Tip: Some people may refer to locking your Social Security number as “freezing your Social Security number,” but this is not to be confused with freezing your credit. There’s no way to freeze your SSN — this is just an unofficial term sometimes used to describe locking your SSN.

Your Social Security number (SSN) is a unique identifier that’s necessary for getting a job, filing taxes, making credit applications, and claiming government benefits. But if this critical piece of personal information falls into the wrong hands, criminals may be able to steal your identity, drain your accounts, or damage your credit.

Locking your Social Security number can help protect against these types of fraud, keeping your identity and finances safer. In this guide, we’ll explain how to lock your SSN and cover other tips that can help you safeguard your SSN to keep your personal information out of the hands of identity thieves.

How to lock your Social Security number

There are two key steps to take to lock your SSN: first, contacting the Social Security Administration (SSA) to block electronic access, and then setting up a Self Lock on E-Verify, an online employment verification service. You can also freeze your credit to get additional protection against identity theft.

1. Call the Social Security Administration

Calling the SSA at (800) 772-1213 to request a block on electronic access is the primary way to lock your Social Security number. This prevents anyone (including you) from viewing or modifying your Social Security records. If you need to make changes, you can unlock your SSN by calling the SSA again, but you’ll need to provide proof of identity.

The SSA recommends blocking electronic access to your SSN if you know that your Social Security information has been compromised. This could be because you’ve lost your SSN card, noticed unfamiliar accounts on your credit report, or received IRS notices about unfiled taxes, for example.

2. Apply a Self Lock with E-Verify

The next step is to use the online Self Lock feature offered by E-Verify, a government service that employers use to confirm applicants’ work eligibility. Setting up a Self Lock helps prevent fraudsters from successfully using your SSN to apply for jobs.

To set up a Self Lock:

- Create an E-Verify account.

- Choose the Self Lock option.

- Set your security questions and answers.

- Confirm that you want to apply a Self Lock.

Bear in mind that applying a Self Lock means your SSN won’t appear in E-Verify searches, so companies won’t be able to verify your employment status. This helps prevent employment-related identity theft and fraud, but it can also cause issues if you want to apply for a new job.

To bypass this restriction, you can temporarily remove the Self Lock whenever a new employer needs to confirm your employment authorization. Just make sure to apply it again once verification is complete to maximize your protection.

3. Lock or freeze your credit

Locking your SSN using the methods above won’t prevent a fraudster who already has it from applying for new credit in your name. To protect against credit fraud using your SSN, you can freeze or lock your credit.

- A credit freeze is a free service that restricts access to your credit report, preventing lenders from approving requests for new credit made in your name. This can prevent credit fraud, but you’ll need to temporarily lift the freeze if you want to submit a credit application.

- A credit lock is similar to a credit freeze, but is typically only available if you have an account or paid subscription service offered by the credit bureaus. It offers more flexibility, allowing you to lock and unlock access to your credit report instantly through an app or online account.

Here’s how to contact the major credit reporting agencies to request a credit freeze:

- Equifax: Call (800) 378-4329 or request a freeze online.

- Experian: Call (888) 397-3742 or request a freeze online.

- TransUnion: Call (800) 916-8800 or request a freeze online.

To get started with setting up credit locks, look into Equifax’s Lock & Alert or Experian’s CreditLock features.

Tip: Unlike a fraud alert, which applies to all three credit bureaus when placed with just one, a credit freeze must be requested individually at each of the three major credit bureaus.

