Identity theft happens when someone steals your personal or financial information to take out loans, make purchases, get healthcare, file taxes, or commit other fraudulent activities using your personal details. American adults lost $43 billion to identity theft in 2023.

Here, we’ll cover some of the most common types of identity theft and review prevention tips. And you can check out our guide to the warning signs of identity theft to learn more about what to look out for.

1. Financial identity theft

Financial identity theft is a crime where someone uses personal information such as bank account or credit card numbers to steal money, make unauthorized purchases, or take loans out fraudulently.

Some warning signs of financial identity theft include:

- Unexpected purchases on your statements

- New accounts appear on your credit report

- Online bank account lock-outs

- Credit score drops

Financial identity theft prevention tip: Don’t share sensitive information through unofficial or unsecured channels. If someone contacts you claiming to be from a financial institution, don’t give them your information. Instead, contact the institution via an official channel and explain the request you received.

And enroll in a strong identity theft protection service to keep your financial information safer. LifeLock helps protect your accounts by monitoring key changes to your credit report and alerting you to potentially fraudulent transactions. And we’ll help you get the expert assistance you need should you ever fall victim to identity theft.

2. Medical identity theft

Medical identity theft happens when someone steals your personal information and poses as you to access healthcare services. Thieves might use this information to get treatment, access prescription medication, or submit fraudulent bills to insurance companies.

Some warning signs of medical identity theft include:

- Bills for treatment you didn’t receive

- Patient notes that don’t make sense

- Unavailable medical treatment because you hit your benefit limits

Medical identity theft prevention tip: Keep your health insurance cards and medical documents safe. Be cautious about sharing information, and only do so when you’ve verified a request.

