A fraud alert is a security measure that notifies creditors that you may be a victim of identity theft or fraud. It prompts them to verify your identity before approving new credit requests, providing a layer of protection against fraudsters opening lines of credit in your name.

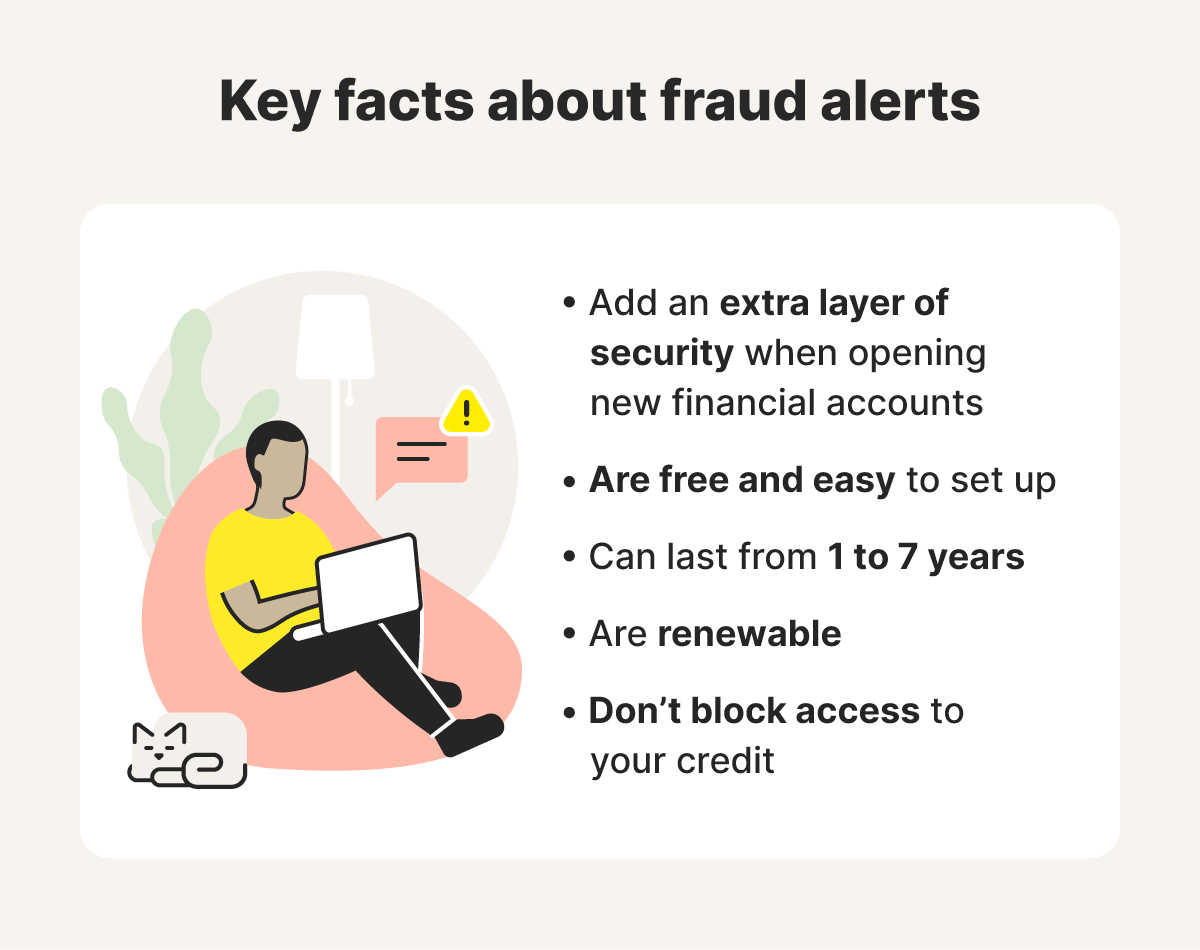

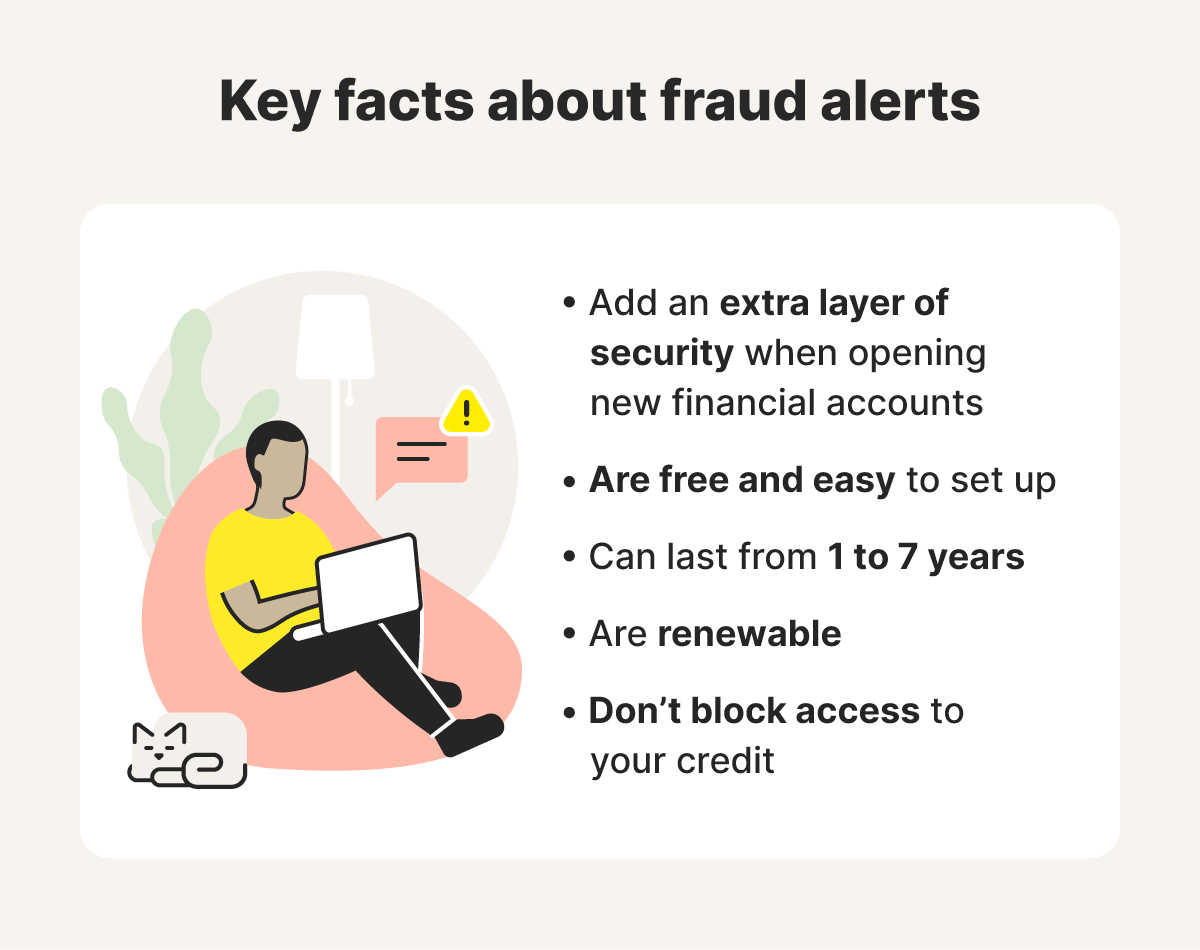

It’s completely free to place a fraud alert and you can remove it at any point. This makes it a great option if you want to strengthen your defenses against credit fraud.

What does a fraud alert do?

A fraud alert places a notice on your credit report that indicates that you may be vulnerable to credit fraud, and requires that creditors run an identity verification check whenever a new credit request is made in your name. This helps prevent fraudsters from opening accounts with stolen information.

When you apply for a credit card or loan, the creditor checks your credit report with one of the three major credit bureaus: Experian, TransUnion, and Equifax.

If you have an active fraud alert placed with the bureau your creditor uses for credit checks, they’ll be notified to confirm your identity by requesting information like your Social Security number, current address, or a government-issued ID. Fraudsters won’t be able to provide this information, meaning their application will be unsuccessful.

Fraud alerts are free and easy to set up. They last between one and seven years, depending on the type of fraud alert, and can be renewed indefinitely.

That said, they don’t provide exhaustive coverage. For example, a fraud alert doesn’t:

- Stop unauthorized users from using your existing credit cards or accounts if they get direct access through theft or hacking.

- Block credit fraudsters who made a credit application before you placed a fraud alert.

- Prevent fraudsters from opening accounts that don’t require credit checks, such as certain checking accounts.

Fraud alerts work best as part of a broader credit fraud defense strategy, combined with other safety measures like credit monitoring.

Types of fraud alerts

There are three different types of fraud alerts, each designed for a different situation:

- Initial fraud alert: Sometimes called a temporary fraud alert, initial fraud alerts are available to everyone, can be placed for any reason, and last for one year before automatically expiring.

