Your credit score and credit report both provide valuable information that can help you track your financial progress and detect potential fraud. We’ve created a complete guide to these two credit tools to help you understand how each one works and why they both matter.

What is a credit score?

A credit score is a three-digit number representing your “creditworthiness,” which is an assessment of your financial reliability and suitability for credit. It’s based on factors like your payment history, credit utilization, credit mix, and credit application history.

There are many credit scoring models, but FICO Score and VantageScore are the two most common. Both models consider similar factors and use a scoring range from 300 to 850 — with a higher score indicating lower risk to lenders.

However, they use different weightings and grade boundaries, which means your credit score and grade may be different depending on which model you check.

Credit score grade |

FICO® Score |

VantageScore® |

|---|---|---|

Poor/Subprime |

300-579 |

300-600 |

Fair/Near prime |

580-669 |

601-660 |

Good/Prime |

670-739 |

661-780 |

Very good/Super prime |

740-799 |

781-850 |

Exceptional |

800-850 |

N/A |

Other credit scoring models, such as TransRisk and Credit Xpert, are used far less frequently. Some are even tailored to suit individual sectors, like the FICO Auto Score which assesses creditworthiness in the specific context of an auto loan.

What is a credit report?

A credit report is a detailed record of your credit history provided by one of the three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau issues its own report, which may vary slightly in format and content. However, all of them fundamentally provide an overview of your borrowing and repayment activity to help lenders assess your credit risk.

Credit reports typically include the following information:

- Personal information: Your name, address, date of birth, and Social Security number.

- Credit accounts: A list of credit cards, loans, and mortgages you’ve opened, showing your borrowing history and current balances.

- Payment history: Your track record of on-time, late, and missed credit payments.

- Credit inquiries: Information about both hard and soft credit inquiries made by lenders or financial institutions.

- Public records: Details addressing legal issues and adverse records, such as Chapter 7 or Chapter 13 bankruptcies.

- Collections: A summary of any accounts sent to collection agencies due to unpaid debts.

