Identity theft is one of the top reported crimes in the U.S., affecting millions of people every year.

According to the Federal Trade Commission’s 2024 Consumer Sentinel Network Data Book, the agency received around 1.1 million reports of identity theft — 18% of all recorded reports for that year. This aligns with trends highlighted in one Gen Threat Report released in early 2025, which shows notable increases in identity-related alerts across our user base, including a(n):

- 13.83% increase in credit alerts

- 11.98% increase in criminal record alerts

- 3.04% increase in transaction alerts

From fraudulent credit accounts to stolen medicare benefits, identity theft can cause serious financial and emotional stress.

This guide walks you through how to check if someone is using your identity, what red flags to watch for, and the steps you can take to protect yourself before it’s too late.

1. Check your credit report for strange accounts or mistakes

One of the easiest ways to check if someone is using your identity is to look at your credit report. Since it lists all your credit accounts and applications, you can quickly spot identity theft or suspicious activity. This is especially important, as cybercriminals often attempt to obtain short-term loans and new credit cards in victims’ names.

A recent Gen Threat Report found that 32% of users received alerts about payday loan fraud, while 15% were tied to new credit card applications — both common forms of identity theft.

To perform a free check to see if your identity has been stolen, visit AnnualCreditReport.com. It’s the only site authorized by the federal government to issue free credit reports from all three major credit bureaus. When reviewing your report, look carefully for new or unfamiliar accounts, credit inquiries you don’t recognize, or incorrect personal details.

