Zelle is a trademark of Early Warning Services, LLC.

The ease of sending money in seconds has made peer-to-peer (P2P) payment apps like Zelle a go-to option for millions of Americans. In 2024 alone, Zelle processed over $1 trillion in transactions — a clear sign of its widespread use and trust.

But with that convenience comes risk. As more people rely on Zelle to pay friends, family, and businesses, scammers have found clever ways to exploit the app’s instant transfers and lack of buyer protection to trick users out of their money.

The platform’s approach to fraud protection measures has even drawn legal attention. The New York Attorney General sued Zelle’s parent company in August 2025, alleging that it failed to protect users by resisting basic safeguards, despite knowing that the platform was vulnerable. The lawsuit claims this enabled fraudsters to steal more than $1 billion, and seeks new anti-fraud protections from Zelle.

In this post, we’ll explore some of the most common Zelle scams, explain why fraudsters favor P2P platforms, and share practical tips you can use to help protect your money.

1. Account takeover scams

Account takeover scams involve scammers attempting to gain unauthorized access to your Zelle account, often by tricking you into revealing your login credentials. Once they’re in, they can quickly initiate transfers and drain your funds before you even realize something’s wrong.

One common tactic involves a fake text message that mimics a fraud alert from your bank. If you click the link and enter your login details, scammers can seize control of your account and move money via Zelle in moments.

You might be facing an account takeover scam if you notice:

- Unsolicited messages asking for your bank login or Zelle verification codes.

- Zelle activity alerts for transactions you didn’t authorize.

- Requests to resend or forward money to unfamiliar accounts, which may be so-called mule accounts for scammers.

2. Facebook Marketplace scams

Facebook Marketplace scams often take advantage of Zelle’s fast, irreversible payments to defraud buyers and sellers. Common red flags include:

- Pressure to use Zelle as the only payment option.

- Suspiciously low prices for high-demand items.

- Sellers refusing to meet in person so you can inspect the item.

- Screenshots of fake Zelle payments that never show up in your bank account.

Zelle scams on digital stores like Facebook Marketplace can target both buyers and sellers. Here's how they typically play out from both sides:

- Fake buyers may try to trick you by sending bogus Zelle confirmation emails or screenshots. They often claim you need to click "accept" to receive the payment and may follow up with a fake payment receipt to make the transaction seem legitimate, but you won’t receive the money.

- Fake sellers running Zelle scams may ask you to make an upfront payment for a product or service, and then vanish without delivering anything. That leaves you with no recourse options, as Zelle payments are instant and usually non-reversible.

One Reddit user detailed their experience with a different type of Zelle Facebook Marketplace scam, explaining how a buyer visited their home, made a Zelle payment, and waited until the funds appeared in their bank account.

But the next day, the funds were reversed with a “Deposit Adjustment,” and the buyer was unreachable. When the seller contacted Zelle and their bank, each pointed fingers at the other, offering no resolution.

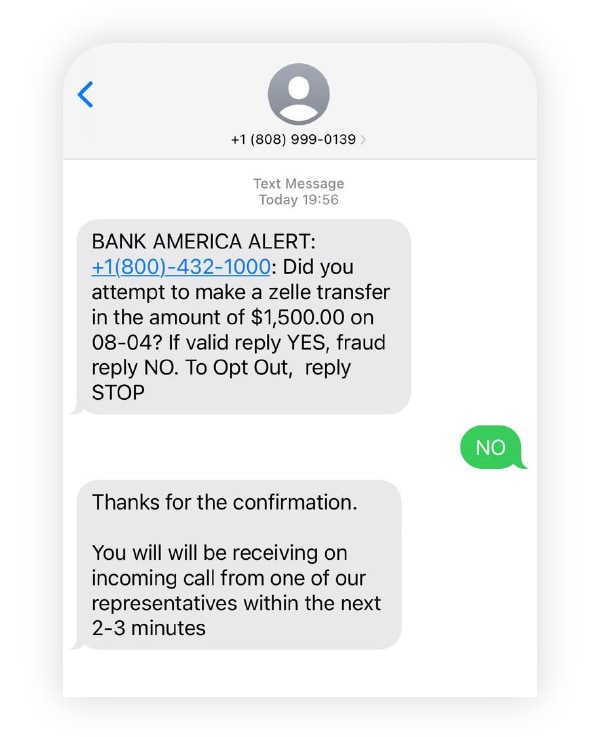

3. Pay yourself scam

This scam often starts with a fake fraud alert text from your bank, followed by a call from a spoofed number made by a scammer posing as the fraud department. The caller will claim there's suspicious activity on your account and ask you to “verify” your account ownership by sending money to yourself.

But instead of your own contact info, you’re tricked into entering theirs. Once you approve the transfer, the money goes straight to the scammer. And because you technically authorized the payment, it’s rarely reversible.

