Knowing how to tell if a check is fake can help you avoid collecting an illegitimate form of payment. Our guide shares the top 10 warning signs of a fake check and what to do if you think you’re dealing with one. By being aware of these indicators, you can help protect against check fraud.

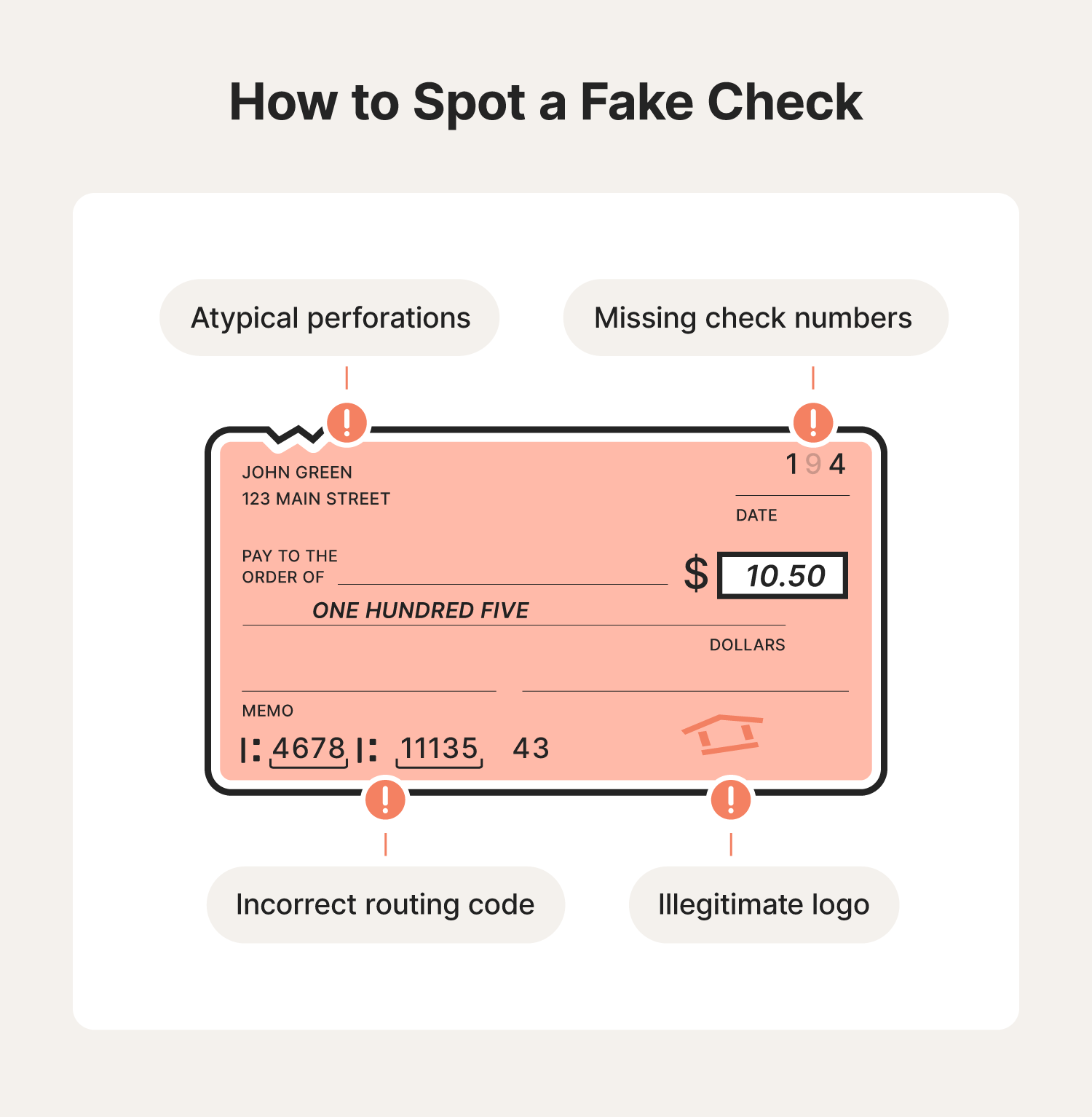

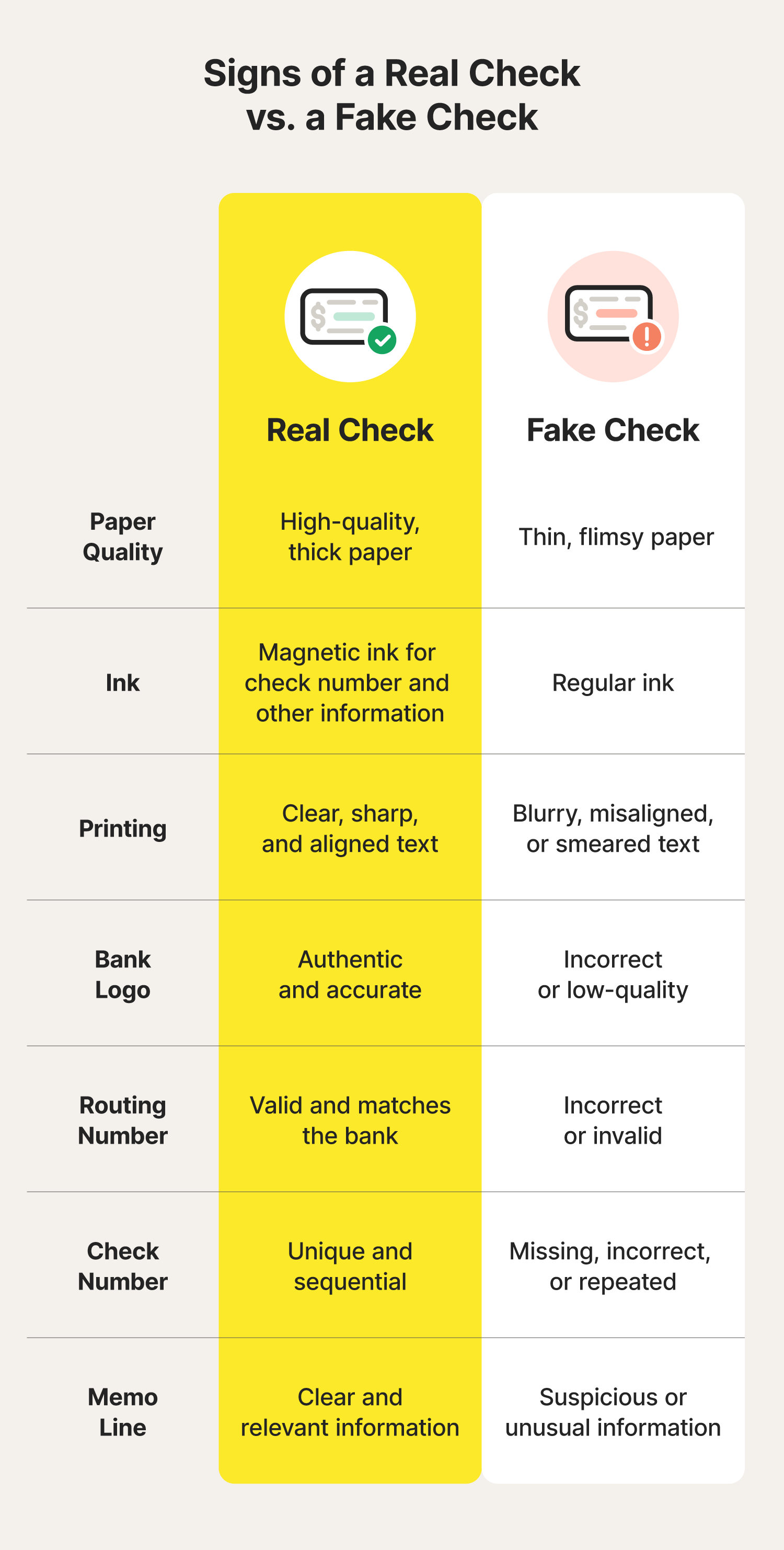

1. Strange perforations

Atypical perforations, or the small holes along the edges of a check, can be a telltale sign of a counterfeit check. On an authentic check, perforations should be consistent in size, shape, and spacing.

Counterfeit checks may also use sub-standard paper. This not only affects the feel of the check but also how the perforations are formed. If a check has been tampered with, the perforations might be uneven or jagged.

2. Missing check numbers

Missing or altered check numbers can indicate a counterfeit check. Every legitimate check is assigned a unique identification number as its fingerprint. This number is typically printed prominently on the check, usually in the top right-hand corner.

