If your lost card ends up in the hands of scammers or cybercriminals, they gain access to your Social Security number and can cause significant damage.

Armed with your Social Security number, criminals can take out loans or open credit card accounts in your name. They might access your online bank or credit card accounts, using your funds to buy electronics, expensive restaurant meals, hotel stays, and whatever else they desire.

Some might even use your Social Security number to file an income tax return in your name and nab any tax refund you were due. Others may sell your Social Security number to bidders on the dark web.

What matters most is helping to protect yourself from potential identity theft. Yes, you can order a replacement card, but your priority should be to block criminals from using your Social Security number to create trouble in your financial life.

How can I help protect myself if I lose my Social Security card?

Fortunately, there are steps you can take to help prevent damage thieves can cause even if they have stolen your Social Security number.

Follow the steps below for help with protection from identity theft.

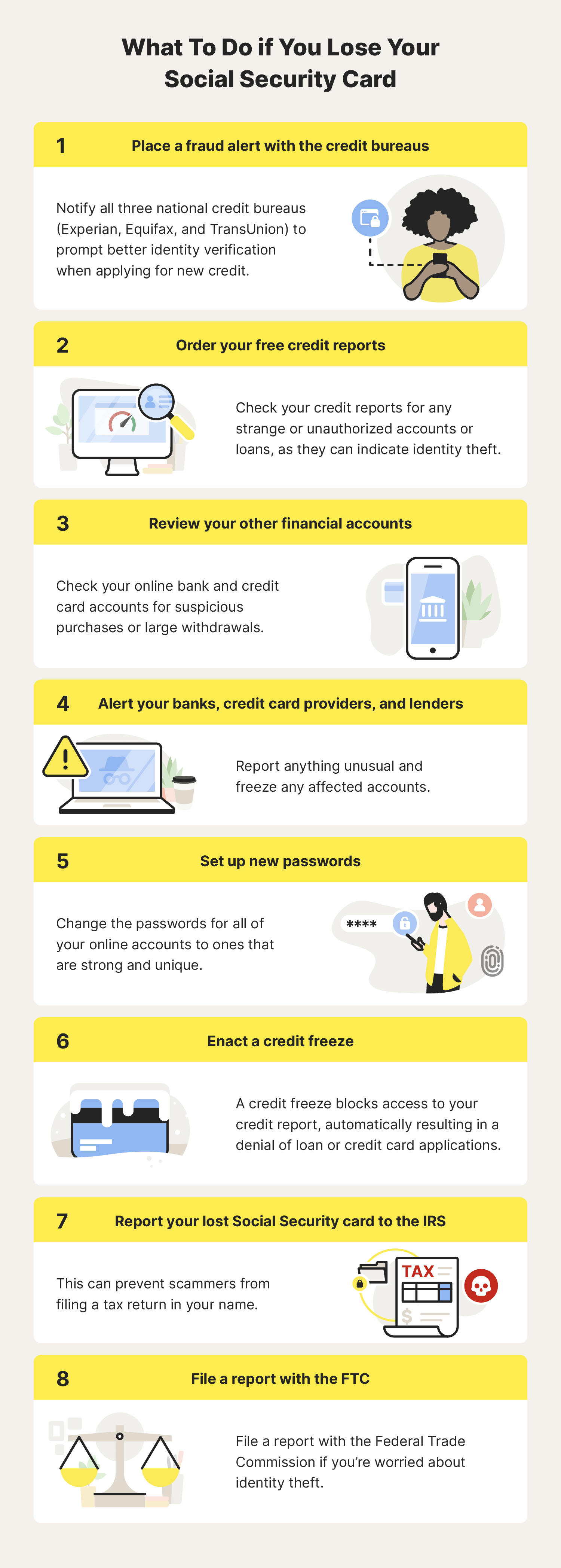

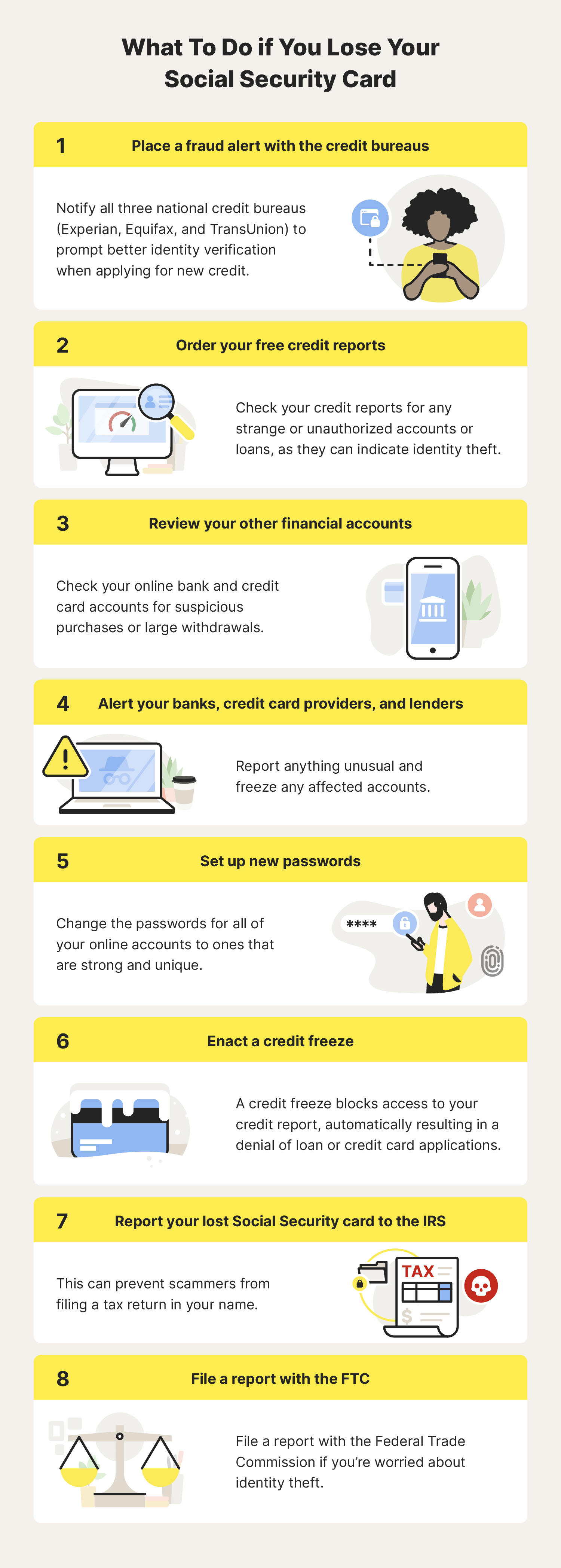

1. Place a fraud alert with the credit bureaus

Placing a fraud alert with the three national credit bureaus— Experian, Equifax, and TransUnion—encourages creditors or lenders to take additional steps to verify that it is you applying for a new loan or credit card and not someone pretending to be you.

For example, if someone applies for a new credit card in your name, the credit card company may call you at the number you provide. You can then verify if you have applied for the card or if someone is trying to fraudulently open an account in your name.