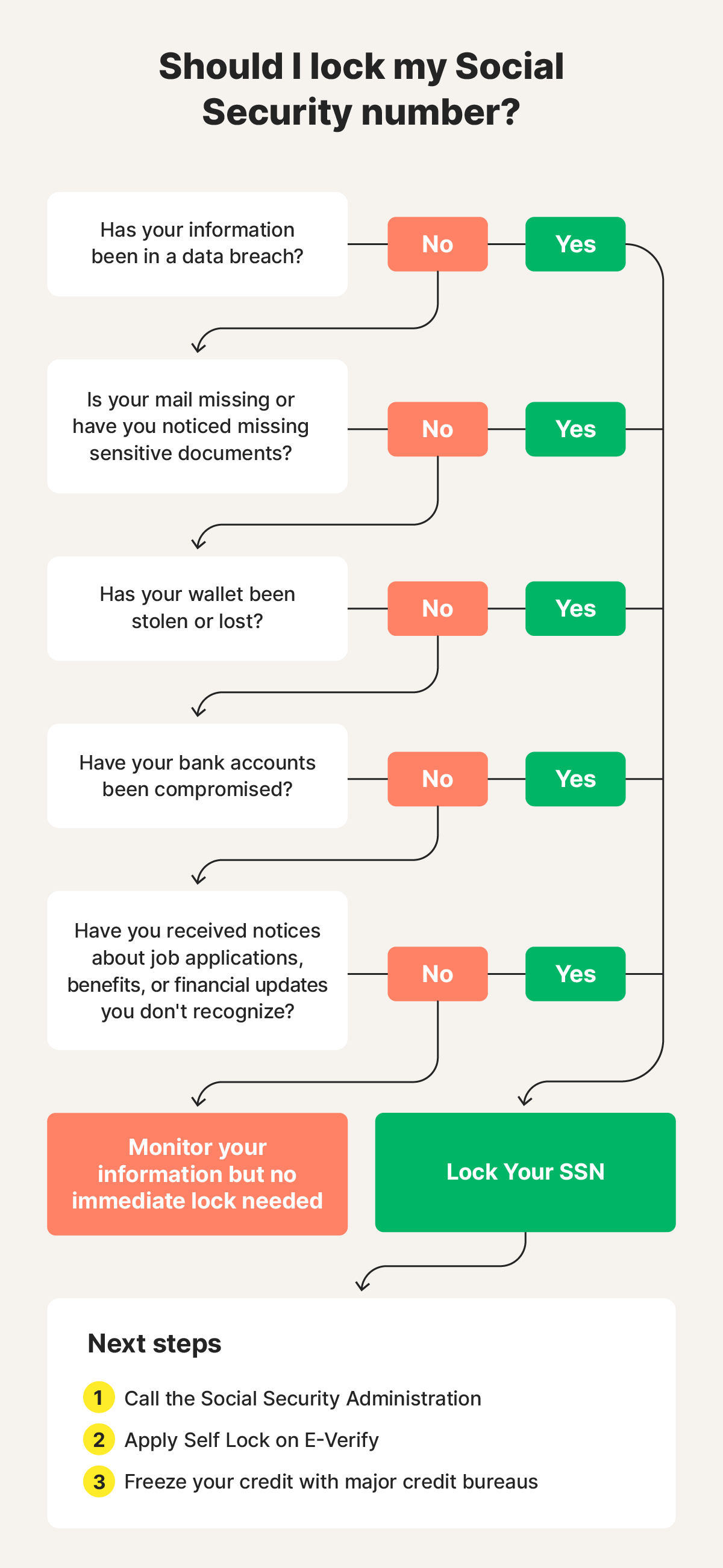

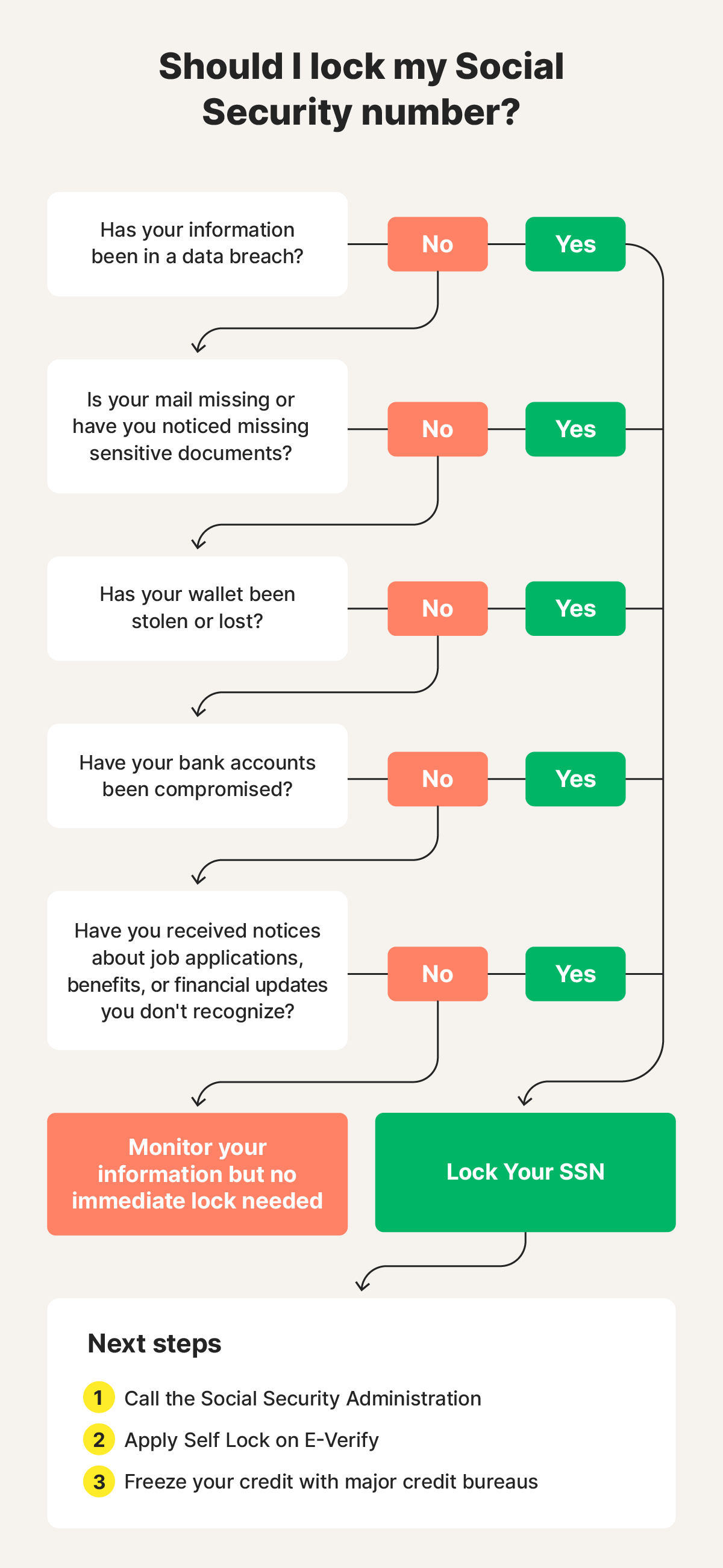

When to lock your SSN

You should lock your Social Security number and freeze your credit if your personal information has been compromised and you need to prevent fraud but don’t plan to open a financial account, apply for a loan, or start a new job soon. These steps can also be taken proactively to reduce the risk of fraud and identity theft.

Examples of situations that should prompt you to consider locking your SSN include your data being leaked in a data breach, your wallet being stolen, your mail going missing, or the appearance of suspicious activity on your credit report or financial accounts.

Here’s some more detail about when exactly you should lock your SSN:

- Your information was in a data breach: A data breach happens when cybercriminals steal sensitive information, like SSNs, from a company’s database. Locking your SSN should be one of the first steps you take after a data breach involving your information.

- Your mail is missing: Thieves will sometimes steal mail hoping to find sensitive documents containing your SSN and other personal information they can use to steal your identity. If you notice missing bills or other sensitive mail, lock your SSN as a proactive step to protect yourself.

- Your wallet is stolen: If you lose your wallet or your Social Security card, it might fall into the hands of a fraudster who can use the information to steal your identity. Lock your SSN and replace your Social Security card to help protect against the risk of identity theft.

- Your bank accounts are compromised: A cybercriminal with access to your bank account may also be able to obtain your SSN and use information from one compromised account to access linked accounts.

- You receive suspicious notifications: If you start getting notified about changes to your employment status, requested benefits, or financial accounts that you don’t recognize, it might mean someone has stolen your SSN and is impersonating you.

- You’ve been targeted by phishing: If you suspect you've fallen for a phishing scam through fake emails, texts, or calls pretending to be from your bank, a government agency, or another trusted source, lock your SSN to help prevent fraud.

What happens when you lock your Social Security number

Locking your Social Security number means no one can access or change your Social Security information with the Social Security administration. This makes it harder for identity thieves to misuse your details, but also limits your access to services that use Social Security information.

