FICO, which stands for Fair Isaac Corporation, uses data analytics while reviewing credit reports to create your credit score. And despite popular belief, checking your FICO credit score yourself doesn’t lower it. Our guide will show you five ways to access your FICO Score, break down the factors that affect your score, and share tips on increasing it.

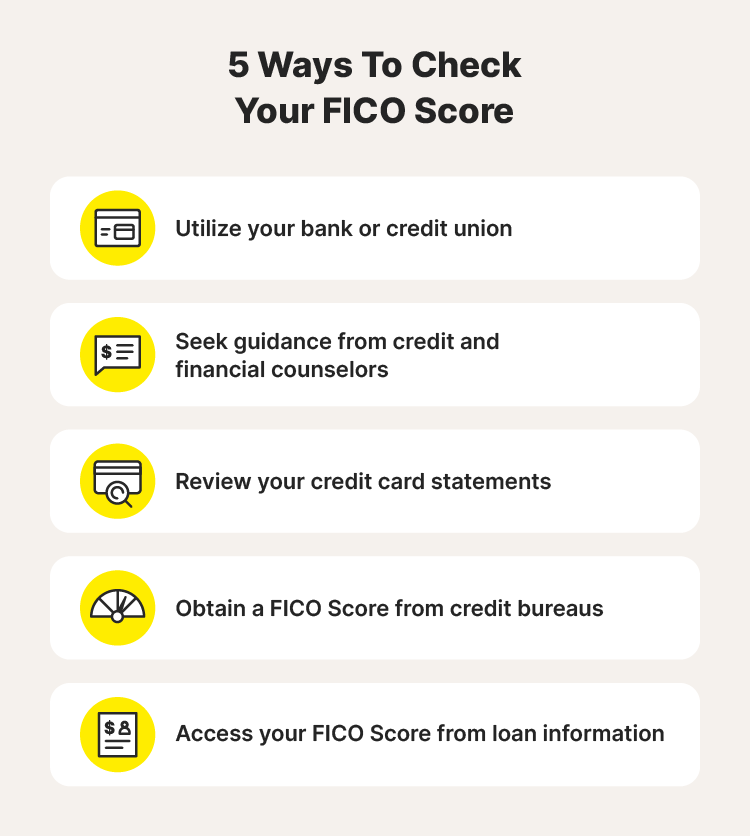

1. Utilize your bank or credit union

Depending on the bank you use, you can check your FICO Score by logging into your online banking portal. Browse through the list of lenders participating in the FICO Score Open Access program and check if your financial institution is one of them. This method is convenient and straightforward, allowing you to check your scores alongside your other banking information.

Additionally, some financial institutions may offer educational resources or personalized advice based on your credit profile, helping you better understand your credit score and how to improve it.

2. Seek guidance from credit and financial counselors

You can ask your financial advisor to check your credit score for you as long as they have your permission to do it—having a trusted finance professional check your score is essential if they’re going to continue advising you on financial matters.

Financial counselors can be invaluable resources if you’re seeking personalized advice on improving your credit score. These professionals analyze your financial situation and can provide tailored recommendations for understanding your credit report, too.

Whether you're facing credit challenges or aiming to optimize your credit health, seeking guidance from these counselors can offer clarity and direction. They can also assist in developing strategies for debt management, budgeting, and credit utilization.

3. Review your credit card statements

Certain credit card companies allow you to see your FICO Score for free—and some credit card issuers now provide customers with their FICO Scores directly on their monthly statements. By reviewing your credit card statements regularly, you can track credit score updates over time, identify any unexpected changes in your score, and take proactive steps to address them.