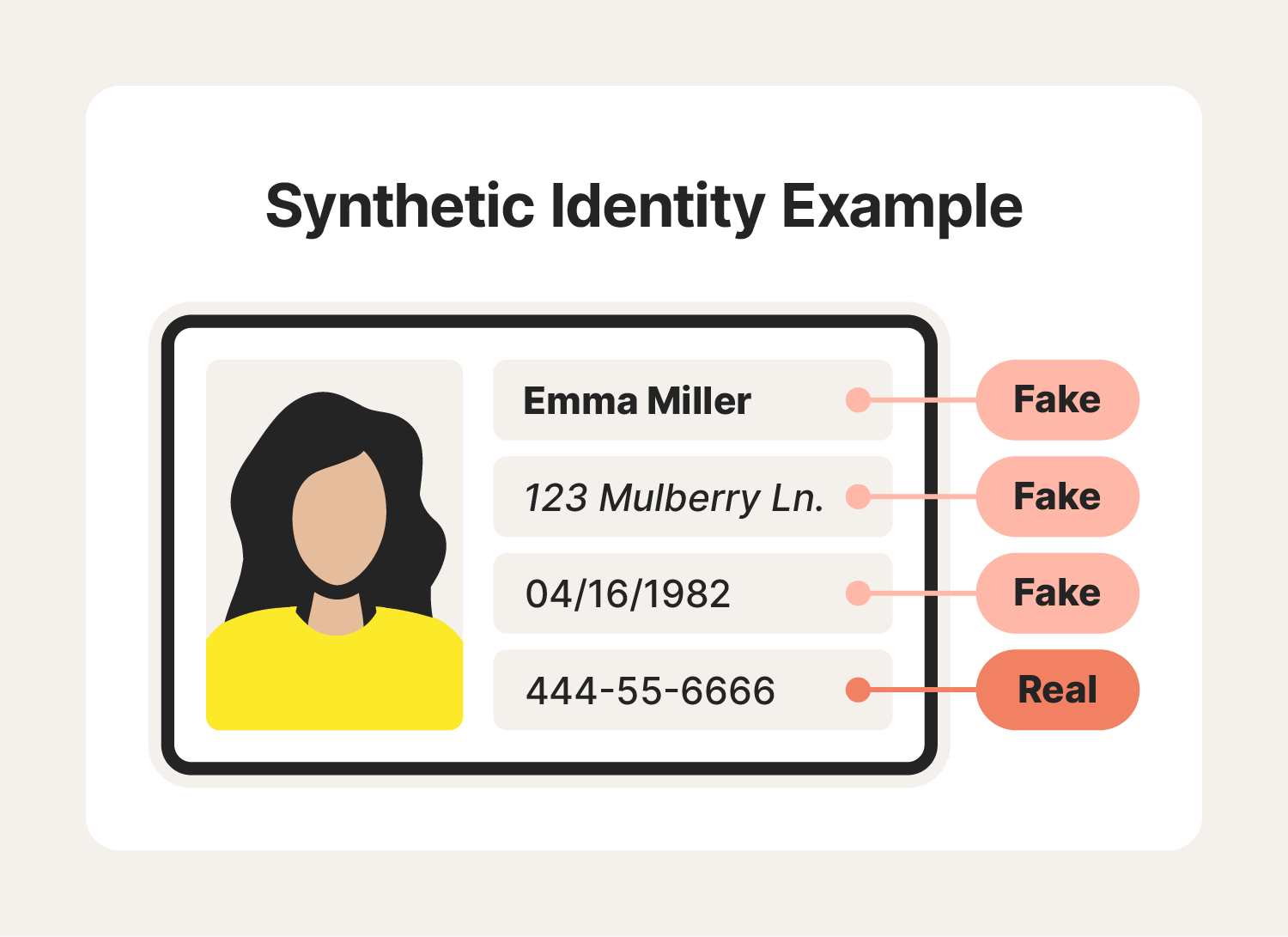

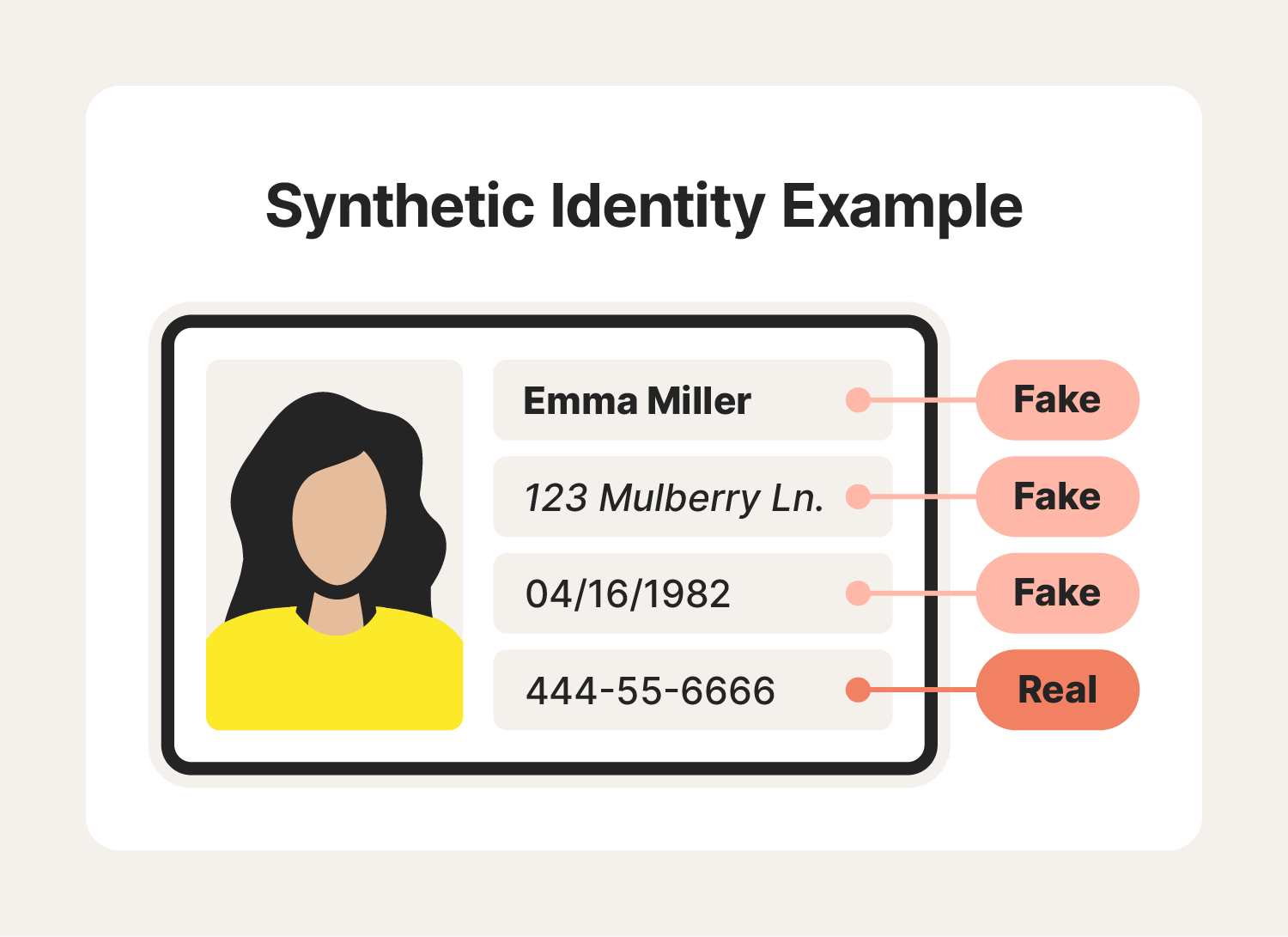

3. Synthetic identity theft

Synthetic identity theft is a type of fraud where a criminal combines real and fake personal information to create a new, fictitious identity.

Some warning signs of synthetic identity theft include:

- High numbers of new credit inquiries

- Unsolicited offers for credit cards or loans

- Debt collection calls

Synthetic identity theft prevention tip: Use strong, unique passwords for all online accounts to help keep intruders from stealing your personal information online. Don’t share too much information publicly on social media and elsewhere online.

4. Employment identity theft

Employment identity theft occurs when someone steals personal information, such as your Social Security number, to apply for a job under your name. This act can damage your credit, make finding new jobs difficult, and even lead to tax issues or legal trouble.

Some warning signs of employment identity theft include:

- Receiving job offers you didn’t apply for

- Being contacted by the IRS about income you didn’t earn

- Seeing unknown jobs on your credit report or background checks

Employment identity theft prevention tip: Recognize phishing attempts trying to steal your personal information like your Social Security number. Be extra vigilant if someone has stolen your wallet with important cards like your driver’s license or Social Security card.

5. Unemployment identity theft

Unemployment identity theft occurs when someone uses your personal information to file a fraudulent unemployment claim. The implications can include tax issues, financial damage, or legal trouble.

