Bank scams aim to steal your money by tricking you into sharing financial account details or sending funds directly under false pretenses.

With AI and other tools potentially making scams harder to spot, losses are on the rise. According to recent FTC data, the number of people who reported losing money to a scam rose by around 11% in 2024 compared to the previous year — with 38% of people who reported fraud saying they lost funds.

In one case, a woman fell for an elaborate bank scam and lost all the fundraising money for her youth cheer program after scammers impersonated her bank and directed her to transfer the funds.

In this guide, we’ll show you how to spot bank scams, share practical tips to help protect your money, and outline your options if a scam does slip through your defenses.

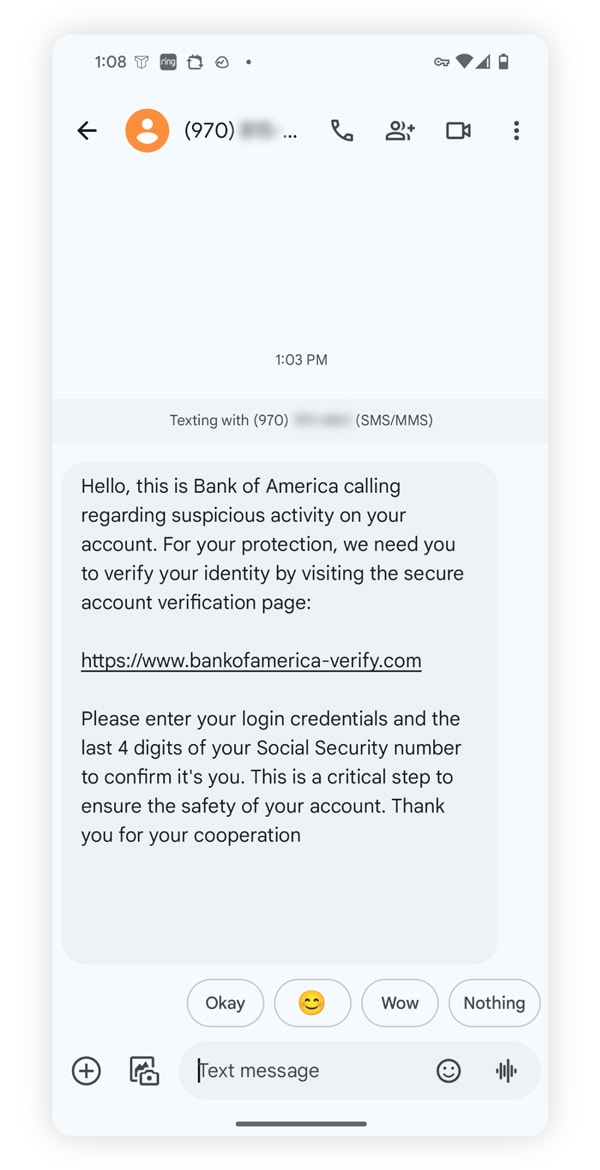

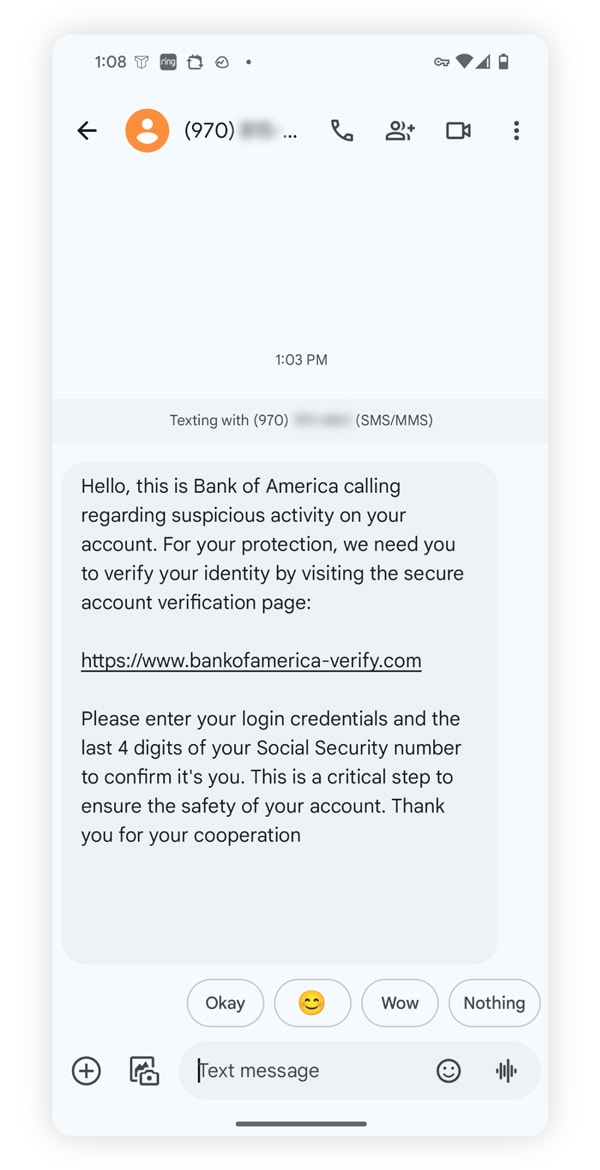

1. Phishing and bank imposter scams

Scammers often pose as representatives from your bank and reach out by text, phone call, email, or even social media to manipulate you into giving up sensitive data.

The bank imposter might claim there’s suspicious activity on your account, pressure you to move money to a different account, or demand you verify personal details or else risk your account being closed. Many of these messages also include phishing links hoping to trick you into handing over sensitive information, initiating a fraudulent transfer, or even installing malware on your device.

For example, I received a text from a scammer pretending to be Bank of America. The message warned of “suspicious activity” and asked me to confirm my identity by clicking a link. Had I followed through, I would have been asked for my login credentials and the last four digits of my Social Security number — precisely the kind of information scammers want to get their hands on.

