Tip: You can identify fake PCH checks if they come with a letter asking for personal information, claiming you need to pay a fee before cashing the check, or suggesting that you get in touch with the sender directly. It’s also a red flag if the check isn’t sent through First Class Mail.

Publishers Clearing House (PCH) scams use the promise of valuable prizes as a powerful motivator. Scammers impersonate PCH representatives online, over the phone, or in emails to steal money or sensitive personal information.

Keep reading to learn about the different types of Publishers Clearing House scams, how to spot them, tips you can use to protect yourself, and what to do if you've been targeted.

Is Publishers Clearing House a scam?

No, Publishers Clearing House itself isn’t a scam. It’s a legitimate company that sells magazines and merchandise. Founded in 1953, PCH gained popularity by organizing high-value contests, games, and sweepstakes to promote their subscriptions. Since then, it’s given away more than half a billion dollars in prize money.

But despite its legitimacy, PCH hasn’t completely avoided controversy. In 2023, the Federal Trade Commission (FTC) sued PCH for using misleading language that suggested making a purchase was necessary to win or would increase the chances of winning.

As a result of the lawsuit, PCH had to pay $18.5 million in damages to compensate users for wasted time. The FTC also ordered an overhaul of the PCH user interface to avoid manipulative designs and help prevent users from incurring surprise fees.

How do Publishers Clearing House scams work?

Publishers Clearing House scams involve fraudsters leveraging the company’s reputation and the excitement of winning a prize to trick victims into giving up sensitive personal information or paying money. These scammers use a variety of convincing approaches, often preying on people who may be particularly vulnerable to scams.

