Tax season puts your entire financial identity in motion, giving scammers and identity thieves the ideal opportunity to steal sensitive information like your Social Security number and banking information. Falling victim to a tax scam can leave you at risk of fraud, financial losses, and the potentially devastating consequences of identity theft.

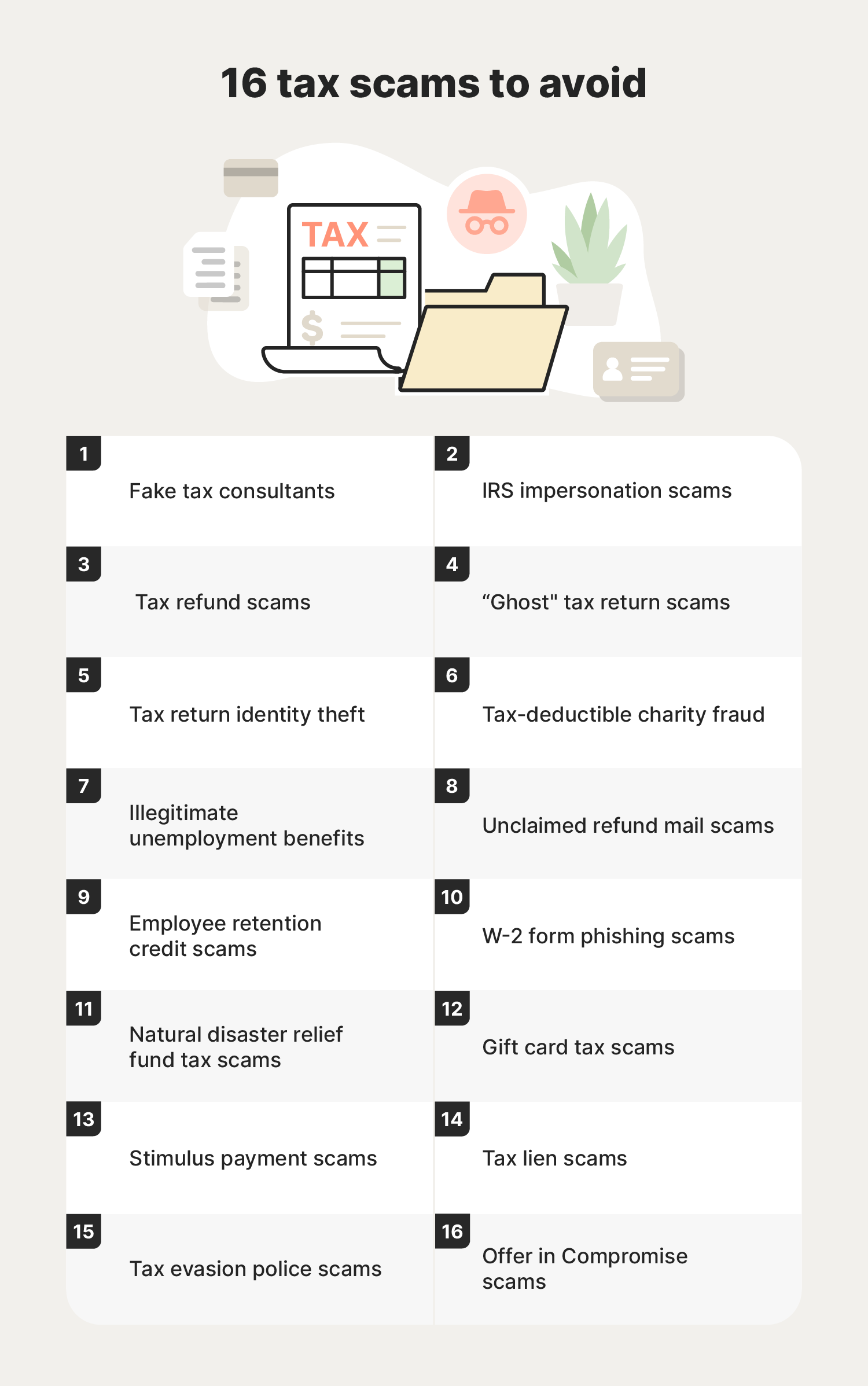

However, by learning about the approaches scammers use, staying vigilant, and applying protective strategies, you can help keep your finances and identity safer. Read on to discover 16 of the most common tax scams to watch out for this tax season, including some listed in the IRS’ Dirty Dozen, and what you can do to protect against them.