- Extended fraud alert: Extended alerts last seven years and are reserved for victims of identity theft or credit card fraud. To qualify for an extended fraud alert, you need to provide a copy of an identity theft report or police report.

- Active duty fraud alert: Active duty fraud alerts are only available to currently deployed active-duty military personnel. They’re similar to initial fraud alerts, also only lasting for one year.

What’s the difference between a fraud alert and a credit freeze?

A fraud alert requires an extra identity check to approve new credit, while a credit freeze prevents anyone (even you) from opening new lines of credit in your name. Fraud alerts and credit freezes can both help prevent credit fraud, but they provide different types of protection and have unique pros and cons.

When a new credit application is made, fraud alerts prompt creditors to run an identity verification check. This reduces the chance of a fraudster being able to open a new line of credit in your name but means you can still get through the process.

Credit freezes, by contrast, block creditors from accessing your credit report altogether. This means neither you nor fraudsters are able to open new credit accounts, even with proper identification. To get access to a new line of credit, you have to temporarily unfreeze your credit.

When should you consider placing a fraud alert?

You should consider placing a fraud alert if you’ve fallen victim to identity theft, suspect someone has unauthorized access to your personal information, or have been alerted that one of your accounts is compromised. You can also place a fraud alert to proactively add a layer of protection against credit fraud.

