What is credit card fraud?

Credit card fraud typically involves a criminal using someone else’s credit card information to make unauthorized purchases, withdraw cash, or transfer funds to another account. In some cases, the term also applies to more insidious forms of identity theft, such as when a fraudster uses stolen personal information to open a new credit account in your name.

It’s one of the most common types of identity theft, with over 200,000 cases reported to the Federal Trade Commission (FTC) in the first half of 2024.

While credit card fraud can happen if your physical card is stolen, these days, it’s more common for card details to be stolen online. If a website where your credit card information is stored suffers a data breach, or a cybercriminal manages to get your personal information through phishing or by hacking into your accounts, you could face financial losses and other consequences of identity theft.

Telltale signs of credit card fraud include transactions you don’t recognize on your statement or new credit accounts you didn’t authorize appearing on your credit report. You can monitor for these signs manually, or use an identity theft protection service with built-in credit monitoring features like LifeLock to get automatic alerts of suspicious activity.

How to report credit card fraud in 3 steps

However you monitor for credit card fraud, it’s important to report it as soon as possible. Contacting your credit card issuer and the credit bureaus can help you protect any compromised cards or accounts and safeguard your finances.

Although the Fair Credit Billing Act means your liabilities following credit card fraud are limited to $50, the quicker you act, the less likely you are to suffer other potential effects like credit score damage. Follow these steps to file reports with the relevant authorities and help protect yourself against financial harm.

1. Contact your credit card issuer immediately

Your first step following suspected credit card fraud should be to contact your credit card issuer to dispute any fraudulent transactions and request that the stolen or compromised credit card be frozen or canceled. This will help prevent the criminal with your card details from making purchases or withdrawing cash.

Contact your issuer via phone or online for the fastest response. The relevant phone number should be printed on the back of your card, but here are details for five of the most popular credit card issuers:

Online fraud report center |

Phone number |

|---|---|

800-955-9060 |

|

800-528-4800 |

|

800-950-5114 |

|

800-427-9428 |

|

800-421-2110 |

If you suspect that the fraudster might also have access to the online account associated with your credit card, change your password and enable two-factor authentication to help protect against an account takeover.

2. Notify the three credit bureaus

If you suspect an identity thief has opened a credit account in your name, or if personal information like your Social Security number has been exposed in a data breach, inform the three major credit bureaus — Equifax, Experian, and TransUnion — to help protect your broader credit file. There are two options for protecting your credit: a fraud alert or a credit freeze. Here’s what they both do to help keep your finances safe from fraudsters:

- Fraud alert: Adds a notice to your credit report informing creditors you’re a victim of credit fraud. This prompts them to verify your identity when approving new credit, offering protection against new accounts being opened in your name without your explicit authorization.

- Credit freeze: Restricts creditors from accessing your credit report, meaning that no new credit accounts can be opened. This also prevents you from making credit applications, but you can temporarily “thaw” or completely unfreeze your credit at any point to get access again.

When choosing between a fraud alert and a credit freeze, consider whether you’ll need to make a credit application in the near future. A credit freeze offers better protection against credit fraud than a fraud alert, but it also comes with the downside of preventing you from applying for credit, too. If you don’t plan on opening new lines of credit any time soon, a credit freeze could be a better option.

You can contact the credit bureaus to place a fraud alert or credit freeze via phone or online.

To place a fraud alert:

Credit bureau fraud alert page |

Phone number |

|---|---|

800-525-6285 |

|

888-397-3742 |

|

800-680-7289 |

To freeze your credit:

Credit bureau credit freeze page |

Phone number |

|---|---|

888-378-4329 |

|

888-397-3742 |

|

800-916-8800 |

You only have to place a fraud alert at one bureau to get coverage across all three — the bureau you contact will automatically notify the other two. However, this isn’t the case with a credit freeze. For full coverage, you’ll need to freeze your credit with all three bureaus individually.

3. File a report with the authorities

Contact any relevant authorities to make them aware of your situation, get support, and help them build evidence that might prevent other people from falling victim to credit fraud in the future.