Keep in mind that if your personally identifiable information has been exposed following a data breach, fraudsters can personalize scams to make them feel more convincing. You may be more likely to fall for a scam call if the person on the other end of the line already knows your full name, date of birth, and part of your bank account number.

What to watch for: If a message feels rushed, includes a sketchy-looking link, or asks for personal info out of the blue, that’s a sign to slow down. Real banks don’t operate like that.

What to do: Don’t click links, don’t reply, and don’t hand over your details. Instead, call the number on the back of your debit or credit card or log in directly through your bank’s official website or app.

2. Phony websites or apps

Scammers sometimes set up fake bank websites or apps designed to trick people into sharing personal information or moving money. These fakes can look incredibly real, even using the FDIC name or “Member FDIC” logo to appear trustworthy.

Scammers may also use these phony banking apps to show fake “proof” of a money transfer. For example, one man selling over £1,000 (roughly $1,300) worth of power tools received what appeared to be confirmation of payment through a fake banking app. He handed the tools to the fraudster, only to find the money never arrived in his account.

What to watch for: Look out for poor design, unusual layouts, or misspellings, like letters out of place or a bank name appearing as part of a strange web address.

What to do: To help confirm if a website or app is legitimate, check the FDIC BankFind resource. And don’t rely on what someone else shows you — always log in to your own bank account to verify any payments or transfers.

