A fraud alert is a free notice you can add to your credit report to help protect against identity theft. To place one, you just have to contact a major credit bureau, choose the type of fraud alert you want, and provide some basic information to confirm your identity.

When your fraud alert is in place, lenders and creditors must take extra steps to verify your identity before approving applications for new accounts or lines of credit. That provides a valuable layer of defense against credit fraud, keeping your finances and your credit score safer.

Here’s a closer look at the simple, three-step process you need to follow to place a fraud alert.

1. Contact a credit bureau

To place a fraud alert that covers your entire credit profile, you only need to contact one of the three major credit bureaus (Equifax™, Experian™, and TransUnion™).

The bureau you contact must notify the other two, so the alert is added to all your credit reports and lenders are prompted to verify your identity before approving new credit, no matter which bureau they run a credit check through.

You can request a fraud alert online, by phone, or by mail. Here’s a summary of how to contact each credit bureau:

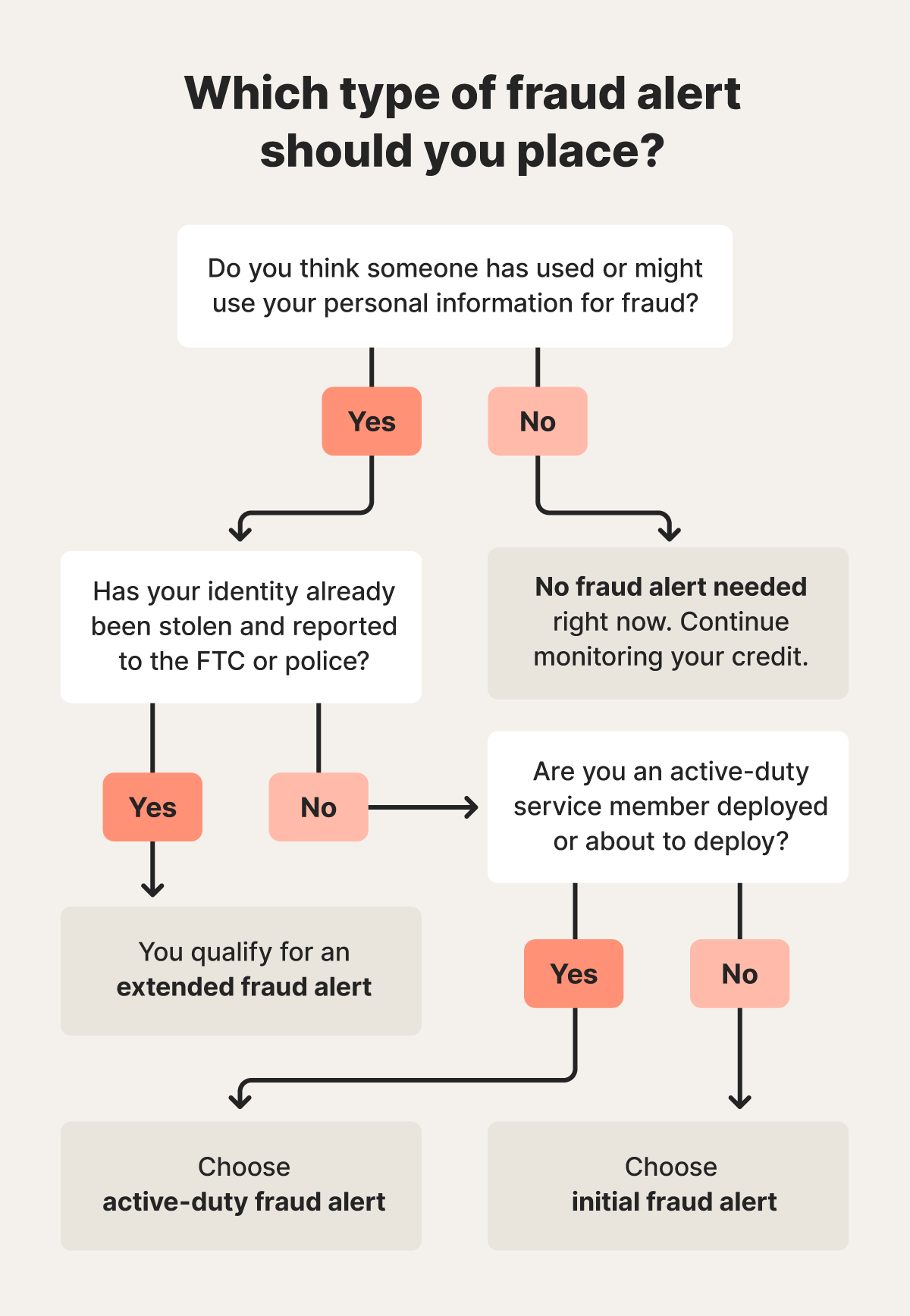

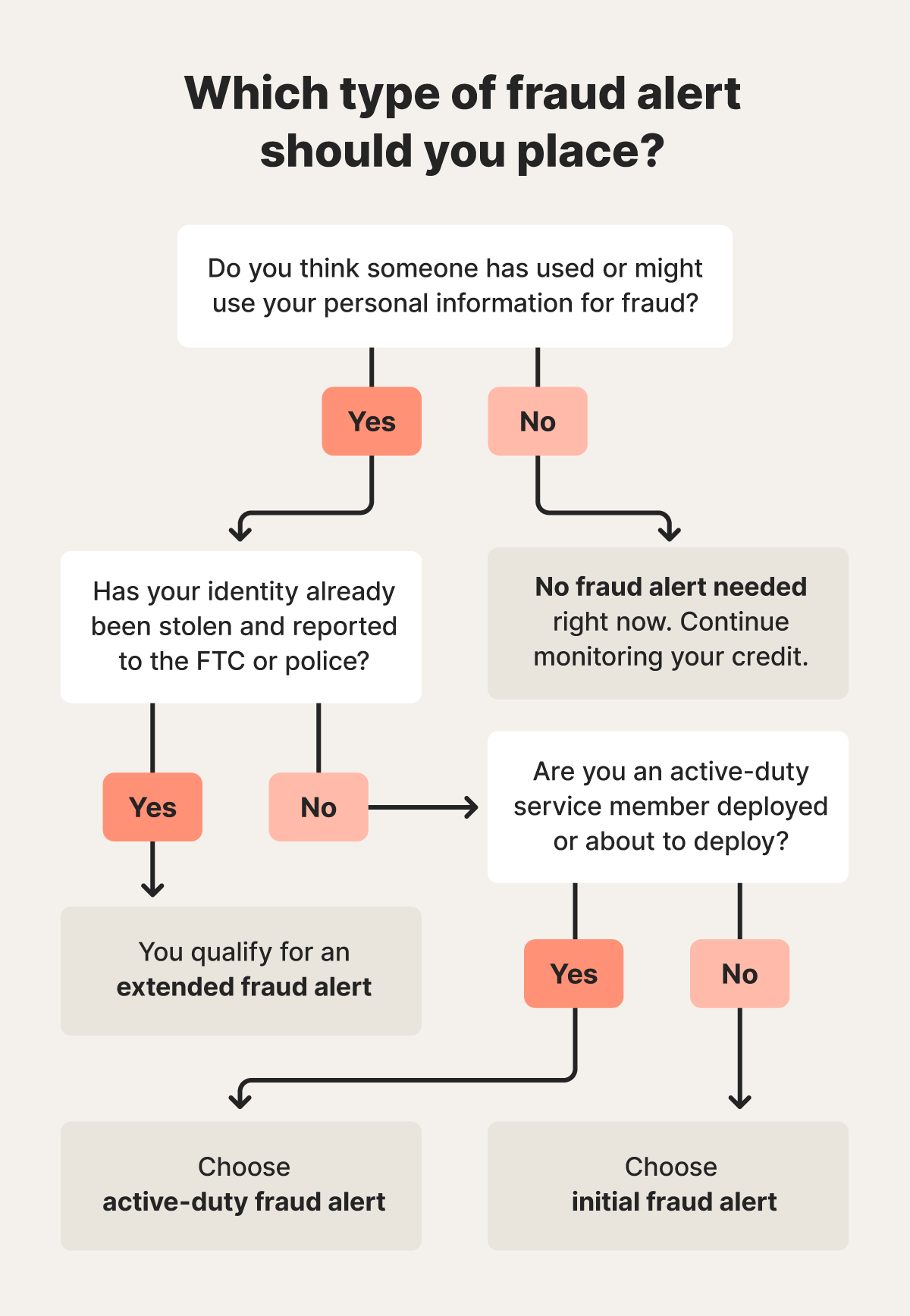

2. Choose the type of fraud alert

There are three types of fraud alert: initial, extended, and active-duty. While each one fundamentally does the same thing (prompts creditors to verify your identity before approving applications), they last for different amounts of time and are intended for people in different situations.

