Looking to get a credit card or mortgage? You’ll need a solid credit score to qualify. And if you don’t have one? You’ll need to learn how to fix your credit. But don’t worry—you’re not alone. According to the credit agency Experian, roughly 13% of people have poor credit.

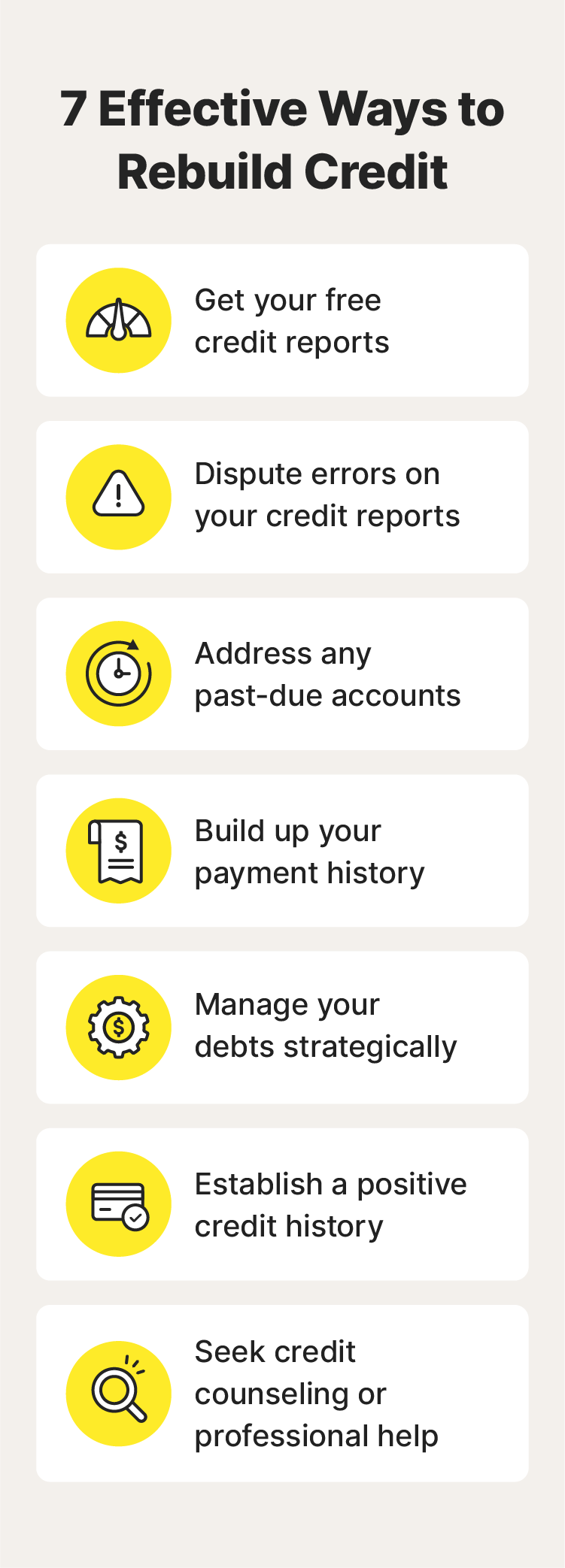

Improving your credit score takes time, but it can be done with patience and a commitment to developing stronger financial habits. Here are seven ways to fix bad credit and improve your score.

1. Check your credit report (and score)

Your credit report is a detailed record of your financial history. You’ll want to review your credit report regularly regularly because it has information on your credit accounts, outstanding debts, and payment history.

You’ll also want to check your credit score, which your credit report doesn’t show. You can check your score using credit scoring websites, through some credit card companies, or with a service like LifeLock Total, which offers easy-to-use features to help you monitor your credit score.

The main reasons why you want to check your credit report and score are to:

- Identify errors: Inaccuracies can negatively impact your score. Regular checks help you spot and dispute these errors promptly.

- Monitor your progress: When looking to fix your credit, tracking your report shows how your efforts impact your score.

- Detect fraud: Unauthorized activity on your report could indicate identity theft—early detection helps you address potential fraud quickly and begin the restoration process.