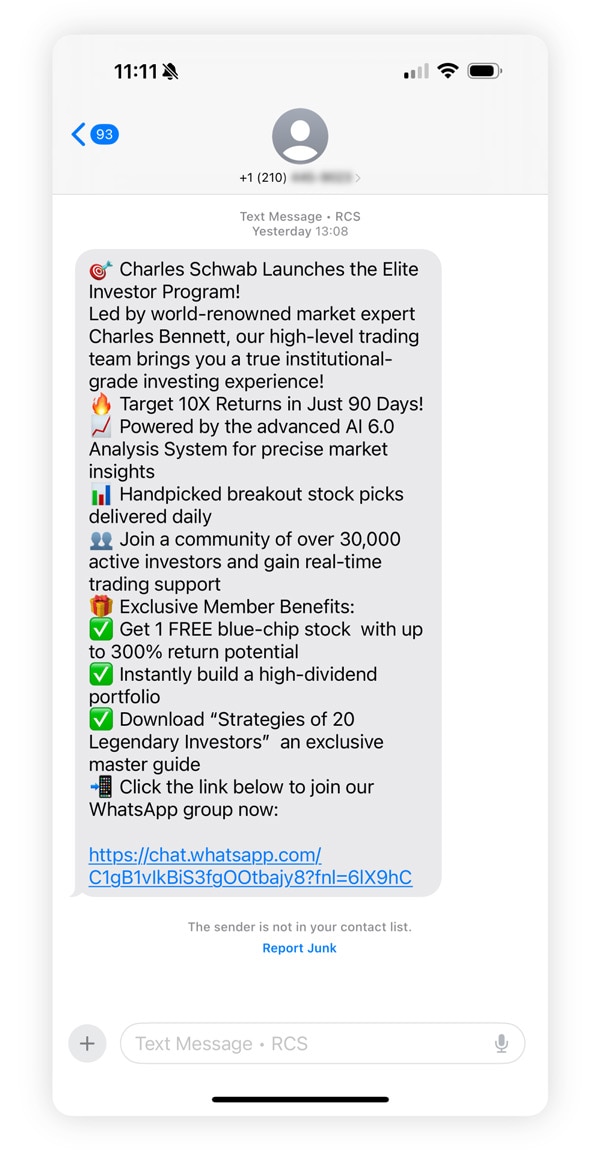

3. Investment scams

Investment scams offer bogus opportunities to invest in mutual funds, stocks, bonds, cryptocurrency, high-yield savings accounts, or certificates of deposit (CDs). Scammers create a sense of urgency around “exclusive” or “time-limited” deals to cloud your judgment, but if you transfer funds to “invest,” the money will be directed right into the scammer’s account.

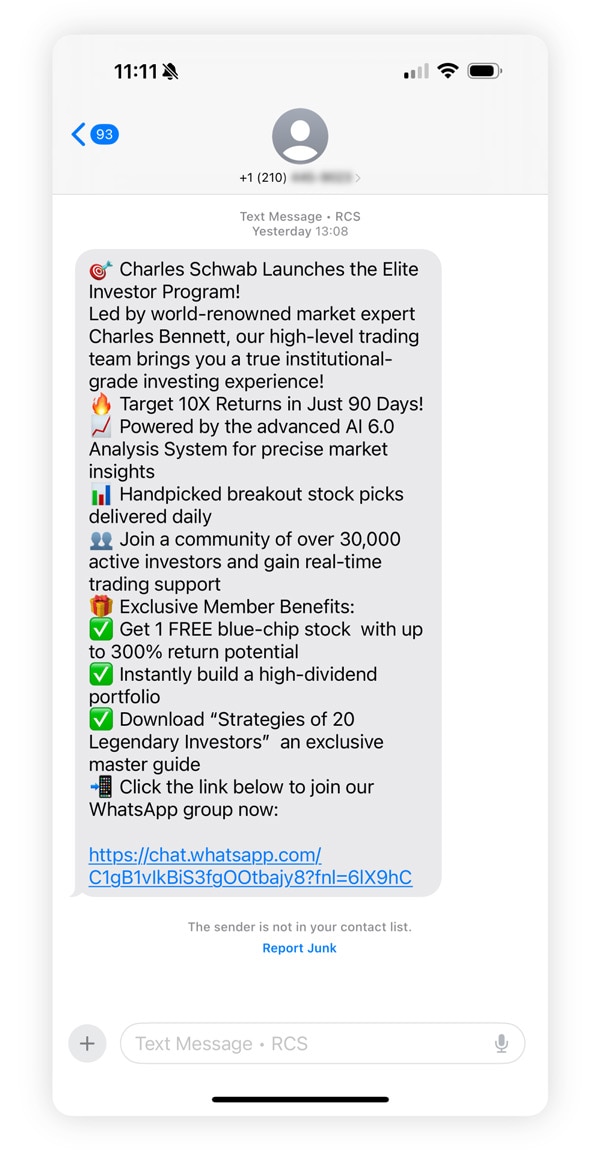

For example, I recently received a text inviting me to join an “Elite Investor Program” supposedly launched by Charles Schwab and led by a world-renowned market expert. The message included a link to a WhatsApp group where the scam would continue.

