmart |

Call 888-537-5503. |

How to avoid gift card scams

The best way to avoid falling victim to a gift card scam is to adopt a policy of never using gift cards as a payment method anywhere other than in the store they’re redeemable at.

Remember, gift cards are not a conventional way to pay other online merchants, charities, or “people in need.” Anyone requesting a gift card payment is trying to leverage the fact that they’re hard to trace or refund.

Here are some other tips to help you identify scammers and keep your finances safer:

- Be wary of phishing attacks: Watch out for unexpected messages that include suspicious links or urgent requests for gift cards, as these are common tactics scammers use to trick people.

- Don’t share gift card numbers or PINs: Avoid giving out gift card details over the phone, by text, or via social media. Only enter them on trusted websites or in-store at authorized retailers.

- Verify the caller’s identity: If someone calls demanding gift cards as payment, hang up and contact the organization directly using a trusted number to verify if the call was legitimate.

- Check for tampering: Before buying a gift card in-store, inspect it for signs of tampering and ask the cashier to verify the balance.

- Activate gift cards only when needed: Wait until you’re ready to use the card before activating it. This reduces the risk of scammers intercepting the balance.

- Gift cash instead: To avoid gift card fraud, consider giving cash to friends and family as a safer alternative.

Protect your wallet (and identity) from scammers

Gift card scams are just one way scammers try to take your money and disappear without a trace. That’s why it’s important to stay alert and have a solution in place to defend against fraud.

LifeLock adds an extra layer of protection to your defenses against scammers, helping you identify fraud and identity threats so you can take the right action. From monitoring features that help you detect exposure of your personal information to alerts that warn if your details are used in potential identity theft, LifeLock gives you the support you need to stay one step ahead of scammers.

FAQs

How do scammers get money from gift cards?

Scammers often turn gift cards into money by selling them on the dark web, where they can exchange the card numbers for cryptocurrency or other forms of payment. Alternatively, they may use the gift cards to buy items, which they can then resell for cash.

How can you tell if a gift card has been tampered with?

There’s no foolproof way to tell if a gift card has been tampered with. But some warning signs include damaged packaging, scratched or exposed PINs, and barcodes that look thicker than usual, which may indicate that a sticker has been placed over the original.

Can I get my money back from a gift card scammer?

Because gift cards work like cash, getting your money back from a gift card scammer is difficult. But it’s not always impossible. You can try contacting the gift card company to report the fraud and request your money back. If you bought the gift card with a credit card, your bank might refund you.

Can someone steal your info with a gift card?

If you purchase a gift card from a legitimate retailer and don’t share any personal information with the scammer, it’s unlikely they could steal your personal data directly. However, if the scammer sends you a link to “register” or verify the gift card and you click on it, they could potentially install malware on your device or steal information through phishing tactics.

Are gift cards security-protected?

No, gift cards don’t have security protections like credit or debit cards do. However, some gift card issuers may offer limited protections or support if you report the fraud quickly.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Fake tech support agents

- 2. Scammers pose as family with an “emergency”

- 3. Scammers pose as government agencies

- 4. Employment-related gift card scams

- 5. Gift card scams on online marketplaces

- 6. Scammers threatening to shut off your utilities

- 7. Fake charities asking for gift cards

- 8. Romantic interests asking for gift cards

- 9. Scammers claiming you won a contest

- 10. Overpayment scams

- 11. Tampered gift cards

- How do gift card scams work?

- Why do scammers want gift cards?

- How to spot a gift card scam

- What to do if you’ve sent a gift card to a scammer

- Can you get your money back from a gift card scam?

- How to avoid gift card scams

- Protect your wallet (and identity) from scammers

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.