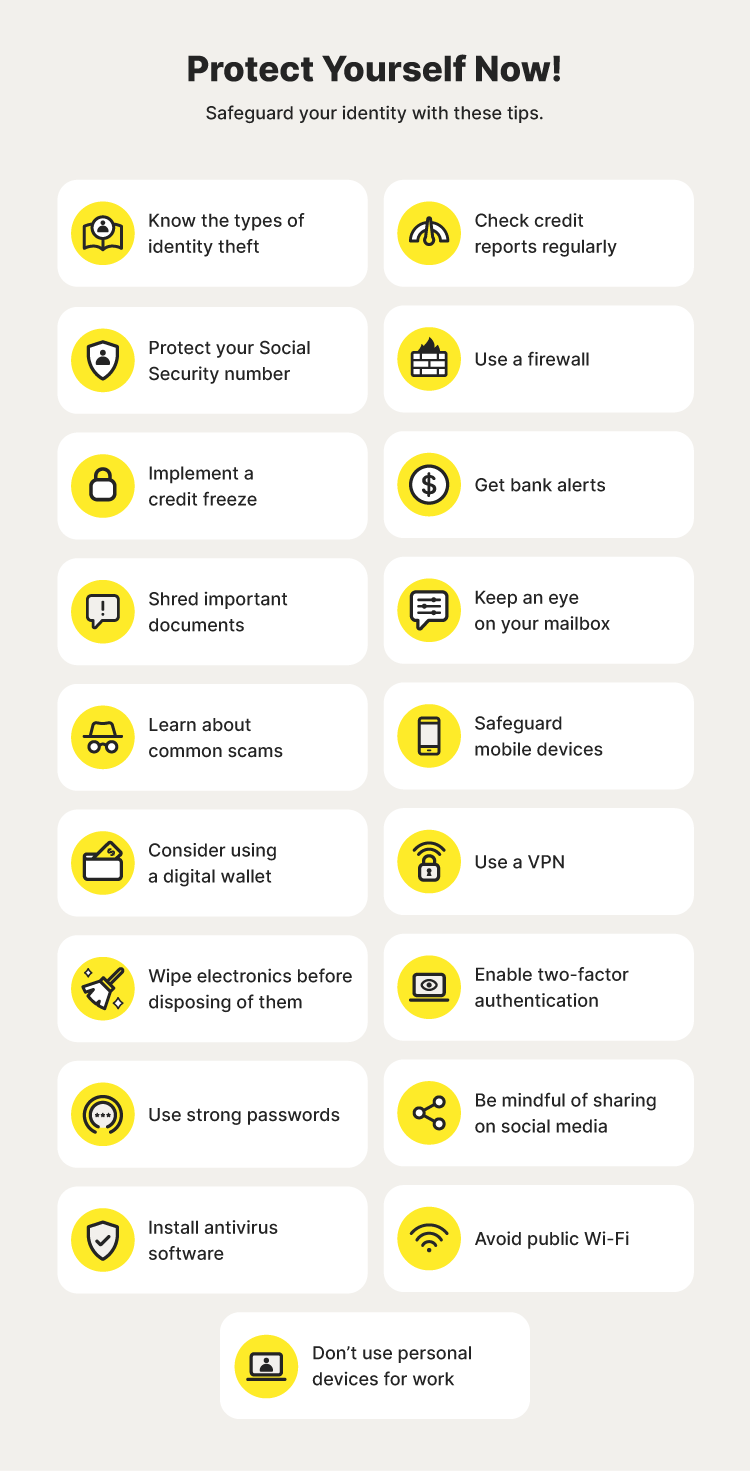

More than 1 million people had their identities stolen in 2023. Thankfully, there are steps you can take to help keep your sensitive personal information secure and avoid that fate. Follow these tips to help protect against identity fraud.

1. Know the types of identity theft

There are many different forms of identity theft. While it’s easy to think of identity theft happening when someone loses their wallet, a lot of it takes place online.

Today, more than 80% of adults say they’re worried about AI-assisted identity theft. Put yourself ahead of today’s identity thieves by learning statistics and facts about different kinds of identity theft used to compromise your sensitive data and replicate your identity.