What to watch for: Be skeptical of unsolicited investment opportunities that sound too good to be true.

What to do: Contact the financial institution through official channels to verify the legitimacy of any investment opportunity. If it ends up being a scam, block the sender.

4. Fake checks and overpayment schemes

Scammers use fake checks in lots of different schemes because banks often take a few days to process them, which gives fraudsters a window of time before the counterfeit is flagged. In fact, a new AFP survey found that checks are the payment method most vulnerable to fraud.

In one scenario, a scammer might pay for goods or services with a fake check. By the time the bank identifies it as counterfeit, the scammer has already taken off with the items.

Another version is the overpayment scam. Here, a scammer intentionally writes a check for more than the amount owed and then asks you to refund the difference. But the original check will eventually bounce, leaving the scammer with the “overpaid” money you’ve refunded while you’re stuck covering the loss once the bank rejects the original deposit.

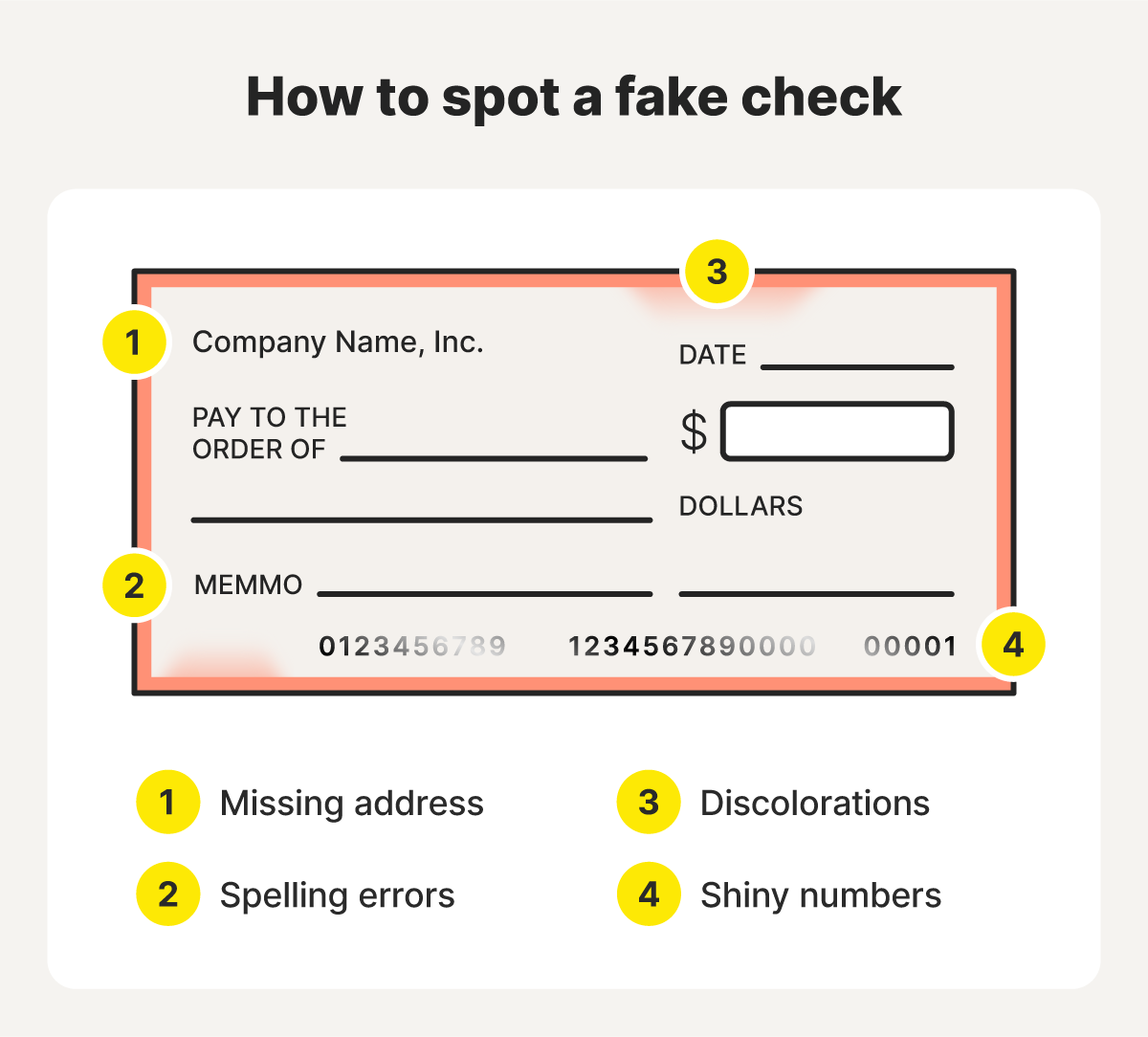

What to watch for: Examine the check and look for signs it may be fake or washed, such as rough edges, misspelled words, and missing components. Review the amount line and box to ensure they match your agreed-upon amount.

What to do: If there are issues with the check, request another form of payment or contact the person’s bank. Never refund any money until the check clears.

5. Advanced fee loan scams

Advance-fee scams target people with poor credit scores who struggle to qualify for loans. Scammers posing as banks promise you’ll get a loan, but first, they trick you into paying a “processing fee” or deposit — and then vanish with your money.

This type of scam doesn’t involve bank infiltration, but it often involves payment methods that are difficult to get back, such as wire transfers, gift cards, and peer-to-peer payment apps like CashApp.

What to watch for: Legitimate lenders don’t promise loans in exchange for money, and any request for a deposit is a major red flag.

What to do: Never pay anyone who offers you a loan out of the blue and demands a deposit.

6. ATM skimming

ATM skimming, or credit card skimming, is a tactic scammers use to capture your credit or debit card information at an ATM or payment terminal. They attach hidden devices to read the data on your card’s magnetic stripe and sometimes use cameras or keypad overlays to record your PIN.

With more cards now using EMV chips, fraudsters have started using “shimmers” inside card readers to steal chip data and potentially create new clone cards.

