Your credit score can open (or close) many doors for you. If you want to buy a car or a home, you’ll probably need to take out a loan, and your credit report includes information these lenders use when deciding whether or not to loan you money.

So, what is a credit score? Your credit score is a number that tells a lender your creditworthiness. It takes information about your current and historical credit accounts and your payment history and distills it into a number between 350 and 850.

What is considered a good credit score?

A good FICO credit score is 670 or higher (800+ being exceptional), and VantageScore prime credit scores start at 661. Lenders use several credit scoring models, but the two most common are FICO and VantageScore.

Because there are three credit bureaus, you will likely have three different credit scores, though they’re usually pretty close to one another. Let’s examine the differences between FICO® and VantageScore® and what qualifies as a good score for each.

What is a good FICO score?

A good FICO score is usually 670 or higher, and the higher the FICO credit score, the better. General FICO scores range from 300 – 850, and the scores for specific industries (auto loans, for example) range from 250 – 900.

FICO (Fair Isaac Corporation) was one of the first groups to develop a system for determining a credit score. FICO scores can vary from agency to agency based on what data they collect, and there are different kinds of FICO scores depending on what type of loan you’re applying for.

What is a good VantageScore?

A good VantageScore is 661 or higher. As a credit scoring model, it weighs factors similarly to a FICO score and assigns a score from 300 – 850.

The VantageScore is a newer score created by the three main credit bureaus. Now on its fourth version, it weighs and assigns a credit score based on the data from all three credit bureaus. They claim this allows for more consistent scores between the bureaus and a more accurate reflection of how people use credit.

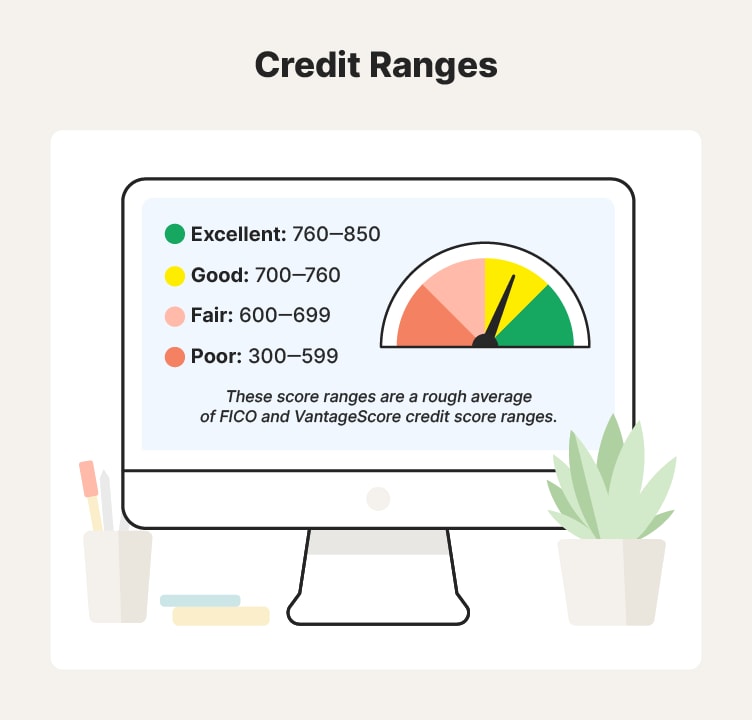

Credit score ranges

Because there are so many variables involved in determining a credit score, it’s important to note that most lenders don’t look for a specific score before issuing a loan. Instead, they look for a score within a certain range.

Below, you’ll see what these ranges are and what they mean for your chances of securing a loan or credit card. Keep in mind that the ranges below can differ slightly depending on the credit scoring model used.

Excellent

A VantageScore of 781 – 850 falls into the excellent range. And when your FICO credit score is between 800 – 850, it’s also in the exceptional range. With scores in these areas, you can get the best rates on home and auto loans, along with high-limit credit cards. If your score is in the excellent range, you likely have a low credit usage ratio, older accounts, and a spotless payment history.

Maintaining or growing your score when you’re in this range can be difficult because there is only so much you can do if you’re already doing things correctly. It’s also important to remember that 850 is the limit—there’s no higher score.

Good

A good FICO credit score is between 670 – 739, and a FICO score of 740 – 799 is very good. The good range of VantageScore is from 661 – 780. With a score in this range, you can finance a home or vehicle with a competitive interest rate, and most major credit card companies will approve you for a new card.

When your credit score is good, you’re probably paying your bills in a timely manner and using your credit responsibly. But remember, if you worked to get your credit score into this range to apply for a mortgage or a home loan, your score could dip after you get it. As the account ages, your score should go back up.

Fair

A fair credit range is between 580 – 669 (FICO) and 601 – 660 (VantageScore). When your credit score is in this range, you can choose from a range of credit cards with decent interest rates and some auto loans. Getting financing for a home if you’re in this range isn’t impossible, but it can mean a bigger down payment and higher interest rates.

Get free credit reports from the three major credit bureaus every year to keep an eye on your credit score. And if you’re serious about repairing or building your credit, consider monitoring your credit more frequently. If you’ve set a credit goal, regular monitoring will show you when you’re getting close.

Poor

We know what constitutes a good credit score, so what’s a bad credit score? The poor or “bad” credit score ranges between 300 – 579 (FICO) and 300 – 600 (VantageScore). Scores in this range might be because of irresponsible spending habits, financial disasters (like losing a job or having a large volume of unexpected and expensive medical bills), or not having much existing credit.

