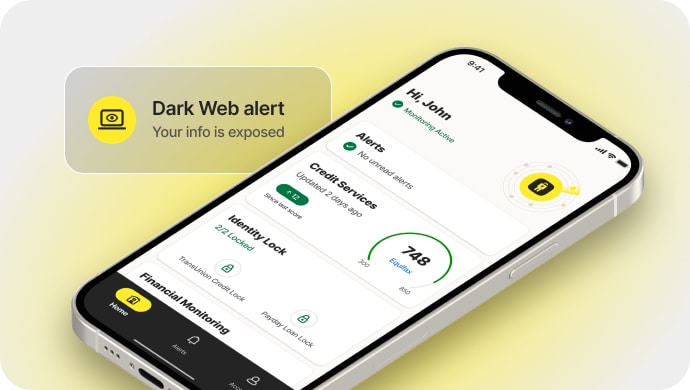

Proactive protection, enhanced credit monitoring, and broader financial coverage. If you become a victim of identity theft, a U.S.-based Restoration Specialist will be dedicated to your case from start to finish, and will fix it, guaranteed.* Plus, now you get Scam Reimbursement coverage.7

LifeLock Identity Theft Protection Advanced

Frequently asked questions

Frequently asked questions

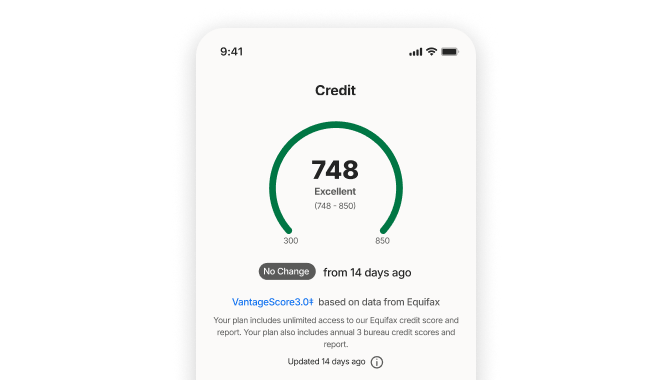

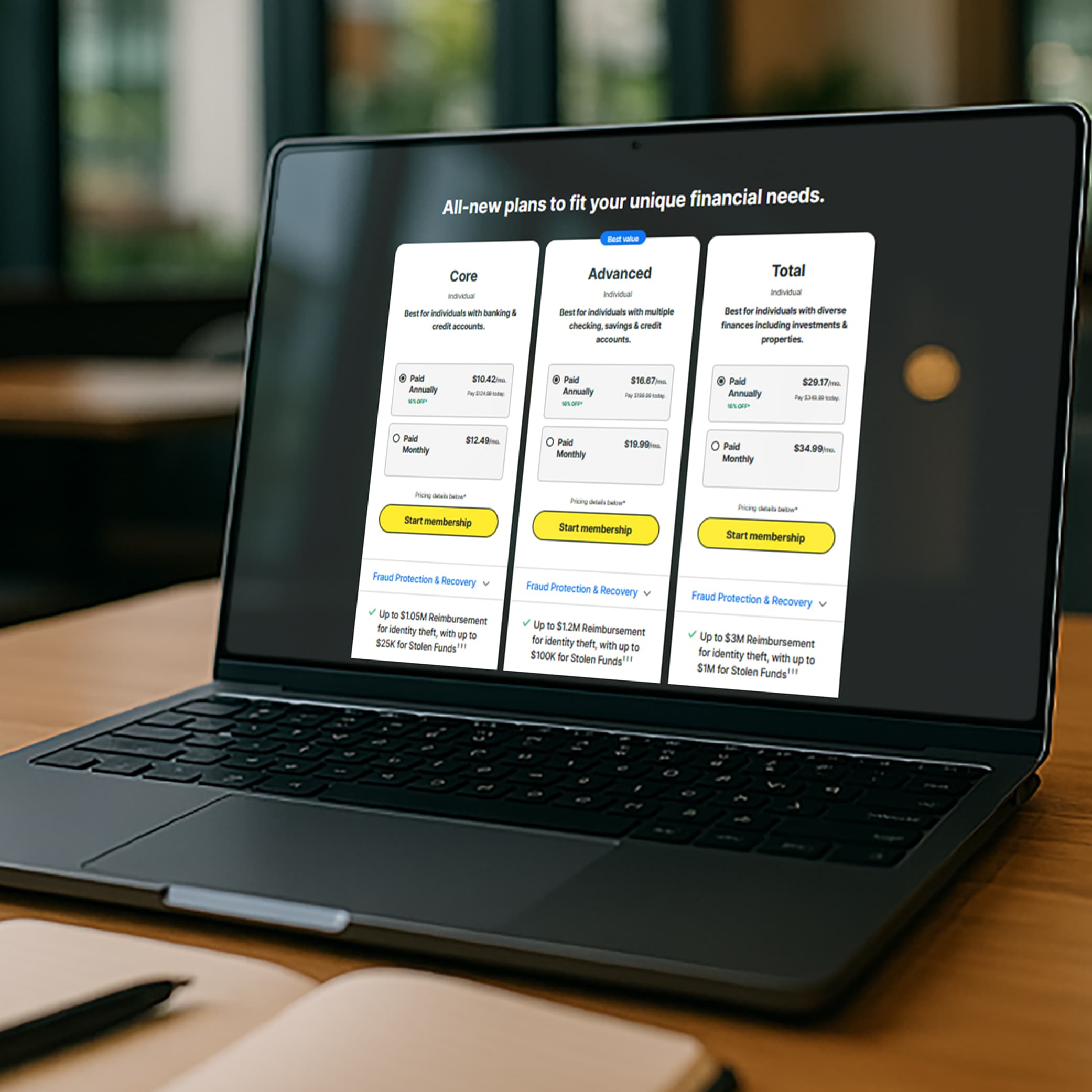

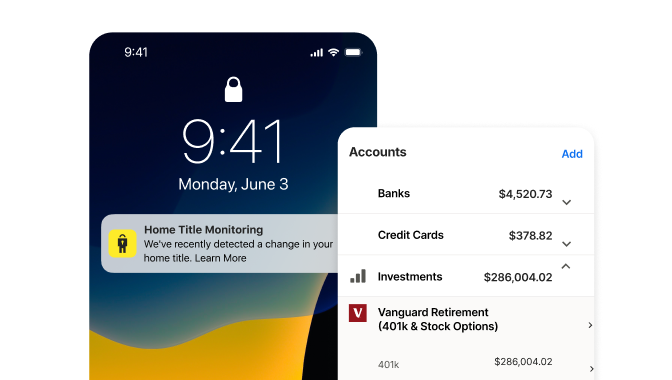

LifeLock Advanced includes everything in LifeLock Core, plus higher reimbursement limits, broader monitoring, and scam protection. It also increases reimbursement limits and adds scam support and reimbursement. It notifies you of suspicious activity across up to five of your credit, checking, and savings alerts vs two accounts in LifeLock Core. LifeLock Advanced also provides credit monitoring1 across all three credit bureaus, in addition to your daily credit score across Equifax, TransUnion, and Experian. With LifeLock Advanced, you also get access to priority customer service support.

Up to $100,000 for stolen funds due to identity theft.

Yes. Personal expenses are covered up to $100,000 per person.

Yes. You’ll receive scam support plus up to $5,000 in scam reimbursement for eligible losses.

LifeLock Advanced monitors up to 5 checking, savings, or credit accounts.

Yes. Advanced includes telco and utility account alerts.

LifeLock Advanced includes three-bureau credit monitoring, annual three-bureau reports, and monthly one-bureau reports.

If you receive an alert from LifeLock, immediately log in to your Norton account (or app) to review the details and click "Yes" or "No" to confirm if you authorized the activity. If fraudulent, select "No" to trigger an investigation and dispute the alert.

