If you’ve lost your wallet, it’s natural to start worrying about fraud or identity theft. But before jumping to the worst-case scenario, take a breath — there’s still a chance you’ve simply misplaced it. Acting quickly but methodically can help you recover it, or limit the damage if it has fallen into the wrong hands.

1. Retrace your steps

If your wallet is missing, begin by retracing your steps. Carefully check every place you’ve had your wallet recently — including your car, office, restaurants, shops, and any pockets or bags where it may have been stored.

Ask yourself these questions as you retrace your steps:

- What were you doing the last time you had your wallet? Think about recent purchases or activities where you may have used it. Reviewing your latest transactions in your banking app can help jog your memory.

- What were you wearing at the time? Check the pockets of any clothes you’ve worn recently in case you left your wallet there without realizing it.

- Where did you drive afterwards? Call or visit locations you’ve visited in the last few days to see if anyone turned your wallet in. Don’t forget to check your car thoroughly, including the dashboard, center console, and between the seats.

- Did you sleep or rest afterwards? Look inside couch cushions, under pillows, around your bed, or even beneath furniture where it might have slipped out unnoticed.

It’s also worth contacting your bank, local post office, and the nearest police station to see if a good samaritan has turned it in. If you lost your passport or driver’s license with your wallet, there’s even a chance someone may return or mail it directly to your home address.

2. Contact your bank

If attempts to locate your wallet prove fruitless, it’s time to contact your bank and request that your debit cards be cancelled and replaced. This will help prevent anyone who finds them from making fraudulent transactions or committing bank fraud, protecting your finances.

Here’s the contact info for each of the major U.S. banks to help you quickly contact yours if you need to report a lost or stolen card:

Banks |

Contact information |

|---|---|

Bank of America |

800-432-1000 |

Chase |

800-935-9935 |

Citibank |

800-950-5114 |

Wells Fargo |

800-869-3557 |

TD Bank |

888-751-9000 |

US Bank |

800-872-2657 |

PNC Bank |

888-762-2265 |

When you report a card as lost or stolen, the bank will also review recent transactions to flag and investigate any potentially unauthorized activity.

Prompt action is essential to limiting your financial vulnerability. If you report a lost card within 48 hours, the Electronic Funds Transfer Act (EFTA) limits your liability to just $50, greatly improving your chances of getting unauthorized charges refunded.

If you miss the initial 48-hour window but report your missing debit card within the following 58 days, you could be liable for up to $500 in unauthorized charges. However, if you wait more than 60 days after discovering the loss, you may be held fully responsible for any fraudulent transactions made with your card.

3. Inform credit card agencies

You should also contact the issuing companies of any credit cards held in your wallet to cancel and replace them. Although credit cards tend to provide greater fraud protection than debit cards, they can still leave you exposed to the risk of financial fraud in the wrong hands.

To take full advantage of the protection, it’s essential to report cards as lost or stolen promptly and transparently.

Here’s how to contact the major credit card companies:

Credit card company |

Phone number |

|---|---|

American Express |

800-528-2122 |

Visa |

800-847-2911 |

MasterCard |

800-627-8372 |

Discover |

800-347-2683 |

Synchrony |

866-419-4096 |

Capital One |

800-227-4825 |

Credit cards offer stronger protection largely because they’re covered by the Fair Credit Billing Act (FCBA), which prevents creditors from taking adverse action while a fraud investigation is underway. The FCBA also requires timely refunds and prompt posting of payments to your account, often shortly after you report the issue.

Additional safeguards include zero-liability protection, which shifts responsibility for fraudulent charges from you to the card issuer. Some issuers even extend the reporting window for lost or stolen cards by up to 30 days, further enhancing the protections offered under the FCBA. Be sure to check with your credit card provider to confirm the specific policies for disputing fraudulent card charges.

4. Review your credit report

To find out if personal information from your lost wallet has been misused for financial fraud, review your credit reports for unfamiliar accounts or suspicious activity linked to your identity. You can access a credit report for free once a week at AnnualCreditReport.com.

If you spot accounts or loans you don’t recognize, contact the credit bureaus immediately to report the fraud. You should also reach out to the financial institution where the fraudulent account was opened. Providing them with a police report can help verify that you’re a victim of identity theft and may support your request to freeze or close the fake account.

