Credit scores hold a lot of weight in the auto loan approval process—especially when setting borrowing terms like annual percentage rates (APR), deposits, and term lengths. We’ll help you learn how your credit score can affect your finances and your chances of driving off the lot in a new vehicle, and we’ll tell you what you need to know about credit score benchmarks, the scoring models lenders use, current interest rates, and tips for getting a car with bad credit.

What is a good credit score for an auto loan?

You typically need a FICO® Auto Score of at least 670 or a VantageScore® (3.0 or 4.0) greater than 661 to get a traditional car loan with good terms. However, a “good” credit score for an auto loan can vary based on factors like whether you’re buying new or used, your lender’s criteria, and which scoring model they check.

Good credit score for an auto loan

670+ is a good credit score to buy a car if your lender uses the FICO Auto Score; 661+ is a good credit score if they use VantageScore.

If your credit score is below 670 (FICO) or 661 (VantageScore), you can still get a car, but you’ll likely be on the hook for a bigger down payment, higher interest rates, and a longer-term loan length.

What is the minimum credit score needed to buy a car?

Many say 600 is the minimum credit score lenders will approve for a car loan. However, car dealerships typically have existing relationships with lenders, and depending on how motivated they are to make a sale, they may be able to get you in a car with a lower credit score—reportedly even into the 400s. But the lower your score, the higher your down payment and interest rates will be. Understanding the basics of developing good credit, such as knowing when to pay your credit card, will make it easier to get a better credit score and car loan.