What to watch for: To spot an ATM skimmer, look for signs it’s been tampered with, like loose parts, mismatched colors, or anything that looks bulkier than usual.

What to do: When possible, use contactless payment options like Apple Pay. This keeps your card in your pocket and helps you avoid skimming devices entirely.

7. P2P payment app scams

Peer-to-peer (P2P) payment apps like Venmo and Zelle are exploited in bank scams because they link directly to your financial accounts and process transfers instantly. Scammers may pose as bank or payment app representatives, trusted contacts, or merchants on online platforms to trick victims into sending money or sharing verification codes.

Using social engineering, they convince victims to authorize transfers themselves, bypassing traditional fraud safeguards. And because P2P payments are typically instant and irreversible, recovering lost funds is often impossible.

What to watch for: Requests from strangers or unfamiliar businesses asking you to send money through payment apps.

What to do: Always verify the identity and legitimacy of any payment request before sending money.

What no legitimate bank will ever ask

Real banks will never ask you for sensitive data in unsolicited emails, phone calls, or text messages. Here are specific requests that can help you identify a scammer:

- Passwords or PINs: No bank employee will ever ask for your login credentials or PIN after making contact completely unsolicited.

- Entire account numbers: While a bank may ask for partial account numbers for verification, it will never request your full account number.

- Verification codes: Never share 2FA or one-time verification codes with anyone. These are for your use only.

- Full Social Security number: Banks generally already have your SSN on file. They might ask to verify your identity with the last four digits, but asking for the full nine digits over an unsolicited call is a dead giveaway that you’re talking to a scammer.

- Remote access to your device: No legitimate bank tech support will ever ask you to grant remote access to your computer, phone, or tablet. Scammers commonly use this tactic to install malware or steal personally identifiable information.

How to protect yourself

You trust your bank, and hackers know that. That’s why they’ll use the financial institution’s earned trust to exploit you and disappear with your savings. Fortunately, with a proactive approach to banking security, you can keep fraudsters away from your account.

Here are smart ways to help protect against banking scams:

- Verify claims with your bank: Scammers often pose as bank representatives to offer bogus loans or investments. Call your bank directly to confirm if an offer is real.

