Last resort: Requesting a new Social Security number is uncommon, and the SSA only issues one in exceptional cases, such as ongoing identity theft or serious personal safety concerns. Having a new SSN may create complications or make it harder to prove your identity in the future.

Your Social Security number (SSN) is a critical piece of your identity and everything that comes with it. If someone else gets hold of it, they could use it to open accounts, apply for loans, and create financial headaches for you.

Ensure to investigate if you notice unusual signs that could signal someone else is using your SSN, such as unrecognizable credit accounts or unexpected mail.

If your SSN was compromised through a scam or data breach, your number could be part of a wider incident, as happened in the enormous National Public Data (NPD) breach that exposed 2.9 billion rows of data, including Social Security numbers.

The sooner you spot suspicious activity, the sooner you can take steps to protect your identity and minimize the damage. Here’s how to check if someone is using your SSN.

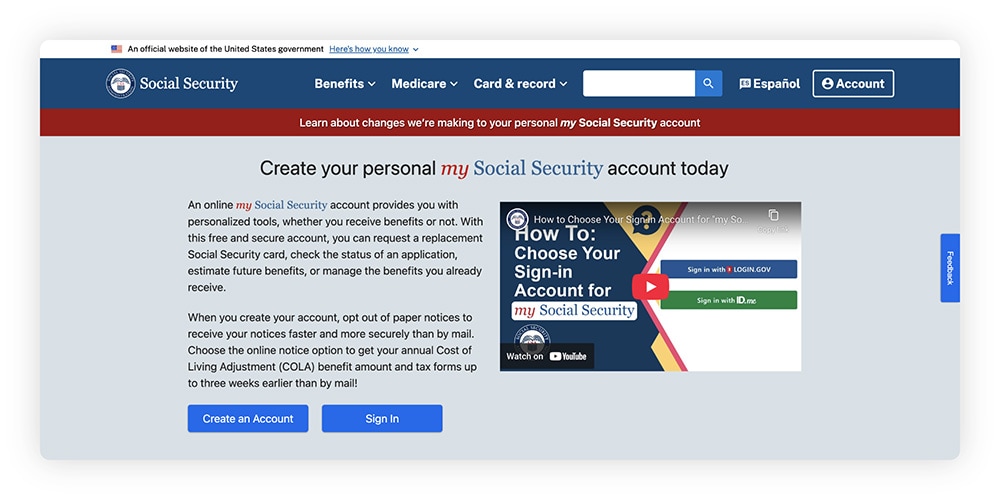

1. Verify your earnings in your Social Security statement

Sometimes, people may use a stolen SSN to get a job or claim government benefits in someone else’s name. Both situations can appear in your Social Security statement, which you can check online. Here’s how:

- Go to ssa.gov/myaccount and click Sign In, or select Create an Account if you don’t already have one. Note that you need an active Login.gov or ID.me account to access your information.

- Review your statement carefully, paying close attention to your earnings record, benefits, and taxes paid.

- If you see employers you don’t recognize, unexpected benefits, or incorrect earnings, contact the Social Security Administration at 1-800-772-1213.

2. Review your credit report for unfamiliar accounts

Your Social Security number is required to open new credit accounts or apply for loans, so reviewing your credit report is a smart way to see if someone else is using it. Look over your credit report for accounts you don’t recognize, like credit cards or loans you never opened, and take note of any hard inquiries you didn’t authorize.

If you’re unexpectedly being rejected for loans or credit, this could be a sign that someone is using your information, since fraudulent activity can cause your credit score to drop.

Checking your own credit report doesn’t lower your credit score, so you can review it as often as needed. Here’s how to check your credit report:

- Go to AnnualCreditReport.com.

- Request a free report from Experian®, Equifax®, and TransUnion®.

- Review each report carefully for unfamiliar accounts or inquiries.

- Keep a record of anything suspicious and follow up with the bureau if needed.

3. Monitor your bank statements for strange activity

Regularly review your bank statements and financial accounts for any unusual transactions, including unexpected purchases, withdrawals, transfers, or fees. When fraudsters get hold of your SSN, they often combine it with other sensitive data to gain unauthorized access to your accounts.

If you notice anything unusual, contact your financial institutions immediately to dispute the charges and take the next steps to secure your accounts.

4. Check your mail for unexpected bills or government notices

Junk mail isn’t just annoying — sometimes it’s the first sign of Social Security fraud. Fraudsters may open credit accounts, file taxes, or even get a job using your SSN, and the paper trail often shows up in your mailbox. Here are a few red flags to watch for:

- W-2 forms for income you didn't earn: This suggests an identity thief may have successfully used your SSN in a job application to carry out employment-related fraud.

- Bills from unfamiliar companies: These could indicate accounts opened in your name without your knowledge.

- Debt collection notices: These are especially concerning if you don't recognize the debt or the creditor.

If you receive any suspicious mail, don't ignore it and contact the sender for more information.