Yes. Advanced includes priority 24/7 customer phone support.

You may also like:

No one can prevent all cybercrime or prevent all identity theft.

- Price valid for introductory term. After that, your price will renew at the standard price.

- Your subscription begins immediately after your transaction is complete. A payment method is required at sign-up for trials, and you will be charged at the end of your trial, unless canceled first.

Prices are subject to change and may be charged up to 35 days prior to renewal. Cancel here or contact Member Services. - Restrictions apply. Automatically renewing subscription required. If you're a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See LifeLock.com/guarantee for complete details.

††† Up to $1 million coverage for Lawyers and Experts included with all plans. Reimbursement and expense compensation vary according to plan. Insurance benefits are issued by third parties. See LifeLock.com/legal for policy info.

1 Credit features require successful setup, identity verification, and sufficient credit history by the appropriate credit bureau. Credit monitoring features may take several days to activate after enrollment.

2 Identity Lock cannot prevent all account takeovers, unauthorized account openings, or credit file inquiries. Deactivates if you downgrade or cancel your subscription.

7 Scam protection coverage as part of identity theft benefits is currently available to all customers residing in the United States, including U.S. territories and the District of Columbia, with the exception of residents of New York. Gen Digital is not a licensed insurance producer. Benefits under the Master Policy are issued and covered by HSB Specialty Insurance Company. You can find further details and exclusions in the summary of benefits.

8 After setup, automatic data broker removal service scans and requests removal every 90 days.