Good to know: All types of identity theft are crimes, but "criminal identity theft" specifically refers to using someone else’s identity to commit a crime or evade detection during an investigation.

What is criminal identity theft?

Criminal identity theft occurs when someone fraudulently uses another person’s identifying information when arrested or investigated for a crime. This can lead to a wrongful criminal record or other legal issues for the victim, who may not even know a crime has been committed.

In committing criminal ID theft, the perpetrator may provide stolen or counterfeit photo identification, or simply false personal information, like someone else’s name, driver’s license number, or Social Security number.

Criminals with access to various types of personal information or specific identification documents can commit criminal identity theft by:

- Posing as you when stopped for traffic violations, resulting in a mark on your driving record and potentially leaving you liable for fines.

- Using your identity during an arrest, linking offenses to your criminal record rather than their own which can result in you failing background checks until you manage to get the charge expunged.

- Using your details to forge official documents like driver’s licenses or passports, which are then used for a variety of illegal activities.

- Opening new credit accounts and racking up debt in your name, potentially affecting your credit score and making it difficult to secure loans and housing.

These types of criminal identity theft don’t always have to be committed by the person who steals your identity. Some identity thieves may sell your information to other criminals on the dark web, who can then use it to cover their tracks.

How does criminal identity theft occur?

Criminal identity theft typically begins when someone steals your ID, or uses personal information, such as your name, address, or Social Security number, to create forged documents. They then use your identity to mislead law enforcement, attributing their crimes to you to evade arrest, prosecution, or other legal consequences.

Understanding the different strategies identity thieves use to get access to personal information can help you safeguard yours, minimizing the risk of having crimes you didn’t commit pinned on you. Here are some of the most common ways identity theft can happen.

Data breaches

Data breaches occur when hackers target and gain access to databases containing personal information like names, Social Security numbers, or driver’s license details. Once obtained, it can be sold on the dark web or used directly to assume a victim’s identity and commit crimes with false information.

Stolen physical documents

If someone steals physical documents like your driver’s license, passport, or Social Security card, they can use them to impersonate you or commit identity theft. These documents give criminals direct access to the information needed to create counterfeit IDs or falsely identify themselves to law enforcement in your name.

Phishing and smishing attacks

Phishing (via email) and smishing (via text) are social engineering attacks that trick victims into sharing personal or financial information. Scammers often impersonate banks, businesses, or government agencies, claiming there’s an issue with your account, or that you may be in legal trouble. Once obtained, this information can be misused for fraudulent purposes.

Malware and keylogging

Malware infections can expose your data like passwords, PINs, account numbers, and other sensitive information. Some types of malware, like keyloggers, record everything you type in, allowing attackers to harvest personal data without your knowledge. Others, such as Remote Access Trojans, can grant hackers full access to your device, enabling them to spy on your activity, steal files, and control your system.

Synthetic identity theft

Synthetic identity theft involves criminals combining stolen information, like a real Social Security number, with fictitious details to create a “new” identity. While often used for financial fraud, criminals can leverage synthetic identities to sidestep law enforcement, further complicating the victim’s attempts to clear their record.

Credit card skimming

Credit card skimming is an identity theft technique that’s primarily used to commit financial fraud, but can also facilitate criminal identity theft. Skimming devices on ATMs, gas pumps, or payment terminals capture card details, which criminals can use to make payments in the commission of crimes which will be linked to the victim’s identity.

