† LifeLock does not monitor all transactions at all businesses.

1 Credit reports, scores, and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

What is synthetic identity theft?

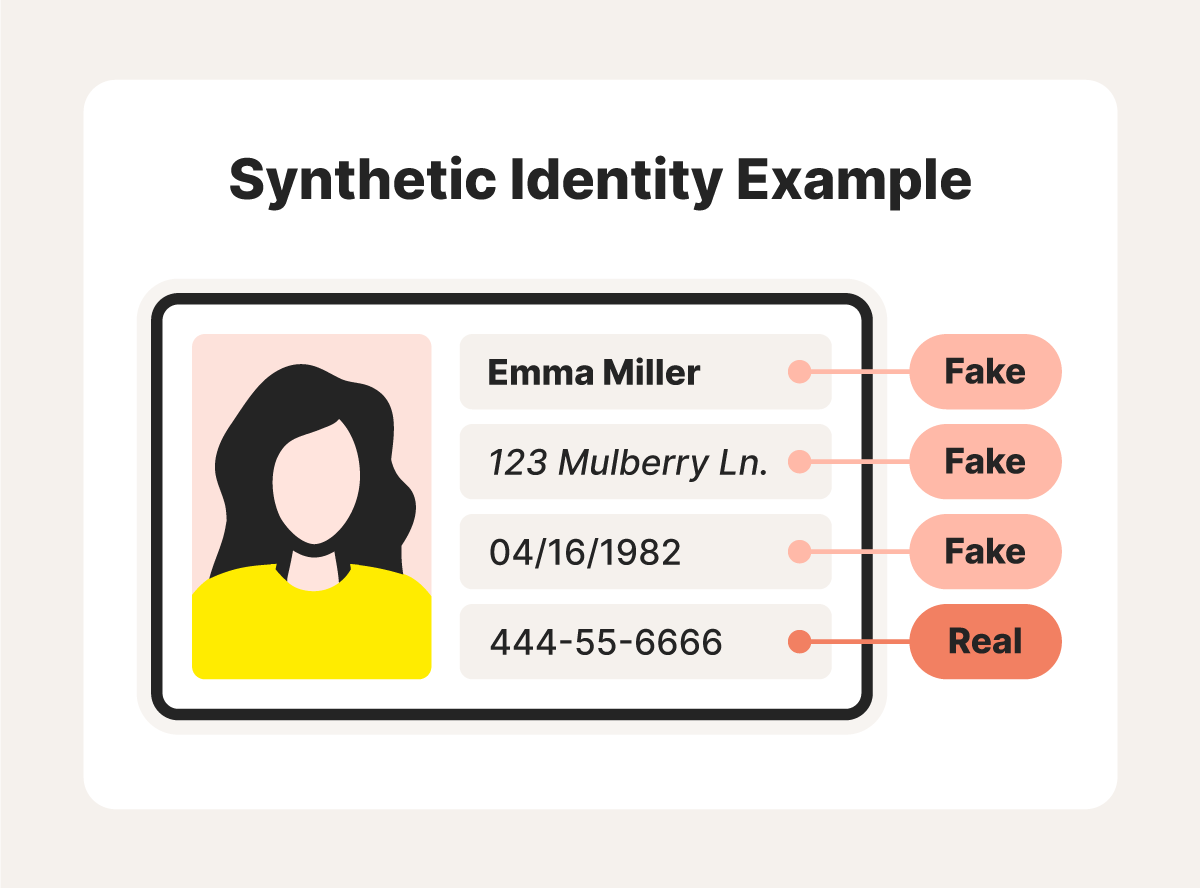

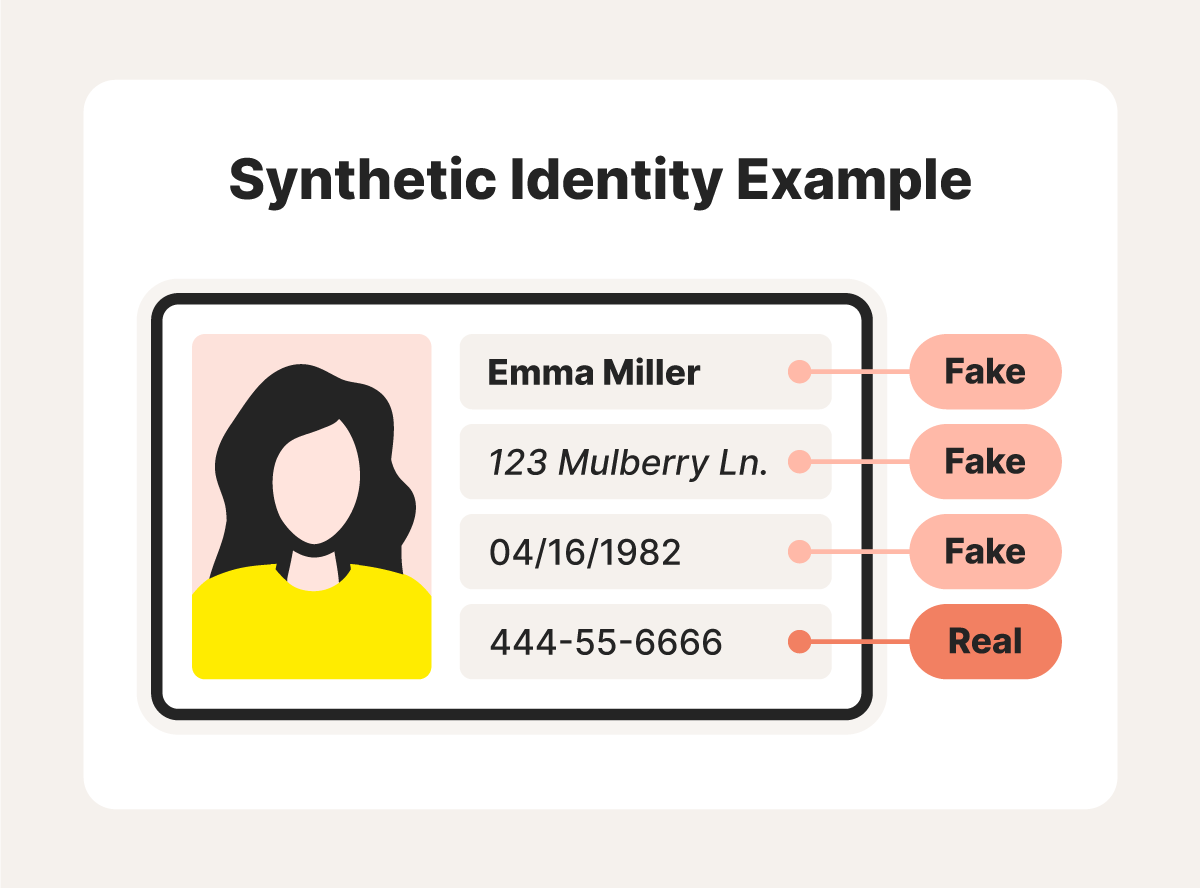

Synthetic identity theft is an advanced form of identity theft that involves using a mix of real and fake information to create a fictitious identity, which scammers can then use to open bank accounts in your name, apply for loans, or commit other types of financial fraud.

This type of identity theft is especially challenging to detect because it often blends valid data, like Social Security numbers or addresses, with fabricated details, making it harder for credit bureaus and financial institutions to recognize the synthetic identity as actually fraudulent.

What is the difference between synthetic and regular identity theft?

While synthetic identity theft involves creating a new, fictional identity, traditional identity thieves impersonate a victim directly. In synthetic cases, criminals blend real and fake information, instead of using someone’s personal data as-is.

How does synthetic identity theft work?

Synthetic identity theft works by combining stolen data that’s real, like a valid Social Security number, with invented details to build a new, fictitious identity that can be used to commit fraud.

Here’s a closer look at how fraudsters typically concoct and use these fake identities:

- Personal information is stolen: Thieves acquire real personal data like a Social Security number, birth date, or address. They can get this information from lost wallets, data breaches, phishing attacks, dumpster diving, or the dark web.

- Fake details are added: Stolen personally identifiable information (PII) is combined with fabricated details, such as a fake name, address, or contact information to create a realistic synthetic identity.

- A fake ID is used to commit fraud: Using the synthetic identity, the thieves can open accounts, obtain credit cards or other loans, and engage in fraud without their activity being linked to their true identity or one individual’s stolen identity.

What do people use synthetic identity theft for?

Criminals use synthetic identities to commit various types of fraud, such as opening credit accounts, applying for government benefits, securing loans, and making purchases. They favor synthetic identities over traditional stolen ones because they’re harder to trace—since the identity doesn’t belong to a real person, it’s more difficult to detect and track.