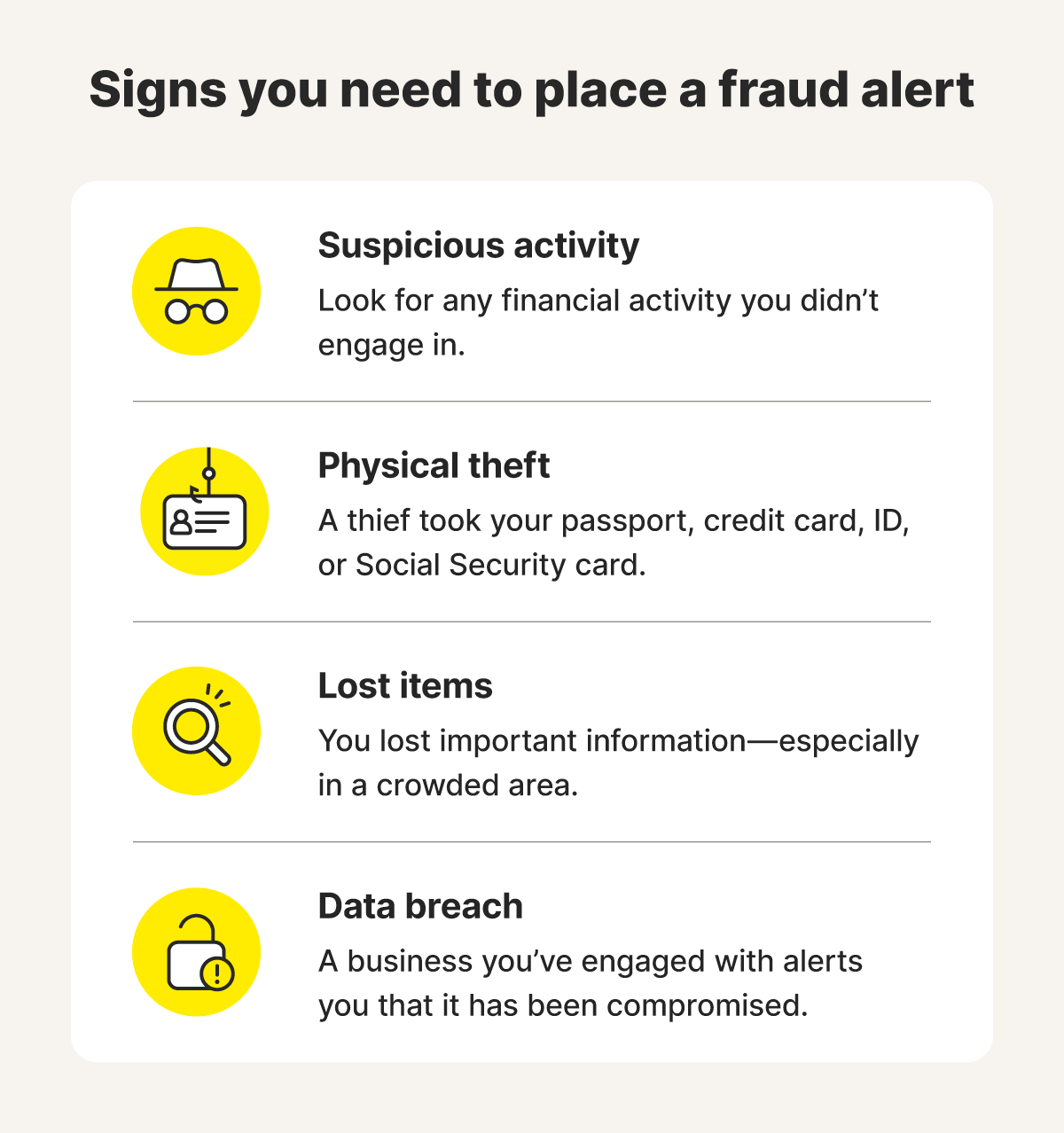

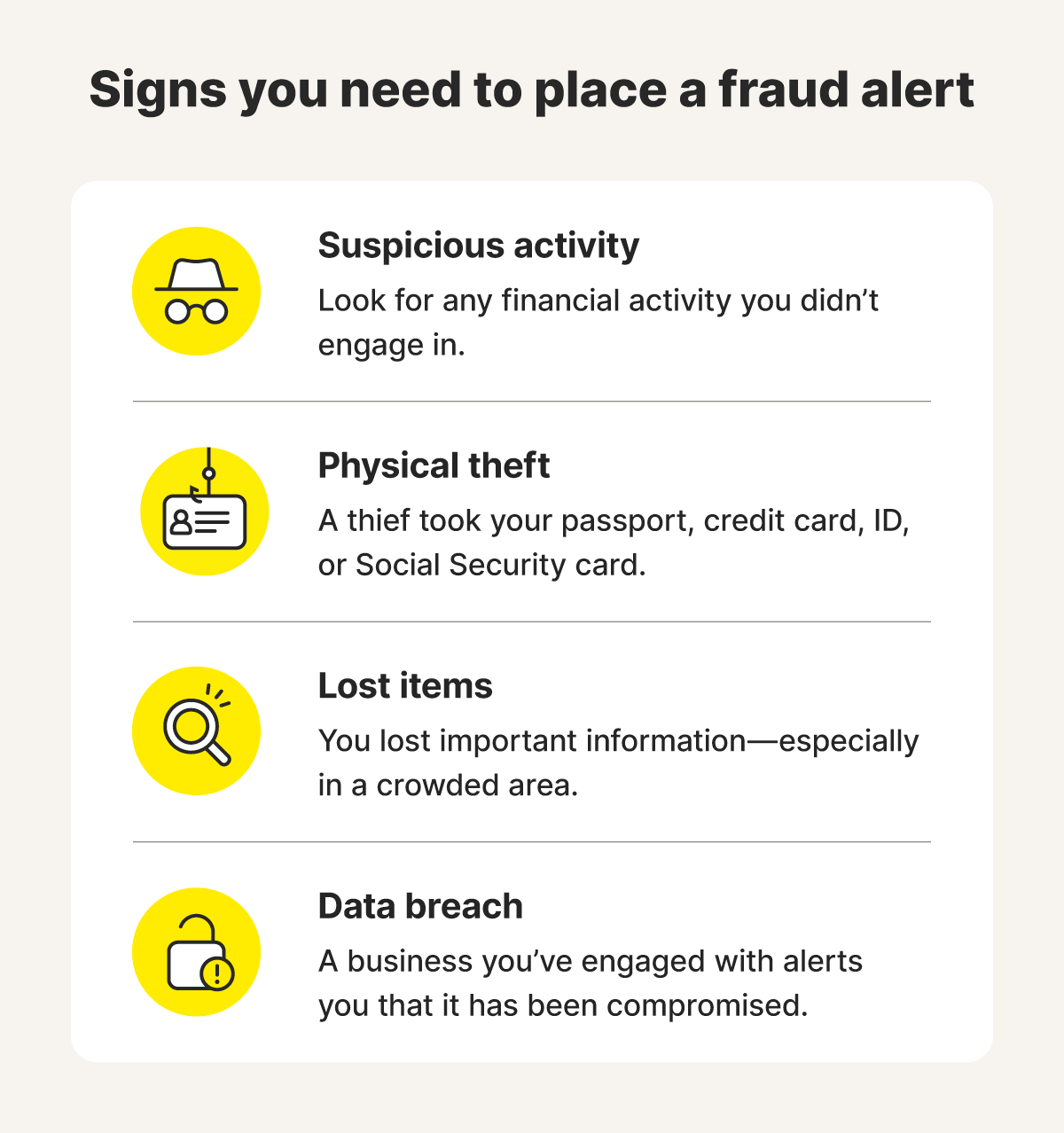

These are some situations where placing a fraud alert with the credit bureaus might make sense:

- Suspicious activity: You notice suspicious activity, such as unauthorized charges or loans you never applied for, on your credit report or bank account statement.