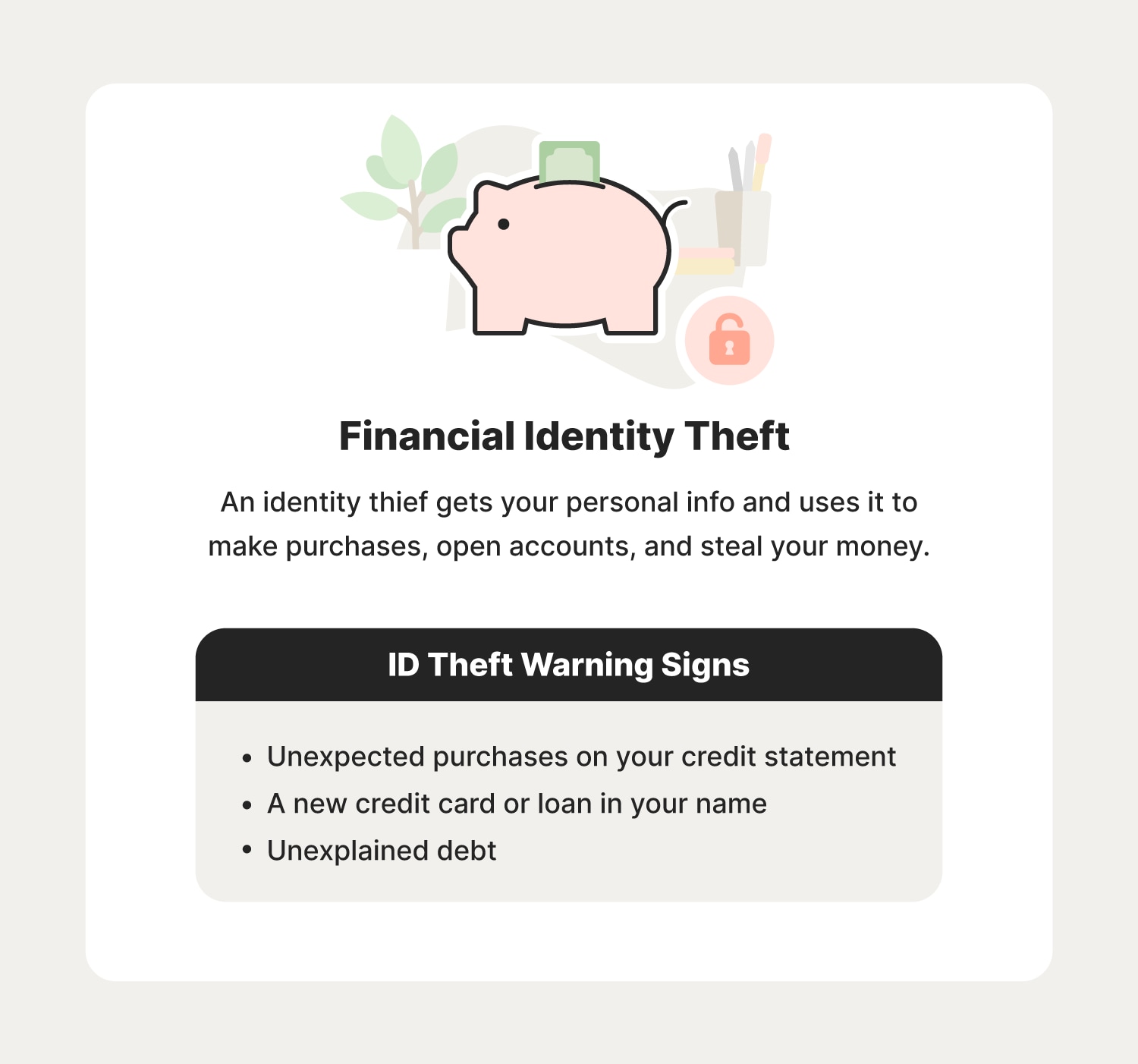

Financial identity theft

Financial identity theft is when a thief gets your personal information and uses it to make purchases, open accounts, and steal your money. This can happen if a cybercriminal finds your passwords, phone numbers, emails, addresses, and other personal data like your Social Security number.

You don’t want to become another statistic. In 2023 alone, cybercriminals stole more than $126 million through identity theft.

