Who are the most common victims of identity theft?

According to the 2023 FTC Consumer Sentinel study, the 30–39 age group reported the most identity theft, followed by those aged 40–49. While seniors and children are also affected by identity theft, they report fewer cases — perhaps because they’re unaware of the problem, don’t don’t know how to report it, or the perpetrator of the crime is a parent or guardian.

Aside from age considerations, people who are active on social media and families who earn higher incomes can be more likely to become victims of identity theft.

Children

Children can be enticing targets for identity theft because they have Social Security numbers and no credit history. Thieves can open fraudulent accounts and rack up debt in the child’s name that can go unnoticed for years. Victims of child identity theft may not even realize until they reach adulthood and try to apply for credit cards or put bills in their own names.

What’s worse? Child identity theft also happens at the hands of people the child trusts, like their parents and close family friends, who have easy access to the child’s personal information. In fact, of U.S. households with child victims of identity fraud in 2022, 67% personally knew the thief.

Some early signs of child identity theft can include the child:

- Receiving pre-approval letters

- No longer qualifying for government benefits

- Receiving unfamiliar medical bills

- Seeing spam and suspicious activity on their social media accounts

- Being denied new copies of government documents like their birth certificate

According to a 2022 study, 915,000 U.S. children were victims of identity fraud in the past year.

Millennials

A subset of Millennials, specifically those born between 1985 and 1994, reported the most identity theft compared to any other age group. This may come as a surprise since digital natives dominate this age group. Still, surveys show this trend may stem from overconfidence and poor cybersecurity habits, like apparently waiting too long to install software updates.

However, since Millennials were raised in the age of the internet, it’s also possible they’re more adept at catching identity theft and reporting crimes before they cause major losses.

People between the ages of 30 and 39 reported the highest number of identity theft of any age group.

Seniors

Seniors are attractive targets for identity thieves. According to an Innovation in Aging study from 2020, 1 in 10 seniors experienced identity theft attacks the previous year, and people 75 and older experienced the most substantial financial losses in each attack.

This is likely because people who grew up between 1930 and 1950 were raised in a culture of trust and often didn’t treat potential scams with enough skepticism. On average, they also monitor their financial accounts less often, and criminals can take advantage of their higher credit scores, healthy savings accounts, and home equity.

Seniors who were targets of fraud, such as identity theft attacks, reported a total loss of $3.1 billion in 2022, which is $1.3 billion more than the age group with the next-highest losses.

Social media users

Heavy social media users may be more likely to become victims of identity theft if they’re inclined to share personally identifiable information like birthdays, addresses, and employment details online. This wealth of information makes it easier for cybercriminals to launch a social engineering attack.

According to the recent Javelin study linked above, 47% of households with children on social media and related apps say their child’s social media account was taken over as part of a fraud incident. This may be because social media, such as Facebook, Instagram, and Snapchat provide an open line of communication with strangers—potentially empowering criminals to employ bait-and-switch schemes, impersonation, romance scams, and tech support scams.

Common social media schemes that led to identity theft included phishing links and crypto scams.

Higher earners

Higher earners (earning $50,000 and up per year) are more likely than other income groups to be victims of identity theft within their lifetime, according to a 2021 survey conducted by the U.S. Department of Justice.

This is likely because they’re a profitable mark for identity thieves. This demographic tends to have more credit cards, savings, investments, and property. Beyond that, they often have a larger digital footprint enabling cybercriminals to steal their personal and financial information.

People who earn $75K or more a year are the most common victims of identity theft.

