Quick tip: Most hospitals have programs that discount or erase bills for eligible patients. However, knowing what to apply for and how to navigate the application process can be tricky. Non-profits are there to help you, and are a great place to ask those initial questions.

Medical bills won’t affect your credit unless they become debt — even then, there is a minimum amount of debt to hit first and a grace period to pay it off. Still, millions of Americans are impacted by medical debt dragging down their credit score if they can’t pay the debt in time.

Therefore, it’s no surprise there was so much talk in 2025 about the rule proposed by the CFPB (Consumer Financial Protection Bureau) to exclude medical debt from credit reports. It was expected to assist around 15 million Americans with medical debt and raise affected credit scores by around 20 points.

Unfortunately, the rule will not officially go into effect. But, there are other methods for managing your medical bills and debt before they critically affect your credit.

Do unpaid medical bills affect your credit?

Medical debt listed on credit reports can hurt credit by lowering credit scores, making it harder to get approved for loans. Damage to your credit can also result in higher interest rates for loans you are approved for.

But which unpaid medical bills affect credit?Unpaid medical bills that are sold to a collections agency appear on credit reports. Delinquent collection accounts can remain on credit reports for up to seven years, but will be removed if you pay them off sooner.

However, the three major credit bureaus will only list medical debt on a credit report if it’s:

- Over $500

- Over 365 days due from the date it became delinquent

How the CFPB’s new rule would have impacted your credit

In January 2025, the CFPB finalized the expected rule, but just months later, the rule was retracted. The CFPB’s rule would have completely removed all medical debt from credit reports. This would have prevented medical debt of any amount from impacting your credit score.

The rule would have also prevented medical bill errors and fraudulent entries resulting from medical identity theft from affecting consumers’ credit. It’s estimated that as many as 80% of medical bills contain errors or overcharges. This is likely why medical debt in credit reports is disputed nearly three times more often than credit card debt.

Strategies for managing medical bills or debt

If your unpaid medical bills are sent to a collections agency, they may eventually appear on your credit reports and harm your credit score. Accruing medical debt can have many negative consequences aside from just damaging your credit. Research shows that people with medical debt are more likely to avoid seeking future medical care, which can lead to worse health outcomes.

The following strategies can help you manage your medical bills or debt and protect your credit.