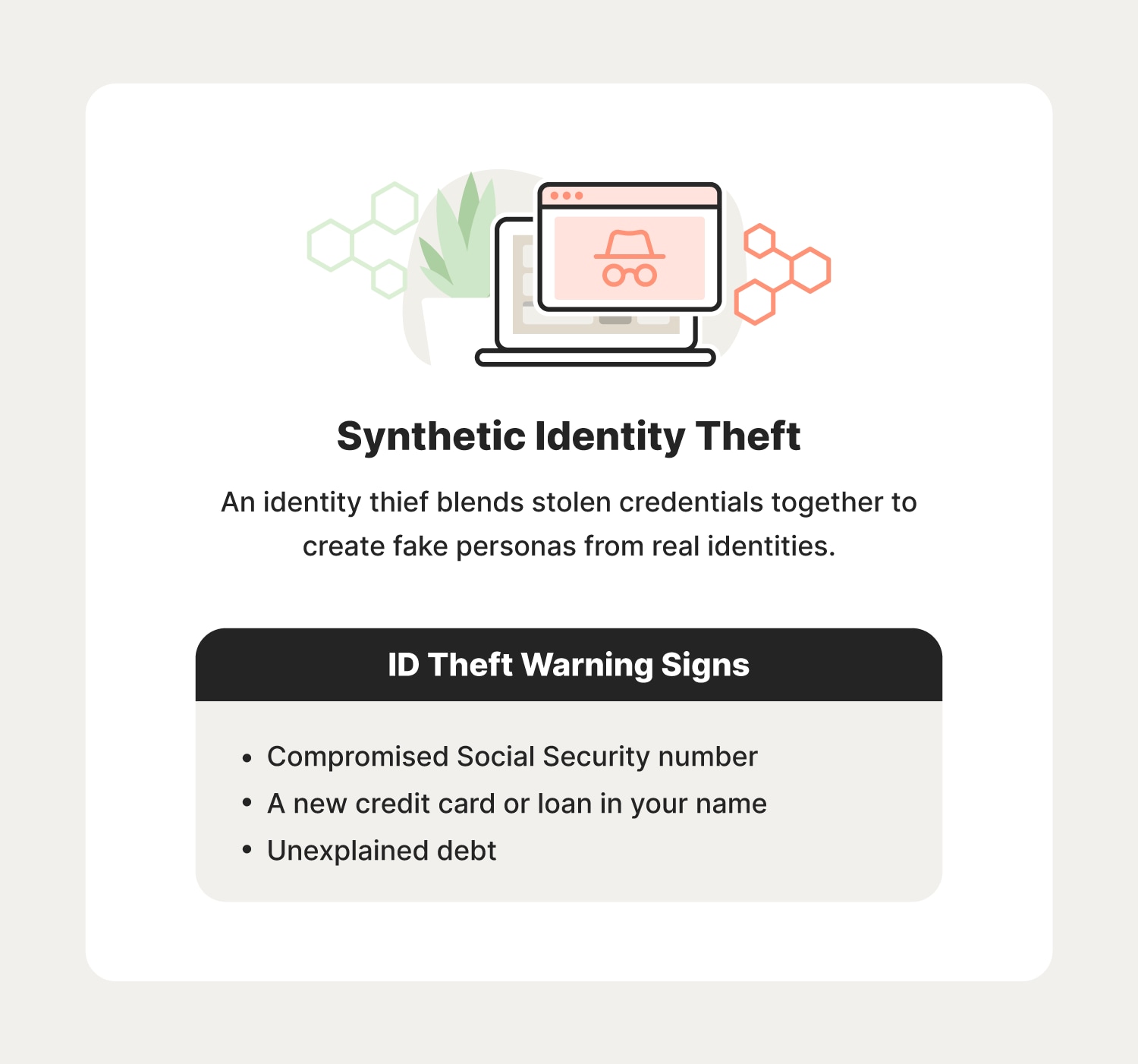

Synthetic identity theft

Synthetic identity theft happens when a criminal blends stolen credentials to create fake personas from real identities. As the fastest-growing type of identity fraud, synthetic identity thieves use these fake identities to carry out the usual crimes associated with identity fraud, such as credit card and insurance fraud.

Some warning signs of synthetic identity theft include a compromised Social Security number, new credit cards or loans in your name, and extra taxable income reported using your name.

