A Medicare scam is a fraudulent scheme targeting Medicare recipients. Scammers typically pretend to be from Medicare or another medical organization to trick you into providing your Medicare ID, Social Security number, or financial information.

As the number of Americans on Medicare continues to grow, with more than 69 million people currently enrolled, these schemes have a larger pool of potential victims. In response to this risk, federal authorities have stepped up enforcement significantly. As part of the Justice Department’s National Health Care Fraud Takedown, prosecutors charged 324 defendants in cases involving more than $14.6 billion in alleged fraud in total.

Being targeted by a Medicare scam puts you at risk of compromised healthcare coverage, financial hardship, and emotional distress. We’ve put together a guide to the most common Medicare scams to watch out for in 2026, and what you can do to avoid them.

The most common Medicare scams in 2026

In 2026, the most common scam pretexts include fake Medicare card renewals, threats to cancel benefits, and billing fraud carried out under a beneficiary’s name. Some people report being contacted so often that they’ve had to change their phone numbers repeatedly. Knowing what to look out for can help you identify a scam if you’re targeted.

1. You’re told to get a new Medicare card

In a Medicare card scam, attackers claim that the federal health insurance program is issuing new cards. They often sell the lie by claiming the card has a new look or security features, and they need to verify your identity before mailing it out. Their end goal is to steal personal details, such as your Social Security number, Medicare ID number, or other personally identifiable information.

However, there are no plans to roll out new Medicare cards to all members in 2026. You’ll only receive a new one if someone committed medical fraud in your name or you asked for a replacement.

2. You’re told your Medicare benefits are canceled

In a benefits cancellation scam, a scammer will get in touch with you and claim you’re at risk of losing your Medicare coverage. They’ll use urgent language and pressure tactics to rush you into making a hasty decision, surrendering your personal information, or encouraging you to send them a payment directly.

Contrary to what these Medicare scam callers insist, there are only a few circumstances that would lead to the cancellation of your benefits, like failing to pay your premiums or committing fraud.

3. You’re offered better or cheaper Medicare coverage

Medicare isn’t 100% free for most people, and costs can vary depending on the type of coverage you have. Some Medicare Advantage plans advertise low or even $0 monthly premiums, and assistance programs like Medicare Extra Help can lower prescription drug costs for people who qualify.

Scammers can take advantage of the confusion surrounding Medicare by claiming you’re eligible for a cheaper plan, better benefits for the same price, or extra drug coverage at no additional cost.

If you fall for their fake offer, the scammer may try to steal your personal or financial information, claiming they need details to process your enrollment or verify eligibility. They might even ask you to make an immediate payment over the phone.

One Reddit user’s story: “I enrolled in Medicare Part A last year and Part B earlier this year. I received a call from someone who identified himself as calling on behalf of Medicare ‘from Fairfax, VA,’ and wanted to make sure I was still enrolled — he already knew my birthdate. He said I should have received a new card in the mail and asked for my ID, which I refused to give over the phone.”

4. You’re offered a rebate or refund for medical expenses

Medicare scammers may claim that you’re entitled to a refund or rebate on prescriptions, equipment, or medical services that you’ve received. However, to get access to the money you’re “owed,” they’ll say you need to confirm your billing details or personal information.

While you may be eligible for some legitimate refunds or rebates, your healthcare provider should inform you about them directly. In other words, if someone you don’t know contacts you unprompted and claims that you’ve overpaid for services and qualify for a rebate, it’s almost always a scam.

5. You’re offered free or discounted medical tests and equipment

Some Medicare scam calls promise free or steeply discounted medical equipment or services (like genetic testing) in exchange for your Medicare or credit card number. Scammers running these schemes may claim to be a representative from Medicare or a third-party medical organization.

Giving up your personal or financial information will leave you exposed to fraud and could even lead to your Medicare coverage being canceled if the scammer makes false claims in your name. Treat any offer of free medical products or services with extreme caution and verify it directly with a trusted medical professional or Medicare representative.

6. You get excessive bills for online or telehealth services

A telehealth scam involves providers who operate over the phone or the internet, exploiting customers for financial gain. They might do this by prescribing medications without completing a thorough exam, billing for consultations that never happened, or misrepresenting services to overcharge.

While telehealth services offered through Medicare are often legitimate and can be an effective and convenient way to get care, some may be fake or fall below minimum quality standards, and could present a scam risk.

Look out for red flags, such as your doctor rushing through your concerns, scheduling multiple appointments for a simple issue, or offering medicine or diagnoses hastily. These can all lead to a bill that’s too high, leaving you unfairly out of pocket.