Some warning signs of unemployment identity theft include:

- Receiving a 1099-G IRS form or getting contacted by the IRS about government benefits you didn’t receive

- Receiving benefits you didn’t apply for

- Getting contacted by unemployment agencies out of the blue

Unemployment identity theft prevention tip: Use secure websites when applying for jobs, and be careful when responding to job advertisements and providing personal information.

6. Social Security identity theft

Social Security identity theft is when someone illegally uses your Social Security number to commit fraud. This can facilitate the various types of identity fraud we’ve mentioned, like opening new credit accounts or obtaining employment in your name, plus many others.

Some warning signs of Social Security identity theft include:

- Getting a new Social Security card in the mail

- Being denied government benefits you should qualify for

- Having your wages garnished for unfamiliar debts

Social Security identity theft prevention tip: Protect your Social Security number and don’t share it with anyone unless you trust them and it’s absolutely necessary. Store your SSN in a safe place and avoid carrying your Social Security card with you.

For added protection, get LifeLock. Monitoring for fraudulent use of your Social Security number and other sensitive details is one of the most essential services LifeLock offers. Become a member today and get greater peace of mind.

7. Tax identity theft

Tax identity theft is when someone uses your personal information to file a fraudulent tax return or commit other tax scams. This may be to claim a refund using your name, but the fraudster will change the payment details so they receive the refund.

Some warning signs of tax identity theft include:

- The IRS auditing your tax return

- Receiving a letter saying someone filed a fraudulent tax return in your name

- The IRS denying your tax refund

Tax identity theft prevention tip: File your tax return as early as possible to help prevent scammers from claiming your refund before you do. Consider an Identity Protection PIN from the IRS, which adds an extra layer of security when filing your taxes.

8. Child identity theft

Child identity theft happens when someone uses a minor's personal information to open new accounts or commit fraud. This can go undetected for years, causing significant financial damage later in life.

1 in 50 American children fall prey to identity theft every year—often at the hands of someone they trust, like a family member or close friend.

Source: Javelin

Some warning signs of child identity theft include:

- Encountering difficulties enrolling your child in school

- Getting a letter from the IRS claiming your child owes taxes

- Bills arriving in your child’s name

Child identity theft prevention tip: Place a credit freeze on your child’s report with each of the three major credit bureaus.

9. Senior identity theft

Senior identity theft occurs when a scammer uses an older person's personal information without permission. Criminals may target this age group with elder scams because of their perceived wealth and vulnerability, using tactics like phishing emails, phone scams, and familial impersonation.

Some warning signs of senior identity theft include:

- Changes to benefits like Social Security and Medicare

- Unexpected bills

- New accounts on a victim’s credit report

Senior identity theft prevention tip: Be cautious of unsolicited calls, emails, or letters claiming to be from government agencies, sweepstakes organizations, or financial institutions, especially if they ask for personal information.