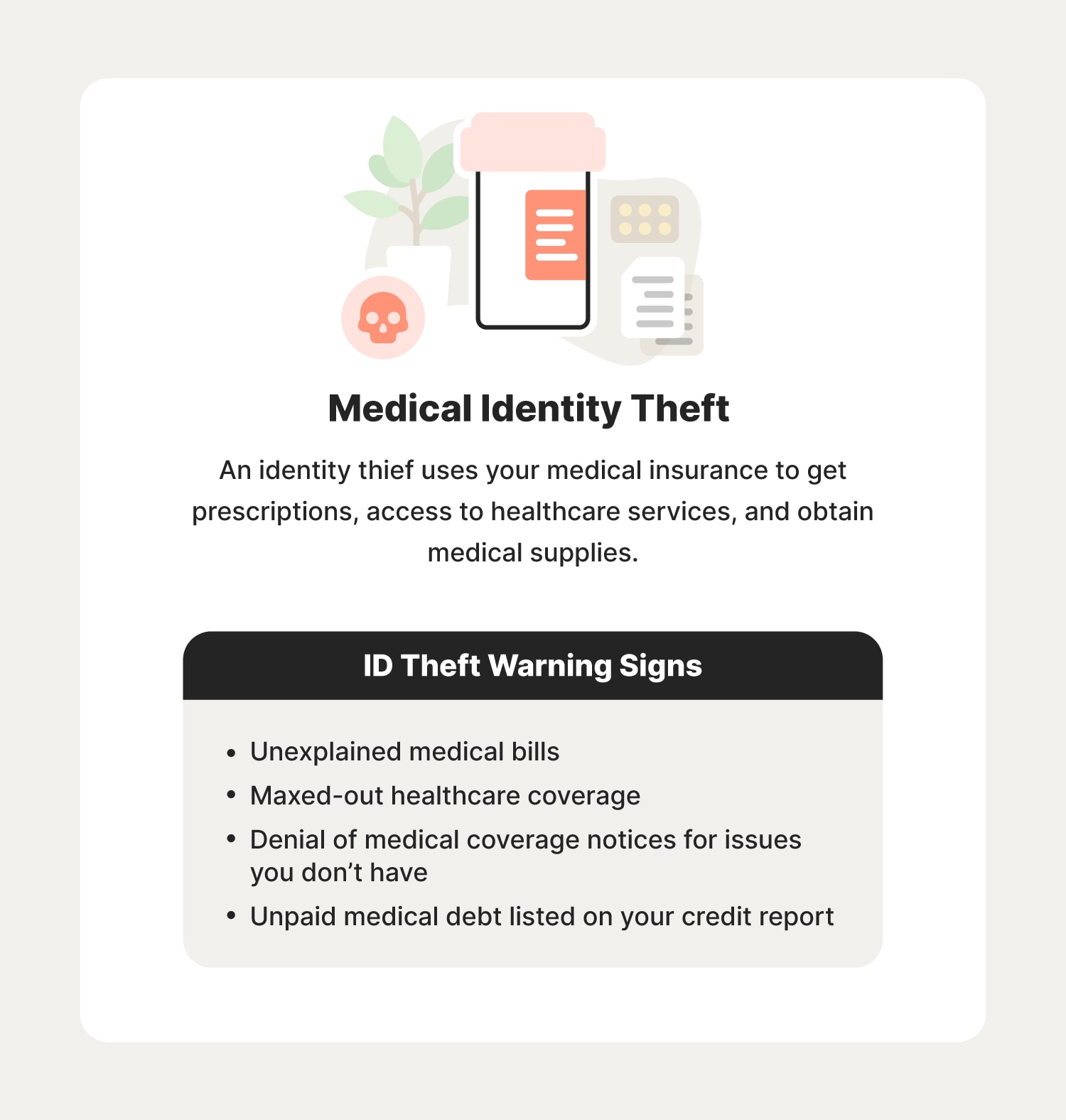

Medical identity theft

Medical identity theft is a very present threat. In 2023, there were 13,683 reports of identity theft relating to medical services. An identity thief can use another person’s medical insurance to get prescriptions, access healthcare services, and obtain medical supplies.

