Your credit score isn’t a static number — it changes based on recent activity like your payment history, new credit applications, and credit limit adjustments. While small fluctuations are normal and mostly harmless, a significant drop could limit your borrowing options and increase your interest rates, costing you over time.

But credit scores don’t drop for no reason, and understanding what caused a decrease can help you recover and avoid similar dips in the future. This guide covers 11 common reasons for a credit score drop and useful tips for how to fix them.

1. You have missed or late payments

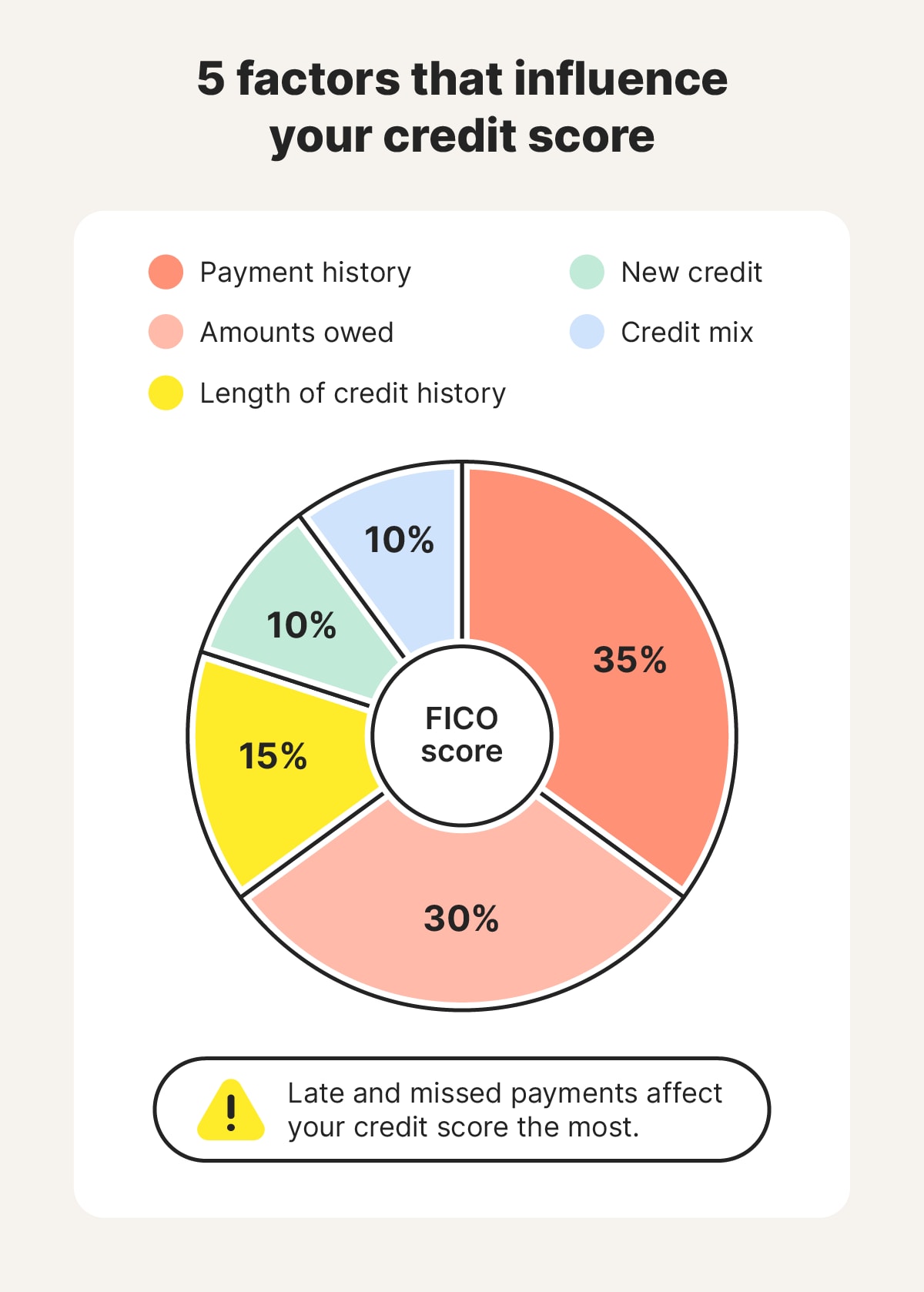

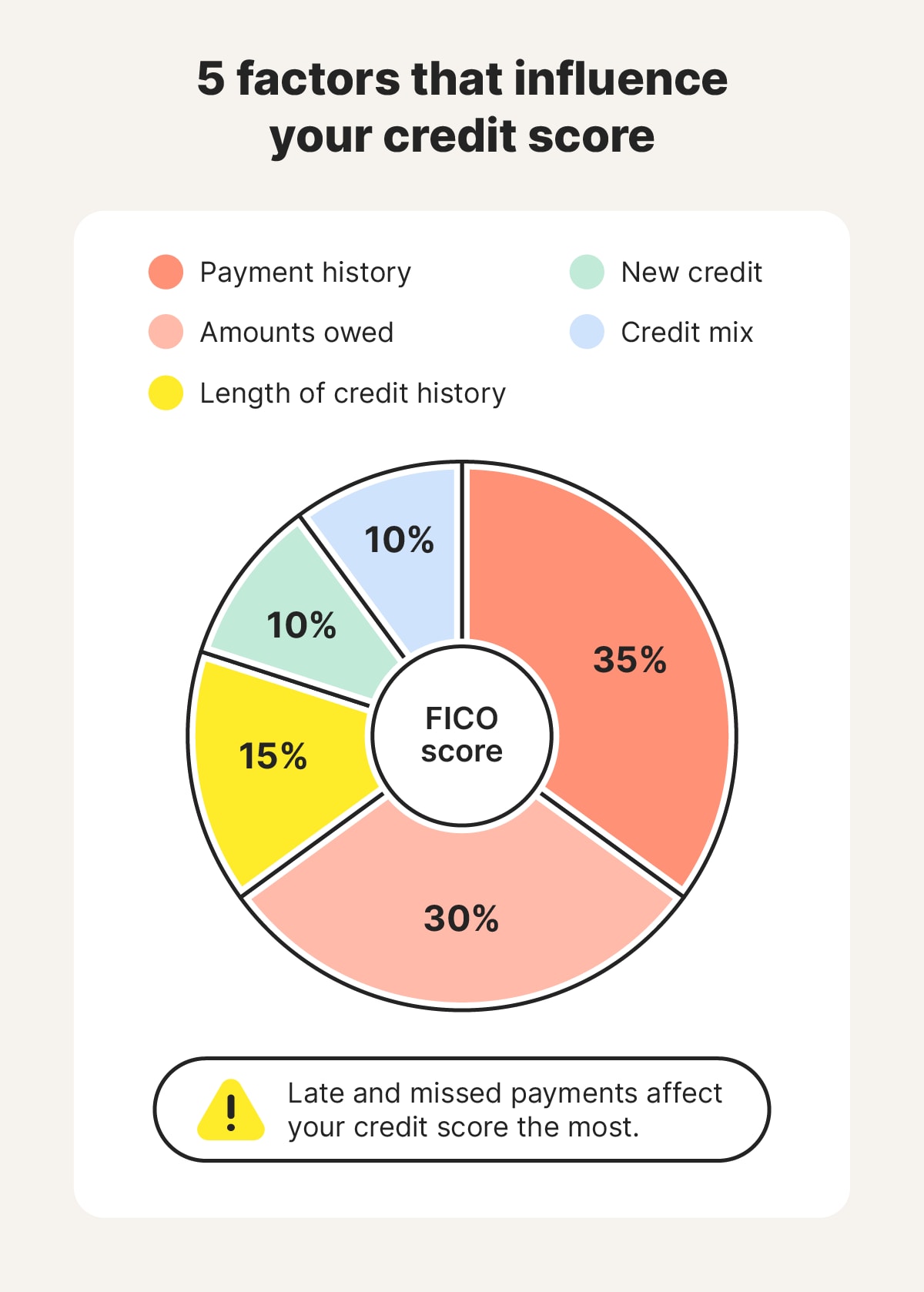

Payment history is the most significant factor that affects your credit score, making up 35% of your FICO® score, for example. That means it’s one of the most likely reasons for a credit score drop, with a single missed or late payment able to cause a relatively significant decrease.

Generally, the later the payment, the greater the impact on your score. Lenders usually classify late payments as:

- 30 days past due

- 60 days past due

- 90 days past due

- 120 days past due

- 150 days past due

- Charge-off (when debt is so far past due that it’s written off)

As you can probably guess, a 150-day late payment hurts your score more than a 30-day one. According to the VantageScore guide, you could see a 30 to 90-point drop from a single 30-day late credit payment and a 45 to 130-point drop from a charge-off, although the exact amount varies based on your specific credit profile.

2. You’re using a high percentage of your available credit

Your credit utilization, or the amount of your total available credit that you’re using, is responsible for 30% of your score according to the FICO model. High credit utilization can hurt your credit score, as lenders may see it as a sign of dependency on debt or financial instability, which could make you a risky borrower.

Financial experts generally recommend keeping your credit utilization ratio below 30% to show that you’re using credit responsibly without overspending. However, credit utilization of 0% can also have a negative impact on your score, so the ideal ratio is between 1% and 30%.

To calculate your utilization ratio, add all of your revolving credit balances together and divide the result by the sum of your credit limits. For example, if you only have two credit accounts with a combined credit limit of $5,000 and your current balance across both accounts is $500, your credit utilization ratio is 10%.