You might be the target of a pay yourself scam if:

- You receive texts about suspicious activity you didn’t initiate.

- Someone urges you to share or verify codes sent to your phone.

- You’re told to send money “to yourself” using a payment app — something legitimate banks will never ask you to do.

In one common example, scammers send victims a text saying, “Did you attempt a $500 transfer?” Moments later, someone calling from a number that looks like your bank will ask you to enter a verification code or send money to “secure your account.” In reality, they’re only interested in rerouting your money directly into their own hands.

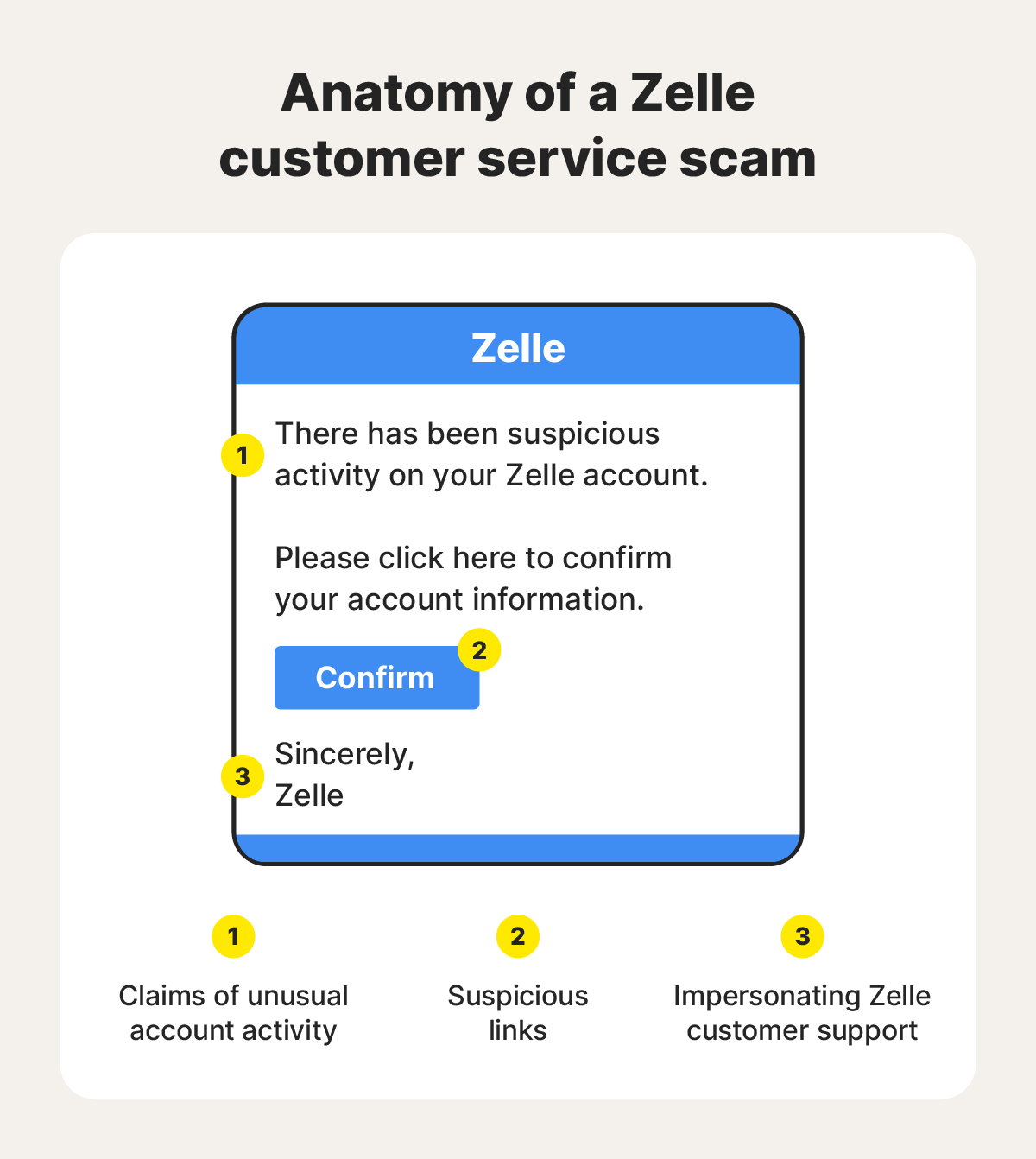

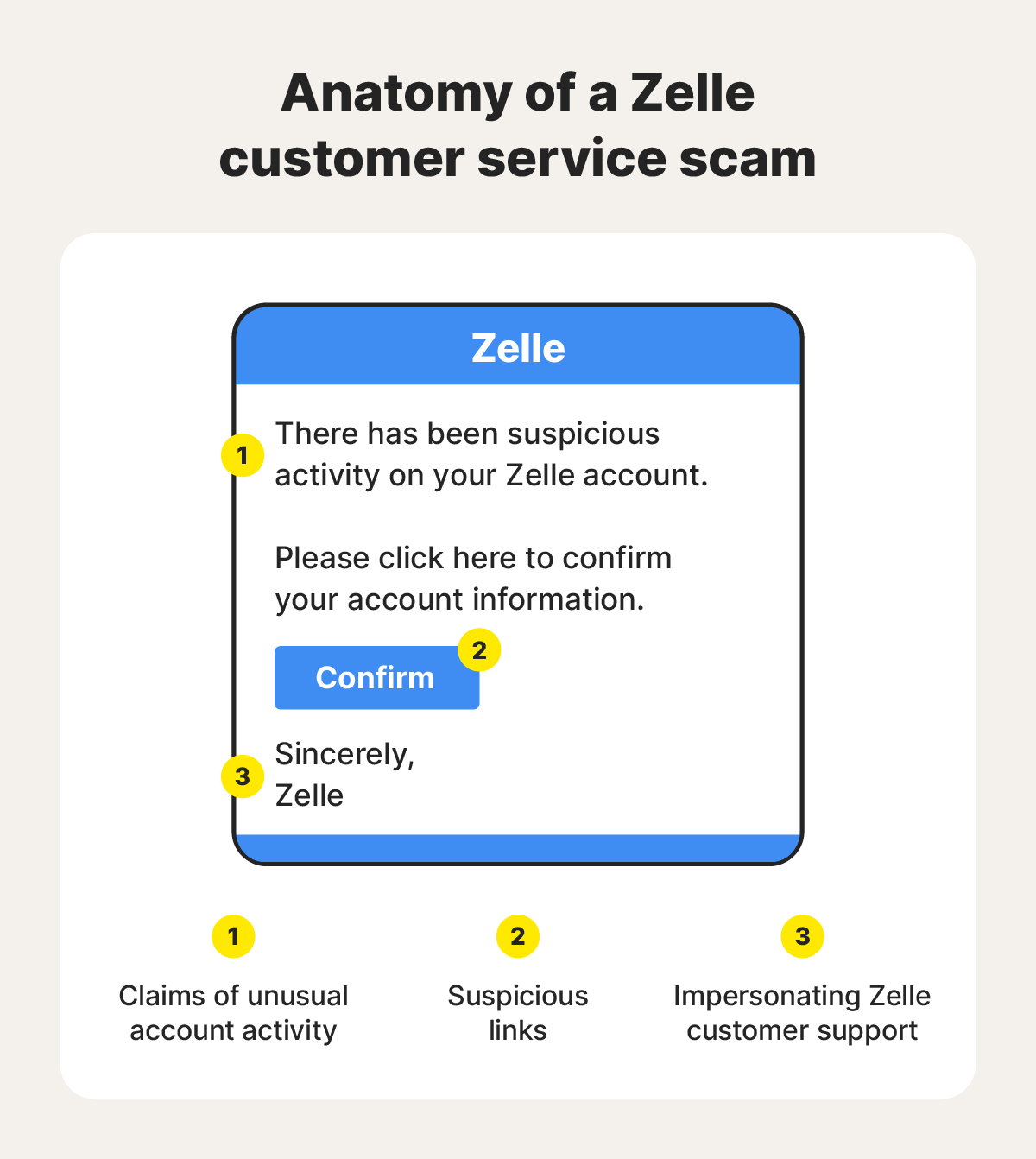

4. Customer service impersonation scams

Customer service impersonation scams involve fraudsters pretending to represent Zelle or your financial institution to trick you into providing access to your accounts. They often create convincing but fake customer service experiences through phone calls, emails, or texts to gain your trust.

These scammers impersonate legitimate support channels to manipulate you into compromising your account security. Be particularly cautious if you encounter any of these red flags:

- Calls from fake support numbers that don’t appear on the official website of the organization claiming to contact you.

- Messages claiming there are problems with your account and requesting you click a link or call a phone number to get support.

- Representatives asking for your login credentials, passwords, or one-time verification codes.

5. Account upgrade scam

Zelle business account scams, also known as account upgrade scams, attempt to trick you with messages claiming you need to pay a fee to upgrade your Zelle account or create a business profile to receive a pending payment. These scams exploit confusion around Zelle’s features and policies, targeting users who may not realize that Zelle doesn’t require upgrades or fees to receive money.

You should be immediately suspicious when you notice these signs of an account upgrade scam:

- Any message claiming you need to upgrade your account to send or receive money on Zelle.

- Demands for payment to unlock features or pending transfers.

