Even though the FTC recommends filing your identity theft report online, you can also call them at 1-877-FTC-HELP (1-877-382-4357) to file your report.

Before involving the authorities, your first move should be to put in place immediate protections against further fraud by contacting any companies involved, such as credit card companies, and alerting them to the identity theft or fraud. Request account closures or freezes and update your passwords. Then, place a fraud alert on your credit report.

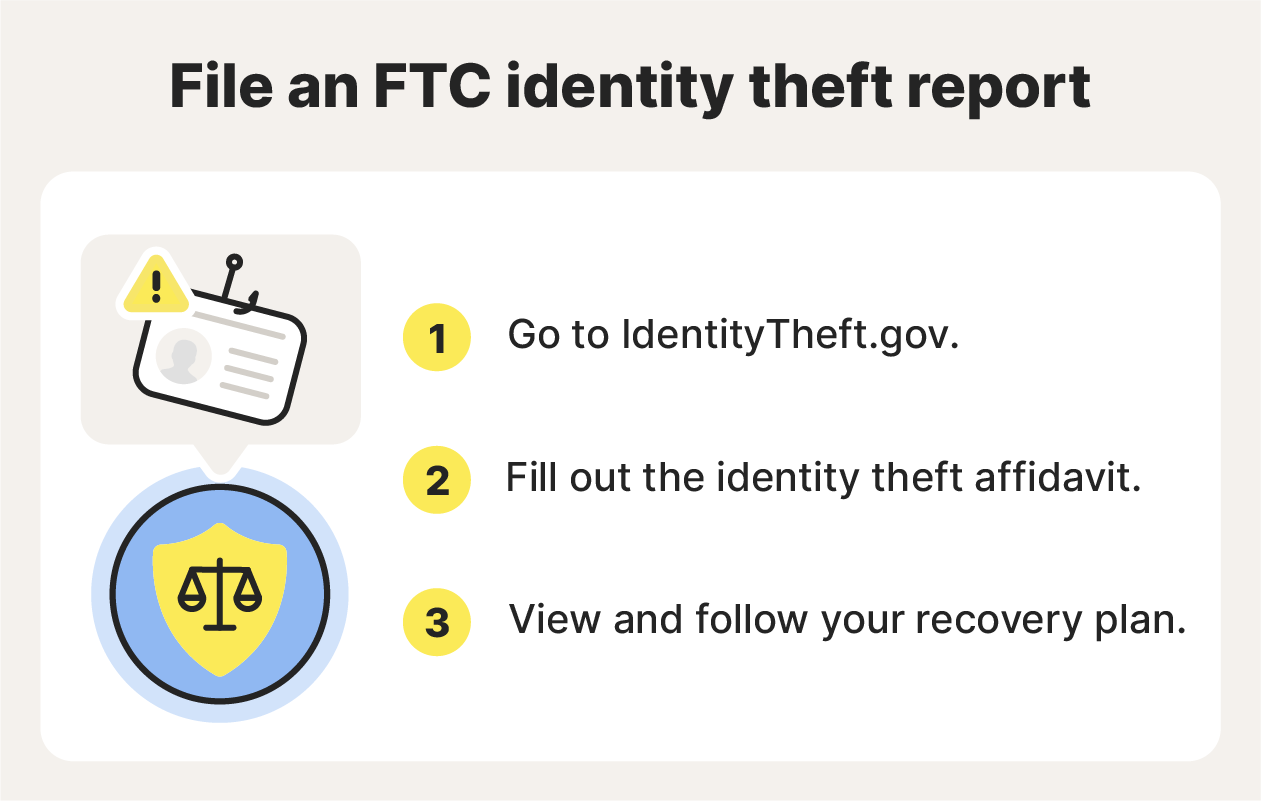

How to report identity theft to the FTC

After taking steps to block the identity thief from further fraudulent activity, report the case of identity theft to the Federal Trade Commission (FTC), who will provide an affidavit to help you file a police report, assist law enforcement investigations, and help you recover lost funds by proving you were a victim of ID theft.

Here’s how to report identity theft to the FTC:

Step 1: Go to the FTC’s identity theft portal

The first step for reporting identity theft to the FTC is to visit IdentityTheft.gov and click Get Started. You’ll be redirected to a screen where you can select your situation. If you’re sure your identity was stolen and used, pick I want to report identity theft.

Step 2: Fill out the identity theft affidavit

Next, you need to produce an identity theft affidavit, which is a sworn document used to officially report identity theft to creditors, financial institutions, and law enforcement, helping to dispute fraudulent accounts or charges.

While filling out the identity theft affidavit, you’ll be asked to provide the following personal information:

- Full legal name

- Birthday

- Social Security number

- Driver’s license number

- Primary address

- Phone numbers

- Email address

Once submitted, the FTC stores your details in a secure online database, allowing other law enforcement agencies to access it easily during their investigation. Be sure to print and keep a copy of your completed identity theft affidavit for your records. You’ll need it to file a report with your local police department.

Step 3: View and follow your recovery plan

After you’ve completed your identity theft report, the FTC will provide you with a personalized plan to help try to resolve the lasting effects of identity theft.