Fraudsters often begin with minor transactions to establish a synthetic identity and create a credible credit history. Over time, as the identity appears more legitimate, they may escalate to larger schemes, like mortgage or insurance fraud, to maximize their gains.

Detecting synthetic identity theft

Detecting synthetic identity theft is notoriously tricky, but by closely monitoring your credit report and other documentation for unfamiliar entries, it’s possible to spot irregularities that could indicate fraudulent activity. The earlier you catch these signs the better, as it allows you to address issues before they escalate.

To give yourself the best chance of detecting synthetic identity theft, make sure you’re regularly checking:

- Credit reports: You’re entitled to one free credit report every week from each of the three major credit bureaus. You can request all your credit reports online, and then review them for unfamiliar accounts or inquiries.

- Social Security statements: Fraudsters employed under a synthetic identity may have their income appear on your end-of-year earnings statement. Confirm that your reported income matches your actual earnings. If there’s a difference, contact the Social Security Administration to address it.

- Your mail: Watch for mail addressed to someone else at your address. This could indicate creditors are trying to reach an identity thief who has used your address in a synthetic ID.

Lenders use fraud detection tools to spot suspicious behavior, but synthetic identity theft is difficult to catch, and you can’t rely on them to defend you against the impact of fraud.

Identity theft protection services like LifeLock can help you keep tabs on how your details are being used by patrolling the dark web for your personal data and alerting you to fraudulent use of your SSN and other personal information. Plus, LifeLock monitors† important changes to your credit file to help you catch irregularities and detect potential fraud.

How to protect yourself against synthetic identity theft

To help protect against synthetic identity theft, be careful about sharing personal information online, secure your accounts, and consider putting a freeze on your credit. A credit freeze makes it harder for criminals to open accounts in your name, reducing the risk of identity theft and minimizing potential threats.

Here are some of the most important actions you can take to help defend against synthetic identity theft:

- Secure your Social Security number: Keep your Social Security card and any documents with your SSN secure. Shred personal documents, including bank statements, credit card information, and tax records, before discarding them.

- Beware of phishing attempts: Identity thieves often use phishing attacks via email, text, or calls to trick people into revealing their SSNs and other personal information.

- Freeze your credit: By freezing your credit, you can prevent identity thieves from opening accounts in your name, even if they have your SSN. If you have kids, consider freezing their credit too, as child identity theft is a real threat.

- Safeguard your personal information: Keep personal information like your date of birth and address private, whether online or in public. Shielding personal information makes it harder for criminals to find and use it when creating synthetic identities.

What happens if you’re the victim of identity theft?

If a fraudster creates a fake identity using your personal information, it can lead to financial loss, credit damage, legal issues, emotional stress, and reputational harm. To minimize the impact, take these steps as soon as you notice a problem:

- Freeze your credit: Contact the three major credit bureaus—Equifax, Experian, and TransUnion—to report the identity theft, and place a freeze or fraud alert on your credit report. That will help stop cybercriminals from opening new accounts with your information.

- File a police report: Contact your local police department and file a report. Down the road, this documentation can help you file an identity theft insurance claim and support police in their investigation of the fraud.

- Contact involved companies: If your information’s been used to obtain credit, healthcare services, a rental property, or other assets, report the identity theft to the organization that approved the request so that they can investigate and help resolve the issue.

- Review your credit report: Request a copy of your credit report, check it for fraudulent activity, and dispute any inaccuracies you find. The three credit bureaus use a centralized reporting service to help consumers more easily access their reports — go to AnnualCreditReport.com or call (877) 322-8228.

- Monitor your accounts: Scrutinize your bank and credit card statements regularly and report any suspicious charges immediately. Inform your bank if your identity has been compromised so they can help protect your accounts.

- Get identity theft protection: It's best to subscribe to identity theft protection services before an issue arises, but they can also help afterward by monitoring for further signs of identity fraud.

Safeguard your identity with LifeLock

When it comes to protecting your identity, let LifeLock do the work. With LifeLock, you can rest easy knowing that we closely monitor your credit,1 SSN, and personal information† for fraudulent use. And, if your identity is compromised, LifeLock will assign you a U.S.-based personal restoration specialist to help get you back on track.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- What is synthetic identity theft?

- How does synthetic identity theft work?

- What do people use synthetic identity theft for?

- Detecting synthetic identity theft

- How to protect yourself against synthetic identity theft

- What happens if you’re the victim of identity theft?

- Safeguard your identity with LifeLock

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.