Tip: Check your credit card statement each month to confirm you recognize all charges. If you have multiple credit cards, check each statement individually.

Unauthorized credit charges can occur after data leaks, physical card theft, card skimming, and in plenty of other ways — some of which are impossible to prevent. According to the FTC, credit card fraud was the most reported form of identity theft in 2023, and victims lost nearly $250 million throughout the year. Thankfully, there’s a straightforward process for disputing unauthorized credit charges when they pop up in your statements.

Here’s how to dispute a credit card charge:

1. Review your purchase history

Look over your recent purchase history for any transactions you don’t recognize, and don’t ignore the small charges. Credit card thieves sometimes use carding schemes, which involve charging your card for a very small amount to validate that it’s active — and sometimes to ensure you’re not paying attention to your history. Make a record of any fraudulent charges.

Check your pending charges, too. You can’t dispute charges that are pending, because the amount might change or get removed from your account, but once the charge has officially been made, you can begin the dispute process immediately.

2. Determine who to contact first

Once you've identified a suspicious charge, determine whether you should first contact the merchant who filed the charge or your credit card issuer. If the charge is for a purchase you made but the amount is wrong, or you’re unhappy with the product or service, contact the merchant directly.

It’s best to reach out to the merchant directly in the following situations:

- You received poor quality or damaged goods.

- You were dissatisfied with the service.

- You were sent the wrong item or service.

- You canceled an order but were still charged.

- You returned an item but haven't received a refund.

- There was an error in how you were billed.

Conduct a quick online search of unfamiliar business names listed on your credit card statement. Many businesses operate under different names or outsource their billing and finance departments, so the charge could be legitimate but listed under a name you don’t recognize.

It’s best to reach out to the credit card company directly in the following situations when you think a charge is fraudulent:

- The location of the charge doesn’t match your recent purchases or travel history.

- The charge is for an unusually large or out-of-pattern amount.

- You notice charges from a merchant you haven’t done business with.

Be sure to check with other authorized users on your account to see if they made the purchase. If you still can’t identify the charge, it may be credit card fraud, and you should contact your credit card company immediately.

3. Contact the merchant

If you’ve determined that contacting the merchant is the best next step, look for their contact information on your credit card billing statement or receipt. If you plan to dispute an incorrect amount charged to your card, you’ll need to provide the proof you collected when you reviewed your purchase history. You’ll also want to find the receipt for the item or service to prove the discrepancy.

If the merchant refuses to handle the dispute, doesn’t want to issue a refund, or you believe the charges were fraudulent, file a dispute with your credit card issuer.

4. File a dispute with your credit card company

If you suspect a charge is fraudulent or a merchant won’t issue a refund, dispute it with your credit card company directly so they can request a chargeback. You can usually do this by phone, online, app, or mail depending on your credit card provider.

The Fair Credit Billing Act allows you to withhold payment on the disputed amount while the charge is being investigated, which typically takes up to 90 days.

How long do you have to dispute a credit card charge?

According to the Fair Credit Billing Act, you have 60 days from the statement date to dispute a charge. However, you should review your credit card issuer’s specific policies since some offer a longer window or have additional requirements to dispute charges.

How long does a dispute take to resolve?

After you file a dispute, your card issuer has 30 days to acknowledge it and must complete the investigation within two billing cycles — usually up to 90 days. While the dispute is being reviewed, you aren’t required to pay the disputed charge, but you should continue paying the rest of your bill.

