Disclosures

* Automatically renews annually after the trial period ends, unless canceled. The price quoted in the cart today is valid for the introductory term after the trial, after which your subscription will be billed at renewal pricing. Renewal pricing is subject to change and may be charged up to 35 days before the active term ends. For support or to cancel automatic renewal, log into your account or contact support.

LifeLock Total: A yearly subscription is $xx per year after the free trial.

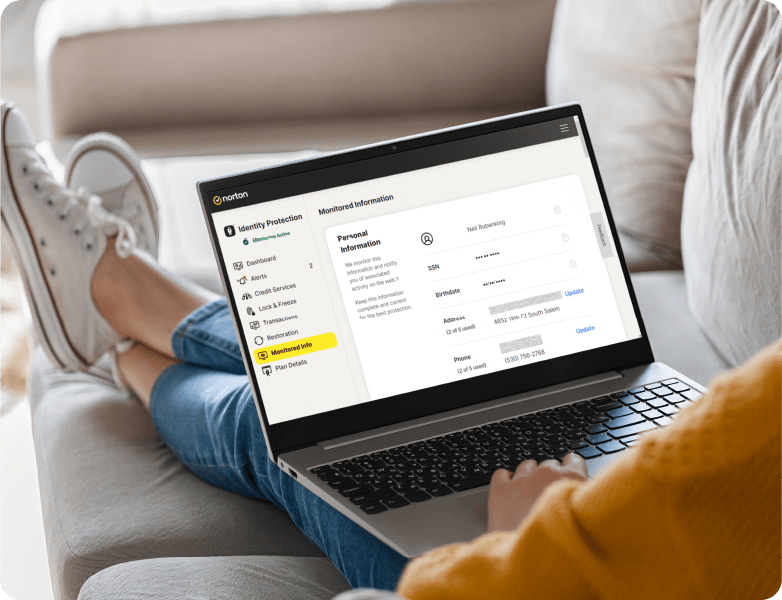

1The credit score provided is a VantageScore 3.0 credit score based on Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

