Can I buy a house with bad credit?

Yes, it may be possible to buy a house with bad credit. There are loan options and strategies to improve your chances of qualifying for a mortgage with poor credit. But you’ll likely have to pay higher interest rates and a larger down payment.

How to buy a house with bad credit

A recent study from Home Bay found that 60% of American renters believe home ownership is out of reach for them. This may be due to inflation, debt, and the extremely competitive housing market. However, a bad FICO® credit score doesn’t have to be another deterrent. Read on to learn how you can buy a house with bad credit.

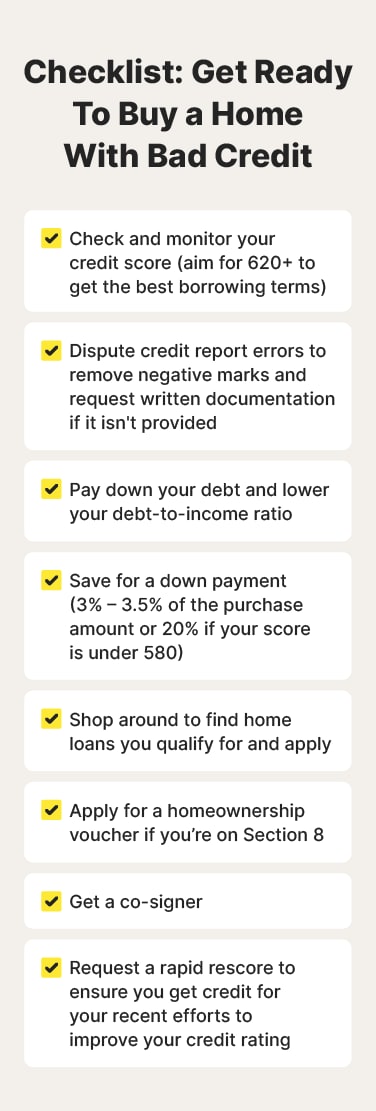

Check your credit

The first step to take when preparing to buy a house is to check your credit score. Use a tool like LifeLock to see your VantageScore, which updates daily. Or, you can typically find your FICO score in your bank or credit card’s app, or through a free online credit check service.

Determine whether your FICO score is poor (<580), fair (580 – 669), good (670 – 739), very good (740 – 799), or exceptional (800+). If you’re in the “good” range, you may have nothing to worry about—you can expect to get approved for a mortgage, with good interest rates to boot.

| FICO credit rating | Credit score range |

| Exceptional | 800+ |

| Very good | 740 – 799 |

| Good | 670 – 739 |

| Fair | 580 – 669 |

| Poor | <580 |

If your borrower risk profile is subprime (credit score of 580 – 619) or deep subprime (less than 580), getting approved for a mortgage may be harder, and lenders may ask you to pay a larger down payment or accept unfavorable interest rates. However, you can still get a house with bad credit in most cases. You just have to leverage some proven home-buying strategies, keep working on improving your credit score, and leverage all available resources.

Spot potential fraud faster with daily credit monitoring to help safeguard your score while you work toward your goal of becoming a homeowner. LifeLock provides daily credit score updates and alerts you when it detects fraudulent activity that threatens to bring your score down.

Build your credit score while you can

Unfortunately, there isn’t a golden ticket guaranteeing you’ll qualify for a mortgage as a home buyer with bad credit. But if you can dedicate one or two months to raising your credit score before submitting your mortgage application—especially if you’re straddling levels—it could make a world of difference.

Let’s take a look at how you can help tip the credit score scales in your favor based on how soon you plan to buy a home.

If you have 30 days or less:

- Pay off as much of your credit card debt as you can.

- Continue making credit card payments on time.

- Request a credit limit increase (but don’t spend more).

- Avoid opening new accounts and closing old ones.

- Don’t authorize any hard inquiries.

If you have six months:

- Pay off high-interest loans and small debt amounts—then tackle your other accounts.

- Start getting credit for recurring bills like your rent or utilities.

