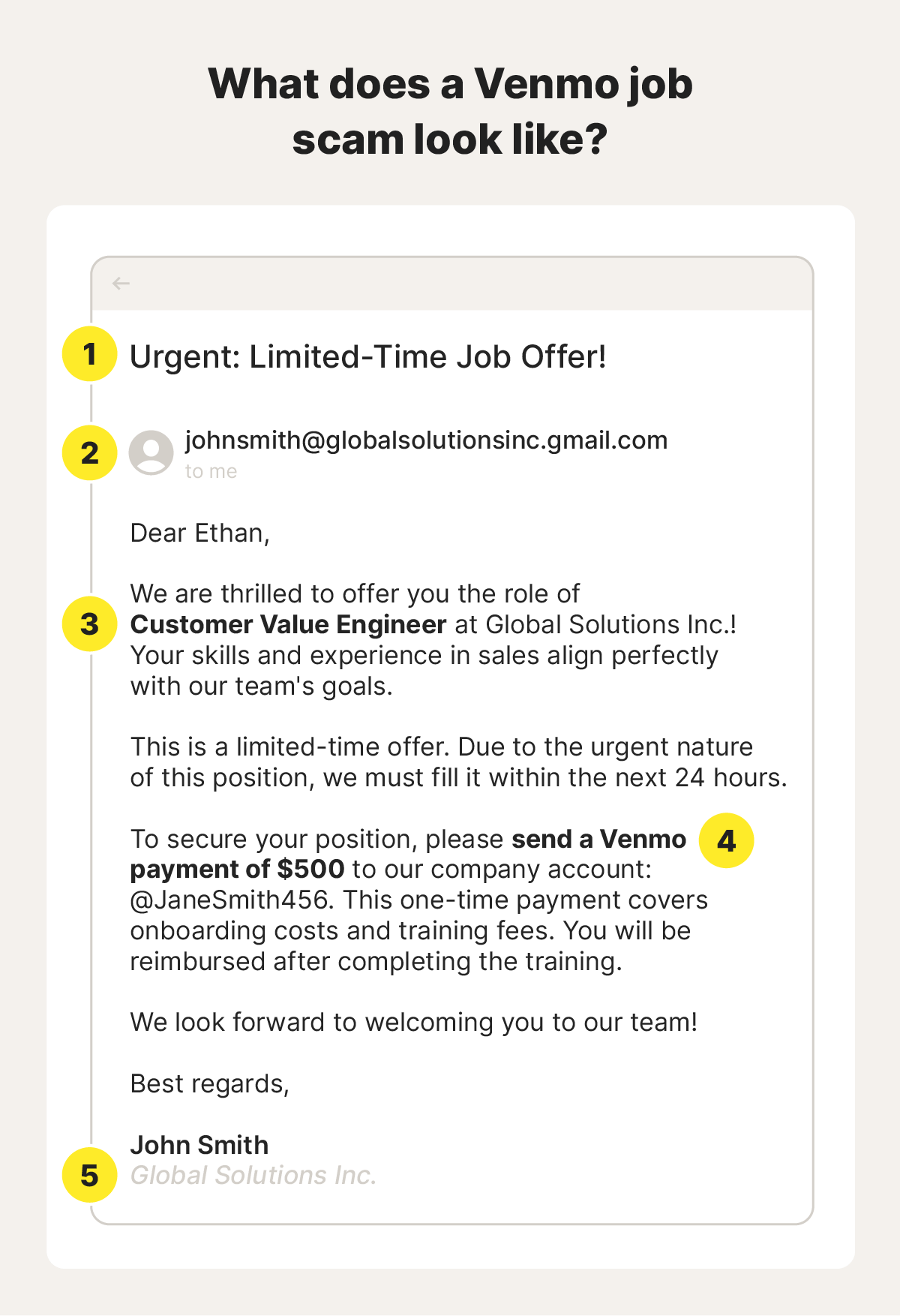

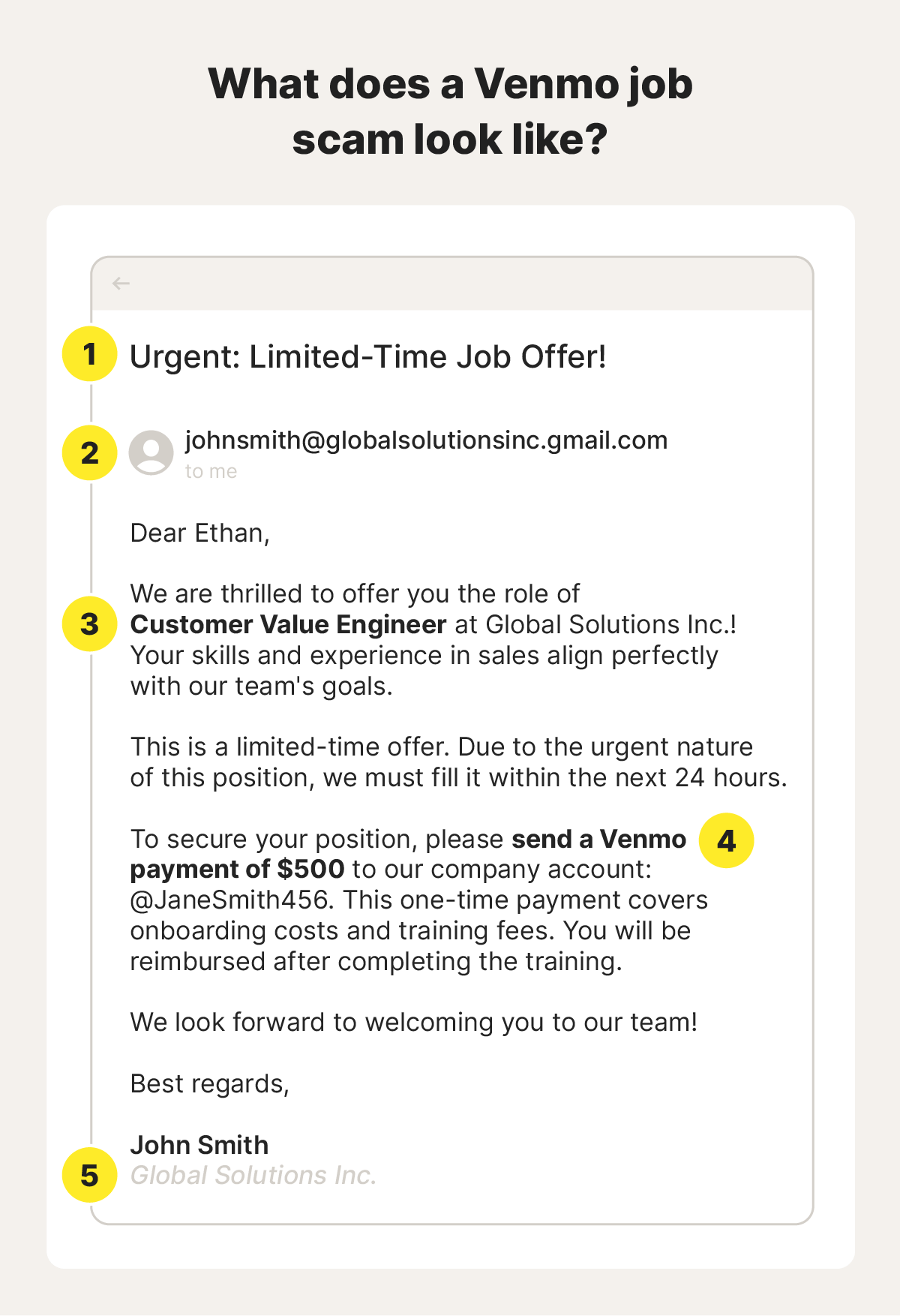

- Scammers create a sense of urgency to rush you into making decisions hastily.

