What is credit card fraud?

Credit card fraud occurs when someone uses your stolen credit card or its information to steal funds or make unauthorized purchases in your name. This type of fraud usually happens when someone steals your physical credit card, but it can also happen if someone has access to your credit card details.

Your credit card information doesn’t live only in your wallet. Your card details can also be found in web databases that store online purchase information. If those databases are compromised or breached, your card information could be stolen and used to commit fraud.

Credit card fraud is currently the most common type of identity theft, with 416,630 instances in 2023, according to the Federal Trade Commission (FTC). If you've ever reviewed a credit card statement and seen charges you didn’t recognize, you’ve found potential signs of fraud.

How credit card fraud happens

Credit card scammers can get their hands on your information in various ways. For example:

- Dumpster diving: A thief digs through your trash and finds credit card statements.

- Fake websites: A malicious link takes you to a fraudulent website that tricks you into providing your card number.

- Data breaches: Your card number gets exposed in a data breach that hits a retailer you’ve used.

- The dark web: A cybercriminal buys your stolen credit card number on the dark web.

With your credit card information, scammers can drain your funds or make fraudulent purchases in your name.

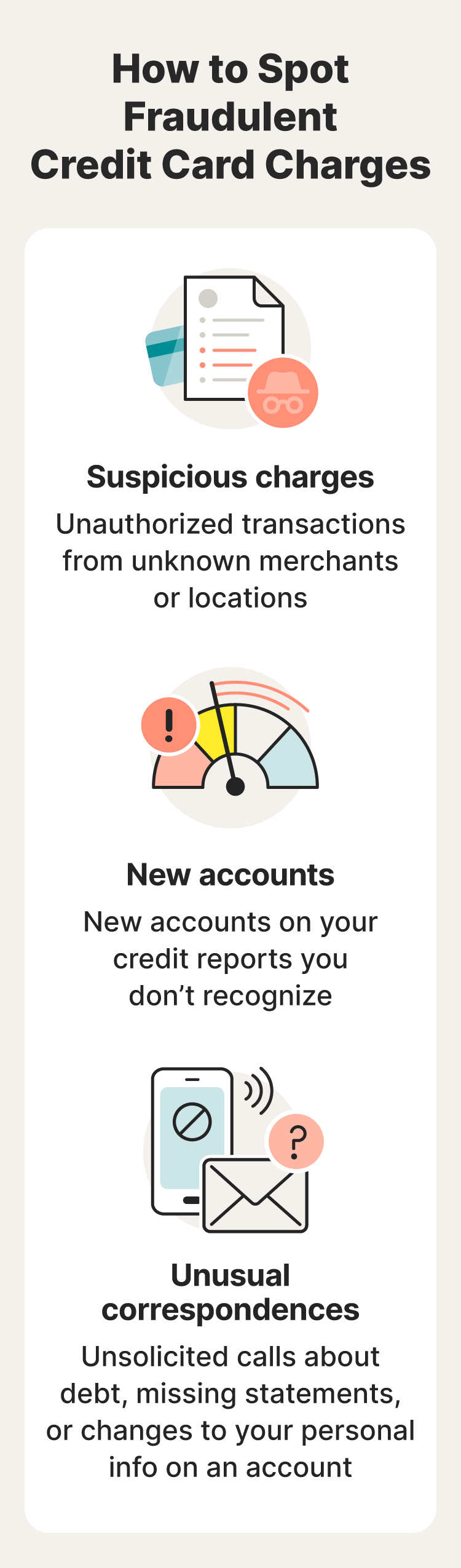

Signs of credit card fraud

Here are some signs to look for that could mean a credit card scammer has targeted you for credit card fraud:

- Suspicious charges: This is the most common sign of fraud. Look for any charges you don't recognize, no matter how small.

- Unknown merchants: If you see charges from merchants you don't recognize or seem out of character for your spending habits, it could be a sign of fraud.

- Payments from other locations: If you see charges from locations where you haven't been, it could be a sign that someone else is using your card.

- New accounts opened in your name: If you receive credit cards or bills for accounts you didn't open, or notice a new account on your credit report, it could be a sign of identity theft.

- Unusual correspondences: If you receive unsolicited calls from credit card companies about debt, it could be a fraudulent account that somebody opened in your name. Also, if you stop getting emails or statements from your card issuer, a thief may have changed your billing information.

- Changes to personal details: Any changes to the personal information on your credit card account should warrant a closer look. For example, a new billing address or phone number on your account or an order for a new card that you didn't request.

Credit card fraud happened to me; here were the signs: I overlooked a few charges for small amounts from a music streaming service and gas stations. Later, I noticed large purchases from an online store. Fraudsters used small charges to test whether the stolen credit card number was active and then made larger transactions later.