LifeLock includes a credit monitoring feature that can help you spot the signs of financial fraud. It tracks changes to your credit report and alerts you to potentially suspicious activity, meaning you can take action quickly if someone attempts to use your identity.

5. Set up fraud alerts and freeze your credit

Setting up fraud alerts can notify you if someone tries to open a new account in your name, while placing a credit freeze blocks new credit inquiries entirely. Either option can add an extra layer of protection against credit fraud.

To request a fraud alert, you only need to contact one credit bureau — they'll notify the others on your behalf. They typically remain active for up to one year, but if you’re a victim of identity theft, you can request an extended fraud alert lasting up to seven years for added protection.

When a fraud alert is in place, credit companies are required to verify your identity before approving any new loan or credit card applications. If a creditor receives a request while an alert is active, they’ll contact you first to confirm that the request is legitimate.

A credit freeze offers slightly more robust protection, in that it prevents new account applications from being processed altogether. That means fraudsters with access to your sensitive information won’t be able to open new accounts, but it’ll also prevent you from making credit applications.

Unlike fraud alerts, you have to contact each credit bureau individually to place a freeze on your credit file. Here are the contact numbers and online form links for each bureau:

Online credit freeze form |

Contact numbers |

|---|---|

c800-685-1111 |

|

888-397-3742 |

|

800-680-7289 |

You can activate both a credit alert and freeze at the same time for added protection.

6. File a police report

Filing a police report with your local law enforcement department is an important step in disputing fraudulent credit accounts opened in your name. You can use that report to submit an identity theft affidavit to the Federal Trade Commission (FTC), which strengthens your ability to dispute fraudulent activity and prevent further misuse of your information.

An identity theft affidavit serves as formal proof that you’re a victim of identity theft. You can provide it to banks, lenders, and other institutions where fraudulent accounts were opened. Once received, many of these institutions will take immediate steps to secure your accounts and block further fraud.

The Internal Revenue Service (IRS) also offers its own version of the identity theft affidavit. Submitting this form helps protect you from tax scams by flagging attempts to file a false return in your name, safeguarding your refund and personal tax records.

7. Order a new driver’s license

You can order a new driver’s license by contacting the Department of Motor Vehicles (DMV) and scheduling an appointment for replacement. To order a new license, you’ll often need proof of your identity and address, such as a birth certificate and recent mail.

Some states, like those listed below, let you replace a lost or stolen driver’s license online:

If your driver’s license was stolen and is being misused, it’s important to submit a verify ID request and apply for a new license number. This request instructs law enforcement to confirm the identity of the person presenting the license during a traffic stop, making it more difficult for ID thieves to commit criminal identity theft by pinning traffic violations to your record, for example.

8. Replace other important items

The process of replacing other important documents from your missing wallet — such as insurance cards, gym memberships, or transit passes — will vary. Taking the time to replace them not only restores your access to these services but also helps prevent criminals from using them fraudulently in your name.

Here are some cards you might have kept in your lost or stolen wallet and how to replace them:

- Auto insurance cards: Contact your auto insurance provider to report the lost or stolen card. While waiting for a replacement, keep a digital copy on hand in case you’re pulled over.

- Health insurance cards: Reach out to your health insurance provider to request a replacement. If the card was stolen, ask whether they can issue a new policy number to protect you from medical identity theft.

- Social Security card: You can request a replacement card online for free. If it was stolen, notify the Social Security Administration, provide a police report, and ask whether they can lock your card or assign a new number to prevent misuse.

- Membership cards: Contact customer service for a replacement. While you’re at it, ask if they can change your membership number to help prevent unauthorized use of services like gym access or library checkouts.

- House keys: If you’ve lost your keys along with your wallet, consider changing your locks as a precaution to prevent intruders from having access to your home.

- Car keys: Traditional keys can often be replaced by a locksmith within hours. For modern key fobs, visit your dealership to reprogram your vehicle and replace the access device, ensuring stolen or lost fobs can’t be used to enter or start your car.

- Car registration: Visit your state’s DMV or motor vehicle agency to request a replacement. In most cases, you’ll need your driver’s license and vehicle details. If your car registration was stolen, file a police report to protect yourself from potential misuse.