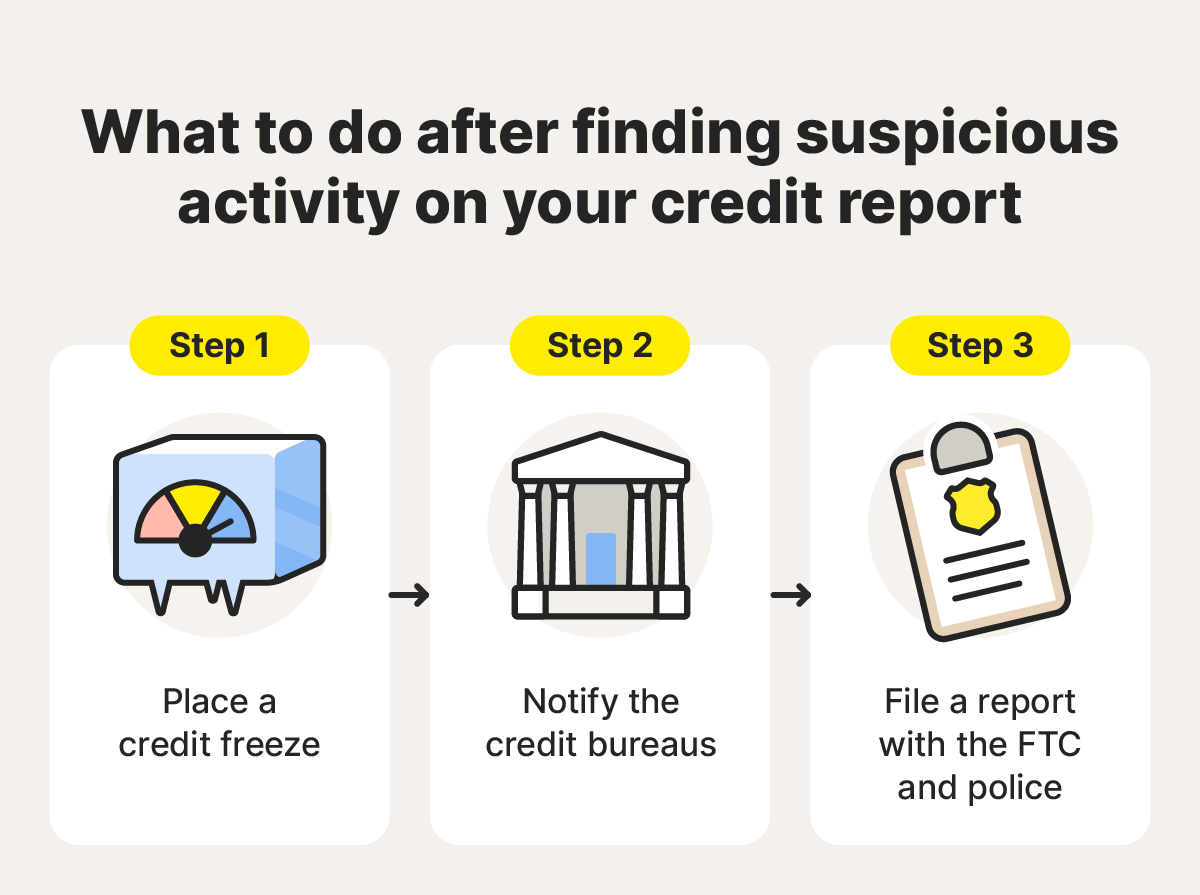

If you find something suspicious, take action immediately. Prioritize these actions:

- Freezing your credit report: A credit freeze prevents lenders from accessing your credit report, which in turn stops them from approving new credit applications without your permission.

- Discussing credit report inaccuracies with the credit bureaus: You can request additional information about how, where, and when the account was opened and find out what they need from you to close it.

- Reporting the fraud to the FTC and the police: To close out fraudulent accounts or file an identity theft insurance claim, you may need a police report. The FTC also has some helpful tips for how to handle identity theft.

Regularly checking your credit reports is one of the best ways to know if your identity has been stolen and protect yourself from further credit card fraud. You can also use an identity theft protection service like LifeLock Total for daily monitoring and faster alerts if someone tries to use your information.

2. Review your mail for unexpected bills

Finding unfamiliar bills, random credit cards, and debt collection letters in your mail is a sign that an identity thief is opening accounts or making charges in your name.

Here’s how to make reviewing your mail easier:

- Keep a list of regular bills: Note each one as it arrives and check them off monthly. If a bill is missing, contact the company right away.

- Verify mailing preferences: For online accounts, confirm your mailing address is correct and that you’ve opted out of physical mail if needed.

- Follow up on missing mail: If your address was changed without permission, report it — someone could be committing mail fraud to steal your identity.

If you get a bill you don’t recognize, don’t ignore it. Contact the sender immediately to report potential identity theft, then check your credit report for related accounts. If the bill appears fraudulent, dispute it with the creditor and report it to the FTC at IdentityTheft.gov.

3. Check your bank statements for errors

With online banking, it’s easier than ever to spot suspicious activity quickly. If you see charges you didn’t make or transfers you didn’t authorize, that’s a clear sign someone may be using your identity.

