A rental scam involves someone deceptively using rental property listings to access a hopeful lessee’s personal information or finances. To protect yourself as you start your search for a new home, follow our guide and learn more about the rental scams you may encounter on popular marketplaces like Craigslist, Facebook, and Zillow.

How do rental scams work and how to spot them

Rental scammers often lure people in by offering amazing prices and pressuring prospective renters to sign a lease without seeing the property. The scammers then demand deposits through channels that can allow them to take the money and run—and that’s just the start.

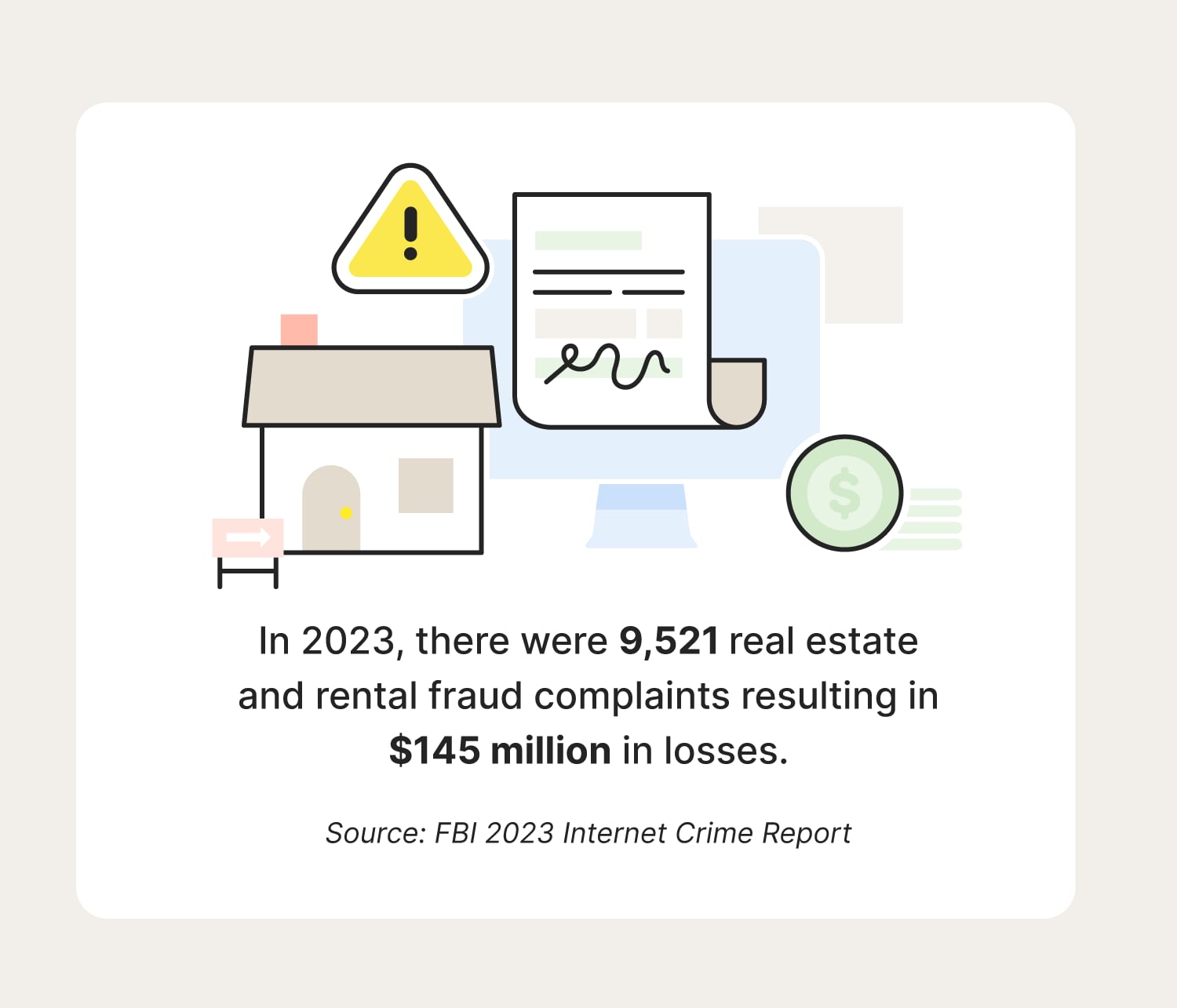

With so many rental scam ruses at their fingertips, scammers stole $145 million from 9,521 complainants in 2023, according to the FBI 2023 Crime Report. Read on to learn the warning signs and how to help avoid falling victim.

1. The price is too good to be true

Finding a rental for a great price might feel like a stroke of luck, but sometimes a swoon-worthy sticker price is a sign a scammer is trying to steal your money or information.

Let your intuition steer you away from properties with dubious price tags. You can also use sites like RentData.org to double-check the average price of properties within a set ZIP code. Learning the average rent range of neighboring properties is a great way to help avoid apartment scams and condo fraud.

2. You can’t verify the address

Legitimate landlords have no reason to withhold a property's address, so if a listing lacks an address, it's a major red flag. Without an address, renters can't verify the property through public records, view it via street view, or check out the neighborhood. This lack of transparency is a tactic scammers use to fabricate details, convincing potential renters to send money for a place that doesn't exist.

