Investing in identity theft protection like LifeLock helps you monitor where your information appears online, including the dark web. If LifeLock finds your data in potentially suspicious places, you'll receive a notification, allowing you to act quickly to secure accounts and guard against fraud.

Monitoring your credit report gives you a clearer picture of your financial health. The Consumer Financial Protection Bureau suggests reviewing it at least once a year to spot errors, detect fraud, and safeguard against identity theft. Below, we’ll discuss why annual credit checks are essential and highlight key situations where they can help protect your finances.

Why is it important to check your credit report often?

Regularly checking your credit report allows you to promptly identify mistakes or signs of fraudulent activity and ensure accurate financial records. This helps you combat identity theft, maintain a good credit score, and stay financially responsible.

Errors on your credit report, such as incorrect balances or unrecognized accounts, can negatively impact your credit score, your chances of getting loan approvals, and the interest rates offered to you. Regularly reviewing your report allows you to catch and fix inaccuracies before they cause financial harm.

Credit report inconsistencies can also help you identify and mitigate cases of identity theft early, allowing you to recover sooner. While annual reviews are recommended as a minimum, check more often if you suspect fraud or you know your information was compromised in a data leak.

When should you check your credit report?

You should check your credit report at least once a year, but consider reviewing it more often if your personal information was compromised, you experienced a major life change, or you noticed a dramatic shift in your credit score.

Here are some specific examples of when you should check your credit report:

At least once per year

Checking your credit report at least once a year helps ensure all the information included is accurate and up to date. These annual reviews help you spot errors or potential fraud before negatively affecting your credit score.

For added financial awareness, consider reviewing your report quarterly. Checking four times a year can help you stay on top of any changes impacting your credit and give you more opportunities to address issues before they escalate.

Before a large purchase

Before making a large purchase, such as a house or car, it's important to check your credit report at least three months in advance. This gives you time to ensure all the information on your credit report is accurate, identify errors or signs of fraudulent activity, and dispute issues that could negatively affect your credit score.

By reviewing your report ahead of time, you can take steps to improve your score if needed, increasing your chances of loan approval and helping you secure better loan terms.

After a major life event

After some major life events, it’s important to review your credit report to ensure that all information is accurate and up to date. Some life changes may not immediately appear on your report, so regular checks are important.

Here are a few life events that can impact your credit:

- Marriage: If you open joint credit cards or loans or co-sign for your spouse, their financial habits could influence your credit. For example, missed payments or high debt balances on shared accounts could appear on both reports.

- Divorce: Shared accounts can impact credit scores during divorce. Late payments or defaults affect both parties, regardless of a divorce decree. Since lenders still hold both liable, removing your name from joint accounts helps protect your credit.

- College graduation: If you took out loans to fund your education, they’ll appear on your credit report. How you manage those loans can either help or hurt your score. Making timely payments on your student loans can improve your credit history, while missed payments can damage it.

- Retirement: Transitioning to retirement often means adjusting to a fixed income, which can change how you manage credit. You might rely more on credit cards for unexpected costs or lifestyle needs. New loans, like a mortgage for downsizing or a vacation home, can also influence your credit score.

If you’re the victim of identity theft

After you've been a victim of identity theft, it's essential to continue checking your credit report regularly to monitor its impact and your recovery. This allows you to track the removal of fraudulent accounts, ensure that corrections have been made, and confirm that your credit is fully restored.

Regularly reviewing your report also helps you spot any delayed impact, such as lingering inaccuracies or unresolved issues that could still hurt your financial standing. By staying proactive, you can continue to protect your credit and avoid long-term damage to your financial health by spotting any additional signs of identity theft early.

If your data is leaked in a data breach

If your data is impacted by a data breach, it's important to monitor your credit report regularly to catch any misuse of your personal information. A breach can expose sensitive data like Social Security numbers, which can be used to open fraudulent accounts or make unauthorized purchases.

Regularly checking your credit report helps spot new accounts or activities from a breach, allowing you to address issues before they snowball into bigger problems that can significantly affect your financial standing. Additionally, investing in breach detection services can help you stay ahead of potential threats you otherwise wouldn’t be aware of.

If a data breach compromised your information, freeze your credit at all three major credit bureaus. This helps stop anyone from accessing your credit or taking out new accounts in your name.

When your credit score changes

A sudden or unexpected drop in your credit score can be a red flag, signaling potential issues like identity theft or credit errors. If you notice a significant decrease, reviewing your credit report for possible explanations is important. These may include unauthorized hard inquiries, fraudulent accounts, or errors on your report.

Your credit score isn't included in your credit report, so you'll need to check it separately. You can do this through official channels, like free credit report services or monitoring tools provided by your credit card issuer.

LifeLock Total monitors both your credit score and credit report, making it easier to track changes and catch any issues before they escalate. You can easily check your score1 whenever you like from the app, and daily credit score updates are available as part of your subscription.