Here’s a closer look at each type, and who can use it:

Initial fraud alert

Also known as a temporary fraud alert, an initial fraud alert lasts for one year and is intended for anyone who believes they’re at risk of fraud. But, since there’s no restriction on placing one, you can add it to your credit report for proactive protection even if you don’t suspect you’re being targeted by a fraudster. You can then renew it after the year is up, as many times as you want.

- How to place one: Contact any one of the three major credit bureaus online, by phone, or by mail.

- Who can place it: While initial fraud alerts are intended for people who suspect they’re at risk of fraud, anyone can place one for any reason.

- What to provide: Proof of identity (e.g., your Social Security number) and proof of address (e.g., a utility bill).

- How long it lasts: One year, but it can be easily renewed for another year and as many times as you want, providing ongoing protection.

- What it costs: Nothing. Initial fraud alerts are free.

Extended fraud alert

An extended fraud alert does the same thing as an initial fraud alert but lasts for seven years instead of one. It’s intended for people who have experienced identity theft and want to protect against the risk of follow-up credit fraud. Placing one requires proof of identity theft, which you’ll get after reporting identity theft to the police or FTC.

- How to place one: After reporting your stolen identity, contact any one of the three major credit bureaus online, by phone, or by mail.

- Who can place it: Only people who have had their identity stolen and reported it to the FTC or the police can submit an extended fraud alert. You can only do it for someone else if you have a Power of Attorney.

- What to provide: The police or FTC identity theft report, proof of identity (e.g., your Social Security number), and proof of address (e.g., a utility bill).

- How long it lasts: Seven years.

- What it costs: Nothing. Extended fraud alerts are free.

Active-duty fraud alert

An active-duty fraud alert is available exclusively to military members who are deployed. It lasts one year and can be renewed continuously. Since deployed service members are away from home and may have limited access to mail or credit monitoring, they’re at risk of military identity theft. In fact, FTC data shows they’re up to 22% more likely than other U.S. adults to report that an identity thief has opened a new account in their name using stolen information.

- How to place one: Contact any one of the three major credit bureaus online, by phone, or by mail.

- Who can place it: Eligible military personnel or someone with Power of Attorney if the person on active duty is already deployed.

- What to provide: Proof of identity (e.g., your Social Security number), proof of address (e.g., a utility bill), and self-attestation that you’re either currently on active duty or about to be deployed.

- How long it lasts: One year, but active-duty fraud alerts are renewable for the remainder of the current deployment.

- What it costs: Nothing. Active-duty fraud alerts are free for deployed military personnel.

3. Provide your information

To place a fraud alert, you’ll need to give the credit bureau some personal information to confirm your identity. Only share this information when you contact the bureau yourself through the official website or phone number. Don’t provide your details to anyone who calls, texts, or emails you unexpectedly, even if they claim to be from a credit bureau, as they might be a scammer.

Required information may include the following:

- Full legal name

- Current and previous addresses

- Social Security number

- Date of birth

- A copy of a government-issued ID (e.g., driver’s license or passport)

- Proof of address (e.g., utility bill, bank statement, or lease)

When should I use a fraud alert?

You should place a fraud alert if you suspect your financial or personal information has been compromised or if you think your identity has been stolen, both of which leave you vulnerable to fraud. For example, you may want to use a fraud alert if your personal information was exposed in a data breach, you lost your wallet, you fell for a phishing scam, or your computer was infected with malware.

Here are some common reasons to put a fraud alert on your credit report:

- Your sensitive information was stolen: If someone has access to your credit card details, Social Security number, or other personal information, you may be at risk of identity theft or financial fraud. Whether your information was stolen following a data breach, your wallet was stolen, or you were targeted by a scammer, placing a fraud alert can provide a layer of protection.

- You notice unauthorized credit activity: If you review your credit report and see new accounts, applications, or changes that you didn’t authorize, consider placing a fraud alert immediately.

- You notice suspicious financial activity: Unexplained charges on your bank or credit card statements, or any other unusual financial activity you notice on your accounts, may signal that your identity has been compromised. A fraud alert can help prevent the problem from worsening.

- You receive debt collection calls: If debt collectors contact you about overdue payments on accounts you don’t recognize, you may already have suffered from credit fraud. Placing a fraud alert can help prevent further misuse of your credit.