- Scammers use fake email domains similar to real companies.

- Fake-sounding job titles are another red flag.

- Be careful about requests to pay upfront for training or onboarding costs.

- Job scams may use generic-sounding company names to trick applicants.

Venmo is a popular peer-to-peer financial payment platform for performing quick and easy transactions between friends, family, and other people you know. However, scammers take advantage of Venmo’s convenience to target users. Help protect against Venmo scams by learning how they work.

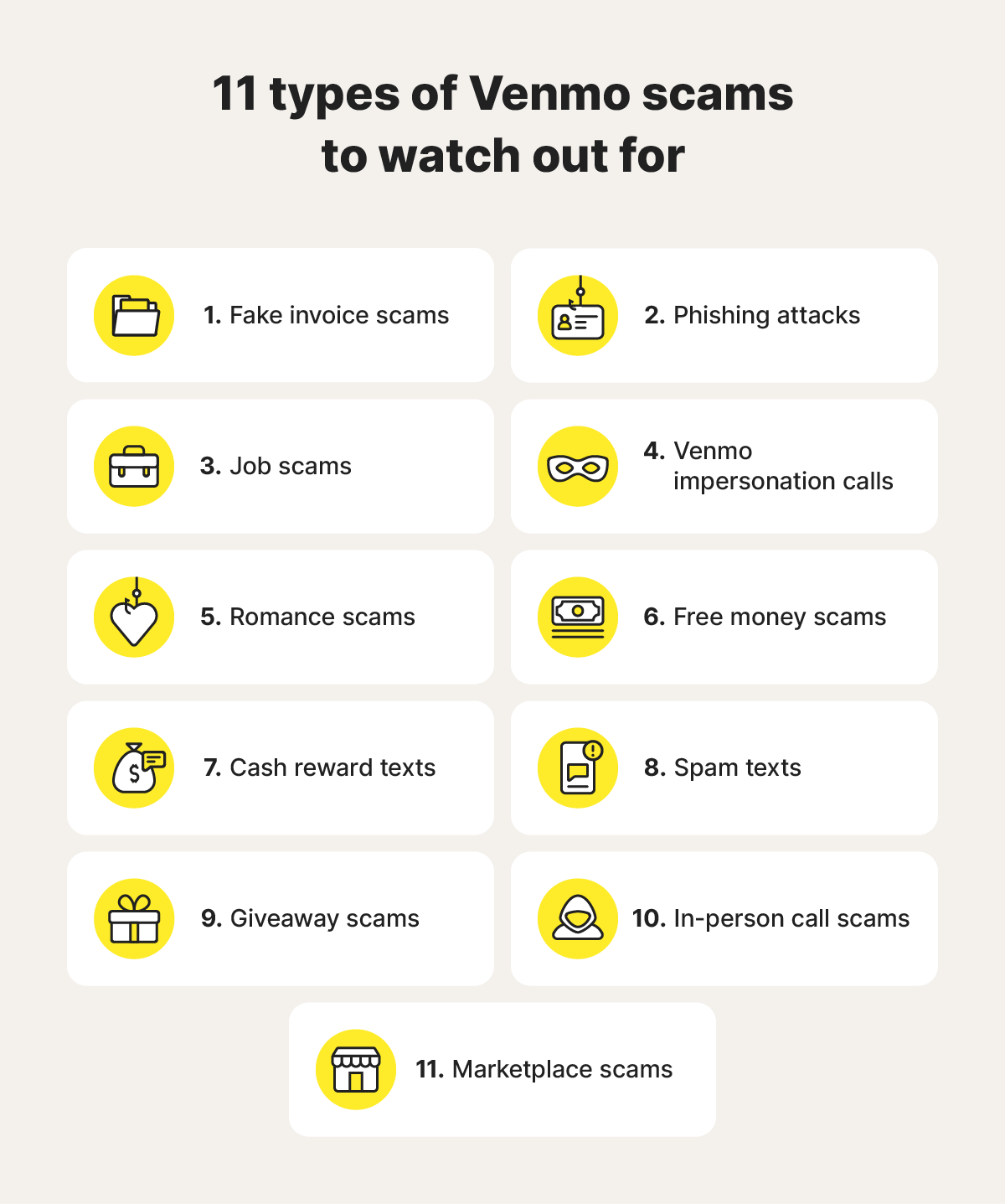

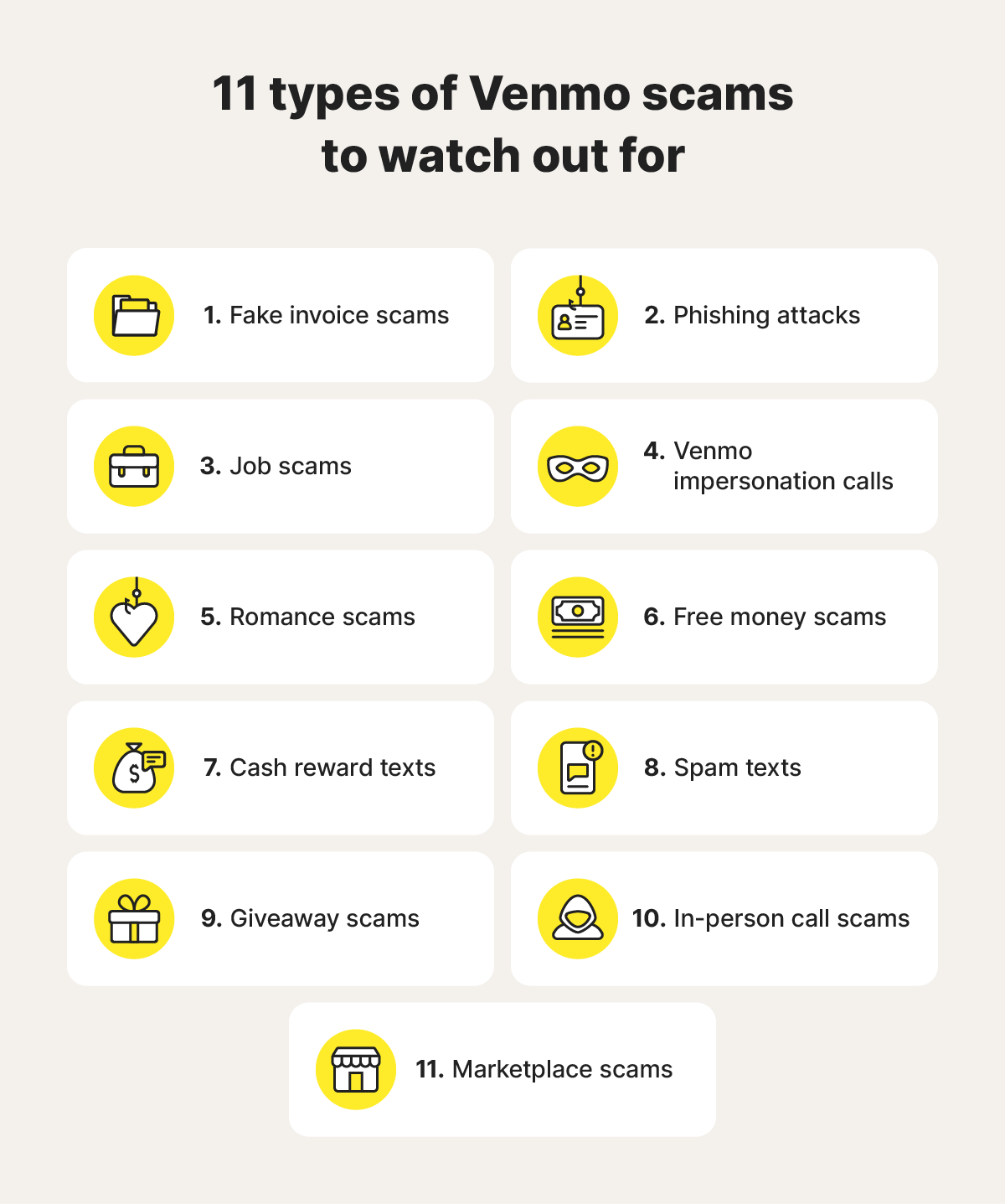

11 types of Venmo scams to watch out for

There are many Venmo scams to watch out for, and they can occur via messages, calls, email, or even in person (if a scammer physically takes your phone and uses your Venmo app). These scams pose a threat to your finances and can lead to identity theft.

