Seeing an unfamiliar charge on your credit card can be stressful. But there are plenty of reasons unfamiliar charges may appear on your statement, and many aren’t fraud-related.

Unfamiliar charges may simply be the result of forgotten purchases, recurring subscriptions, or a family member using your card. It's also common for merchants to appear under different names on credit card statements, making it easy to mistake legitimate purchases for fraudulent charges.

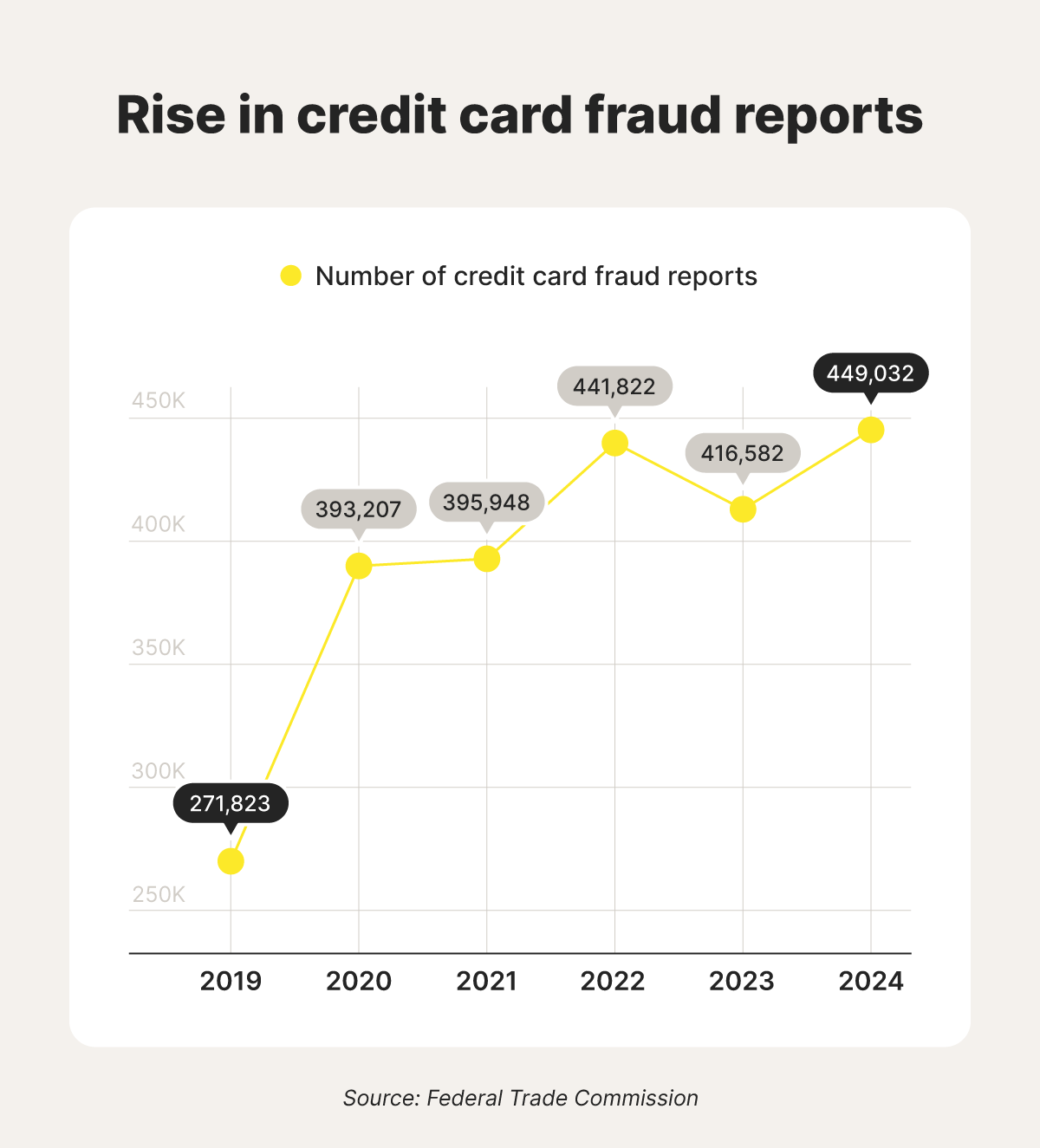

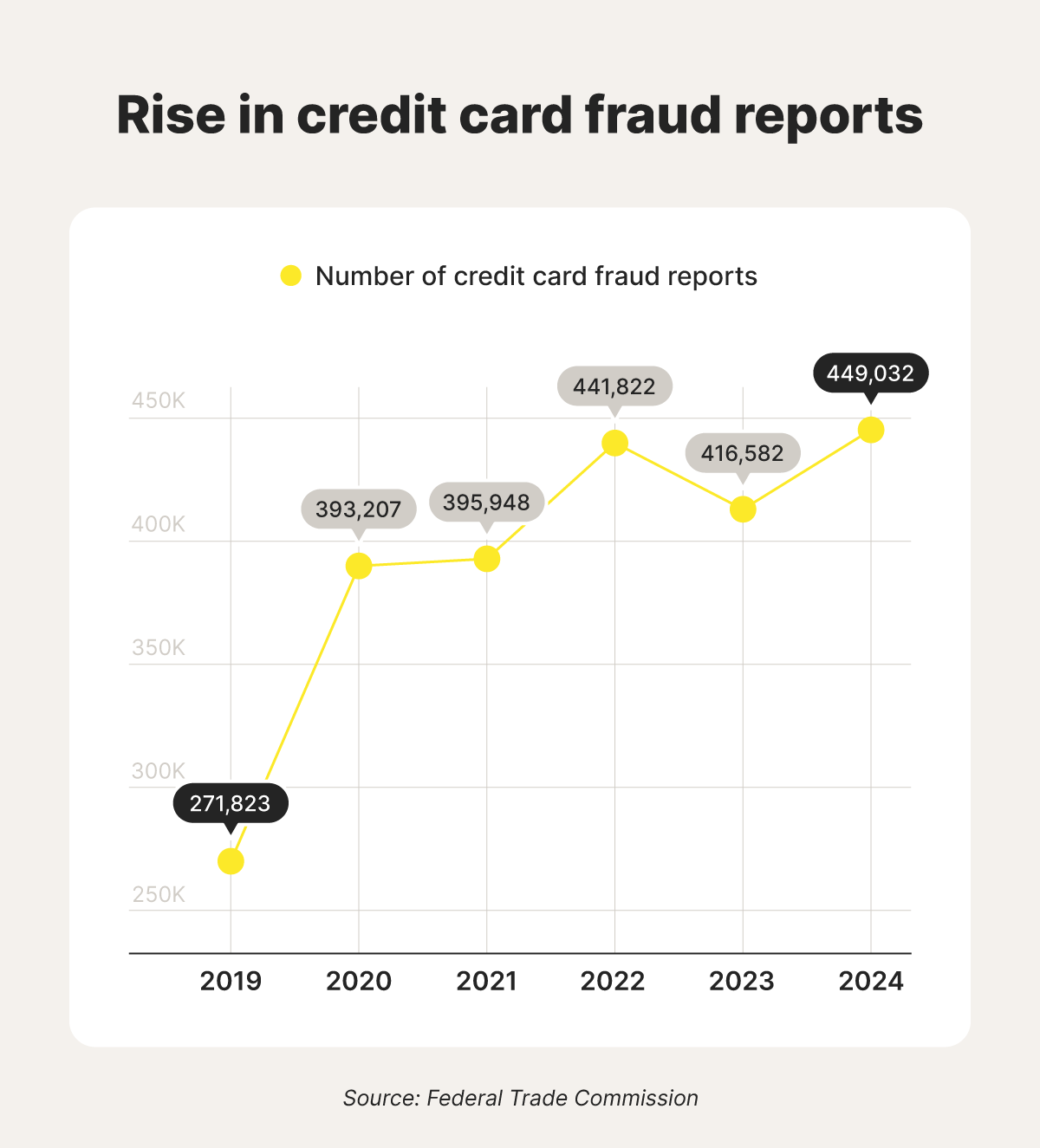

Having said that, credit card fraud is the most prevalent type of identity theft: in 2024, the FTC received over 449,000 reports of credit card fraud, according to recent credit card fraud statistics.

Detecting fraud early is the best way to limit damage. That’s why it’s important to regularly check your credit card statements and do some sleuthing if you find unknown charges.

In this article, you’ll learn how to identify suspicious credit card charges, find out who charged your card, and help protect your finances from fraudsters.