- Scam emails that mimic Zelle's branding but contain links to fraudulent websites.

6. Bank refund and recovery scam

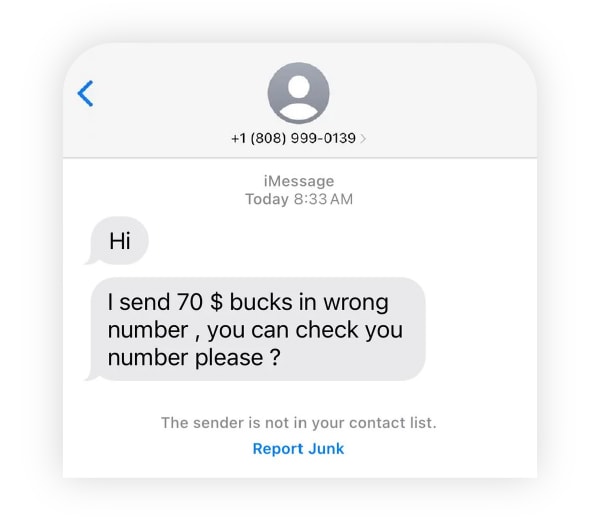

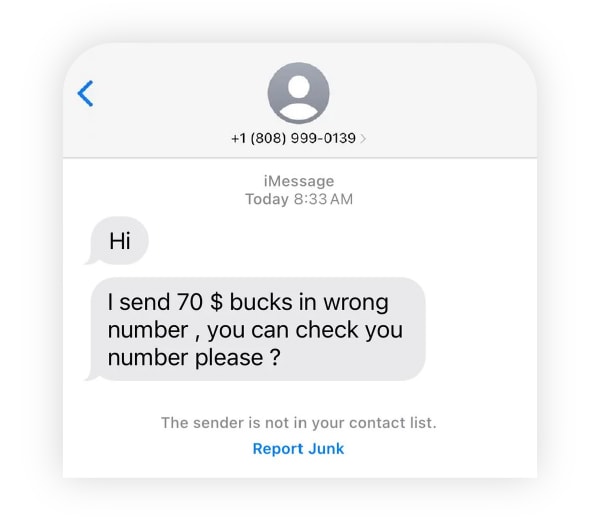

Bank refund and recovery scams involve unexpected payments sent to your account (often using stolen funds), followed by requests to return the money via Zelle. Later, the original deposit is reversed — either by the bank or the real account holder reporting fraud — leaving you out of pocket for the money you “refunded.”

One person targeted by this type of Zelle payment scam reported receiving an unexpected $100 Zelle transfer from a stranger and, sensing something was off, chose to ignore it. Two weeks later, they received another $70 along with a suspicious message pushing them to send the money back.

7. Lottery and prize scams

Lottery and prize scams tempt victims with notifications of winnings from lotteries or sweepstakes they never entered, followed by demands to pay fees or taxes through Zelle before they can claim the prize. These Zelle email scams often present official-looking certificates or letters to appear legitimate.

For example, an email might inform you that you’ve won $10,000 but need to send $300 via Zelle as a processing fee to receive the funds. After payment is made, the scammer disappears.

8. Romance scams

Dating apps and online relationships can be prime targets for financial scams involving Zelle or other P2P payment platforms. You should consider it a serious red flag if your online relationship includes:

- Sudden emergencies that require immediate financial help after an emotional bond is formed.

- Specific requests to send money via Zelle instead of more secure or traditional methods.

- Ongoing excuses to avoid video calls that would confirm their identity.

- Repeatedly canceled plans to meet in person, often with elaborate but questionable explanations.

A common Zelle romance scam begins with a seemingly genuine connection on a dating app, where the scammer poses as someone working overseas. After weeks of affectionate messages, they claim there’s an emergency, like a medical issue, and ask for money through services like Zelle. Once the money is sent, they either vanish or continue inventing new emergencies to extract more funds.

9. Investment scams

Investment scams often lure victims with promises of extraordinary returns and minimal risk, using polished presentations and fake testimonials to build trust. These scammers frequently push for quick decisions and request payment through Zelle — an immediate red flag.

While the offer may seem tempting, legitimate investment opportunities rarely, if ever, involve payments through peer-to-peer apps like Zelle. Warning signs include unverifiable credentials, exaggerated claims of wealth or success, promises of high returns with little or no risk, and pressure to act fast on an exclusive, limited-time offer.

Common scam scenarios usually start with a flashy social media profile showcasing massive profits and glowing reviews. The “expert” offers coaching or a guaranteed opportunity, then asks you to transfer funds via Zelle. Once the payment is sent, they vanish along with your money.