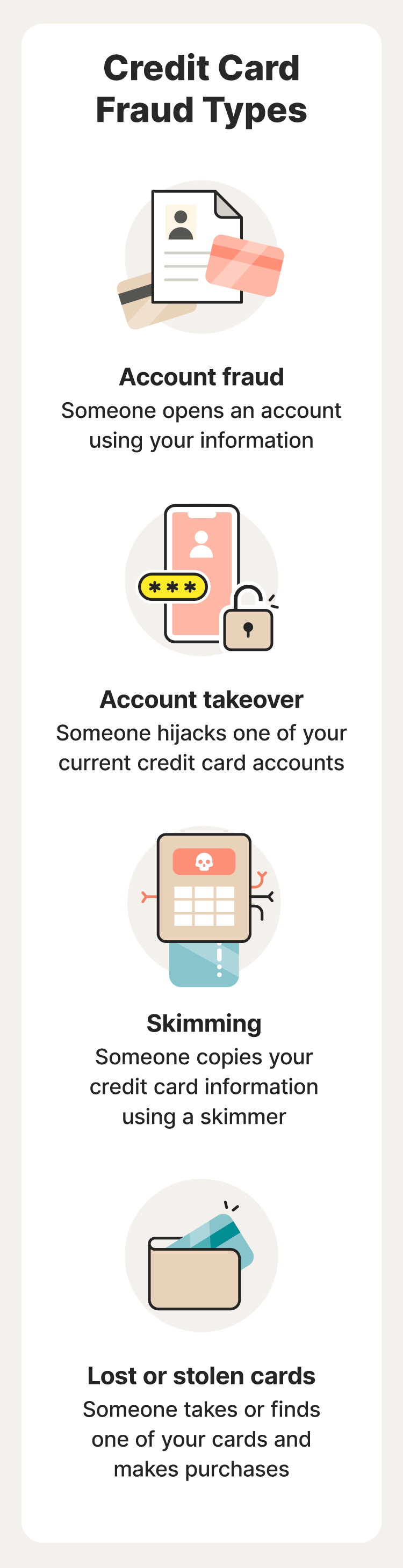

Types of credit card fraud

You can organize credit card fraud into four main categories. The most common types of credit card fraud include:

Credit card application fraud

With your personal information, fraudsters can open new accounts in your name and then make purchases or move your money into their accounts. This could go unnoticed for a long period of time, damaging your credit. Opt out of pre-approved credit card offers to reduce this risk.

How credit card application fraud happened to me: A streaming service I use suffered a data breach, and somebody stole users’ personal information, including my own. With that data, fraudsters applied for credit cards in my name.

Account takeover

Identity theft often involves hijacking accounts that already exist in your name. In many cases, someone committing fraud doesn't need your physical card. With enough information, they can access funds remotely or send a new card to themselves.

This happens via credit card scams meant to trick you into revealing your credit card information through emails, text messages, or fake websites. They can then do an account takeover. Two of the most common credit card scams used to steal information are:

- Phishing: You might receive an email from what looks like your cable company, internet provider, or bank asking you to click a link to confirm your account and credit card information to maintain service. This is a phishing attack. Call your service provider's customer service number to check if the request is legitimate.

- Smishing: These scams use text messages for the same purpose as phishing scams. Be wary of any unsolicited messages requesting financial information or asking you to click a link.

How an account takeover happened to me: I received a phishing email that appeared to be from my bank. The email warned about suspicious activity on my account and provided a link to verify transactions. I clicked the link and entered my username and password, but it was a fake login page. With that, the criminals had my login information and took over my account.

Credit card skimming

A credit card skimmer is a small device thieves install on card readers. Once you insert your card into a skimmer, thieves clone your card to make purchases or move funds in your name.

Thieves typically install credit card skimmers at gas pumps, convenience stores, automated teller machines (ATMs), and grocery stores.

How credit card skimming happened to me: I was in a hurry and used my credit card at a gas pump before checking the card reader. A week later, I noticed a number of unauthorized purchases on my account.

Lost or stolen credit cards

In this scenario, an identity thief steals your physical credit card and uses it to commit fraud. A stolen or lost card can be an easy way to make purchases quickly at different stores or order gift cards or products online.

How lost credit card fraud happened to me: I was shopping with a friend and must have left my wallet in a store or cafe along the way. By the time I noticed, someone had used my card to have a mini shopping spree.