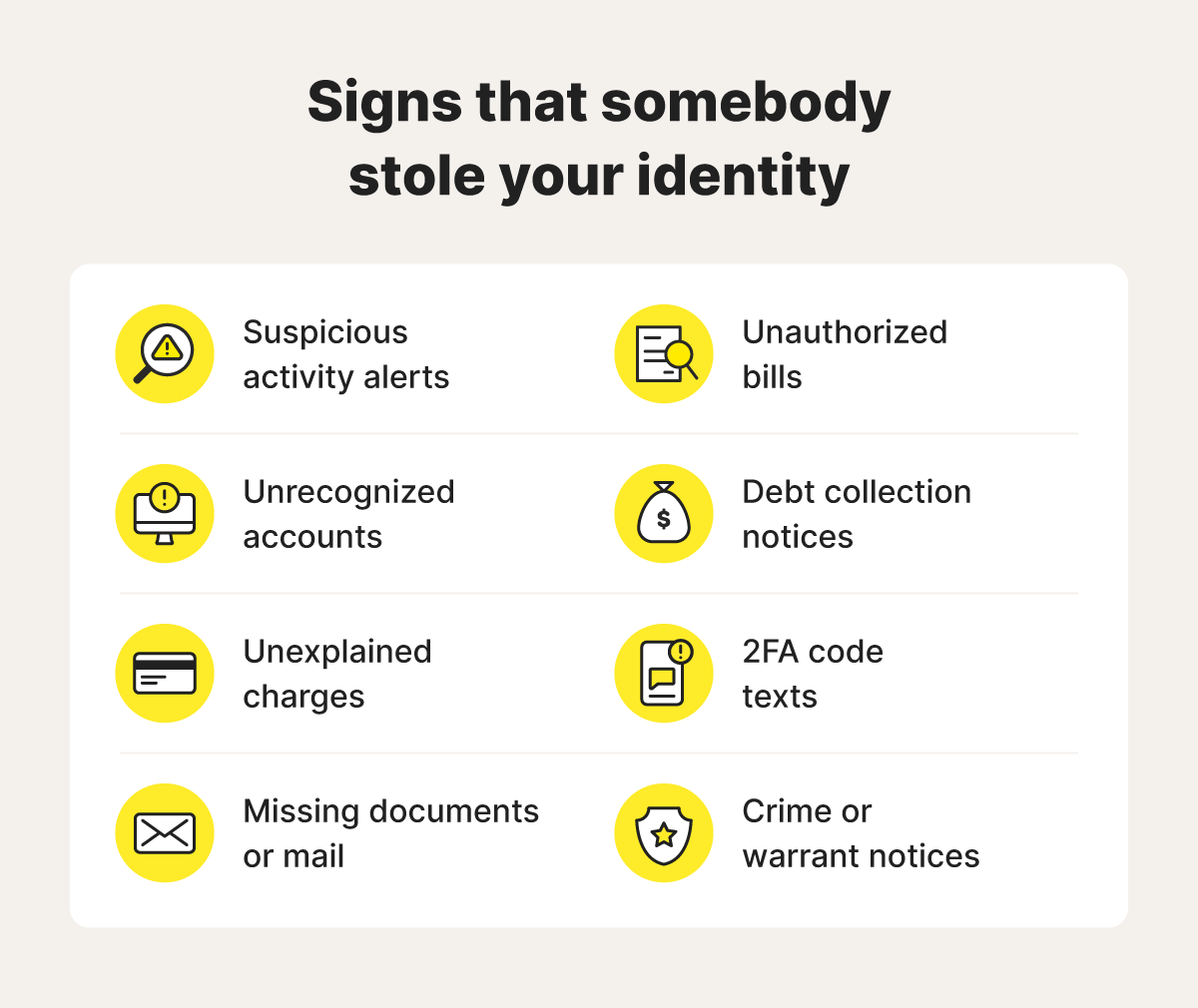

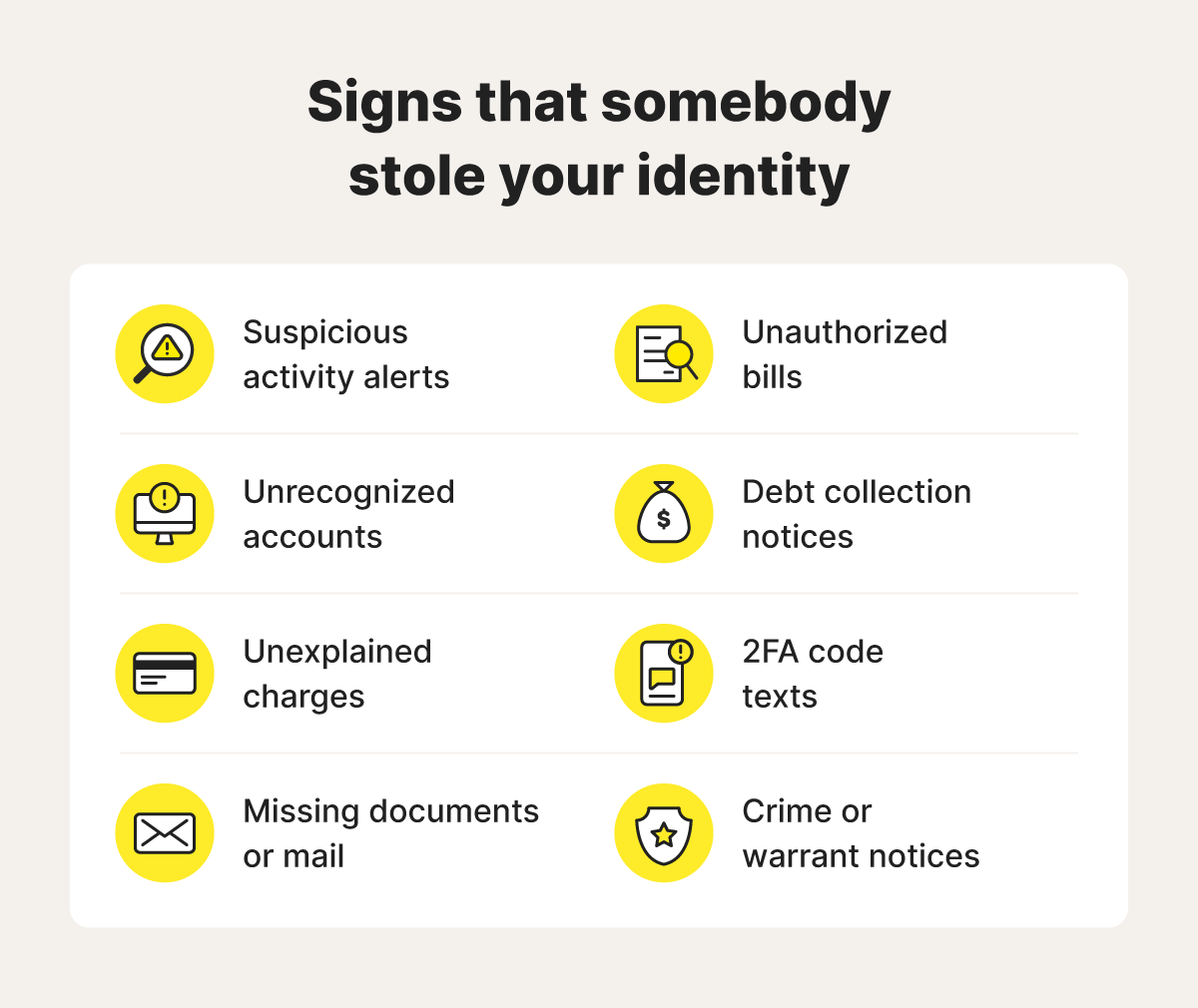

8 red flags that someone has stolen your identity

Without a proactive approach to detecting the signs of criminal identity theft, you might not realize you’ve become a victim until long after a crime has been committed in your name and added to your record.

Pay attention to these potential signs of identity theft to get an early warning you might be at risk.

- Identity theft protection alerts: Suspicious activity alerts from an identity theft protection service like LifeLock can help you spot your personal data appearing online and identify unauthorized credit applications in your name, which may indicate potential criminal activity linked to your identity.

- Unrecognized accounts: A new account that you didn’t open appearing on your credit report is a major warning sign of identity theft. Criminals may be able to use your personal information to apply for credit cards or loans in your name, racking up debt that they have no intention of paying off.

- Unexplained charges: Unauthorized transactions on your credit card or bank statements could mean someone is testing or actively using your accounts. Monitor your accounts regularly to catch discrepancies early and take steps to protect your identity.