Watch out if the check number is:

- Partially obscured

- Illegible

- Altered

- Erased

Scammers who tamper with checks may attempt to disguise or hide the check number to avoid detection. They may smudge, scratch, or even remove it entirely.

3. Incorrect routing codes

If the routing code on the check doesn't match the bank or financial institution listed on it, the check is likely fraudulent. Likewise, if a check contains incorrect digits, or is associated with a bank or financial institution that’s no longer in operation, it is highly likely to be fake.

How to check the routing code:

- Verify the routing code: Ensure that the routing code on the check matches the one listed on the bank or financial institution's website.

- Check for typos: Carefully examine the routing code for any formatting or transcription errors in the digits.

- Use an online tool: Online tools like Routing Number & Bank Account Lookup can help you verify the routing code and associated bank information.

4. Strange MICR lines

Strange magnetic ink character recognition (MICR) lines can also be a sign of a counterfeit check. The MICR line is the magnetically encoded line at the bottom of a check that contains the:

- Check number: A unique identifier for each check.

- Routing number: A nine-digit code identifying the bank.

- Account number: A unique number identifying the specific bank account.

Banks use MICR technology to process checks quickly and efficiently. If the MICR lines appear unusual, altered, or difficult to read, it could be a sign that the check has been tampered with and is a fake check banking scam.

Scammers may attempt to modify or obscure the MICR lines to avoid detection. They might use techniques such as smudging, blurring, or altering the magnetic ink. If the MICR lines look suspicious in any way, contact the issuing bank.

5. Notes in the memo area

Suspicious notes in the memo area, which is typically used for additional information or instructions related to the check, can be a red flag for counterfeit checks.

Be suspicious of notes in the memo area if they are:

- Written in a foreign language or a code: The memo should be in a language that the recipient and bank can understand.

- Contain threats or other inappropriate language: If you receive a check with a threatening memo, consider contacting the police.

- Are suspicious or out of place: If the note doesn't seem related to the check, or the issuer wrote it in an unusual way, it could be a sign of fraud.

If you notice any handwritten or typed notes that are suspicious, out of place, or contain inappropriate language, it could be a sign that the check is fraudulent.

6. Stains on the check

Stains on a check can be another indicator of fraud or tampering. If a check appears stained or discolored, it could be a sign that someone has attempted to alter or obscure information on the check.

Stains can also result from chemical treatments or damage. Criminals may use chemicals or other methods to alter or hide information in a process known as check washing. If the stains obscure important information, such as the check number, routing code, or signature, cashing the check may be impossible.

7. Illegitimate logos

The logo should match the bank or financial institution listed on the check. If you notice any discrepancies between the logo on the check and the legitimate logo of the bank or financial institution, it’s a strong indicator that the check is fraudulent.

Here’s what to look for when examining the logo:

- Colors: The colors should match the legitimate logo. They should not appear faded, distorted, or inaccurate.

- Clarity and detail: The logo should be clear and sharp, with well-defined lines and details.

- Placement: The logo should not be positioned in an awkward spot or appear out of place or askew.

Scammers might use low-quality printing or attempt to copy the legitimate logo but fail to capture the intricate details and design elements.

8. “Void” or “non-negotiable” appears on the check

Do not accept a check with the word “void” written on it, as this indicates that the check has been canceled or invalidated.

Meanwhile, if a check says “non-negotiable,” it may indicate that it is only payable to the original payee and cannot be transferred to anyone else. In other situations, “non-negotiable” checks refer to checks you cannot cash or deposit as the money has been transferred by another means; it is essentially a paper receipt provided as a record of payment.

9. No authorized signature

A valid authorized signature is a crucial component of a check, as it serves as authorization for the bank to pay the funds to the designated payee. You will only be able to cash checks with a valid signature.

Here are some specific things to look for when examining a signature on a check:

- Missing signature: If a signature is missing from a check, you won’t be able to cash it.

- Consistency with previous signatures: If you’ve previously received a check from the payer and the signature appears different or inconsistent, it could signal forgery.

Counterfeiters may use techniques such as tracing or copying signatures from other documents. Depending on their skill and the method they use, the signature could look convincing at first glance.

10. Numerical and written check amounts don’t match

A mismatch between a check’s numerically written and handwritten amounts can indicate fraud or error. These two amounts should always match exactly. If the handwritten amount is different than the numerical amount, you won’t be able to cash it.