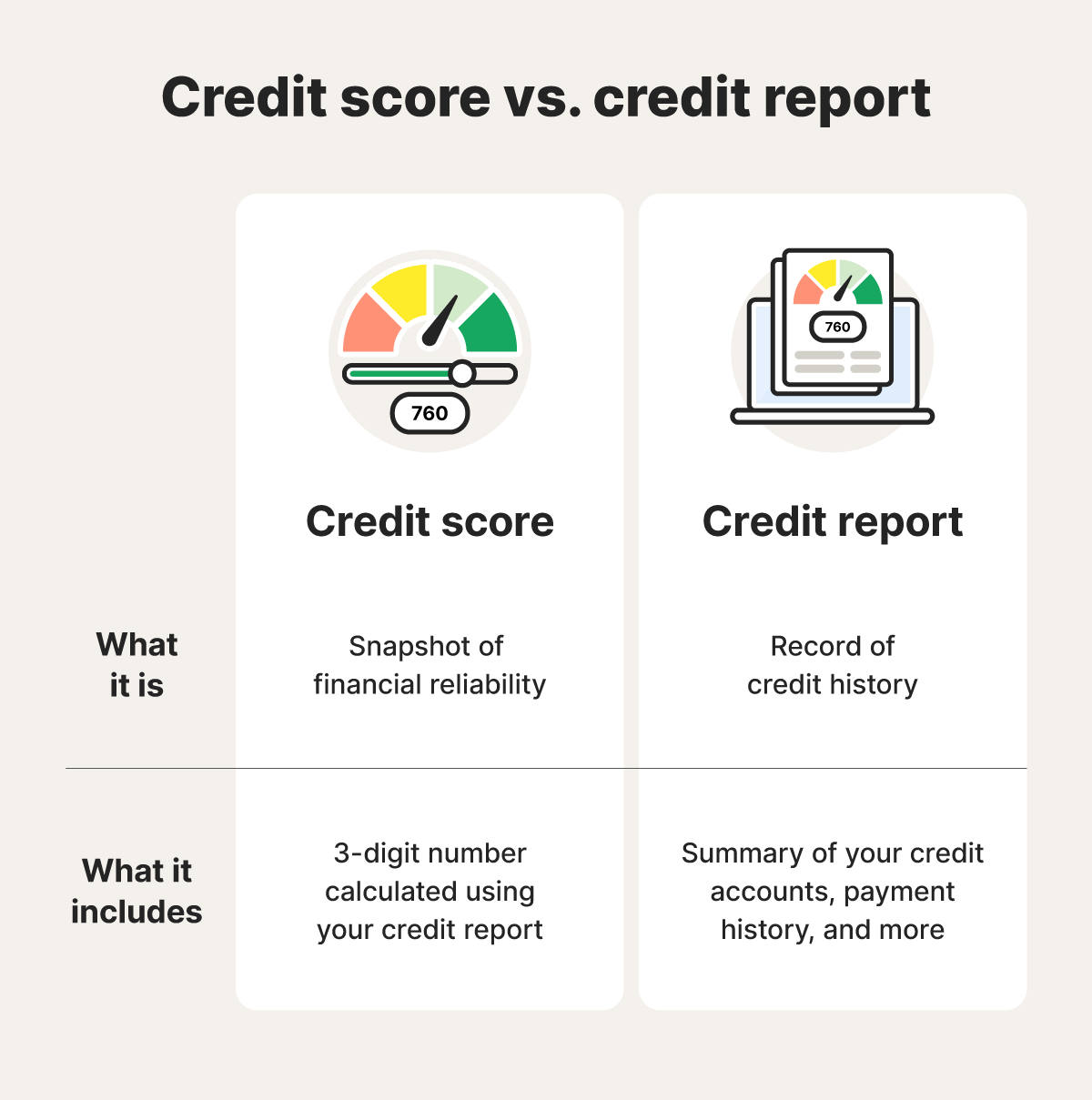

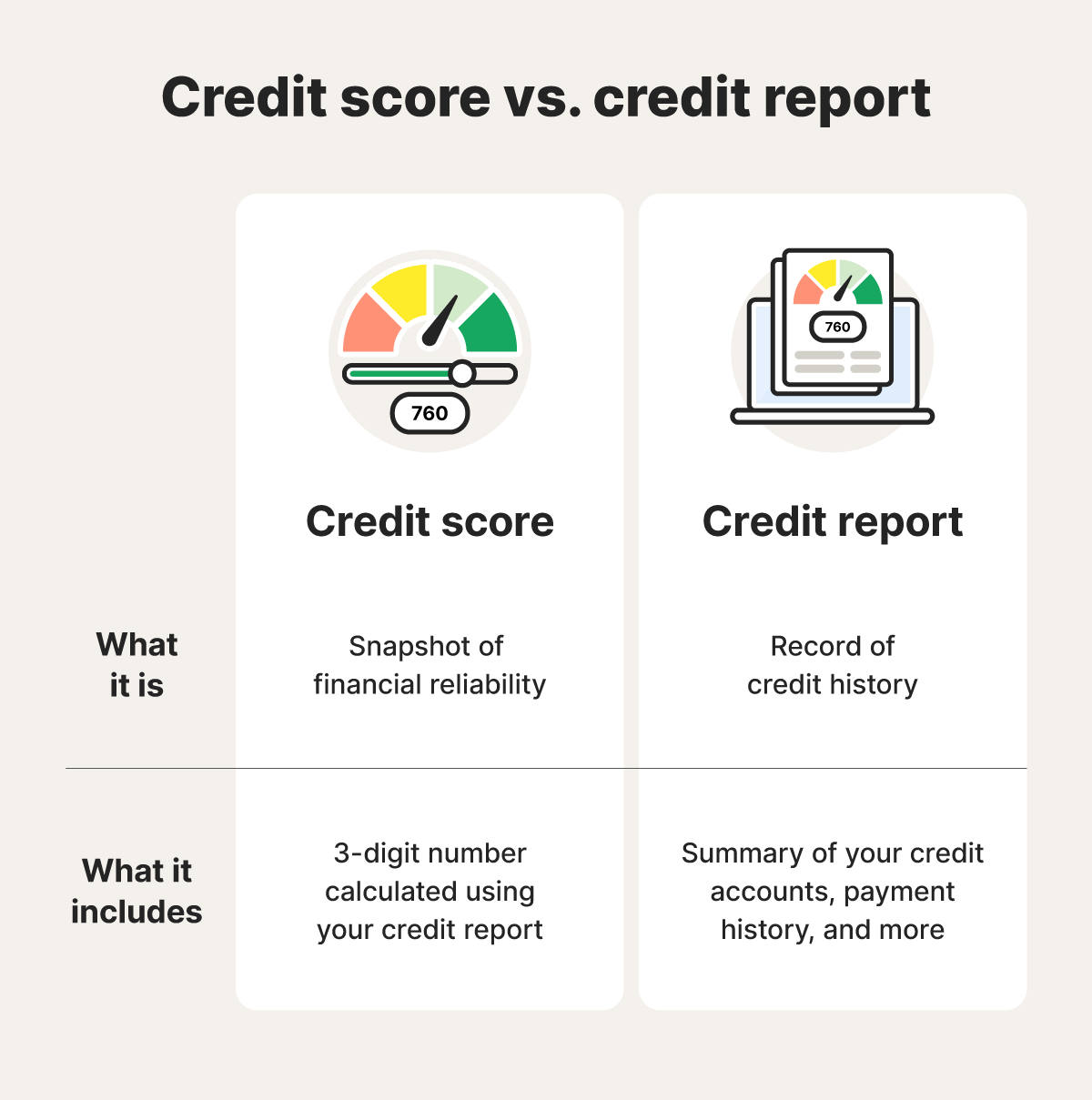

The differences between a credit score and a credit report

The main difference between a credit score and a credit report is that your credit report provides a detailed history of your credit activity, while your credit score is a numerical representation of your financial reliability based on that history.