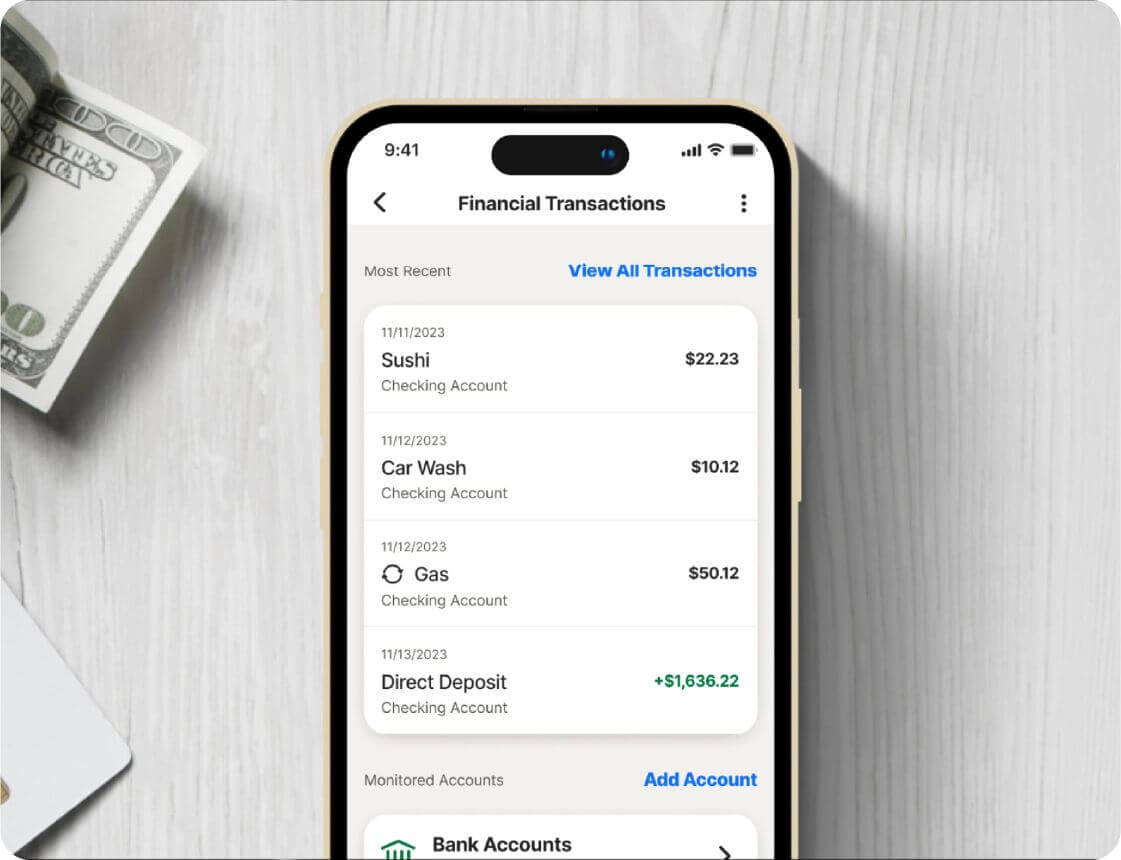

2We do not monitor all transactions at all businesses.

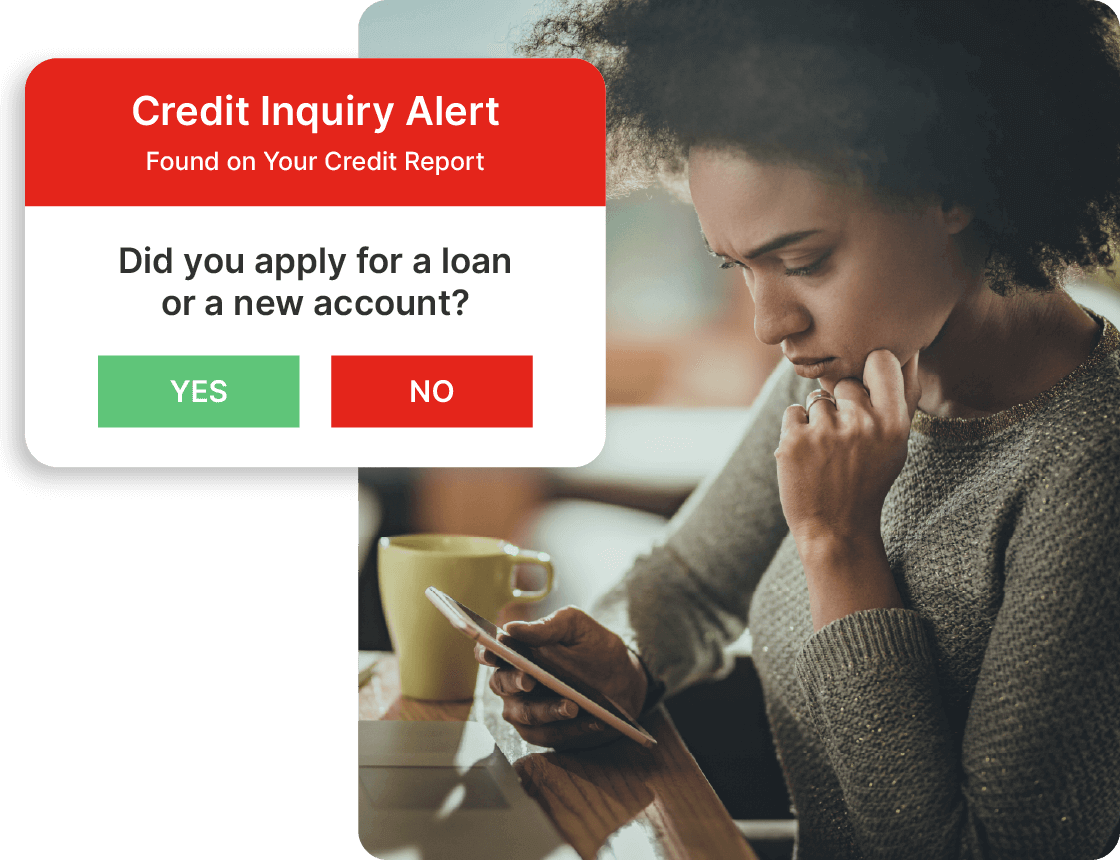

3Identity Lock cannot prevent all account takeovers, unauthorized account openings, or stop all credit file inquiries. The credit lock on your TransUnion credit file and the Payday Loan Lock will be unlocked if your subscription is downgraded or canceled.

Global Privacy Statement | Legal

** Credit features require setup, identity verification, and sufficient credit history by TransUnion and/or Equifax. Credit monitoring features may take several days to activate after enrollment.