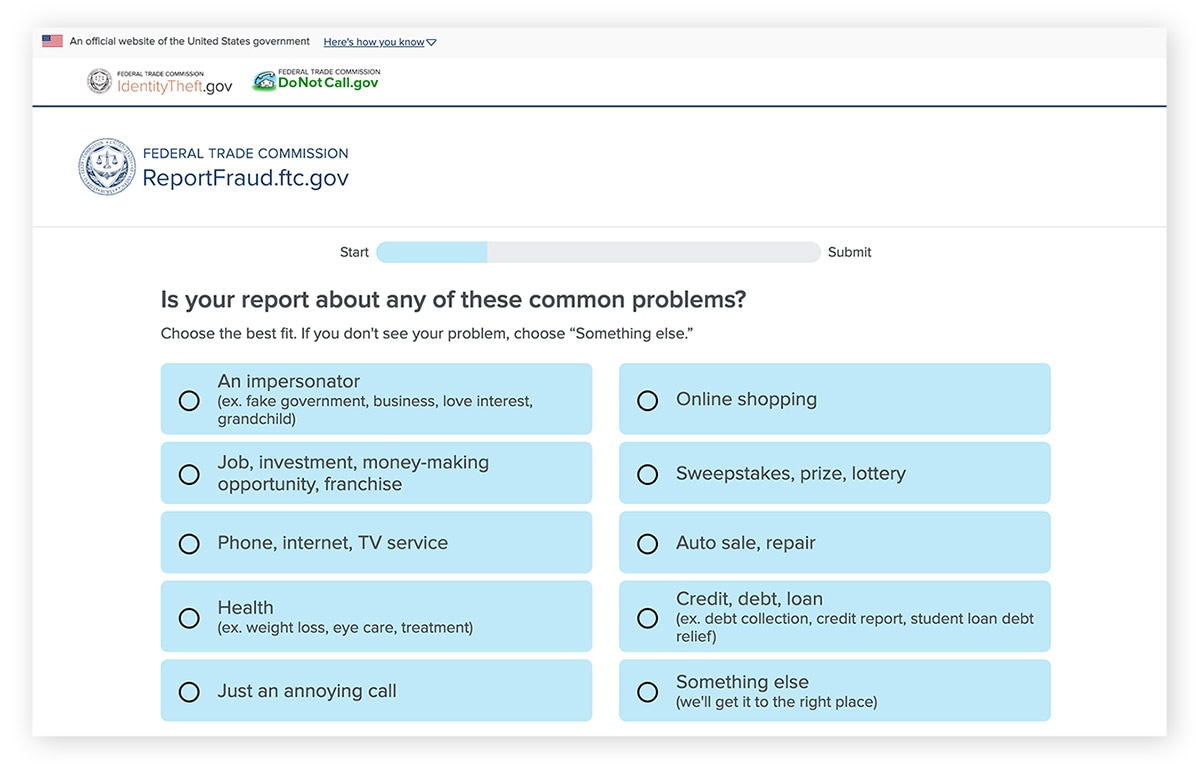

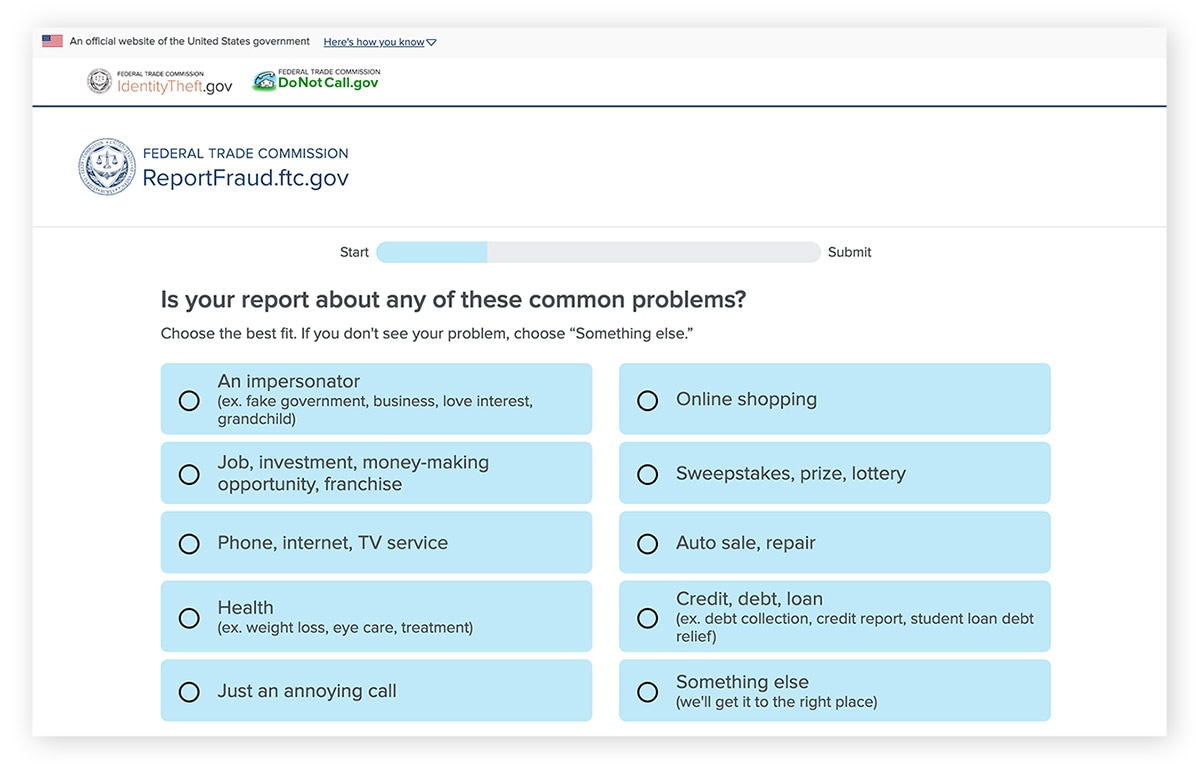

You can file a fraud report with the FTC online at ReportFraud.ftc.gov. They’ll provide you with the next steps to take to help recover from identity theft and protect yourself against subsequent harm. Your report will be shared with the FTC’s law enforcement partners to help with investigations into repeat fraudsters.