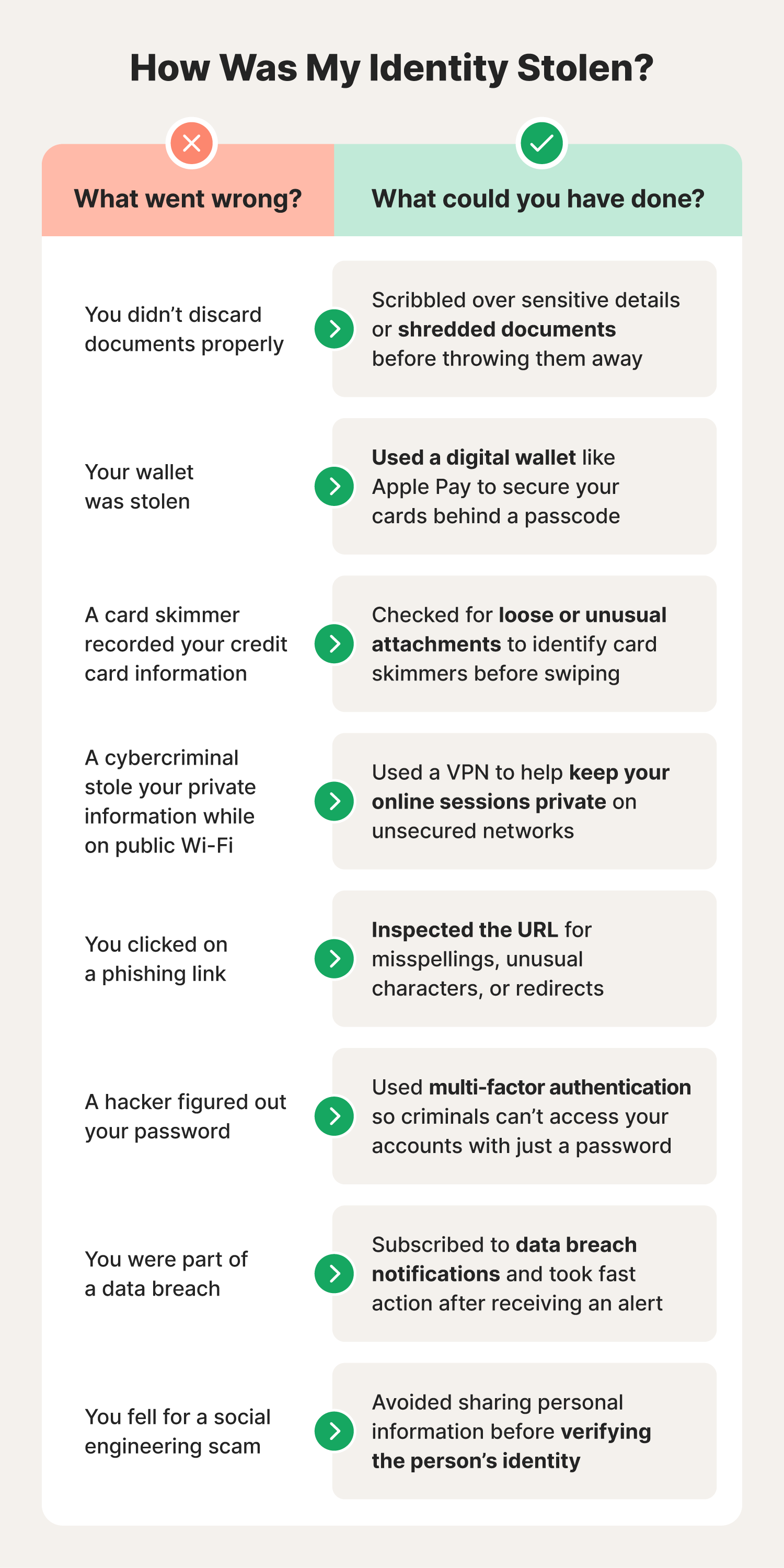

How does identity theft happen?

Identity theft happens commonly due to data breaches, phishing scams, weak password practices, social engineering attacks, and compromised security measures on websites. However, identity theft can also boil down to human error.

Here are some tactics criminals might use to steal your identity:

- In-person: Criminals might glean personal information by reading improperly discarded documents, stealing or picking up lost wallets, or installing ATM skimmers.

- Online: Cybercriminals might lurk on public Wi-Fi networks, send phishing links or attachments, crack your passwords in a brute force attack, buy personal information from data breaches on the dark web, or use social engineering scams to trick you into oversharing personal details.

How to know if someone stole your identity

It’s not always obvious when your identity is stolen, but there may be subtle signs, like an uptick in junk emails and sneaky transactions hiding in your bank statements. With that in mind, here are some obvious and not-so-obvious signs that somebody may have stolen your identity:

- Vendors send you bills for things you didn’t buy.

- Unauthorized transactions appear on your statements.

- Your credit score drops suddenly.

- Debt collectors call about accounts you didn’t open.

- Your credit report shows unfamiliar accounts.

- Lenders deny your loan applications unexpectedly.

- Mail starts to go missing.

- The IRS sends multiple fraudulent tax return notifications.

- Arrest warrants appear for crimes you didn’t commit.

