What does pre-approved mean for a credit card?

If you are pre-approved for a credit card, you meet some or all of the credit card company’s requirements (called a firm offer of credit) for a card. Using the information on your credit report, the lender will extend an offer if they determine you meet the approval criteria and are creditworthy. Some of the factors they might look at include:

- Payment history

- Credit usage

- Credit score

- Bankruptcies

Credit card companies obtain this information using a “soft check,” meaning your credit score will not be affected. However, these companies will do a hard check on your credit if you accept a pre-approved offer or apply for another one of their credit cards.

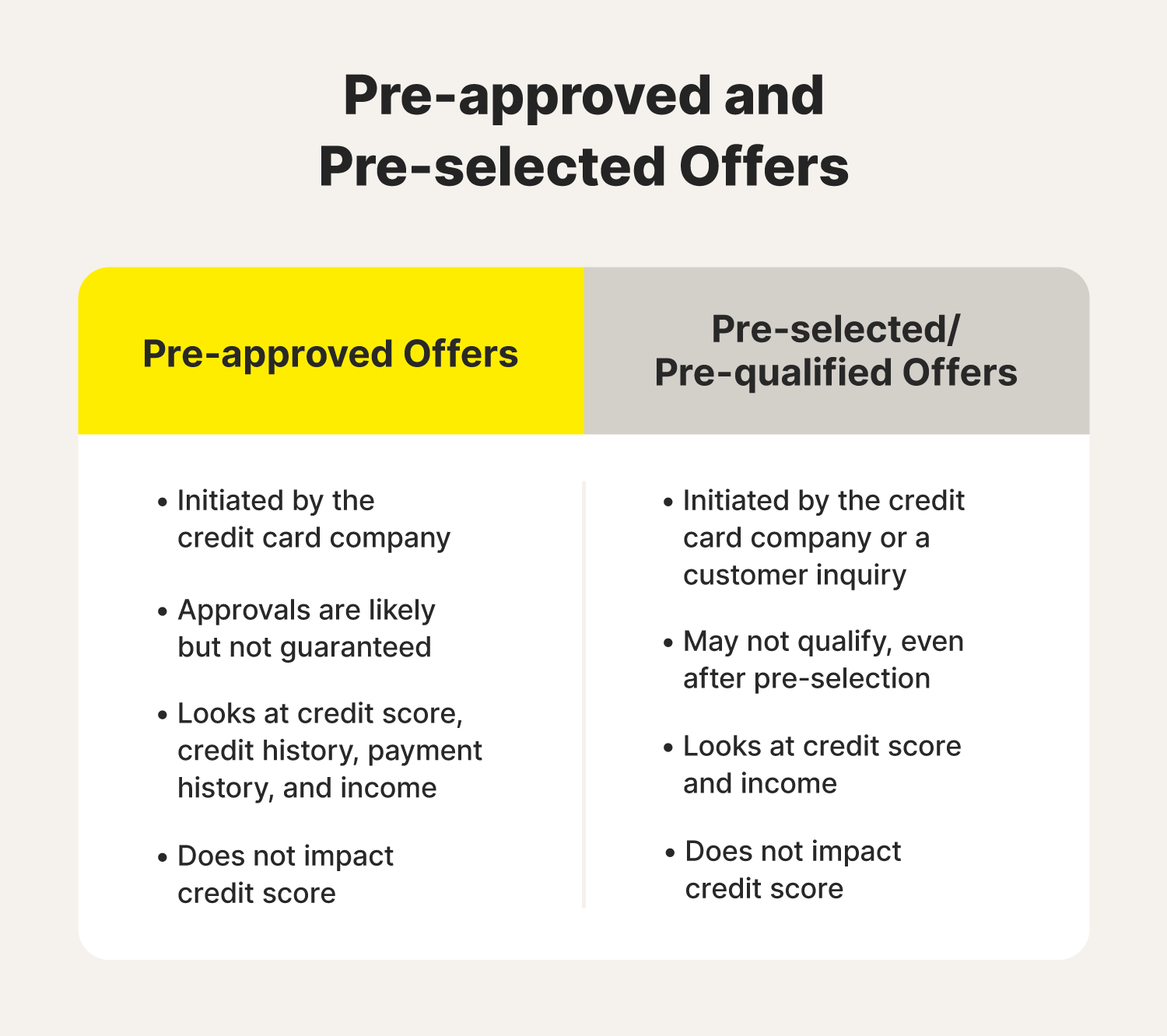

Pre-approved vs. pre-selected: What’s the difference?

A pre-selected offer means that your credit score, location, or another demographic factor simply meets a broader set of criteria the credit card company determines. A pre-approved credit card offer means you will likely receive a credit card if you apply.

