Note: You don’t need to lock and freeze your credit reports simultaneously. One method at each credit bureau is enough to help protect your credit.

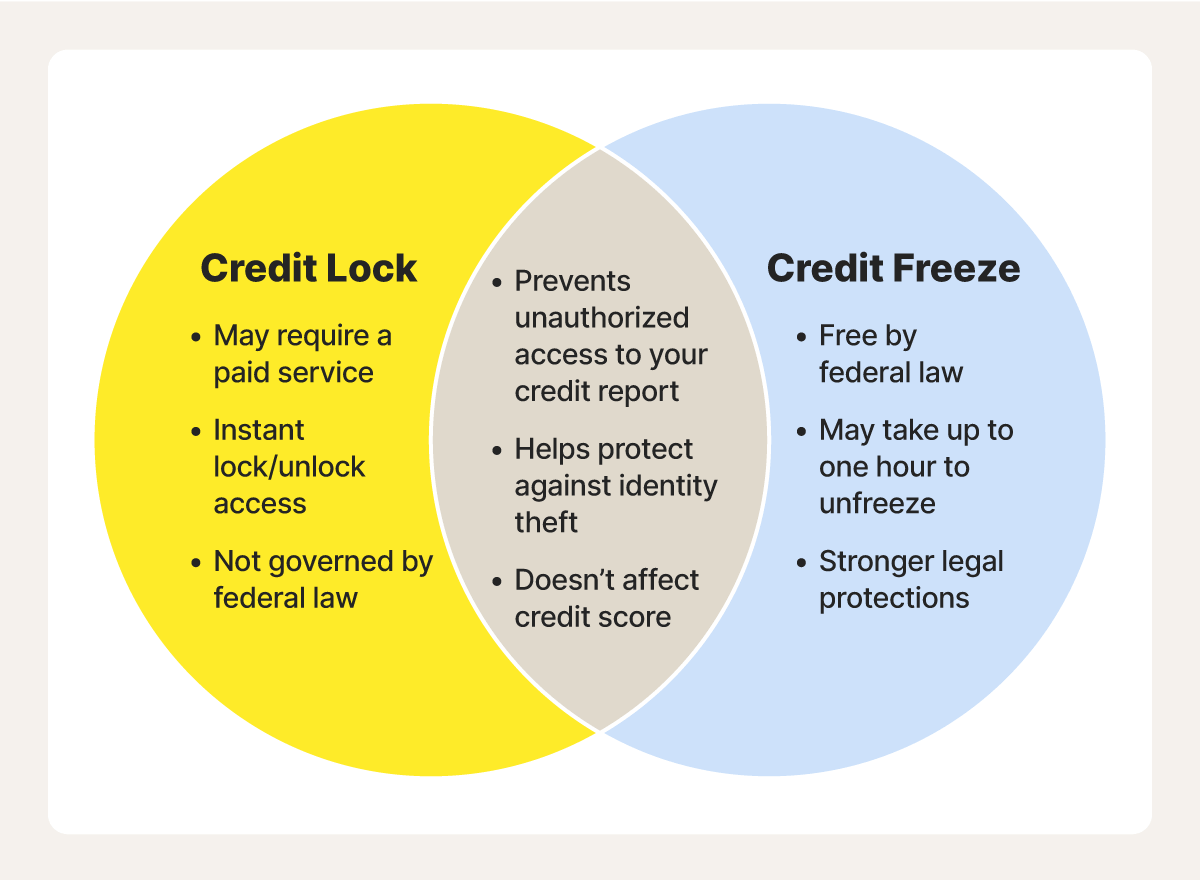

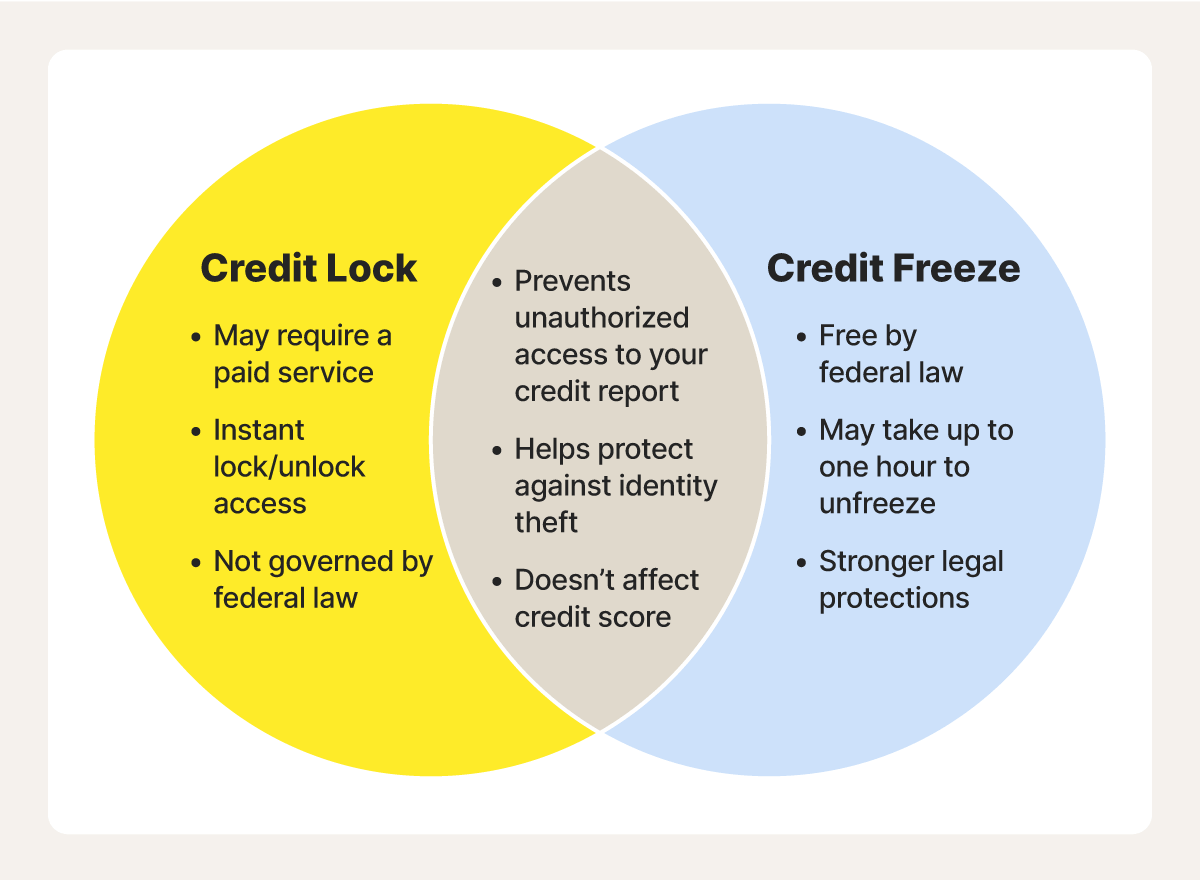

What’s the difference between a credit lock and a credit freeze?

The main difference between a credit lock and a credit freeze is that a credit lock is usually a paid service offered by the credit bureaus, while a credit freeze is a free, federally mandated tool you can use at any time.

Credit locks and freezes essentially do the same thing: restrict access to your credit report to help provide protection against identity theft. But they vary in terms of cost and convenience.

While a credit lock costs money, it’s generally quicker to implement and easier to manage, especially if you apply for new credit often. A credit freeze, on the other hand, is completely free and provides strong protection, but requires a little more effort to place and can take longer to activate.

Here’s a helpful table summarizing the key differences between a credit lock and a credit freeze:

Credit lock |

Credit freeze |

|

|---|---|---|

Cost |

Usually a monthly fee |

Free |

How to activate |

Through an app or website |

Contact each credit bureau individually |

How fast it takes effect |

Instantly |

Usually instantly |

Ease of use |

Convenient; you can lock/unlock in real-time with an app |

Less convenient; multiple steps to freeze/unfreeze |

How long it lasts |

Until you unlock it or stop the service |

Until you lift or remove it |

Best for |

Protection that’s quick and easy to manage |

Free long-term protection |

What is a credit lock?

A credit lock is a service provided by each of the three major credit bureaus — Equifax, Experian, and TransUnion — that restricts access to your credit report. When your credit is locked, it’s inaccessible to lenders, meaning they can’t process credit applications, including unauthorized ones made by a fraudster committing identity theft.

