Simply checking your credit score won’t lower it, but if a credit card provider, mortgage lender, or other creditor checks your report, your score can take a slight dip depending on the circumstances. We'll explore how certain types of credit checks can affect your score for the worse so you can plan to avoid them.

How credit checks affect your score

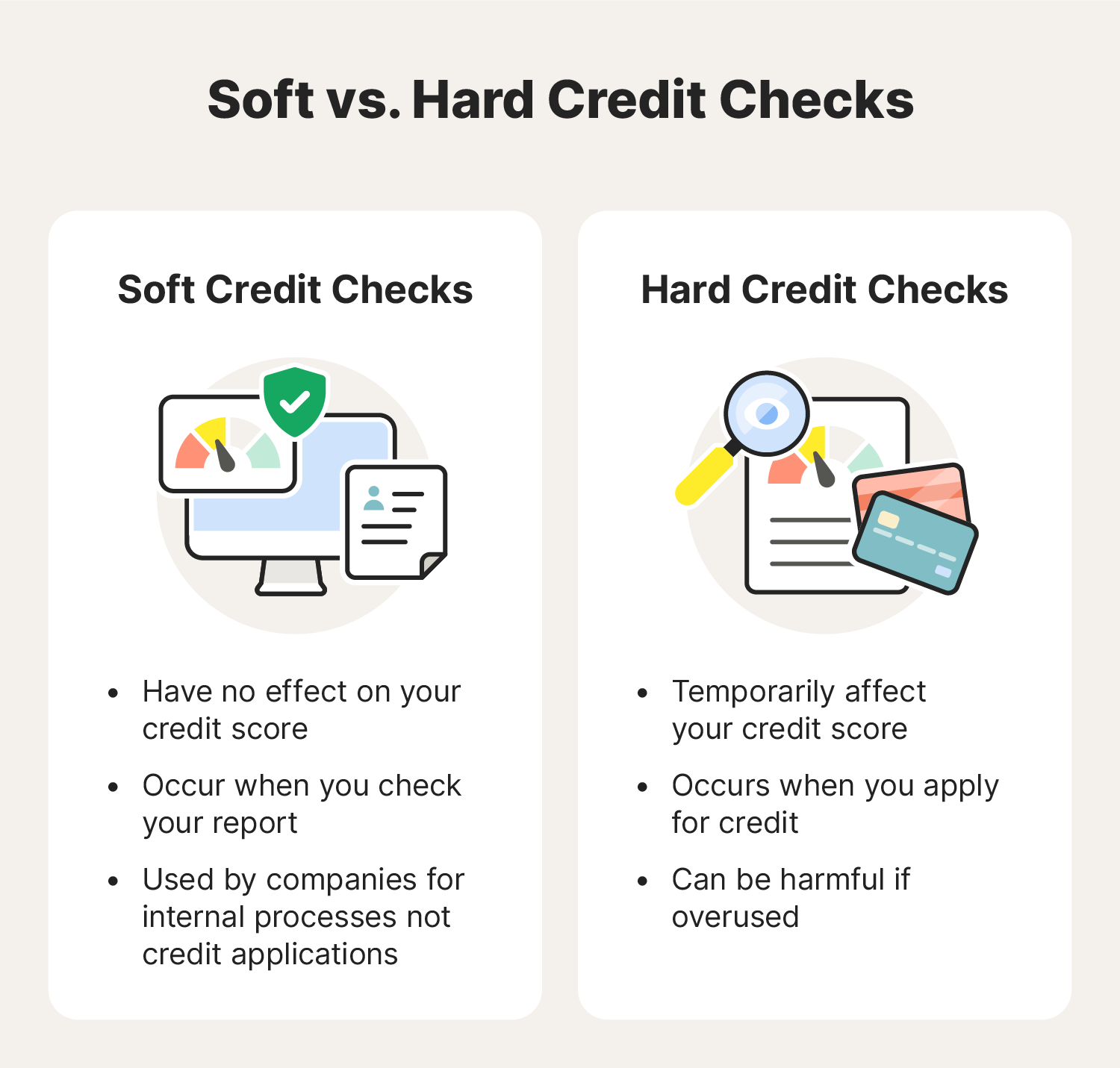

There are different types of credit checks, and not all impact your score—it depends on whether they're considered a hard or soft inquiry. While so-called “soft inquiries” don't affect your score, “hard inquiries” can lower your credit score temporarily.