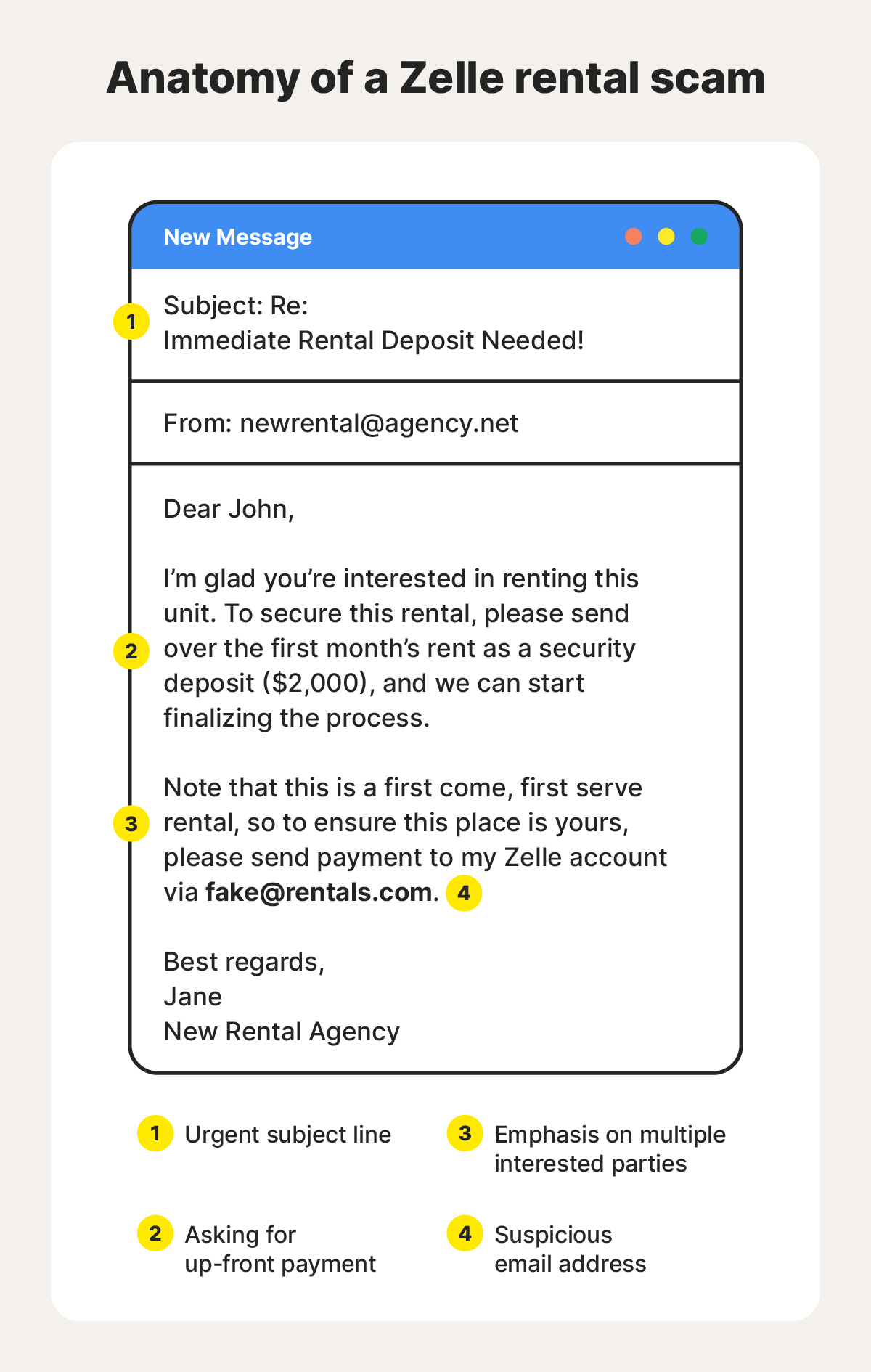

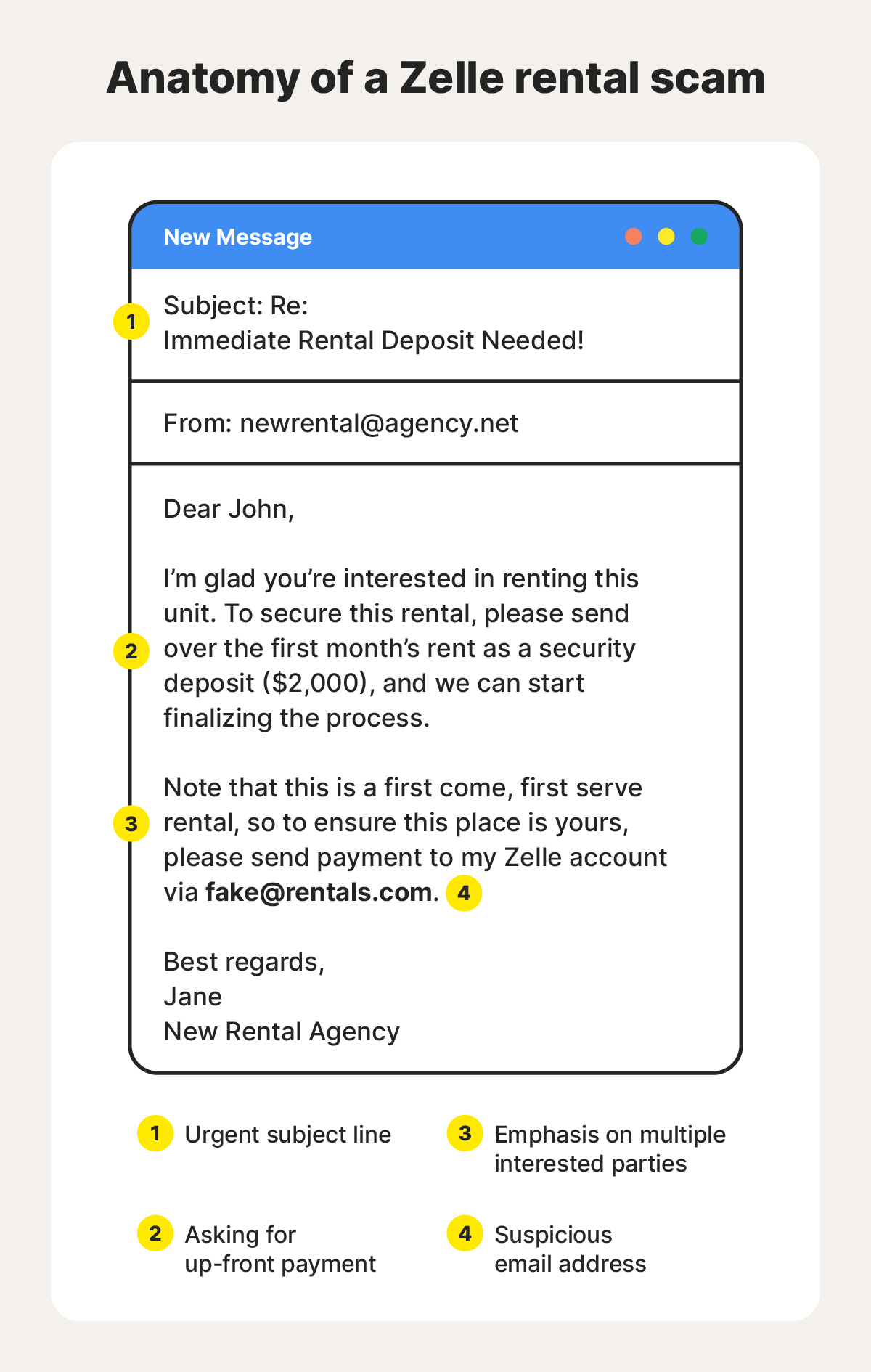

10. Rental scams

Rental scams target people searching for housing by advertising attractive properties at competitive prices, but requesting immediate “deposits” or “fees” through Zelle. These scammers list properties they don't own or control, often collecting payments from multiple victims before disappearing.

A highly competitive housing market creates perfect conditions for rental fraud, especially when prospective tenants feel pressured to act quickly.

You may be dealing with a Zelle rental scam if:

- The property is listed at a suspiciously low rate and features limited details or generic stock photos.

- The “landlord” claims there’s high demand and urges immediate payment to secure the rental.

- They offer excuses for why the property can’t be shown in person before payment.

- They insist on Zelle as the only form of payment, avoiding more traditional and secure methods like bank transfers.

A typical scam scenario unfolds like this: you come across a too-good-to-be-true rental listing. When you express interest, the supposed landlord claims they’re unavailable for a showing but asks you to send a deposit via Zelle to “hold” the unit. Once the payment is made, the listing disappears — and so does the scammer.

11. Employment scams

Employment scams prey on job seekers by presenting fake job opportunities designed to steal money or personal information. Scammers often post convincing listings, conduct brief interviews, and extend job offers, only to request payment for training, equipment, or processing fees through Zelle.

When you're eager to land a position, it’s easy to overlook red flags. Watch out for these warning signs:

- Jobs offering high pay and generous benefits with little to no experience required, paired with vague or unverifiable company details.

- Interviews conducted entirely via text with suspiciously few questions about your skills or background.

- Requests for upfront payments for training materials, equipment, background checks, or administrative fees, especially via Zelle or other untraceable methods.

A typical scam might advertise a job that seems perfect — offering remote working, minimal responsibilities, and good compensation. But before you begin, you're asked to send money through Zelle to cover onboarding costs. Once paid, the contact stops responding, and the job never materializes.