1. Fake tax consultants

Fraudulent individuals or firms can pose as knowledgeable tax professionals or tax preparers offering services to assist you with your tax obligations. These fake tax consultants may promise to minimize your tax liabilities or maximize your refunds. If you use their services, you may face audits, penalties, or legal action due to inaccurate filings or tax avoidance. Alternatively, the scammer might fraudulently direct your refund to their account.

What scammers might say: “Hello, I'm a tax consultant offering exclusive services to minimize your tax liabilities and maximize your refunds. Just provide your personal and financial information, and I'll handle the rest.”

Tips to avoid the scam: Only use credentialed and trustworthy tax professionals that you’ve verified independently, and never share sensitive details with them before confirming they’re legitimate.

2. IRS impersonation scams

IRS impersonation scams involve criminals posing as the IRS, often claiming you owe back taxes, penalties, or interest, and insisting that failure to pay will result in severe consequences. These fraudsters may contact you in convincing fake emails or by phone, spoofing their caller ID to make it look like they’re calling using an official IRS number. They may also request that you use payment methods like Zelle, which the IRS would never accept.

What scammers might say: “Hello, this is the IRS calling to inform you that you have an outstanding tax debt. Failure to settle immediately will result in legal action, including arrest or asset seizure.”

Tips to avoid the scam: If you suspect you’re dealing with a scammer impersonating the IRS, cut contact immediately and contact the IRS directly using the details on the official IRS fraud page to report the scam.

3. Tax refund scams

In refund scams, criminals will contact you to say they recalculated your IRS refund and you are due more money. The message may ask you to click a link to claim your refund, but you’ll instead be directed to a fake web page that installs malware on your device or requests your bank account information.

What scammers might say: “We’ve recalculated your tax refund and need your bank details to return the difference. Please enter your bank account details to expedite the process.”

Tips to avoid the scam: Don’t click links or share financial details when contacted out of the blue. Check your IRS return status directly on the official IRS website instead.

4. “Ghost” tax return scams

In this scam, unethical tax return preparers, or “ghost preparers,” don’t sign the tax returns they prepare. They will usually charge you fees based on the size of the refund you receive. But you could end up in trouble due to bogus deductions and other shifty practices they use to inflate your refund — and their commission.

What scammers might say: “As professional tax preparers, we guarantee we can double your refund. And for your convenience, we manage everything online.”

Tips to avoid the scam: Avoid preparers who won’t sign your return or promise unusually large refunds. If something seems too good to be true, it probably is.

5. Tax return identity theft

Criminals with access to the sensitive information you need to complete a tax return may try to file one in your name, hoping to claim your refund before you get a chance to file your own. You might not find out that your tax refund has been stolen until you go to file your return, when it’ll be rejected by the IRS who says you’ve already filed. Many phishing scams around tax season involve scammers trying to get information they can use to commit tax identity theft.

Tax return fraud is more common than one might think. In fact, in 2024, the IRS flagged $16.5 billion in refunds for possible identity fraud, according to the National Taxpayer Advocate mid-year report to Congress.

What scammers might say: Nothing. If a fraudster already has your sensitive information, you may only find out about tax return identity theft when you come to file your own return.

Tips to avoid the scam: File your tax return as early as possible and report suspected identity theft to the IRS immediately if your return is rejected. Consider proactively setting up an identity protection PIN (IP PIN) to reduce the risk of tax identity theft.

