Elderly scams are on the rise. In 2023, seniors accounted for 50% of reported fraud cases, and total reported losses from elder fraud amounted to nearly $3.4 billion in 2023 in the US alone—an 11% increase from the previous year. To help protect yourself and the seniors in your life from major financial loss, you need to know what types of elderly scams are out there.

What are elderly scams?

Elderly scams are scams that target senior citizens—people over the age of 65, who are often retired—exploiting their particular weaknesses and perceived wealth for financial gain. Many common elderly scams also target other age groups, while some target only seniors. It’s a good idea to be aware of these scams and common scammer tactics no matter your age.

Why do scammers target seniors?

Scammers may target seniors believing that possible social isolation makes them more likely to respond to anyone who seems friendly. They might also hope that their senior targets are less familiar with current technology and modern-day scams. Older adults also tend to have accumulated wealth and assets over the years, which makes them more appealing targets.

And on top of everything else, senior citizens are also less likely to report suspected fraud, so criminals may perceive this as a less risky group to target.

13 scams targeting seniors

The following types of scams, while not always necessarily targeting seniors alone, are among the most common to target seniors. And remember that no matter how old you are, staying aware of the kinds of scams that are out there can help you avoid falling victim.

Here are the most common scams targeting seniors today:

1. Tech support scams

In 2023, tech support scams accounted for the highest number of complaints to the Internet Crime Complaint Center by people over the age of 60. To launch these scams, fraudsters may claim your device has a virus or needs fixing in some other way.

Scammers might call you on the phone or use a text, email, or pop-up message on your computer to warn of the “issue” and provide a number to call them on. But the number is fake and the “tech support person” on the other end of the line just wants control of your computer or your financial information.

In some cases, they’ll suggest that you need to pay for their supposed protection. When you do, you either receive no new software or the "protection" you do receive is just a malware infection.

Tech support scam warning signs: You’re notified via call, pop-up message, email, or text that your computer has a virus or a technical problem. The scammer asks to gain remote access to resolve the issue or asks you to pay for antivirus software immediately.