1. Carefully review your credit card statements

The first step to dealing with unknown charges is to identify them. To do that, you need to review your credit card statements.

Start by logging into your credit card or bank account. Your account contains all your transactions and past statements.

Open your most recent statement and begin reviewing the charges one by one. Make a note of any purchases you don’t recognize.

Remember not to overlook small unknown charges. These seemingly insignificant charges could be part of a carding scheme — where fraudsters often test the waters with smaller transactions before attempting larger amounts.

You may also receive your credit card statements via mail every month, in which case you can review physical copies. But keep in mind that you may not see your most recent transactions as you would online.

2. Look up the merchant online

Next, look at the merchants for each of your unknown charges. You may need to dig into these, as many merchants go by different names on credit card statements.

For example, a merchant might be listed as the name of its parent company, the registered business name, or the franchise owner’s name. So, an online purchase might show up as “XYZ Holdings” on your statement.

If you see a merchant you don’t recognize, focus on the date and amount, and try to remember what you bought that day. It may jog your memory to a legitimate purchase.

If the charge is still unknown, look up the merchant online. If you don’t recognize it, the charge may be fraudulent.

3. Check your calendar, subscriptions, and receipts

It’s easy to forget legitimate purchases. A pair of shoes, a trip to the mechanic, or a concert ticket from months ago can easily slip your mind.

You may also forget about annual subscriptions to apps like Duolingo or services like Amazon Prime.

Checking your email, calendar, and receipts may help identify some of these charges.

You may see a concert on your calendar and remember you bought some merch at the show. Or, you might find a subscription renewal reminder in your inbox that you overlooked.

It’s important to investigate thoroughly before taking action on unauthorized charges. You don’t want to accidentally dispute a legitimate charge or cancel your credit card for no reason.

4. Ask authorized users

Does anyone else use your credit card? Many cards allow authorized users to make charges on the same account as you. You may have made your spouse or child an authorized user and forgotten about it.

Also, ask anyone in your household who could have used your card without telling you — it may have slipped their mind.

Remember that removing an authorized user from your account doesn’t always cancel their recurring payments. As such, if you remove your child from your card after they graduate from college, you might still be paying for their annual subscription to Literary Review.

5. Contact the merchant

Contacting the merchant can help you understand what the purchase was. Or, it might confirm a fraudulent charge.

Look up the merchant online and check for an official email address or phone number. Contact the merchant and let them know you need info about a charge to your credit card.

Give them the date, the amount, and any reference number associated with the charge. They should be able to tell you what was purchased or if there was a billing error.

Common reasons for unknown credit card charges

There are many reasons why unexplained charges can end up on your credit card statement. It’s important to consider all the possibilities before disputing a charge or closing your card.

Here are some common reasons for unknown credit card charges:

- Merchant name discrepancies: It’s very common for merchants to appear on your statement under different names, such as their parent company or registered business name.

- Purchases from authorized users: You might not recognize purchases made by authorized users, and they may have forgotten to tell you.

- Pending transactions: Pending transactions, such as those by hotels, may appear differently from final charges. This is because some businesses pre-authorize a lower amount to ensure you have a legitimate card.

- Duplicate charges: Merchants sometimes charge twice, by accident. These charges are usually easy to spot, as they typically appear next to each other on your statement and look identical.

- Subscriptions and free trials: Subscriptions, especially annual, are easy to forget about. Free trials you didn’t cancel can also convert into paid subscriptions. Cleaning up your email inbox can often help identify these.

- Fraudulent charges: Someone may have stolen your credit card details to make purchases. If your credit card info has been exposed in a data breach, it may have been sold on the dark web. Criminals can purchase data on nefarious dark web websites and use it to commit fraud.

Fraudulent charges are often made from unfamiliar locations, like a country you’ve never been to. They’re also commonly made in small amounts or appear as multiple similar charges in a row, which could mean bots are testing your number.

If you suspect fraud, you should take immediate action.

What to do if the charge is fraudulent

If you see a fraudulent charge, report it to your credit card issuer, protect your credit and accounts, and report it to the police.

- Report the charge to your credit card issuer: Call your credit card company as soon as you notice the suspicious charge. They’ll freeze or replace your card and usually start the process of investigating the transaction.

- File a dispute claim: Most issuers automatically investigate when you report a suspicious charge, but it’s also a good idea to dispute credit card charges in writing. Your issuer may send you documentation after calling to report credit card fraud, otherwise you can find it on their website.