- Get a secured credit card that requires a cash deposit.

- Become an authorized user on someone else’s credit card.

- Dispute credit report errors that are unfairly dragging down your credit score.

- Work with a credit counselor who can help you budget, create a debt repayment strategy, and manage your finances.

- Consider negotiating a “pay-for-delete” agreement so creditors will remove inaccurate or incomplete demerits from your credit report. Note that removing accurate entries is not only misleading and frowned upon by the FTC and credit bureaus, it might have only a minimal impact if any at all.

If you have one year:

- Diversify your credit mix (e.g., installment loans, revolving credit, and open credit).

- Keep your accounts in good standing and let them age a bit.

As for those who can’t wait until their credit rating improves, there are loans available for people with bad credit who want to buy a house—more on these later.

Save up to make a more substantial down payment

If your credit score is low, you’ll likely need to save more and place a larger down payment to lower the total loan amount, minimizing the lender’s potential losses should you default. For example, with a minimum FICO score of 580 an FHA (Federal Housing Administration) loan usually requires buyers to place only a 3.5% down payment. However, if your credit score is between 500 and 579, you need to pay a 10% down payment.

Assume the home you want costs $350,000, and you’re paying for it with an FHA loan. If your credit score is 620+, your down payment would be 3.5% of the house’s cost, or $12,250. But if your credit is bad, you’d have to pay 10% of the home’s cost, or $35,000.

Ultimately, the exact home down payment percentage varies, but is often in the 10% – 20% range, or even more depending on the loan program and your credit score. If you’re worried about saving up for a larger down payment, here are some strategies you can use to give yourself a boost:

- Leverage local or state down payment assistance programs.

- Put money in a high-yield savings account every month.

- Identify expenses you can cut back on temporarily.

- Pick up a side hustle to earn some extra money.

Choose a home loan best for bad credit

If you have bad credit, you can still get certain types of loans to help you buy a house. However, these typically have higher interest rates, shorter loan terms, and additional income verifications, so it’s even more important to shop around, especially if you opt for a private loan.

That said, let’s dig into some common loan types and find out which is the best fit for you.

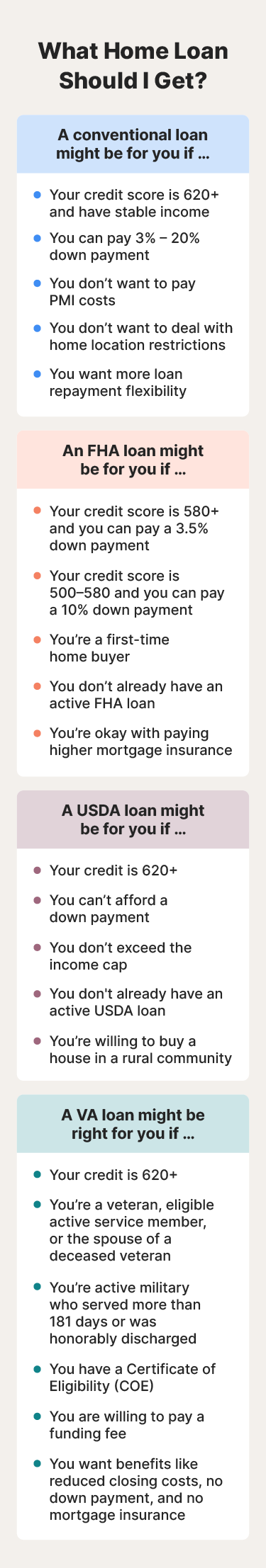

Conventional home loan

- Best for: Buyers with good credit and a stable income

- Minimum credit score: Usually 620

- How to apply: Shop around with banks, credit unions, and mortgage companies. Then, follow your chosen lender’s home loan application instructions.

A conventional home loan is a mortgage offered by a regular bank that isn’t insured by the government. It's popular because it offers more loan options to home buyers and typically decreases private mortgage insurance (PMI) costs.

