What’s the purpose of a credit report?

Businesses use credit reports to determine creditworthiness. The information on the report allows these companies to see how likely you are to be able to make regular payments to repay a loan or pay for insurance.

There are several entities that might examine your credit report, including:

- Businesses

- Banks and credit unions

- Employers

- Insurance companies

- Credit card companies

Because your credit report is tied to so many important milestones in your life, like renting your first apartment or buying a home, ensuring that the information on it is accurate is important. Let’s take a look at what’s on a credit report.

What is on a credit report

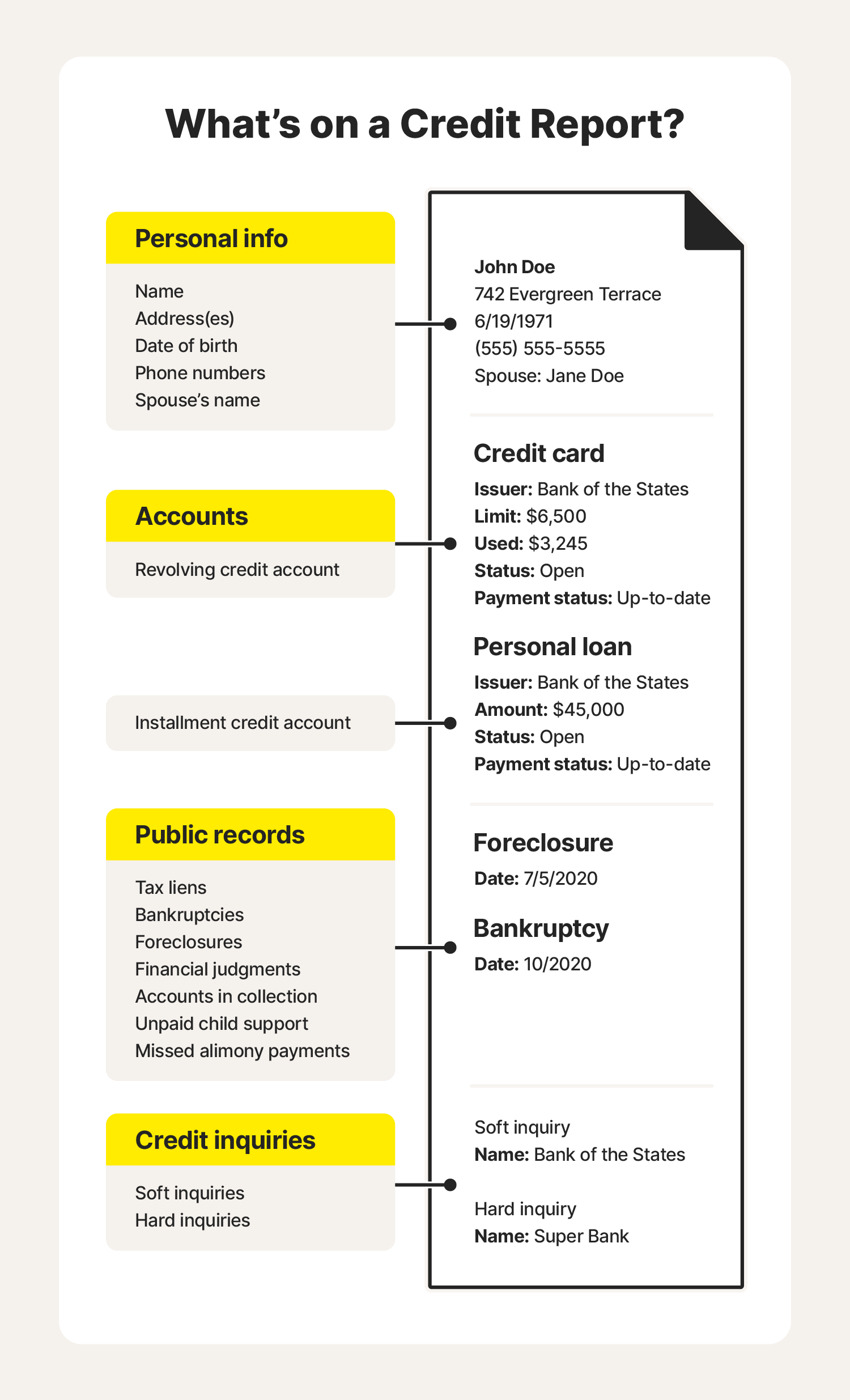

Your credit report is full of facts about you. Credit bureaus, also called consumer reporting agencies, collect financial information from financial institutions to compile these reports. A credit report includes personal information used to identify you definitively, as there may be others out there with your same name or birthday. It also includes public records related to your finances and information about the types and amounts of credit you have. While a credit report contains a lot of data about you, it usually doesn’t include your credit score.