12. Craigslist scam

Craigslist scams involving Zelle typically revolve around fake listings for products or services where the scammer demands payment upfront. Once they receive the money through Zelle, they vanish, never delivering the promised item or service.

You may be dealing with a Craigslist Zelle scam if the seller:

- Refuses to meet in person.

- Communicates only via text or email, avoiding phone calls.

- Offers items at prices that are significantly below market value.

These scams often start with an irresistible deal. The seller pressures you to send payment via Zelle before arranging delivery or pickup. But once the money is sent, the item never arrives, and the seller disappears without a trace.

13. Charity scams

Charity scams exploit their victims’ generosity by posing as charitable organizations and requesting donations through Zelle. These scams often pop up during disasters or crises when many people are eager to help those in need.

A donation request might be fake if it comes as an unsolicited message through email, social media, or text, claims affiliation with established charities (or uses suspiciously similar fake charity names), and employs high-pressure tactics with emotionally manipulative stories to create urgency.

Charity scams can unfold in person, too. In one Zelle scam case, teens in a park claimed to be fundraising for soccer jerseys. When the victim agreed to help, one teen asked to use their phone “to enter the Zelle information,” while another kept them distracted. The first teen then attempted to transfer $1,000 from the victim’s account. Fortunately, they caught on in time and were able to stop the transaction.

14. Concert and event ticket scams

Concert and event ticket scams advertise tickets for popular or sold-out events at attractive prices, requiring payment through Zelle before delivering counterfeit or non-existent tickets. These scams target enthusiastic fans desperate to attend high-demand events.

A Reddit user selling concert tickets was contacted by a buyer who insisted they transfer the tickets before paying. After the seller refused, the scammer sent a poorly made fake Zelle receipt and even requested a $100 refund, clearly hoping to walk away with the tickets and extra cash.

15. Family and friends impersonation scams

Family and friends impersonation scams rely on emotional manipulation, with fraudsters pretending to be loved ones in urgent situations and requesting money through Zelle. Scammers may hack real social media accounts or create convincing fake profiles to build trust and make their stories more believable.

You may be dealing with an impersonation scam if you receive:

- Messages or calls from someone claiming to be a family member or friend using unfamiliar or suspicious communication channels.

- Dramatic stories involving emergencies like car accidents, arrests, or medical crises that supposedly require immediate financial help.

- Requests to keep the situation secret and send money right away, often urging you not to contact other family members.

These scams often start with a message from someone posing as a loved one in distress. Wanting to help, you send money through Zelle, only to discover later that your real family member never contacted you at all.

Is Zelle safe?

Zelle is a safe and secure method of sending money to people you know and trust, thanks to bank-level encryption, which protects your financial data and transactions. And, according to Zelle, 95% of payments made in 2023 were completed without any reported issues relating to fraud or scams.

However, Zelle doesn’t offer fraud protection for authorized payments. If you willingly send money to someone who turns out to be a scammer, there’s a good chance you won’t be able to recover the funds. The best way to protect yourself is to only send money to people you know personally, trust completely, and can verify independently.

How to avoid getting scammed on Zelle

To avoid getting scammed on Zelle, it’s important to understand how the platform works, be cautious when dealing with strangers, and stay wary of warning signs. In 2024, the Federal Trade Commission (FTC) reported nearly $12.5 billion in fraud losses, with imposter and online scams topping the list.

Here are key practices to protect yourself when using Zelle:

- Only send money to people you know and trust: Treat Zelle like handing someone cash — once you send the payment, it's usually gone for good. Avoid using it to pay strangers, online sellers, or service providers unless you're certain they're legitimate.

- Be skeptical of urgency or pressure: Scammers often concoct false emergencies to push you into acting fast. Pause and verify before sending money, no matter how convincing the story sounds.

- Never share personal information: Don’t give out passwords, PINs, or verification codes — especially to anyone contacting you unexpectedly, even if they claim to be from your bank or Zelle.

- Double-check contact info: A small typo in a phone number or email address can send money to the wrong person. Always verify the recipient’s info before hitting “send.”

- Confirm that payments have cleared: Don’t rely solely on Zelle app notifications. Make sure the money is fully available in your bank account before shipping items or issuing refunds.

- Secure your accounts: Set up multi-factor authentication and boost password security by using strong, unique passwords to protect your financial apps and email.

- Avoid clicking suspicious links: Phishing scams often mimic real institutions. Always go directly to your bank’s official site or app to verify communications and avoid calling unknown numbers.

- Watch for red flags in messages: Poor grammar, generic greetings, and vague requests are all signs of a potential scam. Trust your instincts — if something feels off, it probably is.

- Use identity theft monitoring software: Scammers may also try to steal your identity. Identity theft protection services like LifeLock can help monitor for suspicious activity and alert you to potential threats to your personal and financial data.

