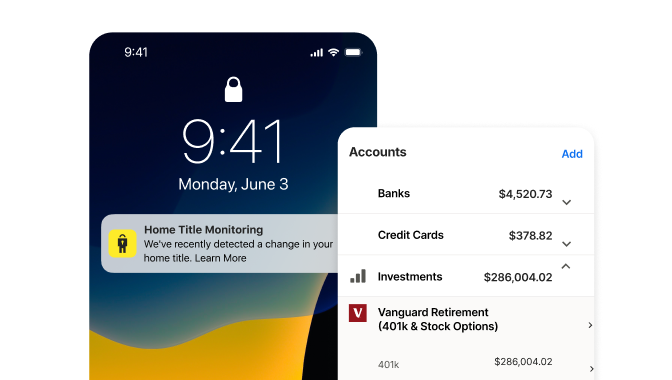

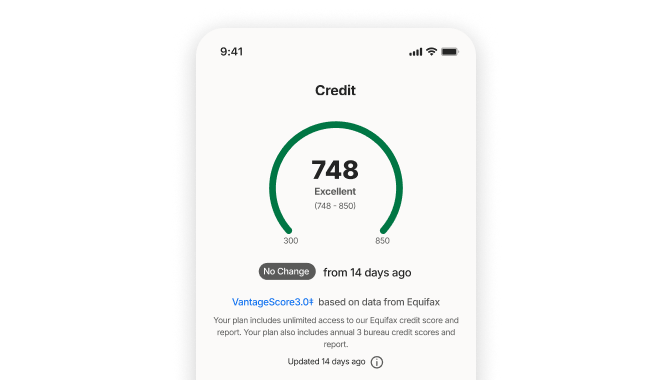

LifeLock Advantage provides enhanced identity theft protection beyond financial and credit fraud. It includes:

Identity & Social Security Number Alerts – Get notified if your personal information is misused.

Dark Web Monitoring – Helps detect your stolen data on hidden marketplaces.

Bank & Credit Card Activity Alerts – Receive alerts for suspicious cash withdrawals, balance transfers, and large purchases.

Identity Lock and Payday Loan Lock – Helps block unauthorized account openings with a simple toggle.

Privacy Monitor – Scans people-search sites and helps remove your personal data.

Stolen Wallet Protection – Get assistance replacing lost or stolen cards and IDs.

$100,000 Stolen Funds Reimbursement – If identity theft leads to financial loss.

Up to $1 million in legal coverage – To help cover legal fees if fraud occurs.