From fraudulent checks to counterfeit items, OfferUp scams rely on a variety of deceptive tactics. Understanding how they work is key to helping avoid falling victim. Below, we’ll break down 14 common OfferUp scams and the key warning signs to watch for:

- OfferUp email scams

- Counterfeit items

- Offers above asking price

- OfferUp shipping scams

- Fake verification codes

- Empty box scams

- Request to use third-party payment

- Phishing scams

- Out-of-town sellers

- Fraudulent checks

- Down payments

- Investment opportunities

- Gift cards as payment

- Fake job listings

Is OfferUp safe to use?

OfferUp is generally safe to use but, as with any other similar marketplace, poses some risks that mean you should exercise caution on the platform. Peer-to-peer transactions make it easier for fraudulent buyers or sellers to operate, but this risk isn't exclusive to OfferUp — similar scams are common on Facebook Marketplace and Craigslist.

14 OfferUp scams to look out for

Here are 14 common OfferUp scams to watch out for, along with red flags to help you identify and avoid them:

OfferUp email scams involve a fraudster requesting your email address during the transaction process, claiming they need it for confirmation or another bogus reason. In reality, they’ll likely sell your address on the dark web or target you with phishing emails containing malicious links designed to steal your information or install malware on your device.

According to one Reddit user, a scammer posing as a buyer requested that they email photos of the listing to their “parents,” claiming they were purchasing the item for their dad. This was likely a sneaky way to acquire the seller’s email address for malicious purposes.

Prevention tip: Be wary of anyone requesting your email address or any other personal information, and don’t engage in any off-platform communication with other OfferUp users.

When shopping on OfferUp, buyers should be cautious of counterfeit products, particularly when purchasing high-value items like designer handbags or electronics.

One user shared their experience of unknowingly buying a counterfeit Samsung phone on OfferUp. The device seemed genuine after a quick inspection, and the buyer paid via Venmo. But after just 15 minutes of use, they discovered the phone was fake. The seller refused a refund, and since the payment was made through a third-party app, the buyer wasn’t covered by OfferUp’s purchase protection.

Prevention tip: Be cautious when purchasing valuable items, especially if the price seems unusually low. Always inspect the item thoroughly before sending payment, and use OfferUp’s payment system for added protection.

Fraudulent buyers may lure sellers with offers above the asking price, claiming an urgent need for the item. Their true intention, however, is to avoid paying entirely. They often use promises of overpayment to pressure sellers into using alternative payment methods or shipping the item to an address not listed on OfferUp.

Prevention tip: Buyers offering overpayment likely have an ulterior motive, such as enticing you into using third-party payment apps.

Scammers may make up excuses to avoid shipping items through OfferUp’s shipping system so you’re not covered by the platform’s purchase protection policies. In most cases, the item will never arrive — at best you’ll be stuck with a bogus product with few to no options for recourse.

Prevention tip: Be cautious of sellers who make up excuses to avoid shipping through OfferUp, such as claiming they don’t have access to their OfferUp shipping label.

