Remember: Venmo will never ask for your six-digit code via phone call, text, email, or chat. If you receive a request for this number, or any other login information, it’s likely a scammer impersonating Venmo.

Venmo is a mobile payment app that allows you to send and receive money directly from your smartphone, and it also features a social media-like feed of your friends’ transactions. It’s so popular that phrases like “I’ll Venmo you” have become part of everyday language.

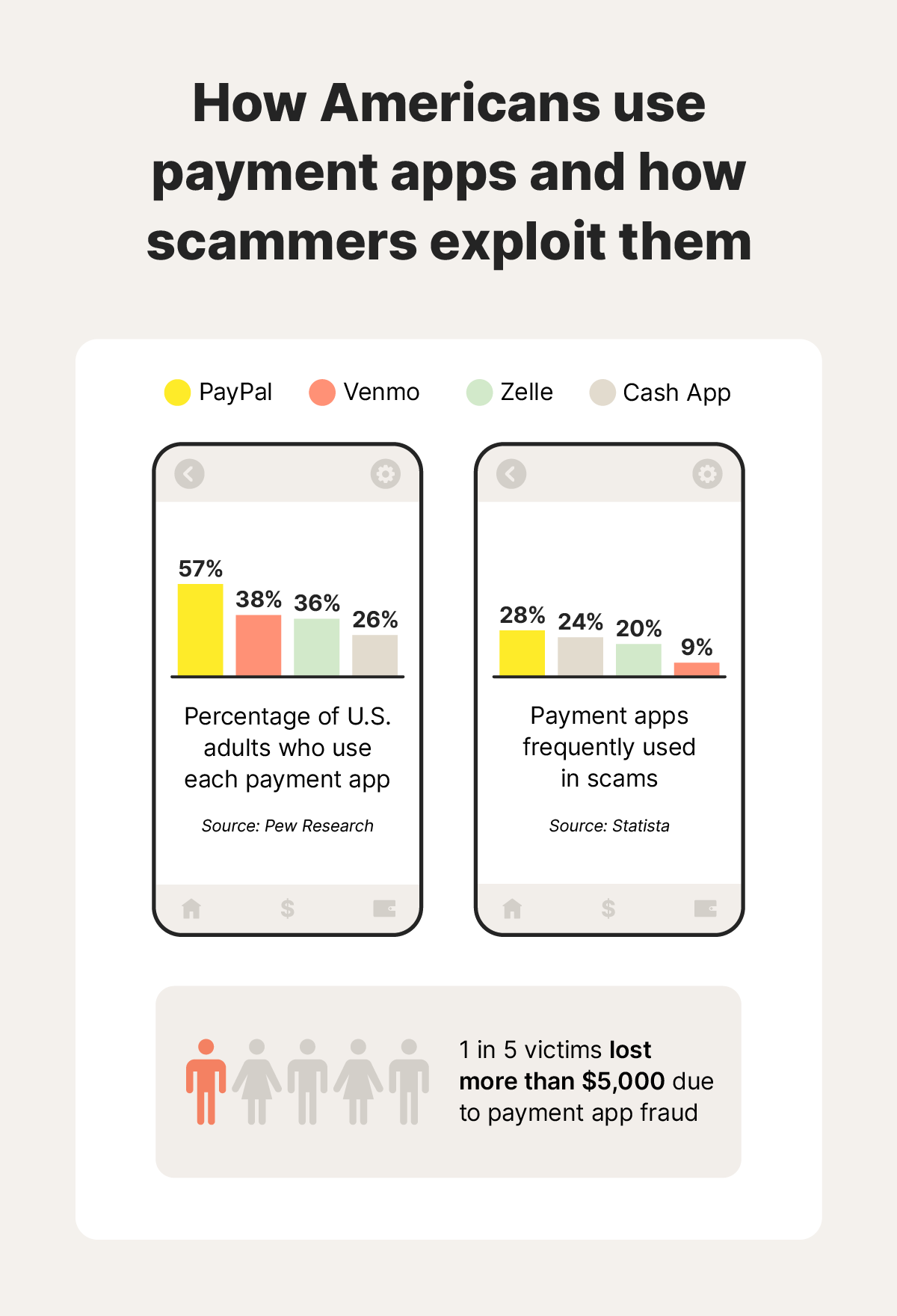

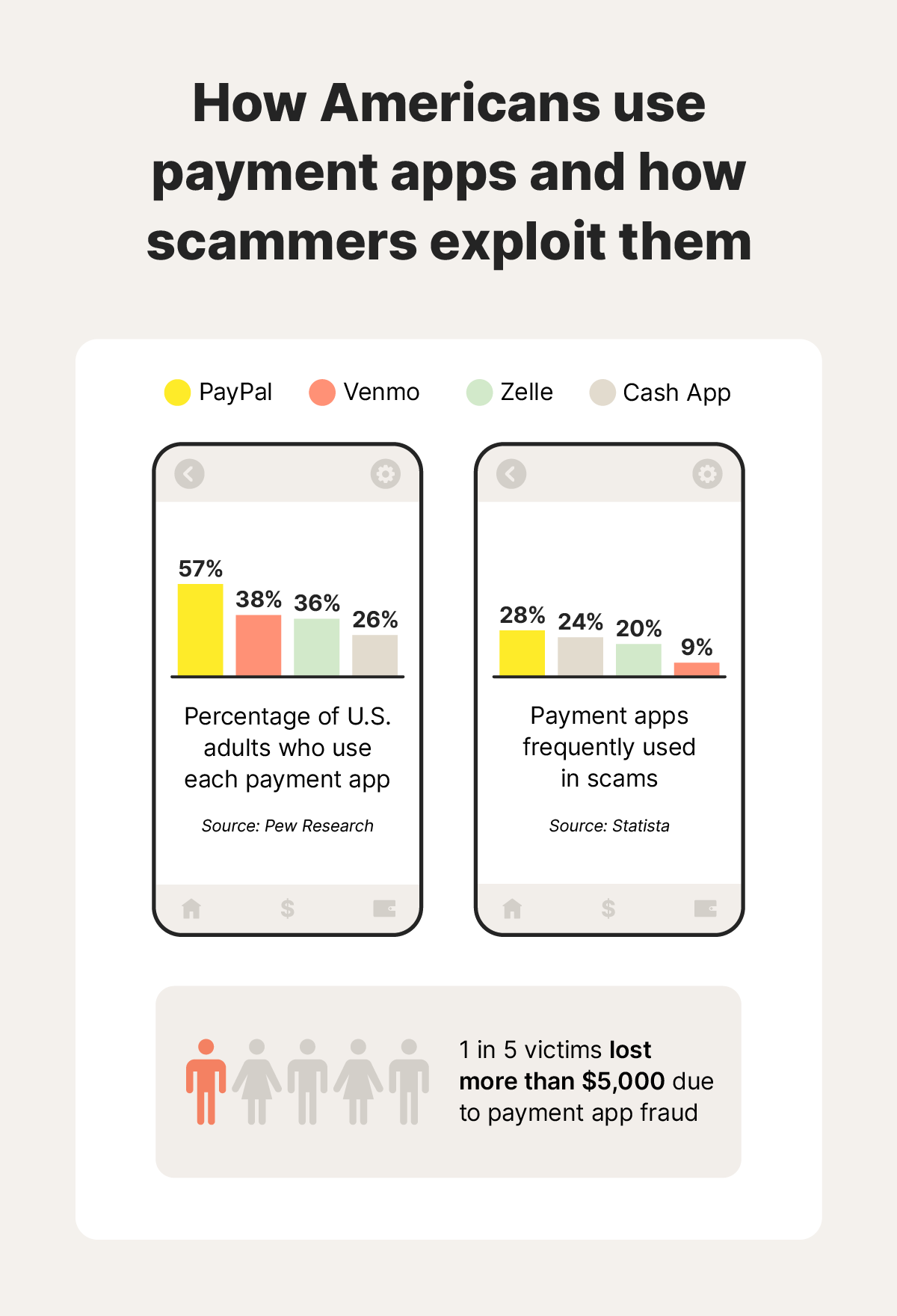

Americans are increasingly turning to payment apps for easy transactions, with over three-quarters (76%) reporting they’ve used one, and 38% saying they’ve used Venmo specifically, according to Pew Research Center.

Although Venmo is convenient for splitting checks, paying your babysitter, or settling bets with your friends, its connection to your finances means you should take every precaution when using it. In this guide, we’ll explore some Venmo risks you should be aware of and tips you can use to transact more safely.