But just because your credit is in the poor range doesn’t mean it will stay there forever. To fix your credit score, you can:

- Pay your bills on time.

- Pay down any credit card debt you have.

- Pay off any accounts in collections.

- Apply for a secured credit card.

- Monitor your credit for fraud involving your personal information.

With a little work, it’s possible to see your credit score improve relatively quickly. And get LifeLock Total to help monitor and protect your credit. LifeLock helps you monitor your credit accounts for fraud, receive alerts when someone tries to open new accounts in your name, and reduce the fallout if you become the victim of identity theft.

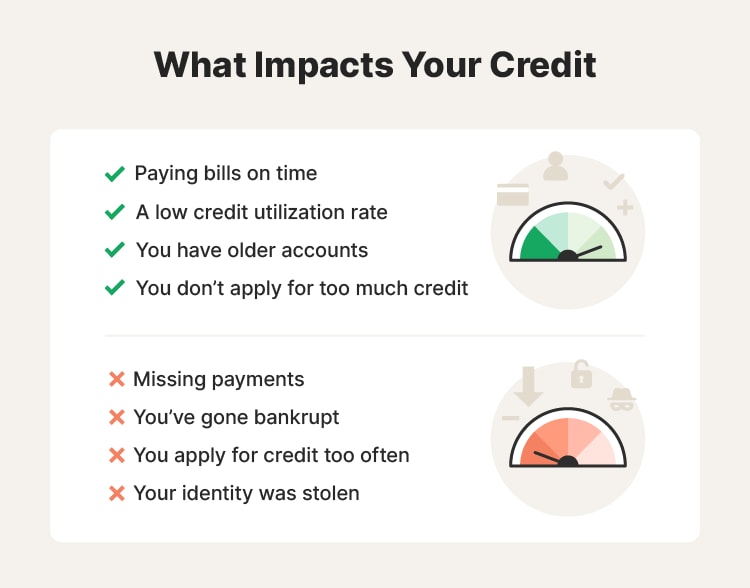

Factors that impact your credit score

Your credit goes up and down depending on several factors. Most of these elements are based on your actions and habits, so it’s smart to understand how you’re contributing to a good or bad credit score each month.

No one starts with a perfect credit score—it’s something you have to work for. You’ll see that it’s about balancing having credit and paying it down on time.

Here are a few factors that can positively affect your credit score:

- Paying bills on time: Missing payments or paying late can lower your creditworthiness and may lead to higher interest rates.

- Having a good credit utilization rate: This is the ratio of available credit to used credit. Try to keep this below 30%.

- Keeping older accounts: Keeping an account in good standing for several years or more shows that you are probably a good investment.

- Not applying for too much credit too often: Limit opening new credit accounts to times when you really need it. One way to help prevent you (or identity thieves) from applying for too much credit too often is to put a credit freeze or credit lock on your account.

- Avoiding bankruptcy: A bankruptcy can negatively impact your credit for 7-10 years (depending on the type of bankruptcy).

- Monitoring for identity theft: While you can dispute credit accounts that an identity thief signed up for, your credit score could drop until the dispute is successful or you rebuild credit.

One of the best ways to keep your credit score in a good range is to monitor it. Credit monitoring services help you monitor your score, see what happens when you apply for (or pay off) credit, and protect against identity theft that can stem from someone trying to use your personal information to open credit accounts in your name.

Protect your credit to start improving it

Whether your credit is in a great spot or you’re working to improve it, knowing where you stand is important for your own peace of mind. With LifeLock Total, you’ll get credit monitoring with the three main bureaus, fraud alerts on select accounts in case someone tries to use your personal info to apply for credit, and daily access to your VantageScore credit score.

FAQs about credit scores

Still have questions about credit scores? We have answers.

What is a good credit score for my age?

There isn’t a single good credit score for people based on their age. Some people responsibly seek and use credit in their teens, while others never get a credit card. To figure out a good credit score for your age, instead look at what you want to do—buy a new vehicle or purchase a home, for instance—and see how close you are to the appropriate range.

What is the average credit score?

According to Business Insider, the average FICO score in the U.S. is 718 and the average American VantageScore is 701. Both of these averages are in the good range. Over the last 10 years, the average American credit score has increased by almost 30 points.

Does checking my credit score lower it?

Checking your credit score yourself does not lower it. In fact, regularly monitoring your credit report and credit score can alert you to identity theft and account errors that could negatively affect your score.

Is FICO or Vantage used more by lenders?

FICO is the more widely used credit scoring model. FICO states that 90% of the top lenders use their model in the U.S. when making lending decisions.

What is a good credit score to buy a house?

A minimum credit score of 600 is best for buying a home, depending on the type of loan. The size of your down payment, home cost, and income all determine whether a lender will qualify you. You can still buy a house with less-than-perfect credit, but it will likely cost you more each month (and over the life of the loan).

What is a good credit score to buy a car?

While there isn’t a single credit score that will guarantee you can qualify for an auto loan, if your credit score is in the good range (670 – 739) or higher, you’ll probably qualify for a decent rate. That doesn’t mean you can’t buy a car with a lower score, but you will likely have higher rates and qualify for smaller amounts of credit.

What is a good credit score to get a credit card?

There is no one score that will guarantee you can qualify for a credit card. Even people with poor credit scores can get a credit card, though it might have a very high interest rate or be a secured card. If you want a credit card with a competitive rate, a score in the good (670 – 739) or higher ranges may be enough.

What is my credit score?

To check your credit score, you can request a credit report from your credit card company, bank, or lender. If those aren’t an option, you can sign up for credit monitoring or visit a free credit scoring site.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.