A mortgage insurance premium is a fee buyers sometimes need to pay if their down payment is less than 20%. Private mortgage insurance is usually not required for conventional loans with a down payment of 20% or more.

However, conventional loans aren’t typically a great option for people with poor credit since they can be harder to get approved for. This is especially true if your lender sticks to the qualification criteria of Fannie Mae and Freddie Mac (enterprises created by Congress to back mortgage loans). Even if you do get approved for a mortgage, you’ll likely end up paying a higher interest rate and down payment to offset the lender’s risk.

FHA loan

- Best for: First-time home buyers and those with lower credit

- Minimum credit score: 580 (or 500 – 579 with a higher down payment)

- How to apply: Find an FHA loan lender in your area and follow their application guidelines.

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration. You can use these loans to purchase a primary residence, and you can only take out one at a time. Since the government backs FHA loans, they tend to be more lenient about qualification requirements to make homeownership more accessible to first-time home buyers and people whose credit scores are in subprime territory.

It’s also important to remember that while this type of home loan can help you get a home with less money up front depending on your credit score, you’ll probably still have to pay higher mortgage insurance premiums and a larger down payment if you have lower credit.

USDA loan

- Best for: Buyers with low to moderate income and near-prime credit scores

- Minimum credit score: 640 (for Section 502 loans)

- How to apply: Find a USDA loan lender in your state and apply.

A USDA home loan is a mortgage program backed by the U.S. Department of Agriculture. It caters to low and moderate-income homebuyers in designated rural areas. The income caps vary by county and household size. However, most one-to-four-person households in rural counties can make around $100K annually and still qualify for this loan.

These loans are attractive because they often require no down payment and come with competitive interest rates. However, to qualify for this loan, your FICO score needs to be firmly within the fair (580 – 669) or near-prime (620 – 659) range. If your credit score fits the bill and you’re willing to buy a home in a rural area, this is one of the most affordable ways to become a homeowner.

VA loan

- Best for: Veterans, surviving spouses of veterans, and active service members

- Minimum credit score: No program minimum, but some lenders require 620+

- How to apply: Get a Certificate of Eligibility (COE) and apply for a loan backed by the VA.

A VA home loan is a mortgage benefit backed by the Department of Veterans Affairs. It offers veterans, spouses of veterans, and eligible service members a path to homeownership with benefits like manageable interest rates, limited closing costs, and the possibility of a zero-down payment. This can help potential homebuyers eliminate the need for private mortgage insurance (PMI).

Beyond that, the VA doesn’t have a credit score minimum for this home loan type. However, lenders can set their own criteria and typically require applicants to have at least a 620 credit score. Even so, VA loans are a great fit for veterans and active service members, especially those with lower credit scores or who are new to the housing market. But remember, you’ll likely have to pay a funding fee to receive the loan. This helps keep the program running for future generations and can be paid upfront or financed into the loan.

Apply for a homeownership voucher

A homeownership voucher, also known as the Housing Choice Voucher (HCV), is a program that helps people with low incomes buy their first homes. You can use this voucher to not only buy a home, but also receive money every month to cover home-related expenses like repairs and upkeep, property taxes, and homeowner’s insurance.

Your credit score shouldn’t affect your ability to get a homeownership voucher since the Department of Housing and Urban Development (HUD) doesn’t have a set minimum for the program. However, you will need to meet the qualification requirements. For example, you need to:

- Be receiving rental assistance from Section 8.

- Go through housing counseling.

- Meet the minimum income requirement set by your city or state.

If you’re unsure if you meet the homeownership voucher qualification criteria, check with your local Public Housing Authority (PHA). They can also confirm whether or not the homeownership voucher program is available in your area and help you apply.