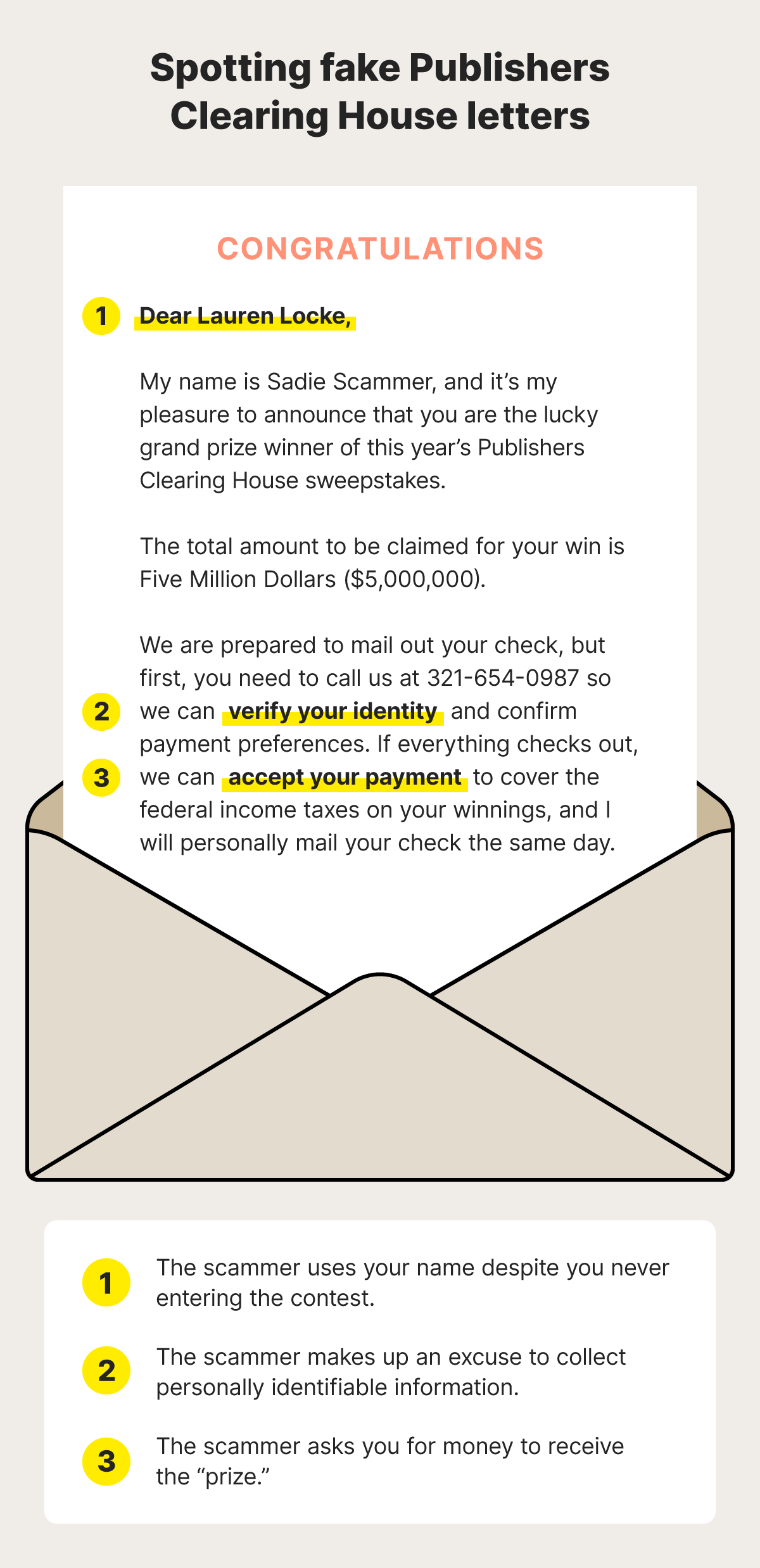

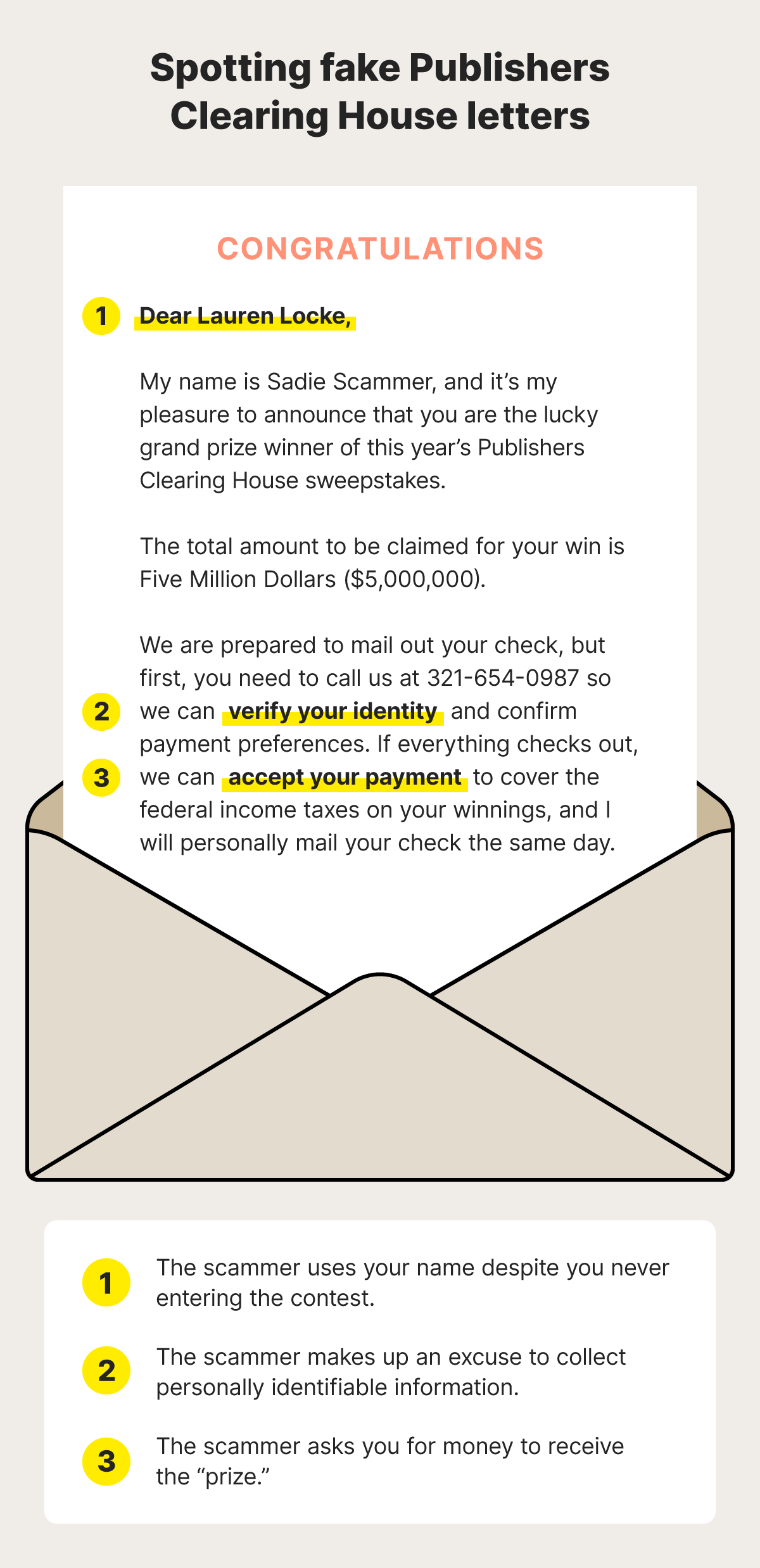

Regardless of the specific approach used by a scammer impersonating PCH, these steps are shared by most PCH scams:

- The scammer gets hold of your contact information, often following a data breach or by using social engineering tactics in a phishing attack. With access to your phone number, email, or postal address, they can contact you directly.

- They’ll pretend to be a representative from PCH, using various fabricated pretexts for contacting you. They may adopt a real PCH representative’s name and attempt to disguise their phone number or email address to look more legitimate.

- The scammer may request personal information that they can use in identity theft, such as your Social Security number or credit card details, claiming they need it to verify your identity. Alternatively, they might ask you to pay taxes to receive your fake winnings or send you a fake check but claim you have to pay a fee before you can cash it. If you send them money, they’ll disappear and you’ll be left out of pocket.

PCH scammers often target the elderly, aiming to get access to sensitive personal or financial information so they can drain their bank accounts. If you think a loved one is at risk of falling victim to a scam, take steps to keep them informed. The Federal Trade Commission’s Pass It On program offers educational resources you can use.

How to identify a Publishers Clearing House scam

The most obvious red flag of a Publishers Clearing House scam is receiving a message claiming you’ve won a prize and requesting information or payment. PCH won’t reach out to you if you’re a winner — you’ll simply receive a check in the mail or be visited in person by the Prize Patrol, depending on how much you’ve won.

Here’s a more detailed look at how you can identify a PCH scam:

- You didn’t enter a giveaway: You’ll never win a competition that you didn’t enter unless you’re accepting the winnings on someone else’s behalf. Ignore messages claiming you’ve won something, from PCH or anyone else, if you didn’t enter a contest.