You might be a victim of medical identity theft if you see:

- Unexplained medical bills

- Maxed-out healthcare coverage

- Denial of medical coverage

- Notices for medical issues you don’t have

- Unpaid medical debt listed on your credit report

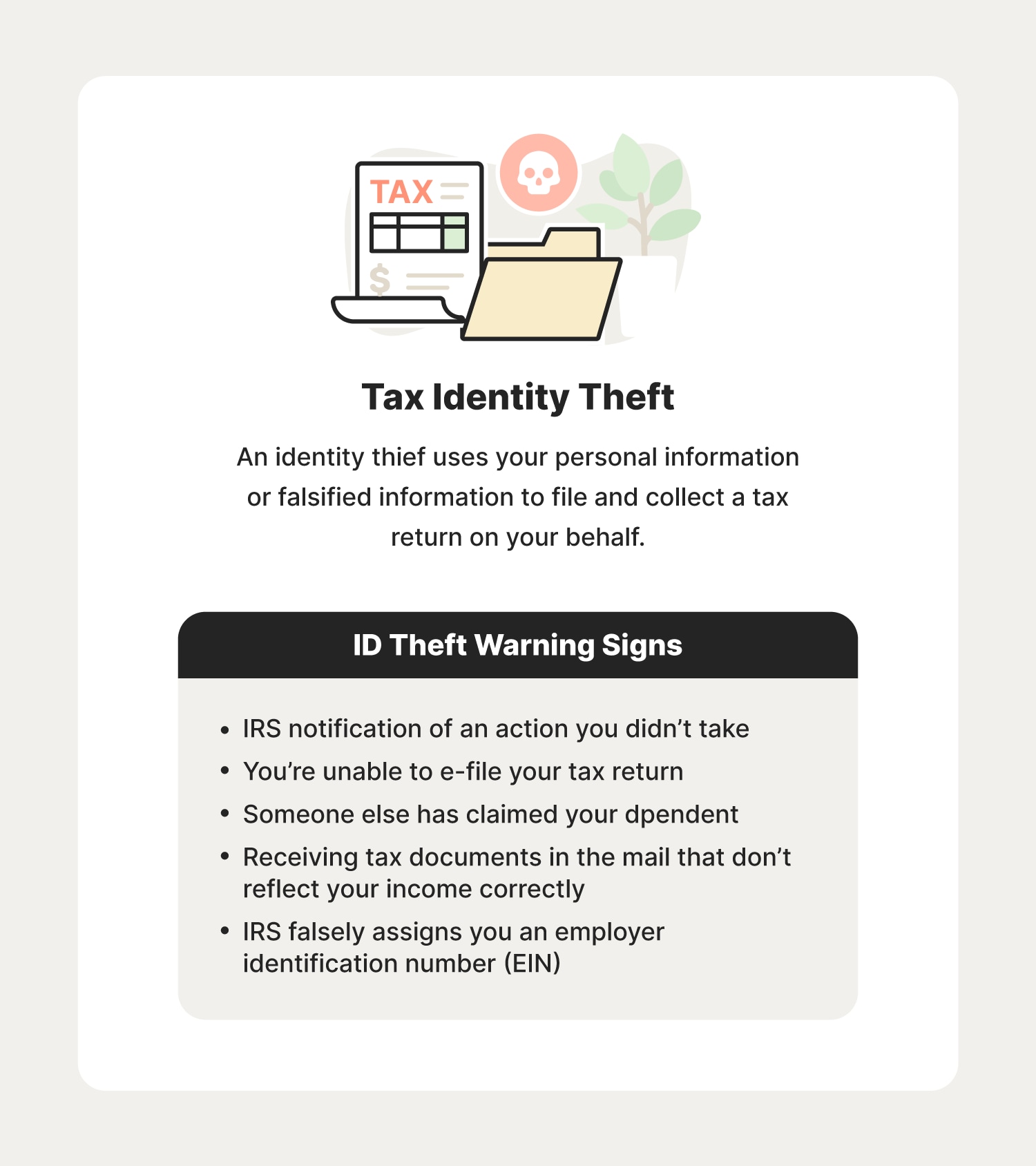

Tax identity theft

When an identity thief uses your personal information or falsified information to file and collect a tax return on your behalf, you’re the victim of tax identity theft. This form of employment identity theft can happen to anyone with a Social Security number or other documentation that allows them to work in the US legally.

You might be the victim of tax-related identity theft or another type of tax scam if you receive a notification from the IRS about an action you didn't take, receive tax documents that don’t reflect your income correctly, the IRS falsely assigns you an employer identification number (EIN), you’re unable to e-file your tax return, or someone else has claimed you as a dependent or claimed to be one of your dependents.