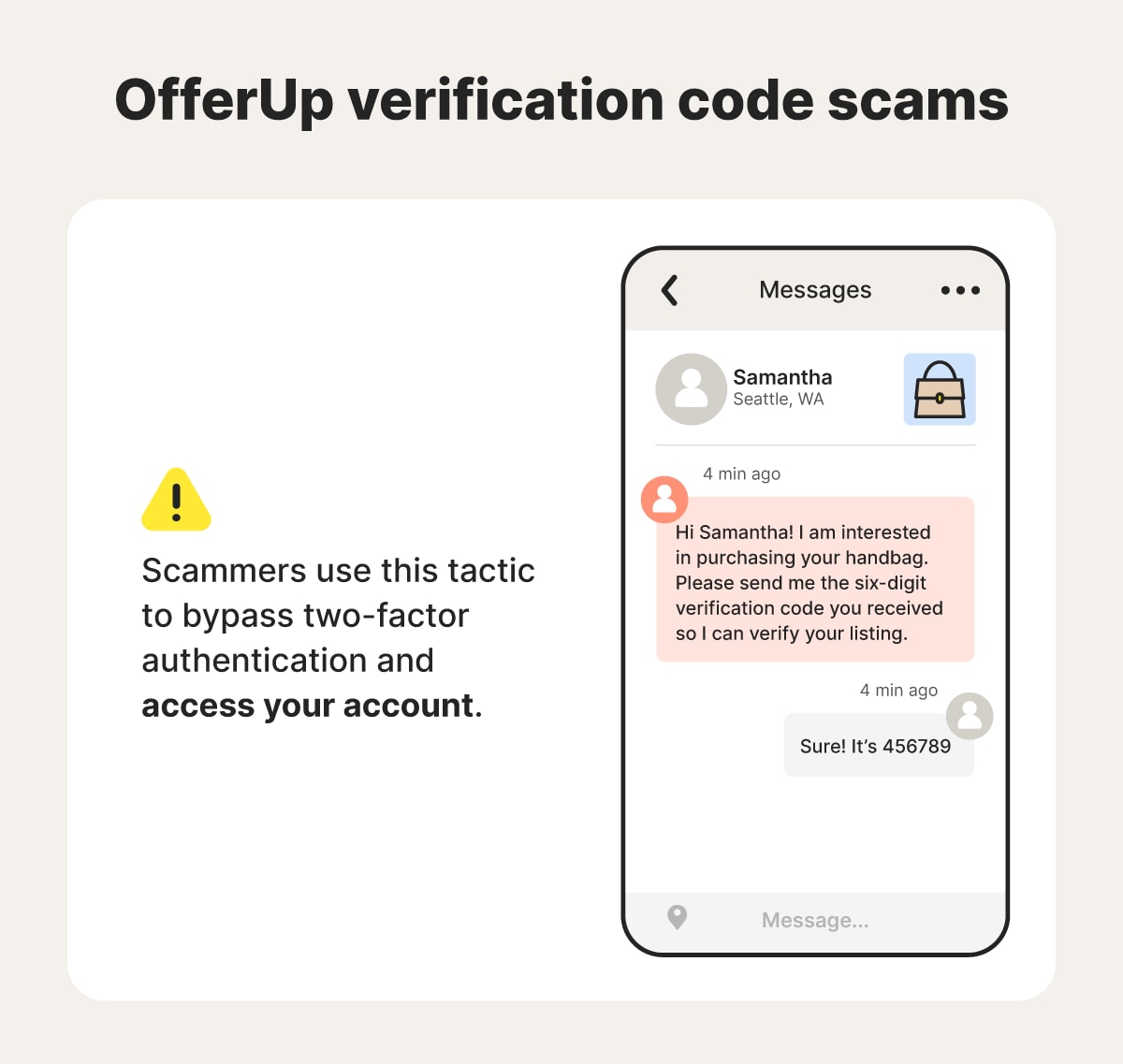

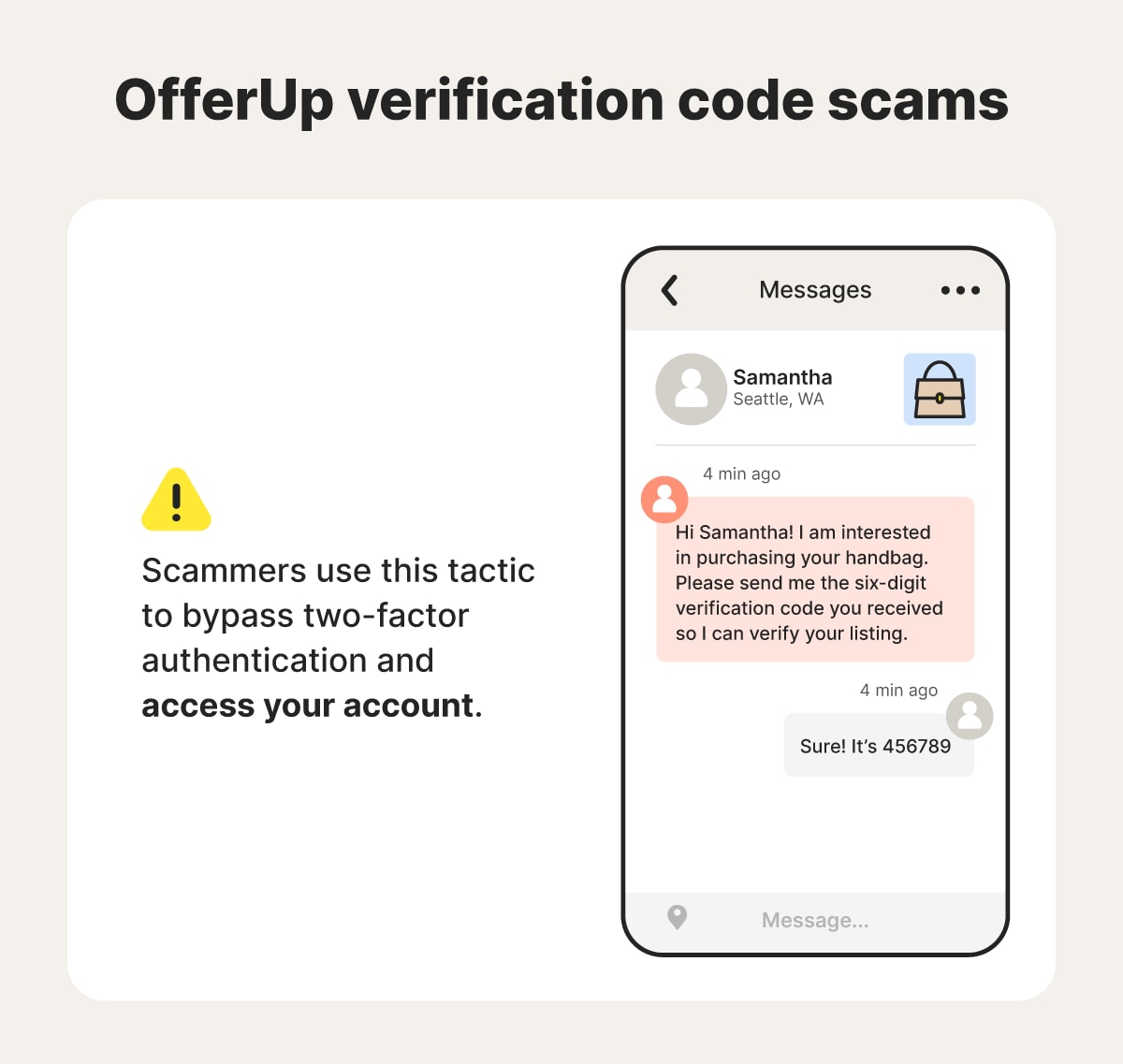

Fraudulent buyers may ask for a verification code, claiming it’s needed to verify your listing. However, OfferUp never requires a code for listing verification. In reality, the scammer is likely trying to access your account and needs the code to complete two-factor authentication.

Prevention tip: Be aware that any request for a verification code is most likely a scam, since the platform doesn’t use codes to verify listings.

If you’re targeted by this scam, you may buy an item from OfferUp only to receive an empty box, or one filled with useless items, instead. For example, one user recalled buying an Xbox on OfferUp only to receive a box filled with scrap paper.

In some cases, the listing is designed to intentionally mislead you, with a small, barely visible disclaimer noting that the seller is only offering the box.

Prevention tip: Always review a seller’s ratings and read the entire listing carefully before placing an order.