- Don’t share banking details: Keep your financial information private. Your bank will never ask you to share sensitive details over email, text, or phone.

- Set secure passwords: Use unique, strong passwords with at least 15 characters, mixing letters, numbers, and symbols to make them harder to crack.

- Use two-factor authentication (2FA): Set up 2FA as a second line of defense to prevent hackers from getting into your bank account even if they have the right login combination.

- Avoid clicking suspicious links: Look for fake bank text messages and emails, especially when they ask you to click a link. Go directly to your bank’s official site instead.

- Download banking apps securely: Only install your bank’s mobile app from the official website or a trusted app store.

- Monitor accounts for unusual activity: Regularly check for unusual charges, withdrawals, or fees so you can catch fraud early.

- Invest in identity theft protection: Identity theft protection services can provide advanced bank and investment account monitoring, including alerts for withdrawals, balance transfers, and potential account takeovers, to give you a bird’s-eye view of your finances.

What to do if you encounter a bank scam

If you encounter a bank account scam, act quickly to notify your financial institution and secure your accounts for the best chance of recovering any stolen money. Here’s what to do:

- Inform your bank: Let them know about the scam so they can monitor your account for suspicious activity and guide you on recovering lost funds.

- Lock the affected cards: If the scammer accessed your credit or debit cards, lock them immediately.

- Change your passwords: Update your login details and PINs to prevent further access to your accounts.

- Protect your credit: If the scammer got hold of other personal information, they could try to open new credit accounts in your name. Consider placing a credit freeze or fraud alert to help block this.

- Contact local law enforcement: Filing a report creates a paper trail and can improve your chances of recovering stolen money.

- Report to federal agencies: Notify agencies like the FTC or IC3 to document the scam and help protect others.

- Monitor your bank accounts: In the months following a bank scam, regularly review your statements to catch any additional unauthorized activity.

Safeguard your finances and identity

No matter how careful you are, some threats may still slip through. That’s why having comprehensive protection is essential for securing your financial future.

LifeLock Total allows you to continuously monitor your banking and investment accounts, immediately flagging suspicious transactions and withdrawals that could indicate fraudulent activity. And if your funds or identity are compromised, you’ll get expert support during the recovery process.

Don’t leave your financial security to chance — get trusted identity protection today.

FAQs

What information does a scammer need to access my bank account?

To access your bank account, a scammer usually needs your login credentials, such as your username and password or PIN. They may also try to obtain answers to security questions to bypass extra authentication. Even if you have 2FA set up, they may be able to access your bank account by intercepting your text messages via a SIM swap attack.

How can I tell the difference between phishing and a message from my bank?

Legitimate bank messages come from official email addresses, use professional branding, and address you by name with specific account details. Phishing messages create false urgency, use generic greetings, and ask for sensitive information. When in doubt, contact your bank directly rather than clicking any links.

While spelling and grammatical errors have historically been a hallmark of phishing messages, AI is making it easier for fraudsters to appear convincing. That said, phishers may purposefully pepper their messages with mistakes to filter out vigilant recipients.

Is it safe to send bank details by text message?

No, sharing bank details via text message isn’t safe. Text messages lack encryption, making your financial information vulnerable to hackers. Additionally, scammers frequently use SMS phishing techniques, also called smishing, to trick people into revealing sensitive information. Your best bet is to use secure, encrypted channels when sharing banking information.

Can someone steal your money if they have your bank account information?

Yes, if a scammer has your bank account and routing numbers, they may be able to withdraw money from your account, often by setting up unauthorized electronic transfers (ACH withdrawals). However, most banks have fraud protection and dispute processes, so you may be able to recover the funds if you report the theft quickly.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- 1. Phishing and bank imposter scams

- 2. Phony websites or apps

- 3. Investment scams

- 4. Fake checks and overpayment schemes

- 5. Advanced fee loan scams

- 6. ATM skimming

- 7. P2P payment app scams

- What no legitimate bank will ever ask

- How to protect yourself

- What to do if you encounter a bank scam

- Safeguard your finances and identity

- FAQs

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.