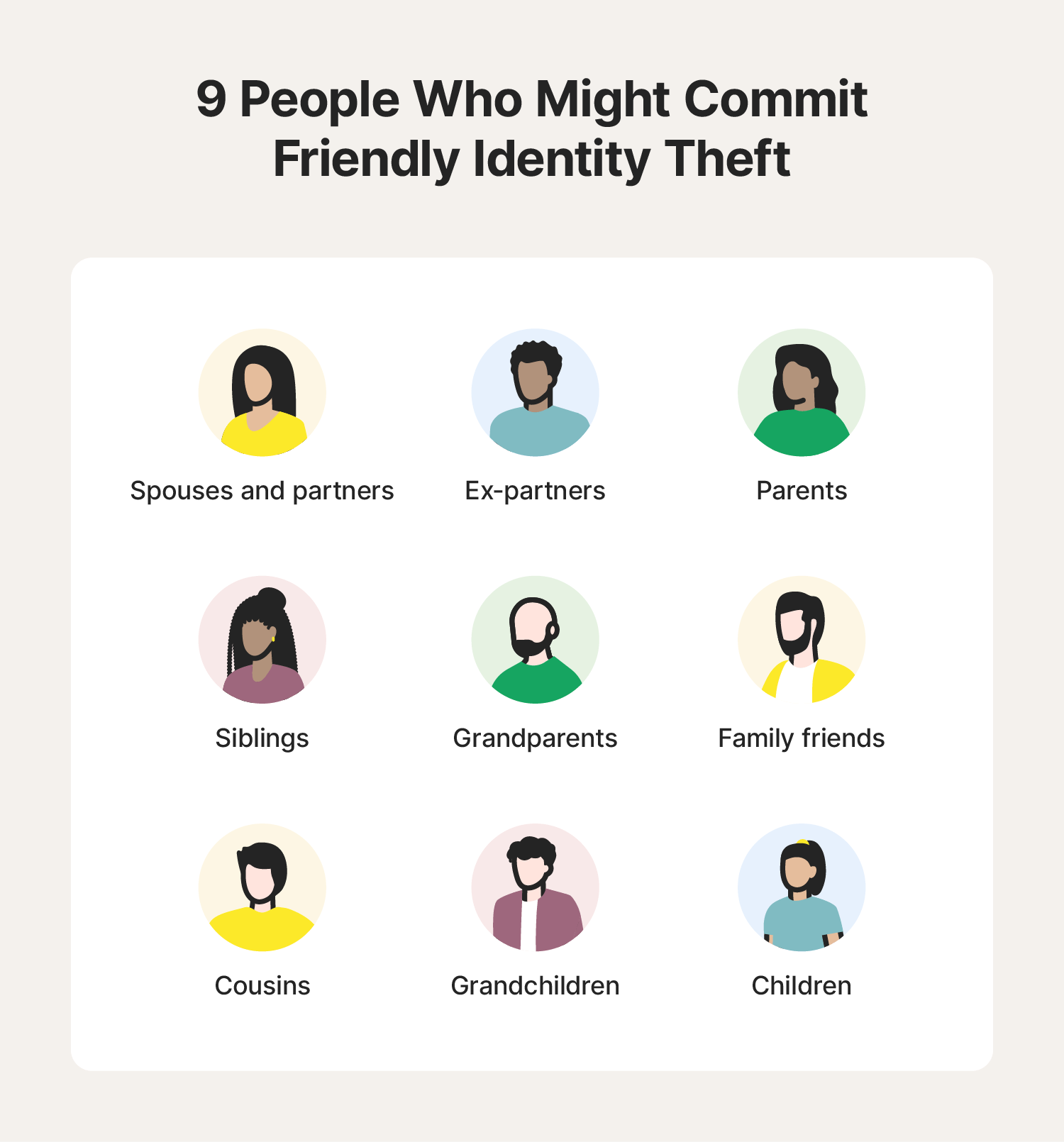

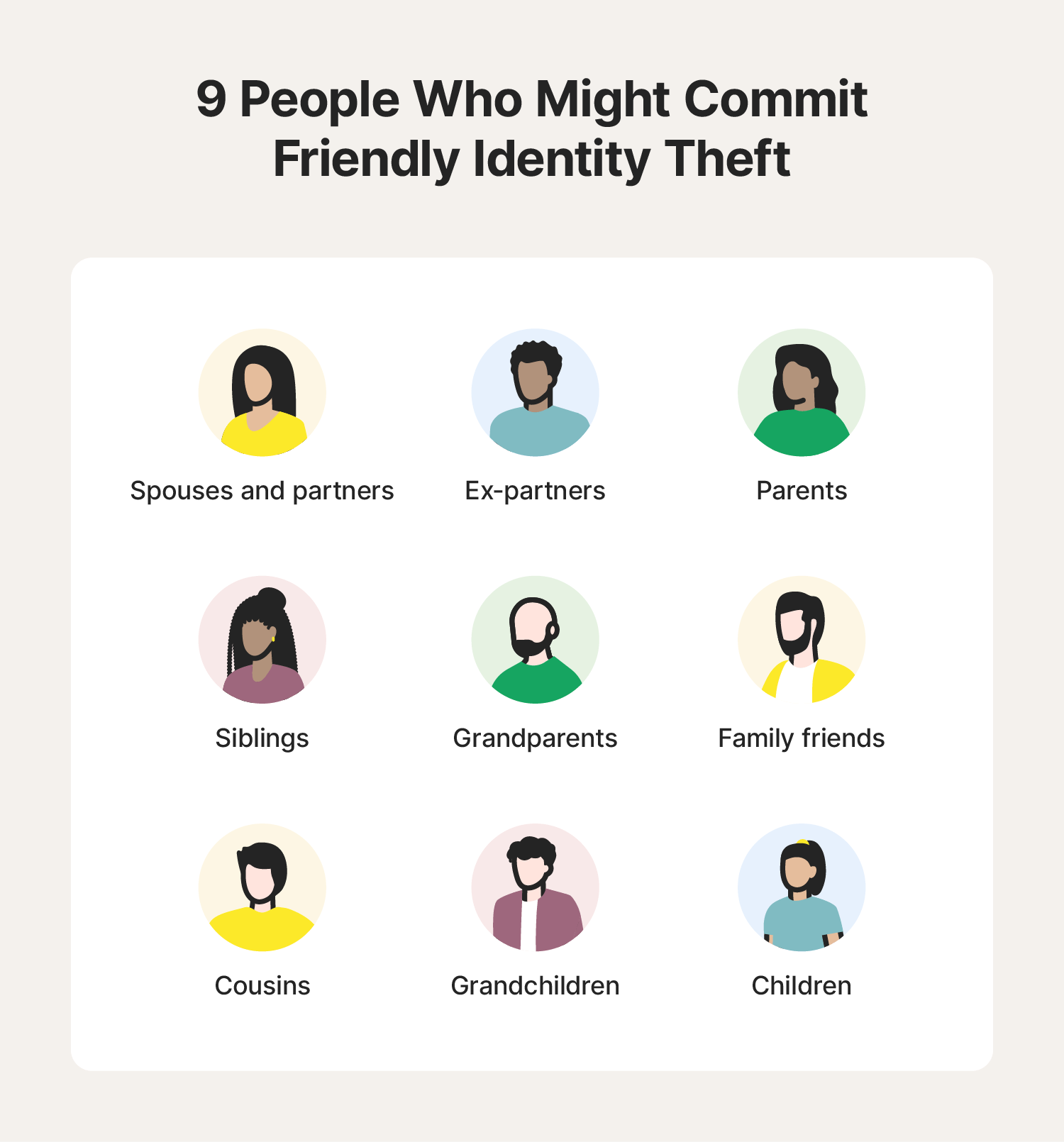

10. Family identity theft

Familial identity theft occurs when someone close to a victim—such as a family member or friend—uses the victim’s credit cards or personal information to make unauthorized purchases or commit fraud. When the victim disputes the charge, the financial institution may pursue a fraud case against them, especially if they try to hide the perpetrator's identity out of loyalty.

