According to Gallup research, financial scams are among the most prevalent crimes impacting American adults, with 15% of respondents reporting that they or a household member had been scammed in the past year. Thankfully, there are telltale signs that someone is trying to get your personal information or money.

Read on to discover how to spot a scammer and protect your sensitive data or money from falling into the wrong hands. Here are nine common signs that you’re dealing with a scam.

1. Unsolicited calls or emails

An unexpected phone call or email from someone requesting your information should raise red flags. Scammers often impersonate legitimate organizations and use these methods to catch people off guard and trick them into divulging personal details. Don’t provide any personal or sensitive information to anyone you don’t know or trust.

If someone asks for information and you think it may be a legitimate request, contact the organization they claim to represent through an official and verified channel to confirm the legitimacy of the request.

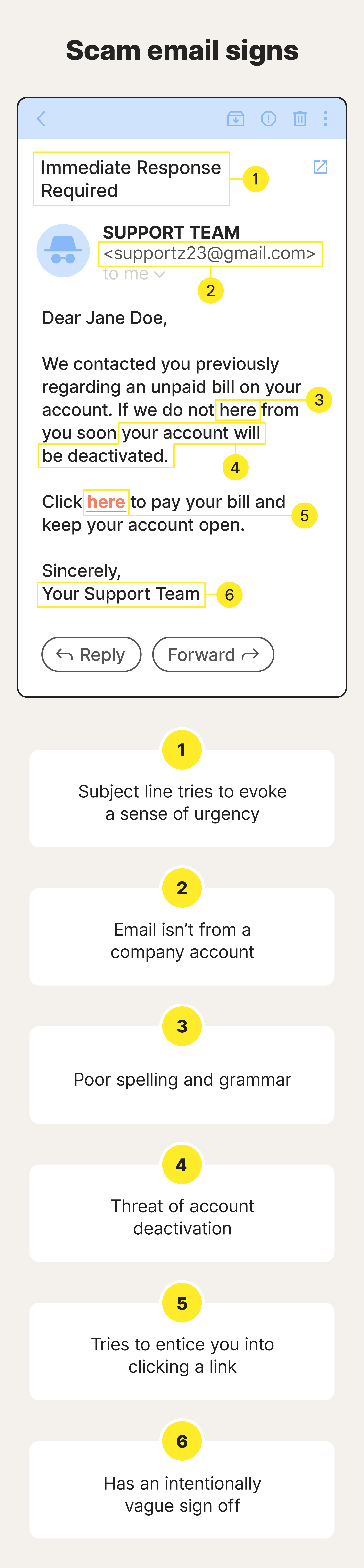

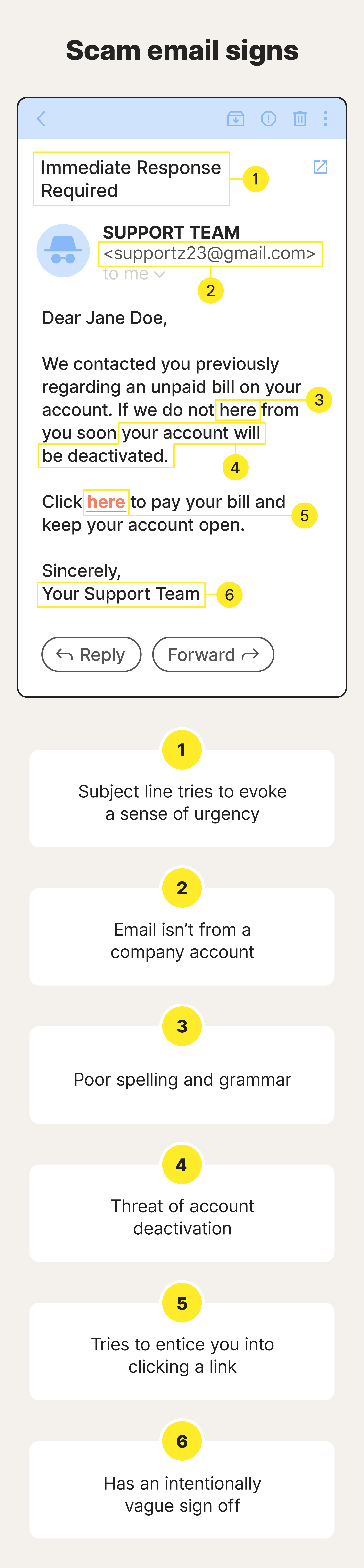

2. Messages with grammatical mistakes and spelling errors

Internet scammers aren’t grammarians, and their emails can be dotted with mistakes and spelling errors. Reputable companies thoroughly proofread all material they send to clients, partners, and employees, and they won’t send emails unless they’re well-written and error-free. If you spot mistakes, don’t click links or provide personal information.