Personal information

The personal information listed on your credit report includes:

- Your full legal name

- Addresses associated with your name

- Your date of birth

- Your phone number

- The name of your spouse

When you view your credit report, look for inaccurate information and dispute it with the credit bureau. The agency will investigate your claim and inform you of what they will do following the investigation. TransUnion, Equifax, and Experian all have pages to file credit report disputes for incorrect or fraudulent information and report identity theft.

Accounts

Your credit report will also list all of the accounts in your name. These include revolving and installment credit accounts. A revolving credit account is any account where you can continue to borrow against a limit even as you are paying it down. Credit cards and home equity lines of credit are two examples of revolving credit. Installment credit accounts are loans of a set amount that you pay off in installments. With an installment credit account, you can only borrow from it once.

A credit report also lists the status of your credit accounts (open or closed), and it includes information about the payment status (whether you’re up-to-date or behind) of each account. It also lists:

- Account balances

- Credit limits

- Date of account opening and closing

- The creditor’s name

Your accounts are one of the most important parts of your credit report to examine for fraud. If any new accounts have been opened in your name that you didn’t apply for, contact the credit bureaus and the issuing institution to learn about your options. Sometimes, you may need to report this kind of identity theft to the police.

Public records

The public records section of your credit report includes legal judgments and obligations related to your finances. This section might list:

- Tax liens

- Bankruptcies

- Foreclosures

- Financial judgments

- Accounts in collections

- Unpaid child support and/or missed alimony payments

These records show potential lenders how risky it may be to provide you with a loan or service, so checking this section for mistakes is vital. Someone may have stolen your identity and used it to obtain credit, get medical treatment, or even get married. If they fail to pay for these services or are required to pay child support or alimony, it could reflect poorly on your creditworthiness.

Credit inquiries

Credit inquiries are any time a business looks at your credit report. There are two types of credit inquiries: soft inquiries and hard inquiries. A soft inquiry means someone (usually a lender reviewing your current account, prescreening checks from possible lenders, and your yearly requests for your credit report) has accessed your report. A hard inquiry is when a lender checks your credit after you have applied for credit with them.

If you see any inquiries on your report that you didn’t make, especially hard inquiries, disputing the credit report is a good idea. While soft inquiries don’t have an effect on your credit score, it could mean that you’re the victim of identity theft.

How to get a copy of your credit report

You can order a free credit report from each agency once per year using the Annual Credit Report website. There are services available that give you access to one or more of your reports whenever you want to look at them (including programs offered by the credit bureaus themselves). However, there are also scams that will try to convince you to sign up for their services for expanded access.

Credit monitoring services will watch your credit information and look for it in data breaches and on the dark web to alert you to potential fraud. You can also monitor your credit reports annually to look for fraud or identity theft.

Help protect your credit and your identity

Now that you understand how important your credit report is, you might be wondering what you can do if you notice fraud on your accounts. Placing a fraud alert on your credit report can be a temporary measure that will stop or slow down any other fraudulent applications. Identity theft protection services also look for suspicious activity using your personally identifiable information to prevent widespread damage to your credit and finances.

LifeLock goes beyond credit monitoring to alert you of fraudulent uses of your name and Social Security number, and it scans public people-search sites for your information so you can opt out of having your data collected and accessible to almost anyone.

FAQs about credit reports

Credit reports can be complicated. We’ve got answers to some of the most common questions about these reports.

How long does information remain on your credit report?

Negative information can be kept on your credit report for up to seven years or until the end of the statute of limitations, depending on which is longer.

Who can see your credit report?

Creditors, lenders, insurers, certain government agencies, utility companies, landlords, and employers can legally access your credit report.

What is the difference between a credit score and a credit report?

The difference between a credit score and a credit report is that a credit report provides a detailed overview of your credit history, and your credit score is a number based on the information in your credit report that determines whether or not you are creditworthy in the eyes of a lender. There is also more than one credit score. Credit bureaus will update your credit score every month based on the information your creditors report.

Why is it bad to not check your credit report?

If you don’t check your credit report, you could be letting identity thieves ruin your credit and be on the hook for bills they ran up in your name. By monitoring your credit report regularly, you’ll be able to see suspicious activity before it has potentially catastrophic results.

What is a charge-off on a credit report?

A charge-off is when a lender has declared that an account is a loss. This status means it is not open to future changes, though the lender can still sell it to a collection agency.

What is the best site to get a free credit report?

AnnualCreditReport.com is the best place to get your free credit report.

What is a consumer credit report?

A consumer credit report is a personal credit report associated with one person. It is separate from a business credit report.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.