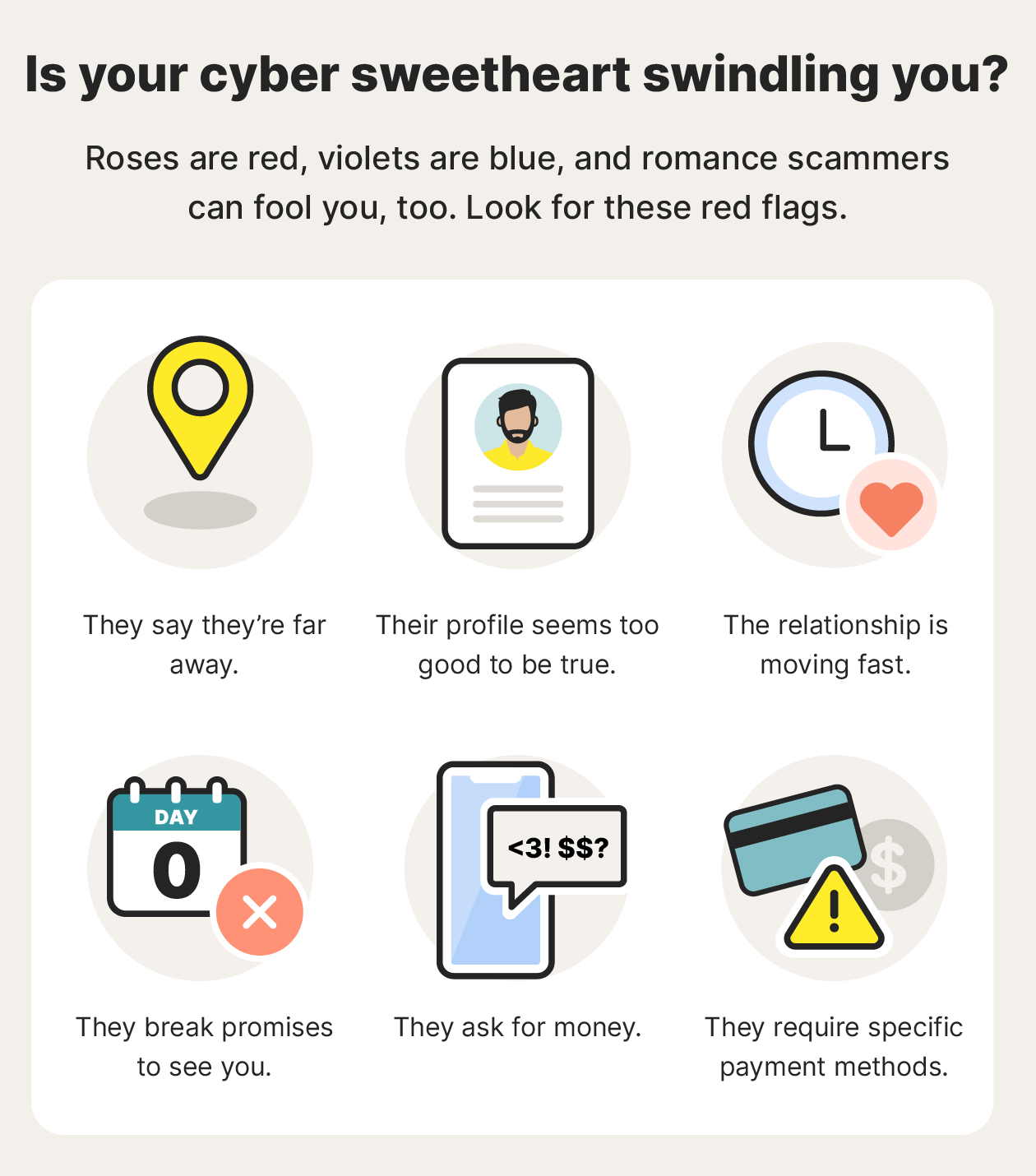

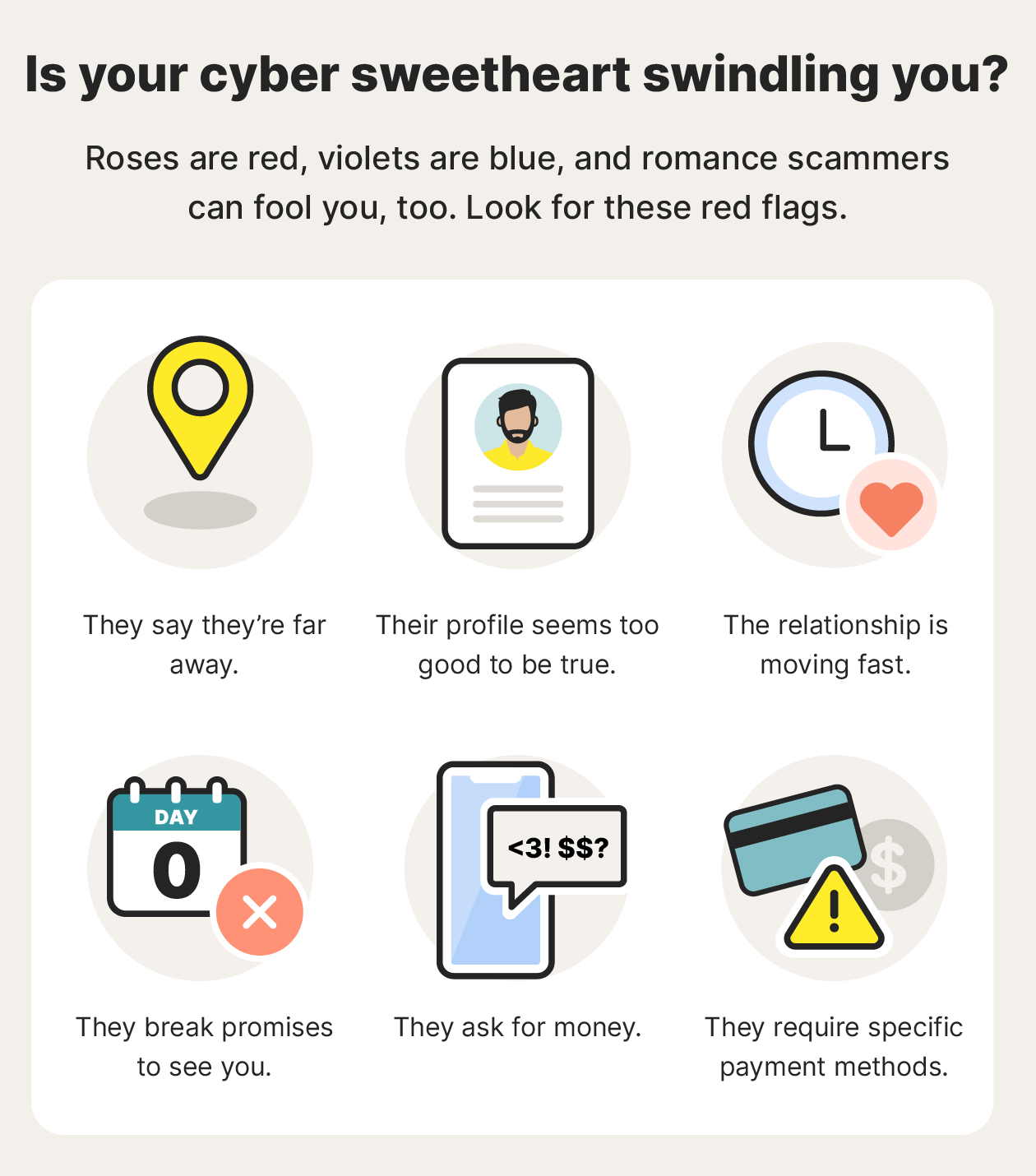

2. Sweetheart scams

Sweetheart scams, or romance scams, involve scammers using fake online profiles to develop a relationship with victims, aiming to build trust quickly in a whirlwind “romance,” until they ask for money (usually via CashApp or non-traceable payment methods like gift cards). Often, the scammer says that the reason they’re asking for money is due to an emergency, such as an accident or urgent help for a loved one. Or, they might need help covering the cost of a plane ticket so they can meet you in person.

Once the scammer has the money, your sweetheart vanishes without a trace—or they keep getting into situations where they need more and more money until you have nothing left to give.

Sweetheart scam warning signs: Your sweetheart has a profile that’s too good to be true—perhaps they’ve tailored it to match your exact hobbies and list all your favorite things. These scammers will also usually say they’re far away, and break promises to see you (in person and on video calls). And they may ask for money or request an untraceable payment method after you’ve only interacted online.

3. Investment scams

Investment scams promise high returns with supposedly little risk, enticing seniors to invest their life savings or retirement funds. Scammers often use persuasive tactics and professional-looking materials to gain trust, exploiting seniors’ desire for financial security in retirement and their apparent propensity to invest in their legacy to pass on to their children.

Investment scam warning signs: They promise big returns for little or no risk as long as you “invest” quickly. They also emphasize the relatively small amount of money you need to give them (which could rise to the thousands) compared to what you’ll supposedly gain from the investment.