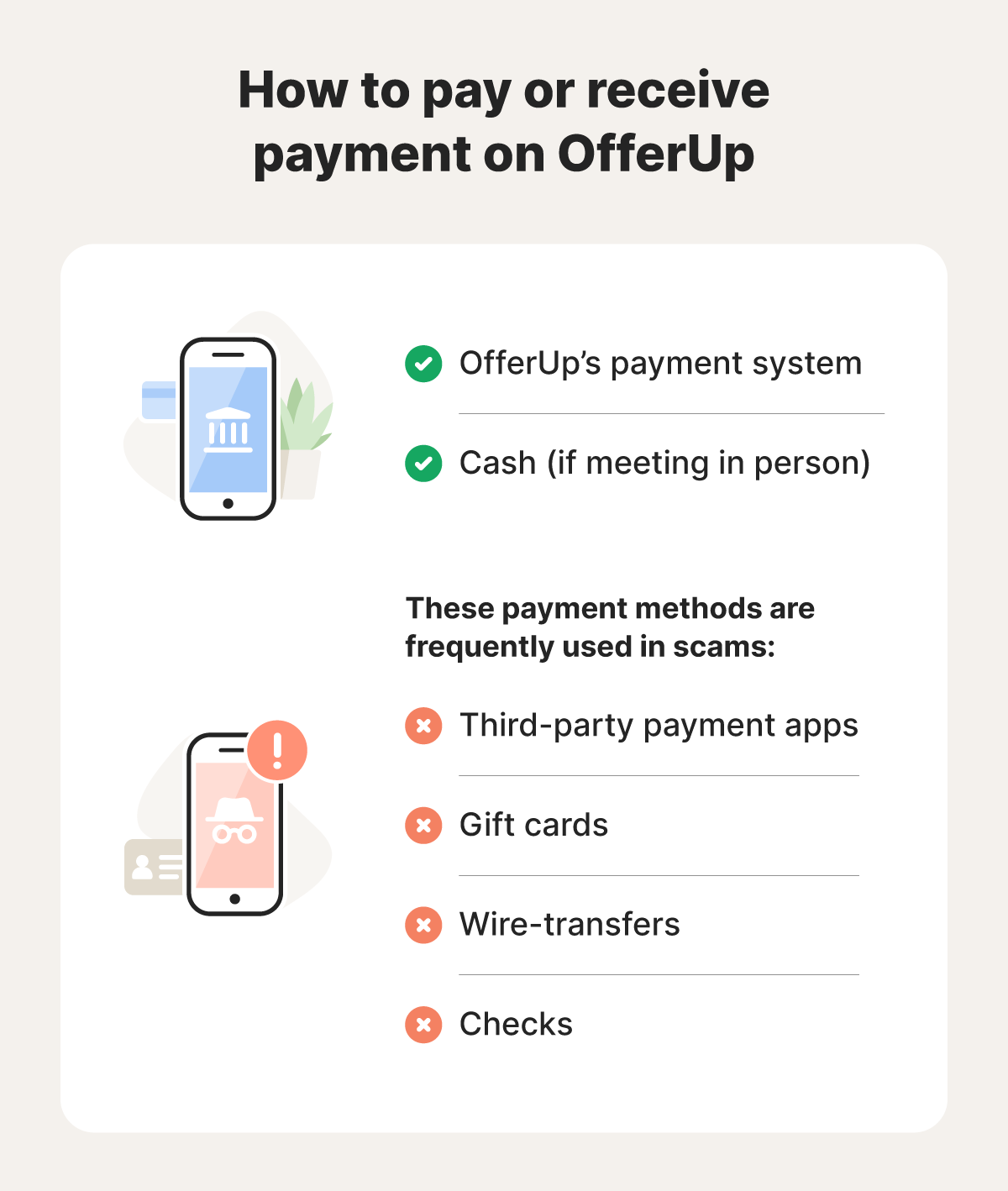

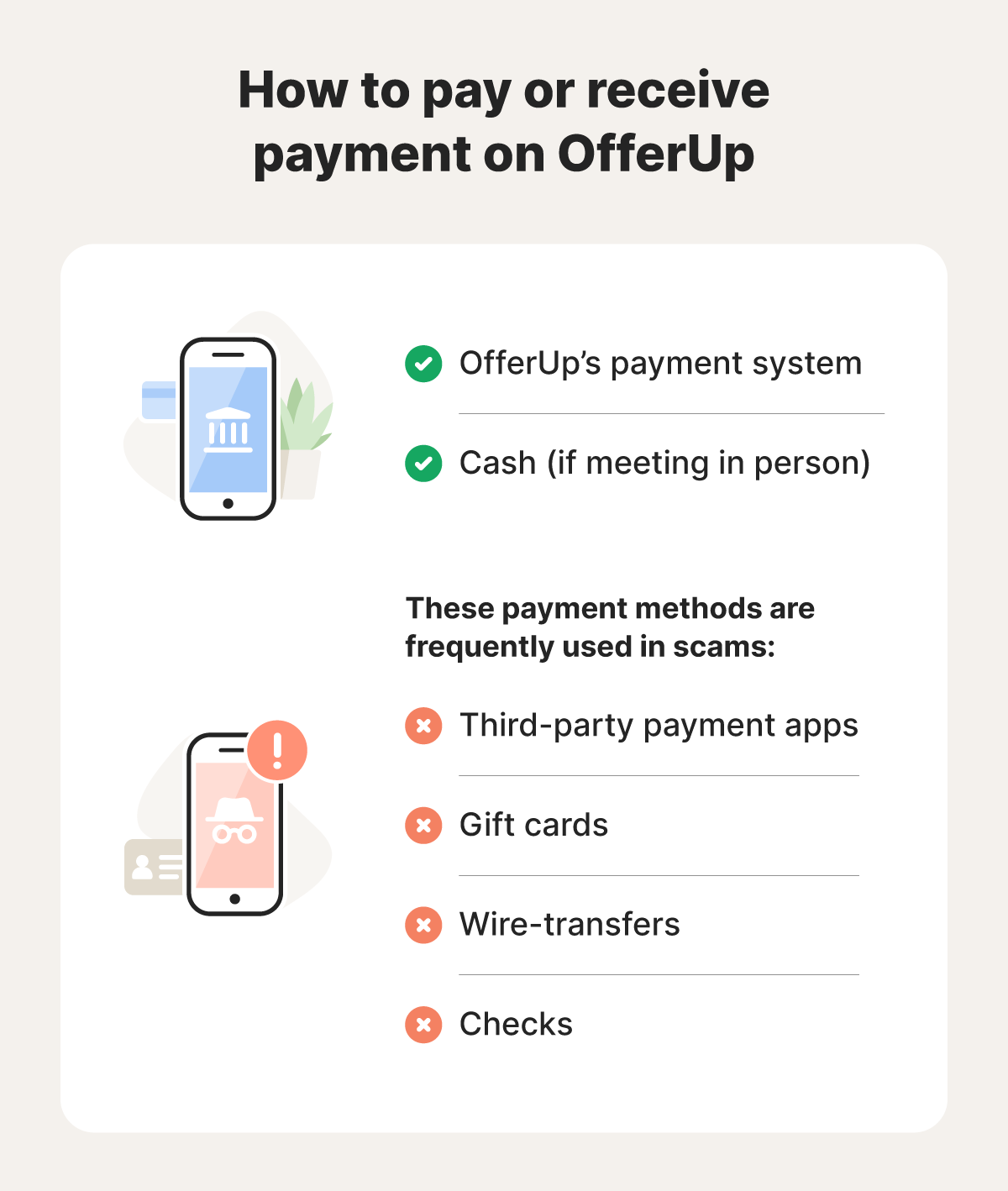

Scammers on OfferUp may ask you to pay outside the platform, using methods like wire transfers or payment apps such as Venmo or Zelle. In these scams, you’ll likely never receive the item you’ve paid for. Since the transaction occurs outside OfferUp, you also won’t be protected by the platform’s purchase protection policy.

For instance, one user shared their experience with a seller who requested payment through PayPal. When the buyer suggested paying through OfferUp instead, the seller refused. Fortunately, the buyer was able to recognize this as a red flag for a potential scam.

Prevention tip: Treat any request by a seller for payment through a third-party app as a red flag. Always pay on-platform for better protection against scams.

OfferUp phishing scams occur when a buyer or seller tricks you into clicking on a malicious link and sharing personal information. They then try to use the information you inadvertently gave up to steal your money or commit identity theft. Here’s an example of how the scam might unfold:

- A buyer sends you a link claiming OfferUp Support directed them to send it to you so you can get paid.

- You click on the link which takes you to a third-party website that appears to display accurate information about your item.

- The site prompts you to input sensitive data, such as your bank account details so you can get paid.

- The scammer uses this information to steal your money or identity.

Prevention tip: Avoid clicking on links that direct you outside of the Offerup platform, whether you’re a buyer or seller.