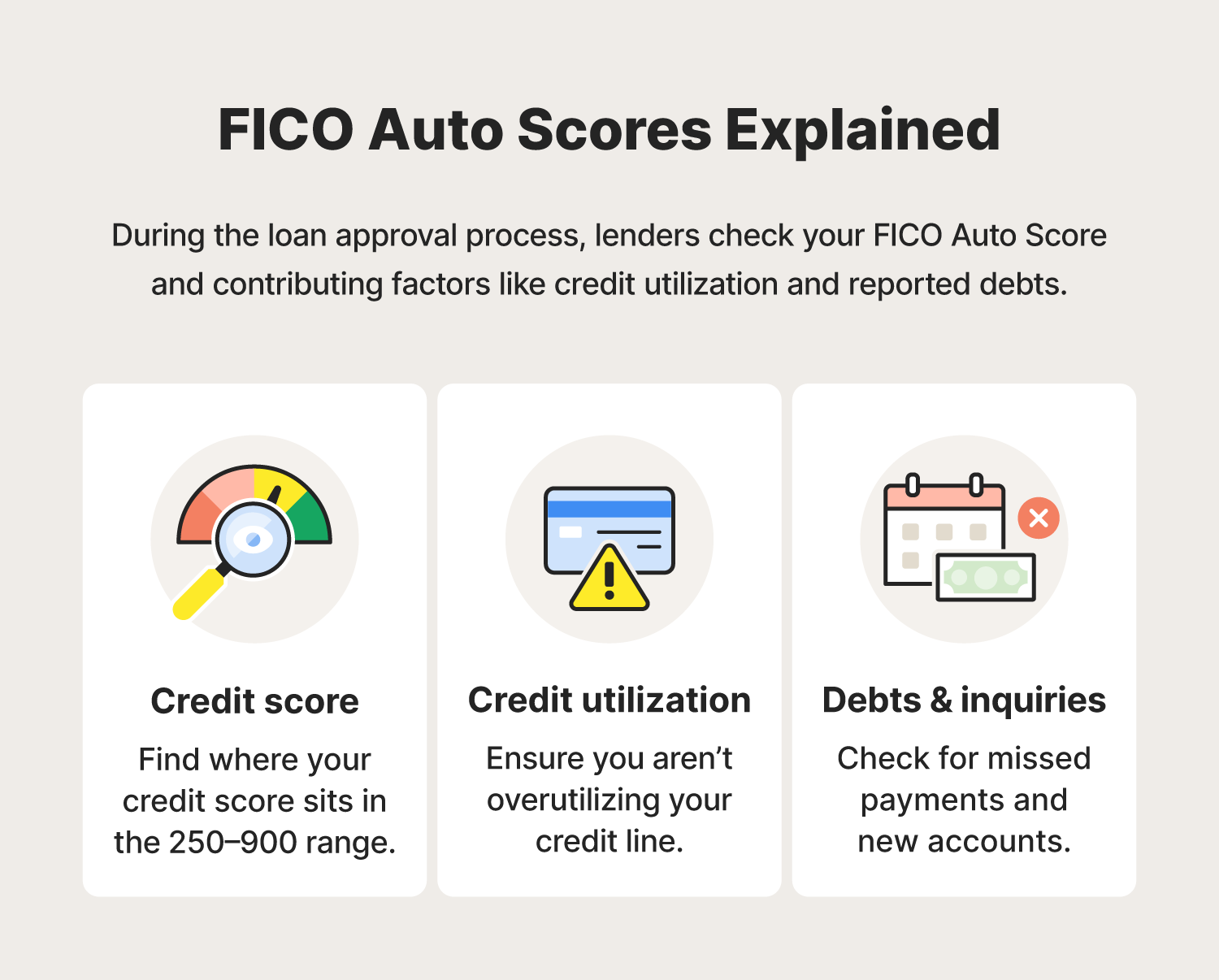

What credit scores do auto lenders use?

Auto loan lenders generally check an applicant’s FICO Auto Score, which ranges from 250 to 900, or their VantageScore, which ranges from 300 to 800. These scores reflect an applicant’s general borrower risk profile, and they help lenders predict how likely a borrower is to repay their auto loan on time.

Both auto scores consider the same factors as a traditional credit score. For example, lenders might check your:

- Payment history: to verify that you pay your bills on time.

- Credit utilization: to ensure you aren’t over-extending your lines of credit.

- Credit history: to see how many years of experience you have successfully managing debt.

- Credit mix: to see how you handle different types of debt.

- New credit lines: to verify that you aren’t taking on more debt than you can manage.

Average auto loan interest rates by credit score

The interest rate or APR you qualify for on your auto loan depends heavily on how good your credit score is. Generally, borrowers with strong credit scores are offered significantly lower rates than those with weaker credit. And that difference in rates can add up to thousands of dollars in cost savings in the end.

With that in mind, here’s a breakdown of recent new and used car auto loan interest rates based on borrower credit scores:

| Credit score (VantageScore) and risk profile | Avg. new car APR | Avg. used car APR |

| 781–850 (Super prime) | 5.64% | 7.66% |

| 661–780 (Prime) | 7.01% | 9.73% |

| 601–660 (Nonprime) | 9.60% | 14.12% |

| 501–600 (Subprime) | 12.28% | 18.89% |

| 300–500 (Deep subprime) | 14.78% | 21.55% |

Source: Experian’s Q4 2023 State of the Automotive Finance Market report.

How to buy a car with bad credit

Auto loans are still available to people with low credit scores, but you’ll probably need a co-signer or a larger down payment. You will also likely have to accept sub-optimal borrowing terms, including a shorter repayment term and higher interest.

Getting a loan with bad credit depends on the lender’s criteria and other factors like your income and total amount of debt. The best way to improve your approval odds is to increase your credit score by paying off your debts on time. However, if you’re looking for a quicker fix, there are a few options.

Look into bad credit auto loans

A bad credit auto loan is a financing option for borrowers with less than prime credit scores. These loans often come with higher interest rates and inconvenient term lengths, which can result in higher costs in the long run. But they can help rebuild your credit score if you make on-time payments.

Tip: Get a car loan without an early payoff penalty, so you won’t be charged a fee if you make extra payments to lower the overall cost of your new vehicle.

Talk to your bank or credit union

Having a longstanding relationship with a bank or credit union can be a saving grace when applying for an auto loan with bad credit. Their familiarity with your financial history can give them a more nuanced view of your situation beyond just your credit score, and they may be more likely to help you finance a vehicle. Just be ready to plead your case and share proof of income if necessary.

Show proof of income

While bad credit can make securing a car loan more challenging, proof of a steady income can counterbalance that. A comfortable income shows you can afford a car loan, especially if your debt-to-income (DTI) ratio isn’t too high. This can incentivize lenders to approve you for a car loan, even if you’ve made some financial missteps. In most cases, a lender may ask you to pay a higher interest rate to help offset some of their risk.

Pay a larger deposit

A larger down payment may be your ticket to securing a car loan with a lower credit score. By putting more money toward the total cost of the car upfront, you reduce the amount you need to borrow. This lowers the loan-to-value ratio (LTV) for the lender, meaning they have less financial risk if you default on the loan.