You only need to place an alert with one of the three credit bureaus, and that bureau will contact the other two. Your fraud alert will remain attached to your credit file for one year. You have the option to renew the alert after the one-year period ends.

Best of all, it’s free to place a fraud alert. You can contact the bureaus here to place an alert on your credit files:

2. Order your free credit reports

You want to identify the signs of identity theft as soon as possible. If you lose your Social Security card, you should order copies of your free credit reports—one each maintained by Equifax, Experian, and TransUnion—from AnnualCreditReport.com.

Typically, you’re allowed to order one free report from each bureau every year. Due to economic uncertainty post-COVID-19, you can order one report at no charge from each bureau every week. This makes it even easier to monitor your credit reports for suspicious activity.

Once you get your reports, check them for any credit card accounts or loans you know you never opened. Strange accounts on your credit reports are a sign that someone is using your identity.

3. Review your other financial accounts

It’s important to check your online bank and credit card accounts for suspicious purchases or large withdrawals, as criminals might have used your Social Security number to access these accounts. If you’re particularly worried about identity theft, consider checking these online accounts daily for suspicious activity.

4. Alert your banks, credit card providers, and lenders

If you spot anything unusual on your credit reports, bank accounts, or credit card accounts, contact the bank, financial institution, or lender connected to these accounts.