You can typically manage credit locks online or through a mobile app, allowing you to lock and unlock your credit instantly as needed. Many credit lock services are bundled with other tools designed to help protect your identity or monitor your credit.

The cost of membership for these bundled services varies. For example, Equifax offers its Lock & Alert feature for free, while TransUnion and Experian include credit locks as part of paid subscription bundles that also offer credit monitoring, identity theft protection, and privacy tools.

Bear in mind that if your credit lock is placed through a paid service, canceling your subscription will remove it and leave your credit file unprotected.

What is a credit freeze?

A credit freeze, also known as a security freeze, is a federally regulated restriction you can place on your credit report to help protect your credit. When a freeze is in place, lenders and other third parties can't access your credit report. That means they’re unable to approve new credit applications in your name, whether they’re made by you or a fraudster.

Unlike credit locks, credit freezes are mandated under federal law, so you can place one for free at any time by contacting the credit bureaus. A freeze stays in effect until you remove it, but you can lift it temporarily if you need to apply for an auto loan, credit card, or mortgage.

Because you control when the freeze is added or removed, it offers strong protection and peace of mind, without preventing you from accessing credit when needed.

When should you lock or freeze your credit?

You should lock or freeze your credit if you’ve accidentally given a scammer sensitive information, know or believe you’ve been a victim of identity theft, or learned that your personal information has been exposed in a data breach.

That said, you don’t have to wait for a risk to present itself to take action. Placing a credit lock or freeze can also offer proactive protection against identity theft, as can keeping your Social Security number locked. You always have the option to temporarily lift the lock or freeze when you’re applying for a new loan or credit card.