Child identity theft

A criminal who uses a child’s personal information to open new accounts or lines of credit, create fake IDs, or make large purchases is committing child identity theft. Many victims only become aware once they try to apply for a student loan or open their first credit card. If you’re a parent, you can freeze your child’s credit to prevent others from using their identity fraudulently.

Signs of child ID theft include unexplained bills in your child’s name, debt collection notices via phone or mail with your child’s name, and IRS letters notifying you that your child owes taxes.

Criminal identity theft

Criminal identity theft occurs when a person arrested by law enforcement provides your name and other identifiable information instead of theirs. They could do this by getting their hands on your lost wallet, stolen driver's license, or creating a fake ID.

Law enforcement may then arrest you for a crime you didn’t commit — examples of lasting effects of identity theft like this include not being able to get a new job or renew your passport. Look out for a court summons in the mail, unexpected bench warrants for your arrest, and failed background checks.

2. Protect your Social Security number

Always be sure to protect your Social Security number. If someone asks for your SSN, always ask why, and never hand it over if you can’t guarantee it’ll stay safe. Other best practices include storing it safely and shredding all paperwork containing the number.

3. Check credit reports regularly

Keeping an eye on your credit score and reviewing your credit reports regularly can help you check if someone is using your identity before it becomes a major issue. Additionally, some institutions offer free weekly credit reports — all to help you stay vigilant and try to put fears of identity theft at bay.

As an added layer of security, use LifeLock for extra credit monitoring support to help protect against identity fraud. With our credit monitoring feature, you can easily see changes to your credit file and detect potential fraud.

4. Implement a credit freeze

A credit freeze blocks anyone from opening new lines of credit or taking out a loan in your name. You can freeze and unfreeze your credit at any time, so consider keeping your credit frozen until you’re ready to open a new account or apply for a loan. If somebody steals your identity, freezing your credit and adding a fraud alert to your report offers even more protection.

5. Use a VPN

Virtual Private Networks (VPNs) encrypt the traffic flowing between your devices and the internet. That makes it safer to use public Wi-Fi because it hides your online activity, keeping it private.

6. Shred personal documents

If it’s easy to access your financial documents — online documents or physical copies — then potential thieves can use them to impersonate you and gain access to your accounts. Regularly clear out financial documents you don’t need on your computer and ensure you completely delete them. Use a shredder to protect yourself from people who may dumpster-dive for identity-related physical documents.

7. Get bank alerts

Most banks or other financial institutions will send you automatic alerts if they detect fraud, unusual login attempts, or wire transfer scams — you just need to set them up. Check out your banking app or head to the bank in person. These alerts can often inform you immediately when money enters or exits your account so you know about any fraudulent transactions.

8. Learn about common scams

Learning about how to prevent identity theft by reading up on common scams, like the UPS scam, could stop you from getting caught up in a giveaway scam, getting catfished, or falling victim to another type of attack. So, arm yourself with knowledge to help prevent joining the 33% of Americans who have faced identity theft at some point in their life.

9. Watch your mailbox

Checking your mailbox daily is effective in warding off potential mail theft. You can also get a US Postal Service-approved lockable mailbox, ask trusted neighbors to collect your mail while you're away, or use a vacation hold to keep your personal information safe.

10. Consider using a digital wallet

Whether you use the digital wallet included on your smartphone or download a trusted app, digital wallets can be safer than carrying your physical wallet and cards around. This is because digital wallets encrypt your information, hiding it from potential criminals who could steal your money or sell your details to carding scammers.

11. Safeguard mobile devices

It’s important to secure your mobile devices to protect against identity theft, as spyware, ransomware, and other malware are just some of the threats to your mobile security and data stored on your phone. Remember to always lock your phone and to only download trustworthy apps from official app stores.

12. Wipe electronics before disposing of them

When you buy a new phone, computer, or tablet, it’s important to dispose of your old device properly. Whether you’re selling, donating, recycling, or throwing it in the junk drawer, do a complete system wipe to reduce your risk in case it ends up in the wrong hands.

13. Create strong passwords

Good password security can make it difficult for identity thieves to use hacking methods like credential stuffing and password spraying to break into your accounts. Password managers are great at helping you create and organize hack-proof passwords. Most password managers are available for computers and mobile devices to help you stay secure wherever you are.