4. Funeral scams

Considering the discomfort many of us feel about death and funerals, it’s no surprise that the funeral industry is exploited by unethical and malicious actors. Having reached a later stage of life, older adults are more likely to be targeted by prepaid funeral scammers. Pretending to be from funeral homes, these scammers con victims into prepaying for a funeral they’ll never receive.

Funeral scam warning signs: There’s no itemized price list, as required by the FTC’s Funeral Rule, or the con artist pressures you into choosing the most expensive services. While funeral scammers might pressure you into paying more than you want, legitimate funeral directors typically won’t do this.

5. Grandparent scams

In grandparent scams, scammers pose as a grandchild or another relative in distress, urgently asking for money. They usually claim to be in an emergency situation, such as an accident or being stranded in a foreign country, and they need money to get out of it. This scam takes advantage of older adults’ emotional attachments to loved ones, in the hope they’ll act quickly.

Grandparent scam warning signs: The scammer contacts you on the phone in hysterics and sounds muffled (often blaming bad reception), doesn’t give specific information about the family (possibly only knows some names from social media), and/or pressures you to act quickly while asking you not to tell anyone they asked you for help.

6. Lottery & fake prize scams

Lottery scams lure you in by saying you’ve won a lot of money, sometimes using legitimate lottery names, such as the Mega Millions jackpot or the Publishers Clearing House sweepstakes. But in order to collect your winnings or prize, you'll need to wire a processing fee, tax, or shipping fee or mail cash directly to the lottery's organizers.