4. Obtain a FICO Score from credit bureaus

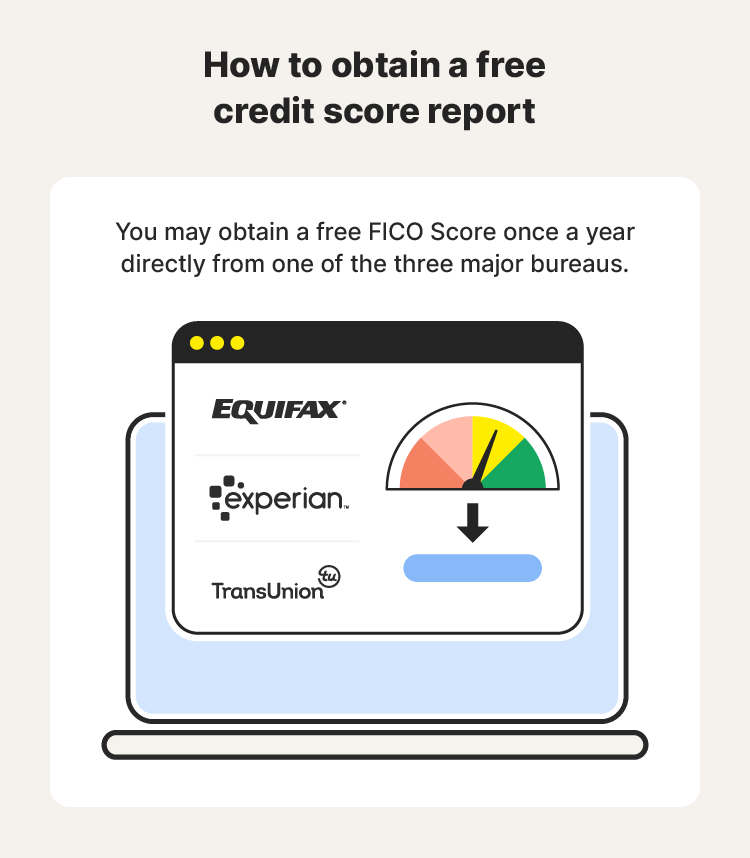

The three major credit bureaus offer free credit reports, which include FICO Scores, allowing you to monitor your credit health at no cost. You can get a free FICO Score once a year directly from one of the three major bureaus:

- Equifax®

- Experian®

- TransUnion®

Additionally, credit bureaus may offer subscription-based services that provide more frequent access to credit reports and scores, along with additional features such as identity theft protection and credit monitoring.

LifeLock also monitors important changes to your credit file with a top credit bureau and alerts you of changes to help detect fraud early. Not only does this help protect your important financial information, you’ll also receive fraud alerts about your Social Security number and more.

5. Access your FICO Score from loan information

Did you recently finance a new car? The finance department at the auto dealership likely pulled your base FICO Score and a FICO Auto Score, which is your history of paying back car loans. You can check your FICO Score for free by asking the finance representative to see your scores on the paperwork.

Student loans are another source of FICO information. Having student debt may not be fun, but if you’re a borrower or co-signer of Sallie Mae Smart Option Student Loans®, you can see your FICO Score online for free.

FICO Score breakdown

Your FICO Score is derived from information in your credit report. Your credit report is a history of how you’ve handled borrowed money in the past. Here’s how FICO determines your credit score:

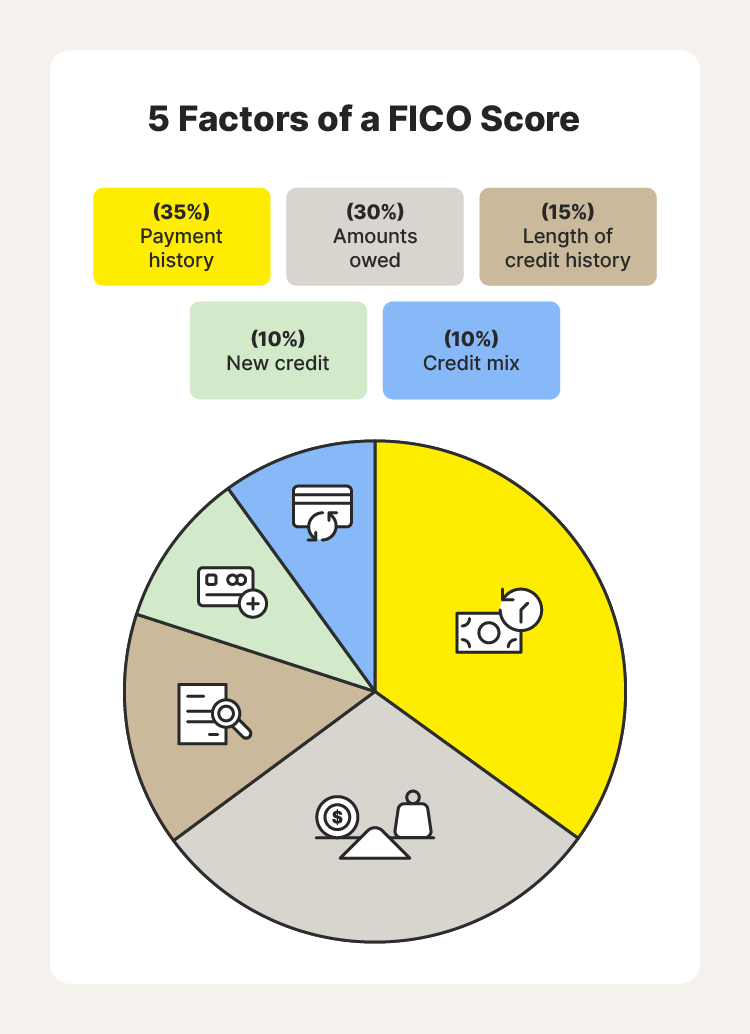

When calculating your credit score, your data falls into five main categories. The percentages reflect the influence each has in determining how your FICO Score is calculated.

Here are the factors and questions considered when calculating your FICO score:

- Payment history (35%): Did you pay past credit accounts on time?

- Amounts owed (30%): How much do you owe? How does it compare to your available credit?

- Length of credit history (15%): How long have your credit accounts been established? What’s the oldest one?

- New credit (10%): How many new accounts have you opened in the last two years?

- Credit mix (10%): What types of credit accounts do you have? Do you have a mix of credit cards, mortgage loans, installment loans, or other loan types?

The factors that go into a FICO Score are based on the borrowing habits of the general U.S. population. FICO may not determine your credit score in exactly the same way as other credit scoring models.

Ways to increase your FICO Score

It takes time to boost your credit score, even if you’re doing everything right. Here are a few ways to get your FICO score in top condition:

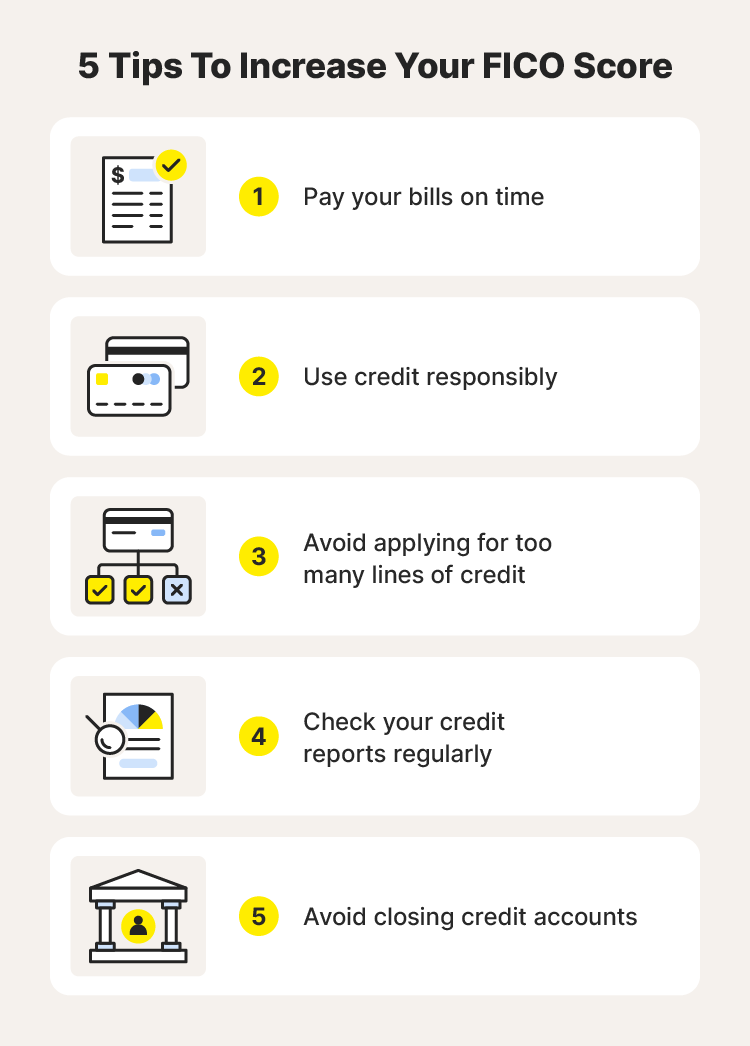

- Pay your bills on time: Delinquent payments can lower your credit score. Be diligent and set reminders to pay bills on time. Remember, payment history is one of the most important factors in determining your FICO Score.

- Use credit responsibly: If you have credit cards, be careful not to rack up debt that might be hard to pay down. Your FICO Score reflects not only your amount of debt, but also how it compares as a percentage of your available credit. It’s a good idea to pay your credit card debt in full, on time, every time.

- Avoid applying for too many lines of credit at once: Creditors may think you need money if you make a lot of credit applications. Also, your credit score may drop if multiple lenders check your credit report. When credit lenders check your credit score, they do a hard credit inquiry, which differs from the soft check that happens when you check your own credit score. And hard credit inquiries can lower your credit score.

- Check your credit reports regularly: Your credit reports may contain inaccurate information. Dispute errors in your credit report right away.

- Avoid closing credit accounts: Lowering the amount of credit you have available could also lower your credit score. Even so, you may want to consider closing seldom-used accounts or switching away from accounts that have an annual fee.

You can help raise your credit score by practicing responsible financial habits. That way, when you get your FICO Score for free, you might be pleasantly surprised.

Keep your credit report secure

After learning how to check your FICO Score, use identity theft protection services like LifeLock to monitor your credit report for suspicious activity and receive alerts about potential threats.

With LifeLock, you can enjoy peace of mind knowing that your personal information, such as your Social Security number, name, and address are being monitored, helping you to take swift action in case of potentially fraudulent activity in your credit report. Stay proactive in safeguarding your credit and financial well-being with LifeLock.

FAQs about how to check your FICO Score

How do I check my FICO Score for free?

You can check your FICO Score for free by accessing your credit report from one of the major credit bureaus (Equifax, Experian, or TransUnion) once per year. Some credit card issuers and financial institutions also offer their customers free access to FICO Scores.

Is your FICO Score your credit score?

Yes, your FICO Score is a type of credit score. Developed by the Fair Isaac Corporation (FICO), a FICO Score is one of the most commonly used credit scoring models in the United States.

Does checking my FICO Score hurt my credit score?

No, checking your own FICO Score through official channels, such as through a credit bureau or financial institution, does not hurt your credit score. These are considered soft inquiries and do not impact your credit. However, too many hard inquiries from credit lenders can lower your credit score temporarily.

What is the safest way to check your credit score?

The safest way to check your credit score is through reputable sources such as official credit bureaus, trusted financial institutions, or LifeLock. Avoid third-party websites that may not offer secure access to your credit information, potentially resulting in a bank scam.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about. For more details about how we create, review, and update content, please see our Editorial Policy.

This article contains

- 1. Utilize your bank or credit union

- 2. Seek guidance from credit and financial counselors

- 3. Review your credit card statements

- 4. Obtain a FICO Score from credit bureaus

- 5. Access your FICO Score from loan information

- FICO Score breakdown

- Ways to increase your FICO Score

- Keep your credit report secure

- FAQs about how to check your FICO Score

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.