6. Tax-deductible charity fraud

This type of charity scam happens when criminals scam money from well-intentioned people by posing as legitimate charities and requesting donations, claiming they’ll be tax deductible. If you send them money, your funds won’t help your intended cause and you won’t be able to deduct your donation on your tax return because the money didn’t go to a registered charity.

What scammers might say: “Make a tax-deductible donation to our charity and receive generous tax benefits while helping people in need.”

Tips to avoid the scam: Verify that the charity is registered with the IRS before donating and never feel pressured to give on the spot.

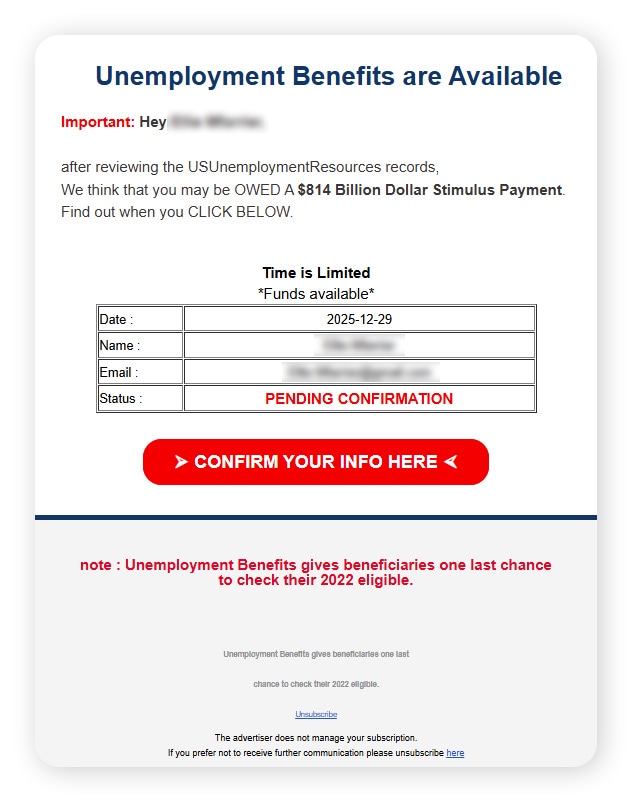

7. Illegitimate unemployment benefits

Illegitimate unemployment benefits scams often begin with scammers acquiring sensitive information through means like data breaches or phishing attacks. If a scammer is able to steal enough of your personal information, including your Social Security number (SSN), they could submit fraudulent unemployment claims on your behalf to illegally receive government benefits.

What scammers might say: “Hello, this is the IRS contacting you to confirm your details. We believe your information may have been compromised in a data breach. Please confirm your SSN and address to secure your data.”

Tips to avoid the scam: Don’t share personal information in response to unsolicited messages and report any unexpected unemployment notices to the relevant authorities immediately.

8. Unclaimed refund mail scams

Unclaimed refund mail scams involve criminals trying to trick you into thinking you have an unclaimed tax refund. You’ll typically receive a document outlining the fake refund in a cardboard envelope delivered by mail. The letter may have a convincing IRS masthead but will include contact details that don’t belong to the IRS. If you contact the scammer and provide personal details, you could fall victim to identity theft.

What scammers might say: “We’re contacting you in relation to your unclaimed refund. We need your personal information to finish processing it. Please call or email us using the contact details provided in this letter.”

Tips to avoid the scam: Treat unsolicited refund letters with caution and verify whether you have an unclaimed refund with the IRS directly, using contact information listed on the official website.

9. Employee retention credit scams

Third-party promoters often advertise their services or send direct mail campaigns about the Employee Retention Tax Credit (ERTC), but these can sometimes be scams. Fraudsters exaggerate who qualifies for the credit and charge upfront fees to help you claim it. If you receive the credit but aren’t eligible, you’ll end up having to repay it and won’t get your fees back. Before applying, check the ERTC requirements.

