†LifeLock does not monitor all transactions at all businesses.

Like most adults in the U.S., you probably use at least one credit card. Managing your repayments is important for building good credit, making it easier to qualify for loans, secure favorable interest rates, and even get approved for housing or rentals. And you should pay your credit card bill by each billing cycle’s due date, at the latest.

Keep reading to learn more about the ins and outs of credit card payments and how these payments impact your credit score.

Understanding the billing cycle

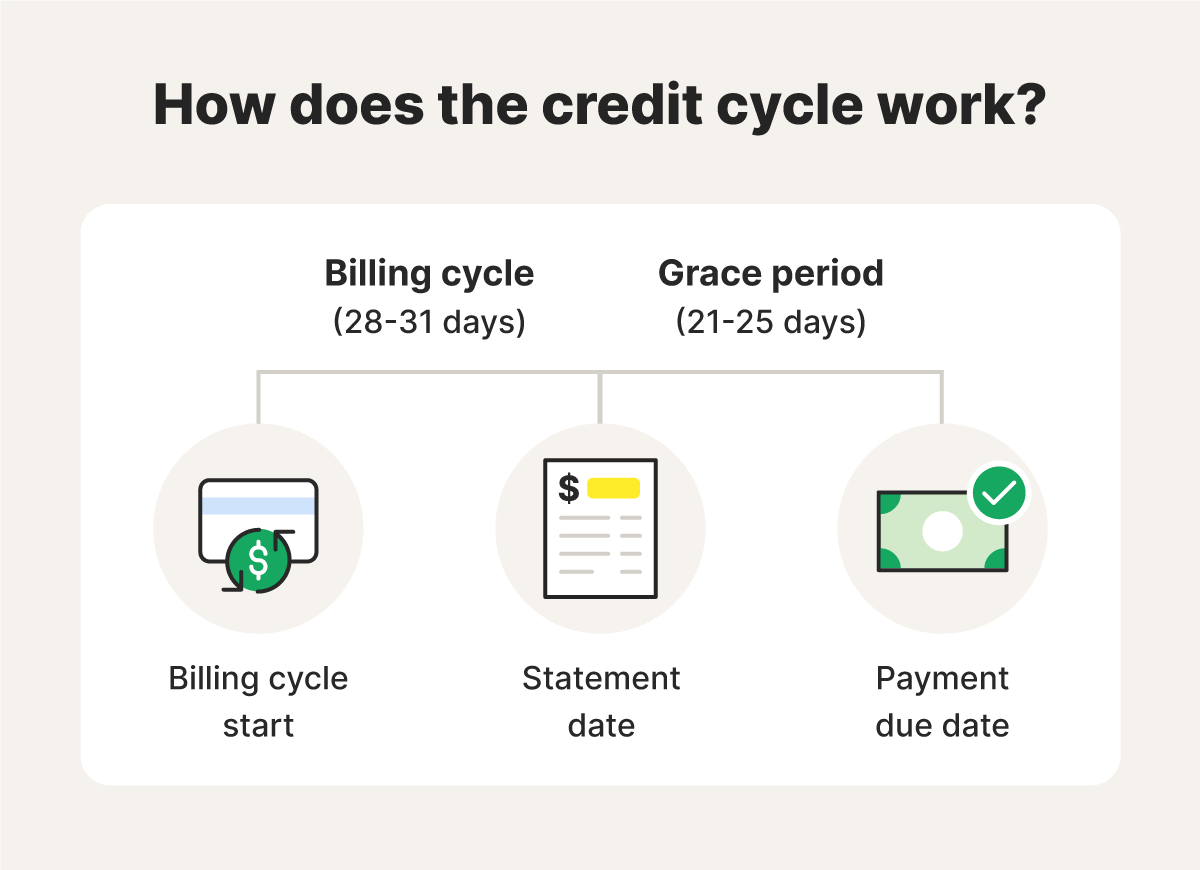

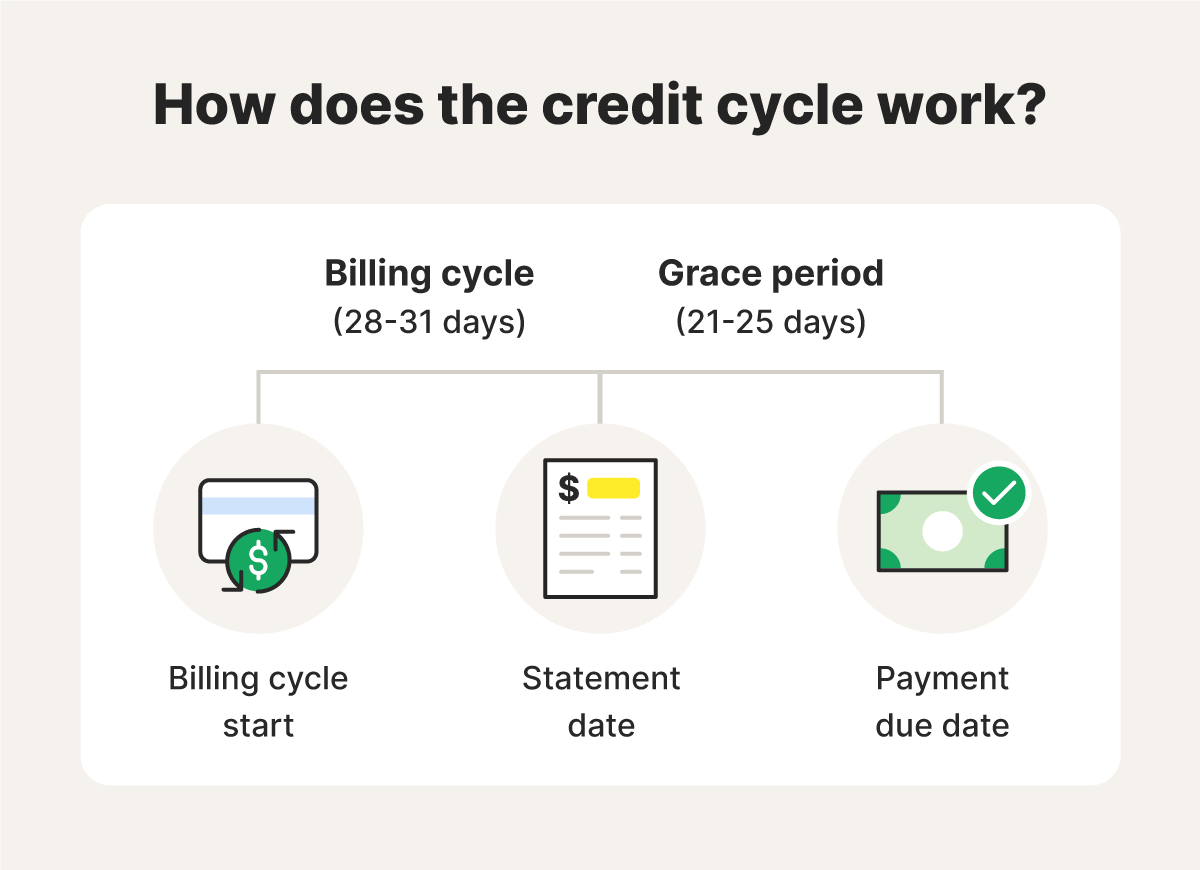

A credit card billing cycle is a regular timeframe during which a credit card company records transactions. At the end of the cycle, the credit card company generates a statement with a list of your purchases and a due date for payment.

Understanding your billing cycle helps you make timely payments, which protects your credit score health by avoiding negative entries on your credit report at the major credit bureaus.

Here's an overview of the elements that make up the billing cycle:

- Length of cycle: Typically 28 to 31 days

- Payment due date: The last day you can pay your bill without incurring late fees

- Statement closing date: The last day of your billing cycle

- Statement balance: The amount you owe on the last day of the billing cycle

- Current balance: The total amount of money you owe, which may include transactions made after the statement closing date

- Grace period: The time between receiving your statement and when the bill is due

How the billing cycle works

To show exactly how the billing cycle works in practice, let’s walk through an example where your credit card statement closing date is the first day of every month:

- On February 1, a statement is generated covering all your credit card transactions in the billing cycle from January 1 to January 31.