3. You closed an old account

Closing an old account can lower your credit score by impacting two key factors: credit utilization and length of credit history.

The first factor is affected by the decrease in your total available credit caused by closing an account. With less available credit but the same amount of utilization, your credit utilization ratio will increase.

For example, if you have two credit cards, each with a $2,000 limit but with a total combined balance of $1,000, your utilization is 25%. If you close one card and have a $1,000 balance on the remaining one, your ratio jumps to 50%, which can hurt your score.

The second factor is relevant because lenders generally favor a long credit history — and the data that comes with it — when assessing creditworthiness to generate a credit score. There are several sub-factors that contribute to your length of credit history in the FICO model, including:

- The age of your accounts, including the oldest, newest, and average

- The amount of time specific accounts have been open

- The amount of time since you last used certain accounts

Closing any account can lower your credit score, but closing your oldest account can have a doubly negative impact since it might significantly decrease the average age of your credit accounts. Fortunately, any score drop after closing an old account is usually temporary, and your credit can bounce back in just a few months.

4. Your credit limit decreased

A reduction in your credit limit can increase your credit utilization ratio, which may negatively impact your credit score. For example, if your credit limit is $4,000 and your balance is $1,000, your utilization is 25%. But if your issuer drops your credit limit to $2,000, that same balance now pushes your utilization to 50%, which can hurt your credit score.

Credit card issuers may lower your credit limit for a number of reasons, including:

- Inactivity: If you rarely use your card or don’t use it at all, your credit card issuer may reduce your limit.

- High credit utilization: Consistently carrying high balances signals to lenders that you might be under financial strain.

- Missed or late payments: Lenders also consider missing due dates to be a sign of increased risk.

- Economic turmoil: Lenders may lower limits during an economic downturn to protect themselves from delinquencies.

If your credit limit was reduced, contact your issuer to understand why and request they restore it, if possible.

5. You applied for new credit

Applying for new credit triggers a hard inquiry, where the lender pulls a full copy of your credit file to assess your eligibility. This can cause a minor drop in your score, typically less than five points. While this is only a small decrease, it can add up if you make lots of new applications.

However, credit scoring models offer a rate shopping window, allowing multiple hard inquiries for the same type of credit within a specific timeframe to count as a single inquiry. FICO scores typically offer a 45-day rate shopping window, while VantageScore uses 14 days. This allows you to shop around for the best option while minimizing the impact on your credit score.

It’s also important to note that checking your own credit score is considered a soft inquiry, and won’t impact it. This is the key difference between a soft and hard credit check.

6. You cosigned a loan or credit card application

Cosigning a loan or credit card involves agreeing to take equal responsibility for someone else’s debt. This can help people with low or non-existent credit scores get access to credit, but it also means that your credit score may be affected if the credit is managed poorly.

While cosigning a loan or credit card doesn’t directly impact your credit score, you may see a drop if the primary borrower makes late payments or defaults on the loan.

Cosigning may also be seen by lenders as increasing your total debt, raising your credit utilization ratio. Before cosigning an application for a friend or family member, make sure you consider the impact it could have on your credit score.

7. You paid off debt

While paying off a loan or credit card is generally a positive step, you may notice an initial dip in your credit score. This is because it affects key factors like your credit mix, length of credit history, and credit utilization.

For example, paying off installment-based credit, like an auto loan, may leave you with only revolving credit (like credit cards), reducing the diversity of your credit mix. Additionally, closing an old credit card after paying it off can shorten your length of credit history and decrease your credit utilization to 0% if it’s your only form of debt, impacting your score.

Despite the potential for a short-term dip, paying off debt is an indicator of financial responsibility and can benefit your credit score over the long term. To minimize the negative impact, consider keeping older credit accounts open even when their balance drops to zero to preserve your credit history and credit mix.

8. Your debt went to collections

If you fall significantly behind on a loan and the lender sells it to a collection agency, your credit score will likely take a hit. Depending on your starting score, the drop you experience from a debt going to collections could be anywhere from 50 to 150 points.

Lenders typically send delinquent credit accounts to collections when a payment is 180 days overdue. Once that happens, the account is marked as “in collections” on your credit report and stays there for seven years from the date of the first missed payment.

If your debt is sent to collections, you can send a "pay for delete" letter, offering to pay the debt in exchange for removing the negative mark from your credit report, which could potentially improve your credit score. However, remember that collection agencies aren’t legally required to negotiate, so this option doesn’t guarantee success.

9. There’s an error on your credit report

A sudden drop in your credit score could be due to an error in your credit report. For instance, a creditor might have mistakenly reported an on-time payment as late, or fraudulent activity could result in inaccurate information on your credit report.