- You’re notified over the phone: PCH will never call ahead to let you know you’ve won. A phone call from a “PCH representative” claiming you’ve won a prize means you’re being scammed, and you should hang up immediately.

- You must pay to receive winnings: PCH will never ask you to pay a fee or cover taxes before you receive your winnings. If you’re ever asked to send money to PCH, you’re being targeted by a scam and should cut contact.

- You’re offered electronic payments: PCH will never offer to send you payments electronically. Official checks are sent via USPS First Class Mail, overnight mail, UPS, or delivered in person by the Prize Patrol.

- You’re asked to pay check fees: PCH won’t require you to pay a fee to receive a prize check. If someone tells you to do this, you’re being scammed and the check is almost certainly fake.

If you’re ever unsure whether you’re being targeted by a PCH scam, you can contact Publishers Clearing House directly via live chat, email, or by calling 800-566-4724. A customer support agent will be able to confirm whether you’re a winner and help you redeem your winnings safely if you are.

What does winning a legitimate PCH sweepstakes look like?

If you win big ($10,000 or more), the Publishers Clearing House Prize Patrol may show up at your door unannounced carrying a jumbo check with your name on it, a cluster of colorful balloons, and a bouquet of red roses. If you’ve won less than $10,000, your award may appear via First Class U.S. Mail or overnight mail instead.

Regardless of how much you’ve won, PCH will never email, text, call, or message you on social media.

Types of Publishers Clearing House scams

Publishers Clearing House scams come in different forms, including fake checks sent through the mail, award notifications through social media, fake websites, scammers pretending to be PCH representatives, and requests to open new bank accounts.