- Freeze your credit: If you think fraudsters may have other personal info besides your credit card details (such as your Social Security number), you should freeze your credit. This will help prevent anyone from opening new credit in your name. Contact all three major credit bureaus to request a freeze.

- File a police report (if necessary): File a police report if you believe your identity has been stolen or if you’ve lost a large amount of money. A police report may help you get a refund of scammed money and restore your credit score.

- Monitor your accounts: Keep a close eye on your accounts for suspicious activity. This includes monitoring your bank accounts, credit card statements, credit reports, and investment accounts. Identity theft protection services, such as LifeLock Total, help monitor these accounts and provide stolen wallet protection to keep you safer from fraud.

How to prevent future unauthorized charges

Credit card fraud is widespread, but it’s not inevitable. Taking a few simple safety precautions can help prevent you from becoming a victim of identity theft. In a nutshell, you need to secure your card, limit where you save your card details, and monitor your credit card account and credit report.

- Keep your card secure: Always keep your credit cards in a secure location. When you’re out, keep them on you. Avoid leaving them in your car’s cupholder or your jacket pocket (unless you’re wearing it). If you have multiple cards, only keep 1-2 cards on you at a time. At home, protect your credit cards by keeping them in a safe or hidden space.

- Don’t swipe or insert your physical card: Tapping your card (paying by contactless chip) is more secure than swiping or inserting your card, which can lead to card skimming and your card being cloned.

- Avoid saving your card details on browsers, apps, and websites: Every place you save your card details increases your vulnerability. If one of these sites or apps is hacked or suffers a data breach, your card information could soon be on the black market.

- Enable account alerts: Most credit card issuers give you the option to enable alerts for specific or suspicious purchases. You can enable alerts for online purchases, international purchases, purchases over a certain amount of money, etc. If a charge is made, you’ll get an email or text.

- Monitor your credit: Credit monitoring can help you learn if fraudsters are opening (or applying to open) lines of credit, such as new credit cards, in your name.

- Set up a fraud alert: Setting up a fraud alert prompts creditors to verify your identity before approving new lines of credit in your name. Setting up an alert is free, and you can remove it at any time.

- Lock or freeze your credit: A credit lock or freeze helps prevent anyone from accessing your credit report — the main difference is that a freeze is free. You can apply a fraud alert and credit freeze simultaneously to make it nearly impossible for anyone to open new lines of credit in your name (including you).

Stay on top of your finances

Becoming a victim of credit card fraud or identity theft can turn your life upside down. To help reduce the repercussions of unknown charges or scams, be proactive with your financial security. If you see a charge you don’t recognize on your credit card statement, follow the steps above to find out who charged your credit card online.

Then, help protect yourself against identity theft and credit card fraud with LifeLock Total. It monitors your bank and credit card accounts to help spot fraudulent transactions, so you can take action and secure compromised accounts. You’ll also benefit from stolen wallet protection, bank account takeover alerts, and much more.

FAQs

What should I do if there’s a charge on my card I don’t recognize?

If you don’t recognize a charge on your credit card, the first thing to do is rule out any legitimate reasons for it. Take note of the merchant, date, and amount, and think of any purchases you might have forgotten. Once you’ve ruled out any reasonable explanation, contact your credit card issuer to report fraudulent activity and dispute the charge.

If someone used my credit card online, can I track them?

Law enforcement may be able to track fraudulent transactions by checking timestamps, IP addresses, and geolocation data. If you notice an unauthorized charge, contact your card issuer immediately to dispute it. Bank investigators will then handle the case, and police may get involved if the losses are significant.

Can the bank see who used my card online?

No, the bank cannot see who charged your credit card online. The bank can see the time, date, merchant, and amount charged. It cannot see personally identifiable information like the buyer’s name, IP address, or shipping address. If you believe you’re a victim of credit card fraud, contact your card issuer immediately. The bank can block your card, investigate the charge, and potentially refund your money.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Carefully review your credit card statements

- 2. Look up the merchant online

- 3. Check your calendar, subscriptions, and receipts

- 4. Ask authorized users

- 5. Contact the merchant

- Common reasons for unknown credit card charges

- What to do if the charge is fraudulent

- How to prevent future unauthorized charges

- Stay on top of your finances

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.