7. You’re not cared for or billed correctly at a hospice

Hospice fraud involves healthcare workers providing subpar hospice services, fraudulently accepting patients who don’t qualify for end-of-life care, or billing incorrectly for services to collect more money from Medicare.

These schemes often target particularly vulnerable victims who might not be able to defend themselves against the risks. To make sure a sick loved one isn’t being exploited, look out for them being pressured to enroll in a hospice when it’s not necessary, denied services or otherwise neglected while in care, or overcharged for hospice services.

8. You receive inaccurate or unexpected medical bills

Healthcare providers can commit billing fraud by submitting false or misleading claims so they’re paid more than they’re owed for services provided. This trending Medicare scam involved sending unprescribed medical equipment so the scammer can then bill the patient.

Other possible approaches include:

- Overcharging for services you received.

- Upcoding, or billing for a more expensive service than the one that was provided.

- Unbundling, or separately billing for components of a single service.

- Phantom billing, or billing for services that were never performed.

Requesting an itemized bill for any healthcare services you receive can help you spot billing fraud, protecting you from paying more than you need to. You can also check for any fraudulent bills by regularly monitoring your claims history on the Medicare website.

How to report Medicare fraud

The process for reporting a Medicare scam or subsequent case of medical identity theft is fairly straightforward. Here’s a step-by-step guide to help you take action if you’re targeted:

Step 1: Gather evidence

Gather as much evidence as you can before reporting a Medicare scam. Here’s how you can do this:

- Log in to your secure Medicare account at Medicare.gov to investigate how your insurance benefits were used and where.

- Take screenshots or save copies of suspected fraudulent communications, including emails, texts, documents, and calls.

- Record any information you have about the scammer and make notes about what happened.

Step 2: Contact the right people

The next step is to contact the right people so that the fraud is documented and investigated. Here are specific organizations to reach out to:

- Report the scam to Medicare by calling the fraud hotline at 800-633-4227 or using the official online form. Medicare’s investigators will look into your claim and possibly pursue legal action against the offender.

- If your identity was stolen, file an identity theft report with the Federal Trade Commission. The FTC can carry out a full investigation and may bring charges against the perpetrator.

- Submit a report with your state’s Senior Medicare Patrol (SMP). This program exists to help protect Medicare beneficiaries and caregivers from fraud, errors, and abuse.

- Report the fraud to any third-party healthcare companies that were involved, especially if you believe one of their medical professionals or administrators was behind the scam. It’s their responsibility to take appropriate action.

- Submit a complaint with the Office of Inspector General if a provider bills for treatment you didn’t receive or makes a fraudulent claim to your insurance company. They can carry out an investigation and help you get restitution.

Step 3: Begin the recovery process and monitor for progress

After reporting the scam, focus on limiting further damage and tracking your recovery. This is how you can do it:

- Keep tabs on any open investigations related to your case.

- Freeze your credit to stop the Medicare scammer from using your personal or financial information to rack up more debt.

- Consider consulting an attorney to understand how to recover any lost funds or insurance coverage.

- If you lost money to Medicare fraud and have a LifeLock membership, file a claim to get reimbursed for stolen funds.