- There’s a 25-day, interest-free grace period, meaning the due date is February 25.

- You need to make a payment toward the statement balance by the due date to avoid late fees.

If you make only a partial payment or miss the due date, interest will apply to the remaining balance and appear on your next statement, dated March 1. Any transactions you make in the meantime will also be included in the next billing cycle.

Statement date vs. due date: What’s the difference?

The statement closing date marks the end of your billing cycle, after which new transactions will be included in the next statement. The payment due date is when you need to make at least the minimum payment toward the statement balance to avoid late fees.

When to pay your credit card to avoid interest

To avoid interest charges, pay off your entire credit card balance by the payment due date. If you pay only the minimum amount, or part of the total, you’ll still accrue interest on the remaining balance. The average median credit card interest rate between July and September 2024 was 24.74%. However, factors like your credit score and debt-to-income ratio can impact the rate banks offer.

A good credit score on the FICO® model is 670 or higher, which typically opens up access to lower interest rates. A credit score below 600 is considered fair to poor and may result in higher interest rates. And higher rates can quickly add up, making it more expensive to carry a balance over time.

Consider the following scenario (the amount owed can vary depending on which method the card issuer uses to calculate interest):

- You have a card with a 24.74% interest rate, and you purchase flight tickets for $500.

- You fail to pay the balance the following month and now owe $510 plus late fees.

- After six months of failing to pay your balance, you owe $565 plus late fees.

- After a year of no payments, the cost of the flight tickets has ballooned to $639 plus late fees, and it will continue to grow until you pay the balance off in full.

Minimum payments vs. paying in full

The minimum credit card payment is the smallest amount required each month to avoid late fees. While making the minimum payments on time keeps your account in good standing, interest will still accrue on the remaining balance, which can cause your debt to grow faster than you’re paying it down.

Paying your credit card off in full means paying the entire balance. This will help you avoid interest charges and late fees and protect your credit score.

