Disclosures

* Automatically renews annually after the trial period ends, unless canceled. The price quoted in the cart today is valid for the introductory term after the trial, after which your subscription will be billed at renewal pricing. Renewal pricing is subject to change and may be charged up to 35 days before the active term ends. For support or to cancel automatic renewal, log into your account or contact support.

LifeLock Total: A yearly subscription is $xx per year after the free trial.

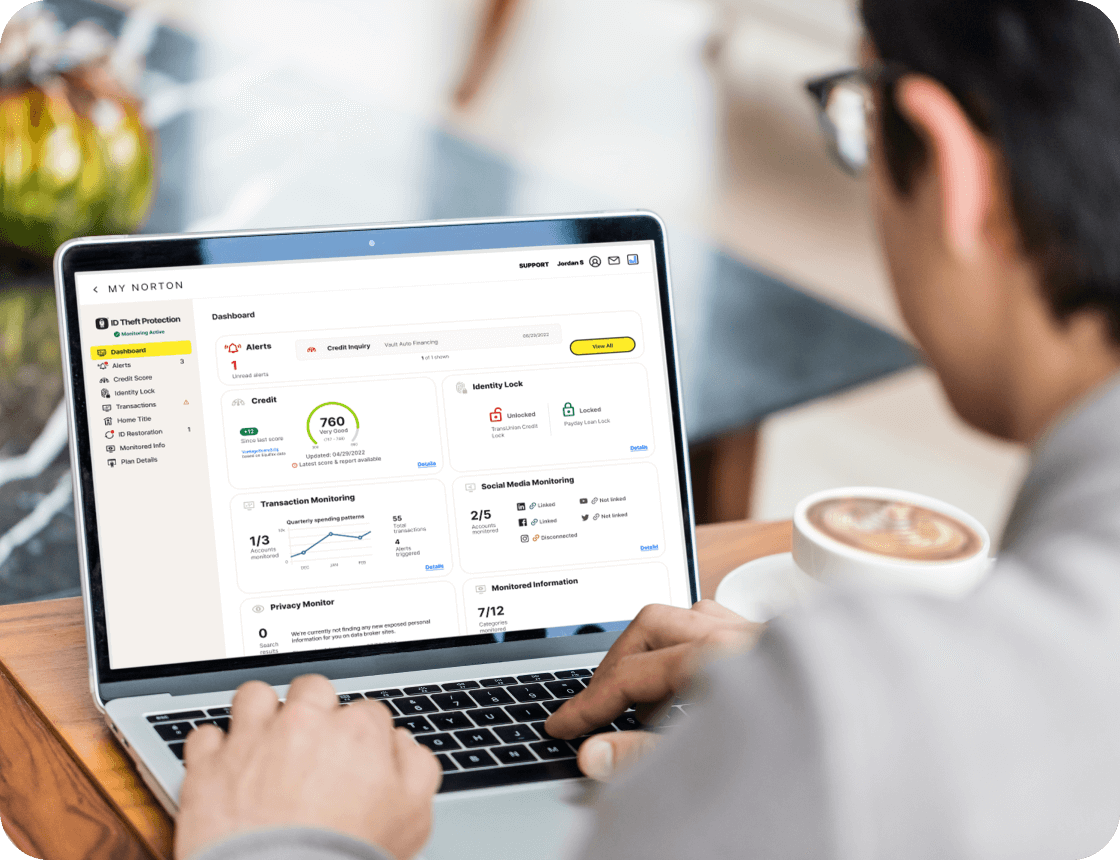

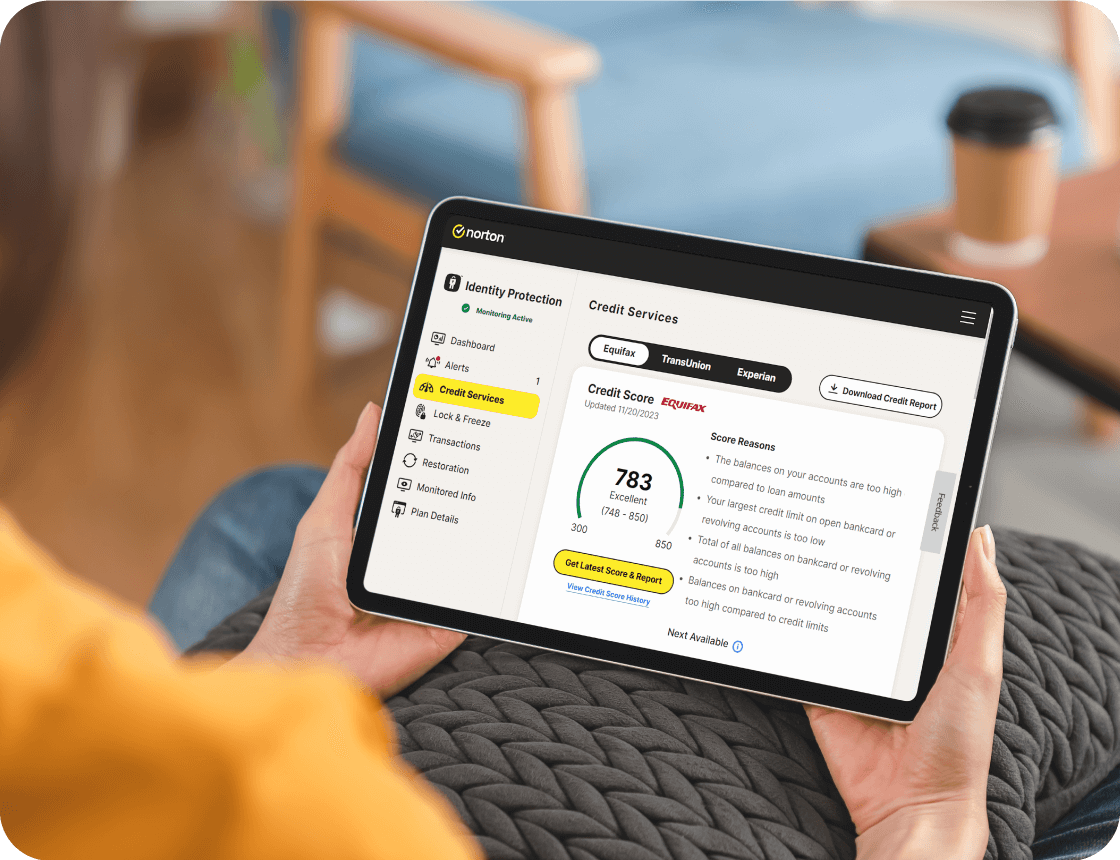

1 Credit reports, scores and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

2 We do not monitor all transactions at all businesses.

3 Up to $1 Million for lawyers and experts (with all plans): If you need a lawyer or other expert to help fight on your behalf to resolve your identity theft issues, the Million Dollar Protection Package will provide lawyers and experts on your behalf and cover up to $1 million in fees for all LifeLock plans.

4 Phone alerts made during normal local business hours.

5 Up to $1 Million reimbursement for stolen funds (limit varies based on plan): If you have money stolen because of identity theft, the Million Dollar Protection Package will reimburse you for those losses, based on the limit of your plan.

6 Up to $1 Million in compensation for personal expenses incurred (limit varies based on plan): The package also includes compensation, based on the limit of your plan, for qualifying personal expenses you may incur as a result of trying to resolve identity theft, such as lost wages, travel expenses, and child or elder care.

Global Privacy Statement | Legal

** Credit features require setup, identity verification, and sufficient credit history by TransUnion and/or Equifax. Credit monitoring features may take several days to activate after enrollment.