How safe is Venmo?

Venmo is generally safe to use thanks to a range of built-in security features that help protect your financial information and support data privacy, including encryption, identity verification, and customizable privacy settings. However, like any peer-to-peer payment app, it also presents some risks, like scams and account takeovers.

Here’s a summary of key features on Venmo designed to keep users safe from these threats:

- Data encryption: All transaction data is encrypted to help safeguard your personal and financial details against hackers and potential insider threats.

- Identity verification: Venmo uses an identity verification system to help prevent fraud and offers tools to ensure you’re paying the right person, including a phone number confirmation system and the option to automatically sync your phone contacts to your friends list.

- Privacy controls: You can customize your privacy settings to control who sees your transaction activity, including the possibility to make it so only you can see your transactions.

- Purchase Protection: Venmo offers Purchase Protection for eligible transactions when buying goods or services from authorized merchants using the platform.

- Access controls: If you lose your phone or a thief steals it, you can log into your Venmo account from another device to revoke access on the device you’ve lost, helping prevent the thief from accessing your finances.

Venmo security risks

Despite Venmo’s security features, cybercriminals and scammers are always looking for ways to bypass the user protections and find attack vectors they can use to commit theft or fraud. Here are some potential risks to watch out for as you use Venmo:

- Scams and fraud: Scammers often target payment apps like Venmo to trick users into sending money, which can be difficult to recover. They may impersonate someone you know or a company you trust in a phishing attack that aims to trick you into revealing sensitive information that could lead to identity theft.

- Account takeovers: If a hacker launches an account takeover attack and gets access to your Venmo account, they could send money to themselves or steal your financial details to defraud you. Weak passwords or your credentials for other platforms being compromised can increase this risk.

- Data breaches: Like any large company, Venmo faces the constant threat of a data breach caused by hackers. And since Venmo requires you to verify your identity with personally identifiable information (PII) like your Social Security number (SSN), a breach could leave you vulnerable to serious fraud or dark web exposure.

- Limited protection: Venmo offers Purchase Protection for buyers and sellers, but it doesn’t apply to most person-to-person payments. If you get scammed in a regular transaction, you likely won’t be reimbursed.

How you can use Venmo safely

Understanding the risks of using Venmo is the first step towards keeping your data, finances, and identity safer. But you can also take proactive steps like boosting your account security, upgrading your privacy settings, and staying alert to potential threats.

Here’s a step-by-step guide of actions you can take to protect yourself on Venmo:

1. Create a strong password

When creating your Venmo account, keep password security in mind to make it harder for hackers to take over your account. Aim for at least 15 characters and include a mix of numbers, uppercase letters, lowercase letters, and symbols for maximum protection.

Avoid passwords that hackers who know you or do some research might be able to guess, like names or birthdays, and make sure to use different passwords for every online account. If you have trouble remembering your login credentials, a password manager can be a helpful tool to store them in one place.

2. Enable multi-factor authentication (MFA)

Setting up MFA or two-factor authentication (2FA) adds an extra layer of protection to your Venmo account. With it enabled, you’ll receive a verification code on your registered phone number each time you sign in from a new device or location, helping confirm it’s really you.

3. Set up a PIN and use biometrics

For added security, enable a passcode or biometric login like Face ID to access your Venmo app. This extra layer of protection helps keep your account safe even if someone gets hold of your phone when it’s unlocked.

Here’s how to set up a passcode and Face ID on your device:

- Open the Venmo app and go to the Me tab in the bottom right corner.

- Tap the Settings icon in the top right.

- Select Face ID & Passcode (iPhone) or Passcode & Biometric Unlock (Android).

- Toggle on the options you’d like to use.

- Set and confirm your passcode.