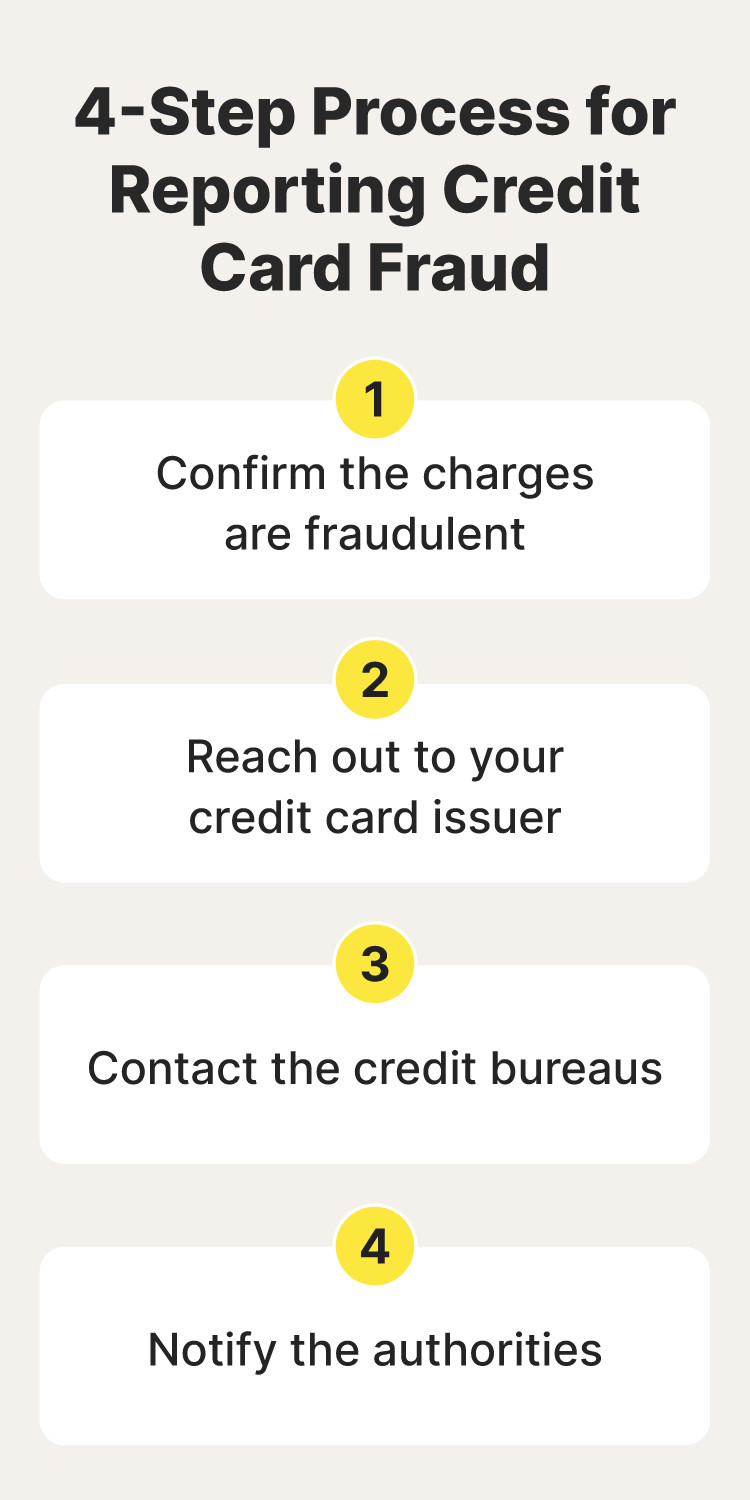

How to report credit card fraud

If you believe you’re the victim of credit card fraud, you need to act quickly. Here are the key steps for reporting credit card fraud:

1. Confirm fraudulent charges

Review your credit card statement carefully. Look for unexpected charges and ask any authorized users whether they made it. Sometimes, a charge shows up differently on your statement than the name of the business or store. If in doubt, call the merchant on your card statement and ask about other names they operate under.

2. Notify your card issuer

If you believe a charge is fraudulent, contact your card issuer as soon as possible. Quickly reporting credit card fraud can help reduce financial damage. Your credit card provider can put a hold on your card or cancel an account if you’re worried. From there, they'll investigate the fraud, give you new cards, and reinstate your account access.

Also, update your security information. Change your security credentials on all financial accounts. Remember to update your login details by creating strong passwords, PINs, and security questions, and set up two-factor authentication (2FA) if you don’t have it on your accounts.

3. Reach out to the credit bureaus

There are three main credit bureaus you need to notify in the event of credit card fraud. The bureaus can freeze your credit and place fraud alerts. These alerts make lenders verify your identity before opening new accounts in your name or approving a loan.