Some warning signs of family identity theft include:

- Difficulty accessing accounts

- Unexplained bills or transactions

- Debt collection notices

- Overly personal questions or unusual behavior from family or friends

Family identity theft prevention tip: Be cautious about sharing your personal information with friends or family members who may have financial difficulties or a history of dishonesty. Don’t share devices; if you do, log out of sensitive accounts like banking or shopping apps.

11. Account takeover fraud

Account takeover fraud occurs when a cybercriminal gains unauthorized access to an online account, such as a bank account or social media profile. Scammers can achieve this through techniques like phishing, malware, or data breaches. Once they gain access, the criminal can use the account to make fraudulent transactions, impersonate you, or even take over other accounts linked to the compromised one.

Some warning signs of account takeover identity theft include:

- Unauthorized account activity

- New credit card charges

- Unexpected account closures or lock-outs

Account takeover fraud prevention tip: Use strong unique passwords and enable two-factor authentication (2FA) on all your online accounts to make it harder for unauthorized individuals to access your accounts.

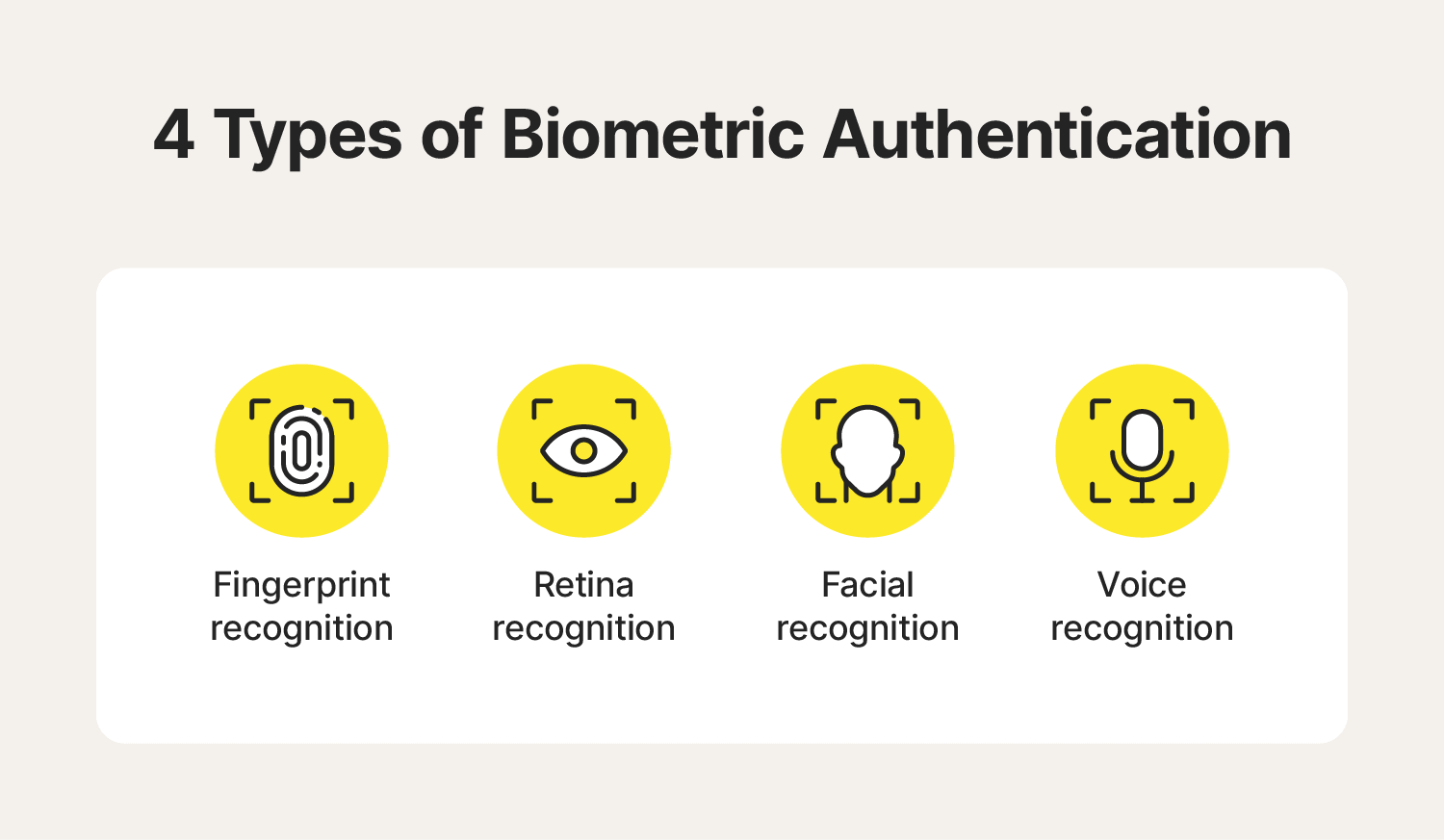

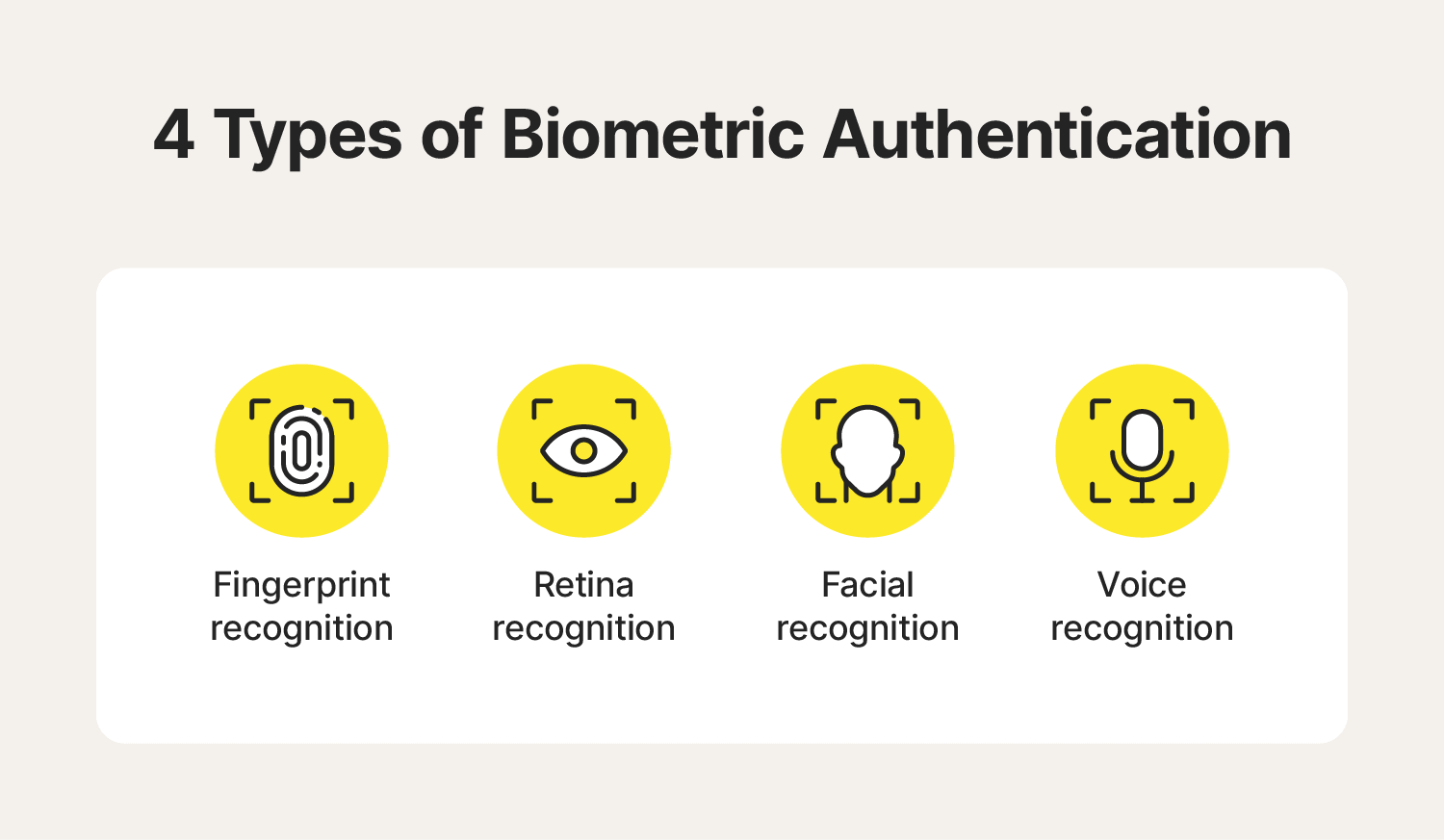

12. Biometric identity theft

Biometric identity theft happens when a hacker manages to access your unique physical or behavioral characteristics like fingerprints, retina scans, facial scans, or voice recordings. They could then use this to impersonate you or access your accounts.

Unlike traditional passwords, you can’t change biometric data, so it’s even more important for you to protect it.

Some warning signs of biometric identity theft include:

- Device malfunctions