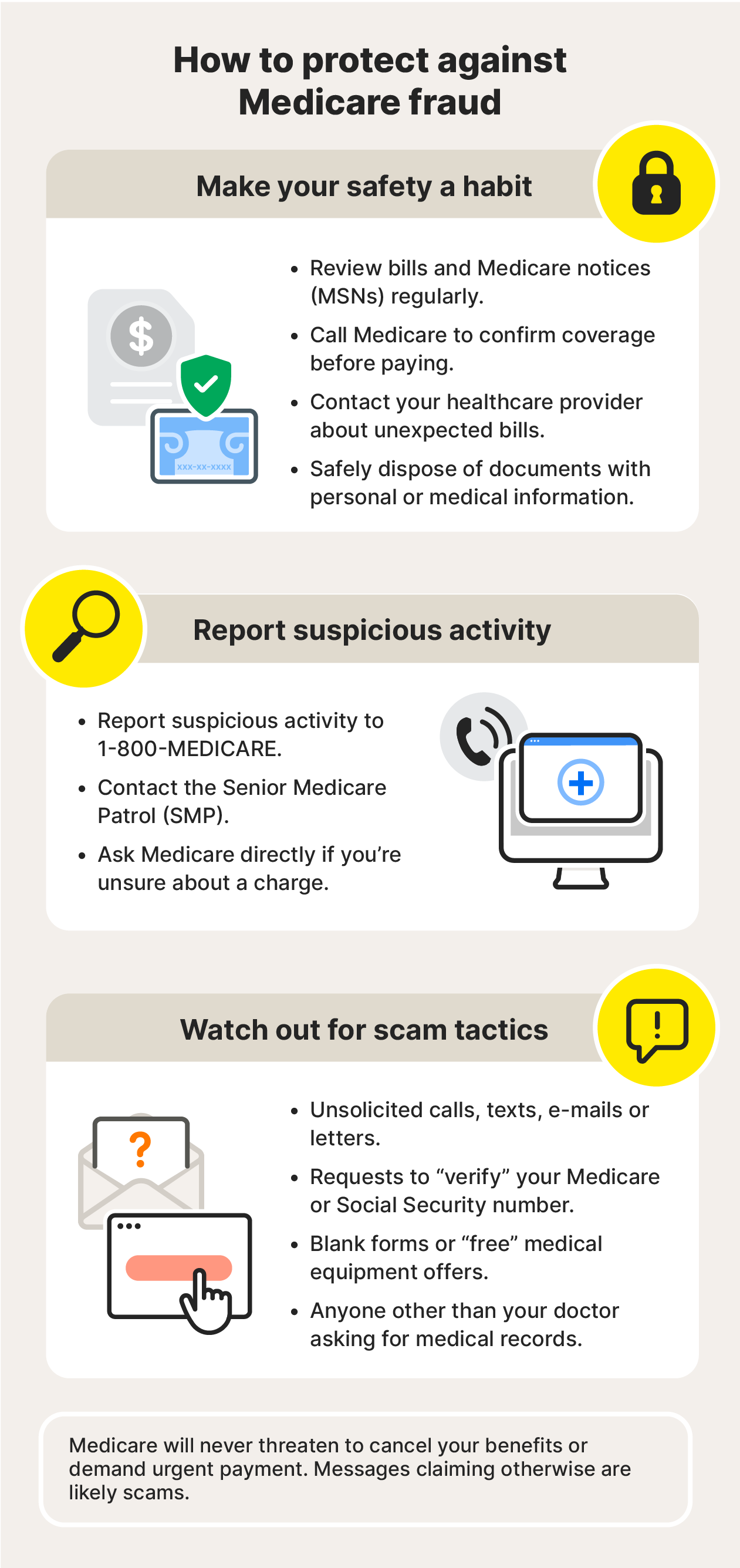

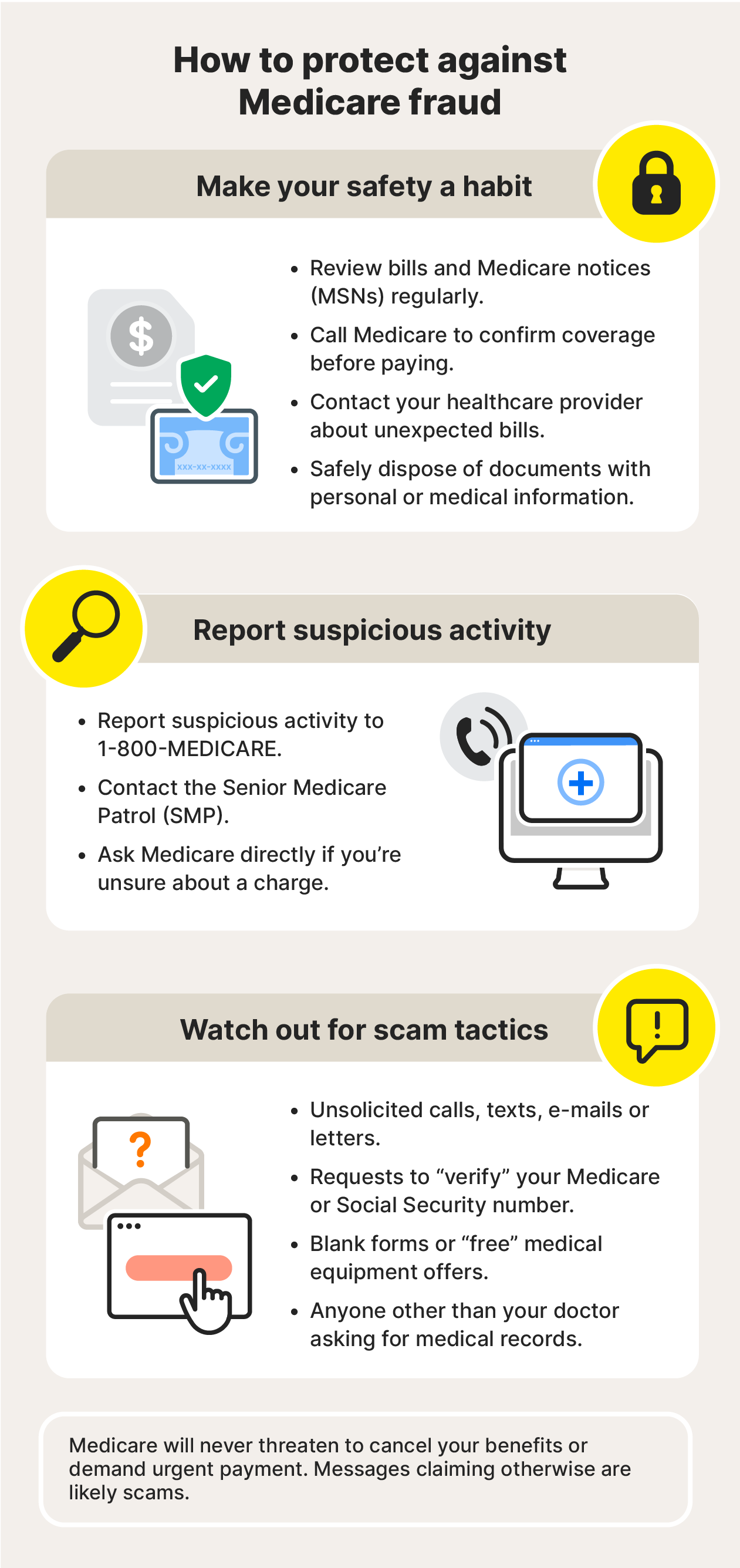

How to protect against Medicare fraud

Regularly reviewing your insurance statements, treating unsolicited contact with caution, and contacting Medicare directly if you have questions about your benefits or bills can all help safeguard you from Medicare fraud.

Here are some other ways to protect against Medicare fraud:

- Review bills and Medicare Summary Notices (MSNs) regularly.

- Report suspicious activity at 1-800-MEDICARE or the Senior Medicare Patrol (SMP).

- Call Medicare to confirm coverage before paying out-of-pocket.

- Contact your healthcare provider if you receive an unexpected bill.

- Safely dispose of documents that contain personal, medical, or financial information.

If you want to help further reduce your risk of Medicare fraud and catch issues early:

- Don’t answer unsolicited calls, emails, texts, or letters.

- Don’t let anyone other than your doctor see your medical records.

- Don’t sign blank forms.

- Don’t accept “free” medical equipment or services.

- Don’t share personal information like your SSN or Medicare number through unofficial channels.

Medicare will never urgently threaten to cut your benefits or endorse specific plans. Any call, text, or letter claiming that they will cancel your coverage unless you “verify your information” or pay a fee is likely a scam.

Get help recovering from Medicare scams

Even if you do everything right, it’s still possible for your Medicare information to be compromised, which is why LifeLock is so valuable when scammers get access to your Social Security number or other personal details and use them to commit healthcare fraud. If that happens, you need expert support on your side.

LifeLock Advanced has credit monitoring features that can help you detect if your information is used in fraudulent financial applications, so you can act fast to protect yourself. It also gives you access to U.S.-based restoration specialists who can help you recover your identity if it’s stolen after a Medicare scam, and you’ll benefit from reimbursement of up to $5k for eligible scam-related losses.