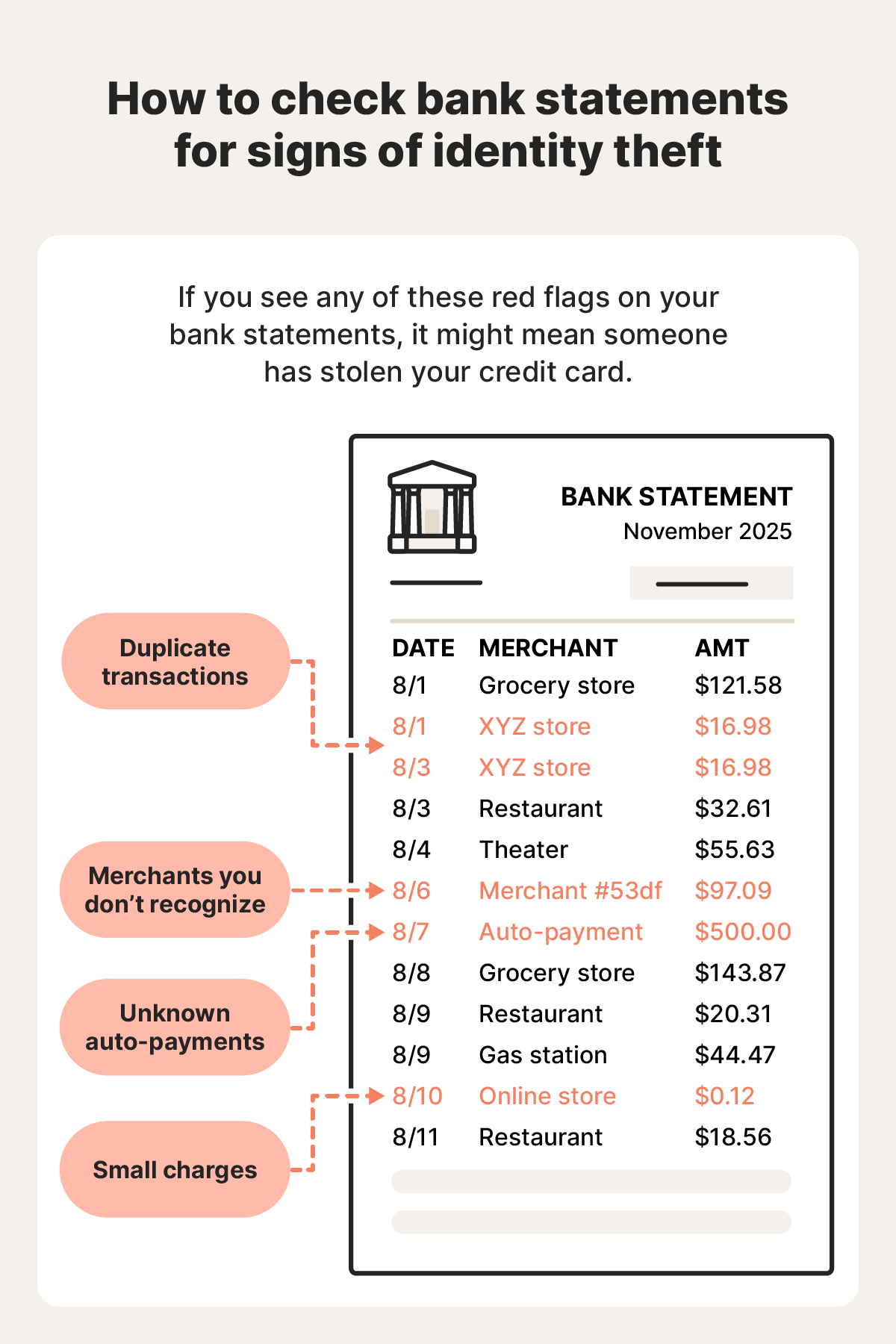

Sorting through every transaction can take time, but if it means catching the problem before someone spends all of your money, it's worth it. Here are a few small signs to look out for on your bank statements:

- Duplicate transactions: A scammer might try to charge you multiple times for the same purchase.

- Small charges: Scammers might start by making small purchases to see if you’re paying attention to how much money is in your account. This could be the first step in a carding scheme as well.

- Merchant names you don’t recognize: Shopping online makes it a bit tougher to directly match the name of a store to the merchant name, but if something looks unfamiliar, double-check the date and time of your recent orders to confirm whether the charge is legitimate.

- Automatic payments you don’t recognize: Automatic payments could be a sign that someone is using your identity and sending regular payments to themselves.

Contact your bank if you have any questions about any of the charges on your statements, or to report any fraudulent transactions.

4. Look at your health records

If your health records show treatments you never received, prescriptions you never filled, or doctor visits in cities you’ve never been to, you may be dealing with medical identity theft — though these inaccuracies can result from provider or billing errors as well.

For example, 2024 saw record-breaking numbers of breached medical records (more than 250 million). To see if someone has been using your identity to receive medical care, check these places:

- Explanation of Benefits (EOB): Your EOB provides an overview of the care you received from a healthcare provider and information about how much your insurance company will cover and when. If you start receiving an EOB for medical services, prescriptions, or medical equipment you didn’t receive, contact your insurer immediately.

- Medical bills: If you receive medical bills for services you haven’t received, contact the doctor and your insurance company as soon as possible.

- Medicare statements: Medicare fraud and Medicare scams are becoming more common, so look at your Medicare statements to check that no one is committing fraud in your name. And watch out specifically for scams that target the elderly if you fall into that category.

If you fail to act on medical identity fraud, you could lose your Medicare coverage or be denied care because you’ve “met” your insurance plan’s limits.

5. Monitor your Social Security Statements

Your Social Security statement can help reveal identity theft because it lists all earnings reported under your name. So if someone is using your Social Security number for employment, you might see wages from a company you never worked for, income in a state you’ve never lived in, or earnings during periods when you weren’t employed at all.

Identity thieves may even use your information to file a tax return in your name and steal your tax refund. You might discover this when your legitimate tax return gets rejected or you receive an IRS notice about wages or refunds you didn’t claim.