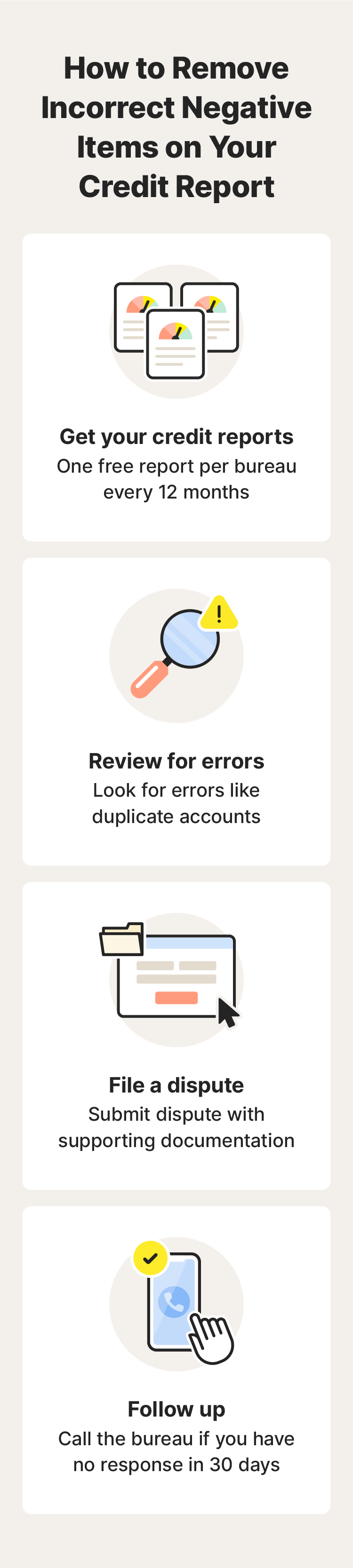

You have the right to a free credit report from the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. You can request them directly from the credit bureaus or check yours at AnnualCreditReport.com.

If you’re looking for easy credit monitoring, in addition to comprehensive identity protection, use a service like LifeLock Total, which offers powerful features like unlimited one-bureau credit checks to help you stay on top of your credit.

2. Review your credit for errors

Even small errors can significantly impact your credit. Key information to review when getting your credit report include:

- Personal information: Check your name, address, date of birth, and Social Security number.

- Credit accounts: Verify all accounts belong to you and there aren’t any you don’t recognize.

- Payment history: Look for any late payments that were inaccurately reported.

- Credit inquiries: Look for hard inquiries (from loan applications) that you don’t recognize as this could signify fraud.

If you find any errors, dispute the credit report immediately with the respective credit bureau and the company reporting the information. It’s free to dispute incorrect information thanks to the Fair Credit Reporting Act (FCRA).

Then, keep track of your dispute and follow up with the credit bureau within 30 to 45 days. The FCRA requires them to investigate and resolve disputes within 30 days, or 45 days if you submit additional information during the initial 30 days.

3. Tackle your past-due accounts

Payment history is important because a single late or missed payment can cause your score to tumble. Having overdue debt will hurt your credit score and stay on your report for up to seven years.

Payments can only be reported to the bureaus when they’re 30 days late. If you’re behind on a payment, but within the 30-day grace period, pay it off immediately so it doesn’t hit your credit report. If you don’t have the funds, see if you can negotiate with the creditor.

If you have multiple overdue accounts, debt consolidation could be an option—this involves taking out a new loan to pay off multiple debts. This is especially useful if you’re paying off credit cards because debt consolidation loans typically charge lower interest rates.

Tip: Creditors can’t report your payments as late until they’re 30 days overdue—so if you’re a week late on your credit card bill, pay it today.

4. Build your payment history

Your payment history is the largest component of your credit score, accounting for 35% of your FICO® Score. So, set up automatic payments to cover at least the minimum due each month. Your credit mix also impacts your credit score, accounting for 10% in Fico’s model. So proving that you can manage several accounts will also help your score.

Tip: If you don’t have many lines of credit open, improve your credit score without opening a new account by becoming an authorized user on a credit card with a responsible primary user. You can leverage their positive payment history to your advantage.

A good credit utilization rate is another major contributor to fixing your credit, making up 30% of your score. The rate is determined by the portion of available credit you use relative to your total credit limits.

For example, if you owe $6,000 across four credit cards, each with a $5,000 credit limit, you’re using $6,000 of your $20,000 available credit—or 30%. If one of these cards has no balance and you close it, you’re now using $6,000 of $15,000 available credit—or 40%. To get your rate as low as possible, you might need to keep unused accounts open or increase your credit limits.

Tip: Aim for a maximum credit utilization rate of 30%—a lower rate (preferably under 10%) is generally preferable.

5. Manage your debt strategically

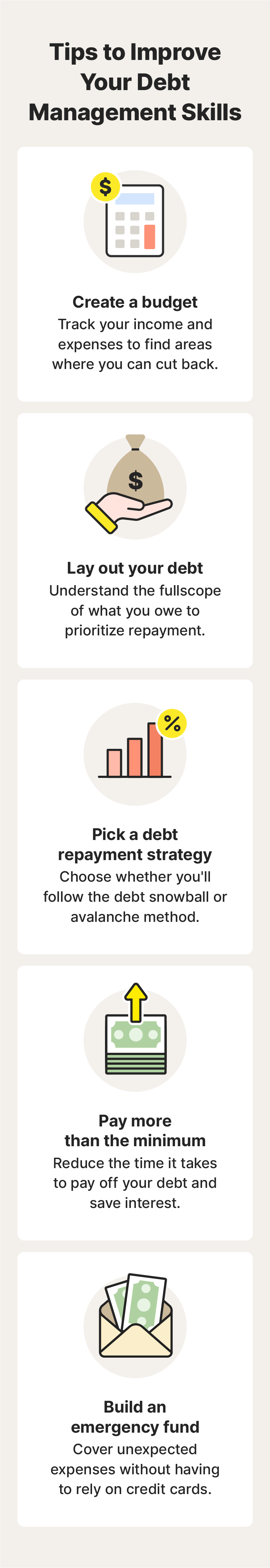

Get into good debt management habits so you can pay off your current debt faster and keep it lower in the future. Follow these tips to help get your debt under control:

- Create a budget: Look at your expenses to see where you can cut back and save money.