Always carefully compare the numerically written and handwritten amounts when examining a check. If there is any discrepancy, no matter how small, investigate further.

What to do if you suspect a check is fake

If you're concerned about the legitimacy of a check you've received, taking precautions to protect yourself from fraud is important. Here are some steps you can take:

- Examine the check: Carefully examine the check for any irregularities in typography or layout, or unusual markings.

- Suggest a safer alternative: If you’re a seller, ask the buyer to use an online payment service like PayPal, which offers seller protection.

- Call the bank: Call the issuing bank directly to verify the check’s legitimacy.

- Avoid wire-back pressure: If you get pressured to wire back funds, it's a red flag. This tactic is often used in overpayment scams, where the issuer says they “accidentally” overpaid and want you to refund them in an attempt at wire transfer fraud. But if the check is fake, it will bounce, and you’ll lose the money you “refunded.”

- Wait for the check to clear: Never withdraw money from a check or send goods until it has cleared your bank.

Following these steps can significantly reduce your risk of falling victim to check fraud.

How to protect yourself from bad checks

Receiving a bad check can be a frustrating and costly experience. By taking proactive steps to verify the legitimacy of checks, you can potentially reduce your risk of falling victim to check fraud.

1. Verify the identity of the sender

Verify the payer's identity before accepting a check, especially if it’s your first check from them. Always make sure that the name and address on the check correspond.

2. Inspect the check for security features

Legitimate checks incorporate security features such as watermarks and proper perforations. Carefully inspect the check for these features and ensure they align with the expected design.

3. Wait for the check to clear

If you’re a seller, never release items or services until the check has fully cleared your bank. Monitor your account for any status changes, and release goods only once funds are confirmed.

4. Verify the check's legitimacy

If you have concerns about a check's authenticity, contact the issuing bank directly to confirm its legitimacy. Make sure you use a phone number from the bank’s official website since any contact information on a fake check might be part of the scam.

5. Avoid overpayments

Never accept a check for more than the agreed-upon amount. If you receive an overpayment, request a new check for the correct amount. Scammers use this ruse when they give someone a fake check for too much, and then ask the payee to transfer the difference. The check won’t clear though, and you’ll be out of pocket for the refund amount and any goods you send them.

6. Reconcile your monthly statements

Regularly review your bank account to ensure all transactions are accurate. Compare your statements to your records and immediately report any suspicious activity to your bank — the quicker you report discrepancies, the better the chance of resolving issues.

Following these guidelines can significantly reduce your risk of falling victim to bad checks and help you protect yourself from financial loss.

Keep your personal information more secure

The consequences of cashing a fake check can be severe, even if you don’t know that the check is fraudulent. But bad checks are just one of the ways scammers steal from their victims.

Get LifeLock to help protect your identity by monitoring the dark web for leaked personal information. We’ll also notify you of large-scale data breaches if your data is compromised so that you can secure your accounts and help protect your personal and financial information.

FAQs

Why do scammers send fake checks?

Scammers send fake checks to trick their victims into believing they’ve received legitimate payments and then run off with goods or money. If the victim falls for the ruse, the check will eventually bounce, leaving them out of pocket.

What happens if you deposit a fake check?

If you deposit a fake check, your bank will typically hold the funds for a few days while they verify the check's authenticity. If the check is determined to be fake, your bank will reverse the deposit, and you’ll be responsible for any overdraft fees or other charges incurred as a result of the reversal.

Can you cash or deposit a check if it's fake?

While you can attempt to cash or deposit a fake check, the consequences can be serious. After your bank tries to verify the check and learns that it’s fraudulent, the bank will reverse the deposit and may report the incident to the authorities, leaving you with potential legal issues to deal with.

Can I get hacked depositing a fake check?

Depositing a fake check itself is not a direct cause of a hacking incident. However, if you provide financial or personal information to the scammy payer, you could be at greater risk of further scams or identity theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Strange perforations

- 2. Missing check numbers

- 3. Incorrect routing codes

- 4. Strange MICR lines

- 5. Notes in the memo area

- 6. Stains on the check

- 7. Illegitimate logos

- 8. “Void” or “non-negotiable” appears on the check

- 9. No authorized signature

- 10. Numerical and written check amounts don’t match

- What to do if you suspect a check is fake

- How to protect yourself from bad checks

- Keep your personal information more secure

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.