Your credit report covers specific details like your account balances, payment history, the length of your credit history, and any derogatory marks like late payments or bankruptcies. Your credit score summarizes that information in a number that quantifies your suitability for new credit.

Lenders, credit card companies, and insurance companies use both credit scores and reports to assess applicants’ credit risk and determine the likelihood that borrowed money will be repaid on time.

Your credit score acts as a quick signal and may influence your lending terms — with a higher score perhaps qualifying you to borrow a greater amount or benefit from better interest rates, for example. Diligent lenders may dive into your credit report to get a better idea of your credit history.

However, your credit report also serves some additional purposes that your credit score doesn’t, providing detailed information about your credit history to landlords, utility companies, dealerships, or government agencies, for example.

You can also use your credit report to spot potential errors or signs of credit fraud. If you find any issues, you can challenge them with the credit bureaus to correct your information and help protect your credit score.

How to access your credit score and credit report

There are various ways to access both your credit score and credit report so you can keep up with your credit progress and monitor for potential fraud.

To check your credit score, you can use any of the following methods:

- Use a free credit score check feature provided by your bank or credit card provider, if they offer it.

- Access your score directly from one of the three major credit bureaus with an account.

- Subscribe to a service like LifeLock Total for daily score updates from one bureau and annual updates from all three major bureaus.

You can access your credit report using one of the following methods:

- Get a free weekly credit report from each of the three major credit bureaus at AnnualCreditReport.com.

- Access your credit report directly through Equifax, Experian, or TransUnion by creating an account.

- Use a service like LifeLock Total for daily credit reports from one bureau and annual reports from all three major bureaus.

Investing in a service that offers comprehensive credit monitoring, like LifeLock Total, is a great way to keep track of your credit score and reports. Not only will you benefit from daily updates, you’ll also get alerts of key changes to your credit file, helping you detect potential fraud so you can take action to mitigate the damage.

Why are your credit score and credit report important?

Your credit score and credit report are key indicators of your credit health and influence your ability to qualify for loans, credit cards, apartments, and even certain jobs.

A good credit score and positive credit history indicate financial responsibility, making it easier to secure benefits like lower interest rates and higher credit limits. What constitutes “good” depends on your specific situation and what kind of credit you’re applying for, but FICO Score and VantageScore define it as beginning at 670 and 661, respectively.

On the other hand, a low score or negative marks on your credit report can restrict your borrowing options and result in higher interest rates. Again, what lenders consider a “bad” credit score varies, but anything below 600 might have a negative impact on your lending terms.

Keeping track of and improving your credit can help you achieve key milestones and maintain your financial stability.

Here are a few ways your credit score and credit report can impact major life decisions:

- Loan approval: A good credit score and positive credit history can make a difference when it comes to securing a mortgage, car loan, or business loan. With a higher score, you’re more likely to be approved for a loan and may be able to borrow a greater amount.

- Interest rates: A good credit score can help you secure lower interest rates on various types of credit, including loans and credit cards, potentially saving you thousands of dollars over time.

- Housing: Landlords often check credit reports when renting out properties. A positive credit history may help you secure an apartment, while a poor report can result in rejection.

- Employment opportunities: Some employers review credit reports as part of the hiring process, particularly for jobs in finance or positions with access to sensitive financial information.

Track your credit and detect fraud

Understanding your credit score and credit report offers critical insights into your financial health. Join LifeLock Total for daily credit scores and reports from one bureau, along with automatic alerts of potentially fraudulent changes to your credit file. With these tools, you’ll be better equipped to work on improving your score and better protected against the risk of fraud harming your credit.

FAQs

How often should I check my credit report and credit score?

You should review your credit report at least annually. However, if your personal information was compromised in a data breach, you notice a dramatic shift in your credit score, or you're experiencing a major life event, checking it more frequently can help you protect against potential fraud or credit damage.

Can I get a free credit report?

Yes, you can get a free weekly credit report from each of the three major credit bureaus — Experian, Equifax, and TransUnion — at AnnualCreditReport.com.

Do lenders look at credit reports or credit scores?

Lenders may look at both credit reports and credit scores when evaluating a borrower. Your credit score provides a quick snapshot of your financial reliability, while your credit report offers a more detailed history of your credit activity.

How do credit checks impact your credit score?

There are two types of credit checks, and only one impacts your credit score. Hard inquiries, which are made when you formally apply for new credit, may cause your score to decrease slightly. Soft inquiries, which are made when you check your own credit or a company runs a pre-approval check, don’t impact your score at all.

What is the connection between a credit report and a credit score?

Your credit score and credit report are connected because the information in your credit report determines your credit score. A positive credit report with timely payments and low credit utilization typically results in a higher score. In comparison, a report with missed payments or high debt can lead to a lower score.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.