1. Fake invoice scams

In this ruse, a scammer will pretend to be a business and send you a fake invoice on the Venmo app or via email. The aim is to get you to respond with personal information, click a malicious link, or open a malware-infected attachment. Even if you haven’t done business with them, they hope you will be curious enough to click through or respond.

2. Phishing attacks

In Venmo phishing attacks, cyber crooks send fake emails or other messages that mimic official ones from the app. These emails typically include malicious links or attachments that trick you into giving away personal or financial information. Venmo doesn’t ask for personal details through email and only uses the official email domain @venmo.com. Watch out for similar, misspelled, or spoofed versions of email addresses.

3. Job scams

In job scams, scammers post fake job listings on social media and “interview” you via email or a messaging app, such as WhatsApp, Messenger, or Telegram. After sending a job offer, they may request upfront fees via Venmo for training or equipment, promising to reimburse you later. Always research a company before accepting a job offer, and never send money upfront.

4. Venmo impersonation calls

Venmo impersonation calls are a type of phishing scam in which scammers pretend to be Venmo customer service representatives and request your account information to resolve a fake issue. They want your sensitive data, such as banking information. Venmo does not call users unprompted or ask them for personal information.

5. Romance scams

Romance scams, often called catfishing, are a common fraud scheme targeting online daters. Scammers emotionally manipulate victims and build trust. After a while, the catfisher requests money to cover travel costs to meet the victim or asks for an emergency loan for a good deed like helping a sick family member. Romance scammers are drawn to Venmo and similar cash apps because they make money transfers hard to trace, and the catfisher can easily disappear.

6. Free money scams

Scammers offer a large sum of money in return for a very small investment. They might ask you to pay them immediately over Venmo or respond to their direct Venmo message with your banking details or Social Security number to see if you “qualify” first. Be wary of offers that seem too good to be true, and don’t share personal information in response to a supposed Venmo email or text.