These credit protection tools are some of the most effective ways to help guard against the consequences of identity theft. Yet, only 3% of consumers froze their credit after being notified of a data breach, according to a 2021 study from the Identity Theft Resource Center.

How to lock your credit

To lock your credit, you’ll need to sign up for services with each of the three major credit bureaus. Unlike a credit freeze, credit locks often require a paid subscription, and if you cancel, the lock is lifted.

Here's how it works at each bureau:

- Experian: Credit locks are available through Experian IdentityWorks Premium, a paid subscription that includes credit monitoring and identity theft protection.

- Equifax: Offers a free service called Lock & Alert, which lets you lock and unlock your Equifax credit report at no cost.

- TransUnion: You'll need to enroll in TransUnion Identity Protection, which includes credit locks and other features like dark web monitoring for a monthly fee.

You can also lock your credit with TransUnion using Identity Lock, a feature included with LifeLock Total. You’ll get access to a suite of identity theft protection tools that can help safeguard your personal information and defend against fraud, including credit monitoring that sends alerts if we detect suspicious activity on your credit file.

How to freeze your credit

To freeze your credit, you’ll need to contact each of the three major credit bureaus separately. You can do this online, by phone, or by mail. In many states, parents can also request a freeze on a minor’s credit, even if they don’t yet have a credit report — this can help protect against child identity theft.

The process is simple, but be sure to have the following information ready:

- Name

- Address

- DOB

- Social Security number

- Driver’s license or passport

Here’s how to place a credit freeze with each credit bureau:

If you place a freeze online or by phone, it should take effect right away. Freezing your credit by mail can take up to three business days.

When you want to unfreeze your credit, you can also contact the credit bureaus online, by phone, or by mail. You can choose to “thaw” your credit temporarily for a set amount of time or remove the freeze entirely.

If you unfreeze your credit online or by phone, it can take up to an hour for the thaw to take effect. If you request it by mail, the bureaus must remove the freeze within three business days after receiving your request.

Is it better to freeze or lock your credit?

Whether a credit freeze or lock is better for you depends on your credit habits and priorities. The short answer is that a credit lock is better if you want more control, while a credit freeze is better if you’re cost-conscious.

Credit locks are more convenient to manage, especially if you frequently apply for new credit and want quick access to your file, since you can lock and unlock it instantly. A credit freeze, on the other hand, is free, but takes a few extra steps to place and remove when needed.

Both options help prevent unauthorized access to your credit report and reduce your risk of identity theft, so the choice ultimately comes down to what works best for you.

Should you opt for a fraud alert instead?

Placing a fraud alert on your credit report can be an alternative to using a credit lock or credit freeze. A fraud alert notifies creditors to take extra steps to verify your identity before approving new credit in your name. While it doesn’t block access to your credit file like a freeze or lock, it still adds a layer of protection against identity theft.

Credit freezes and locks offer stronger security, but a fraud alert can be a good option if you want to avoid the hassle of thawing a freeze or unlocking your credit when applying for new credit. You can also have a fraud alert and credit freeze or lock activated at the same time for added protection.

Placing a fraud alert is straightforward — just contact any of the three major credit bureaus, and they’re required to notify the other two on your behalf. Note that an initial fraud alert remains on your credit report for one year, so consider freezing or locking your credit for lasting protection.

Take the first step toward safer credit

Freezing or locking your credit is a strong first move toward keeping identity thieves from damaging your finances through fraud. Want even greater protection? Join LifeLock for powerful credit monitoring, identity theft alerts, and expert restoration support if your identity is stolen.

FAQs

Does a credit freeze prevent soft inquiries?

A credit freeze doesn’t prevent soft inquiries but does block hard inquiries. The difference between a soft and hard credit check is that hard checks are run when you apply for new credit, while soft checks are for informational purposes, like background checks, preapproved credit card offers, or checking your own credit report.

Will locking or freezing your credit affect your credit score?

No, locking or freezing your credit won’t affect your credit score. However, your credit score will still be affected by the usual factors, such as payment history and utilization, even while your credit is locked or frozen.

Can someone steal your identity if your credit is locked?

Yes, it’s still possible for someone to steal your identity even if your credit is locked. While a credit lock prevents new credit accounts from being opened in your name, it doesn’t stop the various types of identity theft from happening. For example, a fraudster could still misuse your personal information to steal your tax refund or hack your existing accounts.

How long does it take to remove a credit freeze or lock?

You can usually unlock your credit almost instantly. If you request to unfreeze your credit online or by phone, the bureaus are required to thaw it within one hour, although in most cases, it happens within minutes. Mail requests take longer, typically up to three business days.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- What’s the difference between a credit lock and a credit freeze?

- What is a credit lock?

- What is a credit freeze?

- When should you lock or freeze your credit?

- How to lock your credit

- How to freeze your credit

- Is it better to freeze or lock your credit?

- Should you opt for a fraud alert instead?

- Take the first step toward safer credit

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.