What scammers might say: “We’re writing to inform you that you qualify for the Employee Retention Tax Credit. If you would like us to process this for you, simply pay the fee below.”

Tips to avoid the scam: Confirm your eligibility for ERTCs with a trusted tax professional or the IRS before paying any fees or filing for the credit.

10. W-2 form phishing scams

The W-2 phishing scam typically involves scammers targeting HR or finance employees in a business to get access to W-2 forms. They might do this by pretending to be someone senior in the organization, like the CEO or CFO. If the target employee falls for the scam and sends W-2 forms, the fraudster will have access to sensitive information like names, addresses, and SSNs that they can use in tax fraud or identity theft.

What scammers might say: “It’s Greg, I need everyone’s W-2s ASAP in one file. We’re being investigated by the IRS and I need to assure them all the forms were completed correctly.”

Tips to avoid the scam: Verify that any urgent requests for employee tax data are legitimate by contacting the sender through a separate, trusted communication channel.

11. Natural disaster relief fund tax scams

Disaster relief fund tax scams capitalize on the aftermath of catastrophic events by claiming to assist affected communities. Scammers may masquerade as government agencies and promise financial aid to those impacted by a natural disaster, requesting donations that they claim are tax deductible. These fraudulent schemes aim to deceive victims into providing personal information online or paying into non-existent relief funds.

What scammers might say: “Support disaster relief efforts by donating to our local fund for survivors. For a fast donation, pay with a cash app or in gift cards.”

Tips to avoid the scam: Only donate money through organizations you know and trust, and avoid donation requests that demand strange payment methods, like gift cards or cash apps.

12. Gift card tax scams

This form of gift card scam is common around the holiday season and usually begins with a scammer asking you to pay a fake tax bill with gift cards. The most common way that con artists request gift cards is over the phone but they also use text messages, emails, or social media.

What scammers might say: “We're calling from the IRS, and you owe back taxes. To avoid arrest, purchase $200 in gift cards and provide the codes for immediate payment.”

Tips to avoid the scam: Remember that the IRS never accepts gift cards as payment and stop communicating with anyone who requests that you pay your bills with them.

13. Stimulus payment scams

The stimulus payment scam involves scammers claiming that you’re eligible for a stimulus payment and requesting you click a link to provide personal and financial details. Instead, you’ll be led to a fake web page designed to steal your sensitive information or request a processing fee. Since you don’t have to pay a fee to receive a stimulus check, scammers are ultimately trying to steal your identity or money.

What scammers might say: “To claim your stimulus payment, provide your SSN and pay a small processing fee. Act fast to ensure you don't miss this opportunity.”

Tips to avoid the scam: Ignore messages asking for fees or personal details and confirm your eligibility for a stimulus payment directly through official government websites.

14. Tax lien scams

In this mail tax scam, fraudsters pose as a fake agency with a convincing name like the “Bureau of Tax Enforcement” in a letter that threatens you with an IRS lien or levy. If you don’t owe taxes you should scan the letter and send it to phishing@irs.gov. If you’re not sure whether you owe taxes, you can confirm whether the request is legitimate by calling the IRS at 1-800-829-1040.

What scammers might say: “To avoid a federal tax lien, pay your tax debt in full now.”

Tips to avoid the scam: Don’t respond to or comply with demands in threatening letters. Verify your tax status directly with the IRS using their official contact details.

15. Tax evasion police scams

Scammers may impersonate law enforcement officers, claiming to be contacting you on behalf of the tax authorities and accusing you of tax evasion. They may use tactics like threats of arrest, imprisonment, deportation, or imminent legal action to scare you into providing sensitive information or making a payment. If you comply with their demands, you could end up facing an uphill battle to recover from identity theft.

What scammers might say: “This is Officer Smith from the IRS Criminal Investigation Unit. You’re under investigation for tax evasion, and a warrant will be issued for your arrest unless you settle your outstanding tax debt immediately.”