- Missing ID documents or mail: Criminals can use stolen physical documents, such as a driver's license, Social Security card, or credit card statement, to assume your identity. Similarly, if bills or official letters go missing, criminals may have intercepted them to gather your personal information.

- Unauthorized bills: Receiving bills for accounts you didn’t open or services you don’t use is another key indicator that your identity might have been stolen. These could include medical expenses, utility accounts, or even purchases made in your name.

- Debt collection notices: Getting calls or letters from debt collectors about debts that aren’t yours is a red flag that someone may have used your identity. These fraudulent debts can tarnish your credit report and take time to resolve.

- Unexpected 2FA codes: Two-factor authentication (2FA) codes being sent to your phone or email unexpectedly could signal that someone is trying to access your online accounts. Take action immediately by changing your passwords for any potentially vulnerable accounts.

- Notices of crimes or warrants in your name: The most alarming sign of criminal identity theft is receiving notices about crimes or warrants associated with your name. This typically means your identity was used during a traffic stop or legal incident, potentially leaving you with a wrongful criminal record.

Tips to help prevent criminal identity theft

Boosting your chances of preventing identity theft relies on building your awareness of the risks and taking proactive protective measures. While nothing can eliminate the risk of identity theft, taking these steps can lower your vulnerability to becoming a victim.

- Create strong, unique passwords: Secure all online accounts with unique and strong passwords to reduce the risk of breaches.

- Use two-factor authentication: Enable 2FA wherever possible to add an extra layer of security to your accounts.

- Secure your physical IDs and documents: Store important documents like passports and Social Security cards in a safe, secure location.

- Monitor accounts regularly: Frequently review your financial accounts and credit report to detect unauthorized transactions.

- Limit what you share on social media: Avoid oversharing personal information online, which criminals may be able to use to steal your identity.

- Take precautions when using public Wi-Fi: Avoid transmitting sensitive data on potentially vulnerable networks and consider using a VPN to secure your connection.

- Avoid clicking suspicious links: Steer clear of suspicious links in emails or messages from unknown senders to safeguard against phishing attacks or potential malware.

- Protect your credit: Consider placing a fraud alert or freezing your credit to help prevent criminals from opening new credit accounts in your name.

- Use an identity theft protection service: LifeLock Advanced can help you proactively monitor online exposure of your personal information and alert you to crimes committed or credit applications made in your name.

What to do if someone steals your identity

If you're a victim of criminal identity theft, contact both the arresting and your local law enforcement agencies. Your local agency may need to take your fingerprints and share them with the arresting agency to verify your identity, proving you're not the person they believe you to be.

If you have an identity theft protection service that includes remediation services, contact them to see what kind of assistance — legal and otherwise — they’re able to provide.

Here are some other key steps to take if you fall victim to criminal identity theft:

- Contact the FTC and SSA: File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov and notify the Social Security Administration (SSA) if your Social Security number has been compromised.

- Contact credit reporting agencies: Inform the three major credit bureaus (Experian, Equifax, and TransUnion) to place a fraud alert or credit freeze on your account to help protect against misuse.

- File a police report: Report the identity theft to your local law enforcement department and provide any documentation or evidence to support the investigation.

- Call your bank and credit card company: Notify any relevant financial institutions immediately to protect your accounts and help catch unauthorized transactions.

- Contact the Department of Motor Vehicles: Check for fraudulent activities involving your driver's license and report any misuse to the DMV.

- Get a Certificate of Identity Theft: Request a certificate from the FTC to help clear your name and validate your identity when disputing fraudulent claims.

Take control of your identity

Falling victim to criminal identity theft can leave you with a false criminal record, credit score damage, and a potentially stressful journey to recover your identity.

Subscribe to LifeLock Advanced to benefit from powerful identity fraud protection including alerts for crimes committed in your name, credit monitoring,† and stolen wallet protection. And if you ever have your identity stolen, a U.S.-based personal restoration specialist will be on hand to help you restore it.

† Credit reports, scores, and credit monitoring may require an additional verification process and credit services will be withheld until such process is complete.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.