4. Contact the authorities

You’ll also want to report fraud to law enforcement and authorities. You can file an identity theft report on the Federal Trade Commission (FTC) website. The details you enter can help law enforcement find the fraudster responsible. Then, check your statements and online activity regularly to see if there are continued signs of fraud.

Credit card fraud protection strategies

Criminals see the credit card industry as a place to make a quick buck. Fortunately, you can minimize your risk of credit card fraud by taking steps to help protect your information. Here are the top tips for reducing the risk of credit card fraud:

Monitor your accounts regularly

Access your credit card account online. If you log in to your credit card provider's online portal or app, you can often spot fraud quickly. This way, you can check your credit card account proactively instead of waiting for your monthly statement.

Also, many card issuers offer fraud alert options that notify you via text message or email about activity on your card. These alerts can notify you of any suspicious activity on your account, such as a large purchase or a login attempt from a new device.

How I monitor my credit card accounts: I set up text message alerts from my bank for every transaction on my credit card. This way, I get an immediate notification of any purchase and can quickly identify suspicious activity.

Be cautious of scams

Credit card scams can trick you into revealing your credit card information by responding to an email or clicking a link to a fake website. You might receive emails from what looks like your internet provider or bank asking for your credit card information to maintain service. This is a phishing attack. Call your service provider's customer service number to ensure a request is legitimate.

Smishing scams use text messages for the same purpose. Be wary of any unsolicited messages requesting financial information. Also, watch out for phone scams. Thieves might call you saying they’re from your credit card provider, asking for your credit card number so they can "update" your account. Instead, help protect against identity theft by calling your bank directly to verify any issues.

How I’m cautious of credit card scams: I never click links in emails or texts claiming to be from my bank. Instead, I log in to my bank account directly through their website or the app to check for any messages or updates there.

Avoid unsecured websites

When making online purchases, ensure the website is secure. Only shop on websites you trust and that use secure payment methods. Also, avoid using public Wi-Fi for financial transactions as these networks offer less security. And whenever you’re in public, look out for criminals shoulder surfing you as you enter credit card details.

How I avoid unsecured websites: I only shop online from websites with a secure connection (HTTPS) and never HTTP sites. But even HTTPS sites can be malicious and used for phishing. I always check and verify URLs first, and while I try to stick to online retailers I know, I remain vigilant because no site is completely without risk all the time.

Protect your account information

There are various things you can do to keep your personal information out of the hands of fraudsters. For example, shred receipts and old credit card statements or opt for paperless statements. This lessens the chance that thieves will be able to find papers that include your account information.

Also, don't leave account information where others might see it. Keep all of your PINs and passwords in a secure location, and carry only the cards you need.

How I protect my account information: I’ve made all my statements digital so dumpster divers or any thief who manages to intercept my mail can’t steal important details.

Check your credit reports consistently

Once a year, you can order a free copy of your credit report from the three major credit bureaus: Experian, Equifax, and TransUnion. Once you order these reports, check for accounts or loans in your name that you don't remember opening. You can also use an identity theft protection service like LifeLock Total to help you monitor your credit report more easily and potentially catch issues sooner.

Get strong credit card fraud detection with LifeLock

Credit card fraud can happen to anyone. Thankfully, there are services to help you protect your accounts, keep your finances more secure, and safeguard your identity.

With LifeLock Total, you can set up alerts to help monitor your financial accounts for fraudulent transactions. And if your wallet is ever stolen, LifeLock will help you replace your credit cards and other sensitive information.

Help protect against credit card fraud and strengthen the security of your financial accounts today.

FAQs about credit card fraud

The conversation on credit card fraud is complex. To cover the important bases, we’ve answered some frequently asked questions.

Is credit card fraud considered identity theft?

Yes, credit card fraud is a form of identity theft. Thieves use a portion of your identity—your credit card information—to make fraudulent purchases or access cash advances. They could also use your personal information to open a new credit card account in your name.

What happens when you report fraud with a credit card company?

The credit card issuer may contact the merchant that charged your card to get more details about the transaction. If available, they may also request copies of a police report or receipts to compare signatures.

Is credit card fraud a felony?

Depending on where you live and the crime, credit card fraud may count as a felony or misdemeanor. Different states set unique penalties and classifications for credit fraud. Federal statutes govern interstate and foreign commerce, making using a stolen or fraudulently obtained credit or debit card illegal.

Are you liable for credit card fraud?

No, you generally aren’t financially liable for credit card fraud. According to the Fair Credit Billing Act, the most you ever have to pay for unauthorized credit card charges is $50. You aren’t liable for any amount after you report credit card theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.