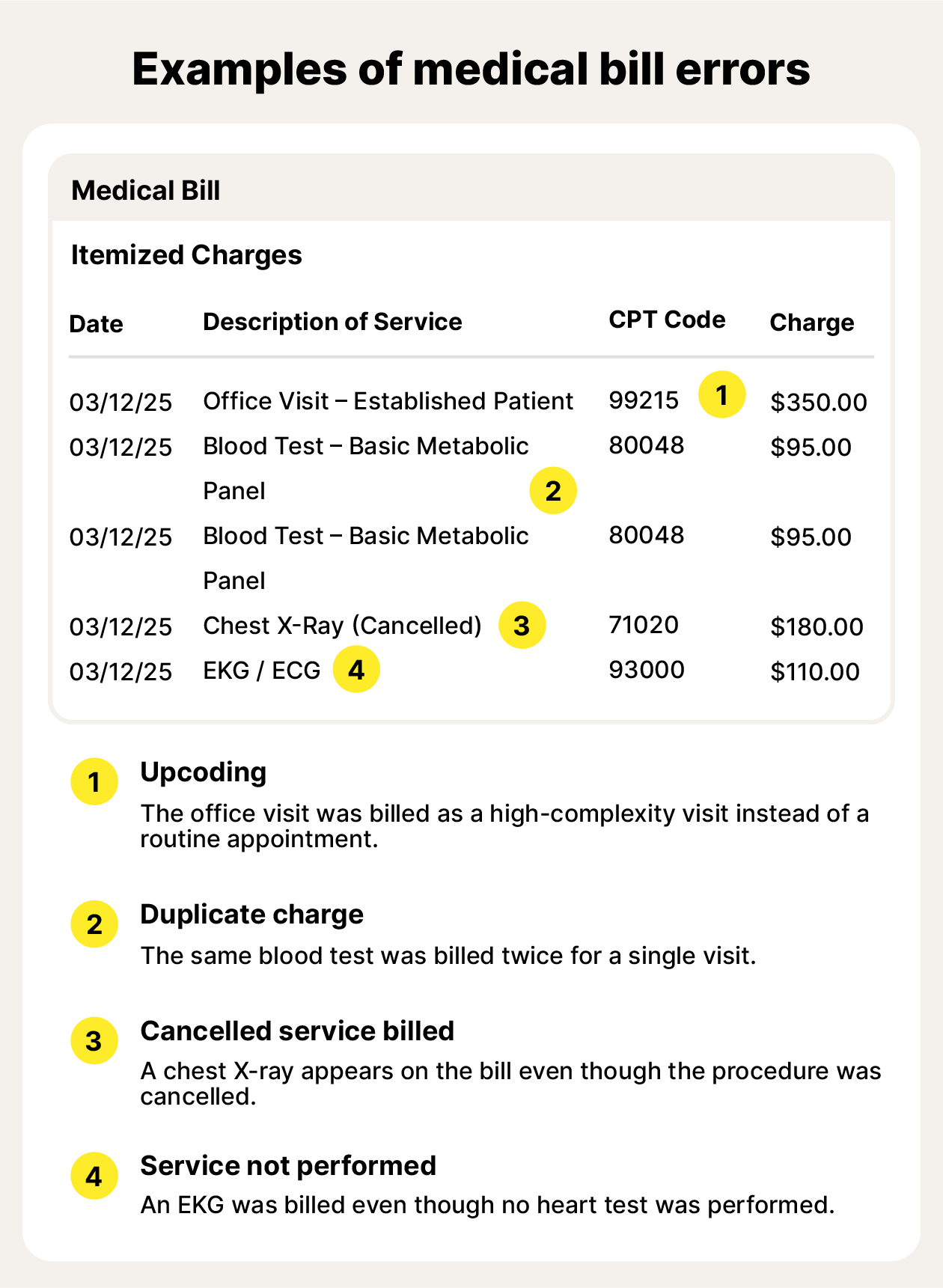

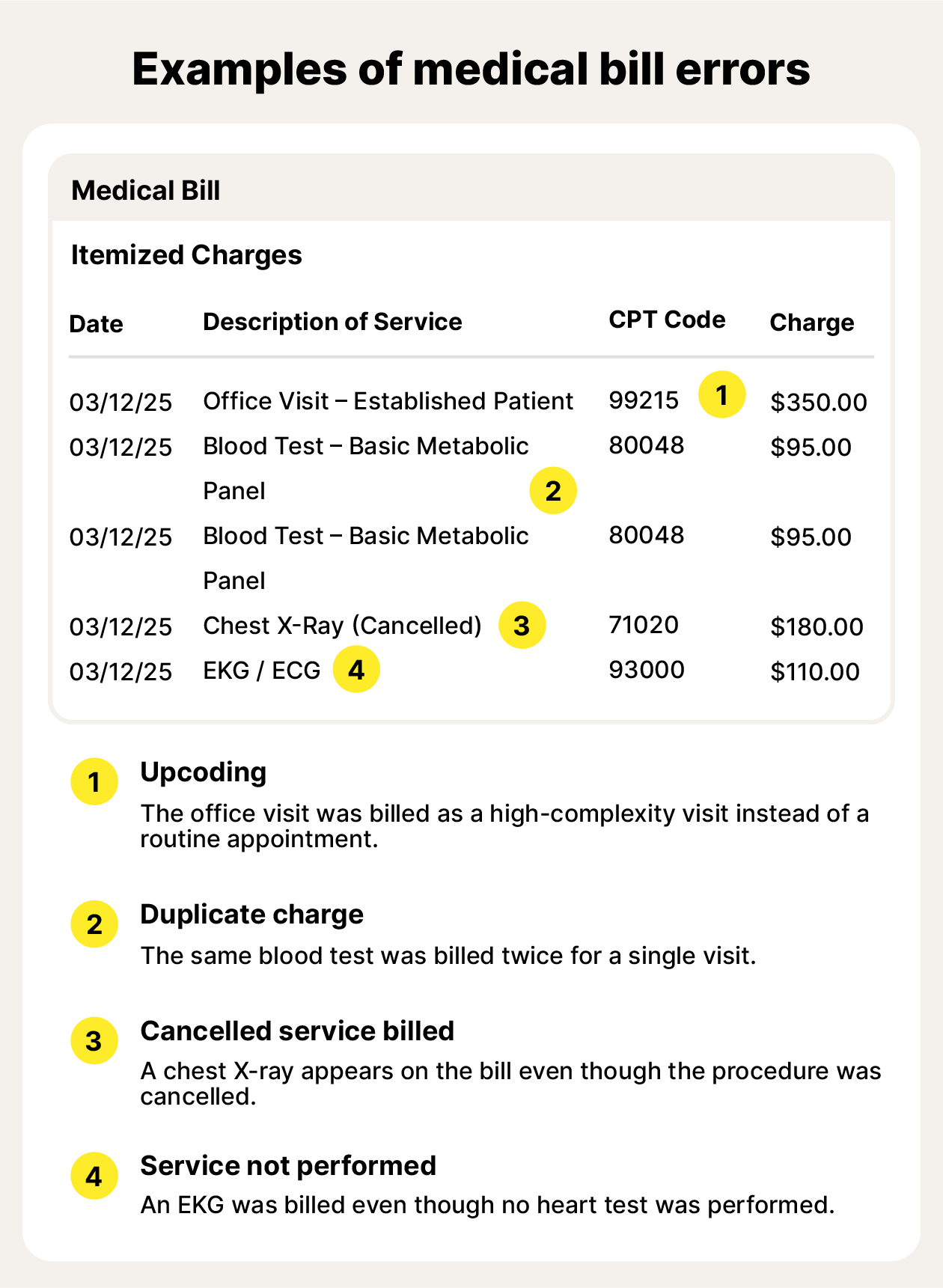

1. Examine your medical bills and credit reports for errors

Medical bills often contain errors, and these may account for thousands of dollars in fees you shouldn’t be paying.