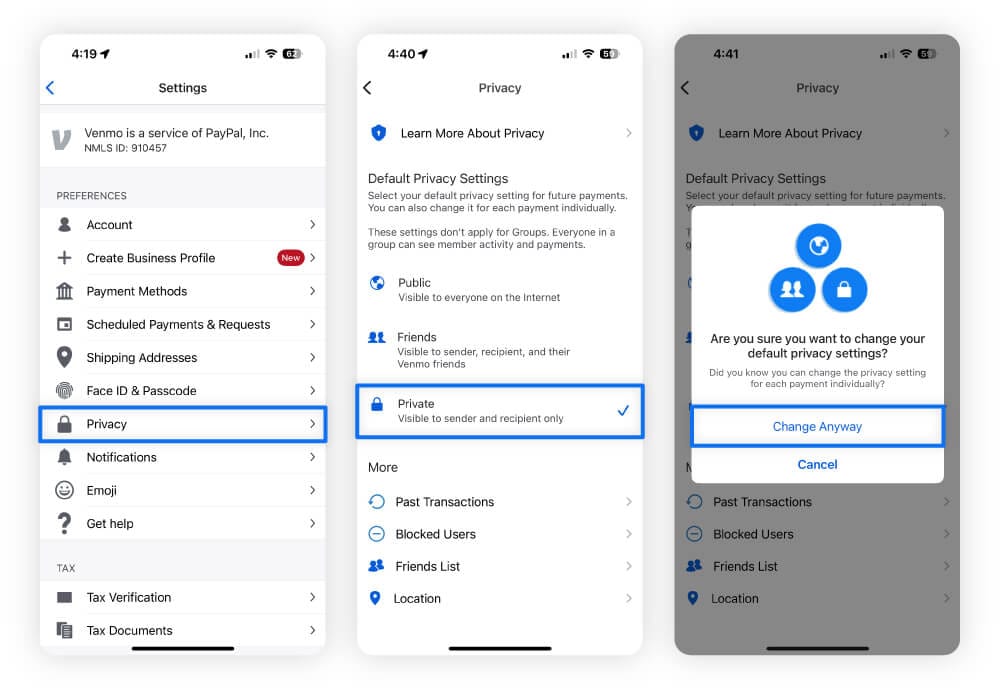

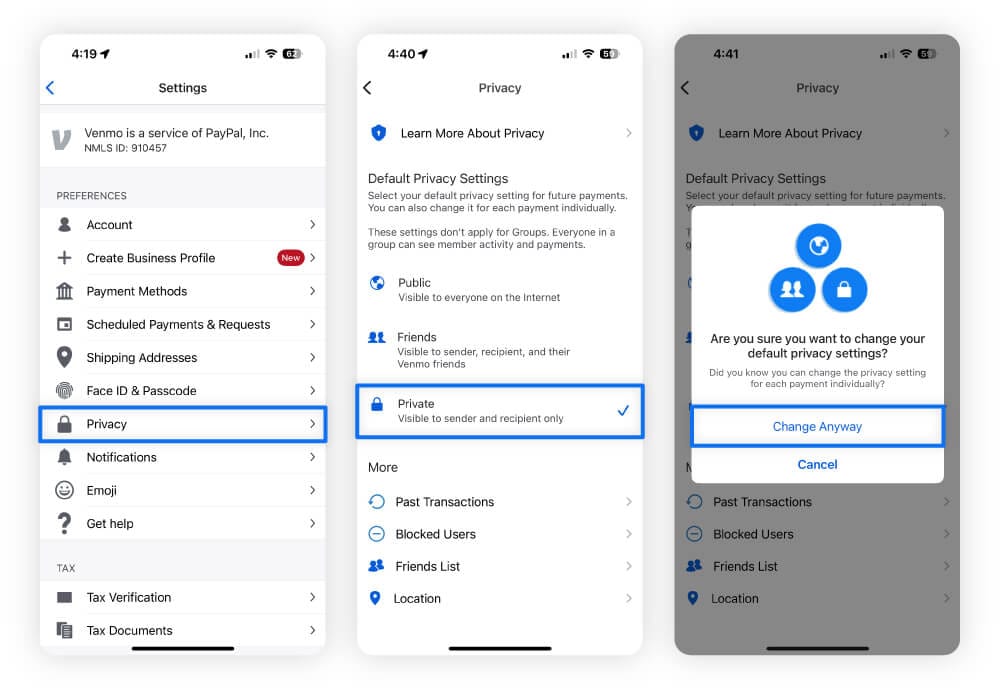

4. Update your Venmo privacy settings

Venmo has three different privacy levels — Public, Friends, and Private — and it’s important to update your settings to enhance your security and protect your personal information.

When you first join the platform, your account defaults to Public settings, meaning anyone on the internet can see your transactions. This includes information like who you’re sending money to, the date of the transaction, and a description of what it’s for. This increases your digital footprint and poses a cybersecurity risk, potentially making it easier for scammers to trick you or expose you to identity theft.