- Unexpected account access

- Unusual bank charges

Biometric identity theft prevention tip: Read agreements and terms carefully, and exercise caution before sharing biometric data with companies. Only share it with trusted entities that enforce strong security measures.

13. Home title fraud

Home title fraud occurs when someone illegally transfers ownership of your property to themselves. They usually do this by stealing your personal information and forging documents. Once they have control of the title, they could potentially take out loans against your home’s equity or rent it out without your knowledge.

Some warning signs of home title theft include:

- Receiving a foreclosure notice

- Getting unexpected property-related mail

- Having difficulty selling your home because of an ownership dispute

Home title fraud prevention tip: Consider purchasing title insurance to help cover legal fees and protect you against financial fallout should you fall victim. Set up alerts with your county (if available) so you’re notified if there are changes to your property records. You can also subscribe to a home title monitoring and restoration service.

14. Mortgage fraud

Mortgage identity theft occurs when a scammer uses your data to secure a mortgage. They may steal your identity by hacking into your accounts, phishing for information, or even dumpster diving. This can lead to significant financial damage—you may be responsible for the loan, and it could cause significant knock-on effects.

Some warning signs of mortgage fraud include:

- Receiving unrequested mortgage offers

- Receiving documents about a property you didn’t buy

- Being contacted by a mortgage lender or debt collector

Mortgage fraud prevention tip: Place a credit freeze on your report with the major bureaus to help prevent fraudulent mortgages from being taken out in your name.