Fake checks in the mail

Publishers Clearing House scammers may mail you a fake check with a phony letter claiming you’ve won and need to send them money to cover made-up costs like taxes, insurance, or legal fees.

They might also try to convince you that you’re receiving an advance on your prize by calling it an “initial installment” and claiming you have to take action, like calling them using a fake number, to receive the rest of your winnings. This approach aims to override your common sense and lower your defenses so they can scam you.

Messages on social media

Some scammers use social media platforms like Facebook to trick victims, either by creating convincing fake pages impersonating PCH or messaging targets directly claiming they’ve won a prize.

While PCH may post footage of the Prize Patrol delivering checks on their official social media pages, they never contact winners in direct messages. PCH only ever sends winning checks unannounced, requesting nothing in return.

Tip: You may be able to identify fake PCH pages on social media by checking their post history and number of followers. If you’re ever unsure whether a page is legitimate, visit the PCH website to find a link to the authentic social media page.

Fake websites

Some scammers effectively emulate PCH’s website, directly copying the design. If you end up on a fake PCH website and enter your personal information thinking you’re entering a real sweepstakes, the scammer may be able to steal your identity — or at least contact you to try and get money.

They’ll typically get in touch claiming you’ve won a prize and request that you send them bank account details, gift cards, or pre-loaded credit cards. Always make sure you’re on the real Publishers Clearing House website before entering personally identifiable information or other sensitive data.

Tip: Fake PCH websites may look convincing, but if the URL in your browser’s address bar isn’t pch.com, you can be sure you’re not on the right site.

Scam phone calls

PCH never reaches out to winners with a phone call, but that doesn’t stop scammers, who may call you and attempt to trick you into thinking you’ve won a prize. They will often try to create a false sense of urgency, pressuring you to provide information before you can identify them as a scammer.

If you suspect you’re speaking to a scam caller, refuse to give any personal information, end the conversation immediately, and block the number. You can then get in touch with PCH using the official phone number listed on their website to verify if the call was legitimate.

Tip: An unsolicited call from PCH asking for personal information or encouraging you to send money is a clear indicator of a scam. The company never calls winners on the phone.

Requests to open a new bank account

A scammer impersonating PCH might tell you that you need to open a new bank account to claim your winnings. They may even offer to open it for you as a ruse to access sensitive information like your Social Security number (SSN) or existing banking information.

If you fall for one of these PCH-related bank scams, take action quickly to protect your finances. That includes freezing your credit as soon as possible and informing any involved financial institutions.

Tip: PCH will never ask you to open a bank account or request personal information from you to open an account on your behalf. If you’ve won a prize, you’ll receive a check in the mail that you can cash yourself.

Tips to help protect against Publishers Clearing House scams

There are some simple ways to safeguard against PCH scams: ignore unsolicited contact attempts from people claiming to be PCH representatives, keep your personal information private, and avoid clicking suspicious links.

Here’s some more information on how to help protect yourself from falling for a PCH scammer:

- Don’t respond to contact requests: Even if you’ve won a prize, PCH will never contact you by calling, sending a text, or messaging you directly on social media. Anyone who claims to be from PCH is likely to be a scammer and should be ignored.

- Don’t trust your Caller ID information: Scammers can mask their phone number with fake Caller ID credentials using a technique known as spoofing. Remember, PCH won’t ever contact you via phone, so don’t answer calls that look like they’re from PCH.

- Don’t share personal information: To enter PCH sweepstakes, you’ll have already entered your information on the official PCH website. PCH won’t ask for your personal information to verify your identity, so don’t share it if you’re ever prompted to.

- Avoid suspicious links: Suspicious links claiming to lead to the PCH website, received in emails or texts, may lead to unsafe websites that can install malware on your device or steal your information. Always double-check that the URL in the link matches the official PCH website address.

- Ignore requests for payment: Winning a sweepstakes doesn’t ever involve sending money to others. Don’t respond to requests for payment in order to claim a prize, and certainly don’t send funds, as your bank might not refund scammed money.

- Report fake PCH social media accounts: Reporting fake PCH social media pages will help them get noticed by moderators sooner, meaning they’ll be removed from the platform to reduce the risk of others being scammed.