For example, when your SSN is locked, you won’t be able to apply for certain government benefits, and employers won’t be able to verify your identity through E-Verify. This can help prevent benefit fraud or job-related identity theft, but may also require that you temporarily unlock your SSN when you need it.

But if someone already has your SSN, locking it won’t prevent them from using it to open new financial accounts in your name. That’s why, for better identity theft and fraud protection, you should also freeze your credit to block fraudsters from causing financial harm or damaging your credit score.

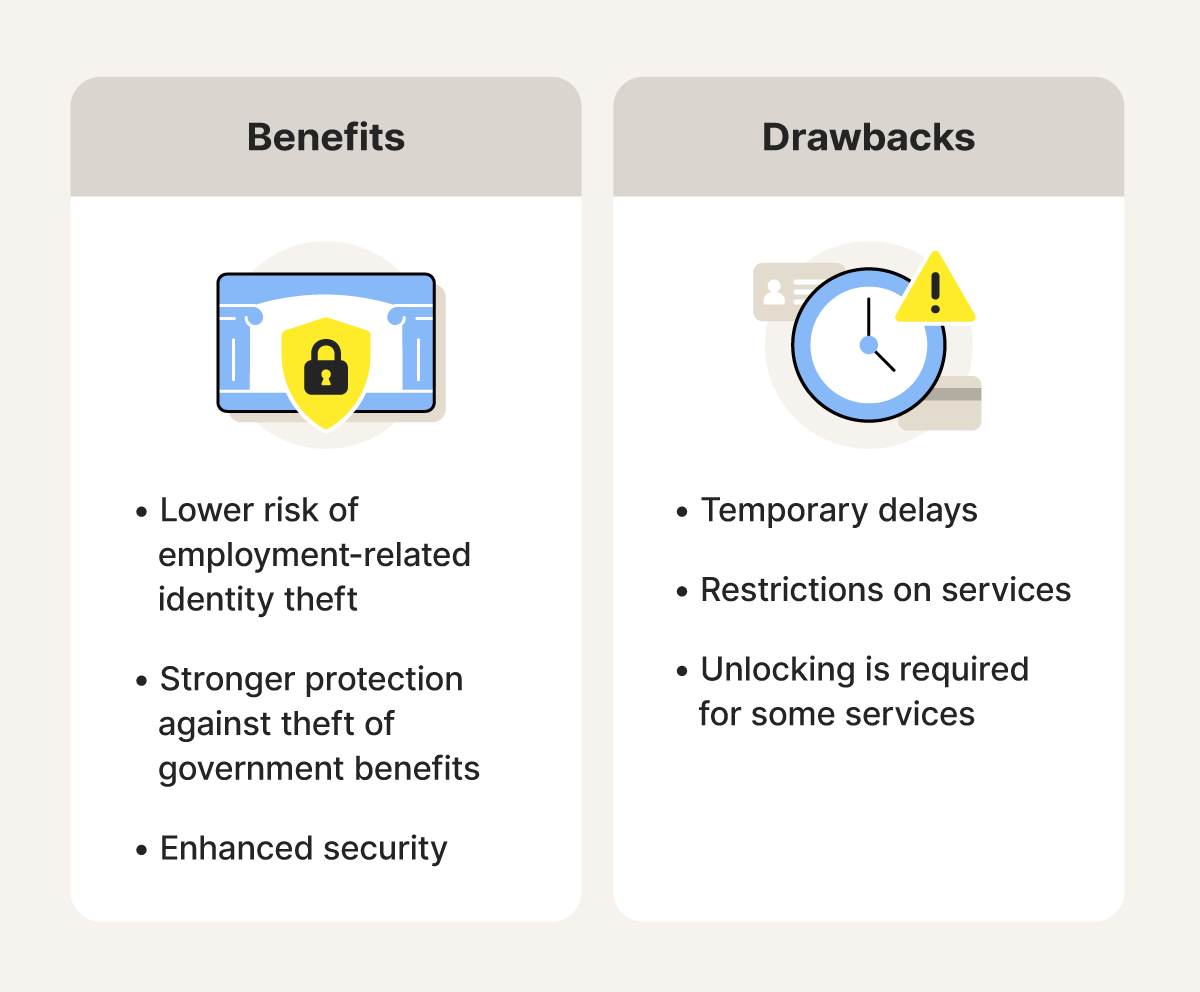

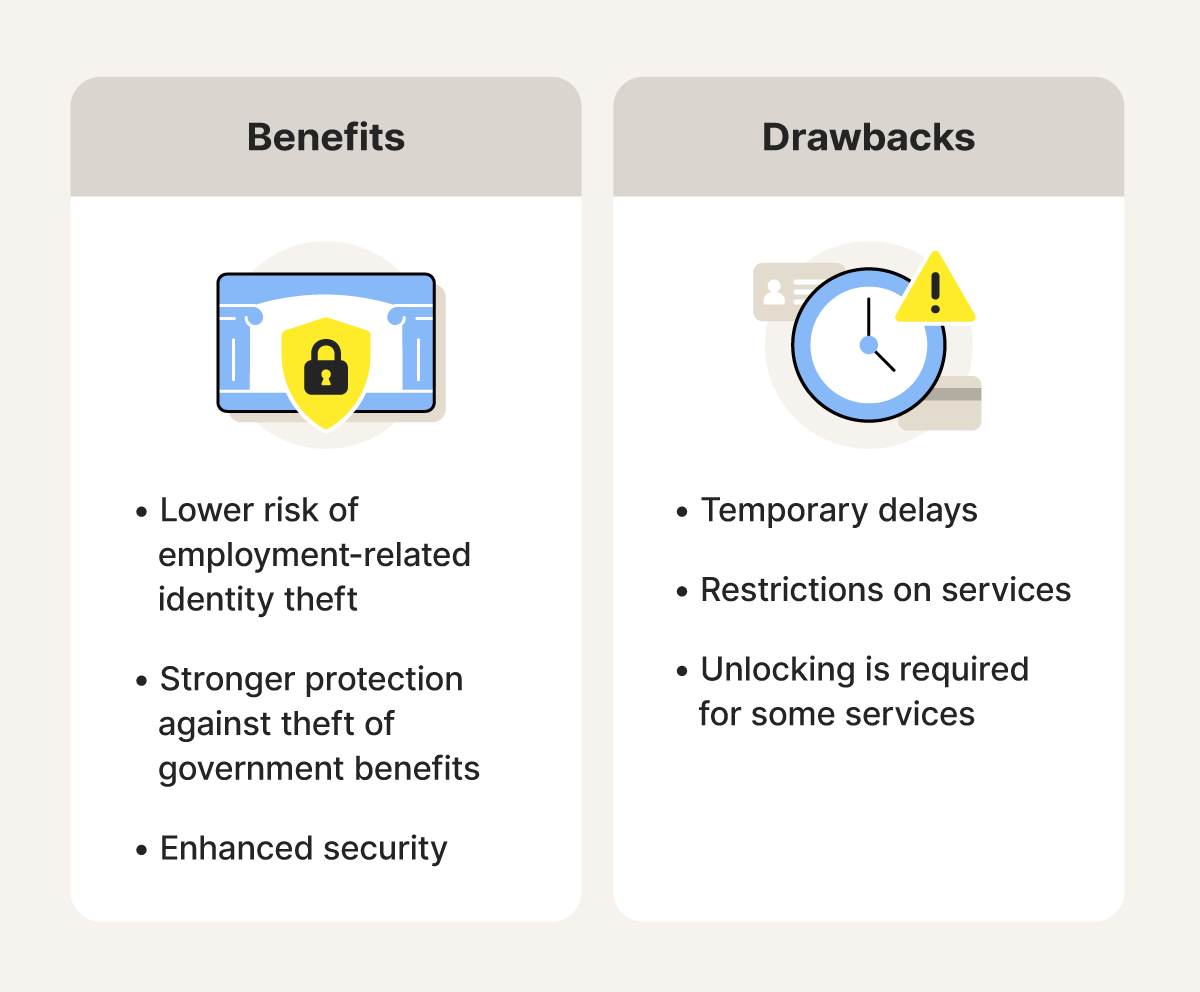

Benefits of locking your SSN

Locking your Social Security number helps prevent thieves from using your personal information to commit certain types of fraud. Even if they have access to your SSN, they won’t be able to use it to change your SSA information or steal your identity to apply for jobs.