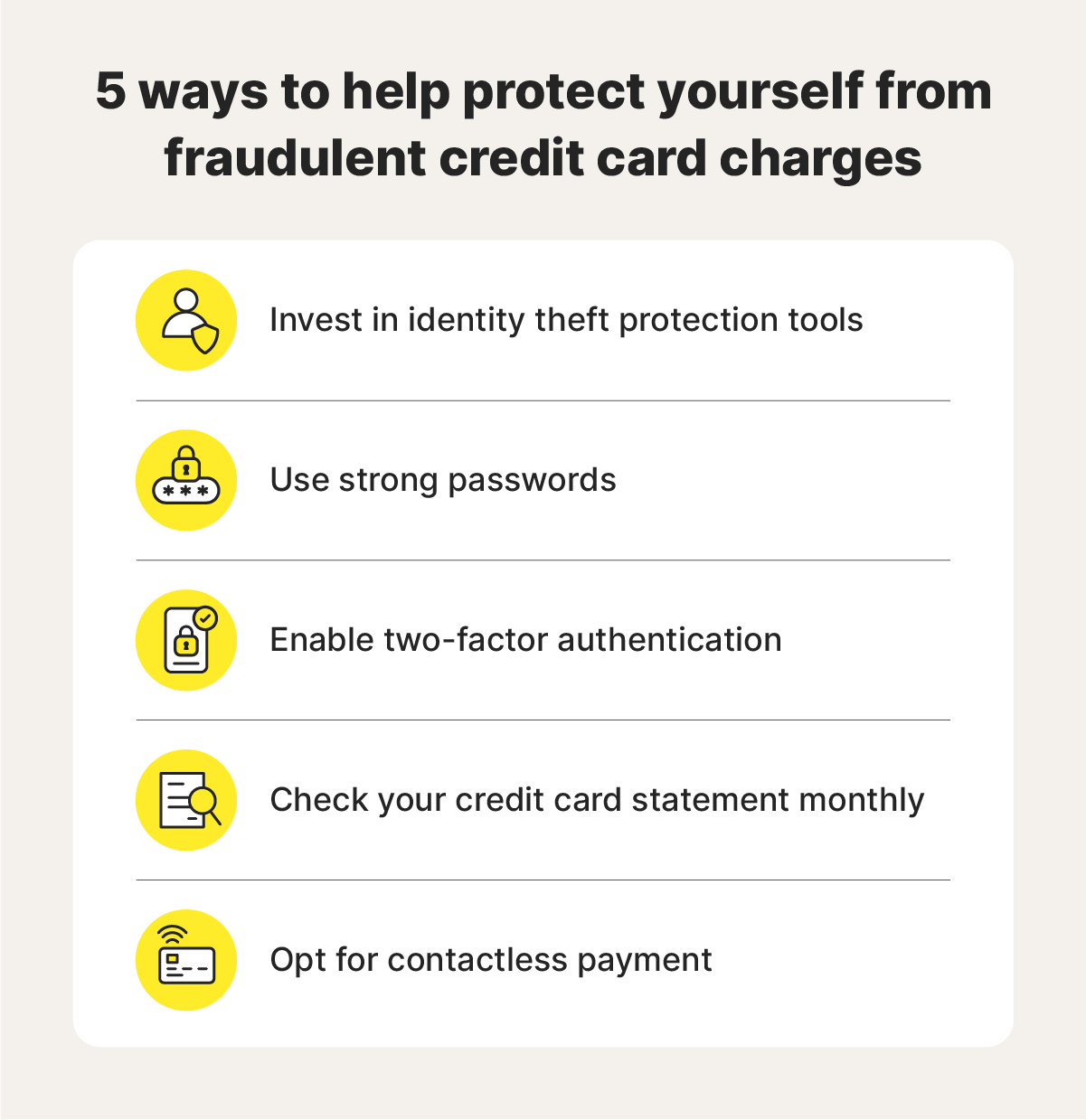

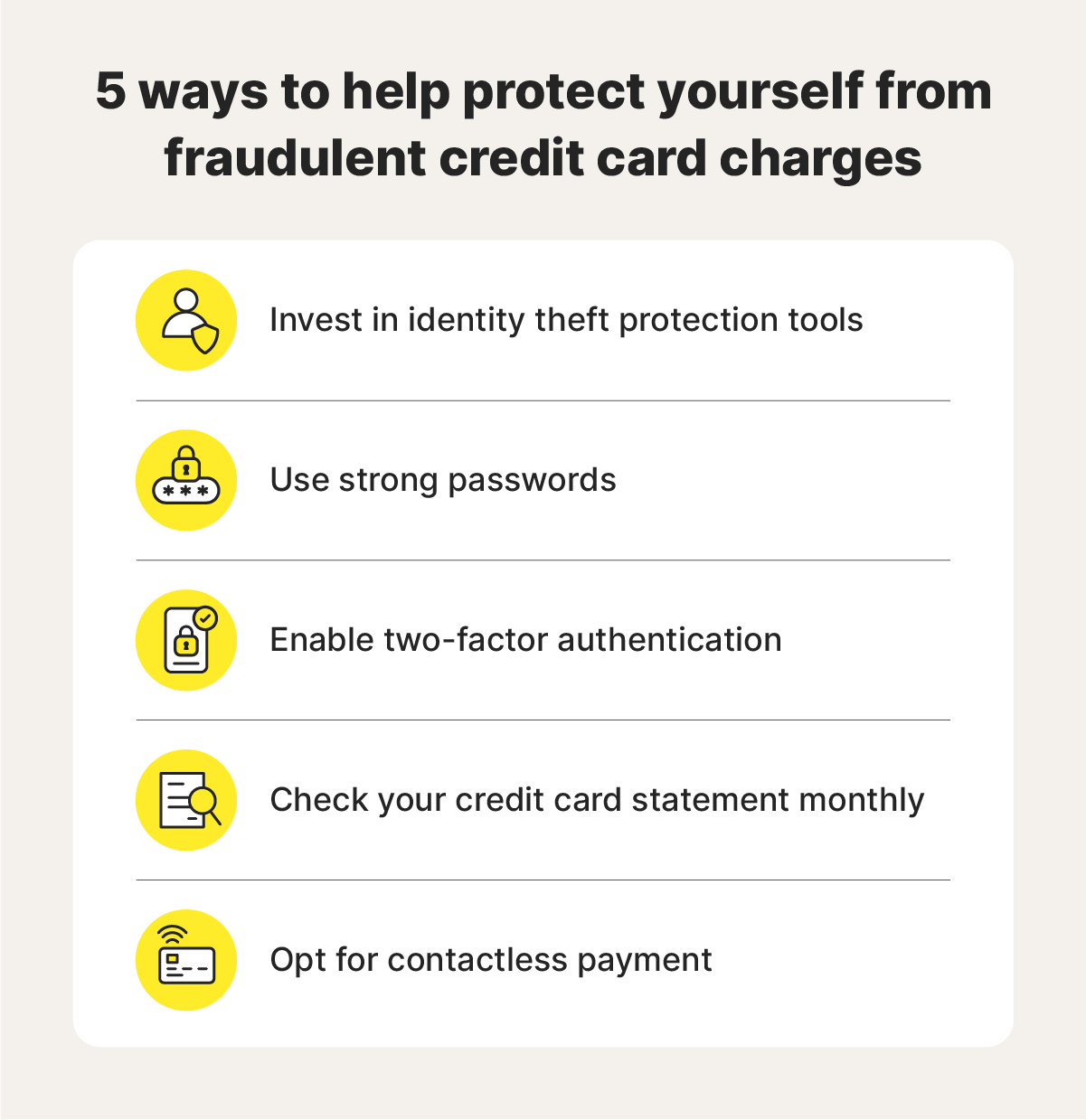

How to protect yourself from fraudulent credit card charges

Receiving a damaged item or lackluster service from a business is annoying, but it's not nearly as alarming as finding out an unauthorized person has your credit card number. Fortunately, there are steps you can take to better protect your personal information and minimize the chances of someone accessing your credit card information.

- Invest in identity theft protection tools: LifeLock monitors millions of internet data points per second and notifies you if your personal information appears in fraudulent credit applications or other unsavory places.

- Use strong passwords: Skip easy-to-guess passwords like your pet’s name or birthday. Use long, strong, and unique passwords, and get a password manager to help generate and store them.

- Enable two-factor authentication: Two-factor authentication helps you stay secure online by requiring you to verify your identity in a way others can't duplicate. This helps prevent cybercriminals from accessing your financial accounts, even if they have your password.

- Check your credit card statement monthly: Review every purchase on your credit card statement monthly to ensure all charges are accurate. If you notice a strange transaction, you’ll have plenty of time to dispute it with the appropriate party.

- Opt for contactless payment: Contactless forms of payment — such as chip cards or digital wallets — help reduce credit card skimming and card cloning. They’re also encrypted forms of payment, meaning that even if data is intercepted, it can’t easily be used to commit credit card fraud.