With either a pre-approved or pre-selected offer, a lender has determined that your creditworthiness meets certain eligibility standards. But you’ll still need to apply for a card (which will result in a more thorough credit check) and neither kind of offer is guaranteed.

You may earn pre-approval by having a certain credit score, a good payment history, or other relevant characteristics on your credit report. While you’re less likely to be approved with a pre-selected offer, your chances are still pretty good.

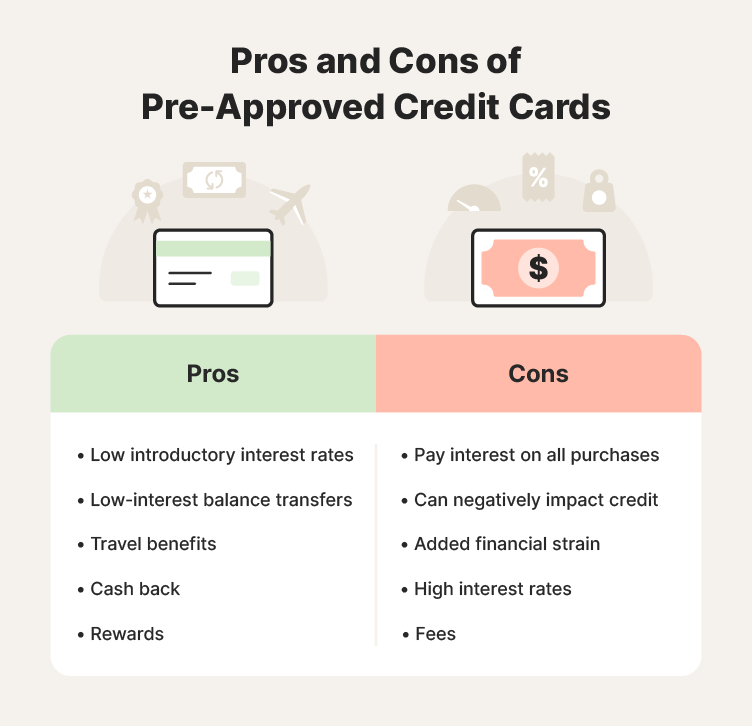

What are the benefits of a pre-approved credit card?

Many credit card companies will offer benefits for people they pre-approve, including:

- Low introductory rates

- Low- or zero-interest balance transfers

- Travel benefits

- Cashback

- Access to special rewards

You might not qualify for all the benefits listed on a pre-approval offer, so read any agreements carefully to ensure you’ll get what you want.

Are there any downsides to a pre-approved credit card?

The downsides of pre-approved credit cards are much the same as any other credit card:

- You pay interest on the outstanding balance each month.

- Hard inquiries could impact your credit.

- You can impact your credit through overuse.

- You can negatively impact your credit if you miss payments.

- You could assume debt that can stress your financial situation.

- Some cards have high interest rates.

- You could become a victim of credit card fraud.

- You may need to pay credit card fees.

- Pre-approved credit card mailers could increase the chances of identity theft.

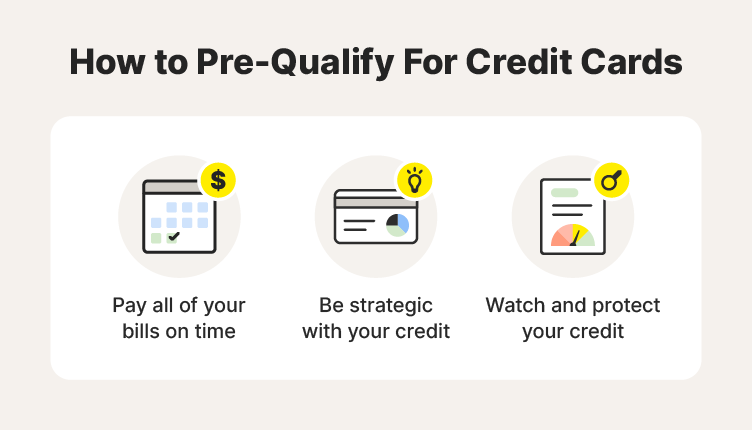

How to pre-qualify for a credit card

Improving your credit score is usually the best way to start pre-qualifying for credit cards. This can be tough if you’re rebuilding your credit after identity theft, but learning how your credit score works and how to improve it is important and worth the time.

Follow these steps to increase your chances of pre-qualifying for a credit card:

Pay bills on time

Creditors want customers who pay their bills on time. If you haven’t had a great payment history, work on paying all your bills by their due date. After several months, you should start to see your credit score improve.