Scammers posing as out-of-town sellers may offer excuses to avoid meeting in person, preventing you from inspecting the item beforehand. While the seller might live locally and initially agree to an in-person exchange, they’ll claim to be out of town due to an emergency, often fabricating a sob story to prey on your empathy. They may then pressure you to pay off-platform, only to never send the item.

Prevention tip: Be cautious of any long-winded excuses sellers use to avoid meeting in person.

Scammers on OfferUp may use fake checks to purchase items. While the check might initially appear to clear, it will bounce days later, leaving sellers out of pocket. That’s why it’s best never to accept checks, especially from unfamiliar buyers, and insist on using more secure payment methods.

When one man sold his jetski on OfferUp and received a $12,500 check from the buyer, he believed he’d made a successful sale — only to later discover that the check was invalid, leaving him without his jetski or his payment.

Prevention tip: A buyer offering to pay you via check could be a sign of a scam. Only accept cash for in-person transactions to protect against the risk of fraudulent checks.

In this scam, a seller lists an expensive item on OfferUp and uses high-pressure tactics to convince you to act quickly, offering to hold or deliver it in exchange for an immediate down payment. Once the deposit is sent, the seller disappears, and you’ll never receive the item.

Prevention tip: Be wary of any request for a down payment and never send money in advance for a local transaction.

Some scammers pose as sellers on OfferUp, offering “investment opportunities” that promise quick and easy money if you follow their plan. The catch? You’ll have to send them money upfront, and the so-called opportunities are typically pyramid schemes or outright scams, where the fraudster takes your money and disappears.