- Lay out your debt: List all of your debts and work out your monthly repayments and the interest you’re paying back on each one.

- Pick a debt repayment strategy:

- Debt snowball approach – Make your minimum monthly repayments and start paying off your lowest account balance first, then move on to the next lowest. This can improve your debt utilization rate, but you’ll pay more interest in the long run.

- Debt avalanche approach – Make your minimum monthly repayments and start paying off your account with the highest interest rate first, then move to the next highest. This will help you pay less interest back in the long run.

- Pay more than the minimum: Pay back as much as you can afford above the minimum repayments to reduce the time it takes to pay off your debt and how much interest you pay.

- Build an emergency fund: Put away money for emergencies, gradually reducing your reliance on credit cards.

6. Establish a positive credit history

Your credit is more than managing your debts and handling overdue accounts, especially if you don’t have a credit history or it’s relatively short.

Here's how you can build a positive credit history if you need to establish or rebuild credit:

- Become an authorized user: If you’re added to a credit card account that’s in good standing, it can show up on your credit report.

- Open new lines of credit: Open new credit accounts but don’t apply for too many in a short time as this can negatively impact your score.

- Consider a secured credit card: It requires a security deposit, but using it responsibly can help rebuild credit.

- Look into credit builder loans: These are easier to qualify for than traditional loans.

- Use credit responsibly: Monitor your credit and avoid maxing out credit cards, keeping to your debt repayment and score-building strategy.

Tip: Having different types of credit accounts, like credit cards and loans, can demonstrate your ability to manage various financial responsibilities.

7. Get credit counseling and expert help

You don’t have to try and fix your credit alone. You can turn to expert guidance for help. Credit counselors can analyze your financial situation and build a personalized plan to help you achieve a good credit score. Credit counselors can:

- Analyze financial situations: Assess your income, debts, and expenses to understand your financial standing.

- Develop personalized plans: Create a tailored plan to help you improve your credit based on your specific needs and goals.

- Provide budgeting advice: Teach you how to create a budget, track your spending, and develop effective money management habits.

- Negotiate with creditors: Secure lower interest rates or monthly payments, making it easier to manage your debts.

- Offer educational resources: Provide you with valuable knowledge about credit, debt, and personal finance to empower you with the tools to make informed decisions.

Beware of credit repair scams that promise quick fixes. Instead, find an accredited credit counseling agency. The National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA) are two of the biggest independent certifiers through which you can find certified counselors.

Tip: If your credit score drops suddenly, you may be a victim of identity theft. Contact one of the three major credit bureaus immediately and place a fraud alert on your credit report to start the process of repairing your credit after identity theft.

Track and monitor your credit with LifeLock

LifeLock Total can help you monitor your credit report for suspicious activity and alert you to potential fraud. With LifeLock, you can proactively safeguard your credit and identity, giving you peace of mind as you work to improve your financial health with easy and regular access to your credit report and credit score.

FAQs about how to fix your credit

Fixing your credit can take time. Here are the most common questions about how to fix your credit:

Can you repair your credit yourself?

Yes, you can repair your credit yourself in a variety of ways. One of the first steps to repairing your credit includes disputing inaccurate items on your credit report and paying off overdue accounts.

Is it possible to increase your credit score by 100 points in 30 days?

Improving your credit score by 100 points in 30 days is possible in some cases but challenging. Whether you can depends on your current score, the specific factors affecting your score, and the steps you take. It may be easier to obtain a 100-point increase if you start with a lower score, simply because as your score gets higher there are often fewer things you can do to raise it further.

Can you pay someone to fix your credit?

Yes, you can pay a certified counselor to help improve your credit score. If you go through a non-profit organization like the National Foundation for Credit Counseling (NFCC), fees can be very low and some services are even offered for free.

How do you reset your credit score?

You cannot reset your credit score since it’s based on your credit history, but you can take steps to improve your credit score. Each of the major credit bureaus updates credit scores at least once a month.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Check your credit report (and score)

- 2. Review your credit for errors

- 3. Tackle your past-due accounts

- 4. Build your payment history

- 5. Manage your debt strategically

- 6. Establish a positive credit history

- 7. Get credit counseling and expert help

- Track and monitor your credit with LifeLock

- FAQs about how to fix your credit

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.