Tips to avoid the scam: Law enforcement agencies won’t demand immediate payment over the phone, so hang up on any suspicious callers and report the call to the IRS.

16. Offer in Compromise scams

An Offer in Compromise (OIC) tax scam tricks you into paying upfront fees with the promise of settling your tax debt for less than the full amount. The IRS offers legitimate OIC programs, but scammers exaggerate your chances of qualifying and pocket your money without helping you negotiate with the IRS.

What scammers might say: “You owe the IRS money and they’re preparing to seize your assets. Let us help you eliminate 100% of your tax debt for pennies on the dollar.”

Tips to avoid the scam: Check your eligibility for an Offer in Compromise directly on IRS.gov and be wary of anyone guaranteeing results or demanding upfront fees.

How a tax scam can lead to identity theft

While some tax scams are relatively simple attempts from a scammer to steal your money, others are gateways to more serious identity theft. Scammers posing as the IRS, a tax preparer, or a government agency might be trying to steal sensitive information, like your SSN, date of birth, or bank account details.

Once scammers have enough of your identifying or financial information, they can use it to commit tax-related identity theft, filing a fraudulent tax return in your name to steal your refund, for example. But the impact can extend way beyond tax season. Stolen tax and financial details can also be used in other forms of fraud, with scammers opening credit accounts, applying for loans, or accessing bank accounts in your name.

Your stolen information could even be sold on the dark web, leaving you vulnerable to follow-up fraud in the months or years to come. And if you do fall victim to tax fraud, the road to recovery can be long: tax-related ID theft victims wait nearly two years for resolution on average, according to the 2025 National Taxpayer Advocate Objectives Report to Congress.

How to spot tax scams

The best way to increase your chances of avoiding tax scams is knowing how to spot them. That starts with understanding the specific approaches scammers use, but it also involves knowing what general red flags to look out for in messages, letters, emails, or phone calls claiming to be from the IRS.

Here are some key warning signs that you’re being targeted in a tax scam:

- Unsolicited communication: Be wary of unsolicited phone calls or emails claiming to be from the IRS. The IRS will always send a letter or notice in the mail before getting in touch with you via any other channel. If you haven’t received a letter, anyone reaching out to you claiming to be from the IRS is likely to be a scammer.

- Pressure tactics: Scammers often use pressure tactics, such as threats of arrest or financial damages, to intimidate victims into providing personal information or making payments. Don’t be pressured into acting quickly, and take the time to call the IRS if you’re ever in doubt.

- Payment requests: The IRS will never demand immediate payment for a tax shortfall or request payment via unconventional methods like gift cards or payment apps. Treat contact from anyone asking for immediate payment as a red flag that you’re being scammed and only ever pay your taxes through the official payments page on the IRS website.

- Phony email requests: Be cautious of emails claiming to be from the IRS and avoid clicking any links or opening attachments. The IRS will never request personal information over email, and they won’t email you at all before first informing you via a letter or notice in the post.

- Fraudulent messages: The IRS will never initiate contact via a text or social media message. Any messages you receive on your phone, Facebook account, or Instagram account claiming to be from the IRS and asking for personal information or direct payment should ring alarm bells.

- Unofficial tax forms: Verify the legitimacy of any IRS forms or notices that you receive in the mail or via email by checking the official IRS website or contacting the IRS directly. Don’t fill in and return forms that you’re suspicious of without ensuring they’re real.

- Threats and intimidation: The IRS cannot revoke a driver’s license, business license, or immigration status, and will never make a threat to do so. If you’re contacted by someone claiming to be from the IRS who threatens you with punishment if you don’t comply, you’re probably being scammed.

If you’re ever suspicious, remember to verify the legitimacy of a communication claiming to be from the IRS before acting. And if you discover that you’ve been targeted by a scam, report it to the IRS and file a fraud report with the FTC to help prevent others from falling victim in the future.