Paying your credit card increases your credit score

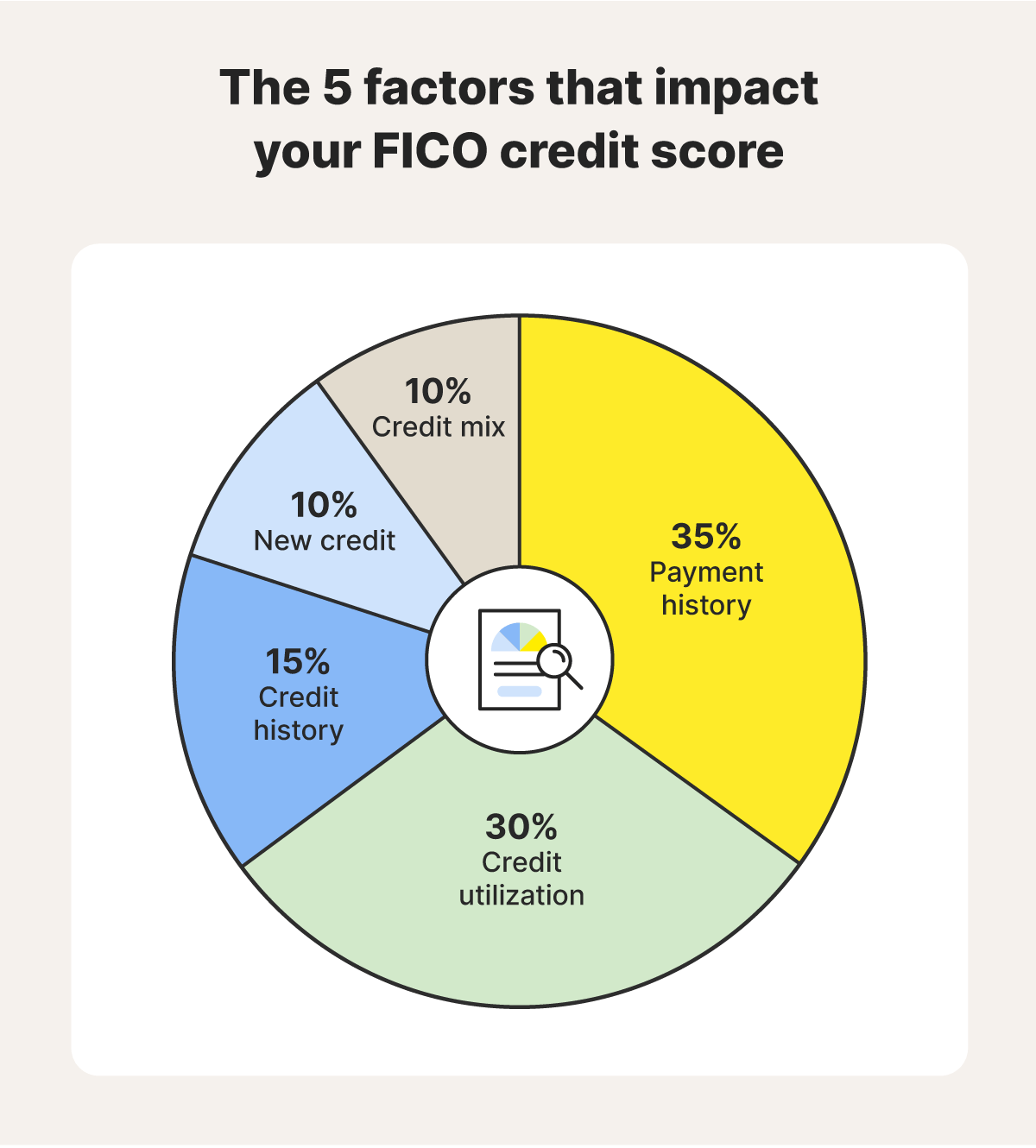

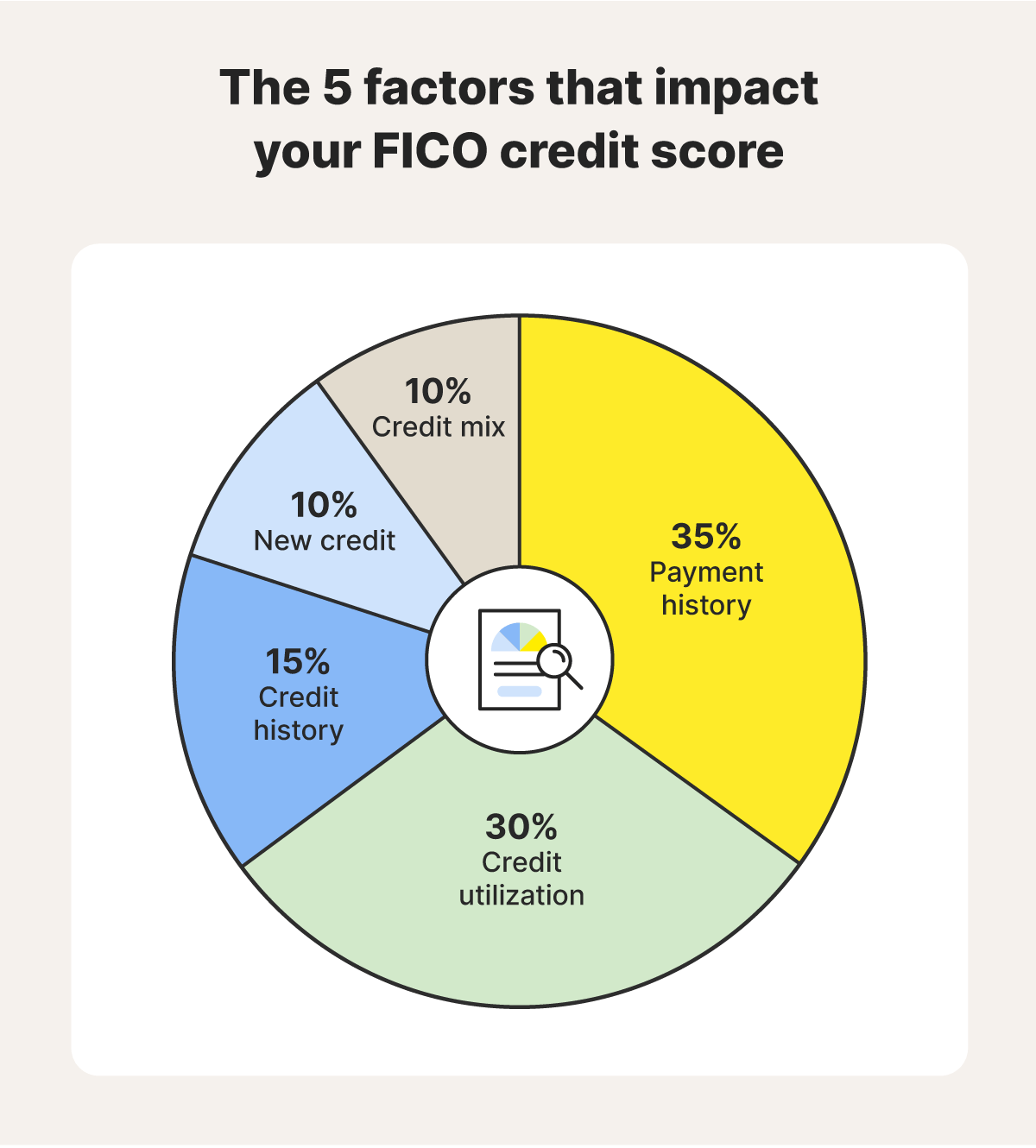

Paying off your credit card balance on time and in full each month can boost your credit score by positively impacting your payment history, which tracks the reliability of your payments. It also lowers your credit utilization, which is a measure of how much of your available credit you’re using. Both factors—timely payments and credit utilization—are essential to maintaining strong credit health.

When should I pay my credit card bill to increase my credit score?

Consistently paying your credit card bill by the due date can help boost your credit score. And to prevent large credit utilization from harming your credit score, it’s best to pay off the full balance as soon as possible.

Even if you can’t pay off the full statement balance, it’s vital that you make the minimum payment on time to avoid negatively impacting your credit score.

What factors have the biggest impact on your credit score?

Payment history and credit utilization are the two most important factors influencing your credit score. To develop and maintain healthy credit, make all payments on time and keep your credit utilization under 30%. Additional factors with a smaller impact include the length of your credit history, your mix of credit types, and the number of recent hard inquiries (triggered whenever you apply for new credit).

How to stay on top of credit card payments

The best way to stay ahead of credit card bills is to avoid spending more than you can afford to pay off each month. Creating and sticking to a budget can help prevent overspending and keep your finances in check.

Here are additional strategies to help you manage credit card payments:

- Use autopay: Set up autopay to avoid late fees.

- Pay in full when possible: Try to pay off your balance in full—or at least more than the minimum payment—to reduce interest charges and avoid accruing debt.

- Create a payment plan: Develop a strategy for paying off credit card debt, focusing on high-interest cards first to save on interest in the long run.

Keep your credit score strong

Paying your credit card on time is crucial for maintaining good credit, but it's just one piece of the puzzle.

LifeLock comes with an app that lets you easily check your credit score daily, and our credit monitoring services help protect your credit with fraud detection that notifies† you of suspicious activity. And should you ever fall victim to identity theft, our restoration experts can help get your life—and your credit score—back on track.

FAQs

Should I pay my credit card in full?

Yes, it's best to pay your credit card in full when possible. That helps you avoid interest charges and protect your credit score.

Is it bad to pay a credit card bill early?

No, paying your credit card bill early is beneficial. It can boost your credit score by reducing your credit utilization.

Does credit card debt improve my credit score?

No, credit card debt does not improve or fix your credit score. But paying off your credit card debt can improve your score and save you money in the long run.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.