5. Scan the dark web for your SSN

The dark web houses many marketplaces where cybercriminals sometimes buy and sell stolen personal data, including passwords, credit card numbers, and SSNs. Conducting a dark web scan can help you determine if your SSN has been compromised and is being passed around by criminals.

While you can't remove your SSN from the dark web once it’s there, nor can you change it as easily as a password, knowing whether somebody exposed your information allows you to take action. If your SSN is found on the dark web, you’ll want to lock your SSN, freeze your credit, and sign up for ongoing dark web monitoring.

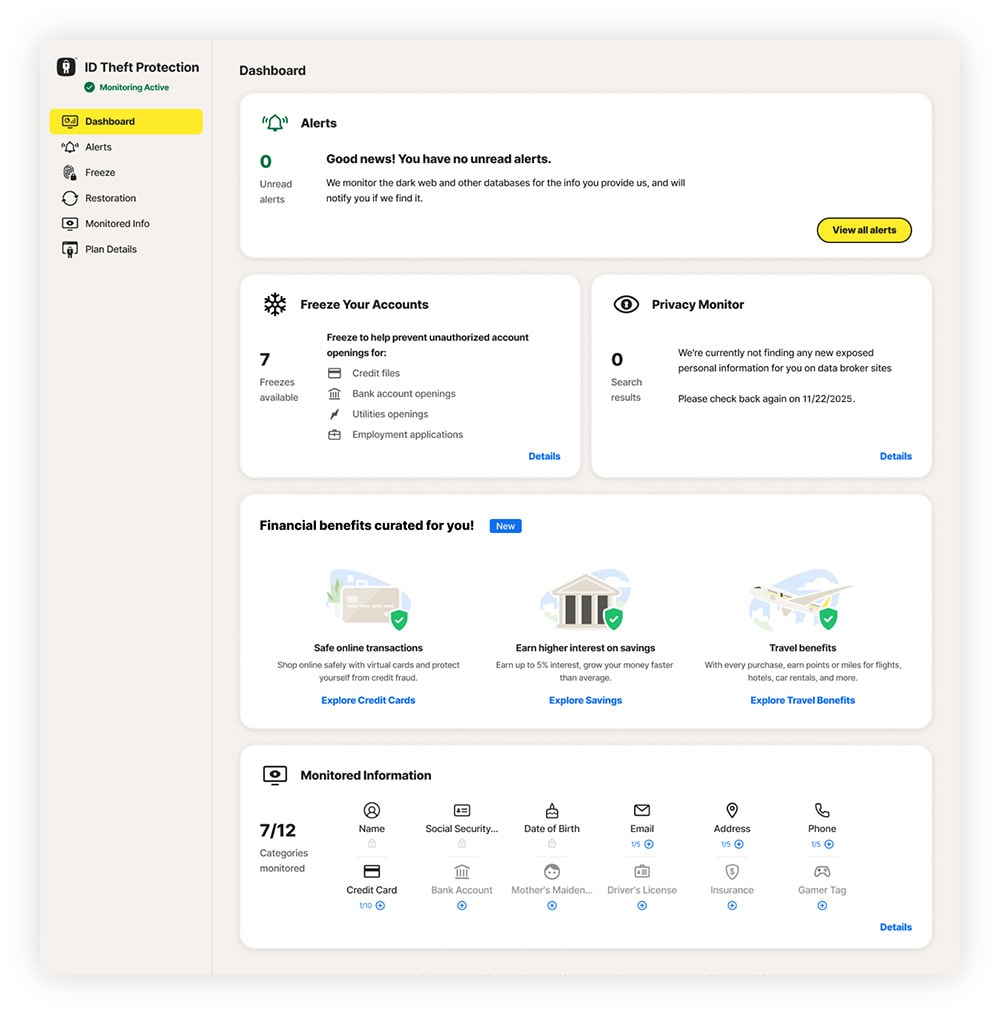

6. Sign up for an identity theft protection service

A trusted identity theft protection service can help keep an eye on your Social Security number and alert you to suspicious activity. LifeLock notifies you if someone uses your SSN, name, address, or date of birth in applications for credit services. It also monitors for other signs of identity theft, such as USPS address changes, so you can act quickly to help protect your identity from further misuse.

What to do if someone steals your Social Security number

If you know or suspect that someone has your Social Security number, it’s crucial to act quickly to protect yourself from further misuse. Steps like placing a credit freeze, locking your SSN, and reporting the incident to the proper authorities can help limit the fallout. These steps also create an important paper trail that could come in handy if more fraudulent activity occurs.

1. Lock your SSN with the SSA

Protecting your Social Security number with an SSA lock helps keep others from accessing and changing your Social Security records online. You can lock your SSN for free through the government’s E-Verify Self Lock tool:

- Go to e-verify.gov.

- Select Self Lock.

- Choose and answer three security questions that you’ll need later if you want to unlock your SSN.

You can also call the Social Security Administration at 1-800-772-1213 for help.