What to do if you fall for a tax scam

Realizing you’ve fallen for a tax scam can be alarming, but acting quickly can help reduce the damage and stop scammers from causing further harm. If you think you’ve shared personal information or made a payment to a fraudster, start with these steps:

- Contact the IRS immediately: If a scammer has filed a return in your name or you believe your tax information has been compromised, get in touch with the IRS using the official contact details listed on the website. They can help you determine whether your account has been affected and advise you on next steps, such as filing Form 14039 (Identity Theft Affidavit).

- Report the scam: Forward suspicious emails to phishing@irs.gov to help the IRS fight back against scammers targeting taxpayers. You can also file a complaint with the Federal Trade Commission (FTC) at reportfraud.ftc.gov to help the authorities track and shut down emerging scams.

- Freeze your credit: A credit freeze helps prevent scammers with access to your sensitive information from opening new accounts in your name. You can freeze your credit for free with each of the three major credit bureaus — Equifax, Experian, and TransUnion.

- Update compromised accounts and information: If you shared passwords, banking details, or account numbers with a scammer, update them right away. Enable multi-factor authentication where available to add an additional layer of protection to your online accounts.

- Monitor your financial accounts and credit reports: Over the next few months, check your bank, credit card, and investment accounts for unfamiliar activity and review your credit report for signs of new accounts, hard inquiries, or changes you don’t recognize. Investing in an identity theft protection service can help make this task easier, while also giving you the safety net of limited reimbursement coverage if an identity thief steals your money.

- Stay vigilant during tax season and beyond: Scammers often attempt follow-up attacks after an initial breach. Be cautious of unexpected communications, especially those claiming to “help” you recover from previous scams — a common tactic known as a recovery scam.

Protect your identity this tax season

Understanding how tax scams work and identifying key warning signs can help protect you against falling victim to fraud or identity theft. For extra protection, join LifeLock. You’ll get access to a range of features including credit monitoring and Social Security number alerts that can help you detect fraud early, so you can take action to safeguard your finances and identity.

FAQ

What are the warning signs of tax scams?

Warning signs of tax scams include being contacted by someone claiming to be from the IRS when you haven’t received a letter in the mail first, requests for immediate payment using unusual methods like payment apps or gift cards, and threats of arrest or legal action.

How do I know if I got scammed on my taxes?

You may have been scammed on your taxes if you discover unauthorized transactions, receive notices from the IRS about unreported income, or are sent records of a duplicate tax return. If you notice these signs, call the IRS directly to discuss the problem and get guidance on what to do.

How will the IRS contact you?

The IRS primarily contacts taxpayers by mail — or by phone after first sending a letter notifying you that they’ll call. They will never initiate contact with a phone call, text message, or social media message.

What do I do if I become a victim of IRS tax scams?

If you fall victim to an IRS scam, report it to the IRS, freeze your credit, and monitor your key financial accounts and credit report for suspicious activity. Reporting IRS tax scams can help prevent others from falling victim in the future.

What was the COVID-19 relief fund tax scam?

The COVID-19 relief fund tax scam took advantage of individuals and businesses in a crisis. Exploiting government aid and relief programs, scammers posed as official entities offering assistance to those affected by the pandemic. They promised financial aid or tax relief but aimed to deceive victims into disclosing personal information.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Fake tax consultants

- 2. IRS impersonation scams

- 3. Tax refund scams

- 4. “Ghost” tax return scams

- 5. Tax return identity theft

- 6. Tax-deductible charity fraud

- 7. Illegitimate unemployment benefits

- 8. Unclaimed refund mail scams

- 9. Employee retention credit scams

- 10. W-2 form phishing scams

- 11. Natural disaster relief fund tax scams

- 12. Gift card tax scams

- 13. Stimulus payment scams

- 14. Tax lien scams

- 15. Tax evasion police scams

- 16. Offer in Compromise scams

- How a tax scam can lead to identity theft

- How to spot tax scams

- What to do if you fall for a tax scam

- Protect your identity this tax season

- FAQ

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.