| Credit bureau contact information | ||

|---|---|---|

| Credit bureau | Mailing address | Phone number |

| Equifax | Equifax Information Services, LLC P.O. Box 740256 Atlanta, GA 30374-0256 |

(888) 378-4329 |

| Experian | Experian P.O. Box 4500 Allen, TX 75013 |

(888) 397-3742 |

| TransUnion | TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016 |

(8800) 916-8800 |

From inflation to high interest rates, the rising cost of living is making it harder for many to pay off their debts. This has led to a 16% increase in bankruptcy filings from 2023 to 2024. Filing for bankruptcy can offer a fresh start for individuals and businesses unable to pay their debts, but it also comes with serious consequences, like a damaged credit score.

If a bankruptcy filing has affected your credit score, you may wonder how to remove it from your credit report. While you can’t remove legitimate filings, you can dispute inaccuracies.

Here are three simple steps to help you remove inaccurate bankruptcies from your credit report.

1. Determine if the bankruptcy was mistakenly filed

You can only remove a bankruptcy from your credit report if it contains errors or was filed incorrectly.

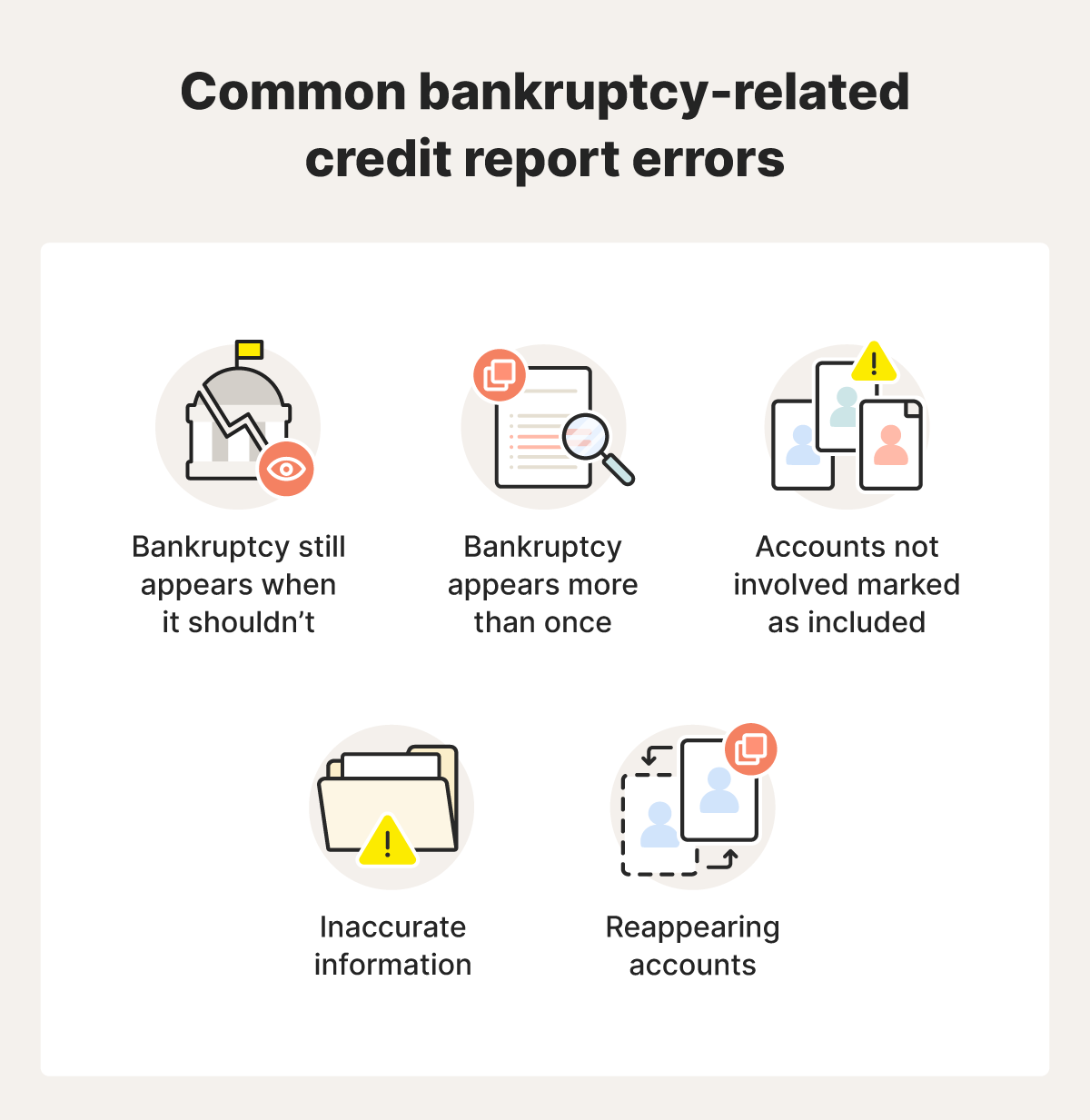

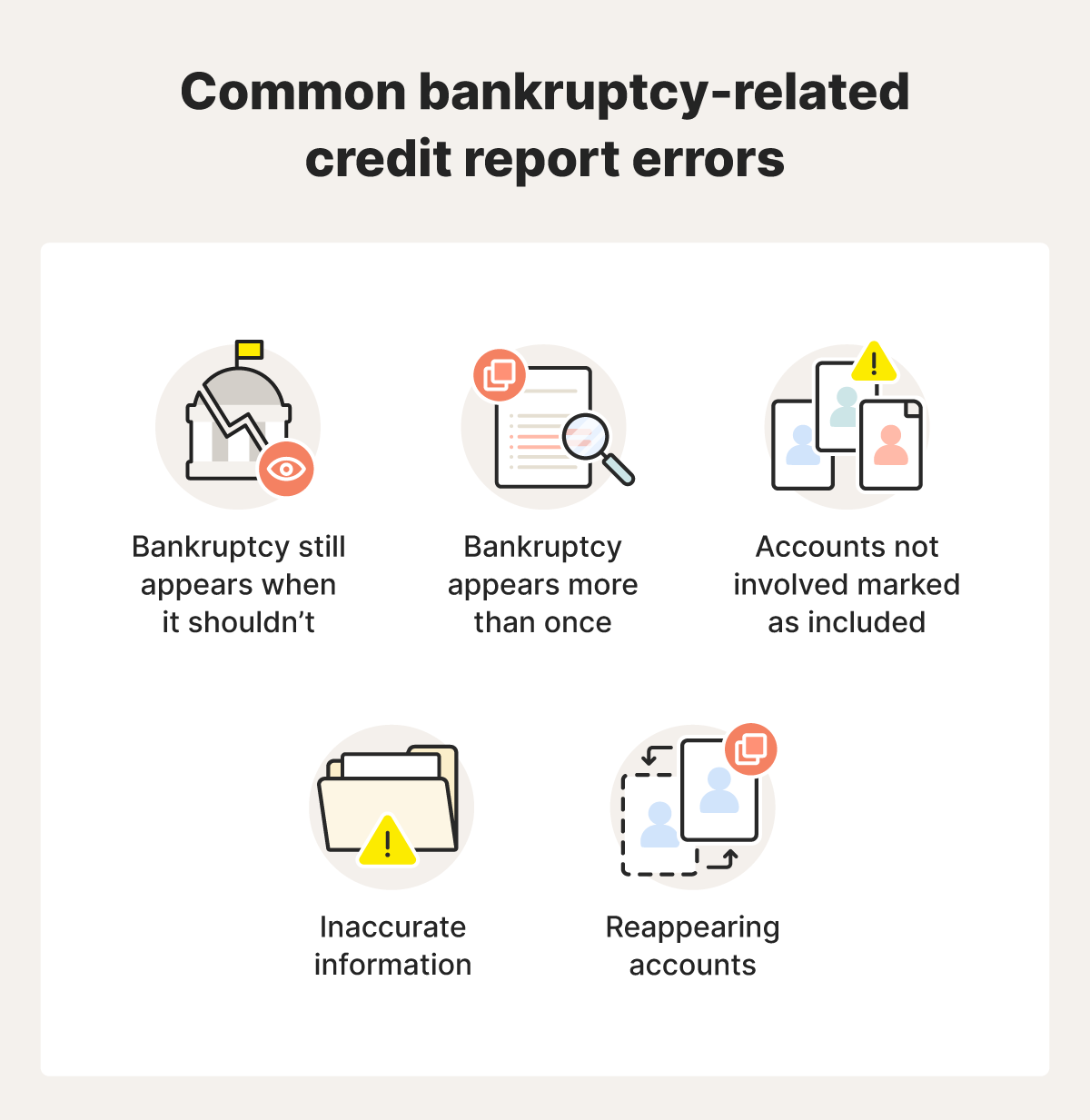

Some common credit report errors related to bankruptcy include the following:

- The bankruptcy still appears on your credit report after ten years (Chapter 7 bankruptcy) or seven years (Chapter 13 bankruptcy).

- The same bankruptcy appears more than once on your credit report.