Much like wire transfer scams, the ultimate goal of PCH scams is to steal your money. Even if you only send basic information that seems harmless, scammers may try to make money from it by selling it on the dark web or attempting to steal your identity.

Educating yourself on how to spot these scams can help you avoid falling for them. And, remember, protecting your personal information should be a top priority when communicating with anyone you do not know.

What to do if you’re tricked by a PCH scam

If your defenses slip and you’re tricked by a PCH scam, key steps to take to limit damages include notifying your bank, freezing your credit, and reporting the scam to the FTC, local law enforcement, Publishers Clearing House, and USPIS.

Here’s some more information on what you should do if you fall for a PCH scam:

- Don’t spend fake checks: If you’ve cashed a fake check and the money has provisionally appeared in your bank account, don’t spend it. Your bank will eventually identify that this money isn’t able to be collected from the payer and deduct the amount from your balance.

- Alert your bank: If you’ve transferred money to a PCH scammer, notify your bank’s fraud department as soon as possible to see if they can prevent the charge from processing. If you’ve shared your banking information with a scammer, ask what can be done to help protect your accounts.

- Monitor and freeze your credit: After realizing you’ve been scammed, you should set up a credit freeze to help prevent the scammer from opening accounts in your name. In the following weeks and months, monitor your credit report closely to look out for any suspicious activity.

- File an FTC report: You can report a PCH scam to the FTC at ReportFraud.ftc.gov. They’ll provide a list of steps you can take to protect yourself. They may also use the information you provide to open an investigation that might help catch the scammer.

- Notify PCH: Report scammers to PCH using the official PCH Scam Incident Report portal. The information you provide will help PCH identify trends so they can take steps to stop future occurrences.

- Contact law enforcement: Filing a report with your local law enforcement office can help create a paper trail that makes it easier for you to prove the scam happened if you suffer from the consequences of identity theft in the future.

- Report to USPIS: If you received a fake check claiming to be from PCH, report it to the United States Postal Inspection Service (USPIS) using their official fraud complaint form.

- Warn friends and family: Scammers with access to your contact information may be able to find your friends’ or family members’, too. Warning them can help put them on guard if a scammer gets in touch so they have a better chance of avoiding the scam.

Protect against PCH scams

PCH scams are just one of the many ways scammers can try to steal your money or information. If they do, your identity could be stolen. That’s where LifeLock comes in.

If you fall for a scam that exposes your personal information, a LifeLock membership helps limit the fallout by protecting your identity and finances.

LifeLock gives you access to features that help you track the exposure of your personal information, learn about potentially fraudulent use of your Social Security number, and catch key changes to your credit file. And if you fall victim to identity theft, LifeLock’s dedicated U.S.-based restoration specialists are standing by to help you recover.

FAQs

How does Publishers Clearing House notify winners?

Publishers Clearing House never calls, texts, emails, or messages winners. If you win, you’ll receive your prize directly, with no prior notice. If the prize is over $10,000, it’ll be sent via overnight mail or the Prize Patrol will deliver it to your house. If it’s between $600 and $10,000, you’ll receive it via overnight mail or UPS. If it’s less than $600, you’ll get a check via First Class U.S. Mail.

What can I do if I’m unsure that a PCH award notification is legitimate?

Contact PCH’s customer service team via chat or call their support line at 800-566-4724 during business hours. A customer support representative can verify if you’re a winner with your name, email address, or customer ID number.

Can I win a PCH prize without entering the sweepstakes?

No, you can’t win money from Publishers Clearing House unless you enter your name into the contest. However, you might receive an award notification if the winner can’t claim their prize and you’re their next of kin.

Can someone else enter me in the Publishers Clearing House sweepstakes?

Yes, someone else can enter you in the sweepstakes if they follow Publishers Clearing House’s rules. However, if you’re contacted by someone claiming to be from PCH and suggesting you’ve won a prize from a sweepstakes you didn’t enter, call the PCH customer support team to verify it’s legitimate.

Publishers Clearing House is a trademark of Publishers Clearing House LLC.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- Is Publishers Clearing House a scam?

- How do Publishers Clearing House scams work?

- How to identify a Publishers Clearing House scam

- Types of Publishers Clearing House scams

- Tips to help protect against Publishers Clearing House scams

- What to do if you’re tricked by a PCH scam

- Protect against PCH scams

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.