15. Criminal identity theft

Criminal identity theft happens when someone uses another person's information to try to avoid being arrested or charged with a crime. Or, upon arrest, they may claim another identity to try to avoid an arrest record or a warrant in their name.

Both can lead to serious consequences for the person who unknowingly became involved, including a criminal record, difficulty finding employment, and financial losses.

Some warning signs of criminal identity theft include:

- Being denied credit or services

- Being arrested and/or detained for a crime you didn’t commit

- Receiving a crime alert about yourself from a law enforcement agency

Criminal identity theft prevention tip: If someone steals your personal details or documents with sensitive data on them, alert the relevant authorities immediately.

How to report identity theft

If you become a victim, report your identity theft to the FTC, local police, your banks and financial institutions, and other affected businesses.

Here’s how to do it:

- Contact the FTC: File a report online at IdentityTheft.gov or by phone at 1-800-ID-THEFT (1-800-438-4338).

- File a police report: Report it to your local police department to record the crime.

- Contact affected businesses: Notify businesses affected by the identity theft, such as credit card companies, banks, and utility companies.

Beyond standard reporting, you can help protect against identity theft by:

- Regularly checking your bank, credit card, and other financial statements for new unauthorized activity.

- Reviewing your credit report for hard inquiries and new credit you might need to dispute.

- Closing compromised accounts and opening new ones.

- Freezing your credit with the three credit bureaus.

Types of identity theft penalties

The penalties for identity theft vary depending on the severity of the offense and the state or federal laws involved. In general, penalties can include fines, imprisonment, and restitution to the victim.

Here’s a more detailed list of potential identity theft penalties:

- Fines: Fines will be set depending on the extent of the damage caused and the number of victims involved.

- Imprisonment: Jail time might be set and will vary depending on the jurisdiction of the crime, the severity of the offense, and the fraudster's criminal history.

- Restitution: A judge may order the defendant to compensate the victim for any financial losses resulting from the identity theft.

- Other penalties: In some cases, a judge may also order the fraudster to perform community service or complete a probation program.

Use a strong identity theft protection service

Identity thieves can steal your data in many ways and use it to commit a wide variety of fraud. LifeLock can help detect unauthorized transactions in your bank or credit accounts to help prevent fraudsters from accessing your personal information or stealing your hard-earned money. LifeLock is the leader in identity theft protection—sign up today and enjoy greater peace of mind.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