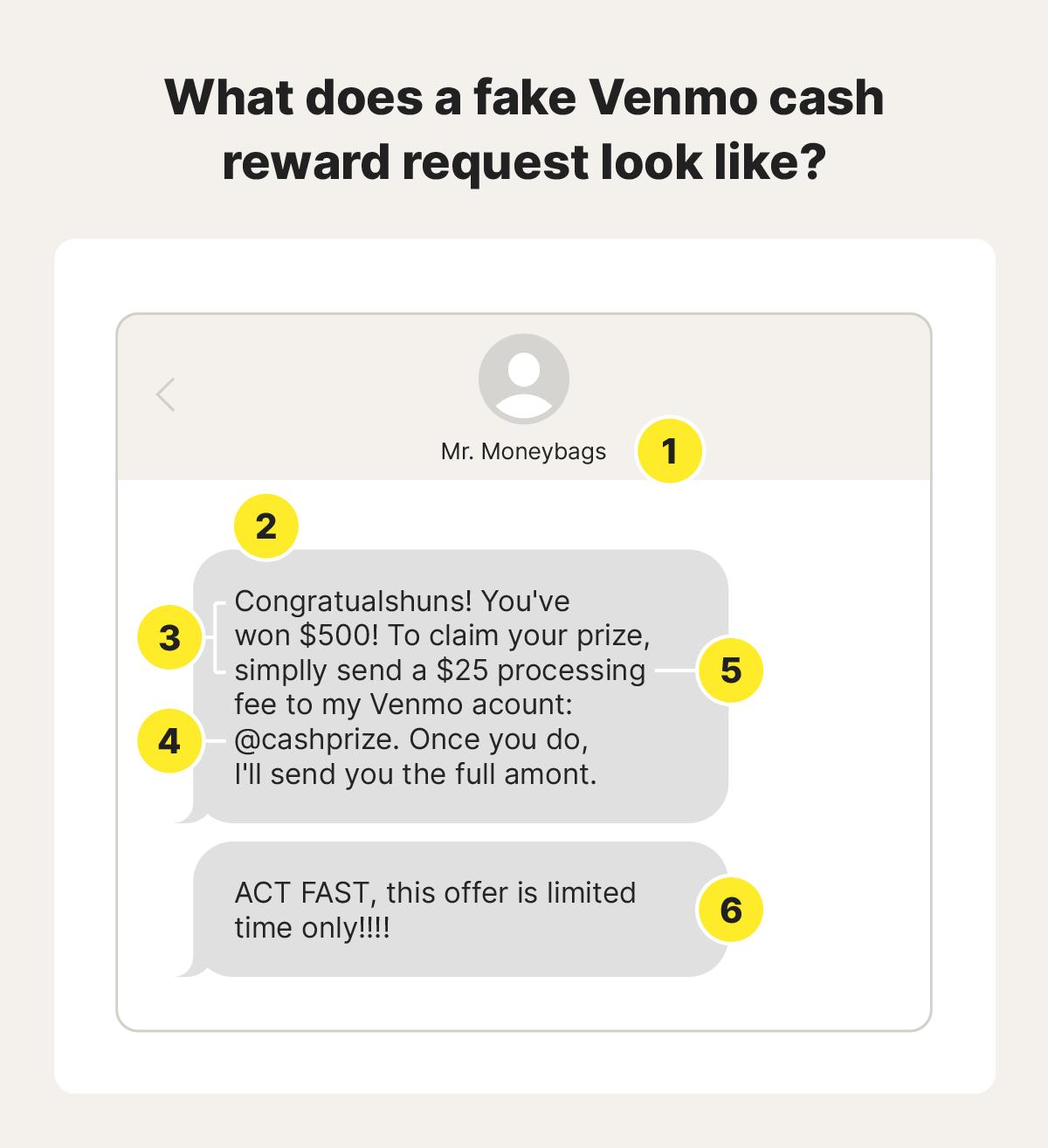

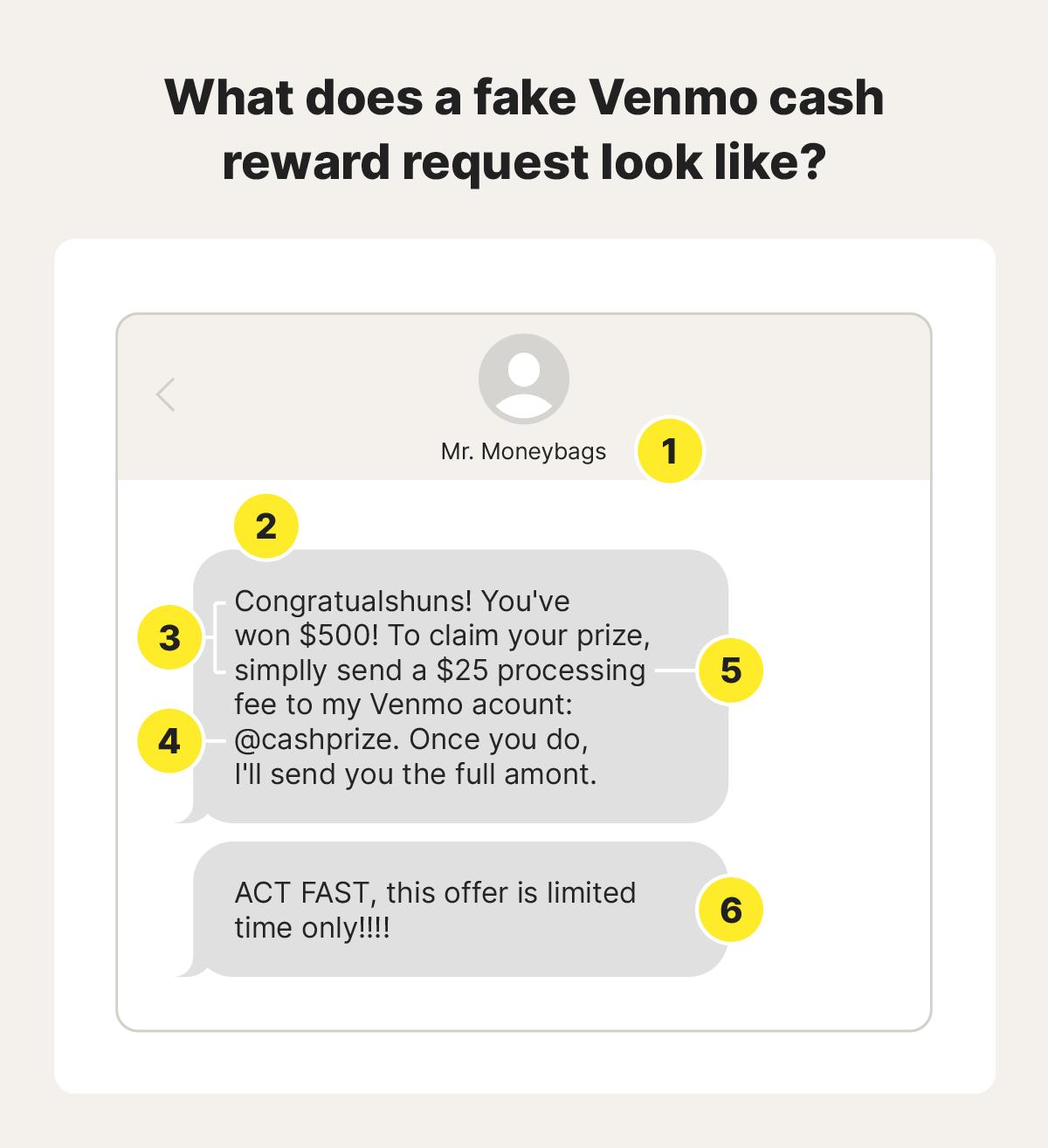

7. Cash reward scam

In a Venmo cash reward scam, a fraudster sends an email or text prompting you to pay a small fee to collect a reward. In another version, the message will claim that Venmo is offering you money because you’re a long-time user or in return for completing a survey. The email or text typically includes a link asking you to log into your account or enter account details to claim your money or start the survey.

As with Cash App scams, never provide your Venmo account information outside the official website or app.

- You receive a text from an unknown number or fake-sounding name.

- The text includes an offer for something you didn't sign up for.

- It contains frequent misspellings or strange wording.

- It requests upfront payment via Venmo since it’s harder to trace a mobile payment app transaction.

- Upfront fees are required to receive the reward.

- The scammer creates a sense of urgency.

8. Spam texts

Scammy Venmo texts are usually sent out en masse, and they can take many forms. Scammers who spam users rely on volume and often have no idea which recipients even have Venmo. Nevertheless, they know that if they send a generic message to enough people, someone may eventually send their Venmo account details or other personal information.

9. Giveaway scams

In a Venmo giveaway scam, targets are lured by a fake giveaway post on social media or in a direct message. To claim the prize, they are asked to send a small processing or shipping fee via Venmo. Besides sending this fee to scammers, victims may also be tricked into revealing sensitive personal details like their address.

10. In-person call scams

If someone you don’t know asks to borrow your phone to make a call, claiming perhaps that their phone was lost or stolen, it might be an in-person call scam. After “not reaching” the intended recipient, the scammer will ask to send a text. Instead of doing so, they open your Venmo and transfer your funds to their own account. Don’t ever let strangers borrow your phone. If it seems like a genuine emergency, initiate the call or send the text yourself.