If you see suspicious income on your Social Security statement or get an unexpected IRS notice:

- Contact the Social Security Administration (SSA) right away to report the fraudulent activity. You can call their hotline at 1-800-269-0271.

- Contact the IRS Identity Protection Specialized Unit at 1-800-908-4490. You might be asked to complete Form 14039, Identity Theft Affidavit, to officially report and resolve the issue.

- Contact one of the three major credit bureaus (Equifax®, Experian®, or TransUnion®) to place a free fraud alert on your credit report. They’ll automatically notify the other two on your behalf.

Regularly reviewing your Social Security and tax records proactively can help you spot identity theft early and take action before it causes lasting financial damage.

6. Look for unknown devices logged into your accounts

Regularly check that all devices connected to your online accounts actually belong to you, and sign out of any that don’t. An unfamiliar device can be a sign that someone is attempting to use your identity. Because phones, tablets, and computers store so much personal information, the accounts tied to them are prime targets for identity thieves.

In one case, an Apple user noticed messages being sent from their Apple ID without their knowledge. After checking their account under Settings > Apple ID > Devices, they found a suspicious device labeled “Roku.” Although they owned a Roku TV, that particular listing wasn’t theirs. It was a hacker hiding under a legitimate-looking device name.

After revoking access from unauthorized devices and ending their sessions:

- Create a new, stronger password than you currently have.

- Enable the strongest security options available, including two-factor authentication whenever you can, to add an extra layer of protection.

- Check any connected accounts for suspicious activity.

- Update your devices for the most up-to-date security settings.

- Run a virus and malware scan.

- Change other passwords using stronger, more secure passwords.

7. Use identity theft protection services

Identity theft protection services are there to inform you of when your information could be in the hands of identity thieves. By regularly scanning the dark web and monitoring data breaches, these services, including LifeLock, are on the lookout for your personally identifiable information in places it shouldn’t be listed.

Because these services have the specialized training and hardware necessary to perform identity theft checks around the clock and alert you when your identity may have been compromised, subscribing is one of the best ways to see if someone might be using your information for their own gain.

These services can:

- Monitor the credit bureaus to see if someone has tried to open a new account in your name.

- Help you lock down your identity if it’s been stolen.

- Enlist expert help, including attorneys, to help resolve your case.

- Provide reimbursement for stolen funds.

Not sure how your personal information got into the hands of a criminal in the first place? It might surprise you how many different ways your data can end up on the dark web or sold between thieves. Get LifeLock to help protect against identity fraud and help secure your finances, credit, and reputation.

How does identity theft happen?

Identity theft can happen in many ways. Whether it’s a phishing email that tricks you into giving up login information, or someone shoulder surfing and watching you type sensitive details, each tactic is designed to capture the personal data criminals need to impersonate you.

Being aware of how it could happen can help you protect your data better. Some of the most common ways identity theft can happen include:

- Phishing: Phishing emails and other scams trick users into providing their data directly to criminals, inadvertently creating openings that expose their data, or downloading dangerous malware.

- Shoulder surfing: When a criminal spies on someone using a smartphone, tablet, computer, or ATM, they can learn that person’s sensitive information and steal their identity.

- Physical theft: Thieves will steal someone’s purse or wallet, break into their homes, or even dig through trash looking for sensitive information.

- Data breaches: A hacker breaks into secure databases, downloads personal data, then distributes or sells it.

- Using public Wi-Fi: Unsecured public internet connections can expose you to vulnerabilities that make it easier for hackers to exploit.

In fact, according to the FTC Consumer Sentinel Network Data Book 2024, the most common type of identity theft was credit card fraud (449,032 reports). This is followed by loan/lease fraud, government document-related fraud, and tax fraud.

Identity theft red flags

The red flags indicating identity theft include both subtle and obvious changes in your accounts and personal records. Unfamiliar charges, accounts you didn’t open, and sudden credit score drops can all signal that someone is using your personal data without permission.

Here are some of the most common red flags that may signal your identity has been stolen:

- Rejected tax return: This could mean someone already filed a return in your name to claim your refund.

- Loan or loan denials: If you’re turned down unexpectedly, someone may have opened accounts or racked up debt using your identity.

- Identity theft protection service alerts: These alerts can signal suspicious activity on your credit or personal accounts.

- Credit score drops: A sudden credit dip could point to new accounts, missed payments, or unauthorized credit activity.

