A credit score is a number that reflects your creditworthiness. These are three-digit numbers that range from 300 to 850. The higher your score, the more likely you are to obtain credit.

The three credit bureaus—Experian, Equifax, and TransUnion—compile credit reports, and the information in these reports is used to generate credit scores based on a scoring model—typically FICO or VantageScore.

Several factors affect your credit score, including how often you miss payments and your credit utilization ratio. Read our guide to learn more about the different credit score components, common mistakes to avoid, and tips for improving your score.

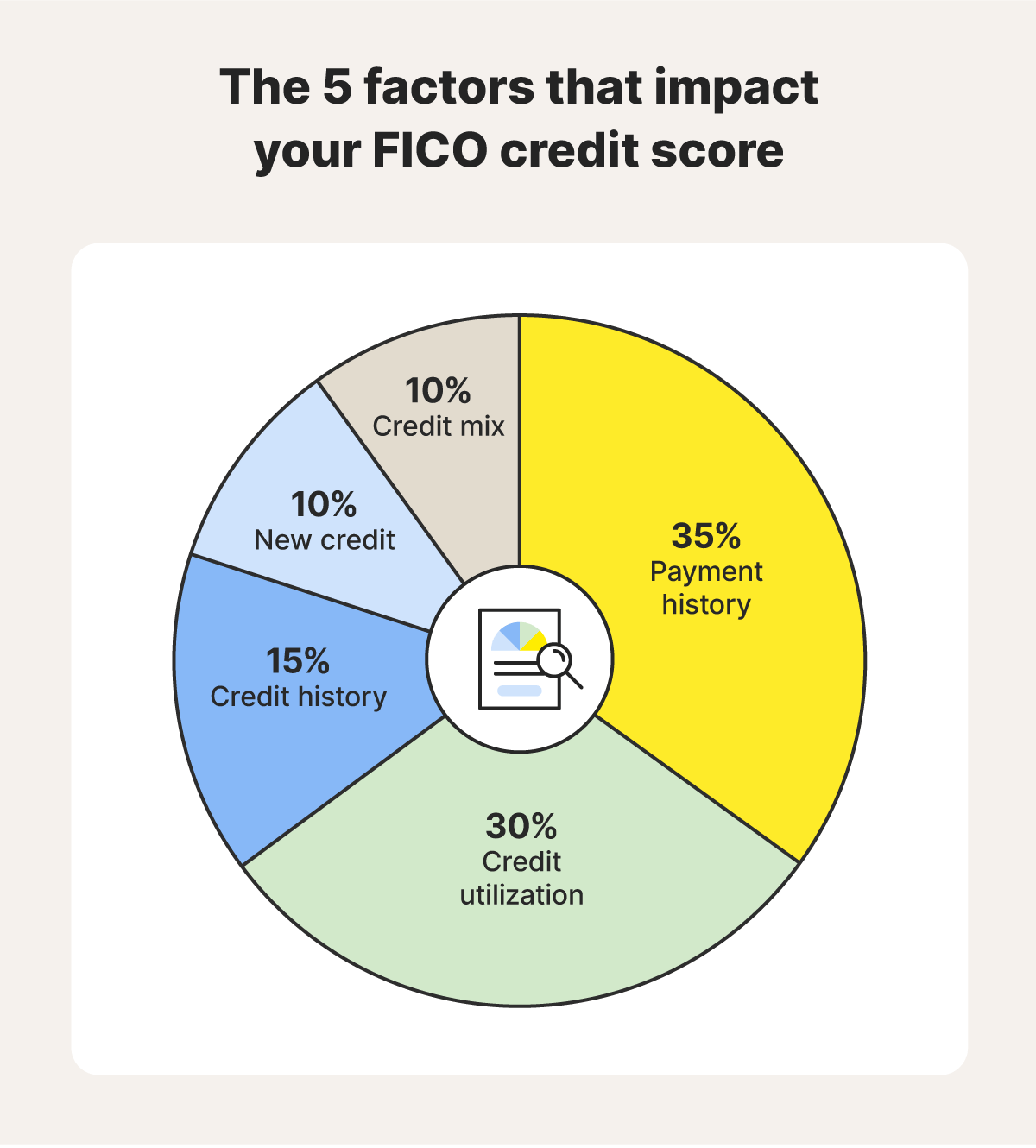

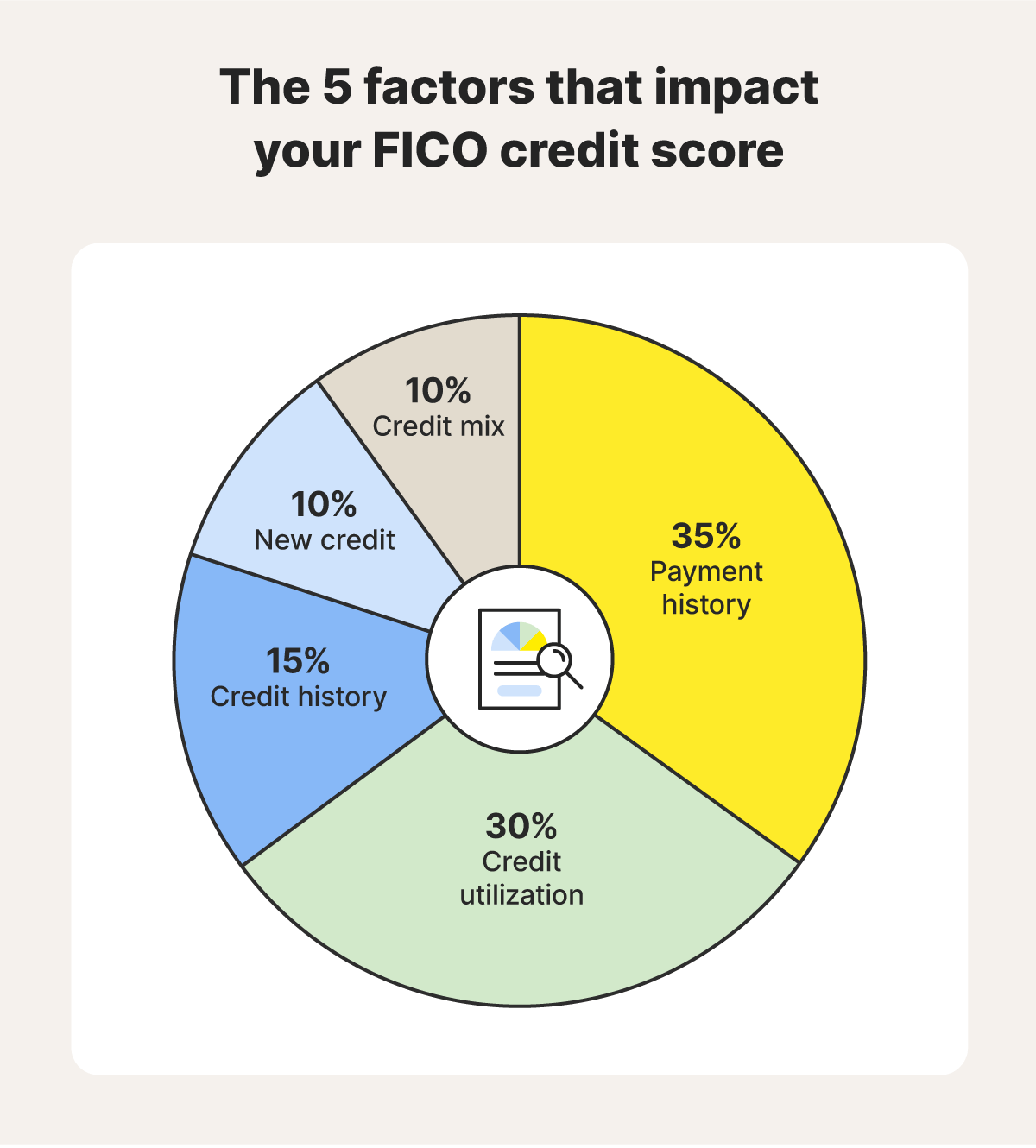

5 factors that affect your credit score

The five factors that affect your credit score are your payment history, credit utilization, credit history, credit mix, and new credit. Some credit factors carry more weight than others. Understanding these factors can help you build a good credit score and find areas for improvement.

FICO scores are the most widely used by lenders and creditors when assessing borrowers’ creditworthiness. Let’s break down the factors that go into creating these scores.