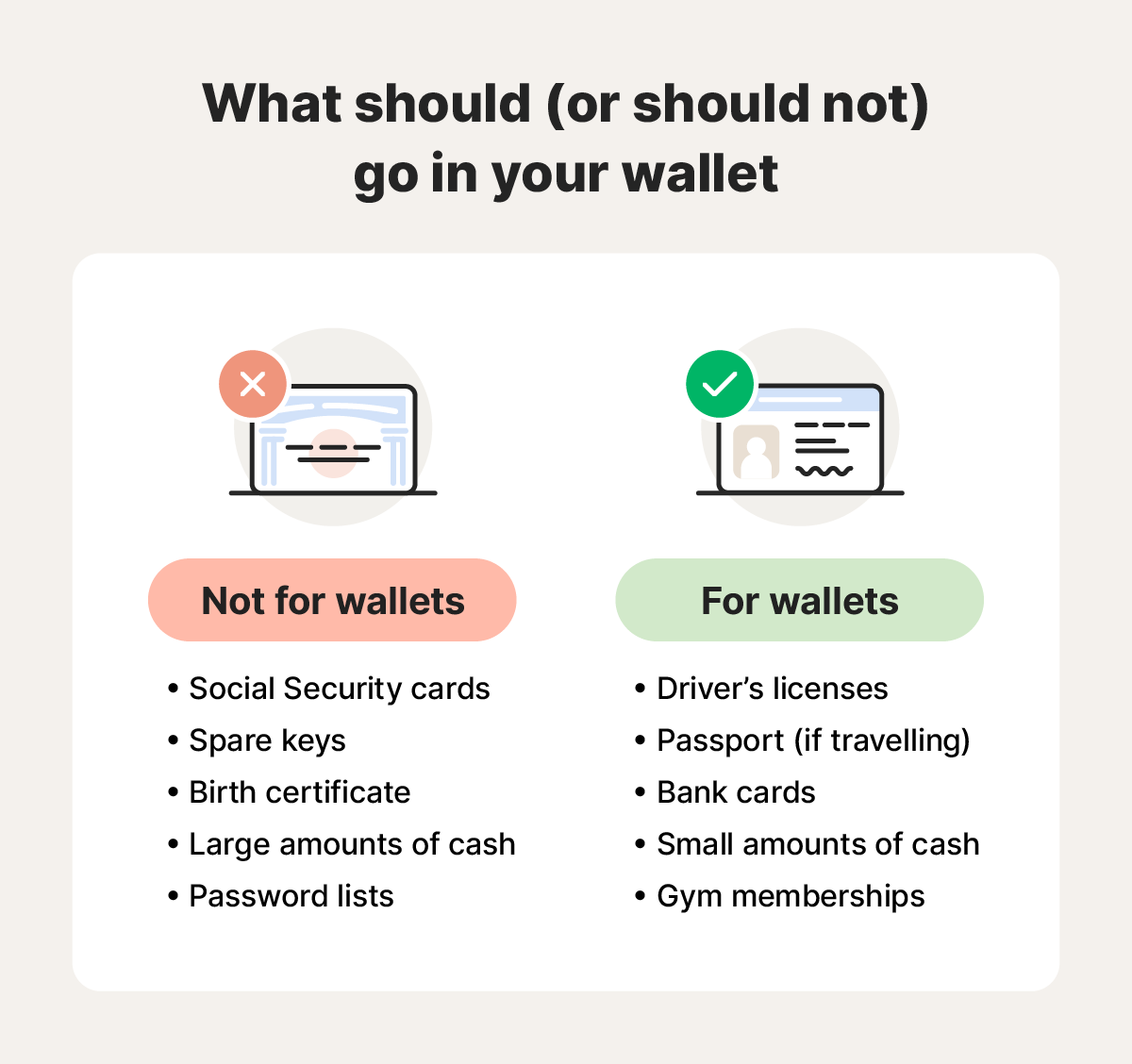

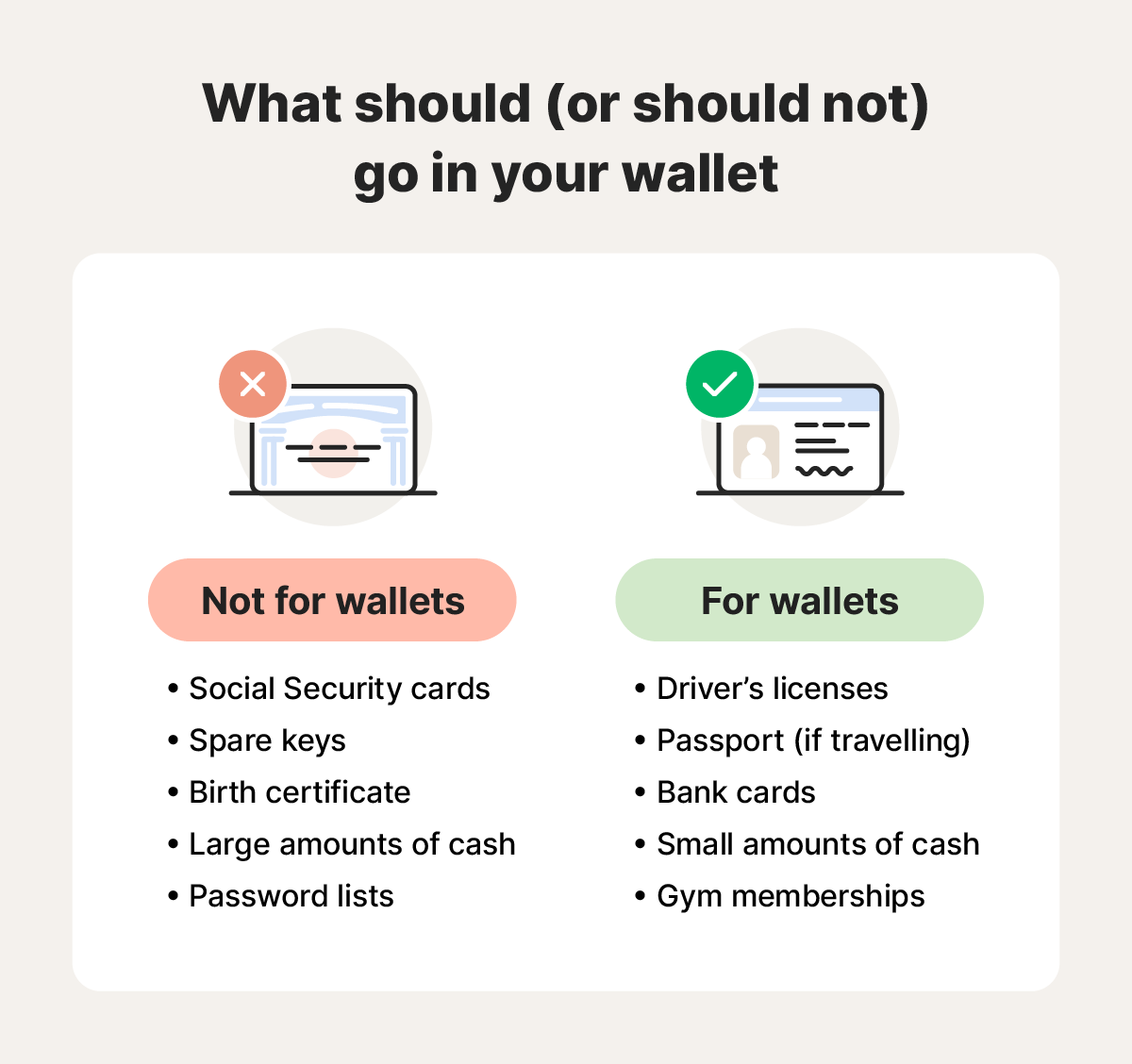

Some items, such as Social Security cards, passports, and birth certificates, should not be kept in your wallet. These are sensitive documents that can leave you exposed to identity theft if stolen, so you should store them in a secure location at home, like a fireproof lockbox.

9. Reset your automatic payments

After replacing your debit or credit cards, be sure to update your automatic payments to avoid missing loan repayments or subscription costs. Missing a loan payment can result in penalties and damage your credit score, while missing other payments may lead to late fees or service disruptions.