What to do if your identity is stolen

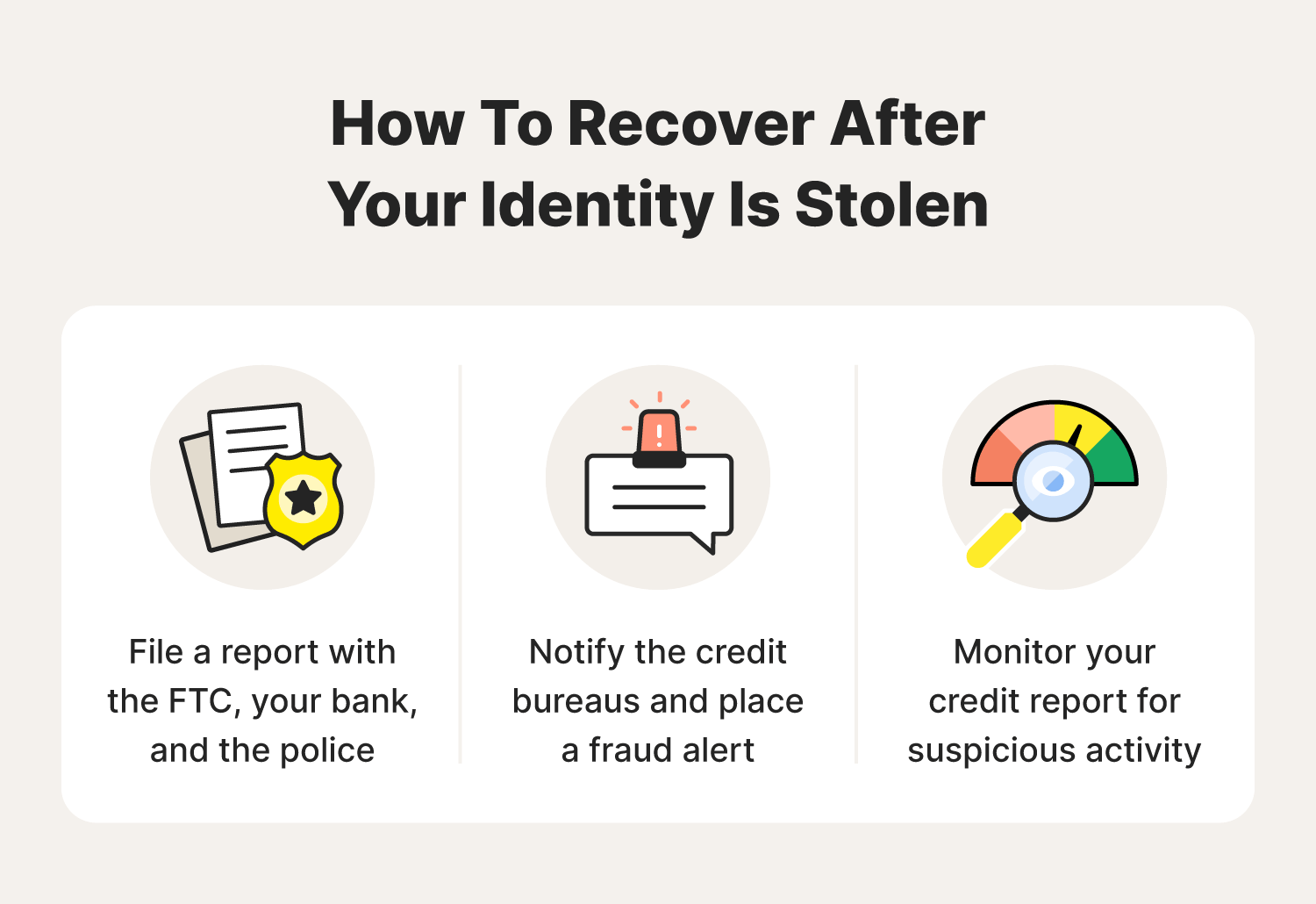

Recovering from identity theft involves reporting the crime, notifying your bank and credit bureaus, monitoring your credit, and even taking legal action in some cases. Ultimately, this can be a time-consuming process, reportedly taking several weeks to a few months to recover. To speed up this process and minimize losses, do these three easy things as soon as you realize your identity was stolen:

- File a report: You can report identity theft to the local police by calling the non-emergency line. Then, submit a report with the FTC online and notify your bank. Together, they can help you create a paper trail, recommend the next steps, and advise you on updating vulnerable accounts.

- Contact the credit bureaus: Contact the three credit bureaus—Equifax®, Experian®, and TransUnion®—and let them know that somebody stole your identity. From there, you can freeze your credit or place a fraud alert.

- Monitor your credit report: Keep an eye out for suspicious activity over the next year and dispute credit report inaccuracies.

Help protect yourself from identity theft

In 2023, U.S. identity theft victims lost around $126 million. With an identity protection tool like LifeLock Total, you can help protect yourself against the financial fallout after identity fraud. With three-bureau credit monitoring and restoration support, LifeLock will help you avoid becoming part of that statistic.

FAQs for identity theft victims

Still have questions about identity theft? Here’s what you need to know.

What is identity theft?

Identity theft is a crime where someone steals another person's personal information. This personal information could be your legal name, Social Security number, or financial data. After the criminal steals the information, they typically use it to commit fraud.

What should I do if my identity is stolen?

If somebody steals your identity, immediately change your passwords, freeze your credit, and report the theft to the police, your bank, the credit bureaus, and the FTC. You should also monitor your bank statements and credit reports closely over the next year.

How many people are victims of identity theft every year?

There were over 1 million cases of reported identity theft in 2023, according to the Consumer Sentinel Network, a database run by the FTC. However, there could be more cases since many people are unaware, unable to report, or choose not to report that they were victims of identity theft.

Who can an identity theft victim call to network with other victims?

You can join online forums and social media groups to share your story and connect with other victims of identity theft. You can also try contacting consumer rights organizations and nonprofits to talk with experts or access resources to aid in the recovery process. Regardless of where you find support, take care not to overshare about your situation to help protect yourself from further identity theft.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.