- Report scams and stay informed: If something goes wrong, contact your bank and Zelle immediately. Also, report the scam to the FTC or FBI, and keep learning about evolving scam tactics to stay a step ahead.

Why scammers use Zelle

Scammers may be drawn to Zelle because of its speed, convenience, and minimal fraud protection for authorized transactions. While these features are beneficial for trusted payments, they also make Zelle a prime target for fast, hard-to-reverse payment scams.

- Instant transfers: Zelle transactions are processed almost immediately, leaving little to no opportunity to cancel or recover the payment once it’s sent.

- Difficulty in recovering funds: Payments made through Zelle are typically irreversible when the user authorizes the transaction, even under false pretenses.

- Exploiting bank connections: Zelle’s integration with major banks gives it an air of legitimacy, which scammers use to their advantage.

- False sense of security: Many users mistakenly believe Zelle offers fraud protections similar to those of credit cards or platforms like PayPal — a fact that scammers readily exploit.

What to do if you’ve been scammed on Zelle

If your money or identity is stolen in a Zelle scam, acting quickly is essential to improving your chances of recovering funds and helping to limit further damage. Here's what to do:

- Contact your bank immediately: Report the unauthorized transaction to your bank as soon as you realize you’ve been scammed. While recovery isn’t guaranteed, prompt reporting improves your chances.

- Report it to Zelle: File a report directly with the Zelle fraud department by calling 844-428-8542 or using their online form. While Zelle generally doesn't refund scam losses, reporting helps them track scammers.

- Notify the credit bureaus: If you've shared sensitive information, place a fraud alert or credit freeze with Equifax, Experian, and TransUnion to help prevent identity theft.

- File reports with authorities: Report the scam to the FTC at ReportFraud.ftc.gov and the FBI's Internet Crime Complaint Center (IC3). If you suffered significant financial losses, file a police report.

- Document everything: Save all communications with the scammer, including emails, texts, screenshots, and call logs. Note dates, times, and details of transactions for your reports.

- Boost your identity protection: Consider whether it’s worth investing in an identity theft protection service to help secure your identity and protect against future fraud.

Help protect yourself against Zelle scams

Zelle scams unfold quickly, and if scammers get hold of your personal information, the fallout can escalate in the blink of an eye, exposing your entire digital life.

That’s where LifeLock comes in — helping you catch threats early, before they cause lasting damage. It monitors your personal information around the clock, alerts you to suspicious activity, and offers expert restoration support if your identity is ever compromised.

FAQs

Can I get my money back after a Zelle scam?

Recovering money lost to a Zelle scam can be difficult, especially if you authorized the payment — even when made under false pretenses, they’re typically not reimbursable. But if someone accessed your account without permission, it may qualify as unauthorized fraud. Report the scam to Zelle and contact your bank immediately for the best chance of getting your money back.

Is it safe to accept Zelle from strangers?

Accepting Zelle payments from strangers is risky. You might receive funds from stolen accounts that later get reversed, expose personal info to scammers, or unknowingly aid fraud. Since Zelle lacks strong buyer and seller protections, it may be safer to use more secure payment methods for transactions with people you don’t know.

Can someone reverse a Zelle payment?

Once a Zelle payment is sent, it cannot be canceled or reversed by the sender. Unlike credit cards or some other payment platforms, Zelle doesn’t offer a dispute process or built-in refund mechanism. The only way to recover the money is if the recipient voluntarily sends it back or if your bank determines fraud occurred and decides to reimburse you.

Will Zelle cover me if I get scammed?

Zelle does not typically reimburse users for scams if the payment was authorized, even if it was made under deceptive circumstances. The service is intended for sending money to people you know and trust, and their user agreement reflects this. But if your account was accessed without permission, it may qualify as fraud under Regulation E.

What should I know about bank liability and my rights as a Zelle user?

Regulation E protects Zelle users from unauthorized transfers, but leaves you liable for any payments you authorized. However, the Consumer Financial Protection Bureau (CFPB) now urges banks to cover losses incurred due to some forms of scams. To boost your chances of reimbursement, report instances of fraud immediately.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Account takeover scams

- 2. Facebook Marketplace scams

- 3. Pay yourself scam

- 4. Customer service impersonation scams

- 5. Account upgrade scam

- 6. Bank refund and recovery scam

- 7. Lottery and prize scams

- 8. Romance scams

- 9. Investment scams

- 10. Rental scams

- 11. Employment scams

- 12. Craigslist scam

- 13. Charity scams

- 14. Concert and event ticket scams

- 15. Family and friends impersonation scams

- Is Zelle safe?

- How to avoid getting scammed on Zelle

- Why scammers use Zelle

- What to do if you’ve been scammed on Zelle

- Help protect yourself against Zelle scams

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.