Explain that you recently lost your Social Security card and you suspect that a criminal is using your Social Security number to make purchases in your name, take out fraudulent loans, or open credit card accounts using your information.

Remember, you are not responsible for these fraudulent purchases, but you must report them. Ask your bank or credit card provider to close your cards and bank accounts to stop any additional purchases or withdrawals.

5. Set up new passwords

The next thing you’ll want to do if you lose your Social Security card is change the passwords on your online accounts. You want to make it as difficult as possible for an identity thief to access those accounts, and protecting them with strong passwords is an easy step to take.

6. Enact a credit freeze

You can gain additional protection from scammers by freezing your credit with the three credit bureaus. A freeze prevents lenders, credit card providers, and other creditors from accessing your credit report, even when you (or someone else using your name) applies for a new loan or credit card.

Because creditors and lenders can’t access your credit, they’ll automatically deny any requests for a loan or new credit card. This stops identity thieves from opening new accounts in your name.

Of course, there are some inconveniences attached to credit freezes:

- If you do want to apply for a loan or credit card, you’ll have to unfreeze your credit.

- Fortunately, both freezing and unfreezing your credit is free, though you must freeze or unfreeze your credit with all three bureaus.

You can initiate a credit freeze with the three bureaus here:

7. Report your lost Social Security card to the IRS

What happens if you lose your Social Security card and someone files a tax return in your name? They might be able to steal your income tax return and possibly cheat you out of thousands of dollars.

Reporting your stolen Social Security card to the IRS can prevent scammers from filing a tax return in your name. For more information, read about identity protection from the IRS.

8. File a report with the FTC

You should also file a report with the Federal Trade Commission (FTC) if you’ve lost your Social Security number and you’re worried about identity theft.

How to get a new Social Security card

Once you’ve taken the steps to protect yourself from identity theft, you can move on to ordering a replacement Social Security card. Fortunately, doing this is a relatively easy process.

Do it online: You are able to order a replacement Social Security card online. To do so, you'll need to set up an account.

Prove your identity: If you can't request a new card online, you'll need to bring certain documents to your local Social Security office. You must bring either original documents or copies certified by the agency that issued them. Social Security agents can't accept photocopies of these documents or notarized copies.

You'll need to prove your identity by providing your U.S. driver's license, state-issued non-driver identification card, or U.S. passport. The Social Security Administration has a helpful list of the documents you might need.

Foreign-born citizens: If you are a foreign-born U.S. citizen, you might need to bring proof of your citizenship. Acceptable documents include your U.S. passport, Certificate of Naturalization, Certificate of Citizenship, Certificate of Report of Birth, or Consular Report of Birth Abroad.

How to apply for a new SSN card: You can apply in person for your new card at any Social Security office.

How long the process takes: Though it varies, you can expect to receive your new Social Security card within seven to 10 business days.

Do I really need a new Social Security card?

Before ordering a new card, you might want to consider whether you need one. You’ll rarely need to show your Social Security card to anyone. You might have to provide your Social Security number, but you don’t need your physical card to do this.

Keep in mind that you aren’t guaranteed an unlimited supply of Social Security cards—you can request a maximum of three replacement Social Security cards a year, and 10 over your lifetime.

If you do get a new card, be extra careful with it. Don’t put it in your wallet where you might lose it again. Instead, keep it at home in a safe place. And, for an added layer of protection, subscribe to LifeLock to get alerts if we spot your SSN in potentially fraudulent applications for credit or services.

FAQs about what happens if you lose your social security card

Read along to learn the answers to some common questions surrounding what happens if you lose your social security card.

Do you need to worry if you lose your Social Security card?

Yes! You don’t want your SSN card to get into the hands of a criminal who could steal your identity. It’s crucial to set up a fraud alert with the credit bureaus to flag any suspicious activity.

Can someone steal your identity if you lose your Social Security card?

Yes, anyone can steal your identity if you lose your Social Security card because you’re providing them with the information they need to open new accounts, receive fraudulent tax refunds, take out loans, and much more.

Can you put a freeze on your Social Security number?

You can lock your Social Security number. Using the government’s e-Verify system, you can prevent others from using your SSN to verify their identity.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.