Some banks offer temporary digital cards you can use while waiting for your new physical cards to arrive. Check your bank’s app to see if this option is available. Once your permanent card is activated, remember to disable the temporary one — its number can still be vulnerable to data leaks or unauthorized use.

10. Consider identity theft protection

Consider identity theft protection to help safeguard against the risks that come with losing your wallet. Criminals can use stolen information from your driver’s license or bank cards to open accounts in your name, leading to serious financial and legal consequences. But having identity protection can help you detect and respond to these threats early.

LifeLock monitors for signs of identity theft, including fraudulent use of your name, address, and date of birth in applications for credit or services. It also offers stolen wallet protection to assist with replacing lost debit, credit, and identity cards. Combined with credit monitoring, these features can help you detect suspicious activity and limit the potential damage.

How to protect yourself if you lose your wallet

You can help prevent wallet loss by keeping close track of its location and contents. Designate a specific spot to keep it — like a particular pocket, bag compartment, or place at home — and make a habit of always storing your wallet there. However, no matter how careful you are, wallets can still go missing, so you should take steps to reduce your potential exposure.

Follow these additional tips to help keep yourself safe in the event of losing your wallet:

- Get a GPS tracker: Attaching a GPS tracker to your wallet allows you to locate it quickly if it’s lost or misplaced, giving you added peace of mind and a better chance of recovering it.

- Carry only what you need: Avoid carrying bank cards you don’t use, passports you don’t need locally, and Social Security cards.

- Get a travel wallet: Get a smaller travel wallet for your passport. These wallets sometimes contain RFID-blocking technology to help protect you from criminals stealing card information remotely.

- Create digital copies of cards: Use digital copies of your ID, membership cards, and insurance information to protect your information and make it harder to steal. Just be sure your phone is locked using a PIN or fingerprint to protect these digital copies from being misused.

- Keep an information card in your wallet: Storing a card providing your phone number can make it easier for people to return your wallet if it’s lost.

- Set up 2FA on your accounts: Identifying information in your wallet can sometimes be used to access online accounts. Using two-factor authentication (2FA) on your accounts adds an extra layer of security, requiring a code sent to your phone or email address to be entered before a login attempt is successful.

- Consider identity theft protection: Information in your wallet, like your full name, driver’s license number, and address, can be used to steal your identity. Identity theft protection can help mitigate the damage from theft and make recovery easier.

Protect your identity in the case of a stolen wallet

Losing your wallet can put your identity at risk, but the right protection can make all the difference. LifeLock includes stolen wallet protection, which helps you cancel and replace vulnerable items like credit cards and IDs. Plus, you’ll have access to expert support from a U.S.-based restoration specialist to guide you through identity theft recovery, every step of the way.

FAQs

What are the chances of finding a lost wallet?

That depends on where you lost it and how quickly you realize it’s missing. The sooner you start looking for a lost wallet, the better your chances of recovering it. As more time passes, the likelihood that someone may take or misuse the wallet increases.

How do I track a lost wallet?

You can track a lost wallet using a GPS tracking device, widely available online or at many retail stores. Tuck the tracker discreetly inside your wallet or purse and connect it to a phone app to make locating it easier if it goes missing.

How will I know that someone is using the information in my wallet?

Signs that someone is misusing your wallet’s contents include unfamiliar transactions on your bank card, new credit accounts you didn’t apply for, and unexpected traffic violations linked to your driver’s license. Review what items were in your wallet to help identify which pieces of information might have been compromised.

Where do people turn in lost wallets?

People often turn in lost wallets to nearby banks, USPS post offices, or the business where they were found. In many cases, staff will store it in a lost and found or take steps to return it if possible.

How do I check if someone is using my identity?

To check for signs that your identity is being misused, review your credit report for unfamiliar accounts or inquiries. Other indications of identity theft include changes to your mailing address, tax filings you didn’t submit, or receiving government benefit notices for programs you never applied to.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Retrace your steps

- 2. Contact your bank

- 3. Inform credit card agencies

- 4. Review your credit report

- 5. Set up fraud alerts and freeze your credit

- 6. File a police report

- 7. Order a new driver’s license

- 8. Replace other important items

- 9. Reset your automatic payments

- 10. Consider identity theft protection

- How to protect yourself if you lose your wallet

- Protect your identity in the case of a stolen wallet

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.