If you’re just starting to build your credit, ensure your prompt rent and utilities payments are being reported to the credit bureaus. This can help you get a credit card and other types of credit.

Be strategic with credit

Credit card companies and other lenders look at your credit utilization ratio, mix of credit, payment history, and credit score. While no piece of financial advice works for everyone, keeping your credit utilization ratio at or below 30% is a good idea. That shows credit card companies that you can manage your finances and use credit responsibly.

Using different kinds of credit, like credit cards, personal loans, auto loans, and mortgages responsibly can improve your odds of being pre-approved for a new card. Balancing revolving credit with installment loans shows lenders that you can manage your credit.

Watch and protect your credit

Checking your credit report for errors can help you maintain a healthy credit score. If you see an error, report it to the credit bureaus immediately. If someone has applied for credit using your name, you should freeze or lock your credit to stop anyone else from opening new accounts in your name.

If you think you may have been the victim of fraud, you can place a fraud alert. You’ll still be able to apply for credit, but creditors will be encouraged to take extra steps and get more information to verify your identity before approving a loan or credit card. Remember that checking your credit score doesn’t lower it, and it’s often helpful to be proactive.

Signing up for identity theft protection and credit monitoring will help you take action quickly if your credit score is in jeopardy. LifeLock offers advanced credit monitoring tools and helps you protect your identity and credit by monitoring your Social Security number and other personal information for fraudulent activity.

Should I accept a pre-approved credit card?

It’s important to weigh the pros and cons of any new credit card or loan before you accept an offer. Some of the most important details to consider include:

- Debt-to-income ratio: This is your total monthly debts, including credit cards, loans, mortgages, child support, and other recurring expenses divided by your gross monthly income. A lower debt-to-income ratio means you’re more likely to meet new payment obligations. If you’re below 43%, you should be able to handle a new credit card without undue strain on your finances.

- Interest rate: Credit cards have higher interest rates than other forms of credit. Consider a personal loan if you need credit but want a lower interest rate.

- Rewards and perks: Some of the perks and rewards credit cards offer to new account holders can save you money or make traveling more affordable. Just watch out for yearly fees.

- Introductory offers: Many credit cards offer temporary rates lower than normal. In contrast, others might give you more cash back for the first year or let you transfer the balance from another card with no interest charges for the first six or 12 months.

How to opt-out of pre-approved credit card offers

Pre-approved credit card offers can be a nuisance, especially when you have a good credit score and aren’t interested in a new card. And, if somebody steals your mail or it gets delivered to the wrong address, these offers could even increase your chances of identity theft. Luckily, there’s a way to stop these offers from clogging up your mailbox.

Visit the OptOutPreScreen website to opt out of insurance and credit card offers. Opting out means that credit reporting agencies like Equifax, Experian, Innovis, and TransUnion will remove your name from the lists they generate for credit card companies and insurance providers.

If you want to start getting pre-approved offers again, you can opt back in at any time.

Help keep your credit score in good shape

Taking care of your credit is vital. Without good credit, you might not be able to buy a new home or vehicle or qualify for other kinds of loans or credit cards. That’s where services like LifeLock come in, to help you maintain healthy credit. Get credit monitoring, dark web monitoring, and features for removing your personal information from the web today.

FAQs about pre-approved credit cards

Still have questions about pre-approved credit cards? We have answers.

Does pre-approval or pre-qualification impact your credit score?

Pre-approval or pre-qualification impacts your credit score only if you accept the offer. Once you accept the offer and apply, the application will trigger a hard inquiry that can impact your credit score.

Can you be denied a pre-approved credit card?

Yes, you can be denied a pre-approved credit card. If a hard inquiry reveals your financial situation differs from when the bank sent the approval, a credit card company can choose not to approve your application.

What is a normal first-time credit limit?

There is no “normal” first-time credit limit. If you’re young and have minimal credit history, you may qualify for a card with a limit below $1,000. You may qualify for a few thousand dollars if you have built up a good credit record.

What builds credit fastest?

There are several ways to build your credit relatively quickly. You can apply for secured credit cards, pay all your bills on time, ask to be added as an authorized user on family members’ accounts, and know when to pay your credit card (pay it off in full quickly for the best results). Having several types of credit (credit cards and a mortgage) can also help you build your credit.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- What does pre-approved mean for a credit card?

- What are the benefits of a pre-approved credit card?

- How to pre-qualify for a credit card

- Should I accept a pre-approved credit card?

- How to opt-out of pre-approved credit card offers

- Help keep your credit score in good shape

- FAQs about pre-approved credit cards

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.