However, since AI has made it easier for online scammers to write clean emails, it can be trickier to identify a scam if you look only at the content of the email. Pay close attention to the address the email was sent from, because scam emails will likely come from unusual or spoofed email addresses.

3. A sense of urgency

Scammers often display a sense of urgency to trick you into quickly providing personal information without thinking. Scam messages often include phrases such as “Your account will be suspended if you don’t act now,” “Immediate action required to avoid penalties,” or “You’ve won a prize, but you need to claim it right away.”

Other scams might try to impersonate a friend or family member in trouble, and they’ll ask for immediate help with some personal crisis. While receiving these calls is alarming, do not provide any information. Instead, call the individual directly to confirm their safety and whereabouts.

4. Too-good-to-be-true offers

Scammers may try to entice you to share personal information by offering incredible opportunities or deals, like a free vacation or a job at your dream company without an interview. In fact, the Better Business Bureau estimates that 14 million people are exposed to employment scams annually. When evaluating an offer, remember the old saying, “If something sounds too good to be true, it probably is.”

5. Payment requests

One of the clearest signs of a scam is when someone asks for payment before delivering on their promise. Whether it's a prize, debt relief, or a job opportunity, if you're required to pay an upfront fee to claim it, you're likely dealing with a scam.

Scammers often request payment through hard-to-trace methods like gift cards, wire transfers, or cryptocurrency. Legitimate organizations rarely, if ever, ask for payment this way.