A lower LTV makes you a more attractive borrower in their eyes, potentially increasing your chances of approval and even qualifying you for a more favorable interest rate.

Find a co-signer

Adding someone with a strong credit history to your loan application offers two important benefits. First, a co-signer significantly increases your chances of getting approved for a loan in the first place. Second, the lender will consider both your credit scores and your co-signer's good credit, which can reduce your interest rates.

But keep in mind that this is a big ask, so approach someone you already have a strong and trusting relationship with like a parent, spouse, or some other family member. You should also have a plan in place to avoid defaulting and damaging their credit or finances.

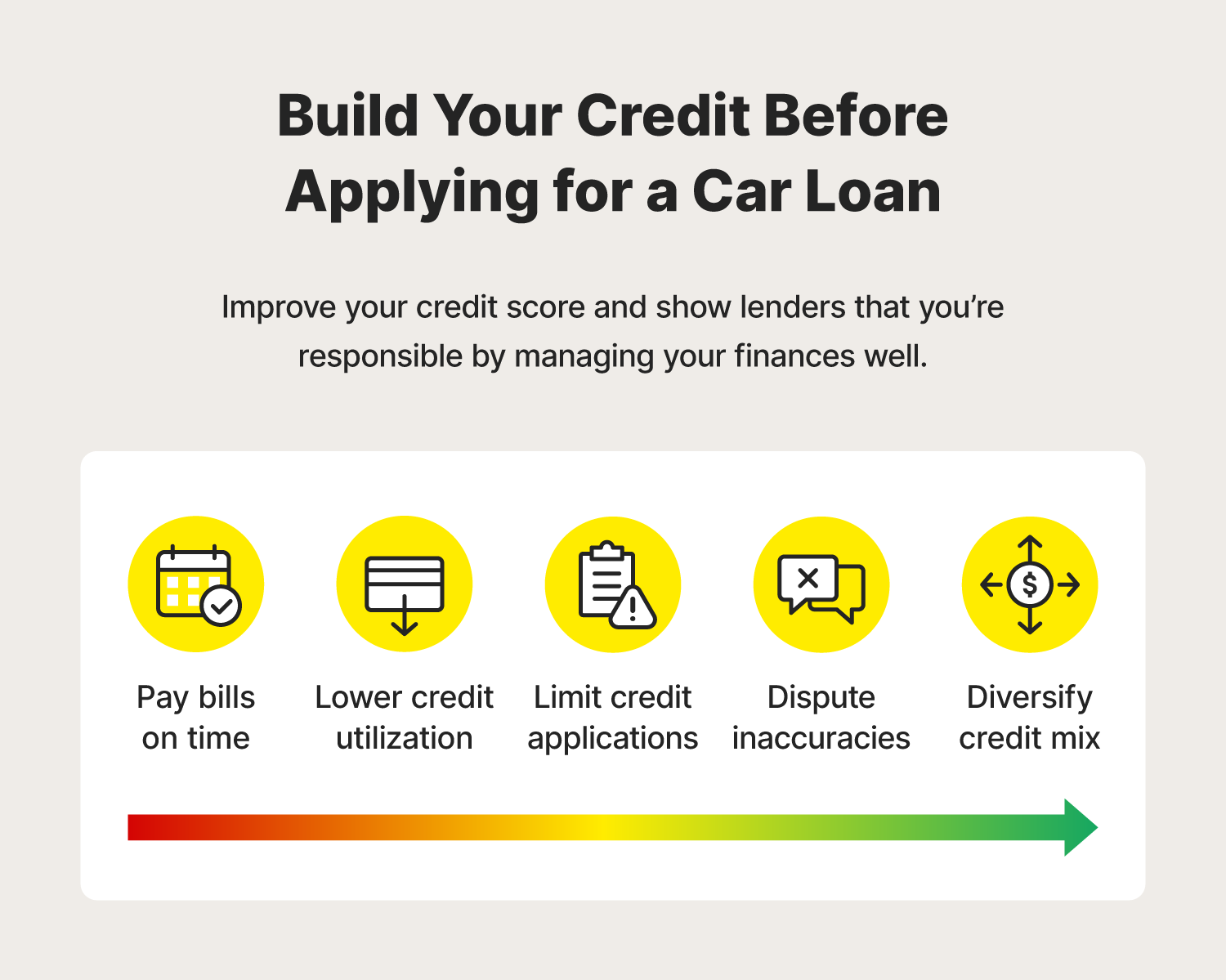

5 ways to improve your credit score before buying a car

If you have time before applying for a car loan, there are things you can do to try to improve your credit score. It’s understandable to want to head directly to the car lot and get your new car. But if your credit score is low and you have some flexibility, you can try to strengthen your credit score first to improve your borrowing terms.