For example, if an identity thief stole your credit card information and used it for credit card fraud, the FTC will provide you with a road map for disputing the fraudulent purchases. The FTC will also provide you with pre-filled forms and letters to report identity theft quickly and easily to any necessary parties.

How to report identity theft to the police

Unless there’s an immediate threat or active crime, wait to report identity theft to the police until after completing your FTC affidavit. Attaching the affidavit to your police report creates a comprehensive identity theft report, which will be invaluable when dealing with affected companies and financial institutions.

Here’s how to file a police report for identity theft:

Step 1: Gather the necessary documentation

Before you can report identity theft to the police, you’ll need to gather the following documentation:

- A copy of your FTC identity theft affidavit

- Any other proof of the theft, such as credit card statements, IRS notices, medical bills, or new credit report additions

- A government-issued photo ID

- Proof of address, like a mortgage statement or utility bill

- The FTC’s Memo to Law Enforcement

Step 2: File a police report

Once you have all the documents you need, visit your local police department or the one where the theft occurred. Present all your information and keep a copy of the visit date and the police report number for your records.

Step 3: Obtain a copy of your police report

Make sure you get a copy of your police report and attach it to your FTC affidavit. Store the completed identity theft report securely, as creditors, credit bureaus, and other parties will need it when you report the theft and work to resolve the issues.

If the police won’t take an identity theft report, ask if they’ll take a “miscellaneous incidents” report — or go to a different station, the sheriff’s department, state police, or federal authority.

When should you report identity theft?

While it may take some time before you notice that someone has stolen your identity, you should report it as soon as you realize you’re a victim of identity theft.

Some warning signs of identity theft include:

- Charges for items you didn’t purchase

- Debt collection calls for accounts you didn’t open

- Unfamiliar inquiries or accounts on your credit report

- Denials for loan applications

- A random decrease in mail

- Receiving unexpected mail

- An unexpected credit score drop

- Account credentials like passwords not working

A single warning sign might not always indicate identity theft, but if you notice something suspicious, review your accounts and use a data breach checker. If you suspect identity theft, report it immediately to minimize further damage and improve your chances of recovering your stolen identity.

Cybercriminals around the world keep finding new ways to steal identities, which is one reason why subscribing to an identity theft protection service is so important. LifeLock monitors† for fraudulent use of your personal info and identity. And if you do fall victim, LifeLock’s restoration specialists are standing by to help you recover, every step of the way.

Additional steps to take if your identity is stolen

After placing an initial fraud alert on your credit report and filing your identity theft report, your top priority should be to take extra steps to stop identity thieves from causing further damage and begin the recovery process.

Here are some steps you can take to maximize your protections:

- Put your credit on ice: Freeze your credit to help stop identity thieves from opening accounts or taking out loans in your name. Your credit report will be frozen until you unfreeze it.

- Review your credit card and bank statements: Keep a close eye on your credit card and bank statements if an identity thief has compromised any of your other accounts.

- Alert your credit card companies: Tell any other credit card companies that your identity has been compromised, even if that card hasn’t been used. They may suggest setting up a new account or sending you a new card.

- Change your passwords: Update your account passwords to help block unauthorized access by identity thieves. Consider using a secure password manager to create strong passwords for all your accounts.

- Add two-factor authentication: Enabling two-factor authentication (2FA) adds an extra layer of security to your accounts, helping to keep them secure even if your password is compromised.

- Check your credit report: Repair your credit after ID theft by making sure there are no unauthorized accounts on your credit report, which can harm your credit score.

- Use identity theft protection services: Identity theft protection services like LifeLock can help reduce the risk of identity theft by scanning websites and patrolling the dark web to check if your personal information has been compromised. Additionally, LifeLock will alert† you about potentially fraudulent use of your Social Security number and other personal details. And should the worst ever happen, LifeLock will help you with identity theft victim assistance.

Safeguard your identity with LifeLock

The ultimate impact of identity theft often comes down to how quickly it’s spotted, and the steps you take to mitigate the impact and recover from any damage.

With a LifeLock subscription, you’ll gain access to a powerful detection and alert system of identity protection services, including Dark Web Monitoring and identity and Social Security number alerts.† And, if you do fall victim to identity fraud, a U.S.-based restoration specialist will help you reclaim your stolen identity.

FAQs

How can I find out if someone is using my Social Security number?

Identity theft protection services like LifeLock include Social Security number monitoring to alert† you if potentially fraudulent use of your SSN is detected. Alternatively, you can check your credit reports for suspicious activity and look out for unexpected mail about a new job or another activity or account that would require your SSN.

What happens after you file a police report for identity theft?

After filing a police report for identity theft, you'll receive a copy of the report, which can be used to dispute fraudulent charges or accounts. The police may investigate the crime, and the report can also be helpful when working with creditors, credit bureaus, or the FTC to resolve the issue.

What should you do if you’re unable to file a police report?

If your local police won’t take your identity theft report, and you’ve shown them the FTC’s Memo to Law Enforcement and all your evidence, try filing with another law enforcement department. If they won’t take your report, try the state police or another federal authority.

† LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.