Prevention tip: Investment opportunities are not allowed on OfferUp, so treat any you come across as a scam. Avoid listings promoting investing, especially if they require upfront payments.

Scammers may request to pay for items via gift cards instead of paying through OfferUp’s payment system or giving you cash in person. In most cases, these gift cards are either fake or have no money loaded, leaving you empty-handed after the transaction.

Alternatively, shady sellers may request that you pay them in the form of gift cards because they’re almost impossible to trace, helping scammers to remain anonymous and making it harder for you to recover your funds.

Prevention tip: Treat a buyer requesting payment via gift card as a major red flag. Never accept gift cards as payment, or agree to purchase an item using gift cards.

Fake job application scams on OfferUp aim to steal sensitive data or financial details. For example, a scammer posing as an employer may ask for an upfront payment for a background check or equipment. Another variation involves fake application forms that ask for sensitive information, such as your Social Security Number or bank account details.

Prevention tip: While OfferUp does allow job listings, job seekers should be cautious of any job posts that seem too good to be true, request an upfront fee, or require you to purchase and resell items.

How to avoid scams on OfferUp

To help avoid getting scammed on OfferUp, always verify seller or buyer profiles and ratings, don’t communicate or make payments off-platform, and trust your instincts if something feels off.

Follow these tips to help protect yourself when using OfferUp:

As a buyer:

- Check the seller’s profile to read their ratings and get insights into other users’ experiences buying from them.

- Only pay through the OfferUp payment system to ensure you’re covered under the platform’s purchase protection policy.

- Inspect items before paying for local transactions to ensure they match the description and are free of defects.

- Be skeptical of deals that seem too good to be true since scammers may use amazing prices to lure buyers.

As a seller:

- Review the buyer’s profile to see their history of successful transactions.

- Never accept payment through a third-party app such as Venmo, Zelle, or Cash App, and only allow cash if meeting in person.

- Don’t ship items before payment and only send orders via OfferUp’s built-in shipping process.

- Suggest a safe meetup location for the buyer to get their item, such as a brightly lit public area with a lot of people.

What to do if you get scammed on OfferUp

If you’ve been scammed on OfferUp — whether you’re a buyer or a seller — it’s important to act fast by reporting the scam to the relevant parties. Follow these steps to help prevent identity theft and potentially recoup any financial losses:

- Contact your bank: If you sent money to the scammer or provided any financial details, immediately contact your bank to dispute the charges and inform them about the situation.

- File a fraud alert: If your personal information was compromised, consider using a credit freeze or placing a fraud alert on your credit report to help protect against credit fraud.

- File a 2-Day Purchase Protection claim: If you didn’t receive an item or it was damaged, fill out the 2-Day Purchase Protection form to request a refund.

- Report the scam to OfferUp: If you encounter a scam, report the user to OfferUp. You can do this from their profile page or the messaging system.

- Contact your local authorities: If you believe a crime has been committed, report the scam to your local police department.

Help protect against identity fraud with LifeLock

Getting scammed out of your hard-earned cash is a bitter pill to swallow, but it could be just the start of your troubles if scammers also gain access to your personal information.

LifeLock offers protection against identity theft by monitoring for fraudulent use of your personal details and helping you remove your sensitive information from online databases. And if you do become a victim of identity theft, our dedicated U.S.-based restoration specialists can help you recover your identity and reimburse you for stolen funds.*

FAQs

Is OfferUp legit?

Yes, OfferUp is a legitimate and widely-used platform for buying and selling items. However, like any peer-to-peer marketplace, it's important to take precautions against scams by using secure payment methods, meeting in public places, and verifying buyer and seller profiles.

Does OfferUp have buyer protection?

Yes, OfferUp has a 2-Day Purchase Protection Policy for shipped purchases, which protects buyers if the item is missing, damaged, or not as described.

Does OfferUp refund scams?

Depending on the nature of the scam, you may be eligible for a refund through OfferUp’s 2-Day Purchase Protection Policy.

Is it safe to give your phone number and address on OfferUp?

No, it is not safe to give out your phone number, address, or other personal information in messages on OfferUp. Sharing personal details can leave you vulnerable to OfferUp scams, identity theft, and other risks.

OfferUp is a trademark of OfferUp, Inc.

* Reimbursement and Expense Compensation, each with limits of up to $1 million for Total, up to $100,000 for Advanced and up to $25,000 for Core. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.