Here are a few ways to improve your credit:

- Pay your bills on time: Payment history apparently accounts for a whopping 35% of your entire credit score, so it’s important to pay your credit cards, mortgages, student loans, and medical bills on time.

- Keep your credit utilization low: Try to keep your credit utilization (the percentage of your available credit that you're currently using) under 30% for a greater chance at good borrowing terms. Of course, it’s even better if you can get that number down to single digits.

- Limit credit applications: Hard inquiries can hurt your credit score for up to a year, so avoid applying for several new lines of credit if you plan on buying a car soon.

- Dispute inaccurate credit report entries: Discrepancies on your credit report can unfairly affect your score—report them to help give yourself a credit boost.

- Diversify your credit mix: Diversifying your credit mix means having both revolving credit (like credit cards) and installment loans (like car loans). A mix of credit shows responsible management of different credit types and can boost your credit score.

Build and monitor your credit

A good credit score is the key to getting approved for an auto loan with low interest rates and great borrowing terms. If your credit score isn’t where you want it to be, you can work to try to improve it. Regularly review your credit reports, dispute inaccuracies, and manage your credit responsibly.

Thankfully, there are services you can use to help you monitor and manage your credit. LifeLock is an identity theft protection service with a powerful credit monitoring feature that will monitor your credit score and financial and investment accounts to help you keep track of potential inaccuracies. Having a partner in your credit journey will give you greater peace of mind as you consider whether you’re ready to make some of life’s most important financial decisions.

FAQs about credit scores for auto loans

Still have questions about auto loans and credit scores? Here’s what you need to know.

Can I buy a car with no credit?

Yes, you can qualify for a car loan without a credit history, but you’ll likely need a larger down payment, steady income, and a co-signer. Vehicles are big-ticket items, and many lenders will be wary of loaning money to people who haven’t established fiscal responsibility.

Do new or used cars have better interest rates?

You can usually get lower interest rates on a new car loan because they’re less likely to need repairs and have a more predictable resale value. However, your credit score will ultimately play a bigger role in the interest rate you qualify for.

How will my interest rates change if I use a co-signer?

Using a co-signer with good credit can improve your chances of getting approved for an auto loan and potentially help you qualify for a lower interest rate. However, you won’t get the same low interest rate as they would if they applied alone. Instead, the lender will consider your credit scores and set a rate based on your combined risk.

Will it hurt my credit score if I check it before applying for an auto loan?

Checking your own credit won’t hurt your credit score because it’s just a soft inquiry. Always check your credit score before applying for an auto loan to ensure you find the right lender and good borrowing terms. However, getting pre-approved or pre-qualified involves a hard inquiry. So, if a bank runs a check, you can expect your credit score to dip temporarily.

Editor’s note: Our articles provide educational information. LifeLock offerings may not cover or protect against every type of crime, fraud, or threat we write about.

This article contains

- What is a good credit score for an auto loan?

- What is the minimum credit score needed to buy a car?

- What credit scores do auto lenders use?

- Average auto loan interest rates by credit score

- How to buy a car with bad credit

- 5 ways to improve your credit score before buying a car

- Build and monitor your credit

- FAQs about credit scores for auto loans

Start your protection,

enroll in minutes.

LifeLock is part of Gen – a global company with a family of trusted brands.

Copyright © 2026 Gen Digital Inc. All rights reserved. Gen trademarks or registered trademarks are property of Gen Digital Inc. or its affiliates. Firefox is a trademark of Mozilla Foundation. Android, Google Chrome, Google Play and the Google Play logo are trademarks of Google, LLC. Mac, iPhone, iPad, Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Alexa and all related logos are trademarks of Amazon.com, Inc. or its affiliates. Microsoft and the Window logo are trademarks of Microsoft Corporation in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Other names may be trademarks of their respective owners.