14. Use a firewall

Firewalls are software or hardware that help block unwanted traffic between your devices and the internet. Most computers will have a basic built-in firewall function, but you can also purchase one as standalone software or in a cybersecurity bundle.

15. Enable two-factor authentication

Enabling two-factor authentication can help prevent identity thieves from getting into accounts that hold your most important information. With the help of biometric authentication like fingerprint scanning or a physical authentication device, replicating your identity becomes much more difficult.

16. Be mindful of sharing on social media

We share a lot of seemingly harmless information on social media that scammers can use. Before you post or share anything, consider how your behavior on social media could lead to identity theft. For example, a throwback post showing off your first car seems innocent but potentially reveals the answer to a common password recovery question.

17. Install antivirus software

Antivirus software adds an extra layer of protection to help block viruses and malware from infecting your devices. Security software can make getting access to your private information much harder and allows you to use your devices with confidence, knowing a trusted antivirus is watching your back.

18. Avoid public Wi-Fi

Using public Wi-Fi can jeopardize any personally identifiable information that you send and receive. Whether a cybercriminal is monitoring the traffic on a poorly secured network or someone shoulder surfs you to learn your logins, be careful about using the internet in public. If you need to get online, use a VPN to encrypt your traffic.

19. Don’t use personal devices for work

As more and more people work remotely, it’s easy to check your work email or respond to a chat while on your personal devices. But that could expose sensitive data — personal and work data — to hackers and cybercriminals. Keep your work on work devices and vice versa to keep these aspects of your life separate.

Help protect your identity with LifeLock

Identity theft can have devastating and long-lasting consequences. While there’s no guaranteed way to completely prevent identity theft, LifeLock provides powerful protection against identity fraud and gives you added peace of mind knowing that we’re there to assist in restoring your identity in the event that something goes wrong.

FAQs about preventing identity theft

Keep reading to learn the answers to these common ID theft questions.

What are three ways to help prevent identity theft?

Protecting your personal information is one of the best ways to help prevent identity theft. Three simple tips are:

- Create strong, unique passwords for all accounts.

- Use a VPN, antivirus software, and a firewall to browse the internet more safely.

- Keep your mailbox secure and collect mail daily.

What are some of the most common causes of identity theft?

Three common causes of information exposure, which can lead to identity theft, are:

- Mass data breaches

- Responding to phishing messages

- Not protecting personal documents and information

How can I find out if someone is using my identity?

You can determine if someone is using your identity by closely monitoring bills, credit reports, and financial accounts to see if there’s any activity you didn’t initiate. You might also consider using identity protection services such as LifeLock to help alert you to suspicious activity.

Who is most at risk for identity theft?

People between the ages of 30 and 39 are the most common targets of identity theft, followed by people 40 to 59 years old.

How do I report ID theft?

Reporting identity theft can help stop it from happening again in the future and bring criminals to justice. Here are the steps to take:

- Report the identity theft to the credit bureaus.

- Place a fraud alert and obtain credit reports from the credit bureaus.

- Freeze or lock your credit report.

- Contact the authorities, including the FTC and local law enforcement.

The Federal Trade Commission offers personalized recovery plans, guidance, and pre-filled letters and forms on IdentityTheft.gov to assist you once you contact the police. You can also speak to someone for assistance by calling 1-877-438-4338.

How do identity thieves get your information?

Some of the most common ways criminals steal your information include:

- Hacking

- Wallet or phone theft

- Stealing mail

- Phishing

- Credit card skimming

- Mass data breaches

- Monitoring public Wi-Fi

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Know the types of identity theft

- 2. Protect your Social Security number

- 3. Check credit reports regularly

- 4. Implement a credit freeze

- 5. Use a VPN

- 6. Shred personal documents

- 7. Get bank alerts

- 8. Learn about common scams

- 9. Watch your mailbox

- 10. Consider using a digital wallet

- 11. Safeguard mobile devices

- 12. Wipe electronics before disposing of them

- 13. Create strong passwords

- 14. Use a firewall

- 15. Enable two-factor authentication

- 16. Be mindful of sharing on social media

- 17. Install antivirus software

- 18. Avoid public Wi-Fi

- 19. Don’t use personal devices for work

- Help protect your identity with LifeLock

- FAQs about preventing identity theft

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.