- Physical theft: A thief steals your wallet, meaning they have access to the sensitive information on your credit or debit cards, insurance cards, or even membership cards.

- Lost items: You've lost your passport, insurance documents, or other sensitive items and are worried someone else might have found them.

- Data breach: A company you’ve shared personally identifiable information with suffers a data breach. Even if it’s a company that doesn’t have much of your data, your login details leaking could compromise your financial accounts.

It's best to be proactive. If you think someone may have unauthorized access to your information, consider implementing a fraud alert.

How to set up a fraud alert

Setting up a fraud alert is a simple and free process that you can do in a few steps:

- Choose a type of fraud alert: You first need to determine which type of fraud alert you’d like to set up. If you’ve had your identity stolen, an extended fraud alert is recommended. If you’re placing the alert proactively or are on military deployment, an initial or active duty fraud alert is the right choice.

- Contact one of the credit bureaus: You can submit a fraud alert online, by phone, or by mail. You only need to contact one of the bureaus — your fraud alert will automatically apply to all three.

- Provide information: You’ll be asked to provide a copy of your government-issued ID and proof of address when placing a fraud alert. If you’re applying for an extended fraud alert, you’ll also need to provide an official identity theft report.

If you apply online or over the phone, the fraud alert will go into effect immediately. Applying by mail may take a few days, depending on how quickly the letter gets delivered.

How to remove a fraud alert from your credit report

Fraud alerts naturally expire and drop off your credit report, with active duty and initial fraud alerts lasting one year and extended fraud alerts lasting seven. If you want to remove a fraud alert before it expires, take the following steps:

- Submit a request: Contact the credit bureau that you placed the fraud alert with online, over the phone, or by mail.

- Provide documentation: You’ll be asked to verify your identity with a government-issued ID and proof of address. If you’re removing an extended fraud alert, you may also need to provide proof that your identity theft case has been resolved.

- Get confirmation: You’ll receive confirmation that your request has been logged. From here, the credit bureau may take a few days to remove the alert.

Additional steps to take if you’ve been a victim of identity theft

If your personal information has been compromised, submitting a fraud alert isn’t the only thing worth considering. Think about taking the following actions to help safeguard your identity and finances:

- Report the identity theft: Reach out to the Federal Trade Commission (FTC) at IdentityTheft.gov or call (877) 438-4338. You can also report identity theft to your local police.

- Consider a credit freeze: A credit freeze adds an extra layer of protection against credit fraud, essentially making it impossible for fraudsters to open new lines of credit in your name. You can freeze your credit as well as placing a fraud alert for maximum protection.

- Look out for suspicious activity: In the months following your personal information being compromised, monitor your key financial and personal accounts for fraudulent activity.

- Dispute fraudulent charges: If you notice fraudulent charges on your bank or credit card statements, dispute the errors as soon as possible to start the recovery process.

- Update your accounts: Go through your accounts and change any potentially compromised passwords or logins. If applicable, establish two-factor authentication (2FA) for extra security.

Stay one step ahead of identity thieves

Proactively protecting yourself against the risk of credit fraud by placing a fraud alert or credit freeze is a great first step. Subscribing to LifeLock helps you go the extra mile to maximize your protection.

With features including Social Security number alerts, credit monitoring coverage, and stolen wallet protection, LifeLock will help alert you to signs of identity theft and give you the tools you need to recover if you’re ever targeted.

FAQs

How long does a fraud alert last?

Initial fraud alerts and active duty fraud alerts last for one year, while extended fraud alerts last for seven. You can remove a fraud alert before its expiration date by contacting the credit bureau you filed the report with.

How much does a fraud alert cost?

Fraud alerts are completely free to place. You can contact one of the three major credit bureaus via the web, phone, or mail to get started and freely remove or renew the alert as needed.

Does placing a fraud alert affect your credit score?

No, placing a fraud alert does not affect your credit score. It’s a free, preventative measure that you can use to keep your information safe when you believe it’s at risk.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- What does a fraud alert do?

- Types of fraud alerts

- What’s the difference between a fraud alert and a credit freeze?

- When should you consider placing a fraud alert?

- How to set up a fraud alert

- Additional steps to take if you’ve been a victim of identity theft

- Stay one step ahead of identity thieves

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.