1. Payment history

The factor that affects a credit score the most is payment history. This metric evaluates whether you pay your bills on time. Missed payments tell creditors that you may be unable to afford your expenses. Non-payments can lower your score, but they’ll be removed from your credit report after seven years.

Poor payment history happens if you regularly miss payments, have debts in collections, or file for bankruptcy. If you’re late on a payment, catching up within 30 days is important to avoid a credit score drop. Creditors can report a late payment only after it’s 30 days overdue.

Tip: To build or maintain a good payment history, set up auto-pay so you never miss a payment. If you fall behind on a repayment one month, make sure you cover it within 30 days.

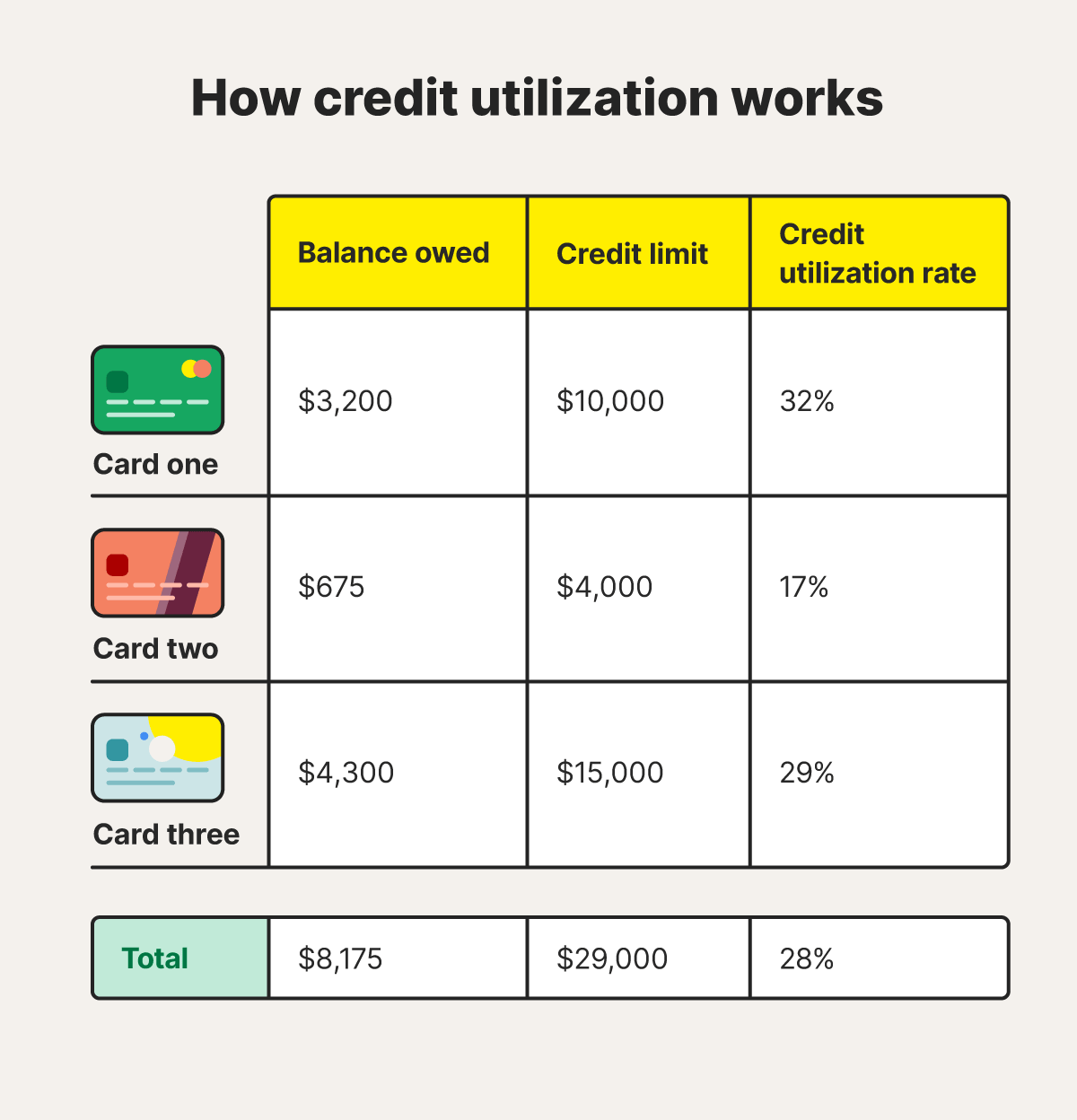

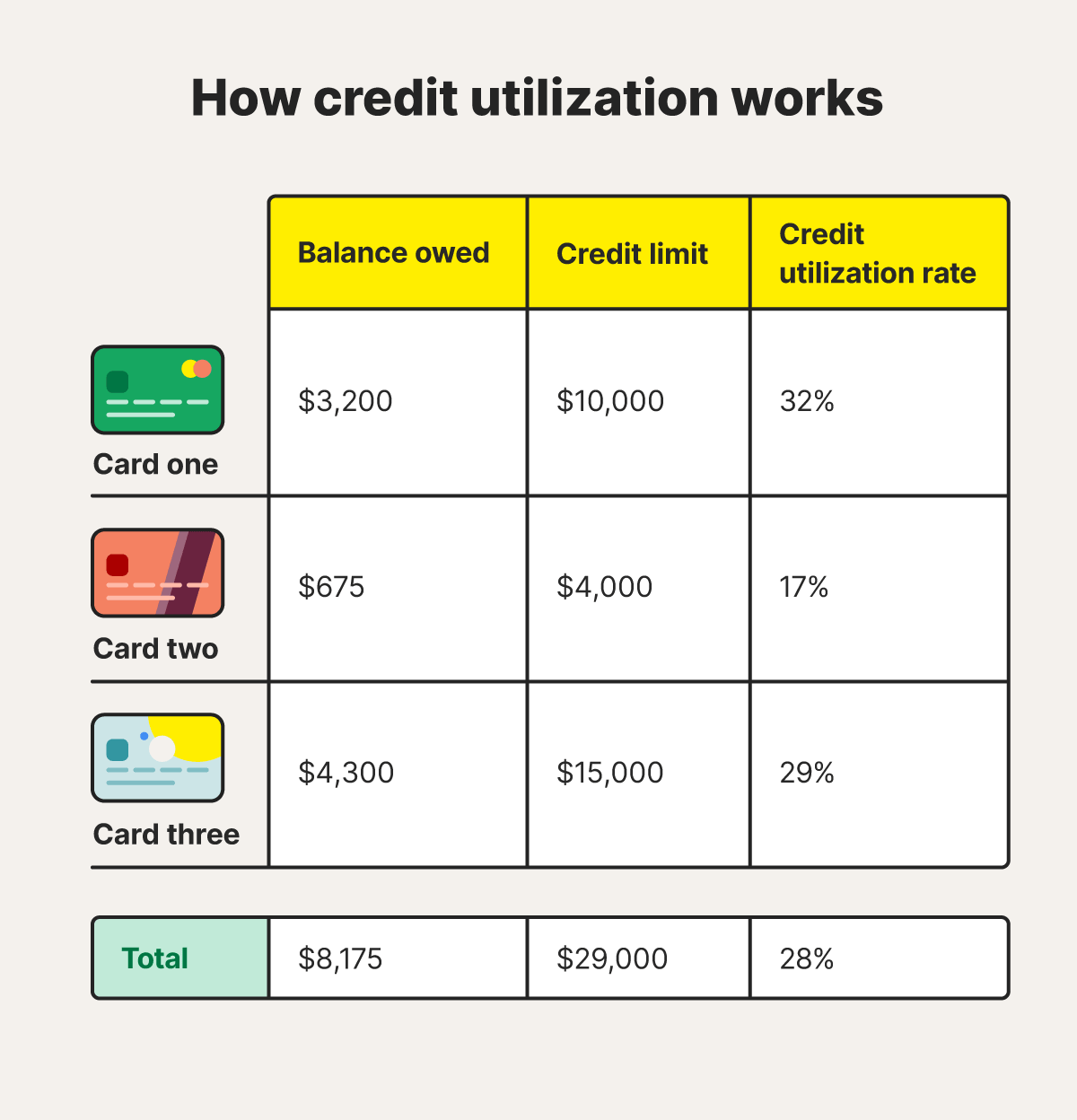

2. Credit utilization

Credit utilization is a ratio or percentage determined by how much credit you have available (your credit limit) and how much you’re using (your balance). Try to keep your utilization rate below 30% to help your score and under 10% if you want the maximum results.