If you spot an error on your credit report, file a dispute with the credit bureau to have it corrected as soon as possible. The investigation typically takes up to 30 days, with an additional 30 days for your credit score to reflect any changes.

10. Your credit report has a derogatory mark

A derogatory mark is a negative item on your credit report that signals increased risk to lenders and can cause a substantial fall in your credit score. Late payments and accounts sent to collections are two of the most common derogatory marks, but others that can appear on your credit report include:

- Charge-offs: Debts that creditors write off as a loss due to missed payments.

- Foreclosure: When a lender seizes a home due to missed mortgage payments.

- Repossession: When a lender seizes an asset, such as a car, because of missed payments.

- Bankruptcy: A legal process for individuals who can’t pay their debts.

The impact of a derogatory mark varies, but bankruptcy can cause a whopping 100-200 point drop, or even more in unique cases. Most derogatory marks remain on your credit report for seven to 10 years. However, their impact on your score lessens over time, and you can rebuild your credit by managing your finances responsibly.

11. You’re a victim of identity theft

If your credit score is going down and none of the above potential reasons explain it, you may have fallen victim to identity theft. If someone is using your identity to open credit accounts in your name and rack up debt, you’ll feel the impact on your credit score.

To check for potential identity theft, request credit reports from all three major bureaus and carefully review them for unfamiliar accounts or hard inquiries. Credit monitoring features like those offered with a LifeLock membership can also help alert you to potential credit fraud automatically, so you can work on protecting yourself and your score.

If you’ve been a victim of identity theft, take these steps to start repairing your credit:

- Place a fraud alert on your credit report to prompt lenders to verify your identity before issuing credit in your name.

- Close unauthorized accounts opened in your name by contacting the financial institution and informing them of the fraud.

- Report the theft to the Federal Trade Commission at ReportFraud.ftc.gov.

- Dispute fraudulent information with the credit bureaus by contacting each one directly online, by phone, or by mail.

How to fix your credit score after a drop

A credit score drop isn’t permanent, and you can take steps to rebuild it. By following general best practices to build your credit score, like paying bills on time, optimizing your utilization ratio, and limiting the number of hard inquiries you make, you should be able to fuel reliable, long-term credit score growth.

Here’s some more detail on how you can work on improving your score:

- Pay your bills on time: Late and missed payments can significantly hurt your credit, so set up automatic payments or reminders to maintain a good score.

- Optimize your credit utilization ratio: Aim to keep your credit utilization below 30% — generally speaking, the lower your balances, the better it is for your credit score.

- Request a credit limit increase: A higher credit limit can help lower your credit utilization ratio, so consider pursuing an increase if you get a pay rise.

- Dispute credit report inaccuracies: If you notice errors on your credit report that could be negatively affecting your score, dispute them with the credit bureaus.

- Limit hard inquiries: Only apply for new credit when necessary to limit the number of hard inquiries. As a rule of thumb, you should wait six months between new credit applications to mitigate the effect on your score.

- Consider expanding your credit mix: Diversifying the types of credit you have, including both revolving facilities like credit cards and installment-based debt like loans, can help your score.

- Pay off collections: Most scoring models don’t decrease your score if you pay off any debts that have gone to collections, so prioritize settling overdue debt to remove the derogatory mark from your report.

Don’t let identity theft sink your score

Credit score drops might seem to come out of nowhere, but understanding the key factors that contribute to your score can help you mitigate them in the future.

If you’re serious about protecting your credit score, join LifeLock for credit monitoring features and identity theft alerts. They could help you spot the signs of fraud early so you can take steps to avoid serious, long-lasting damage.

FAQs

Why did my credit score go down when I paid everything on time?

Even if you pay your bills on time, your credit score could drop for a number of reasons, including high credit utilization, an old account closing, or inaccuracies on your credit report.

Why did my credit score drop after paying off a loan?

Your credit score may drop after you pay off a loan because it affects your credit mix, shortens your credit history, and increases your credit utilization ratio. However, the lower debt may still benefit your score in the long term.

How many points does your credit score drop with a hard inquiry?

While the number of points your credit score drops with a hard inquiry varies based on your specific credit file, it usually results in a decrease of less than five points.

Does checking your credit score lower it?

No, checking your credit score does not lower it, as that's considered a soft inquiry. Only hard inquiries, typically carried out by lenders making a decision on your creditworthiness, affect your credit score.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. You have missed or late payments

- 2. You’re using a high percentage of your available credit

- 3. You closed an old account

- 4. Your credit limit decreased

- 5. You applied for new credit

- 6. You cosigned a loan or credit card application

- 7. You paid off debt

- 8. Your debt went to collections

- 9. There’s an error on your credit report

- 10. Your credit report has a derogatory mark

- 11. You’re a victim of identity theft

- How to fix your credit score after a drop

- Don’t let identity theft sink your score

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.