Lottery scam warning signs: A sure warning sign is a request for payment before collecting winnings or a prize. Real lotteries never do this. And if you don’t recognize the lottery or remember entering the lottery in the first place, it’s most likely a scam.

7. Charity scams

Charity scams often run rampant immediately after a disaster breaks out, like war, floods, or a pandemic. Fraudsters may reach out to you by phone, text, or email asking that you support a real charitable cause through a fake charity. They might also post fake ads or posts and masquerade as a volunteer from a legitimate charity.

Charity scam warning signs: Unsolicited contact from a charity you don’t recognize (they can also pretend to be from a well-known charity), pressure to donate immediately, and requests for donations made by gift card or a money-transfer app. When in doubt, search the name of the charity and verify it through Charity Navigator and Charity Watch, then donate through the charity’s website or official phone number.

8. Internet scams

Internet scams try to trick seniors into handing over money or sensitive information. This can be done via phishing emails, scammy social media messages, or fake websites. Scammers who target seniors may do so hoping they aren’t technologically savvy and/or won’t be as aware of online scams.

Internet scam warning signs: Watch out for emails supposedly from a trusted organization or a website that has poor grammar or a suspicious sender address or URL. If you hover over a link and the address that appears at the bottom of your screen isn’t what you expect, then it could direct you to a malicious page or download.

9. Government impersonation scams

A government impersonation scam begins with a call, text, email, or social media message from a scammer claiming to be from the IRS, Social Security Administration, or the FTC. They might provide a fake employee ID number that sounds convincing and ask for money or personal information to resolve a non-existent issue.

Government impersonation warning signs: Someone contacts you from a government agency via phone, email, or social media message asking for money or personal information—a government agency will never do that.

10. Medicare scams

Medicare scams are a form of government impersonation scams that usually target seniors since Medicare is typically for people 65 and older. Senior Medicare Patrol states that losses to medicare fraud, errors, and abuse are estimated to be around $60 billion a year.

Scammers may say that you need a new Medicare card or that you’re eligible for additional coverage at a steep discount or a cheaper plan. They’ll usually say you need to send them your medical and personal information first, which they could then sell on the dark web or exploit for identity theft.

Medicare scam warning signs: The biggest red flag for a Medicare scam is that they ask you for personal or medical information. No legitimate Medicare representative requests this information, and certainly not through an unsolicited phone call, email, text, or social media message.

11. Robocalls & phone scams

Phone scams aim to get a voice signature from the target, money, or personal information. An example of a robocall scam is the “Can you hear me?” call. When the older person answers, the scammer has a voice signature they can use to authorize fraudulent charges. Other scam calls might scare the elderly target by saying they must pay a fine or they’ll be sued or arrested.

Phone scam warning signs: Like with many scams, phone scammers will often pressure you to act quickly. They might also ask for personal information that legitimate entities would never request over the phone. Another sign is if the caller claims unusual account activity or unknown fines, and evades your questions.

12. Reverse mortgage scams

A reverse mortgage allows seniors to unlock money from their home equity based on the difference between the market value of their home and mortgage balance.

There are multiple ways scammers launch these attacks, including offering fake reverse mortgage offers for a fee. They may also claim to help the senior get a real reverse mortgage and convince them to transfer the title to them in attempted home title theft. Or, they might trick an elderly person into moving into a home to obtain a reverse mortgage on the property so the scammer can take the equity.

Reverse mortgage scam warning signs: Reverse mortgage scams are often unsolicited offers and promise terms that are too good to be true. They might use complex terminology in documents making them appear official and difficult to understand or validate.

13. Online shopping scams

Online shopping scams come in many forms and aren’t limited to just one platform. From Facebook Marketplace to Craigslist and beyond, scammers take advantage of people looking for the perfect item or a bargain. They can also run fake websites or apps. Scams can include selling an item that doesn’t exist or shipping an item of lesser value or quality than the listing. A common example includes eBay scams, where fraudulent sellers may exploit the platform’s trust to deceive buyers.

Online shopping scam warning signs: Watch out for prices that are too good to be true, or if the seller requests payment via wire transfer or a payment app like Zelle. A legitimate shop and app should accept credit cards, and if it’s an individual selling on an informal marketplace, use one of the platform’s recommended payment methods.