- You have issues filing a tax return: If someone tries to file taxes in your name as part of a tax scam, preventing you from filing your own return, it likely means they have access to your SSN. Placing a fraud alert can help protect you against the fraudster targeting your credit, too.

- You’re on active military duty: Service members who are currently deployed or about to deploy may be at greater risk of being targeted by fraudsters and identity thieves. Placing an active-duty fraud alert will make it harder for anyone to open unauthorized accounts while deployed.

However, since there’s no restriction on who can place an initial fraud alert, you can set one up even if you don’t believe you’re at risk. This gives you proactive protection, reducing the risk of credit fraud hitting you out of nowhere.

How to remove a fraud alert

If at any point you want to remove a fraud alert you’ve placed, whether it’s because the danger has passed or you’ve taken steps to recover from identity theft and rebuild your credit, you have two options: allow the fraud alert to expire (which may take one to seven years, depending on what type you placed) or manually request that it’s removed immediately.

To remove a fraud alert before its expiration date, you need to contact each of the credit bureaus individually. Here’s how:

- Experian: You can remove a fraud alert online or by mail.

- Equifax: You can remove a fraud alert online, by calling (888) 836-6351, or by mail.

- TransUnion: You can remove a fraud alert through the TransUnion Service Center or by calling (800) 916-8800.

Why would you want to remove a fraud alert? While they don’t impact your credit score, they do make the process of opening new credit lines a little longer, as organizations must take extra steps to verify your identity.

If you’re expecting to need to make lots of new credit applications, removing a fraud alert, even temporarily, can help. However, you might consider adding it again afterwards to ensure you’re protected again.

What to do after placing a fraud alert

A fraud alert provides a solid first line of defense against credit fraud, but there are other steps you can take for further protection. They include considering a credit freeze, monitoring your credit, contacting your bank, and securing your devices.

If you’re concerned about the risk of fraud, whether you’re just being proactive or you have reason to suspect you might be vulnerable, here are next steps to consider after placing a fraud alert:

- Keep it renewed: Initial fraud alerts only last one year, so set a reminder to renew it if you want the protection to continue.

- Consider a credit freeze: A credit freeze provides more robust credit file protection than a fraud alert, restricting access to your credit report and effectively preventing new accounts from being opened altogether. Bear in mind that this will apply to you, too, so you’ll need to temporarily unfreeze your credit if you want to apply for a new account.

- Monitor your credit: Regularly check your credit reports for any suspicious activity or unauthorized accounts. A credit monitoring tool, often included as part of identity theft protection services can help you monitor your credit automatically, providing alerts when changes are detected.

- Contact your bank: Alert your bank or credit union about potential fraud and review your accounts for unusual transactions.

- Secure devices and accounts: Keep all of your personal devices, including computers, phones, and tablets, protected with security software and boost your online account security with strong passwords and two-factor authentication.

Monitor your credit with LifeLock

Placing a fraud alert can help protect your identity, but for more comprehensive protection, invest in identity theft protection. LifeLock can help you monitor your credit and receive alerts if potential signs of fraud or identity theft appear, helping you take action to protect your credit. You’ll also get support from our U.S.-based restoration experts if your identity is stolen, making the recovery process easier to navigate.

FAQs

Are fraud alerts free?

Yes, fraud alerts are free to place. Fraud alerts also grant you additional free credit reports: one free report from each bureau when you place an initial or active-duty fraud alert, and two free reports per bureau per year with an extended fraud alert.

How quickly do fraud alerts take effect?

A fraud alert placed online or by phone should show up on your credit report the same day that you place it. If you send a fraud alert request by mail, there’s no way of guaranteeing when the credit bureau will receive it, and it could even go missing. For the quickest action, call the bureau directly or contact them online.

What’s the difference between a credit freeze and a fraud alert?

The main difference between a credit freeze and a fraud alert is that a credit freeze restricts access to your credit report altogether while a fraud alert just adds an extra identity verification step to the credit approval process. In other words, credit freezes provide stronger protection, preventing anyone (including you) from opening new credit accounts in your name.

Does a fraud alert affect your credit?

Placing a fraud alert doesn’t affect your credit score. It simply adds a note to your credit report telling lenders to verify your identity before opening new accounts. It won’t hurt your credit or limit your access, but it may slightly delay new credit applications while your identity is confirmed.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.