After locking your SSN, you can also freeze your credit to help protect against scammers trying to use your SSN to open lines of credit fraudulently or commit medical identity theft.

Here’s a breakdown of some of the benefits of locking your Social Security number:

- Lower risk of employment-related identity theft: Locking your SSN through E-Verify makes it much harder for someone else to use your information to get a job.

- Stronger protection against government benefits fraud: Locking your SSN through the SSA makes it more difficult for criminals to modify your existing government benefits or apply for new ones (like Social Security or Medicare) in your name.

- Enhanced security: Pairing a Social Security lock with a credit freeze gives you powerful protection against criminals trying to open new financial accounts in your name or steal your identity.

Drawbacks to locking your SSN

While locking your SSN provides strong protection against identity theft, it also comes with some drawbacks. Any lock you put on your SSN also applies to you, meaning you won’t be able to do certain things like pass employment verification checks through E-Verify, or apply for new government benefits while your SSN is locked.

Thankfully, you can unlock your Social Security number at any point to access these services. And you don’t need to remove all the locks from your SSN — only those that apply to the services you need. Just bear in mind that the unlocking process might cause delays in certain situations, such as when applying for a job or seeking medical treatment.

How to unlock your Social Security number

If you’ve locked your Social Security number but need it to pass an identity verification check for a new job or apply for benefits, you can unlock it by contacting the SSA and removing the Self Lock you applied through E-Verify.

Here’s how to unlock your SSN:

- Call the SSA at (800) 772-1213 to remove the SSN lock that blocks electronic access.

- Sign in to your E-Verify account and follow the instructions to remove the Self Lock.

Once you’ve completed your business, you can relock your SSN through both the SSA and E-Verify for continued protection.

If you also froze your credit, you can temporarily or permanently unfreeze it by contacting each credit bureau, using the same method you used to freeze it:

- Equifax: Call (800) 378-4329 or unfreeze your credit online.

- Experian: Call (888) 397-3742 or unfreeze your credit online.

- TransUnion: Call (800) 916-8800 or unfreeze your credit online.

What to do if your Social Security number is compromised

Locking your Social Security number is an effective way to help prevent it from being used in employment- or benefit-related identity theft. But it isn’t enough to stop identity theft altogether — especially if other elements of your personal information or some of your online accounts have already been compromised.

Here are some other ways you can help protect yourself from identity theft or minimize the damage if your Social Security number has been compromised:

- Monitor your credit: Check your credit reports regularly or use a dedicated credit monitoring service to catch suspicious activity, like the appearance of accounts you didn’t open.

- Contact creditors: Let your bank and other financial institutions you do business with know that you’ve experienced identity theft and your SSN has been compromised. They may be able to assist you in protecting your financial accounts.

- Get an IP PIN: An Identity Protection PIN is a six-digit code provided by the IRS to help protect against fraudsters with your Social Security number submitting false tax returns in your name. You can apply for an IP PIN through the IRS website.

- Contact authorities: File an identity theft report with the Federal Trade Commission (FTC) and any other relevant authorities as quickly as possible. The FTC will provide you with guidance on the next steps to take to begin your recovery.

- Use identity theft protection services: Identity and Social Security number alerts are the foundation of ID theft protection services like LifeLock, providing automatic alerts if somebody uses your SSN or other personal information in applications for credit or services.

LifeLock also offers a range of other features that can help you protect against identity theft and fraud, including two-bureau credit monitoring, data breach notifications, and stolen wallet protection. Join today to help safeguard your identity.

How to protect your Social Security number

Even if your Social Security number hasn’t been compromised, it’s a good idea to take proactive steps to protect it. Identity theft is more common than you might think, but knowing how to safeguard your Social Security number can help you minimize the risk of it happening to you.

1. Leave your Social Security card at home

There may be times when you need to show your SSN to someone, but carrying your Social Security card with you means it’s more likely to be lost or stolen. In general, it’s a good idea to avoid carrying your card or any documents that display your SSN unless absolutely necessary.