- Calls from debt collectors: Calls about debts you don’t recognize are a major sign your identity has been used fraudulently.

- Receiving unemployment or benefit paperwork: If you didn’t apply, someone may be using your Social Security number to collect benefits.

- Unexpected login alerts or password reset emails: Hackers may be trying to take over your online accounts.

- Unknown devices or locations linked to online accounts: Unfamiliar logins could mean someone has gained access to your account.

- Verification codes you didn’t request: This often means someone has your username or password and is trying to log in.

6 steps to take if you’re the victim of identity theft

If you act quickly after your identity has been stolen, you can reduce the overall effects of the thief’s efforts. Here’s a more in-depth look at the steps you should take to help protect yourself:

- Lock down your accounts: This will look different for each of your accounts, but at the very least, you should change your passwords, enable two-factor authentication, and revoke access for other devices.

- Freeze your credit: Each major credit bureau allows you to freeze your credit report. If your identity has been compromised, a credit freeze is essential. Even if it hasn’t, keeping your credit frozen until you apply for new credit can reduce the risk of fraudulent accounts opened in your name.

- Add a fraud alert to your credit report: After freezing your credit, report the identity theft to the credit bureaus. If you’re unsure your identity was stolen but believe your information may have been exposed, place a fraud alert on your credit report. This prompts lenders to request extra verification before approving credit in your name.

- Report ID theft to the FTC, banks, and police: The Federal Trade Commission has a website devoted to dealing with this kind of crime, and they’ll show you how to create a recovery plan. Informing your banks will enable them to implement stricter controls on your accounts. You should also report any identity theft to the police.

- Clean up your devices: Run reputable security software to detect and remove malware as soon as possible. Update your operating systems, antivirus and anti-malware tools, and all regularly used apps before signing back into accounts. Delete unused apps and any suspicious files.

- Use identity theft protection: Identity theft protection can be especially valuable if you’re at higher risk. These services know where to monitor for exposed data and can help limit the damage to you and your family. If identity theft occurs, LifeLock protection plans can also assist with restoration and reimbursement.

Now that you know what to do if your identity is stolen, plan ahead and take preventive measures before it happens to lessen your chances of it happening in the first place.

Help protect yourself from identity theft

Even with the best precautions, identity theft can happen to anyone. Staying proactive can help you catch suspicious activity early. However, for round-the-clock protection and alerts, using an identity theft protection service is even better.

With LifeLock, you get alerts if your Social Security number, financial accounts, or personal information show up where they shouldn’t, including on the dark web. And depending on your plan, you also get up to $1 million in reimbursement coverage for lawyers, experts, and stolen funds.

FAQs

Is there a way to find out who stole my identity?

Usually no. Cybercriminals generally work pretty hard to cover their tracks. But if you file a police report and contact the credit bureaus and the institutions where the thief applied for or received credit in your name, you may uncover their identity.

How do I lock my Social Security number?

You can visit the government’s E-Verify website to place a self-lock on your SSN to prevent someone else from using your Social Security number to get a job. You can block electronic access to your Social Security information by contacting the SSA at 1-800-772-1213.

How do I check if someone is using my identity for unemployment?

Someone may be using your identity to claim unemployment if you receive mail from the government about an unemployment claim you didn’t file or a 1099-G for unemployment you didn’t apply for or receive. Contact your state’s labor board or unemployment agency to report it.

How to check if someone stole my identity online?

To see if someone stole your identity online, check your credit reports for accounts you don’t recognize, watch your bank and credit card statements for strange charges, and track your credit score for sudden drops. If anything looks off, set up a fraud alert or freeze your credit to stop further damage.

How do I know if someone is using my SSN?

You’ll know someone might be using your Social Security number if you spot unfamiliar accounts on your credit report, strange charges on your bank statements, or errors in your tax or Social Security records. Unexpected bills, debt collection calls, and notices about benefits you never applied for are some red flags of SSN misuse.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Check your credit report for strange accounts or mistakes

- 2. Review your mail for unexpected bills

- 3. Check your bank statements for errors

- 4. Look at your health records

- 5. Monitor your Social Security Statements

- 6. Look for unknown devices logged into your accounts

- 7. Use identity theft protection services

- How does identity theft happen?

- Identity theft red flags

- 6 steps to take if you’re the victim of identity theft

- Help protect yourself from identity theft

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.