What is a hard credit check?

A hard credit check, also known as a “hard inquiry” or a “hard pull,” occurs when a lender or credit card issuer checks your credit report and score after you apply for a loan or credit card. This type of inquiry can cause your credit score to drop temporarily.

Accumulating multiple hard inquiries within a short time frame can further negatively impact your score, because this might signal to lenders that you are seeking to take on significant debt, potentially raising concerns about your ability to manage payments responsibly.

What is a soft credit check?

A soft credit check, also known as a “soft inquiry” or “soft pull,” happens when you check your credit score through a credit monitoring service or with one or all of the three national credit bureaus. Soft credit checks don’t impact your credit score.

A credit check is also considered a soft inquiry if a lender or credit card provider checks your report when looking to pre-approve you—if you proceed to full approval, then a hard inquiry happens. Other examples of soft inquiries are employment background checks, rental checks, and insurers assessing risk when providing quotes.

How to check your credit score without lowering it

Requesting or checking your own credit score or report will never result in a hard inquiry, only a soft one. Here are several ways to check your credit score:

- Check your financial statements: Many financial institutions provide credit scores for customers. Check your credit card and bank statements or loan statements to see if your credit score is included.

- Purchase your score: You can request your score directly from one of the credit bureaus or a provider like FICO®, for a fee.

- Use a credit monitoring service: Subscribe to LifeLock and check your score daily for free. It also provides credit monitoring services and identity theft protection, helping to keep your finances and identity safer.

4 Factors that can lower your credit score

While checking your credit score can’t lower it, other factors do have a big impact. And since a higher credit score provides you with more financial opportunities for everything from housing to credit cards and auto loans, it’s important to manage your score carefully.