3. There are problems with the listing

Vague descriptions, spelling and grammar errors, incomplete listings, and copy-pasted content all indicate a potential rental scam. These factors point toward a lack of effort or legitimacy on the part of the poster.

A genuine landlord or property manager will usually invest time and resources to create a professional listing with clear descriptions, high-quality photos, and accurate information. Be especially cautious of copy-pasted listings (identical to others you see online), as they may be attempts to mimic real ones and steal credibility.

4. The lister avoids meeting you in person

If the “realtor” you’ve chatted with for weeks is never available for a face-to-face meeting or property tour, they may be a scammer. In cases where the lister is dodging you, it could be in hopes of getting your money or personal information without exposing themselves.

Much like elder scams, rental scam schemes play on the goodwill of unsuspecting individuals. Fraudsters may offer seemingly valid reasons why they can’t meet you. If you notice a pattern with their excuses or if their answers seem too convenient, it's best to cut off contact as soon as possible.

5. They want you to place a deposit before signing a lease

Receiving paperwork for a property that you're excited about is a cause for celebration—unless the lessor is pressuring you to put down a deposit first. Asking for a deposit before signing a lease is often a sign of rental fraud, because the landlord is asking for money without providing a legally binding agreement, leaving you unprotected.

This scam might be tougher to recognize if you aren't well-versed in real estate or if you’re moving to a new city you’re unfamiliar with. Carefully read any physical or digital documents that come your way. Check for notary signatures and watermarks—or a lack thereof. And, when in doubt, ask a lawyer you trust for advice before transferring money.

6. They request deposits via payment apps

A request for a wire transfer via payment apps can be a sign of a rental scam because this method can be difficult to trace, making it easier for scammers to disappear with your money without delivering on their promises.

Thankfully, these ploys are easy to spot. If a “realtor” asks for money via a payment app like Cash App, Venmo, or Zelle—especially before you’ve even seen the property—that’s a major red flag. Stop all communications and report the listing to the platform you found it on.

It’s safer to make payments through your bank using an Automated Clearing House (ACH) transfer, or with your credit or debit card.

7. They request personal information right off the bat

A lessor immediately asking for personal information may be a scammer hoping to exploit your identity. Be wary of anyone who asks for your SSN or credit card and CVV number, especially if you haven’t met them or toured the property yet.

Wait until you’ve viewed the property and trust the lessor. If you can’t view the property in person, send someone you trust. Sensitive information is usually reserved for background and credit checks, so no lessor should need this until you express serious interest in the property and are applying to rent it.

Protecting your personal information helps protect against identity theft, but you should also consider a dedicated identity protection service. With LifeLock, you’ll get peace of mind knowing that we monitor hundreds of millions of data points a second, and we’ll help you fix identity theft if it does occur, guaranteed, or your money back.*

How to avoid rental scams

Remembering every small detail about rental scams may seem overwhelming, but there are several simple tips renters can fall back on to help avoid being duped while looking for properties:

- Research listing agents and companies: You can find most listing agents on well-known platforms like LinkedIn, and you can locate legitimate real estate and property management companies in the Better Business Bureau directory.

- Check for multiple listings: If a property you’re keen on is listed in multiple cities or states, that’s a red flag that one or all of them are fraudulent.

- Use street view to scope out the property: This method can ensure property photos are accurate and current.

- Physically visit and tour the property: Seeing the property directly helps establish trust between you and the lessor, and it lets you determine if the property meets your expectations and needs.

- Consult a legal representative: An attorney may notice discrepancies that you can overlook.

- Don’t pay a deposit in cash or via payment apps: Use a secure payment method that’s traceable and offers fraud protection.

- Verify who owns the property: If you’re dealing with a private landlord, search city or county tax assessment websites to confirm they’re the legitimate owner.

When you’re looking for a rental, trust your instincts while you're browsing online. After all, you can never be too cautious when your finances and sensitive information are involved. You should also be aware of other real estate scams and know how to identify and report them.

How to report rental scams

To report a rental scam you’ve spotted, contact the listing site so they can investigate and take action. If you’ve been scammed and shared sensitive information and lost money, you should report the potential identity theft to the relevant authorities.

Report rental fraud to the following authorities:

- Federal Trade Commission (FTC): Inform the FTC about the incident by filing a report on their website.

- Internet Crime Complaint Centre (IC3): The IC3 operates under the FBI; victims of any cybercrime, including rental fraud, should report it to the IC3.

- State attorney general: Contact the attorney general’s office for your state and file a complaint.

- Local police: Call the police department’s non-emergency line or report the scam in-person.

Help protect your identity with LifeLock

Even if you’re as careful as can be, your information can still fall into the wrong hands. Subscribe to LifeLock to get an all-in-one identity theft protection service for better peace of mind. We monitor hundreds of millions of data points a second, and we’ll fix identity theft if it does occur, guaranteed or your money back. Plus, we’ll help reimburse you for stolen funds and personal expenses to help make you whole again.

* Restrictions apply. Automatically renewing subscription required. If you are a victim of identity theft and not satisfied with our resolution, you may receive a refund for the current term of your subscription. See LifeLock.com/Guarantee for complete details.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.