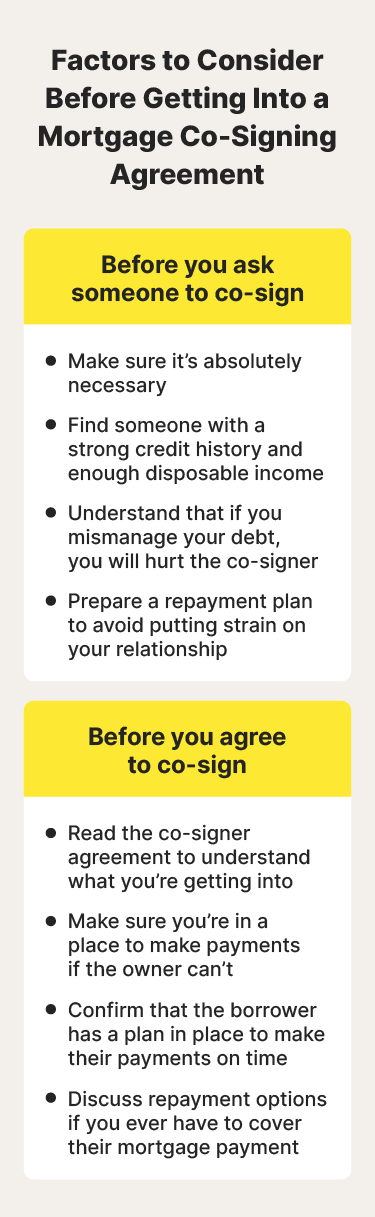

Ask someone to co-sign your home loan

Having bad credit can make qualifying for a mortgage difficult or expensive. A co-signer can help lessen the burden by letting you piggyback on their good credit, strengthening your mortgage application. This can increase your chances of approval and potentially unlock lower interest rates, saving you money in the long run.

A co-signer is typically a close friend or family member with a solid credit score and steady income. But beware, it's a serious commitment. If you miss payments, it can damage both your and the co-signer's credit score.

Before asking someone to commit to co-signing, make sure you have a transparent conversation about expectations and a plan for building your own creditworthiness.

Request a Rapid Rescore

Rapid rescore is a service homebuyers can use to fast-track credit score updates to ensure their credit report accurately reflects their recent activity. Typically, positive changes to your credit, like paying off a debt, are reported monthly to the credit bureaus, even if it takes a little longer for the changes to actually show up on your credit report.

Rapid rescore bypasses this waiting period. By working with your lender, you can submit proof of recent improvements directly to the credit bureaus. You may benefit from this resource if you’ve recently:

- Paid off delinquencies

- Lowered your credit utilization

- Disputed credit report errors

- Paid off a secured loan

This can lead to a quicker credit score update, potentially boosting your score in time to qualify for a better mortgage rate or loan approval. However, it's important to note that you can't initiate a rapid rescore yourself—your lender needs to be involved in the process, and there may be associated fees.

Monitor your credit until you’re ready to close

Navigating the path to homeownership can be complex, especially with less-than-perfect credit. The good news is that home ownership could be well within reach if you find the right loan. And using a credit monitoring and identity protection tool like LifeLock will help safeguard your credit to make sure you’re ready for life’s most important financial decisions.

FAQs about how to get a house with bad credit

Still have questions about buying a house with bad credit? Here’s what you need to know.

What do mortgage lenders consider a bad credit score?

It varies by lender, but most mortgage lenders consider a FICO score under 620 a bad credit score when they’re evaluating home loan applications.

Is a 500 credit score enough to buy a house?

You can buy a house with a 500 credit score, but it’ll be much harder. The FHA will likely work with you, but you’ll have to pay a much higher interest rate, a larger down payment, and you’ll likely have stricter income requirements.

How can I tell if a bad credit home loan is predatory or a scam?

Some signs a home loan might be a scam or predatory include high upfront fees, pressure tactics, and too-good-to-true interest rates. If something is off, avoid rushing in and get advice from a qualified mortgage advisor.

What interest rate and fees should I expect to pay as a home buyer with bad credit?

It’s hard to say because your interest rate and fees depend on your income, debt, credit score, closing costs, and loan type. Talk to your preferred lenders or use a home loan mortgage calculator to get a customized estimate.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.