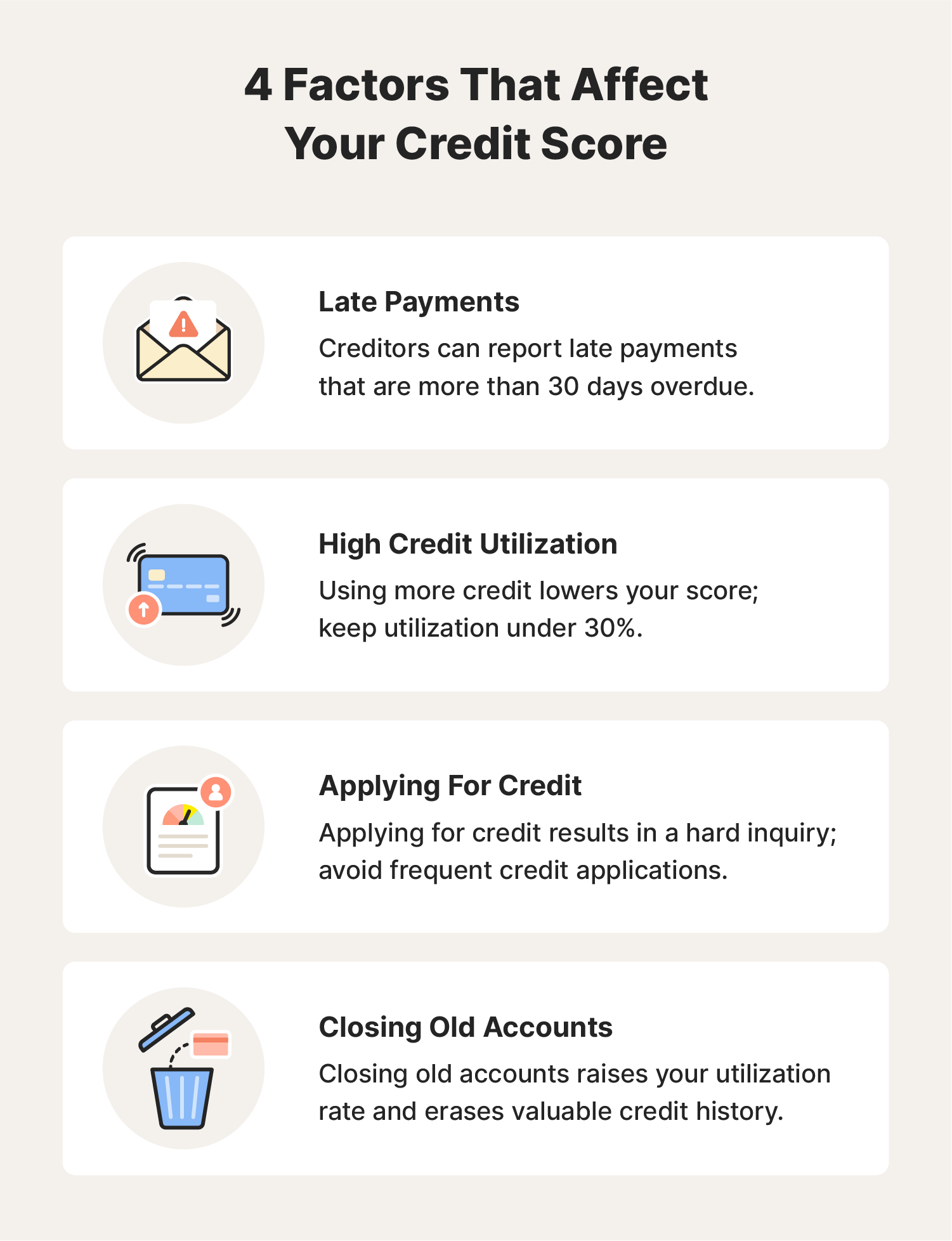

Here are four factors that can affect your credit score:

1. Late payments

A late payment is the most significant factor that impacts your credit score. Late payments can only be reported to credit bureaus after 30 days, but their effect on your score worsens the longer it remains overdue. To keep your score in line, ensure that your payments are made on time, and settle overdue payments as soon as possible.

2. High credit utilization

Another major factor affecting your credit score is your credit utilization; the proportion of available credit you use. For example, using $3,000 of $10,000 in available credit results in a 30% credit utilization rate. The more credit you utilize, the more negatively it will affect your score. Try and keep your credit utilization below 30%, and under 10% for the best improvement to your score.

3. Applying for credit

When you apply for a new line of credit, a hard inquiry is placed on your report. This typically lowers your score for one year. If you apply for multiple lines of credit at once, a cascade of hard inquiries can have a more substantial negative impact on your score, so try and avoid this scenario if possible.

4. Closing old accounts

Closing old accounts can impact your credit history and utilization rate. Since the length of your credit history counts toward your credit score, closing your oldest account will shorten your average account age. Closing accounts also reduces your total available credit, increasing your utilization rate. If you have an old account you don’t use, consider leaving it open.

Tips to improve your credit score

If you have a good credit score, you’re more likely to be granted credit and obtain a favorable interest rate. If your score is on the lower side, you should start taking active steps toward raising it.

Here are some ways you can improve your credit score:

- Make payments on time: It all starts with making payments on time; at the very least pay them before they reach 30 days overdue.

- Diversify your credit mix: Aim for different types of credit like credit cards, auto loans, home equity loans, etc., but don’t overextend yourself.

- Check your report for errors: Inaccuracies on your report or fraudulent items can harm your score so dispute any errors as soon as you find them.

- Keep your credit utilization low: Aim to keep your credit utilization under 30% (the lower the better). You may need to open new lines of credit or increase your credit limits.

- Keep old accounts open: Old accounts show you have a credit history and aid your utilization score—keep them open even if you don’t use them.

- Become an authorized user: Becoming an authorized user on a responsible user’s credit card is a good way to improve your score.

- Limit hard inquiries: Don’t apply for new credit accounts unless you have to, and try to avoid too many applications simultaneously.

- Get credit for your bills: You can get credit for some of your bills like utilities and rent for free using Experian Boost.

Protect your credit score with LifeLock

If you care about your future, you care about your credit score. Identity theft can quickly destroy the credit score you’ve spent years building. Use a service like LifeLock that helps you protect your personal information against fraudulent use as well as monitor your credit score to catch changes more quickly.

Your credit score is key to your future and the important financial decisions you make in life. LifeLock is a powerful identity theft protection service with smart credit monitoring features to help you check your credit to ensure your score is where you need it to be.

FAQs

You've asked the question, does checking your credit score lower it? But, you may have additional questions about the credit score process.

How often should you check your credit score?

The major credit bureaus update scores at least once a month. The more often you check your credit score, the faster you can find any discrepancies. If someone has used your credit, you can place a fraud alert sooner and help mitigate further damage.

Does checking your credit score look bad?

No, checking your credit score or report doesn’t look bad. You should regularly monitor your report to check that it’s accurate and free of fraud. When you check your credit report, a soft inquiry is made, which doesn’t affect your score.