2. Store your SSN safely

A document as important as your Social Security card deserves a safe home. Store it in a lock box or file folder kept in a secure place to help prevent it from being damaged or stolen. And don’t forget to safely store any other sensitive documents your SSN appears on, too.

3. Only share your SSN when necessary

You may have to provide your Social Security number to your bank or employer, but there’s no reason a food delivery service needs it. If someone asks for your Social Security number, ask questions before providing it to determine why it’s required, how it’ll be used, and if there’s an alternative form of identification you can use instead.

4. Beware of phone, text, and email scams

Identity thieves often attempt to steal SSNs through phishing scams, posing as an employer, a government agency, or another trusted organization in phone calls or emails. To reduce the risk, always contact organizations directly to verify any request before sharing personal information. Whenever possible, only provide your SSN in person.

5. Strengthen your passwords

Using strong passwords across all of your online accounts can help prevent identity thieves from getting access to them, and the sensitive information they contain. Just remember to never use your Social Security number as a password, or the last four digits as a PIN.

6. Shred sensitive documents

Make sure to shred, or otherwise destroy, all documents that contain your SSN or other personally identifiable information before tossing them in the trash. If you don’t, dumpster-diving thieves could steal them from your garbage or landfill and use any information they get access to in identity theft.

7. Exercise caution online

Sharing your SSN electronically can leave you open to security risks like a hacker intercepting it. To keep your data safer, avoid transmitting it on unsecured platforms and consider using a VPN for extra protection, especially on public Wi-Fi networks. Whenever possible, use alternatives to sharing your SSN through email or text, such as in-person conversations or secure document-sharing services.

8. Keep an eye on your accounts

If someone steals your SSN — whether through a data breach or other means — the first signs of fraud may appear as unfamiliar charges on your bank, credit card, or benefits statements. To catch identity theft early, set up alerts with your financial institutions for unusual activity, such as large withdrawals or purchases.

Additionally, monitor your credit score and review your credit reports regularly for errors or suspicious activity. You’re entitled to a free weekly credit report from each of the three major credit bureaus, available at AnnualCreditReport.com.

9. Use an identity theft protection service

Identity theft protection services like LifeLock can alert you if personal information like your SSN has been leaked in a data breach or found on the dark web, so you can take steps to protect yourself. You’ll also get access to other features that can help you catch identity theft early, like credit monitoring, and personalized recovery support if your identity is ever stolen.

Help protect your identity against identity thieves

Locking your Social Security number is a great first step in protecting yourself from identity theft, but it’s not a complete solution.

Join LifeLock for extra protection against identity fraud, including automatic alerts if your SSN is used in fraudulent applications for credit or services, reliable two-bureau credit monitoring, and stolen wallet protection.

FAQs

Can I lock my SSN online?

You can apply a Self Lock on your SSN by visiting the E-Verify website, creating an account, and following the instructions. However, to block electronic access to your Social Security record with the SSA, you’ll need to call them at (800) 772-1213.

How do I change my SSN after identity theft?

You can change your Social Security number if you’ve been a victim of identity theft and have attempted to fix any problems with SSN misuse, but still face issues. To request a new Social Security number, contact your local Social Security office to book an in-person appointment.

How can I find out if someone is using my identity?

There are several ways to check if someone’s using your identity, including reviewing your credit report, bank statements, and Social Security statements for suspicious activity like new accounts you didn’t open or transactions you didn’t make. Other signs you may be a victim of identity theft include missing mail and alerts from an identity theft protection service.

What happens when someone steals your SSN?

When someone steals your SSN, they could use it to open credit card accounts in your name, apply for jobs in your name, or commit other types of identity fraud. This can result in you suffering financial losses, employment problems, and benefits issues.

How do you put a pin on your Social Security number?

You can apply for an IP PIN through the IRS. This six-digit number helps prevent tax-related identity theft by adding a verification layer to the tax return filing process, preventing someone with your SSN from filing a fraudulent return.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- How to lock your Social Security number

- When to lock your SSN

- What happens when you lock your Social Security number

- How to unlock your Social Security number

- What to do if your Social Security number is compromised

- How to protect your Social Security number

- Help protect your identity against identity thieves

- FAQs

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.