11. Marketplace scams

In this scam, a scammer poses as a buyer for an item you’re selling on an online marketplace. They offer to pay via Venmo, asking for your email to complete the payment, which is not a standard requirement for Venmo transactions. The scammer then sends fake emails mimicking Venmo, falsely stating that you’ve been sent money in the hope that you’ll ship them the item without noticing the fraud.

Tips to avoid getting scammed on Venmo

Understanding some best practices for staying safe on Venmo can help reduce your risk of identity theft and other scams:

- Never share private information: Be cautious about sharing personally identifiable information (PII) with others, in person and online. Remember, once something is online, it’s public.

- Update privacy settings: Adjust Venmo’s privacy settings to “private” so only you and the other person involved in the transaction can see the details.

- Don’t give out your Venmo handle to strangers: A Venmo handle is a unique identifier that connects you with other users. Only give it to individuals you trust.

- Enable 2FA: 2FA is an additional lock for your digital security. It provides an extra security layer, requiring a second form of identification when signing into an app like Venmo.

- Set a strong password: Creating unique passwords for different accounts and platforms protects you if your credentials are compromised.

- Use antivirus software: Antivirus software can help protect your devices from malware, hackers, and online scams.

- Invest in identity protection: Robust fraud protection like LifeLock can help mitigate the fallout if you fall for a scam.

How to report a Venmo scam

You should report a Venmo scam even if you weren’t directly impacted. If your details and finances have been compromised, you need to take further steps to secure your identity and mitigate the damage.

- Contact Venmo’s support team: Once you’re aware of a scam, you can report it in the app (from the transaction or profile of the scammer), on the Venmo website, or by email (support@venmo.com).

- Contact the FTC: Report the scam to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov.

If your personal or banking information was compromised:

- Change your password: If you’ve been scammed on Venmo, immediately update your password.

- Report it to your bank: If money was stolen and your card is linked to Venmo, contact your bank or credit card company to dispute the charge and secure your account.

- Report it to the FTC: Report the identity theft to the FTC at IdentityTheft.gov.

- Monitor your credit: Place a fraud alert on your credit report or freeze your credit to help stop criminals from taking out credit in your name.

Is Venmo safe to use?

Venmo is generally safe to use, but like any digital payment platform, you need to stay vigilant for fraud. Venmo is designed for payments between family, friends, and people you know. For purchases and transactions with strangers, take extra precautions or consider another payment method that offers buyer protection.

When used responsibly and as intended, Venmo should be a safe payment platform. The app includes security features like two-factor authentication (2FA), verification for emails and phone numbers, and encryption to help protect your financial information.

Take action against identity theft

Even with the most comprehensive knowledge of Venmo scams and other online threats, it’s still possible to fall victim to identity theft. That’s why you should do everything in your power to protect your identity. LifeLock can help protect against identity fraud and handle things for you if it does occur. This extra layer of protection and support could make all the difference.

FAQs

Is it safe to give someone your Venmo username?

It is generally safe to give your Venmo username to someone you know and trust. It’s also typically fine to give it to someone who owes you money or for use in another legitimate transaction.

Does Venmo call you about suspicious activity?

Venmo will not call you about suspicious activity or ever request sensitive information via phone. If there’s unusual activity on your account, they may send an in-app notification or email.

Are there any current Venmo scams?

At present, Venmo scams typically involve phishing messages with malicious links or requests for personal information. Payment requests via Venmo for fake goods, prizes, or other crafty reasons are also common. Staying informed about the latest scams is a great way to protect yourself from Venmo fraud. You can always visit the Venmo website for up-to-date information about current scams.

Can someone get your bank info from Venmo?

Venmo doesn’t give your bank information to anyone you’ve paid or anyone who has paid you unless you give your express permission or Venmo is issued with a subpoena or other legal process.

Venmo is a trademark of PayPal, Inc.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.