Are there side effects to checking your credit score?

No, there are no harmful side effects to checking your credit score. When you check your credit score without pulling your credit report, it doesn’t even trigger a soft inquiry. Checking your credit report leads to a soft inquiry, but this doesn’t impact your credit score either.

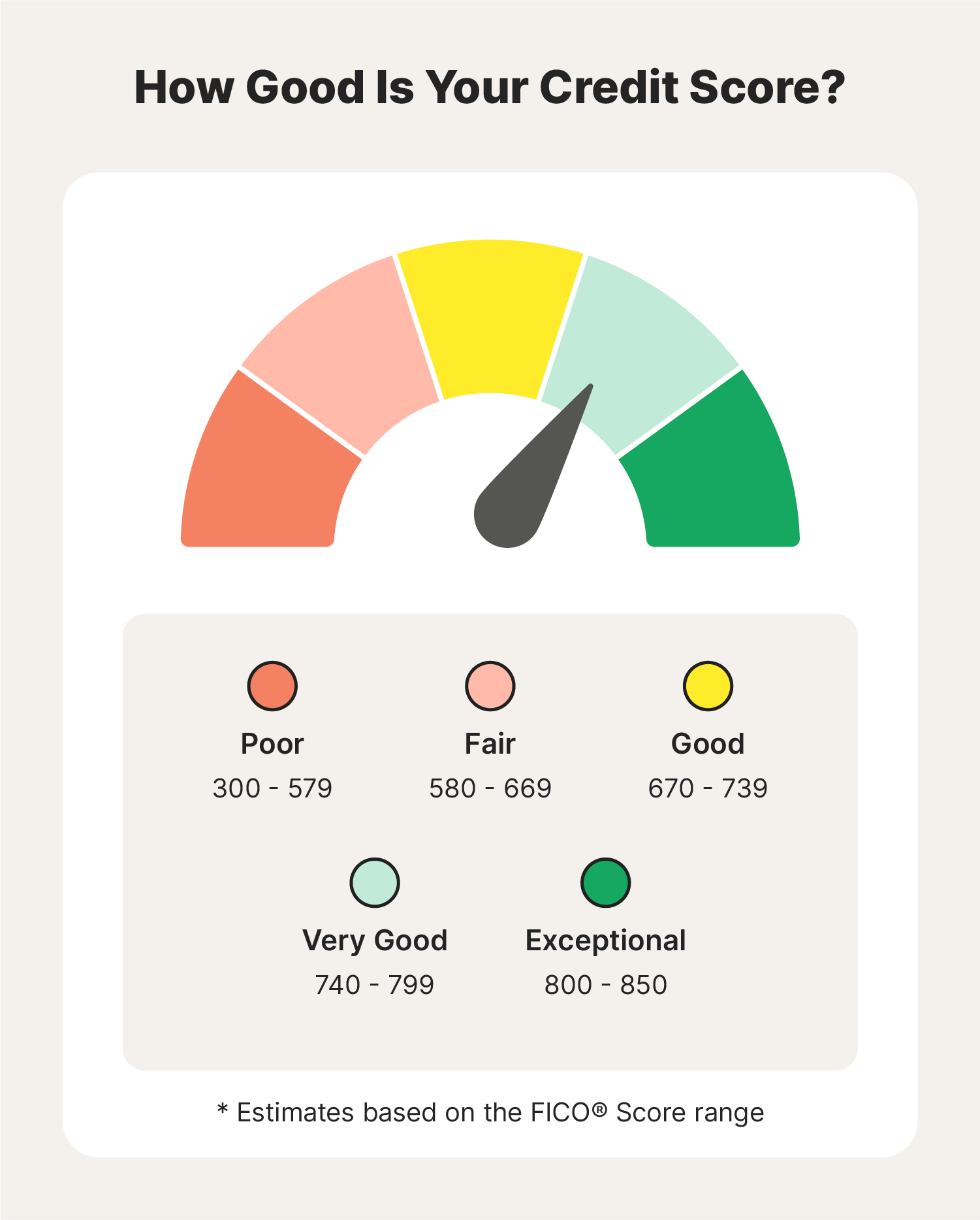

What is a good credit score?

A good FICO credit score falls between 670 and 739, very good is between 740 and 799, and exceptional is between 800 and 850. The better your credit score, the better your chances of being approved for a loan or credit card, and it may provide you with lower interest rates.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.