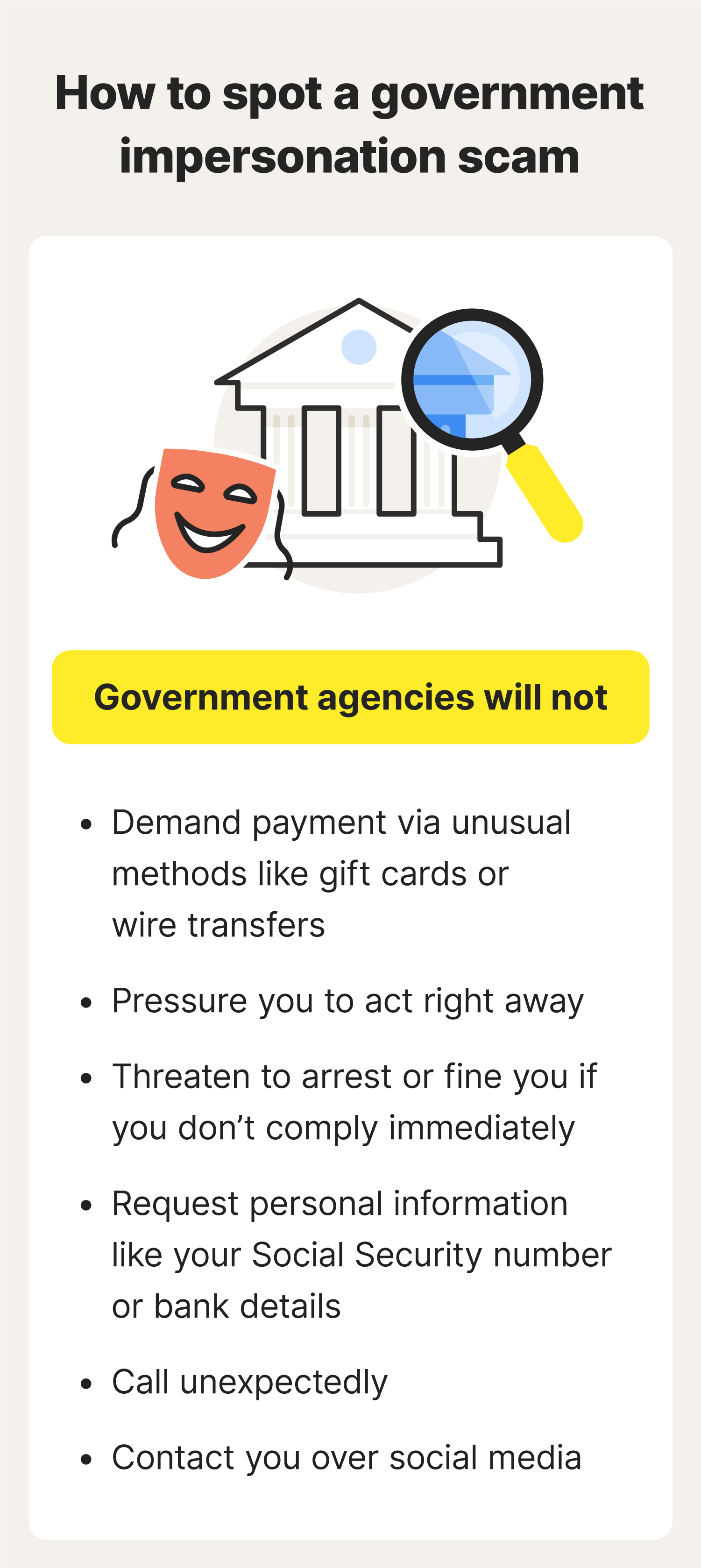

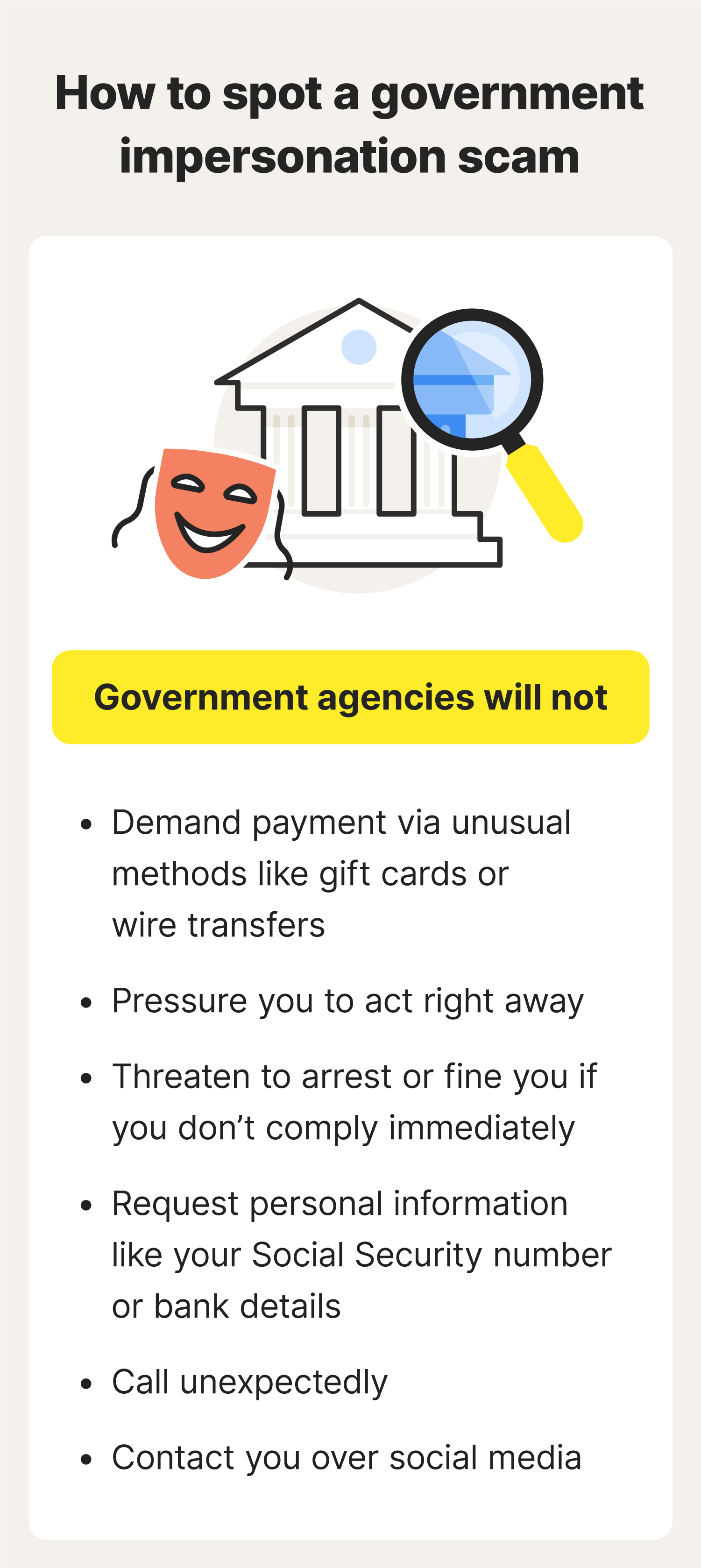

6. Claims purporting to be from a government agency

In government imposter scams, a fraudster impersonates government agencies like the IRS or Social Security Administration to trick you into providing personal information or money. These criminals will often claim you owe money for phony reasons and demand payment.

Legitimate government agencies will almost always contact you via the mail, and they’ll never request sensitive information or immediate payment over the phone or through unsolicited emails.