2. Request a credit freeze with the credit bureaus

Placing a credit freeze with the three credit bureaus — Experian, Equifax, and TransUnion — blocks lenders from accessing your credit file to approve new loans or accounts. This helps prevent identity theft since no one can open credit in your name while the freeze is in place, including you.

For example, if someone tries to apply for a new credit card using your information, the lender won’t be able to pull your credit unless you first lift the freeze.

Credit freezes are always free, and you’ll need to contact each bureau individually to set one up. Here’s how to contact each bureau to freeze your credit and help protect against Social Security number misuse:

Equifax |

Experian |

TransUnion |

|---|---|---|

1-888-378-4329 |

1-888-397-3742 |

1-800-916-8800 |

Equifax Information Services LLC |

Experian Security Freeze |

TransUnion Consumer Solutions |

Another option is to place a fraud alert, which encourages creditors or lenders to take additional steps to verify that it’s you applying for a new loan or credit card. You only need to place an alert with one of the three credit bureaus, and that bureau will contact the other two.

3. Report the identity theft to the FTC and IC3

When you report identity theft or that your SSN has been stolen your SSN has been stolen to the FTC and IC3, you may help insulate yourself from fraudulent activities undertaken in your name. You don’t want to be liable for fraudulent debt, and spreading the word about your identity theft can help mitigate damage.

How to report Social Security fraud to the FTC:

- Go to the FTC’s identity theft portal.

- Click Get Started and select the option that best reflects your situation.

- Follow the FTC’s personalized recovery plan. If you were the victim of ID theft, they also provide prewritten letters to send to the right parties to dispute damages.

If you’d rather speak to someone on the phone, call 1-877-FTC-HELP (1-877-382-4357).

How to report Social Security fraud to the IC3:

- Go to the IC3’s complaints page and click File a Complaint.

- The IC3 asks that you have the following information ready before you proceed: your address, email address, phone number, description of the incident, and any additional information requested in the form deemed relevant to your report.

- It will guide you through the remaining steps with on-screen instructions.

4. Notify your local police

Reporting Social Security fraud to the police can strengthen your case in certain instances. While the police don’t specialize in identity theft, they have access to information that can increase your chances of finding the culprit who committed fraud.

Here’s what you should do when reporting Social Security fraud to the police:

- Gather materials, like your FTC report, valid ID, and proof of address.

- File a police report. How to do this will depend on your local police department.

- Keep a copy of your police report.

5. Contact the IRS

Contact the IRS and tell them your SSN has been stolen. In one of the most nefarious tax scams, criminals can use your SSN to file and claim your tax return. If your SSN has been used fraudulently for taxes, you may need to file IRS Form 14039 to report identity theft and protect your tax record.

6. Send a letter to debt collectors

You have the right to block contact with debt collectors regarding debts that you don’t owe. The FTC provides a sample letter on page 25 of the recovery guidance document. You’ll need to provide some evidence, like your FTC identity theft report.

7. Regularly monitor your accounts

When someone has your SSN, they could open credit accounts in your name, leading to unexpected debt and negatively affecting your credit score. Keeping a close eye on your credit report helps you catch any unusual activity early.

If staying on top of it feels overwhelming, a credit monitoring service can track your reports and alert you to important changes, giving you peace of mind and more control over your identity.

Monitor your SSN for fraudulent use

No matter how careful you are, you can still fall victim to identity theft. Many businesses and institutions have your Social Security number on file, and it only takes one of them to get hit with a cyberattack or data breach for that information to get out, along with your name and other personal information.

LifeLock offers various identity theft protection tools and services, including monitoring your Social Security number for signs of fraudulent use. We’ll also support you if your wallet is stolen by helping you cancel or replace your Social Security card, credit cards, and more. Get LifeLock as your first line of defense against identity theft.

FAQs

Should I be worried if someone has my Social Security number?

Yes, if someone has your Social Security number and other personal details, they could use it to open credit accounts or apply for jobs in your name. This can lead to lasting effects of identity theft, affecting your credit, employment history, and making it harder to get loans, buy a home, or take advantage of other financial opportunities in the future.

Can I put an alert on my Social Security number?

Yes, you can set up credit alerts via the three credit bureaus. LifeLock also includes Social Security number alerts that notify you of suspicious activity linked to your SSN.

How can Social Security identity theft occur?

Social Security identity theft happens when someone gets hold of your SSN, through social engineering scams, data breaches, or stolen mail, and uses it to commit fraud in your name. This can include opening credit accounts, filing false tax returns, or applying for government benefits.

Can someone steal my identity with the last four digits of my SSN?

Yes, organizations use the last four digits of your SSN to verify your identity. If someone has these digits along with other personally identifiable information used in the verification process, they could potentially use it to commit identity theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Verify your earnings in your Social Security statement

- 2. Review your credit report for unfamiliar accounts

- 3. Monitor your bank statements for strange activity

- 4. Check your mail for unexpected bills or government notices

- 5. Scan the dark web for your SSN

- 6. Sign up for an identity theft protection service

- What to do if someone steals your Social Security number

- Monitor your SSN for fraudulent use

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.