Ask your healthcare provider for itemized receipts for your care and compare them with the services you received. If you see a discrepancy, contact your healthcare provider and insurance company to report it. Likewise, if you see a potential overcharge for a procedure or medication, query it.

You should also monitor your credit for changes or suspicious activity, and dispute your credit report if you find errors or fraudulent entries. You have three credit reports — one from each of the credit bureaus: Equifax, TransUnion, and Experian. You can request free copies of your credit reports once a week by visiting annualcreditreport.com.

2. Negotiate with healthcare providers

Healthcare providers are sometimes willing to offer lower rates for their services if you say that you’re unable to pay, or that you can pay a lower lump sum to clear the bill or debt.

It’s important to start these negotiations as early as possible. If your debt has already been sent to collections, there’s less flexibility to negotiate.

To start negotiations, contact your healthcare provider’s billing department and ask about a reduction in your balance. Be open about your financial situation and insurance coverage. Some hospitals offer sliding-scale rates for underinsured or uninsured patients. Be prepared to go through a few rounds of negotiations, as, like most negotiations, you won’t usually get the best offer on your first call.

3. Set up a payment plan

When your healthcare provider sends you a bill, you don’t have to pay in full right away. Healthcare providers offer payment plans that split your medical bills into manageable installments over time.

Setting up a payment plan and sticking with it can prevent your medical bill from turning into unpaid debt and possibly ending up on your credit report.

To set up a payment plan, contact your healthcare provider’s billing department. Their number should be listed on your medical bill. Tell them how much you can reasonably pay per month, and ask about no-interest plans.

4. Avoid paying medical bills with high-interest cards

Never pay your medical debts with high-interest credit cards or pre-approved credit cards, no matter how dire the situation may seem. Americans have many resources for medical debt assistance and relief.

But if you pay your medical debt with a credit card, it will become credit card debt, which usually means you pay more in the end. Credit cards typically come with much higher interest rates, which can quickly increase your debt. It will be much harder to pay off your credit card than your medical debt.

5. Seek nonprofit assistance

If your debt is already unmanageable, seek help from a nonprofit organization. There are many nonprofits dedicated to helping people navigate their medical debt, lower their payments, or receive debt forgiveness.

Don’t confuse these organizations with others that offer predatory loans or financial relief. Financial hardship loan scams prey on those who are overburdened with debt and desperate, but these scams aim to steal your personal information.

Some legitimate non-profits offer to cover your debts or help cover the cost of future medication or treatment. Others work with you and collection agencies to negotiate better terms. Or, they help you apply for relief opportunities provided by the government or healthcare providers.

Some legitimate medical assistance nonprofit organizations include:

- The HealthWell Foundation: Helps cover out-of-pocket healthcare expenses.

- NeedyMeds: Connects people to programs that can help them afford healthcare costs.

- Dollar For: Helps patients with hospital bills apply for a discount or bill erasure, even after bills have been sent to collections.

- Undue Medical Debt: Buys and erases medical debt for people who can’t afford to pay it.

6. Leverage your HSA

A Health Savings Account (HSA) is a special type of savings account for people with high-deductible health plans (HDHPs). You can withdraw the money from the account tax-free if you use it for healthcare expenses, such as paying for healthcare costs not covered by your insurance.

Funds added to HSA accounts are tax-deductible and grow tax-free. This means adding money to this account will reduce your annual tax burden. However, there are limits to how much you can deposit per year.

If your insurance coverage is limited, opening an HSA is a smart way to prepare for unexpected medical bills. If you already have an HSA, you may be able to use the funds to pay off your debt.

Keep tabs on your credit with LifeLock

Medical bills will eventually affect your credit if you don’t pay them, and they can be disastrous for your credit score. If you’re afraid you may not be able to pay your medical bills, seek assistance quickly by contacting your healthcare provider, insurance provider, or nonprofit organizations.

It’s also important to monitor your credit reports for medical identity theft and errors. LifeLock offers one-bureau credit monitoring so you can keep an eye on things while you pay off medical bills. We’ll also alert you if suspicious activity or fraud is found associated with your personal data. Choose LifeLock to help protect your credit and identity.

FAQs

What happens if I ignore my medical bills?

If you ignore your medical bills, your healthcare provider will send your debt to a collections agency. This typically happens within 90-180 days of not paying your bill.

The collections agency will continue to pursue payment from you. After one year, the collections agency can report your medical debt to the credit bureaus, which would likely impact your credit.

How much does a medical bill have to be to go to collections?

There’s no minimum amount required for a medical bill to be sent to a collections agency. Healthcare providers can send any unpaid bill to collections. However, your debt won’t appear on your credit report or affect your credit score if it’s under $500.

What is the lowest you can pay for medical bills?

There’s no set minimum payment for medical bills; they vary depending on the amount owed. However, you can reduce costs by negotiating early for lower rates. Hospitals may offer discounts for uninsured patients, and non-profits may forgive debt for eligible patients. Be careful of unsolicited messages offering a rebate or refund, though, as these are common Medicare scams.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.