- Accounts that weren’t part of the bankruptcy are marked as "included in bankruptcy."

- Inaccuracies associated with the bankruptcy — such as the wrong name, Social Security number, address, filing date, or discharge date — appear on your report.

- Accounts reappear on your credit report after being discharged in bankruptcy (known as re-aging).

In rare cases, an unrecognized bankruptcy may appear on your credit report due to identity theft. This can happen if someone facing foreclosure or repossession lists you as an owner of assets they want to protect and then files for bankruptcy to delay the proceedings and hide said assets. Alternatively, identity thieves may open accounts in your name, accumulate debt, and file for bankruptcy in your name to avoid repayment, leaving you with the consequences.

If your identity is stolen it can have long-lasting effects if you don’t reverse the damage quickly. As soon as you discover you’re a victim, you should report the identity theft. What starts out as bankruptcy identity theft could also lead to new credit lines being opened in your name and other fraud. Avoiding this could save you from having to repair your credit due to ID theft.

2. Dispute the bankruptcy filing

If you discover an error in your bankruptcy filing on your credit report or suspect identity theft, you can dispute it by contacting the credit bureau that generated the report. Contact them explaining the mistake and include supporting documents that verify the correct information. You’ll also need to provide this to the organization that provided the inaccurate data.

The Fair Credit Reporting Act (FCRA) requires credit bureaus to investigate and resolve disputes within 30 days, or 45 days if you submit additional information during the initial 30 days.

3. Wait it out

If your dispute is successful, the credit bureaus will correct the information on your credit report, and your credit may improve. However, if the bankruptcy is legitimate, your only option is to wait for it to fall off your credit report.

How long does bankruptcy stay on your credit report?

Chapter 7 bankruptcy, which involves liquidating assets to pay off debts, typically stays on your credit report for ten years from the filing date. Chapter 13 bankruptcy, which allows for a repayment plan to manage debt over a few years, generally remains on your report for seven years after filing.

How does bankruptcy impact your credit?

Your payment history is the largest factor impacting your credit score, so filing for bankruptcy has a significantly negative impact on your credit initially. Depending on your credit profile and various factors, you could see up to 200 points wiped off your credit score. Individuals with a good credit score may notice a greater impact, whereas those with a poor score may not see as much.

As time passes, the impact of your bankruptcy filing on your score will lessen. So, a bankruptcy filing doesn’t mean you are forever doomed to a poor credit score.

How to rebuild your credit after bankruptcy?

Filing for bankruptcy can feel like a devastating blow to your credit. However, you can take steps to help your credit rebound long before your bankruptcy filing falls off your credit report.

Rebuild your credit using the following strategies:

- Monitor your credit: Tools like LifeLock Total can help you catch errors on your report more quickly and track improvements to your score, all from within an app.

- Create a budget and track spending: Establish a clear budget to manage expenses, avoid overspending, and prioritize paying bills on time.

- Get a secured credit card: Use a secured card to rebuild credit with small, manageable balances. Pay off the balance each month to show responsible credit use.

- Apply for a credit-builder loan: Many banks and credit unions offer credit-builder loans to help improve credit. Payments are reported to credit bureaus, helping to build your credit profile.

- Become an authorized user: Become an authorized user on a trusted friend or family member’s credit card to benefit from their good payment history.

If you were a victim of identity theft, securing your identity as quickly as possible is essential to protect your credit.

Safeguard your credit with LifeLock

Removing incorrect or fraudulent bankruptcies from your credit report can improve your credit score. An app that lets you monitor your credit score directly on your phone makes it easier to identify these errors.

LifeLock Total provides insights into your credit health and alerts† you to unusual activity, helping protect your financial well-being. Combining solid financial habits with credit monitoring will help strengthen your credit over time and help ensure you catch potential issues so you can take corrective action as early as possible.

FAQs

Can your credit recover after bankruptcies?

Yes, your credit can recover after bankruptcy, but it will take time. Rebuilding your credit starts with practicing good financial habits, like consistently paying bills on time. In seven to ten years, the bankruptcy filing will also fall off your credit report, which can help boost your score.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 bankruptcy involves selling assets to clear debts, while Chapter 13 allows debt repayment over 3-5 years without asset liquidation. Chapter 7 is faster, but Chapter 13 can be a better option for those with steady income who can manage some repayment.

Do bankruptcies fall off your credit automatically?

Yes, bankruptcies automatically fall off your credit report. A Chapter 7 bankruptcy typically remains on your credit report for ten years, while a Chapter 13 bankruptcy stays for seven years from the filing date.

† LifeLock does not monitor all transactions at all businesses.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.