You can also report credit card fraud to the police to create a documented record of the crime that might help you prove you were a victim of fraud when dealing with any potential consequences. Contact your local police department directly to get started.

Types of credit card fraud

Credit card fraud can take many forms. Understanding how each one works can help you protect your finances.

- Lost or stolen credit card fraud: If a criminal steals your credit card, or finds it after you’ve lost it, they can use it to make fraudulent purchases or withdraw cash. Knowing what to do if you lose your credit card, including reporting it to your issuer and monitoring your credit report, can help keep your finances safer.

- Skimming: Card skimming is a type of credit card theft involving the use of a “skimmer,” a small device that fits on top of a card reader and captures card information. Thieves who get access to your card details through skimming can use them in fraudulent transactions, sell them, or try to clone your card.

- Card-not-present (CNP) transactions: If your credit card information falls into the wrong hands following a data breach, phishing incident, or account takeover, criminals can use it to make purchases online or over the phone. These are called card-not-present transactions and can be hard to detect unless you regularly monitor your statements.

- Carding: Carding is a specific type of card-not-present fraud that involves criminals known as “carders” stealing credit card information, testing if it works, and then buying untraceable prepaid gift cards to cover their tracks.

- Account takeovers: Account takeover attacks involve cybercriminals using stolen login credentials to access your online credit card account. Once they have access, they can change your password to lock you out, steal your funds, and order new cards to their address.

- Credit card application fraud: Criminals with access to enough of your personal information, like your name, address, and Social Security number, may be able to use your identity to apply for new credit cards. This can go unnoticed for long periods of time unless you use a service that offers credit monitoring that provides alerts for potentially fraudulent applications.

LifeLock Total can help protect against credit card fraud, offering credit monitoring and timely alerts for potentially fraudulent use of your personal details in credit applications. Become a member to help safeguard your finances and minimize the risk of identity theft.

Tips to help prevent credit card fraud

There are lots of strategies to help protect against the risk of credit card fraud, including safeguarding your personal information, using fraud alerts, and diligently monitoring your financial statements. Here’s a more detailed look at what you can do to help keep yourself safer from fraudsters in the future:

- Protect your credit cards: Keep all of your cards safely stored in your wallet and check regularly to make sure they’ve not been lost or stolen. You should also take care to protect your PIN from shoulder surfers at ATMs or checkouts.

- Secure your credit card information: Your credit card details, including the card number and CVV, falling into the wrong hands can leave you vulnerable to fraud. Avoid sharing them with others, be wary of phishing schemes that aim to trick you into revealing them, and look out for data breaches that may involve your financial information.

- Review your statements regularly: Commit to reviewing your monthly credit card statements. This will help you catch unauthorized transactions that may be a sign of fraud. You can then contact your issuer to dispute suspicious payments and take appropriate action to protect yourself from further consequences.

- Consider a fraud alert or credit freeze: You can place a fraud alert or freeze your credit at any time to add an extra layer of security to your credit profile. This can be an effective way to help protect against certain types of credit card fraud, limiting a fraudster’s ability to use your details to open new accounts.

- Monitor your credit reports: Using a credit monitoring service or requesting a free copy of your credit report will help you spot irregularities like new accounts or credit cards that you don’t recognize. These are common signs that you’ve fallen victim to identity theft, prompting you to take action to mitigate credit score damage and financial losses.

Boost your credit card fraud protection

Taking steps to protect yourself against the risks of credit card fraud and other forms of identity theft is critical for your financial well-being. Subscribe to LifeLock Total for a range of features designed to help you safeguard your credit, including credit card activity alerts, three-bureau credit monitoring, and a daily credit report.

FAQs

What’s the difference between credit card fraud vs. identity theft?

Credit card fraud involves the unauthorized use of stolen credit card details. Meanwhile, identity theft is a broader term describing any situation where a criminal uses someone else’s personal information for illicit purposes. Some types of credit card fraud involve identity theft, but others, like using a stolen card to make purchases, don’t.

How does credit card fraud happen?

Credit card fraudsters can get access to the information they need to commit fraud by stealing your credit card, dumpster diving for statements, successfully phishing for your credit card details, or exploiting information that’s exposed in a data breach. They can then use this information to make purchases, rack up debt in your name, or open new accounts.

What are some warning signs of credit card fraud?

Warning signs of credit card fraud include unfamiliar transactions on your statements, changes to your credit card accounts that you don’t remember making, or new accounts being opened in your name. If you notice any of these signs or get an alert of suspicious activity from your credit monitoring service, investigate the issue and take action as soon as possible.

What happens when credit card fraud is reported?

After you submit a credit card fraud report, your card issuer may take several actions, including canceling or freezing the affected card, refunding fraudulent payments, and launching a full fraud investigation.

Can you go to jail for lying about credit card fraud?

Lying about credit card fraud is itself a form of fraud, and can result in criminal charges. You should only report fraud to your issuer, the FTC, and the police if you truly suspect you’ve been targeted by a fraudster.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.

-and-prevention-tips-thumb.jpg)