How to avoid elderly scams

Under the right circumstances, nearly anyone can fall for a scam. But, there are some practical steps you can take to help avoid elderly scams:

- Don’t rush: Scammers often create a sense of urgency to get you to act without thinking. Resist the pressure to act immediately and consult with a trusted family member or friend before sending any money from an unsolicited call or email.

- Be skeptical: If something sounds too good to be true, it probably is. Always question unexpected offers or prizes.

- Verify identities: Confirm the identity of those who contact you, especially if they ask for money or personal information—if you think the request or offer is legitimate, contact the company back on an official channel. If someone claims to be a relative, ask a specific question only they could answer. If you’re still in doubt, verify with another relative as to their whereabouts and circumstances.

- Don’t share personal information: Never give out your Social Security number, bank account details, or other sensitive info unless you’re sure the requester, site, or app is legitimate.

- Understand phishing: Phishing scams are some of the most common and can be very convincing. Stay on top of the new tactics and remember that spoofing and other techniques mean you need to question every communication before acting or responding.

- Hang up on unsolicited calls: If you receive a suspicious call, hang up immediately and do not engage with the caller. Then block the number or ask a family member to help you do it.

- Do your research: Before giving any organization money, search for the name on the web. Check for reviews and verify their legitimacy with official resources.

- Use secure payment methods: Avoid wire transfers or prepaid debit cards for payments. Use credit cards or other secure payment methods that offer fraud protection.

- Use technology wisely: Be careful not to overshare on social media and set your accounts to private wherever possible.

- Use online security software: Make sure you have reputable security software on all your connected devices. Pick one that can help protect you from online scams, malicious links, and malicious websites.

How to report an elderly scammer

If you believe you or a loved one has been scammed, there are several steps you can take to report it. If identity fraud has been involved, learn how to recover from identity theft and the important steps to take like freezing or locking your credit.

- Contact the police: Contact your local police department and report the identity theft or scam.

- Notify your bank: If you’ve given out financial information to a scammer, contact your bank to protect your accounts and cut off the scammer immediately. Lost funds may or may not be recovered, but you can help prevent further damage from being done.

- File a report with the FTC: File a report online or call 1-877-FTC-HELP (382-4357) and follow the instructions given. Once you file the report, you’ll be provided with the next steps to take.

- Report it to the Internet Crime Complaint Center (IC3): If it was an internet scam, also file a claim with the IC3. Click the link “Elder Fraud (Victims 60 and Over)” and you’ll see the information you need to provide.

- Report it to the platform: If the scam started on a website or social media platform, report it to the administrators so they can take action and possibly help prevent others from being scammed.

Don’t become a senior scam statistic

Even when you know what to look out for, there’s still the possibility of being scammed. LifeLock Ultimate Plus can help protect against identity theft by monitoring the dark web for your information and scanning for names on accounts connected with your Social Security number.

LifeLock Ultimate Plus can also help detect unauthorized banking transactions and monitor your credit by monitoring hundreds of millions of data points a second. We also guarantee help restoring your identity and stolen funds should you fall victim to identity theft*, with a U.S.-based restoration specialist ready to help you resolve your case. Subscribe now for greater peace of mind.

FAQs about elder fraud

Still have questions about elder fraud? We’ve got answers.

Why are older adults potentially more vulnerable to scams?

Older adults can be more vulnerable to senior scams because they may lack deep knowledge of modern technology and experience increased social isolation that can result in their not being familiar with common scam tactics. Senior citizens also tend to have more assets that can be stolen, which can make them more attractive targets to scammers.

What should I do if my elderly family member is being scammed?

If you suspect your elderly family member is being scammed, report it immediately and talk to them about their financial accounts and how to secure them and their identity. You can also help educate your parent about scams so they are more aware in the future.

How do banks and other financial institutions help prevent elder scams?

Many banks and other financial institutions help prevent elder scams by providing staff training to recognize signs of elder financial exploitation, providing educational material about recognizing scams, and monitoring and flagging unusual account activity. The Senior Safe Act of 2018 further encourages financial institutions to report suspected cases of elder abuse and fraud.

* Restrictions apply. Automatically renewing subscription required. If you are a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See LifeLock. com/Guarantee for complete details.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2025 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.