7. Unlisted or unknown numbers

You’ve likely received calls from unknown numbers before. Often, the call is from an innocuous telemarketer; but it might be a phone scammer trying to trick you. Some scammers use numbers with your area code to make you think someone local is calling.

As a rule of thumb, if you don't know the number, don’t pick up—unless you’re expecting to be contacted, but even then the caller will almost certainly leave a text message if it’s important.

Call-blocking services help stop unwanted calls, reducing your chances of receiving calls from scammers.

8. Requests for personal information

Many scammers aim to collect personally identifiable information like your name, Social Security number, or account number. They can then sell your data on the dark web or use it to commit identity theft or credit card fraud. Be wary of any unsolicited requests for personal information, especially if the sender pressures you for an immediate response.

9. Automated messages or scripts

One of the top phone scam warning signs is automated messages. Also known as robocall scams, these calls use pre-recorded scripts or AI to impersonate legitimate businesses or government agencies.

The popular "Can you hear me?" scam uses an automated message to trick people into saying the word "yes." Criminals can then use the recording of your voice to agree to a contract, authorize transactions, or even target loved ones using your voice.

If you receive a call from an unknown number, always wait until the other person (or bot) starts talking. If you think it’s a bot, hang up without responding.

What to do if you've been scammed

So you accidentally gave a scammer your personal information or money—what now? Follow these steps to help prevent further damage.

- Place a fraud alert: A fraud alert is a warning on your credit report that tells lenders to verify your identity before opening new accounts.

- Keep an eye on your financial accounts: Regularly check your financial accounts for unusual activity or unauthorized transactions.

- Freeze your credit: A credit freeze helps stop anyone from opening new accounts in your name.

- Change your passwords: Update your passwords and use strong and unique ones for all your accounts.

- Report the scam: Report the scam to the FTC and any other relevant authorities, depending on the severity of the scam.

- Invest in identity theft protection tools: Services like LifeLock help monitor† your personal information and alert you if any suspicious activity is detected. If you happen to fall victim to identity theft, LifeLock’s dedicated U.S.-based customer support team is standing by to help you recover.

How to help avoid being scammed

Now that you know how to spot a scam, what else can you do to help protect your personal information and avoid identity theft? Use the following best practices to steer clear of scammers.

- Contact organizations through verified channels: If someone reaches out to you saying they’re from a company or organization, hang up and contact the organization using a phone number or email address from their official website.

- Don't open emails from unknown sources: Delete emails from unfamiliar senders to avoid potential scams or malware.

- Don't click any links: If you have to open an email from an unknown source, don’t click links or download attachments to help prevent phishing scams and malware attacks.

- Block sketchy numbers: Block suspicious phone numbers to stop unwanted scam calls and texts from that caller in the future. Use a spam-blocking filter or service to help block scam callers.

- Don't get bullied into acting immediately: Take your time and verify requests before acting. Don’t ever feel pressured to respond to a message or communication you’re uncertain about.

Get proactive scam protection

Understanding how to identify scams empowers you to navigate potential threats more confidently. For additional reassurance, get a LifeLock membership to monitor† your personal information and receive alerts if suspicious activity or fraud is detected.

And if your identity is ever stolen, LifeLock’s expert U.S.-based restoration specialists will work with you to help restore your identity and get you back on track. Get LifeLock today to stay safer against scams and fraud.

FAQs about how to identify a scammer

Still have questions about how to identify a scammer? Here's what you need to know.

What is a scammer?

Online and phone scammers are individuals who intentionally deceive people to gain access to their personal information or money. If they steal information, scammers can sell it on the dark web or commit identity theft.

How does a scammer know my name and address?

Scammers can exploit publicly available data like voter registration records or people-search sites to obtain names and addresses. If a scammer has your address and name, they can use those details for delivery scams or even doxxing attacks.

What do I do if I sent a picture of my ID to a scammer?

Report that your ID has been compromised to the relevant office (e.g., the Department of Motor Vehicles if it was your driver’s license). You should also file a police report and place a fraud alert or freeze your credit.

What are some common internet scams?

Some common internet scams include:

- Fake job offers

- Phishing attacks

- Romance scams

- Tech support scams

- Online shopping scams

- Rental scams

- Investment scams

- Lottery scams

†LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Unsolicited calls or emails

- 2. Messages with grammatical mistakes and spelling errors

- 3. A sense of urgency

- 4. Too-good-to-be-true offers

- 5. Payment requests

- 6. Claims purporting to be from a government agency

- 7. Unlisted or unknown numbers

- 8. Requests for personal information

- 9. Automated messages or scripts

- What to do if you've been scammed

- How to help avoid being scammed

- Get proactive scam protection

- FAQs about how to identify a scammer

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.