While you might be tempted to set your account to Public or Friends to share fun details like a cute martini emoji when sending money for drinks, it’s not worth the risk. To protect your digital footprint and keep your financial activity secure, it’s best to set your account to Private.

Here’s how to change your Venmo privacy settings:

- Open the Venmo app and tap the Me tab in the bottom right corner.

- Tap the Settings icon in the top right, then select Privacy.

- Choose Private, then confirm by tapping Change Anyway.

5. Consider linking a credit card

When using Venmo to send or receive money, you can link a bank account, debit card, or credit card. For the best protection against fraud, it’s safest to link a credit card that offers stronger consumer protections, including the ability to dispute unauthorized charges.

Keep in mind, though, that Venmo charges a 3% fee for payments sent using a linked credit card, although the fee doesn’t apply when you send money to authorized merchants.

Remember: Venmo will never contact you to request banking or credit card information. Protect your privacy and never disclose sensitive data over the phone.

6. Don’t keep a balance in your Venmo account

Avoid storing large amounts of money in your Venmo account, as it doesn’t offer the same protections as traditional bank accounts. According to the Consumer Financial Protection Bureau (CFPB), money held in payment apps like Venmo may not be safe during times of economic instability since they’re not always covered by federal deposit insurance.

To protect your funds, transfer your Venmo balance to your bank account as soon as possible. Standard transfers can take up to three business days, while instant transfers are available for a fee.

7. Stay alert for potential scams

Scammers often target Venmo users with tactics to trick them into sending money. To protect yourself, get familiar with common Venmo scams and learn how to recognize the warning signs.

Some common tactics include phishing attempts, impersonating Venmo customer support, and catfishing users on dating apps. To identify a scammer, watch for red flags like urgent requests for money from people you don’t know.

Remember: Ignore texts containing suspicious links or threats about your Venmo account being locked. Go directly to the app or official website if you’re unsure.

8. Only exchange money with trusted contacts

Venmo was created to split bills between friends and family, but as its popularity has grown, so has its use among mere acquaintances and even strangers. This is especially common when buying items through online marketplaces like OfferUp.

The problem? Venmo doesn’t offer Purchase Protection for standard peer-to-peer payments. That means you’re likely out of luck if you fall for an OfferUp scam, send money to someone you don’t know, and things go wrong.

To stay safe, only exchange money on Venmo with people you know and trust. If you’re using the platform to pay for goods or services, toggle the purchase option. This activates Venmo’s Purchase Protection, which can help if your item arrives damaged or counterfeit — or if it doesn’t show up at all.

Help protect your finances with LifeLock

Although Venmo is a reliable platform, the risk of fraud still exists. To add an extra layer of protection to your finances and identity, get LifeLock. You’ll benefit from a range of features that can help you protect against fraud and identity theft, including credit monitoring and automatic alerts of data breaches that may have compromised your information.

FAQs

Which is safer, Venmo or PayPal?

While both PayPal and Venmo are generally considered safe, there’s an argument for the former being the safer platform. PayPal offers more robust security features, including 24/7 fraud monitoring and stronger purchase protection for buyers and sellers. That said, no platform is scam-proof, and users can still fall victim to fraud on either app.

Can Venmo be hacked?

Yes, as with most online platforms, your Venmo account can be hacked, especially if your account isn’t properly secured. Cybercriminals may gain access by guessing your weak or reused password, stealing your information in a phishing scam, or exploiting an unsecured device.

Can someone get my bank account information from Venmo?

Venmo doesn’t share your bank account details with others during transactions. However, if someone hacks your Venmo account, they could potentially access your linked bank information.

Is Venmo safe to use with strangers?

Venmo isn’t considered safe to use with strangers since doing so can increase the likelihood of encountering scams or fraud. If you transfer money to a scammer, you generally won’t be covered by the Venmo Purchase Protection policy.

Is Venmo safe to use for Marketplace purchases?

Using Venmo for Marketplace purchases can be risky due to the rise of Facebook Marketplace scams, which often involve payment apps like Venmo. To protect yourself, mark the payment as a purchase to enable Venmo’s Purchase Protection, which can help you get reimbursed if the item doesn’t arrive or isn’t as described.

Venmo is a trademark of PayPal, Inc.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.