Common mistakes that can hurt your credit utilization score include making only minimum payments, closing an old account, and maxing out your credit limits. Improve your credit score utilization rate by paying down debts as quickly as possible, keeping open accounts you don’t use, and applying for higher credit limits.

Certain types of credit and loans don’t impact your credit utilization score. These include installment loans such as car loans, student loans, personal loans, and home mortgages.

3. Credit history

Accounting for 15% of your credit score, your length of credit history is calculated by looking at the age of your oldest account, the age of your newest account, and the average age of all your accounts. It also considers the age of specific credit accounts and how long it’s been since you’ve used various accounts.

The idea is that the longer you’ve had credit, the more likely you are to maintain good credit, as your credit history allows creditors to see how well you’ve managed your accounts in the past. Avoid closing old accounts—unless there’s an identity theft risk or the fees are unmanageable.

Tip: Keep old accounts open to help improve your credit history and utilization ratio.

4. Credit mix

Credit mix measures the different types of credit accounts you have, such as credit cards, retail accounts, and mortgage loans. It’s good to have a variety of revolving and installment credit accounts.

- Revolving credit examples: Credit cards, retail credit cards, gas station cards

- Installment credit examples: Mortgages, auto loans, student loans

Since your credit mix only counts toward 10% of your total score, be careful opening new accounts to boost this factor because opening new lines of credit also impacts your score.

5. New credit

Any time you apply for a new line of credit, whether signing up for a new credit card or financing a car, a hard inquiry is documented on your credit report. Having too many hard inquiries on your report can harm your score. To avoid this, only apply for credit that you really need and qualify for, and space your applications out.

Tip: Opening multiple credit accounts quickly can negatively affect your score, especially if you don’t have a long credit history.

Common mistakes that can negatively affect your credit score

There are several common mistakes that people make when managing their credit. While some stem from the five scoring factors, others are easier to overlook.

- Co-signing for someone else’s line of credit: When you co-sign for someone, you’re also responsible for the debt that person may accrue if they don’t make the payments. All co-signed loans appear on your credit report, too, so missed payments can affect your credit score. If you co-sign for someone, make sure they’re responsible with their money.

- Not monitoring for identity theft: Criminals can try to open new accounts or apply for loans using stolen information like your Social Security number and financial details. Credit scores update at least once a month, and you should check your report and score regularly to spot any irregularities early and mitigate damage.

- Making only minimum repayments: Many accounts allow you to pay a minimum amount each month. While this can help lower expenses initially, it can be costly in the long run due to interest rates, which may cause you to miss payments down the line, hurting your score. Try to pay off more than the minimum amount to save money in the long term and help your utilization rate.

- Opening too many new accounts at once: Your credit score can suffer since each application triggers a hard inquiry on your report.

- Closing old credit card accounts: If you close old accounts, your score might drop because you’ll have less history, meaning the average age of all your accounts will decrease. This can also impact your credit utilization rate, because your total credit available would decrease.

Factors that don’t affect your credit score

Now that you know how credit scores work and what impacts them, let’s talk about factors that don’t affect your credit score.

- Checking your own credit score: You can check your FICO score, Vantage score, or credit report without impacting your credit score. That’s because checking your own report is considered a soft inquiry, not a hard inquiry.

- Making or missing rent and utility payments: The consequences of not paying your rent will typically include late fees or eviction but won’t generally affect your credit score, unless your landlord sends the debt to collections.

- Your salary: Your credit score doesn’t reflect how much money you make. You can have a lower income and a max credit score of 850. Alternatively, you can have a high income and bad credit if you don’t make payments on time. Creditors will consider your salary when offering lines of credit and increasing your credit limit, but your salary doesn’t impact your actual credit score.

- People you live with or are married to: Your credit score isn’t affected by the people around you, unless you’re financially tied to them (like having a joint bank account or credit card).

Find out if identity thieves are tanking your credit score

Mistakes on your credit report or identity thieves opening accounts in your name can significantly impact your credit score. You can help protect your credit and identity with LifeLock, which lets you check your credit score conveniently from the app.

LifeLock has a suite of other features, too—it keeps track of your personal information and notifies you if fraudulent use is detected. And if you ever become the victim of identity theft, LifeLock’s dedicated U.S.-based restoration specialists will guide you through the recovery process.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.