How to check your credit report

To check your credit report, visit AnnualCreditReport.com, the official site for free reports from the three major credit bureaus — Equifax, Experian, and TransUnion. You can access your report weekly for free, though the site does not provide your credit score.

Alternatively, you can check your credit report daily with one credit bureau or annually at all three with LifeLock Total and get daily updates on your credit score.1

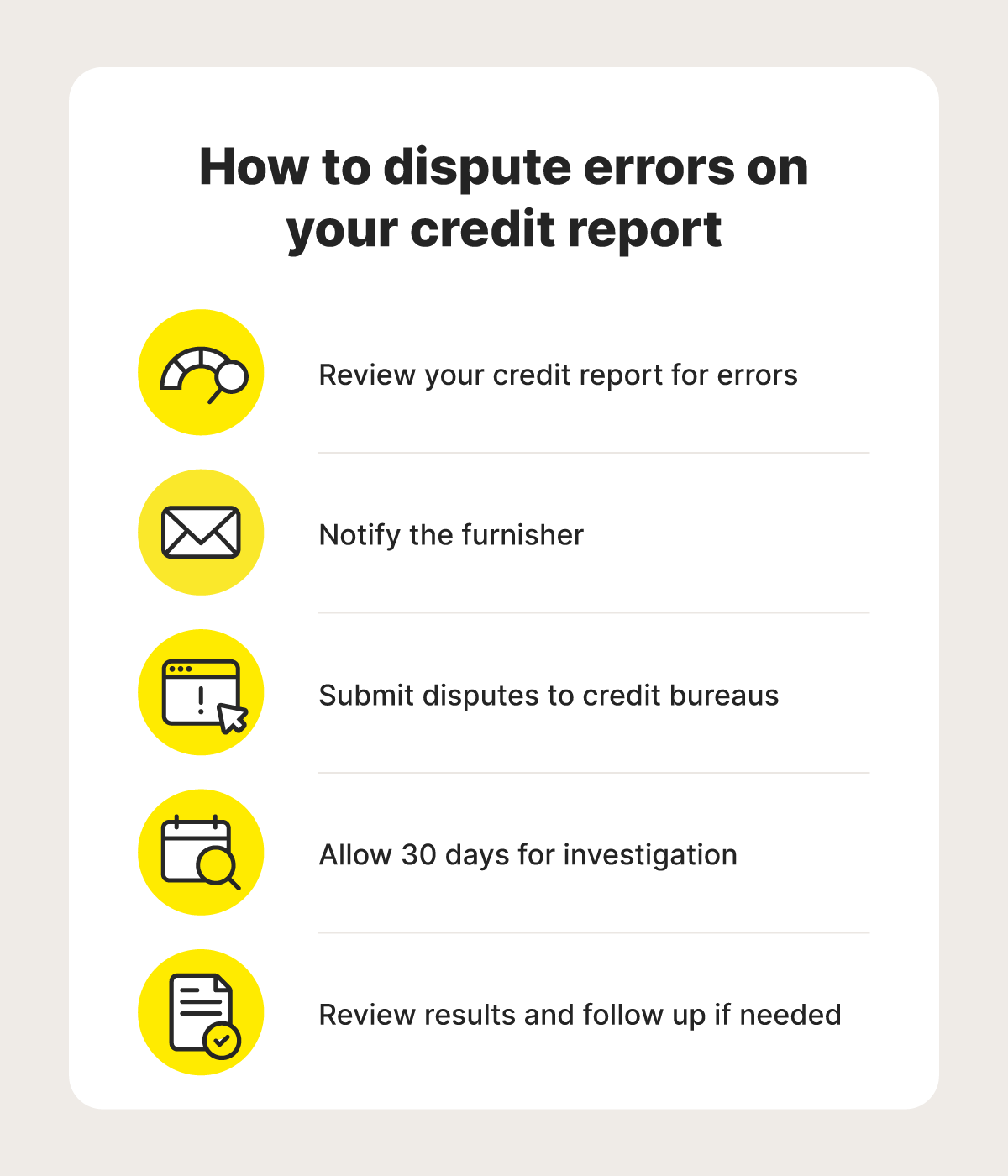

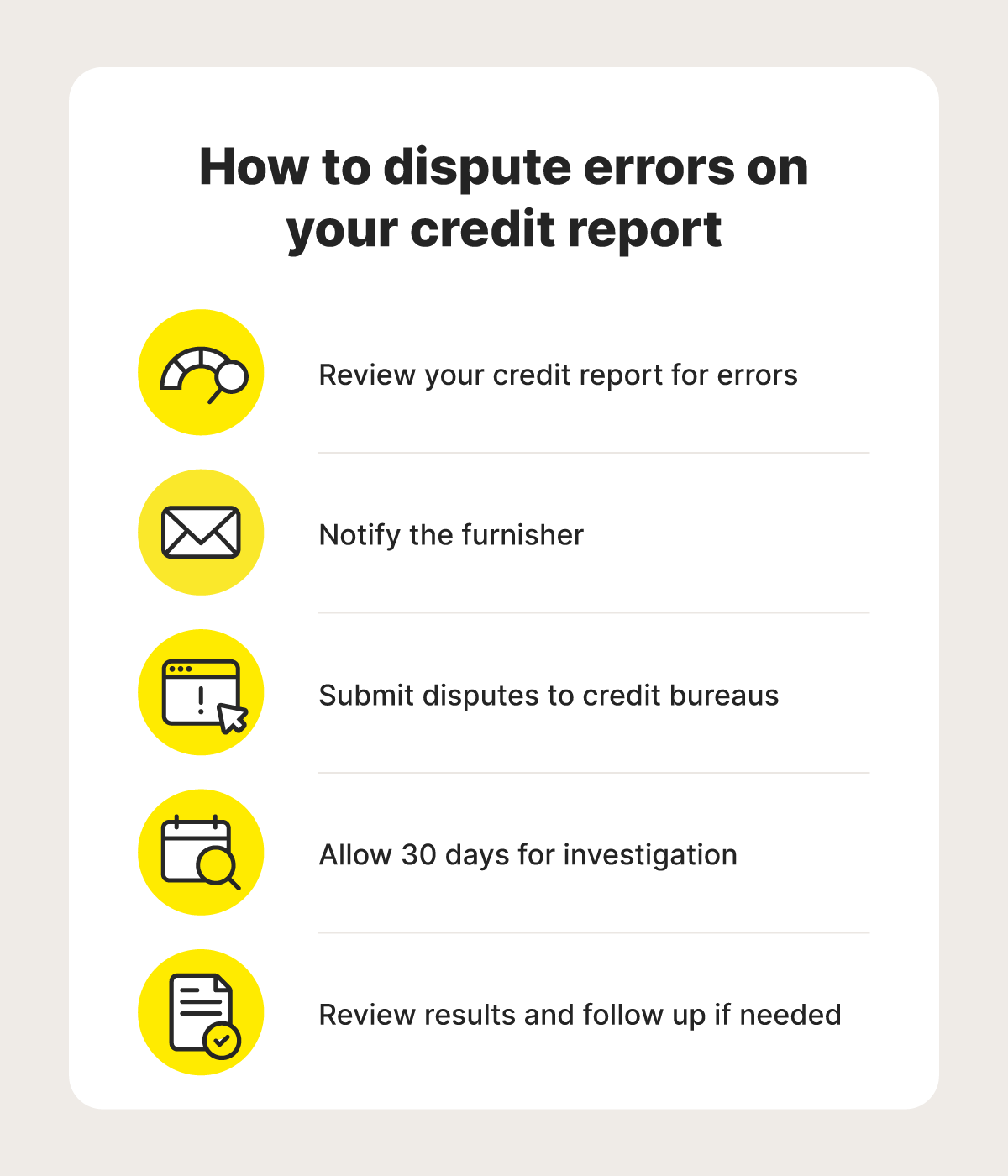

What to do if there’s an error on your credit report

If you’ve spotted an error, you should dispute the credit report as soon as possible, either online or in writing, with the credit bureau. They are required to investigate the issue within 30 days.

If the error is due to identity theft, it’s important to act quickly to protect your financial well-being. This includes freezing your credit to prevent further fraudulent activity and closely monitoring your financial accounts for any signs of unauthorized transactions.

Keep tabs on your financial health with LifeLock Total

Regularly checking your credit report can help you catch errors and fraudulent activity, safeguarding your credit.

For added protection, get LifeLock Total to more easily monitor your credit report as often as you want. You’ll also receive alerts† for possible fraudulent use of your Social Security number or other details in applications for loans and services, letting you take swift action to help prevent damage to your credit score.

FAQs

What is a credit report?

A credit report is a detailed record of your credit history, including information about your loans, credit cards, payment history, and any outstanding debts. Lenders, landlords, and other entities all use it to assess your credit profile.

How often should you check your credit report for errors?

You should check your credit report for errors at least once a year. However, if you've recently experienced a major life event, noticed a drop in your credit score, or suspect fraudulent activity, it's a good idea to review it more frequently.

Why is it important to check your credit report at least once a year?

Checking your credit report at least once a year helps ensure the information is accurate and up to date, minimizing any negative impact on your credit. It also lets you spot errors or signs of identity theft early, helping protect your financial health.

Does checking your credit score lower it?

No, checking your own credit score does not lower it. This type of inquiry is considered a “soft” rather than a “hard” inquiry and doesn’t impact your score. Hard inquiries occur when a lender checks your credit for a loan or credit application, which can slightly lower your score.

1 Credit features require successful setup, identity verification, and sufficient credit history by the appropriate credit bureau. Credit monitoring features may take several days to activate after enrollment.

† LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.