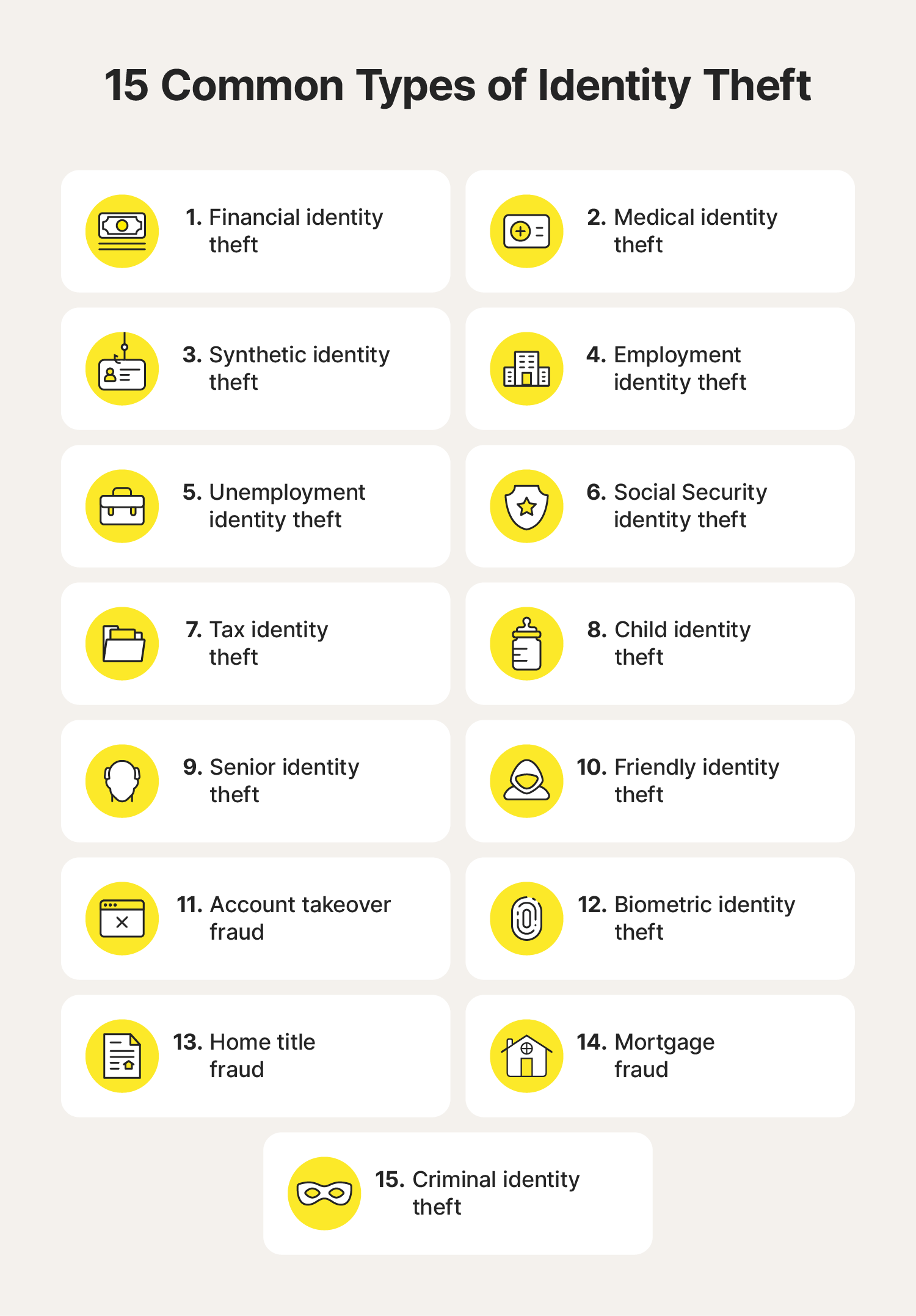

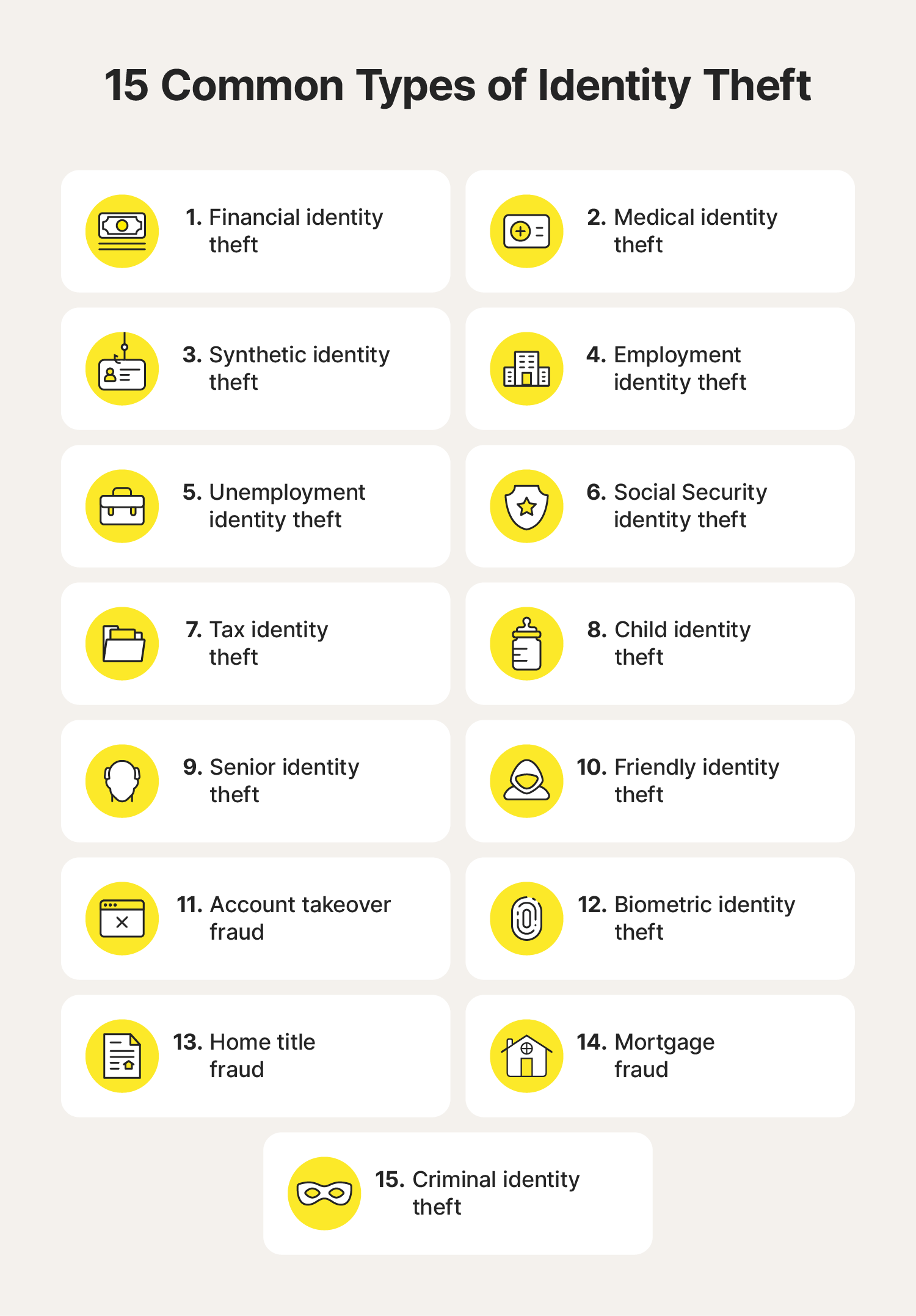

This article contains

- 1. Financial identity theft

- 2. Medical identity theft

- 3. Synthetic identity theft

- 4. Employment identity theft

- 5. Unemployment identity theft

- 6. Social Security identity theft

- 7. Tax identity theft

- 8. Child identity theft

- 9. Senior identity theft

- 10. Family identity theft

- 11. Account takeover fraud

- 12. Biometric identity theft

- 13. Home title fraud

- 14. Mortgage fraud

- 15. Criminal identity theft

- How to report identity theft

- Types of identity theft penalties

- Use a strong identity theft protection service

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.