Help protect your credit with LifeLock

LifeLock Advanced provides added protection from credit card fraud by alerting you if we detect potentially unauthorized credit card applications and purchases.* By taking a more proactive approach to monitoring your credit and personal information, you can help protect yourself and your credit against fraud.

FAQs

Can I dispute a credit card charge I willingly paid for?

It depends. If you paid for an item or service of poor quality, you can contact the merchant to dispute the charge. However, if you willingly made a purchase that you don’t plan to return or are satisfied with, you cannot dispute that charge. Attempting to file a dispute for a purchase you knowingly made to get a refund is known as friendly fraud and is considered unethical.

Who pays when you dispute a charge?

If the dispute is resolved in your favor, the charge will be removed, and you won’t need to pay anything; in such cases, it’s typically the merchant who ends up paying. If the dispute is not resolved in your favor, you must pay the charge.

What happens if your credit card dispute is denied?

Your credit card company will explain why the dispute was denied, and you will likely be responsible for paying the charge.

*LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Review your purchase history

- 2. Determine who to contact first

- 3. Contact the merchant

- 4. File a dispute with your credit card company

- How long do you have to dispute a credit card charge?

- How long does a dispute take to resolve?

- How to protect yourself from fraudulent credit card charges

- Help protect your credit with LifeLock

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.