FAQs

Does Medicare ever call you on the phone?

No, Medicare will not call you unexpectedly to sell you plans, ask for your Medicare number, request payment, or verify personal information. Any unsolicited calls like these are likely scams. Medicare only calls you when they’re returning a call that you initiated.

Does Medicare ask for your Social Security number?

The only time Medicare asks for your Social Security number is during the initial enrollment process — and that information is handled through secure channels, not through unsolicited outreach.

Is Medicare issuing new cards?

Medicare has not announced plans to release new cards for beneficiaries, with the last major Medicare card update completed in 2019. If somebody contacts you claiming they can send you a new card, they’re likely running a scam.

What can a scammer do with your Medicare number?

A scammer with your Medicare number can steal your identity, filing false claims or fraudulently accessing medical care under your name and accumulating charges with providers. They can also redirect your prescriptions to their address, instead of your own.

Why am I getting so many spam calls about Medicare?

An increase in spam calls might be the result of fraudsters getting access to your contact information if it was leaked in a data breach and sold on the dark web. You may also get more spam calls if your phone number is being sold by data brokers. You can minimize unwanted calls by adding your phone number to the National Do Not Call Registry or using your phone’s spam-blocking features.

How do I get Medicare scammers to stop calling?

Start by not answering any unsolicited calls. If you do happen to find yourself on the receiving end of an uninvited Medicare call, don’t engage. Just hang up. Next, add your number to the National Do Not Call Registry, enable your phone’s spam blocking, and block numbers as they appear (although scammers frequently switch lines).

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.